0001015739false00010157392023-11-012023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): November 1, 2023

AWARE, INC.

(Exact name of registrant as specified in its charter)

|

|

|

Massachusetts |

000-21129 |

04-2911026 |

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

76 Blanchard Road, Burlington, MA, 01803

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (781) 687-0300

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

Common Stock, par value $.01 per share |

AWRE |

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On November 1, 2023, Aware, Inc. issued the press release, attached to this Form 8-K as Exhibit 99.1, describing the results of operations and financial condition of the company as of and for the quarter ended September 30, 2023.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

No financial statements are required to be filed as part of this Report. The following exhibits are filed as part of this report:

(d) EXHIBITS.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

AWARE, INC. |

|

|

|

|

Dated: November 1, 2023 |

|

By: |

/s/ David K. Traverse |

|

|

|

David K. Traverse |

|

|

|

Chief Principal Officer |

Exhibit 99.1

|

|

Company Contact Gina Rodrigues Aware, Inc. 781-276-4000 grodrigues@aware.com |

Investor Contact Matt Glover Gateway Group, Inc. 949-574-3860 AWRE@gatewayir.com |

|

|

Aware Reports Third Quarter and Nine Month 2023 Financial Results

Quarterly Total Revenue Increased 112% from prior year quarter to $6.4 Million

Generated $2.5 million in Operating Cashflow in Q3 2023, the Highest Quarterly Level Since Q4 2018

BURLINGTON, MASS. – November 1, 2023 –Aware, Inc. (NASDAQ: AWRE), a global biometric platform company that uses data science, machine learning, and artificial intelligence to tackle everyday business and identity challenges through biometrics, today reported financial results for the third quarter ended September 30, 2023.

Third Quarter 2023 and Nine Month 2023 Financial Highlights

•Total revenue for the third quarter of 2023 increased 112% to $6.4 million compared to $3.0 million in the third quarter of 2022.

•Total revenue for the nine months ended September 30, 2023, increased 16% to $13.9 million, compared to $11.9 million in the same year-ago period.

•Operating cashflow for the third quarter of 2023 totaled $2.5 million, compared to cash usage of $2.0 million in the same year-ago period.

•Net income for the third quarter of 2023 totaled $1.1 million, or $0.05 per diluted share. Adjusted EBITDA (a non-GAAP metric reconciled below) for the third quarter of 2023 totaled $0.4 million.

•Based on results for the first nine months of 2023, and line of sight into the fourth quarter ending December 31, 2023, the Company reiterates its full-year guidance for total revenue and annual recurring revenue (ARR) growth of 15% and to exit the year with neutral operating cashflow.

•Strong balance sheet with $27.5 million of cash and cash equivalents and marketable securities.

•Repurchased 81,083 common shares of stock at a weighted average price of $1.52 per share as part of the company’s previously announced share buyback program.

Third Quarter 2023 and Recent Operational Highlights

•Secured a $3.4 million contract with the U.S. government which includes five-years of annual maintenance options that could value the total contract at $5.1 million. We also deployed AwareABIS to three law enforcement agencies. Along with the $5 million contract we secured with our largest BioSP customer in Q2, these are expected to contribute over $1.5 million to the Company’s annual recurring revenue.

•Launched a formal partner program that enables midmarket and large technology providers, value-added-resellers (VARs) and consulting partners to increase their revenue streams by leveraging Aware’s biometric solutions.

•Enhanced AwareID® platform with facial identification capabilities, superior backend support and optimized user experience which includes a new developer hub.

•Aware’s facial presentation attack detection (PAD) algorithms were ranked a top performer for both impersonation and evasion detection in one of the use cases of the National Institute of Standards and Technolgy’s Face Analysis Technology Evaluation (FATE) Benchmarking test, which tested 82 presentation attack detection algorithms.

Management Commentary

“Our strong third quarter performance reflects our continued efforts to increase ARR and drive sustainable future growth,” said Robert Eckel, Aware’s Chief Executive Officer and President. “This quarter we secured several deals that we expect to meaningfully contribute to our recurring revenue, including a multi-year contract with a large agency of the U.S. federal government. Moreover, the debut of our formal partner program and rollout of additional product enhancements to our SaaS platform are expanding our reach and enabling new revenue streams in both the government and commercial space, while simultaneously optimizing our costs.”

