0001387467false00013874672025-02-052025-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________

FORM 8-K

_________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 5, 2025

_________________________________

Alpha and Omega Semiconductor Limited

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Bermuda | | 001-34717 | | 77-0553536 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

Clarendon House

2 Church Street

Hamilton HM 11

Bermuda

(Address of principal registered offices)

(408) 830-9742

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class

| Trading Symbol(s)

| Name of each exchange on which registered

|

| Common Shares | AOSL | The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

The information in Item 2.02 of this Current Report, including the accompanying exhibit, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of Section 18. The information in Item 2.02 of this Current Report shall not be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language contained in such filing.

On February 5, 2025, Alpha and Omega Semiconductor Limited (the “Company”) issued a press release regarding its financial results for the fiscal second quarter of 2025 ended December 31, 2024. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 5, 2025

| | | | | | | | |

| | |

| Alpha and Omega Semiconductor Limited |

| |

| By: | | /s/ Yifan Liang |

| Name: | | Yifan Liang |

| Title: | | Chief Financial Officer and Corporate Secretary |

Exhibit 99.1

Alpha and Omega Semiconductor Reports Financial Results for the Fiscal Second Quarter of 2025 Ended December 31, 2024

SUNNYVALE, California, February 5, 2025 - Alpha and Omega Semiconductor Limited (“AOS”) (NASDAQ: AOSL) today reported financial results for the fiscal second quarter of 2025 ended December 31, 2024.

The results for the fiscal second quarter of 2025 ended December 31, 2024 were as follows:

| | | | | | | | | | | | | | | | | | | | |

| GAAP Financial Comparison |

| Quarterly |

| (in millions, except percentage and per share data) |

| (unaudited) |

| | Three Months Ended |

| | | | | | |

| | December 31,

2024 | | September 30,

2024 | | December 31,

2023 |

| Revenue | | $ | 173.2 | | | $ | 181.9 | | | $ | 165.3 | |

| Gross Margin | | 23.1 | % | | 24.5 | % | | 26.6 | % |

Operating Loss | | $ | (5.9) | | | $ | (0.3) | | | $ | (1.1) | |

Net Loss | | $ | (6.6) | | | $ | (2.5) | | | $ | (2.9) | |

Net Loss Per Share - Diluted | | $ | (0.23) | | | $ | (0.09) | | | $ | (0.10) | |

| | | | | | | | | | | | | | | | | | | | |

| Non-GAAP Financial Comparison |

| Quarterly |

| (in millions, except percentage and per share data) |

| (unaudited) |

| | | | | | |

| | Three Months Ended |

| | December 31, 2024 | | September 30, 2024 | | December 31, 2023 |

| Revenue | | $ | 173.2 | | | $ | 181.9 | | | $ | 165.3 | |

| Non-GAAP Gross Margin | | 24.2 | % | | 25.5 | % | | 28.0 | % |

| Non-GAAP Operating Income | | $ | 3.0 | | | $ | 7.8 | | | $ | 8.4 | |

| Non-GAAP Net Income | | $ | 2.7 | | | $ | 6.4 | | | $ | 7.2 | |

| Non-GAAP Net Income Per Share - Diluted | | $ | 0.09 | | | $ | 0.21 | | | $ | 0.24 | |

The non-GAAP financial measures in the schedule above and under the section “Financial Results for Fiscal Q2 Ended December 31, 2024” below exclude the effect of share-based compensation expenses, amortization of purchased intangible, legal costs related to government investigation, equity method investment loss from equity investee, and income tax effect of non-GAAP adjustments in each of the periods presented. A detailed reconciliation of GAAP and non-GAAP financial measures is included at the end of this press release.

Financial Results for Fiscal Q2 Ended December 31, 2024

•Revenue was $173.2 million, a decrease of 4.8% from the prior quarter and an increase of 4.8% from the same quarter last year.

•GAAP gross margin was 23.1%, down from 24.5% in the prior quarter and down from 26.6% in the same quarter last year.

•Non-GAAP gross margin was 24.2%, down from 25.5% in the prior quarter and down from 28.0% in the same quarter last year.

•GAAP operating expenses were $45.9 million, up from $44.8 million in the prior quarter and up from $45.1 million in the same quarter last year.

•Non-GAAP operating expenses were $39.0 million, up from $38.5 million from last quarter and up from $37.9 million in the same quarter last year.

•GAAP operating loss was $5.9 million, up $0.3 million of operating loss in the prior quarter and up from $1.1 million of operating loss in the same quarter last year.

•Non-GAAP operating income was $3.0 million as compared to $7.8 million of operating income for the prior quarter and $8.4 million of operating income for the same quarter last year.

•GAAP net loss per diluted share was $0.23, compared to $0.09 net loss per share for the prior quarter, and $0.10 net loss per share for the same quarter a year ago.

•Non-GAAP net income per share was $0.09, compared to $0.21 net income per share for the prior quarter and 0.24 net income per share for the same quarter a year ago.

