45.1% Subscription Revenue Growth Including

Book4Time

Quarter Adjusted EBITDA of $14.7M and

Adjusted EPS of $0.38

Revises Full Fiscal Year Total Revenue

Guidance To $273M, While Reiterating Previous Subscription Growth

Guidance

Agilysys, Inc. (NASDAQ: AGYS), a leading global provider of

hospitality software solutions that deliver High Return

Hospitality, today reported results for its fiscal 2025 third

quarter ending December 31, 2024.

Summary of Fiscal 2025 Third Quarter Financial

Results

- Total net revenue increased 14.9% to a record $69.6 million

compared to total net revenue of $60.6 million in the comparable

prior-year period.

- Recurring revenue (comprised of subscription and maintenance

charges) was a record $44.4 million, or 63.8% of total net revenue,

compared to $35.1 million, or 58.0% of total net revenue, for the

same period in fiscal 2024. Subscription revenue increased 45.1%

year-over-year and was 63.8% of total recurring revenue compared to

55.6% of total recurring revenue in the third quarter of fiscal

2024.

- Gross margin was 63.0% in the fiscal 2025 third quarter

compared to 62.5% in the comparable prior-year period.

- Net income attributable to common shareholders in the fiscal

2025 third quarter was $3.8 million, or $0.14 per diluted share,

compared to $76.9 million, or $2.85 per diluted share, in the

comparable prior-year period. Net income during prior-year fiscal

2024 third quarter included discrete tax events such as a release

of valuation allowances against certain deferred tax assets.

- Adjusted EBITDA (non-GAAP) was $14.7 million compared to $11.8

million in the comparable prior-year period (reconciliation

included in financial tables).

- Adjusted diluted EPS (non-GAAP) was $0.38 per share in the

fiscal 2025 third quarter compared to $0.35 per share in the

comparable prior-year period (reconciliation included in financial

tables).

- Free cash flow (non-GAAP) in the fiscal 2025 third quarter was

$19.7 million compared to free cash flow of $11.3 million in the

fiscal 2024 third quarter (reconciliation included in financial

tables). Ending cash balance was $60.8 million compared to ending

cash balance of $144.9 million as of fiscal 2024 year-end.

Ramesh Srinivasan, President and CEO of Agilysys, commented,

“Subscription revenue continues to grow at a healthy pace and we

are pleased with the integration progress of the Book4Time

acquisition. However, revenue levels, especially one-time product

revenue, continue to be impacted by recent sales challenges with

point-of-sale products, mainly in the managed food services

vertical, caused by our final modernization transition phase.

While we expect fiscal 2025 to end up as a good year for

subscription revenue growth of at least 38%, product revenue

including hardware revenue, will remain challenged. Professional

services revenue has returned to more realistic levels as we have

completed most of the development phase of a large project. We are

therefore revising fiscal 2025 annual total revenue guidance to

$273 million.

"We are confident the overall structural strengths of the

business, increasing competitive advantages and growing product

innovation capabilities will continue to fuel strong growth, which

will accelerate as we move past these short-term transition

challenges," he concluded.

Fiscal 2025 Outlook

The Company revises full year fiscal 2025 total revenue guidance

to approximately $273 million while maintaining at least 38%

year-over-year subscription revenue growth. Adjusted EBITDA is

expected to be 18% of revenue for the full fiscal year.

Dave Wood, Chief Financial Officer, commented, “We are pleased

to report strong subscription revenue growth results for the

quarter. One time revenue remains challenged as we see continued

impacts from our slow point-of-sales bookings during the first half

of the year and wind down the heavy lift of significant development

efforts related to large projects. While we are disappointed with

the short-term headwinds leading to the reduction in our annual

total revenue guidance, we remain confident in the strength of our

product ecosystem and future revenue growth opportunities.”

2025 Third Quarter Conference Call and Webcast

Agilysys is hosting a conference call and webcast today, January

21, 2025, at 4:30 p.m. ET. Both the call and the webcast are open

to the public. Please register at

https://register.vevent.com/register/BId9a48404836f4457a5b8630114e30243

15 minutes prior to the call to receive confirmation and further

instruction in a timely manner. After registration, an email

confirmation with a personalized PIN will be provided along with

further access details.

Interested parties also can access the conference call live on

the Investor Relations page of Agilysys.com under the Events and

Presentations headline. Approximately two hours after the call has

concluded, an archived version of the webcast will be available for

replay at the same location.

Forward-Looking Language

This press release contains “forward-looking statements” within

the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements can be identified by words such as: “anticipate,”

“intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,”

“expect,” “strategy,” “future,” “likely,” “may,” “should,” “will”

and similar references to future periods. Examples of

forward-looking statements include, among others, our revenue,

subscription revenue and Adjusted EBITDA guidance for the 2025

fiscal year and statements made about future revenue growth.

