UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

(Amendment No. 1)

Under the Securities Exchange Act of 1934

ALLIED

GAMING & ENTERTAINMENT INC.

(Name of Issuer)

Common Stock, $0.0001 par value

(Title of Class of Securities)

01917019

(CUSIP Number)

Primo Vital Limited

Ourgame International Holdings Limited

31/F, Tower Two,

Times Square,

1 Matheson Street, Causeway Bay,

Hong Kong, China

Attention: Jingsheng Lu

Telephone 86-10-82378118

(Name, Address and Telephone Number of Persons

Authorized to Receive Notices and Communications)

October 3, 2024

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-l(e),

240.13d-l(f) or 240.13d-l(g), check the following box ¨.

| 1 |

NAME OF REPORTING PERSONS

Primo Vital Limited |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

(a)

¨

(b) ¨ |

| 3 |

SEC USE ONLY |

| |

|

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS)

00 (Other - See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e) |

¨ |

| |

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

11,986,523 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

11,986,523 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

11,986,523 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES

(SEE INSTRUCTIONS) |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

31.4%(1) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

CO |

(1) Percentage calculated based on 38,185,313 shares of Common Stock issued and outstanding as of August 14, 2024, as reported in the Issuer’s Form 10-Q for the quarter ended June 30, 2024 (filed on August 19, 2024).

| 1 |

NAME OF REPORTING PERSONS

Ourgame International Holdings Limited |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

(a)

¨

(b) ¨ |

| 3 |

SEC USE ONLY |

| |

|

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS)

00 (Other - See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e) |

¨ |

| |

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

11,986,523 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

11,986,523 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

11,986,523 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES

(SEE INSTRUCTIONS) |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

31.4%(1) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

CO |

(1) Percentage calculated based on 38,185,313 shares of Common Stock

issued and outstanding as of August 14, 2024, as reported in the Issuer’s Form 10-Q for the quarter ended June 30, 2024 (filed on

August 19, 2024).

| 1 |

NAME OF REPORTING PERSONS

Lu Jingsheng |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

(a)

¨

(b) ¨ |

| 3 |

SEC USE ONLY |

| |

|

| 4 |

SOURCE OF FUNDS (SEE INSTRUCTIONS)

00 (Other - See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e) |

¨ |

| |

|

|

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

People’s Republic of China |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

60,000(2) |

| 8 |

SHARED VOTING POWER

11,986,523 |

| 9 |

SOLE DISPOSITIVE POWER

60,000 |

| 10 |

SHARED DISPOSITIVE POWER

11,986,523(3) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

12,046,523 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES

(SEE INSTRUCTIONS) |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

31.5%(1) |

| 14 |

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN |

(1) Percentage calculated based on 38,185,313 shares of Common Stock issued and outstanding as of August 14, 2024, as reported in the Issuer’s Form 10-Q for the quarter ended June 30, 2024 (filed on August 19, 2024).

(2) Consists of (i) a grant of restricted stock units to receive 20,000

shares of Common Stock subject to vesting; and (ii) options to buy up to 40,000 shares of Common Stock subject to vesting.

(3) Represents shares indirectly owned by Mr. Lu Jingsheng through

Primo Vital Limited, which is a wholly owned subsidiary of Ourgame International Holdings, Ltd. Mr. Lu Jingsheng is the Chairman and Chief

Executive Officer of Ourgame International Holdings, Ltd and the sole director of Primo Vital Limited. Mr. Lu Jingsheng may exercise voting

and dispositive power over the shares beneficially owned by Primo, and disclaims any beneficial ownership in such shares except to the

extent of his pecuniary interest.

AMENDMENT NO. 1 TO SCHEDULE

13D

This Schedule 13D/A amends and restates in its

entirety the statement on Schedule 13D filed by the Reporting Persons with the U.S. Securities and Exchange Commission September 18, 2019.

Item 1 Security and Issuer.

Item 1 is hereby amended as follows:

This Schedule 13D/A relates

to shares of the Common Stock, $0.0001 par value, of Allied Gaming & Entertainment Inc., a Delaware corporation (the “Issuer”

or the “Company”). The address of the principal executive offices of the Issuer is 745 Fifth Avenue, Suite 500, New York,

NY 10151. Prior to August 9, 2019, the name of the Company was Black Ridge Acquisition Corp.

Item 2 Identity and Background.

Item 2 is amended as follows:

(a) This 13D/A is being filed jointly by the following persons (the “Reporting Persons”):

· Primo Vital Limited

(“Primo Vital”), a British Virgin Islands exempted company;

· Ourgame International

Holdings Limited (“Ourgame”), a Cayman Islands corporation; and

· Lu Jingsheng, an individual who is the chairman, executive director and chief executive officer of Ourgame and the sole director of Primo Vital. Mr. Lu Jingsheng is a director of the Issuer since 2021.