•Consolidated cash flow provided by operating activities was $14.1 million, as compared to $11.0 million of cash flow provided by operating activities in the prior quarter.

•The Company closed the quarter with $182.6 million of cash and cash equivalents.

AOS Chief Executive Officer Stephen Chang commented, “Our fiscal Q2 results were in-line with our revenue and EPS guidance driven by seasonal declines in each of our major segments. We saw strength in Communications and Industrial segments, with notable sequential growth in graphics cards, quick chargers, PC desktops and power tools.”

Mr. Chang concluded, “We expect a typical seasonal decline in the March quarter primarily in markets for battery PCM in smartphones and quick chargers. While visibility is limited for the remainder of calendar year 2025, we are well positioned for growth driven by our strategic focus to “go deeper” with total solutions, expanding our addressable markets and achieving higher BOM content and market share.”

Business Outlook for Fiscal Q3 Ending March 31, 2025

The following statements are based on management’s current expectations. These statements are forward-looking, and actual results may differ materially. AOS undertakes no obligation to update these statements.

Our expectations for the fiscal third quarter of year 2025 are as follows:

•Revenue to be approximately $158 million, plus or minus $10 million.

•GAAP gross margin to be 21.5%, plus or minus 1%. We anticipate non-GAAP gross margin to be 22.5%, plus or minus 1%. The expected quarter-over-quarter decline is largely due to the decrease in license and engineering service revenue and, to a lesser extent, the anticipated increase in manufacturing costs during the Lunar New Year period.

•GAAP operating expenses to be in the range of $46.5 million, plus or minus $1 million. Non-GAAP operating expenses are expected to be in the range of $39.5 million, plus or minus $1 million.

•Interest expense to be approximately equal to interest income, and

•Income tax expense to be in the range of $1.1 million to $1.3 million.

Conference Call and Webcast

AOS plans to hold an investor teleconference and live webcast to discuss the financial results for the fiscal second quarter ended December 31, 2024 today, February 5, 2025 at 2:00 p.m. PT / 5:00 p.m. ET. To listen to the live conference call, please dial +1 (833) 470-1428 or +1 (404) 975-4839 if dialing from outside the United States and Canada. The access code is 034315. A live webcast of the call will also be available in the "Events & Presentations" section of the company’s investor relations website, http://investor.aosmd.com. The webcast replay will be available for seven days after the live call on the same website. In addition, a copy of the script of management’s prepared remarks and a live webcast of the call will also be available in the "Events & Presentations" section of the company’s investor relations website, http://investor.aosmd.com.

Forward-Looking Statements

This press release contains forward-looking statements that are based on current expectations, estimates, forecasts and projections of future performance based on management’s judgment, beliefs, current trends, and anticipated product performance. These forward-looking statements include, without limitation, market trends in the semiconductor industry and growth in calendar year 2025, our ability to outperform market, seasonality of our business, our ability to pursue new opportunities, our projected amount of revenue, gross margin, operating income (loss), income tax expenses, net income (loss), and share-based compensation expenses, non-GAAP gross margin, non-GAAP operating expenses, income tax expenses, our ability to grow our sales and market share, and other information under the section entitled “Business Outlook for Fiscal Q3 Ending March 31, 2025.” Forward-looking statements involve risks and uncertainties that may cause actual results to differ materially from those contained in the forward-looking statements. These factors include, but are not limited to, the state of semiconductor industry and seasonality of our markets; decline of PC markets; our lack of control over the joint venture in China; difficulties and challenges in executing our diversification strategy into different market segments; ordering pattern from distributors and seasonality; changes in regulatory environment and government investigation; our ability to introduce or develop new and enhanced products that achieve market acceptance; government policies on our business operations in China; the actual product performance in volume production; the quality and reliability of our product, our ability to achieve design wins; the general business and economic conditions; our ability to maintain factory utilization at a desirable level; and other risks as described in our SEC filings, including our Annual Report on Form 10-K for the fiscal year ended June 30, 2024 filed by AOS with the SEC and other periodic reports we filed with the SEC. Other unknown or unpredictable factors or underlying assumptions subsequently proving to be incorrect could cause actual results to differ materially from those in the forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance, or achievements. You should not place undue reliance on these forward-looking statements. All information provided in this press release is as of today’s date, unless otherwise stated, and AOS undertakes no duty to update such information, except as required under applicable law.