Forward-looking statements are neither historical facts nor

assurances of future performance. Instead, they are based only on

our current beliefs, expectations and assumptions regarding the

future of our business, future plans and strategies, projections,

anticipated events and trends, the economy and other future

conditions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict and many of

which are outside of our control. Our actual results and financial

condition may differ materially from those indicated in the

forward-looking statements. Therefore, you should not rely on any

of these forward-looking statements. Important factors that could

cause our actual results and financial condition to differ

materially from those indicated in the forward-looking statements

include, among others, the impact macroeconomic factors may have on

the overall business environment, our ability to achieve our fiscal

2025 guidance, future revenue growth, the company's ability

maintain sales levels, the Company's ability to integrate Book4Time

and realize future synergies, and the risks described in the

Company’s filings with the Securities and Exchange Commission,

including the Company’s reports on Form 10-K and Form 10-Q.

Additionally, references to "record" financial and business levels

in this document refer only to the time period after Agilysys made

the transformation to an entirely hospitality focused software

solutions company in FY2014.

Any forward-looking statement made by us in this press release

is based only on information currently available to us and speaks

only as of the date on which it is made. We undertake no obligation

to publicly update any forward-looking statement that may be made

from time to time, whether written or oral, whether as a result of

new information, future developments or otherwise.

Use of Non-GAAP Financial Information

To supplement the unaudited consolidated financial statements

presented in accordance with U.S. GAAP in this press release,

certain non-GAAP financial measures as defined by the SEC rules are

used. These non-GAAP financial measures include EBITDA, Adjusted

EBITDA, adjusted net income, adjusted basic earnings per share,

adjusted diluted earnings per share and free cash flow. Management

believes that such information can enhance investors’ understanding

of the Company’s ongoing operations.

The Company has included the following non-GAAP financial

measures in this press release: adjusted net income, adjusted basic

earnings per share and adjusted diluted earnings per share. The

Company believes these non-GAAP financial measures provide valuable

insight into the Company’s overall profitability from core

operations before certain non-cash and non-recurring charges. The

Company defines adjusted net income as net income before

amortization expense (including amortization of developed

technology), share-based compensation, other charges, and legal

settlements, less the related income tax effect of these

adjustments, as applicable, and tax events and defines adjusted

earnings per share as adjusted net income divided by basic and

diluted weighted average shares outstanding.

See the accompanying tables below for the definitions and

reconciliation of these non-GAAP measures to the most closely

related GAAP measures.

About Agilysys

Agilysys exclusively delivers state-of-the-art software

solutions and services that help organizations achieve High Return

Hospitality™ by maximizing Return on Experience (ROE) through

interactions that make ‘personal’ profitable. Customers around the

world use Agilysys Property Management Systems (PMS), Point-of-Sale

(POS) solutions and Food & Beverage Inventory and Procurement

(I&P) systems to consistently delight guests, retain staff and

grow margins. Agilysys’ 100% hospitality customer base includes

branded and independent hotels; multi-amenity resorts; casinos;

property, hotel and resort management companies; cruise lines;

corporate dining providers; higher education campus dining

providers; food service management companies; hospitals; lifestyle

communities; senior living facilities; stadiums; and theme parks.

Agilysys operates across the Americas, Europe, the Middle East,

Africa, Asia-Pacific, and India with headquarters located in

Alpharetta, GA. For more information visit Agilysys.com.

AGILYSYS, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(UNAUDITED)

Three Months Ended December

31,

Nine Months Ended December

31,

(In thousands, except per share

data)

2024

2023

2024

2023

Net revenue:

Products

$

10,677

$

12,678

$

31,077

$

38,100

Subscription and maintenance

44,379

35,107

123,853

101,481

Professional services

14,505

12,781

46,422

35,662

Total net revenue

69,561

60,566

201,352

175,243

Cost of goods sold:

Products

5,550

6,707

15,982

20,023

Subscription and maintenance

9,531

7,371

26,466

22,812

Professional services

10,625

8,664

31,967

26,428

Total cost of goods sold

25,706

22,742

74,415

69,263

Gross profit

43,855

37,824

126,937

105,980

Gross profit margin

63.0

%

62.5

%

63.0

%

60.5

%

Operating expenses:

Product development

14,971

14,551

45,863

42,455

Sales and marketing

9,013

6,137

24,822

19,838

General and administrative

9,536

9,057

30,181

27,207

Depreciation of fixed assets

985

909

2,738

3,042

Amortization of internal-use software and

intangibles

1,622

343

2,777

1,120

Other (gains) charges, net

(12

)

(924

)

2,576

45

Legal settlements

330

—

699

—

Total operating expense

36,445

30,073

109,656

93,707

Operating income

7,410

7,751

17,281

12,273

Other income (expense):