Mr. Eric Yang resigned

from Ourgame on June 30, 2020 so is no longer deemed to be a Reporting Person.

(b) The principal office and place of business for Primo Vital, Ourgame and Mr. Lu Jingsheng is 31/F, Tower Two, Times Square, 1 Matheson

Street, Causeway Bay, Hong Kong, China.

(c) Primo

Vital’s principal business activities involve investing in the equity securities of the Company. Ourgame’s principal business

activities involve developing and operating online card and board games in China, with integrated online and offline operations. Primo

Vital is a 100% owned subsidiary of Ourgame. Lu Jingsheng is an individual who is the executive director and chief executive officer

of Ourgame and and the sole director of Primo Vital.

(d) –

(e) During the last five years, none of the Reporting Persons have been convicted in a criminal proceeding (excluding traffic

violations and similar misdemeanors) nor have the parties been a party to a civil proceeding of a judicial or administrative body of

competent jurisdiction as a result of which such individual was or is subject to a judgment, decree, or final order enjoining future

violations of, or prohibiting, or mandating activity subject to, federal or state securities laws or finding any violation with

respect to such laws.

(f) Primo

Vital is a British Virgin Islands exempted company. Ourgame is a Cayman Islands corporation. Lu Jingsheng is a citizen of the People’s

Republic of China.

Item 3 Source and Amount

of Funds or Other Consideration.

Item 3 is amended as follows:

The Reporting Persons acquired

beneficial ownership of the securities of the Company described herein pursuant to the Agreement and Plan of Merger, dated as of December

19, 2018 and amended by the Amendment dated August 5, 2019 (as so amended, the “Merger Agreement”), by and among the Company,

Black Ridge Merger Sub Corp. (“Merger Sub”), Allied Gaming and Entertainment, Inc. (f/k/a Allied Esports Media, Inc.) (“AEM”),

Noble Link Global Limited (“Noble”), Ourgame, and Primo Vital. On August 9, 2019 (the “Effective Date”), such

parties completed merger transactions (the “Mergers”) and other related transactions (together with the Mergers, the “Transactions”)

under which, among other things, AEM became a wholly-owned subsidiary of the Company and the Company assumed ownership of the businesses

of Allied Esports (“Allied Esports”) and the World Poker Tour® (“WPT”). The consideration for the issuances

of securities to the Reporting Persons is described below.

Issuances

in the Transactions. In the Transactions, among other things, the Reporting Persons received the following equity securities

of the Company or rights to receive such equity securities in the future:

1. In

the Mergers, on the Effective Date, the Company issued shares of common stock to the former owners of AEM and WPT, including 9,543,692

shares issued to Primo Vital.

2. In

the Mergers, on the Effective Date, the Company issued to the former owners of AEM and WPT five-year warrants to purchase shares of Company

common stock at a price per share of $11.50 (the “Warrants”), including 3,125,640 Warrants issued to Primo Vital. These warrants

expired in August 9, 2024.

3. On

the Effective Date, the Company issued 1,842,831 shares of common stock to Primo Vital in cancellation of $12,144,260 of debt owed by

Allied Esports and WPT.

4. On

the Effective Date, the Company assumed $10,000,000 of the debt obligations of Ourgame and Noble Link Global Limited (including an additional

$1,200,000 of accrued interest) and repaid Ourgame a balance of $23,800,000 owed under the Merger Agreement by (a) paying $3,500,000 in

cash to Ourgame and its designees, (b) issuing to Ourgame’s designees 2,928,679 shares of the Company’s common stock (including

the 1,842,831 shares issued to Primo Vital referred to in paragraph 4 above), and (c) Ourgame retaining $1,000,000 of the proceeds of

such loans to pay its transaction expenses incurred in the Mergers. Black Ridge Oil & Gas, Inc., a founding stockholder of the Company,

also agreed to transfer an aggregate of 600,000 shares of the Company’s common stock held by it to Ourgame, which transfer was completed

on the Effective Date.

Item 4. Purpose of Transaction.

Item 4 is amended as follows:

The Reporting Persons may

from time to time and at any time: (1) acquire additional Common Shares and/or other securities and/or instruments (including equity,

debt or other securities or instruments) of the Issuer (or its affiliates) in the open market, in privately negotiated transactions, or

otherwise, (2) dispose of any or all of their Common Shares and/or other securities and/or instruments of the Issuer (or its affiliates)

in the open market, in privately negotiated transactions, or otherwise, (3) enter into swap and/or other derivative transactions with

brokerdealers and/or financial institutions counterparties with respect to the securities of the Issuer (or its affiliates) which may

be deemed to either increase or decrease the Reporting Persons economic exposure to the value of the Common Shares or other securities

of the Issuer, and/or (4) engage in any other hedging or similar transactions with respect to the Common Shares and/or other securities

or instruments of the Issuer.