Use of Non-GAAP Financial Measures

To supplement our unaudited consolidated financial statements presented on a basis consistent with U.S. GAAP, we disclose certain non-GAAP financial measures for our historical performance, including non-GAAP gross profit, gross margin, operating expenses, operating income (loss), net income (loss), diluted earnings per share (“EPS”) and EBITDAS. These supplemental measures exclude, among other items, share-based compensation expenses, legal and professional fees related to government investigation, amortization of purchased intangible, income tax effect of non-GAAP adjustments and equity method investment loss from equity investee. We also disclose certain non-GAAP financial measures in our guidance for the next quarter, including non-GAAP gross margin and operating expenses. We believe that these historical and forecast non-GAAP financial measures provide useful information to both management and investors by excluding certain items and expenses that are not indicative of our core operating results or do not reflect our normal business operations. In addition, our management uses non-GAAP measures to compare our performance relative to forecasts and to benchmark our performance externally against competitors. Our use of non-GAAP financial measures has certain limitations in that such non-GAAP financial measures may not be directly comparable to those reported by other companies. For example, the terms used in this press release, such as non-GAAP net income (loss) or non-GAAP operating expenses, do not have a standardized meaning. Other companies may use the same or similarly named measures, but exclude different items, which may not provide investors with a comparable view of our performance in relation to other companies. In addition, we included the amount of income tax effect of non-GAAP adjustments in the non-GAAP net income (loss) of reconciliation table for all periods presented as the management believes that such non-GAAP presentation provides useful information to investors, even though the amounts are not significant. We seek to compensate for the limitation of our non-GAAP presentation by providing a detailed reconciliation of the non-GAAP financial measures to the most directly comparable U.S. GAAP measures both in the text in this press release and in the tables attached hereto. Investors are encouraged to review the related U.S. GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable U.S. GAAP financial measures.

About Alpha and Omega Semiconductor

Alpha and Omega Semiconductor Limited, or AOS, is a designer, developer, and global supplier of a broad range of discrete power devices, wide band gap power devices, power management ICs, and modules, including a wide portfolio of Power MOSFET, SiC, IGBT, IPM, TVS, HV Gate Drivers, Power IC, and Digital Power products. AOS has developed extensive intellectual property and technical knowledge that encompasses the latest advancements in the power semiconductor industry, which enables us to introduce innovative products to address the increasingly complex power requirements of advanced electronics. AOS differentiates itself by integrating its Discrete and IC semiconductor process technology, product design, and advanced packaging know-how to develop high-performance power management solutions. AOS’ portfolio of products targets high-volume applications, including portable computers, flat-panel TVs, LED lighting, smartphones, battery packs, consumer and industrial motor controls, automotive electronics, and power supplies for TVs, computers, servers, and telecommunications equipment. For more information, please visit www.aosmd.com.

The following unaudited condensed consolidated financial statements are prepared in accordance with U.S. GAAP.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Alpha and Omega Semiconductor Limited |

| Condensed Consolidated Statements of Operations |

| (in thousands, except percentages and per share amounts) |

| (unaudited) |

| | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| | December 31,

2024 | | September 30,

2024 | | December 31,

2023 | | December 31,

2024 | | December 31,

2023 |

| | | | | | | | | |

| Revenue | $ | 173,156 | | | $ | 181,887 | | | $ | 165,285 | | | $ | 355,043 | | | $ | 345,918 | |

| Cost of goods sold | 133,145 | | | 137,361 | | | 121,284 | | | 270,506 | | | 250,992 | |

| Gross profit | 40,011 | | | 44,526 | | | 44,001 | | | 84,537 | | | 94,926 | |

| Gross margin | 23.1 | % | | 24.5 | % | | 26.6 | % | | 23.8 | % | | 27.4 | % |

| | | | | | | | | |

| Operating expenses: | | | | | | | | | |

| Research and development | 23,968 | | | 22,478 | | | 22,919 | | | 46,446 | | | 45,032 | |

| Selling, general and administrative | 21,951 | | | 22,300 | | | 22,216 | | | 44,251 | | | 41,647 | |

| | | | | | | | | |

| Total operating expenses | 45,919 | | | 44,778 | | | 45,135 | | | 90,697 | | | 86,679 | |

| Operating income (loss) | (5,908) | | | (252) | | | (1,134) | | | (6,160) | | | 8,247 | |

| | | | | | | | | |

| Other income (loss), net | 663 | | | (650) | | | (472) | | | 13 | | | (446) | |

| Interest income | 1,135 | | | 1,265 | | | 1,323 | | | 2,400 | | | 2,644 | |

| Interest expenses | (701) | | | (812) | | | (1,049) | | | (1,513) | | | (2,141) | |

| | | | | | | | | |

| | | | | | | | | |

| Net income (loss) before income taxes and loss from equity method investment | (4,811) | | | (449) | | | (1,332) | | | (5,260) | | | 8,304 | |

| | | | | | | | | |

| Income tax expense | 1,242 | | | 1,040 | | | 894 | | | 2,282 | | | 2,032 | |

| Net income (loss) before loss from equity method investment | (6,053) | | | (1,489) | | | (2,226) | | | (7,542) | | | 6,272 | |

| Equity method investment loss from equity investee | (561) | | | (1,007) | | | (697) | | | (1,568) | | | (3,409) | |

| | | | | | | | | |

| | | | | | | | | |

| Net income (loss) | $ | (6,614) | | | $ | (2,496) | | | $ | (2,923) | | | $ | (9,110) | | | $ | 2,863 | |

| | | | | | | | | |

| Net income (loss) per common share | | | | | | | | | |

| Basic | $ | (0.23) | | | $ | (0.09) | | | $ | (0.10) | | | $ | (0.31) | | | $ | 0.10 | |