“Aware continues to secure business in competitive markets, and does so in a proven, responsible, and trusted way” continued Eckel. “Our leading biometric technology and ability to adapt to customers’ needs while remaining demographically neutral allows us to leverage partnerships to gain additional market share as well as capitalize on the growing traction for AwareID® and broader industry tailwinds. With a reinforced partner-centric sales strategy, positive customer renewal rate, success with expansion of existing customers and high-fidelity pipeline of promising opportunities, we continue our confidence that we can achieve or exceed our financial goals to grow total revenue and ARR by 15% in 2023 and to exit the year with neutral cashflow. As we move through the fourth quarter, we look forward to building upon the progress we’ve made this year to further enhance revenue and shareholder value.”

Third Quarter 2023 Financial Results

Revenue for the third quarter of 2023 was $6.4 million, compared to $3.2 million in the second quarter of 2023 and $3.0 million in the same year-ago period. The sequential and year-over-year increase in revenue was primarily due to an increase in software licenses revenue.

Recurring revenue (a non-GAAP metric reconciled below) for the third quarter of 2023 totaled $2.2 million, an increase of 4% compared to $2.1 million in the third quarter of 2022.

Net income for the third quarter of 2023 totaled $1.1 million, or $0.05 per diluted share, which compares to net loss of $2.7 million, or $(0.13) per diluted share, in the second quarter of 2023 and net income of $2.6 million, or $0.12 per diluted share, in the same year-ago period. Net income for the third quarter of 2023 included a $0.8 million one-time gain related to our fair value adjustment to the contingent acquisition payment from our 2021 acquisition of FortressID. Net income for the third quarter of 2022 included a $5.7 million one-time gain related to the sale of the company’s building located in Bedford, MA in July 2022.

Adjusted EBITDA (a non-GAAP metric reconciled below) for the third quarter of 2023 totaled $0.4 million, compared to adjusted EBITDA loss of $2.4 million in the second quarter of 2023 and adjusted EBITDA loss of $2.5 million in the same year-ago period. The significant sequential and year-over-year improvement in adjusted EBITDA was primarily due to higher revenue.

Nine Month 2023 Financial Results

Revenue for the nine months ended September 30, 2023 was $13.9 million, compared to $11.9 million in the same year-ago period. The increase in revenue was primarily due to higher software licenses revenue.

Recurring revenue (a non-GAAP metric reconciled below) for the nine months ended September 30, 2023 totaled $7.3 million, an increase of 3% compared to $7.1 million in the same year-ago period.

Net loss for the nine months ended September 30, 2023 totaled $3.1 million, or $(0.15) per diluted share, which compares to net income of $31,000, or $0.00 per diluted share, in the same year-ago period. Net income for the nine months ended September 30, 2023 included a $0.8 million one-time gain related to our fair value adjustment to the contingent acquisition payment from our 2021 acquisition of FortressID. Net income for the nine months ended September 30, 2022 included a $5.7 million one-time gain related to the sale of the company’s building located in Bedford, MA in July 2022.

Adjusted EBITDA loss (a non-GAAP metric reconciled below) for the nine months ended September 30, 2023 was $3.3 million, compared to adjusted EBITDA loss of $3.9 million in the same year-ago period. The decrease in adjusted EBITDA loss was primarily due to higher revenue.

Cash, cash equivalents and marketable securities totaled $27.5 million as of September 30, 2023, compared to $29.0 million as of December 31, 2022.

Webcast

Aware management will host a webcast today, November 1, 2023, at 5:00 p.m. Eastern time to discuss these results and provide an update on business conditions. A question-and-answer session will follow management’s prepared remarks.

Date: Wednesday, November 1, 2023

Time: 5:00 p.m. Eastern time (2:00 p.m. Pacific time)

Webcast: Register Here

The presentation will be made available for replay in the investor relations section of the Company’s website. The audio recording will be available for approximately 90 days following the live event.

About Aware

Aware is a global biometric platform company that uses data science, machine learning, and artificial intelligence to tackle everyday business and identity challenges through biometrics. For over 30 years we’ve been a trusted name in the field. Aware’s offerings address the growing challenges that government and commercial enterprises face in knowing, authenticating and securing individuals through frictionless and highly secure user experiences. Our algorithms are based on diverse operational data sets from around the world, and we prioritize making biometric technology in an ethical and responsible manner. Aware is a publicly held company (NASDAQ: AWRE) based in Burlington, Massachusetts. To learn more, visit our website or follow us on LinkedIn and X.

Safe Harbor Warning

Portions of this release contain forward-looking statements regarding future events and are subject to risks and uncertainties, such as estimates or projections of future revenue, earnings and non-recurring charges, and the growth of the biometrics markets. Aware wishes to caution you that there are factors that could cause actual results to differ materially from the results indicated by such statements.