Interest income

416

1,252

3,293

3,580

Interest expense

(657

)

—

(1,116

)

—

Other income (expense), net

574

95

804

(15

)

Income before taxes

7,743

9,098

20,262

15,838

Income tax provision (benefit)

3,913

(68,043

)

962

(67,396

)

Net income

$

3,830

$

77,141

$

19,300

$

83,234

Series A convertible preferred stock

dividends

—

(286

)

—

(1,204

)

Net income attributable to common

shareholders

$

3,830

$

76,855

$

19,300

$

82,030

Weighted average shares outstanding -

basic

27,667

25,808

27,446

25,256

Net income per share - basic:

$

0.14

$

2.98

$

0.70

$

3.25

Weighted average shares outstanding -

diluted

28,314

26,979

28,248

26,463

Net income per share - diluted:

$

0.14

$

2.85

$

0.68

$

3.10

AGILYSYS, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

data)

December 31, 2024

(Unaudited)

March 31, 2024

ASSETS

Current assets:

Cash and cash equivalents

$

60,761

$

144,891

Accounts receivable, net of allowance for

expected credit losses of $937 and $974, respectively

49,275

29,441

Contract assets

4,016

2,287

Inventories

6,360

4,587

Prepaid expenses and other current

assets

10,798

7,731

Total current assets

131,210

188,937

Property and equipment, net

16,872

17,930

Operating lease right-of-use assets

17,017

18,384

Goodwill

128,544

32,791

Intangible assets, net

73,539

16,952

Deferred income taxes, non-current

68,041

67,373

Other non-current assets

8,638

8,063

Total assets

$

443,861

$

350,430

LIABILITIES AND SHAREHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

11,684

$

9,422

Contract liabilities

80,338

56,148

Accrued liabilities

17,497

19,522

Operating lease liabilities, current

5,431

4,279

Total current liabilities

114,950

89,371

Deferred income taxes, non-current

11,540

554

Operating lease liabilities,

non-current

17,469

19,613

Debt, non-current

38,000

—

Other non-current liabilities

5,111

4,415

Commitments and contingencies

Shareholders' equity:

Common shares, without par value, at $0.30

stated value; 80,000,000 shares authorized; 33,342,288 shares

issued; and 27,961,890 and 27,376,862 shares outstanding at

December 31, 2024 and March 31, 2024, respectively

10,003

10,003

Treasury shares, 5,380,398 and 5,965,426

at December 31, 2024 and March 31, 2024, respectively

(1,616

)

(1,791

)

Capital in excess of stated value

105,017

94,680

Retained earnings

157,055

137,755

Accumulated other comprehensive loss

(13,668

)

(4,170

)

Total shareholders' equity

256,791

236,477

Total liabilities and shareholders'

equity

$

443,861

$

350,430

AGILYSYS, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(UNAUDITED)

Nine Months Ended

December 31,

(In thousands)

2024

2023

Operating activities

Net income

$

19,300

$

83,234

Adjustments to reconcile net income to net

cash provided by operating activities:

Loss (gain) on asset disposals

24

(1,145

)

Depreciation of fixed assets

2,738

3,042

Amortization of internal-use software and

intangibles

2,777

1,120

Deferred income taxes

(980

)

(66,506

)

Share-based compensation

12,656

9,489

Changes in operating assets and

liabilities

(8,539

)

(10,855

)

Net cash provided by operating

activities

27,976

18,379

Investing activities

Cash paid for business combination, net of

cash acquired

(144,945

)

—

Capital expenditures

(2,082

)

(7,658

)

Additional investments in corporate-owned

life insurance policies

(27

)

(2

)

Net cash used in investing activities

(147,054

)

(7,660

)

Financing activities

Payment of preferred stock dividends

—

(1,663

)

Debt proceeds, net of issuance costs

49,646

—

Debt repayments

(12,000

)

—

Proceeds from Employee Stock Purchase Plan

purchases

453

—

Repurchase of common shares to satisfy

employee tax withholding

(2,848

)

(5,734

)

Principal payments under long-term

obligations

—

(2

)

Net cash provided by (used in) financing

activities

35,251

(7,399

)

Effect of exchange rate changes on

cash

(303

)

38

Net (decrease) increase in cash and cash

equivalents

(84,130

)

3,358

Cash and cash equivalents at beginning of

period

144,891

112,842

Cash and cash equivalents at end of

period

$

60,761

$

116,200

AGILYSYS, INC.