| Diluted | $ | (0.23) | | | $ | (0.09) | | | $ | (0.10) | | | $ | (0.31) | | | $ | 0.10 | |

| | | | | | | | | |

| Weighted average number of common shares used to compute net income (loss) per share | | | | | | | | | |

| Basic | 29,163 | | | 29,004 | | | 27,939 | | | 29,083 | | | 27,816 | |

| Diluted | 29,163 | | | 29,004 | | | 27,939 | | | 29,083 | | | 29,830 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | |

| Alpha and Omega Semiconductor Limited |

| Condensed Consolidated Balance Sheets |

| (in thousands, except par value per share) |

| (unaudited) |

| | December 31, 2024 | | June 30, 2024 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 182,592 | | | $ | 175,127 | |

| Restricted cash | 206 | | | 413 | |

| Accounts receivable, net | 19,879 | | | 12,546 | |

| | | |

| Inventories | 183,733 | | | 195,750 | |

| Contract assets | 8,451 | | | — | |

| Other current assets | 15,433 | | | 14,165 | |

| Total current assets | 410,294 | | | 398,001 | |

| Property, plant and equipment, net | 317,793 | | | 336,619 | |

| Operating lease right-of-use assets | 23,317 | | | 25,050 | |

| Intangible assets, net | 1,893 | | | 3,516 | |

| | | |

| Equity method investment | 357,941 | | | 356,039 | |

| Deferred income tax assets | 540 | | | 549 | |

| | | |

| Other long-term assets | 22,166 | | | 25,239 | |

| Total assets | $ | 1,133,944 | | | $ | 1,145,013 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 40,816 | | | $ | 45,084 | |

| Accrued liabilities | 71,392 | | | 72,371 | |

Payable related to equity investee, net | 18,137 | | | 13,682 | |

| Income taxes payable | 2,943 | | | 2,798 | |

| Short-term debt | 11,742 | | | 11,635 | |

| Deferred revenue | — | | | 2,591 | |

| Finance lease liabilities | 970 | | | 935 | |

| Operating lease liabilities | 5,032 | | | 5,137 | |

| Total current liabilities | 151,032 | | | 154,233 | |

| Long-term debt | 20,826 | | | 26,724 | |

| Income taxes payable - long-term | 3,724 | | | 3,591 | |

| Deferred income tax liabilities | 26,754 | | | 26,416 | |

| Finance lease liabilities - long-term | 1,787 | | | 2,282 | |

| Operating lease liabilities - long-term | 18,851 | | | 20,499 | |

| Other long-term liabilities | 8,390 | | | 19,661 | |

| Total liabilities | 231,364 | | | 253,406 | |

| Shareholders' Equity: | | | |

| Preferred shares, par value $0.002 per share: | | | |

| Authorized: 10,000 shares; issued and outstanding: none at December 31, 2024 and June 30, 2024 | — | | | — | |

| Common shares, par value $0.002 per share: | | | |

Authorized: 100,000 shares; issued and outstanding:36,367 shares and 29,232 shares, respectively at December 31, 2024 and 36,107 shares and 28,969 shares, respectively at June 30, 2024 | 73 | | | 72 | |

| Treasury shares at cost: 7,135 shares at December 31, 2024 and 7,138 shares at June 30, 2024 | (79,192) | | | (79,213) | |

| Additional paid-in capital | 370,494 | | | 353,109 | |

| Accumulated other comprehensive loss | (10,722) | | | (13,419) | |

| Retained earnings | 621,927 | | | 631,058 | |

| | | |

| | | |

| Total shareholders' equity | 902,580 | | | 891,607 | |

| Total liabilities and shareholders' equity | $ | 1,133,944 | | | $ | 1,145,013 | |

| | | | | | | | | | | |

| Alpha and Omega Semiconductor Limited |

| Selected Cash Flow Information |

| ( in thousands, unaudited) |

| | | |

| Six Months Ended December 31, |

| 2024 | | 2023 |

| Net cash provided by (used in) operating activities | $ | 25,126 | | | $ | (9,628) | |

| Net cash used in investing activities | (14,100) | | | (21,431) | |

| Net cash used in financing activities | (3,732) | | | (2,146) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (36) | | | 80 | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | 7,258 | | | (33,125) | |

| Cash, cash equivalents and restricted cash at beginning of period | 175,540 | | | 195,603 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 182,798 | | | $ | 162,478 | |

| | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Alpha and Omega Semiconductor Limited | |

| Reconciliation of Condensed Consolidated GAAP Financial Measures to Non-GAAP Financial Measures | |

| (in thousands, except percentages and per share data) | |

| (unaudited) | |

| | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended | | | |

| | December 31,

2024 | | September 30,

2024 | | December 31,

2023 | | December 31,

2024 | | December 31,

2023 | | | | | |

| | | | | | | | | | | | | | | |

| GAAP gross profit | | $ | 40,011 | | | $ | 44,526 | | | $ | 44,001 | | | 84,537 | | | $ | 94,926 | | | | | | |