On September 24, 2024, Ourgame

delivered a letter to the board of directors of the Issuer (the “Board”) demanding the Board to grant Ourgame a similar exemption

which the Issuer granted to Knighted Pastures LLC and Roy Choi (collectively, “Knighted”), permitting Ourgame to acquire additional

shares of common stock of the Issuer, up to a level exceeding 10% of Knighted’s holding without being treated as an “acquired

person” under a shareholder rights plan adopted by the Issuer in February 2024. In addition, Ourgame urged the Board to initiate

necessary amendments to the Bylaws to perform the obligations under the Agreement and Plan of Reorganization, dated as of December 19,

2018.

On

October 3, 2024, Mr. Lu Jingsheng, in his capacity as a member of the nominating and corporate governance committee of the Issuer (the

“Nominating Committee”), delivered a Notice of Nomination for Directors (the “Notice”) to the Nominating

Committee and a summary of the Notice is as follows:

Mr.

Lu Jingsheng requested that the Nominating Committee consider the nominations of two highly qualified candidates, Mr. Li Zhang

and Mr. Shaohua Ma to replace Mr. Yushi Guo and Mr. Yuanfei Qu and recommend these nominations for approval by all members of the board

of the Issuer.

The two candidates are: Zhang

Li and Ma Shaohua and their biographies are set forth below:

Zhang Li:

Mr. Zhang Li, aged 49, has

extensive experience and knowledge in accounting and financial management. Mr. Zhang has been the chief accountant of Joinach Certified

Public Accountants since 2009. Prior to that, Mr. Zhang was a regional finance director of China of Popular Holdings from 2005 to 2007

and an assistant to president of Shandong Wohua Pharmaceutical Co., Ltd. from 2003 to 2005.

Mr. Zhang obtained a Master

of Business Administration from the China Europe International Business School and has the qualifications of Chinese Certified Public

Accountant, the Chinese Certified Tax Agent and Fund Practice.

Ma Shaohua:

Mr. Ma Shaohua, aged 45, holds

a Bachelor of Law degree from North Jiaotong University (now known as Beijing Jiaotong University) and a Master of Public Administration

degree from the Party School of the CPC Central Committee. Since 2018, he has worked at Legend Holding Company

Mr. Lu Jingsheng intends to

propose that the following directors be replaced by the above candidates:

Yushi Guo

Director Guo has been a director

of Issuer since 2022 and is a member of Issuer’s Compensation Committee.

Yuanfei Qu

Director Qu has been a director

of Issuer since 2022 and is a member of Issuer’s Compensation Committee.

On October 3, 2024, Ourgame

also delivered a letter to the Issuer, which among other things, called upon the Issuer to promptly schedule and announce the date for

the Issuer’s 2024 annual meeting of stockholders according to the Bylaws of the Issuer.

The foregoing list of intentions,

plans, strategies, negotiations, discussions, activities and potential transactions under consideration is subject to termination, evolution,

modification or change at any time, without notice, and there can be no assurance that any of the Reporting Persons will take any of the

actions set forth above. Notwithstanding anything contained herein, the Reporting Persons specifically reserve the right to change their

intention with respect to any or all of the matters described in this Item 4.

Other than as set forth above,

the Reporting Persons do not have any plans or proposals as of the date of this filing which relate to or would result in any of the actions

enumerated in Item 4 of the instructions to Schedule 13D.

THIS SCHEDULE 13D IS NOT A SOLICITATION. THE REPORTING

PERSONS ARE NOT HEREBY SOLICITING,AND DO NOT INTEND TO SOLICIT, ANY STOCKHOLDER TO VOTE, WITHHOLD A VOTE, GRANT A PROXY WITHREGARD TO,

OR IN ANY OTHER WAY TAKE ACTION WITH REGARD TO THE ELECTION OF DIRECTORS,PROPOSED CHANGES TO THE BYLAWS, REMOVING CERTAIN EXISTING DIRECTORS

FOR CAUSE OR ANY OTHERMATTER TO BE VOTED UPON AS DESCRIBED IN THIS SCHEDULE 13D. THE REPORTING PERSONS WILL NOTACCEPT PROXIES FROM ANY

STOCKHOLDER IN CONNECTION WITH THE ACTIONS CONTEMPLATED BY THIS SCHEDULE 13D.

Item 5 Interests in Securities

of the Issuer.