Risk factors related to our business include, but are not limited to: i) our operating results may fluctuate significantly and are difficult to predict; ii) we derive a significant portion of our revenue from government customers, and our business may be adversely affected by changes in the contracting or fiscal policies of those governmental entities; iii) a significant commercial market for biometrics technology may not develop, and if it does, we may not be successful in that market; iv) we derive a significant portion of our revenue from third party channel partners; v) the biometrics market may not experience significant growth or our products may not achieve broad acceptance; vi) we face intense competition from other biometrics solution providers; vii) our business is subject to rapid technological change; viii) our software products may have errors, defects or bugs which could harm our business; ix) our business may be adversely affected by our use of open source software; x) we rely on third party software to develop and provide our solutions and significant defects in third party software could harm our business; xi) part of our future business is dependent on market demand for, and acceptance of, the cloud-based model for the use of software: xii) our operational systems and networks and products may be subject to an increasing risk of continually evolving cybersecurity or other technological risks which could result in the disclosure of company or customer confidential information, damage to our reputation, additional costs, regulatory penalties and financial losses; xiii) our intellectual property is subject to limited protection; xiv) we may be sued by third parties for alleged infringement of their proprietary rights; xv) we must attract and retain key personnel; xvii) our business may be affected by government regulations and adverse economic conditions; xviii) we may make acquisitions that could adversely affect our results; and xix) we may have additional tax liabilities.

We refer you to the documents Aware files from time to time with the Securities and Exchange Commission, specifically the section titled Risk Factors in our annual report on Form 10-K for the fiscal year ended December 31, 2022 and other reports and filings made with the Securities and Exchange Commission.

AWARE, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

Software licenses |

|

$ |

4,391 |

|

|

$ |

814 |

|

|

$ |

7,535 |

|

|

$ |

5,459 |

|

Software maintenance |

|

|

1,889 |

|

|

|

1,786 |

|

|

|

5,491 |

|

|

|

5,267 |

|

Services and other |

|

|

101 |

|

|

|

415 |

|

|

|

844 |

|

|

|

1,219 |

|

Total revenue |

|

|

6,381 |

|

|

|

3,015 |

|

|

|

13,870 |

|

|

|

11,945 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of services and other revenue |