| Share-based compensation | | 1,123 | | | 1,015 | | | 1,504 | | | 2,138 | | | 1,716 | | | | | | |

| Amortization of purchased intangible | | 811 | | | 812 | | | 812 | | | 1,623 | | | 1,624 | | | | | | |

| | | | | | | | | | | | | | | |

| Non-GAAP gross profit | | $ | 41,945 | | | $ | 46,353 | | | $ | 46,317 | | | $ | 88,298 | | | $ | 98,266 | | | | | | |

| Non-GAAP gross margin as a % of revenue | | 24.2 | % | | 25.5 | % | | 28.0 | % | | 24.9 | % | | 28.4 | % | | | | | |

| | | | | | | | | | | | | | | |

| GAAP operating expense | | $ | 45,919 | | | $ | 44,778 | | | $ | 45,135 | | | $ | 90,697 | | | $ | 86,679 | | | | | | |

| Share-based compensation | | 6,827 | | | 5,887 | | | 7,187 | | | 12,714 | | | 7,893 | | | | | | |

| Legal costs related to government investigation | | 114 | | | 347 | | | 16 | | | 461 | | | 68 | | | | | | |

| Non-GAAP operating expense | | $ | 38,978 | | | $ | 38,544 | | | $ | 37,932 | | | $ | 77,522 | | | $ | 78,718 | | | | | | |

| | | | | | | | | | | | | | | |

| GAAP operating income (loss) | | $ | (5,908) | | | $ | (252) | | | $ | (1,134) | | | $ | (6,160) | | | $ | 8,247 | | | | | | |

| Share-based compensation | | 7,950 | | | 6,902 | | | 8,691 | | | 14,852 | | | 9,609 | | | | | | |

| Amortization of purchased intangible | | 811 | | | 812 | | | 812 | | | 1,623 | | | 1,624 | | | | | | |

| | | | | | | | | | | | | | | |

| Legal costs related to government investigation | | 114 | | | 347 | | | 16 | | | 461 | | | 68 | | | | | | |

| | | | | | | | | | | | | | | |

Non-GAAP operating income | | $ | 2,967 | | | $ | 7,809 | | | $ | 8,385 | | | $ | 10,776 | | | $ | 19,548 | | | | | | |

| Non-GAAP operating margin as a % of revenue | | 1.7 | % | | 4.3 | % | | 5.1 | % | | 3.0 | % | | 5.7 | % | | | | | |

| | | | | | | | | | | | | | | |

| GAAP net income (loss) | | $ | (6,614) | | | $ | (2,496) | | | $ | (2,923) | | | $ | (9,110) | | | $ | 2,863 | | | | | | |

| Share-based compensation | | 7,950 | | | 6,902 | | | 8,691 | | | 14,852 | | | 9,609 | | | | | | |

| Amortization of purchased intangible | | 811 | | | 812 | | | 812 | | | 1,623 | | | 1,624 | | | | | | |

| | | | | | | | | | | | | | | |

Equity method investment loss from equity investee | | 561 | | | 1,007 | | | 697 | | | 1,568 | | | 3,409 | | | | | | |

| | | | | | | | | | | | | | | |

| Legal costs related to government investigation | | 114 | | | 347 | | | 16 | | | 461 | | | 68 | | | | | | |

| Income tax effect of non-GAAP adjustments | | (83) | | | (151) | | | (96) | | | (234) | | | (502) | | | | | | |

Non-GAAP net income | | $ | 2,739 | | | $ | 6,421 | | | $ | 7,197 | | | $ | 9,160 | | | $ | 17,071 | | | | | | |

| Non-GAAP net margin as a % of revenue | | 1.6 | % | | 3.5 | % | | 4.4 | % | | 2.6 | % | | 4.9 | % | | | | | |

| | | | | | | | | | | | | | | |

| GAAP net income (loss) | | $ | (6,614) | | | $ | (2,496) | | | $ | (2,923) | | | $ | (9,110) | | | $ | 2,863 | | | | | | |

| Share-based compensation | | 7,950 | | | 6,902 | | | 8,691 | | | 14,852 | | | 9,609 | | | | | | |

| Amortization and depreciation | | 14,128 | | | 14,562 | | | 13,573 | | | 28,690 | | | 26,524 | | | | | | |

| | | | | | | | | | | | | | | |

Equity method investment loss from equity investee | | 561 | | | 1,007 | | | 697 | | | 1,568 | | | 3,409 | | | | | | |