Item 5 is amended as follows:

Primo Vital beneficially owns

11,986,523 shares of common stock of the Company, representing 31.4% of the issued and outstanding common stock. (All percentages are

based on 38,185,313 outstanding shares as of August 14, 2024, as reported in the Issuer’s Form 10-Q for the quarter ended June 30,

2024. Primo Vital shares the power to vote or direct the voting of all of such shares and shares the power to dispose or direct the disposition

of all of such shares.

Ourgame beneficially owns

11,986,523 shares of common stock of the Company, representing 31.4% of the issued and outstanding common stock. This beneficial ownership

includes all of the shares beneficially owned by Primo Vital, because Primo Vital is a wholly owned subsidiary of Ourgame.

Mr. Lu Jinsheng beneficially

owns 12,046,523 shares of common stock of the Company, representing 31.5% of the issued and outstanding common stock. This beneficial

ownership includes all of the shares beneficially owned by Primo Vital and Ourgame, because Mr. Lu Jingsheng is a controlling person of

both such companies. Mr. Lu Jingsheng beneficially owns (i) 11,986,523 outstanding shares; (ii) 20,000 restricted stock units granting

Mr. Lu Jingsheng the right to receive one share of common stock of the Issuer (the "Common Stock"). The RSUs shall vest: (i)

twenty-five percent (25%) immediately upon granting and (ii) the remaining shares shall vest in three (3) equal successive installments

upon the Reporting Person's completion of each six (6) month period of service over the eighteen (18) month period measured from the date

of grant; and (iii) options to purchase 40,000 shares of Common Stock vesting 10,000 shares vest on each of 5/6/2022, 5/6/2023, 5/6/2024,

and 5/6/2025. Mr. Lu Jingsheng has sole power to vote or direct the voting and dispose or direct the disposition of 60,000 shares. Mr.

Lu Jingsheng shares the power to vote or direct the voting of 11,986,523 shares. Mr. Lu Jingsheng shares the power to dispose or direct

the disposition of 11,986,523 shares.

(c) The

Transactions in which the Reporting Persons acquired beneficial ownership of the shares are described in Item 3.

(d) Not

applicable.

(e) Not

applicable.

Item 7 Material to be Filed

as Exhibits.

SIGNATURE

After reasonable inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

Date:

October 3, 2024

| PRIMO VITAL LIMITED |

|

| |

|

| |

|

| By: |

/s/ Lu Jingsheng |

|

| |

Lu Jingsheng |

|

| |

Sole Director |

|

| |

|

| |

|

| OURGAME INTERNATIONAL HOLDINGS LIMITED |

|

| |

|

| |

|

| By: |

/s/ Lu Jingsheng |

|

| |

Lu Jingsheng |

|

| |

Chief Executive Officer |

|

| |

|

| |

|

| /s/ Lu Jingsheng |

|

| Lu Jingsheng |

|

EXHIBIT 99.1

Agreement to File Jointly

The undersigned hereby agree

that the Statement on Schedule 13D/A (amendment no. 1) with respect to the shares of Common Stock, $0.0001 par value per share, of Allied

Gaming & Entertainment, Inc. and any further amendments thereto executed by each and any of us shall be filed on behalf of each of

us pursuant to and in accordance with the provisions of Rule 13d-1(k)(1) under the Securities Exchange Act of 1934, as amended, and further

agree that this Agreement to File Jointly be included as an Exhibit to such joint filing.

This Agreement may be executed

simultaneously in any number of counterparts, all of which together shall constitute one and the same instrument.

Date:

October 3, 2024

| PRIMO VITAL LIMITED |

|

| |

|

| |

|

| By: |

/s/ Lu Jingsheng |

|

| |

Lu Jingsheng |

|

| |

Sole Director |

|

| |

|

| |

|

| OURGAME INTERNATIONAL HOLDINGS LIMITED |

|

| |

|

| |

|

| By: |

/s/ Lu Jingsheng |

|

| |

Lu Jingsheng |

|

| |

Chief Executive Officer |

|

| |

|

| |

|

| /s/ Lu Jingsheng |

|

| Lu Jingsheng |

|

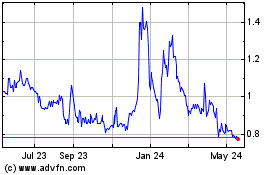

Allied Gaming and Entert... (NASDAQ:AGAE)

Historical Stock Chart

From Dec 2024 to Jan 2025

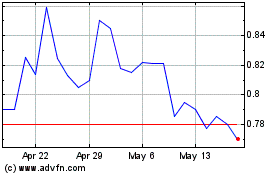

Allied Gaming and Entert... (NASDAQ:AGAE)

Historical Stock Chart

From Jan 2024 to Jan 2025