|

|

410 |

|

|

|

282 |

|

|

|

1,033 |

|

|

|

920 |

|

Research and development |

|

|

2,264 |

|

|

|

2,279 |

|

|

|

6,909 |

|

|

|

6,932 |

|

Selling and marketing |

|

|

2,171 |

|

|

|

1,874 |

|

|

|

6,118 |

|

|

|

5,067 |

|

General and administrative |

|

|

1,601 |

|

|

|

1,808 |

|

|

|

4,679 |

|

|

|

4,895 |

|

Fair value adjustment to contingent acquisition payment |

|

|

(812 |

) |

|

|

— |

|

|

|

(812 |

) |

|

|

— |

|

Gain on sale of fixed assets |

|

|

— |

|

|

|

(5,672 |

) |

|

|

— |

|

|

|

(5,672 |

) |

Total costs and expenses |

|

|

5,634 |

|

|

|

571 |

|

|

|

17,927 |

|

|

|

12,142 |

|

Operating income (loss) |

|

|

747 |

|

|

|

2,444 |

|

|

|

(4,057 |

) |

|

|

(197 |

) |

Interest income |

|

|

397 |

|

|

|

155 |

|

|

|

982 |

|

|

|

228 |

|

Net income (loss) |

|

$ |

1,144 |

|

|

$ |

2,599 |

|

|

$ |

(3,075 |

) |

|

$ |

31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per share – basic |

|

$ |

0.05 |

|

|

$ |

0.12 |

|

|

$ |

(0.15 |

) |

|

$ |

0.00 |

|

Net income (loss) per share – diluted |

|

$ |

0.05 |

|

|

$ |

0.12 |

|

|

$ |

(0.15 |

) |

|

$ |

0.00 |

|

Weighted-average shares – basic |

|

|

21,049 |

|

|

|

21,725 |

|

|

|

21,017 |

|

|

|

21,674 |

|

Weighted-average shares – diluted |

|

|

21,131 |

|

|

|

21,798 |

|

|

|

21,017 |

|

|

|

21,733 |

|

AWARE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

September 30,

2023 |

|

|

December 31,

2022 |

|

ASSETS |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

5,683 |

|

|

$ |

11,749 |

|

Marketable securities |

|

|

21,839 |

|

|

|

17,229 |

|

Accounts and unbilled receivables, net |

|

|

8,291 |

|

|

|

6,246 |

|

Tax receivable |

|

|

— |

|

|

|

1,362 |

|

Property and equipment, net |

|

|

616 |

|

|

|

726 |

|

Goodwill and intangible assets, net |

|

|

5,615 |

|

|

|

5,926 |

|

Note receivable |

|

|

2,695 |

|

|

|

2,601 |

|

Right of use assets |

|

|

4,332 |

|

|

|

4,538 |

|

Other assets, net |

|

|

1,111 |

|

|

|

815 |

|

|

|

|

|

|

|

|

Total assets |

|

$ |

50,182 |

|

|

$ |

51,192 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Accounts payable and accrued expense |

|

$ |

1,877 |

|

|

$ |

1,921 |

|

Deferred revenue |

|

|

5,912 |

|

|

|

3,733 |

|

Operating lease liability |

|

|

4,528 |

|

|

|

4,517 |

|

Contingent acquisition payment |

|

|

— |

|

|

|

812 |

|

Total stockholders’ equity |

|

|

37,865 |

|

|

|

40,209 |

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

50,182 |

|

|

$ |

51,192 |

|

|

|

|

|

|

|

|

Non-GAAP Measures

We define adjusted EBITDA as U.S. GAAP net loss plus depreciation of fixed assets and amortization of intangible assets, stock-based compensation expenses, other (expense) income, net, and income tax provision. We discuss adjusted EBITDA in our quarterly earnings releases and certain other communications, as we believe adjusted EBITDA is an important measure. We use adjusted EBITDA in internal forecasts and models when establishing internal operating budgets, supplementing the financial results and forecasts reported to our Board of Directors, and evaluating short-term and long-term operating trends in our operations. We believe that the adjusted EBITDA financial measure assists in providing an enhanced understanding of our underlying operational measures to manage the business, to evaluate performance compared to prior periods and the marketplace, and to establish operational goals. We believe that the adjusted EBITDA adjustments are useful to investors because they allow investors to evaluate the effectiveness of the methodology and information used by management in our financial and operational decision-making.

We define recurring revenue as the portion of Aware revenue that is based on a term arrangement and is likely to continue in the future, such as annual maintenance or subscription contracts. We use recurring revenue as a metric to communicate the portion of our revenue that has greater stability and predictability. We believe that recurring revenue assists in providing an enhanced understanding of effectiveness of our efforts to transition to a subscription-based business model.

Adjusted EBITDA and recurring revenue are non-GAAP financial measures and should not be considered in isolation or as a substitute for financial information provided in accordance with U.S. GAAP. These non-GAAP financial measure may not be computed in the same manner as similarly titled measures used by other companies. We expect to continue to incur expenses similar to the financial adjustments described above in arriving at adjusted EBITDA and investors should not infer from our presentation of this non-GAAP financial measure that these costs are unusual, infrequent or non-recurring. The following table includes the reconciliations of our U.S. GAAP net income (loss), the most directly comparable U.S. GAAP financial measure, to our adjusted EBITDA for the three and nine months ended September 30, 2023 and 2022 and for the three months ended June 30, 2023 and (ii) our U.S. GAAP revenue, the most directly comparable U.S. GAAP financial measure, to our recurring revenue for the three and nine months ended September 30, 2023 and 2022.

AWARE, INC.

Reconciliation of GAAP Net loss to Adjusted EBITDA

(In thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

September 30, |

|

|

June 30, |

|

|

September 30, |

|

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

Net income (loss) |

|

$ |

1,144 |

|

|

$ |

(2,652 |

) |

|

$ |

2,599 |

|

Depreciation and amortization |

|

|

140 |

|

|

|

148 |

|

|

|

141 |

|

Stock based compensation |

|

|

360 |

|

|

|

403 |

|

|

|

548 |

|

Fair value adjustment to contingent acquisition payment |

|

|

(812 |

) |

|

|

— |

|

|

|

— |

|

Gain on sale of fixed assets |

|

|

— |

|

|

|

— |

|

|

|

(5,672 |

) |

Interest income |

|

|

(397 |

) |

|

|

(284 |

) |

|

|

(155 |

) |

Adjusted EBITDA |

|

$ |

435 |

|

|

$ |

(2,385 |

) |

|

$ |

(2,539 |

) |

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended

September 30, |

|

|

|

2023 |

|

|

2022 |

|

Net income (loss) |

|

$ |

(3,075 |

) |

|

$ |

31 |

|

Depreciation and amortization |

|

|

437 |

|

|

|

587 |

|

Stock based compensation |

|

|

1,097 |

|

|

|

1,356 |

|

Fair value adjustment to contingent acquisition payment |

|

|

(812 |

) |

|

|

— |

|

Gain on sale of fixed assts |

|

|

— |

|

|

|

(5,672 |

) |

Interest income |

|

|

(982 |

) |

|

|

(228 |

) |

Adjusted EBITDA |

|

$ |

(3,335 |

) |

|

$ |

(3,926 |

) |

AWARE, INC.

