0001323885False00013238852024-10-292024-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) of the

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 29, 2024

AtriCure, Inc.

(Exact name of registrant as specified in charter)

| | | | | | | | |

Delaware | 000-51470 | 34-1940305 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

7555 Innovation Way, Mason OH 45040

(Address of Principal Executive Offices, and Zip Code)

(513) 755-4100

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $.001 par value | ATRC | NASDAQ Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On October 29, 2024, AtriCure, Inc. issued a press release regarding its financial results for the third quarter ended September 30, 2024. The Company will hold a conference call on October 29, 2024 at 4:30 p.m. Eastern Time to discuss the financial results. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference.

The information in Item 2.02 of Form 8-K and in the press release attached as Exhibit 99.1 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in each of Item 2.02 of this Form 8-K and Exhibit 99.1 shall not be incorporated by reference in any filing or other document under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in any such filing or document.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

| No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File--the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | ATRICURE, INC. |

| | | |

| Dated: | October 29, 2024 | By: | /s/ Angela L. Wirick |

| | | Angela L. Wirick |

| | | Chief Financial Officer |

For immediate release

October 29, 2024

AtriCure Reports Third Quarter 2024 Financial Results

•Worldwide revenue of $115.9 million – an increase of 17.9% year over year

•U.S. revenue of $95.5 million – an increase of 16.8% year over year

•Achieved 20% growth on revenues from open appendage management devices in the U.S.

•International revenue of $20.5 million – an increase of 23.3% year over year

•Positive cash flow generation of $16.3 million in third quarter 2024

MASON, Ohio, October 29, 2024 – AtriCure, Inc. (Nasdaq: ATRC), a leading innovator in surgical treatments and therapies for atrial fibrillation (Afib), left atrial appendage (LAA) management and post-operative pain management, today announced third quarter 2024 financial results.

“Our broad-based growth in the third quarter reflects strong, ongoing adoption trends throughout our business,” said Michael Carrel, President and Chief Executive Officer at AtriCure. “During the quarter, we launched several new products in the United States and Europe, leading to an acceleration in growth along with continued improvement in profitability and positive cash flow generation. Our results are a testament to our commitment to expand access to our innovative solutions for patients and providers worldwide.”

Third Quarter 2024 Financial Results

Revenue for the third quarter 2024 was $115.9 million, an increase of 17.9% over third quarter 2023 revenue (17.8% on a constant currency basis), reflecting continued adoption of our products by physicians globally for the treatment of patients with Afib, LAA management and post-operative pain management. On a sequential basis, worldwide revenue for the third quarter 2024 decreased approximately 0.3% from the second quarter 2024 due to normal seasonality of procedures in summer months.

U.S. revenue was $95.5 million, an increase of $13.8 million or 16.8%, compared to the third quarter 2023. U.S. revenue growth was driven by sales across key product lines, including the ENCOMPASS® clamp in open ablation, AtriClip® Flex·V® device in appendage management and cryoSPHERE® probes for post-operative pain management. International revenue increased $3.9 million or 23.3% (22.4% on a constant currency basis) to $20.5 million, realizing significant growth across all franchises in Europe and most of our other major geographic regions.

Gross profit for the third quarter 2024 was $86.8 million compared to $73.9 million for the third quarter 2023. Gross margin was 74.9% for the third quarter 2024, a decrease of 27 basis points from the third quarter 2023, reflecting less favorable geographic and product mix. Loss from operations for the third quarter 2024 was $7.4 million, compared to $8.1 million for the third quarter 2023. Basic and diluted net loss per share was $0.17 for the third quarter 2024, compared to $0.20 for the third quarter 2023.

Adjusted EBITDA for the third quarter 2024 is $7.9 million, an increase of $3.2 million from third quarter of 2023. Adjusted loss per share for the third quarter 2024 was $0.17, compared to $0.20 for the third quarter 2023.

Constant currency revenue, adjusted EBITDA and adjusted loss per share are non-GAAP financial measures. We discuss these non-GAAP financial measures and provide reconciliations to GAAP measures later in this release.