RECONCILIATION OF NET INCOME

TO EBITDA AND ADJUSTED EBITDA

(UNAUDITED)

Three Months Ended

Nine Months Ended

December 31,

December 31,

(In thousands)

2024

2023

2024

2023

Net income

$

3,830

$

77,141

$

19,300

$

83,234

Income tax provision (benefit)

3,913

(68,043

)

962

(67,396

)

Income before taxes

7,743

9,098

20,262

15,838

Depreciation of fixed assets

985

909

2,738

3,042

Amortization of internal-use software and

intangibles

1,622

343

2,777

1,120

Amortization of developed technology

acquired

163

39

301

119

Interest expense (income), net

241

(1,252

)

(2,177

)

(3,580

)

EBITDA (a)

10,754

9,137

23,901

16,539

Share-based compensation

4,218

3,638

12,656

9,489

Other (gains) charges, net

(12

)

(924

)

2,576

45

Other non-operating (income) expense,

net

(574

)

(95

)

(804

)

15

Legal settlements

330

—

699

—

Adjusted EBITDA (b)

$

14,716

$

11,756

$

39,028

$

26,088

(a) EBITDA, a non-GAAP financial measure, is defined as net

income before income taxes, interest income (net of interest

expense), depreciation and amortization (including amortization of

developed technology)

(b) Adjusted EBITDA, a non-GAAP financial measure, is defined as

net income before income taxes, interest expense (income), net,

depreciation and amortization (including amortization of developed

technology), and excluding charges relating to i) share-based

compensation, ii) other (gains) charges, net, iii) other

non-operating (income) expense, net, and iv) legal settlements

AGILYSYS, INC.

RECONCILIATION OF NET INCOME

TO ADJUSTED NET INCOME FOR ADJUSTED EARNINGS PER SHARE

(UNAUDITED)

Three Months Ended

Nine Months Ended

December 31,

December 31,

(In thousands, except per share

data)

2024

2023

2024

2023

Net income attributable to common

shareholders

$

3,830

$

76,855

$

19,300

$

82,030

Amortization of developed technology

acquired

163

39

301

119

Amortization of internal-use software and

intangibles

1,622

343

2,777

1,120

Share-based compensation

4,218

3,638

12,656

9,489

Other (gains) charges, net

(12

)

(924

)

2,576

45

Legal settlements

330

—

699

—

Tax events (a)

1,964

(69,644

)

(5,965

)

(69,644

)

Income tax adjustments

(1,461

)

(978

)

(3,828

)

(2,610

)

Adjusted net income (b)

$

10,654

$

9,329

$

28,516

$

20,549

Basic weighted average shares

outstanding

27,667

25,808

27,446

25,256

Diluted weighted average shares

outstanding

28,314

26,979

28,248

26,463

Adjusted basic earnings per share

(c)

$

0.39

$

0.36

$

1.04

$

0.81

Adjusted diluted earnings per share

(c)

$

0.38

$

0.35

$

1.01

$

0.78

(a) Tax events include excess tax benefits or expense related to

share-based compensation, release of valuation allowances against

deferred income taxes, and changes in uncertain tax positions

(b) Adjusted net income, a non-GAAP financial measure, is

defined as net income attributable to common shareholders before

amortization expense (including amortization of developed

technology), share-based compensation, other (gains) charges, net,

and legal settlements, less the related income tax effect of these

adjustments, as applicable, at the Company’s current combined

federal and state income statutory tax rate and, as defined under

(a) above, tax events

(c) Adjusted earnings per share, a non-GAAP financial measure,

is defined as adjusted net income divided by basic and diluted

weighted average shares outstanding

AGILYSYS, INC.

RECONCILIATION OF NET CASH

PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW

(UNAUDITED)

Three Months Ended

Nine Months Ended

December 31,

December 31,

(In thousands)

2024

2023

2024

2023

Net cash provided by operating

activities

$

20,288

$

12,909

$

27,976

$

18,379

Capital expenditures

(562

)

(1,656

)

(2,082

)

(7,658

)

Free cash flow (a)

$

19,726

$

11,253

$

25,894

$

10,721

(a) Free cash flow, a non-GAAP financial measure, is defined as

net cash provided by operating activities, less capital

expenditures

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250121556475/en/

Investor Contact: Jessica Hennessy Senior Director

Corporate Strategy & Investor Relations Agilysys, Inc.

770-810-6116 or investorrelations@agilysys.com

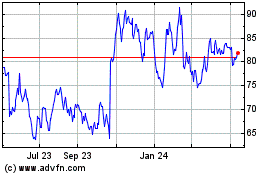

Agilysys (NASDAQ:AGYS)

Historical Stock Chart

From Dec 2024 to Jan 2025

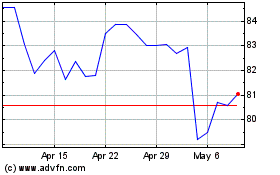

Agilysys (NASDAQ:AGYS)

Historical Stock Chart

From Jan 2024 to Jan 2025