Shareholder Alert: Bernstein Litowitz Berger & Grossmann LLP Announces the Filing of Securities Class Action Lawsuit Against ASML Holding N.V.

15 November 2024 - 8:52AM

Business Wire

Today, prominent investor rights law firm Bernstein Litowitz

Berger & Grossmann LLP (“BLB&G”) filed a class action in

the U.S. District Court for the Southern District of New York

alleging violations of the federal securities laws by ASML Holding

N.V. (“ASML” or the “Company”) and certain of the Company’s current

and former senior executives (collectively, “Defendants”). The

action is brought on behalf of all persons or entities that

purchased ASML ordinary shares on the Nasdaq Stock Market (the

“Nasdaq”) between January 24, 2024, and October 15, 2024, inclusive

(the “Class Period”).

BLB&G filed this action on behalf of City of Hollywood

Firefighters’ Pension Fund, and the case is captioned City of

Hollywood Firefighters’ Pension Fund v. ASML Holding N.V., No.

24-cv-8664 (S.D.N.Y.). The complaint is based on an extensive

investigation and a careful evaluation of the merits of this case.

A copy of the complaint is available on BLB&G’s website by

clicking here.

ASML’s Alleged Fraud

Based in The Netherlands, ASML is one of the world’s leading

manufacturers of photolithography machinery that is an essential

component in the fabrication of semiconductor chips. These

machines, which the Company sells to chip manufacturers around the

world, use powerful lasers to create the tiny integrated circuitry

embedded on computer chips.

In November 2022, ASML provided three-year financial guidance,

telling investors that by 2025 the Company would generate sales

between €30 billion and €40 billion, and a gross margin between 54%

and 56%. In March 2023, the Dutch government announced plans to

implement new regulations restricting the export of certain

semiconductor technology. These restrictions, which became

effective in September 2023, further limited the number and types

of machines that ASML could ship to customers in China, an

important growth market for the Company. Following the announcement

of these new regulations, ASML benefitted from strong demand from

customers in China as chipmakers rushed to order the Company’s

products before the export restrictions became effective. This

surge in demand from customers in China helped offset the effects

on ASML from a downturn in the semiconductor industry in 2023.

The complaint alleges that, throughout the Class Period,

Defendants made numerous material misrepresentations and omissions

regarding ASML’s growth prospects and the strength of demand for

its chip-building machinery, as well as the expected impact of new

regulations restricting the export of chip-making technology.

Specifically, Defendants repeatedly reiterated ASML’s optimistic

financial targets for 2025, and claimed that the Company was poised

to deliver on those targets due to an expected strong year in 2025

driven by several factors, including the increased proliferation of

artificial intelligence and a significant number of new

semiconductor chip manufacturing plants being built around the

world. The Company also downplayed concerns about the impact that

tighter export regulations would have on ASML’s business, with

ASML’s Chief Financial Officer assuring investors: “one thing is

for sure, China will remain very strong in our numbers also in

2024.” As a result of these misrepresentations, ASML ordinary

shares traded at artificially inflated prices during the Class

Period.

The truth began to emerge on October 15, 2024, when ASML

announced financial results for the third quarter of 2024, a day

earlier than previously scheduled, purportedly due to a “technical

error.” ASML disclosed net bookings of just €2.6 billion,

representing a 53% decline from the €5.6 billion in bookings during

the prior quarter and missing analysts’ estimates by €3 billion. As

a result, ASML cut its 2025 guidance. The Company now expected 2025

net sales to between €30 billion and €35 billion, at the bottom

half of its previous range of €30 billion to €40 billion. ASML also

reduced its gross margin target to between 51% and 53%, down from

its prior guidance of 54% to 56%.

During ASML’s earnings call the next day, the Company disclosed

that its “relatively low order intake is a reflection of the slow

recovery” of the semiconductor industry, which will “extend well

into 2025.” ASML also revealed that its sales in China had declined

to “a more normalized” level, expecting China sales to be around

20% of the Company’s total revenue in 2025 and implying a

significant decline compared to the prior year. ASML further

disclosed that the decline in sales of its products to customers in

China would negatively impact the Company’s gross margins. As a

result of these disclosures, the price of Nasdaq-traded ASML

ordinary shares declined by $188.75 per share, or 21.6%, from a

closing price of $872.27 per share on October 14, 2024, to a

closing price of $683.52 per share on October 16, 2024.

If you wish to serve as Lead Plaintiff for the Class, you must

file a motion with the court no later than January 13, 2025, which

is the first business day on which the U.S. District Court for the

Southern District of New York is open that is 60 days after the

publication date of November 14, 2024. Any member of the proposed

Class may seek to serve as Lead Plaintiff through counsel of their

choice, or may choose to do nothing and remain a member of the

proposed Class.

If you wish to discuss this action or have any questions

concerning this notice or your rights or interests, please contact

Scott R. Foglietta of BLB&G at 212-554-1903, or via e-mail at

scott.foglietta@blbglaw.com.

About BLB&G

BLB&G is widely recognized worldwide as a leading law firm

advising institutional investors on issues related to corporate

governance, shareholder rights, and securities litigation. Since

its founding in 1983, BLB&G has built an international

reputation for excellence and integrity and pioneered the use of

the litigation process to achieve precedent-setting governance

reforms. Unique among its peers, BLB&G has obtained several of

the largest and most significant securities recoveries in history,

recovering over $40 billion on behalf of defrauded investors. More

information about the firm can be found online at

www.blbglaw.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114599978/en/

Scott R. Foglietta Bernstein Litowitz Berger & Grossmann LLP

1251 Avenue of the Americas, 44th Floor New York, New York 10020

(212) 554-1903 scott.foglietta@blbglaw.com

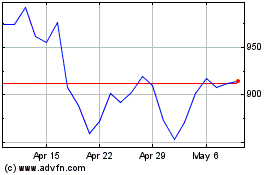

ASML Holding NV (NASDAQ:ASML)

Historical Stock Chart

From Nov 2024 to Dec 2024

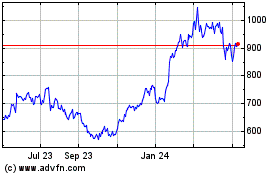

ASML Holding NV (NASDAQ:ASML)

Historical Stock Chart

From Dec 2023 to Dec 2024