Interest income | | (1,135) | | | (1,265) | | | (1,323) | | | (2,400) | | | (2,644) | | | | | | |

| Interest expenses | | 701 | | | 812 | | | 1,049 | | | 1,513 | | | 2,141 | | | | | | |

| Income tax expense | | 1,242 | | | 1,040 | | | 894 | | | 2,282 | | | 2,032 | | | | | | |

| EBITDAS | | $ | 16,833 | | | $ | 20,562 | | | $ | 20,658 | | | $ | 37,395 | | | $ | 43,934 | | | | | | |

| | | | | | | | | | | | | | | |

| GAAP diluted net income (loss) per share | | $ | (0.21) | | | $ | (0.08) | | | $ | (0.10) | | | $ | (0.29) | | | $ | 0.10 | | | | | | |

| Share-based compensation | | 0.25 | | | 0.22 | | | 0.29 | | | 0.47 | | | 0.32 | | | | | | |

| Amortization of purchased intangible | | 0.03 | | | 0.03 | | | 0.03 | | | 0.05 | | | 0.05 | | | | | | |

| | | | | | | | | | | | | | | |

Equity method investment loss from equity investee | | 0.02 | | | 0.03 | | | 0.02 | | | 0.05 | | | 0.11 | | | | | | |

| | | | | | | | | | | | | | | |

| Legal costs related to government investigation | | 0.00 | | | 0.01 | | | 0.00 | | | 0.02 | | | 0.00 | | | | | | |

| | | | | | | | | | | | | | | |

| Income tax effect of non-GAAP adjustments | | (0.00) | | | (0.00) | | | (0.00) | | | (0.01) | | | (0.01) | | | | | | |

Non-GAAP diluted net income per share | | $ | 0.09 | | | $ | 0.21 | | | $ | 0.24 | | | $ | 0.29 | | | $ | 0.57 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Weighted average number of common shares used to compute GAAP diluted net income (loss) per share | | 29,163 | | | 29,004 | | | 27,939 | | | 29,083 | | | 29,830 | | | | | | |

Weighted average number of common shares used to compute Non-GAAP diluted net income per share | | 31,411 | | | 31,169 | | | 29,874 | | | 31,290 | | | 29,830 | | | | | | |

| | | | | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Investor and media inquiries:

The Blueshirt Group

Gary Dvorchak, CFA

In US +1 323 240 5796

In China +86 (138) 1079-1480

gary@blueshirtgroup.co

The Blueshirt Group

Steven Pelayo

+1 (360) 808-5154

steven@blueshirtgroup.co

Exhibit 99.2

Alpha and Omega Semiconductor Limited

Prepared Remarks for the Investor Conference Call

for the Quarter Ended December 31, 2024

February 5, 2025

Steven Pelayo

Good afternoon, everyone, and welcome to Alpha and Omega Semiconductor’s conference call to discuss fiscal 2025 second quarter financial results. I am Steven Pelayo, Investor Relations representative for AOS. With me today are Stephen Chang, our CEO, and Yifan Liang, our CFO. This call is being recorded and broadcast live over the Web. A replay will be available for seven days following the call via the link in the Investor Relations section of our website.

Our call will proceed as follows today. Stephen will begin business updates including strategic highlights, and a detailed segment report. After that, Yifan will review the financial results and provide guidance for the March quarter. Finally, we will have the Q&A session.

The earnings release was distributed over wire today, February 5, 2025, after the market close. The release is also posted on the company's website. Our earnings release and this presentation include non-GAAP financial measures. We use non-GAAP measures because we believe they provide useful information about our operating performance that should be considered by investors in conjunction with the GAAP measures. A reconciliation of these non-GAAP measures to comparable GAAP measures is included in the earnings release.

We remind you that during this conference call, we will make certain forward-looking statements, including discussions of the business outlook and financial projections. These forward-looking statements are based on management's current expectations and involve risks and uncertainties that could cause our actual results to differ materially. For a more detailed description of these risks and uncertainties, please refer to our recent and subsequent filings with the SEC. We assume no obligations to update the information provided in today's call.

Now, I will turn the call over to our CEO, Stephen Chang. Stephen?

Stephen Chang

Thank you, Steven. Welcome to Alpha and Omega’s fiscal Q2 earnings call. I will begin with a high-level overview of our results and then jump into segment details.

We delivered fiscal Q2 revenue and EPS results in-line with our guidance. Revenue was $173.2 million, non-GAAP gross margin was 24.2%. Non-GAAP EPS was $0.09.

While we saw seasonal sequential declines in fiscal Q2 from each of our major segments, the Communications and Industrial segments outperformed our initial forecasts, and we saw sequential growth in graphics cards, quick chargers, PC desktops and power tools. These increases were offset by seasonal declines in gaming, notebooks, tablets and wearables.

With the December quarter now complete, we can reflect on our performance in calendar 2024 where AOS revenue increased 4.1% year-over-year. While this modest overall growth might not seem overwhelming, the recovery in our segments suggests the inventory correction is clearly behind us. Further, a closer examination by segment validates AOS's strategic shift from a component supplier to a total solutions provider. This transition is enabling us to tap into new opportunities, gain market share, and increase BOM content.

Most notably,

•Our Computing and Communication segments each grew more than 25% in calendar 2024 driven by market share gains and BOM content growth in motherboards, A.I., graphics cards, and tablets. In smartphones, our battery PCM product line contributed the largest incremental dollar growth to the company in calendar year 2024. We now believe AOS is the industry leader in smartphone battery PCM.

•We also saw strong growth in wearables and e-mobility in calendar 2024, further proving our ability to build on existing customer relationships, while broadening into new and adjacent markets.