2024 Financial Guidance

AtriCure now expects full year 2024 revenue of approximately $459 million to $462 million, reflecting growth of approximately 15% to 16%. Management continues to expect full year 2024 Adjusted EBITDA of approximately $26 million to $29 million, with improvements annually thereafter. Projected full year 2024 adjusted EBITDA represents a 34% to 49% increase over full year 2023. Full year 2024 adjusted loss per share is expected to be in the range of $0.74 to $0.80.

Conference Call

AtriCure will host a conference call at 4:30 p.m. Eastern Time on Tuesday, October 29, 2024 to discuss third quarter 2024 financial results. To access the webcast, please visit the Investors page of AtriCure’s corporate website at https://ir.atricure.com/events-and-presentations/events. Participants are encouraged to register more than 15 minutes before the webcast start time. A replay of the presentation will be available for 90 days following the presentation.

About AtriCure

AtriCure, Inc. provides innovative technologies for the treatment of Afib and related conditions. Afib affects more than 37 million people worldwide. Electrophysiologists, cardiothoracic and thoracic surgeons around the globe use AtriCure technologies for the treatment of Afib, reduction of Afib related complications, and post-operative pain management. AtriCure’s Isolator® Synergy™ Ablation System is the first medical device to receive FDA approval for the treatment of persistent Afib. AtriCure’s AtriClip® Left Atrial Appendage Exclusion System products are the most widely sold LAA management devices worldwide. AtriCure’s Hybrid AF™ Therapy is a minimally invasive procedure that provides a lasting solution for long-standing persistent Afib patients. AtriCure’s cryoICE cryoSPHERE® probes are cleared for temporary ablation of peripheral nerves to block pain, providing pain relief in cardiac and thoracic procedures. For more information, visit AtriCure.com or follow us on X (formerly known as Twitter) @AtriCure.

Forward-Looking Statements

This press release contains “forward-looking statements”– that is, statements related to future events that by their nature address matters that are uncertain. This press release also includes forward-looking projected financial information that is based on current estimates and forecasts. Actual results could differ materially. For details on the uncertainties that may cause our actual results to be materially different than those expressed in our forward-looking statements, visit http://www.atricure.com/forward-looking-statements as well as our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q which contain risk factors. Except where otherwise noted, the information contained in this release is as of October 29, 2024. We assume no obligation to update any forward-looking statements contained in this release as a result of new information or future events or developments, except as may be required by law.

Use of Non-GAAP Financial Measures

To supplement AtriCure’s condensed consolidated financial statements prepared in accordance with accounting principles generally accepted in the United States of America, or GAAP, AtriCure provides certain non-GAAP financial measures in this release as supplemental financial metrics.

Revenue reported on a constant currency basis is a non-GAAP measure, calculated by applying previous period foreign currency exchange rates to each of the comparable periods. Management analyzes revenue on a constant currency basis to better measure the comparability of results between periods. Because changes in foreign currency exchange rates have a non-operating impact on revenue, the Company believes that evaluating growth in revenue on a constant currency basis provides an additional and meaningful assessment of revenue to both management and investors.

Adjusted EBITDA is calculated as net income (loss) before other income/expense (including interest), income tax expense, depreciation and amortization expense, share-based compensation expense, acquisition costs, legal settlement costs, impairment of intangible assets and change in fair value of contingent consideration liabilities. Management believes in order to properly understand short-term and long-term financial trends, investors may wish to consider the impact of these excluded items in addition to GAAP measures. The excluded items vary in frequency and/or impact on our continuing results of operations and management believes that the excluded items are typically not reflective of our ongoing core business operations and financial condition. Further, management uses adjusted EBITDA for both strategic and annual operating planning. A reconciliation of adjusted EBITDA reported in this release to the most comparable GAAP measure for the respective periods appears in the table captioned “Reconciliation of Non-GAAP Adjusted Income (Adjusted EBITDA)” later in this release.