•The primary headwinds to calendar 2024 growth were mostly concentrated in gaming and quick chargers, yet both markets have now digested excess inventories and returned to growth in the past few quarters.

As we look ahead, we are delivering on our commitments and advancing our transformation from a component supplier to a total solutions provider. Our strategic focus is to “go deeper” by leveraging strengths in high-performance silicon, packaging, and intelligent ICs. Our goal is to leverage premier customer relationships to expand market share and increase BOM content with a broader portfolio.

With that, let me now cover our segment results and provide some guidance by segment for the next quarter.

Starting with Computing. December quarter revenue was up 6.0% year-over-year, but down slightly (-0.5%) sequentially and represented 43.9% of total revenue. These results were better than typical seasonality, but slightly worse than our original expectation for slight sequential growth. We saw relative strength from PC desktops and graphics cards offset by the seasonal decline in notebooks and tablets. Servers and A.I.-accelerator cards were also softer as the industry prepares for the next platform transition.

We continue to see a good opportunity in advanced computing and we are encouraged by the progress we have made thus far. Within A.I. for large data centers, we are a contender in the middle stages of the design-in phase and we see potential for these products to contribute to revenue in the middle of the calendar year. On graphics cards, the next generation platform is ramping up to mass production. With this new platform, we expect BOM content to increase as more power stage ICs, paired with our controller, are being used to power the GPU.

Looking forward into the March quarter, the Computing segment will likely decline due to seasonality, however the PC market is expected to be flat as tariff uncertainty is leading to demand pull-in with PC makers.

Turning to the Consumer segment, December quarter revenue was down 3.9% year-over-year and down 28.8% sequentially and represented 13.0% of total revenue. The results were in-line with our forecast driven by seasonality in gaming and home appliances, as well as a pullback in wearables following a record level achieved in the third calendar quarter. As a reminder, we don’t expect gaming to return to meaningful growth until the customer transitions to the next platform.

For the March quarter, we forecast a low single digit sequential decline in the consumer segment driven by continued seasonality in gaming, TVs, and softness in home appliances.

Next, let’s discuss the Communications segment, revenue in the December quarter was up 14.5% year-over-year, but down 6.4% sequentially, and represented 19.2% of total revenue. These results were above our initial expectations for a double-digit sequential decline as broad-based demand from our Tier 1 U.S. smartphone customer and China OEMs moderated only slightly, while Korea saw an increase in preparation for product launches in the first calendar quarter. We believe the better-than-expected results are due to combination of market share gains, a mix-shift to higher end phones in China, and generally higher charging currents driving increased BOM content.

Looking ahead, we anticipate a low teens sequential decline in the March quarter for the Communications segment mostly due to seasonality.

Now, let’s talk about our last segment, Power Supply and Industrial, which accounted for 20.2% of total revenue and was flat year-over-year and up 9.6% sequentially. The results were ahead of our forecast for low single digit sequential growth driven by seasonal strength in quick chargers, as well as an increase in power tools. Demand also held relatively steady quarter-over-quarter in AC-DC power supplies and e-mobility. As we stated before, we see additional opportunities in 2025 for quick chargers due to increased BOM content driven by higher charging currents. Further, we are leveraging relationships in Taiwan to partner on DC fans for server racks.

For the March quarter, we expect a low teens sequential decline for the Power Supply and Industrial segment primarily driven by seasonal decline in quick chargers. This decline will be partially offset by some sequential growth in e-mobility and AC-DC power supplies.

In closing, December quarter revenue was slightly ahead of our expectations, while gross margin was a bit softer. The continued year-over-year revenue growth confirms the inventory corrections we experienced over the past year are complete. Seasonality has returned and new markets like A.I. and advanced computing are emerging.

As we look ahead to 2025, visibility remains limited, and the first quarter is typically affected by seasonal softness. The subdued market environment will likely pressure pricing and the wind down of licensing and engineering revenue will further impact gross margin. We expect both revenue and margin to recover beyond the March quarter with incremental growth likely from smartphones, graphic cards and A.I.

AOS is well-positioned for growth, supported by our advanced technology, broad product range, and a premier customer base across various industries. Strategic initiatives over the past few years are yielding results, with successful design integration of controllers and power stages into PCs, graphics cards, and AI applications. We are poised to accelerate this expansion, capturing new opportunities and increasing our BOM content.

Power management remains at the core of major industry trends, including AI, digitalization, connectivity, and electrification—critical to achieving a low-carbon, sustainable future. We anticipate continued growth driven by advanced computing and data centers, AI integration in PCs and smartphones, and higher charging currents in smartphones. Beyond Computing and Communication, we see many opportunities in solar, motors and e-mobility, gaming, home appliances, and power tools.

With that, I will now turn the call over to Yifan for a discussion of our fiscal second quarter financial results and our outlook for the next quarter. Yifan?

Yifan Liang (Chief Financial Officer)

Thank you, Stephen. Good afternoon, everyone and thank you for joining us.