Adjusted loss per share is a non-GAAP measure which calculates the net loss per share before non-cash adjustments in fair value of contingent consideration liabilities, impairment of intangible assets, debt extinguishment and legal settlements. A reconciliation of adjusted loss per share reported in this release to the most comparable GAAP measure for the respective periods appears in the table captioned “Reconciliation of Non-GAAP Adjusted Loss Per Share” later in this release.

The non-GAAP financial measures used by AtriCure may not be the same or calculated in the same manner as those used and calculated by other companies. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for AtriCure’s financial results prepared and reported in accordance with GAAP. We urge

investors to review the reconciliation of these non-GAAP financial measures to the comparable GAAP financials measures included in this press release, and not to rely on any single financial measure to evaluate our business.

CONTACTS:

Angie Wirick

AtriCure, Inc.

Chief Financial Officer

(513) 755-5334

awirick@atricure.com

Marissa Bych

Gilmartin Group

Investor Relations

(415) 937-5402

marissa@gilmartinir.com

ATRICURE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In Thousands, Except Per Share Amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| United States Revenue: | | | | | | | |

| Open ablation | $ | 30,601 | | | $ | 25,844 | | | $ | 90,661 | | | $ | 77,988 | |

| Minimally invasive ablation | 11,117 | | | 10,893 | | | 35,263 | | | 31,900 | |

| Pain management | 16,314 | | | 12,591 | | | 44,059 | | | 36,249 | |

| Total ablation | 58,032 | | | 49,328 | | | 169,983 | | | 146,137 | |

| Appendage management | 37,420 | | | 32,364 | | | 111,257 | | | 98,647 | |

| Total United States | 95,452 | | | 81,692 | | | 281,240 | | | 244,784 | |

| International Revenue: | | | | | | | |

| Open ablation | 8,607 | | | 8,007 | | | 25,679 | | | 23,015 | |

| Minimally invasive ablation | 1,681 | | | 1,578 | | | 5,559 | | | 4,820 | |

| Pain management | 1,590 | | | 547 | | | 3,768 | | | 1,214 | |

| Total ablation | 11,878 | | | 10,132 | | | 35,006 | | | 29,049 | |

| Appendage management | 8,580 | | | 6,466 | | | 24,784 | | | 18,869 | |

| Total International | 20,458 | | | 16,598 | | | 59,790 | | | 47,918 | |

| Total revenue | 115,910 | | | 98,290 | | | 341,030 | | | 292,702 | |

| Cost of revenue | 29,117 | | | 24,421 | | | 86,125 | | | 72,147 | |

| Gross profit | 86,793 | | | 73,869 | | | 254,905 | | | 220,555 | |

| Operating expenses: | | | | | | | |

| Research and development expenses | 20,960 | | | 20,354 | | | 61,221 | | | 53,119 | |

| Selling, general and administrative expenses | 73,238 | | | 61,604 | | | 219,174 | | | 185,451 | |

| Total operating expenses | 94,198 | | | 81,958 | | | 280,395 | | | 238,570 | |

| Loss from operations | (7,405) | | | (8,089) | | | (25,490) | | | (18,015) | |

| Other expense, net | (126) | | | (919) | | | (2,882) | | | (2,416) | |

| Loss before income tax expense | (7,531) | | | (9,008) | | | (28,372) | | | (20,431) | |

| Income tax expense | 322 | | | 47 | | | 758 | | | 218 | |

| Net loss | $ | (7,853) | | | $ | (9,055) | | | $ | (29,130) | | | $ | (20,649) | |

| Basic and diluted net loss per share | $ | (0.17) | | | $ | (0.20) | | | $ | (0.62) | | | $ | (0.45) | |

| Weighted average shares used in computing net loss per share: | | | | | | | |

| Basic and diluted | 47,105 | | | 46,411 | | | 46,912 | | | 46,262 | |

ATRICURE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In Thousands)

(Unaudited)

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| Assets | | | |

| Current assets: | | | |

| Cash, cash equivalents, and short-term investments | $ | 130,335 | | | $ | 137,285 | |

| Accounts receivable, net | 54,909 | | | 52,501 | |

| Inventories | 76,546 | | | 67,897 | |

| Prepaid and other current assets | 7,496 | | | 8,563 | |

| Total current assets | 269,286 | | | 266,246 | |

| | | |

| Property and equipment, net | 43,537 | | | 42,435 | |

| Operating lease right-of-use assets | 6,100 | | | 4,324 | |

| Goodwill and intangible assets, net | 293,133 | | | 298,767 | |

| Other noncurrent assets | 3,012 | | | 2,160 | |

| Total Assets | $ | 615,068 | | | $ | 613,932 | |

| Liabilities and Stockholders' Equity | | | |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 71,716 | | | $ | 72,036 | |

Current lease liabilities | 2,715 | | | 2,533 | |

| Total current liabilities | 74,431 | | | 74,569 | |

| Long-term debt | 61,865 | | | 60,593 | |

| Finance and operating lease liabilities | 12,548 | | | 11,368 | |

| | | |

| Other noncurrent liabilities | 1,203 | | | 1,234 | |

| Total Liabilities | 150,047 | | | 147,764 | |

| Stockholders' Equity: | | | |

| Common stock | 49 | | | 48 | |

| Additional paid-in capital | 851,306 | | | 824,170 | |

| Accumulated other comprehensive loss | (147) | | | (993) | |

| Accumulated deficit | (386,187) | | | (357,057) | |

| Total Stockholders' Equity | 465,021 | | | 466,168 | |

| Total Liabilities and Stockholders' Equity | $ | 615,068 | | | $ | 613,932 | |

ATRICURE, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP RESULTS TO NON-GAAP RESULTS

(In Thousands)

(Unaudited)

Reconciliation of Non-GAAP Adjusted Income (Adjusted EBITDA)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net loss, as reported | $ | (7,853) | | | $ | (9,055) | | | $ | (29,130) | | | $ | (20,649) | |

| Income tax expense | 322 | | | 47 | | | 758 | | | 218 | |

| Other expense, net | 126 | | | 919 | | | 2,882 | | | 2,416 | |

| Depreciation and amortization expense | 4,928 | | | 4,111 | | | 13,907 | | | 10,634 | |

| Share-based compensation expense | 10,364 | | | 8,661 | | | 30,020 | | | 26,416 | |

Gain from legal settlements | — | | | — | | | — | | | (4,412) | |

| Non-GAAP adjusted income (adjusted EBITDA) | $ | 7,887 | | | $ | 4,683 | | | $ | 18,437 | | | $ | 14,623 | |

Reconciliation of Non-GAAP Adjusted Loss Per Share

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net loss, as reported | $ | (7,853) | | | $ | (9,055) | | | $ | (29,130) | | | $ | (20,649) | |

| Loss on debt extinguishment | — | | | — | | | 1,362 | | | — | |

Gain from legal settlements | — | | | — | | | — | | | (4,412) | |

| | | | | | | |

| | | | | | | |

| Non-GAAP adjusted net loss | $ | (7,853) | | | $ | (9,055) | | | $ | (27,768) | | | $ | (25,061) | |

| Basic and diluted adjusted net loss per share | $ | (0.17) | | | $ | (0.20) | | | $ | (0.59) | | | $ | (0.54) | |

| Weighted average shares used in computing adjusted net loss per share | | | | | | | |

| Basic and diluted | 47,105 | | | 46,411 | | | 46,912 | | | 46,262 | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

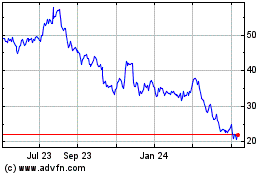

AtriCure (NASDAQ:ATRC)

Historical Stock Chart

From Oct 2024 to Nov 2024

AtriCure (NASDAQ:ATRC)

Historical Stock Chart

From Nov 2023 to Nov 2024