Revenue for the quarter was $173.2 million, down 4.8% sequentially and up 4.8% year-over-year.

In terms of product mix, DMOS revenue was $113.0 million, down 7.8% sequentially and up 3.8% over last year. Power IC revenue was $53.7 million, up 1.5% from the prior quarter and 6.8% from a year ago.

Assembly service and other revenue was $1.1 million, as compared to $0.9 million last quarter and $0.7 million for the same quarter last year. License and engineering service revenue was $5.4 million for the quarter versus $5.6 million in the prior quarter and $5.5 million for the same quarter a year ago. The license and engineering service revenue will end in the mid-February after the 24-month contract expires.

Non-GAAP gross margin was 24.2%, compared to 25.5% last quarter and 28.0% a year ago. The quarter-over-quarter decrease was mainly impacted by ASP erosion and mix changes.

Non-GAAP operating expenses were $39.0 million, compared to $38.5 million for the prior quarter and $37.9 million last year. The slight quarter-over-quarter increase was primarily due to higher R&D expenses.

Non-GAAP quarterly EPS was $0.09, compared to $0.21 per share last quarter and $0.24 per share a year ago.

Moving on to cash flow. Operating cash flow was $14.1 million, including $5.0 million of repayment of customer deposits. By comparison, operating cash flow was $11.0 million in the prior quarter and negative $23.5 million last year. We expect to refund $11.1 million customer deposits in the March quarter. EBITDAS for the quarter was $16.8 million, compared to $20.6 million last quarter and $20.7 million for the same quarter a year ago.

Now let me turn to our balance sheet.

We completed the December quarter with a cash balance of $182.6 million, compared to $176.0 million at the end of last quarter.

Net trade receivables decreased by $4.7 million sequentially. Days Sales Outstanding were 12 days for the quarter, compared to 15 days for the prior quarter.

Net inventory decreased by $1.2 million quarter-over-quarter. Average days in inventory remained at 125 days for the quarter.

CapEx for the quarter was $7.4 million, compared to $6.7 million for the prior quarter. We expect CapEx for the March quarter to range from $7.0 million to $9.0 million.

Now, I would like to discuss March quarter guidance.

We expect:

•Revenue to be approximately $158.0 million, plus or minus $10.0 million.

•GAAP gross margin to be 21.5%, plus or minus 1%. We anticipate non-GAAP gross margin to be 22.5%, plus or minus 1%. The expected quarter-over-quarter decline is largely due to the decrease in license and engineering service revenue and, to a lesser extent, the anticipated increase in manufacturing costs during the Lunar New Year period.

•GAAP operating expenses to be $46.5 million, plus or minus $1.0 million. Non-GAAP operating expenses are expected to be $39.5 million, plus or minus $1.0 million.

•Interest expense to be approximately equal to interest income, and

•Income tax expense to be in the range of $1.1 million to $1.3 million.

With that, we will now open the call for questions. Operator, please start the Q&A session.

Closing:

This concludes our earnings call today. Thank you for your interest in AOS and we look forward to talking to you again next quarter.

Special Notes Regarding Forward Looking Statements

This script contains forward-looking statements that are based on current expectations, estimates, forecasts and projections of future performance based on management's judgment, beliefs, current trends, and anticipated product performance. These forward looking statements include, without limitation, statements relating to projected amount of revenues, gross margin, operating expenses, operating income, tax expenses, net income, noncontrolling interest and share-based compensation expenses, expected financial performance of market segments; our ability to capture market shares and increase BOM content; expected seasonality; business opportunities in A.I. and data centers; our ability and strategy to develop new products; fluctuation in customer demand and market segments; and other information regarding the future development of our business. Forward looking statements involve risks and uncertainties that may cause actual results to differ materially from those contained in the forward-looking statements. These factors include, but are not limited to, the state of semiconductor industry and seasonality of our markets; decline of the PC industry and our ability to respond to such decline; difficulties and challenges in executing our diversification strategy into different market segments; ordering pattern and seasonality; our ability to introduce or develop new and enhanced products that achieve market acceptance; the actual product performance in volume production, the quality and reliability of our product, our ability to achieve design wins, the general business and economic conditions, our ability to maintain factory utilization at a desirable level; and other risks as described in our SEC filings, including our Annual Report on Form 10-K for the fiscal year ended June 30, 2024 and other periodic reports filed by AOS. Other unknown or unpredictable factors or underlying assumptions subsequently proving to be incorrect could cause actual results to differ materially from those in the forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance, or achievements. You should not place undue reliance on these forward-looking statements. All information provided in this press release is as of today's date, unless otherwise stated, and AOS undertakes no duty to update such information, except as required under applicable law.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

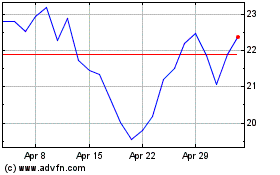

Alpha and Omega Semicond... (NASDAQ:AOSL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Alpha and Omega Semicond... (NASDAQ:AOSL)

Historical Stock Chart

From Feb 2024 to Feb 2025