Revenue Breakout

(In thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

June |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Recurring revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Software subscriptions |

|

$ |

292 |

|

|

$ |

304 |

|

|

$ |

444 |

|

|

|

1,824 |

|

|

|

2,159 |

|

Software maintenance |

|

|

1,889 |

|

|

|

1,767 |

|

|

|

1,646 |

|

|

|

5,491 |

|

|

|

4,957 |

|

Total recurring revenue |

|

|

2,181 |

|

|

|

2,071 |

|

|

|

2,090 |

|

|

|

7,315 |

|

|

|

7,116 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-recurring revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Software licenses |

|

|

4,099 |

|

|

|

735 |

|

|

|

510 |

|

|

|

5,711 |

|

|

|

3,610 |

|

Services and other |

|

|

101 |

|

|

|

378 |

|

|

|

415 |

|

|

|

844 |

|

|

|

1,219 |

|

Total non-recurring revenue |

|

|

4,200 |

|

|

|

1,113 |

|

|

|

925 |

|

|

|

6,555 |

|

|

|

4,829 |

|

Total revenue |

|

$ |

6,381 |

|

|

$ |

3,184 |

|

|

$ |

3,015 |

|

|

$ |

13,870 |

|

|

$ |

11,945 |

|

###

Aware is a registered trademark of Aware, Inc.

Flutter and the related logo are trademarks of Google LLC. Aware is not endorsed by or affiliated with Google LLC.

Aware, Inc. NASDAQ: AWRE Biometrics Simplified

Safe Harbor Statement Portions of this presentation contain forward-looking statements regarding future events and are subject to risks and uncertainties, such as estimates or projections of future revenue, earnings and non-recurring charges, and the growth of the biometrics markets. Aware wishes to caution you that there are factors that could cause actual results to differ materially from the results indicated by such statements. Risk factors related to our business include, but are not limited to: i) our operating results may fluctuate significantly and are difficult to predict; ii) we derive a significant portion of our revenue from government customers, and our business may be adversely affected by changes in the contracting or fiscal policies of those governmental entities; iii) a significant commercial market for biometrics technology may not develop, and if it does, we may not be successful in that market; iv) we derive a significant portion of our revenue from third party channel partners; v) the biometrics market may not experience significant growth or our products may not achieve broad acceptance; vi) we face intense competition from other biometrics solution providers; vii) our business is subject to rapid technological change; viii) our software products may have errors, defects or bugs which could harm our business; ix) our business may be adversely affected by our use of open source software; x) we rely on third party software to develop and provide our solutions and significant defects in third party software could harm our business; xi) part of our future business is dependent on market demand for, and acceptance of, the cloud-based model for the use of software: xii) our operational systems and networks and products may be subject to an increasing risk of continually evolving cybersecurity or other technological risks which could result in the disclosure of company or customer confidential information, damage to our reputation, additional costs, regulatory penalties and financial losses; xiii) our intellectual property is subject to limited protection; xiv) we may be sued by third parties for alleged infringement of their proprietary rights; xv) we must attract and retain key personnel; xvii) our business may be affected by government regulations and adverse economic conditions; xviii) we may make acquisitions that could adversely affect our results, xix) we may have additional tax liabilities; and xx) our business and operations could be adversely affected by health epidemics, including the current COVID-19 pandemic, impacting the markets and communities in which we, our partners and clients operate. We refer you to the documents Aware files from time to time with the Securities and Exchange Commission, specifically the section titled Risk Factors in our annual report on Form 10-K for the fiscal year ended December 31, 2022 and other reports and filings made with the Securities and Exchange Commission.

Biometrics Simplified Trusted Since 1993 We are a global biometric platform company that uses data science, machine learning, and artificial intelligence to tackle everyday business and identity challenges through biometrics.

Global market for biometric technology expected to grow >20% between now and 20271. Expanded portfolio of proven, world-class solutions are ready to fuel immediate growth for current, emerging and future use cases. For more than a decade, data, AI and machine learning have powered our portfolio, based on our full stack model for all onboarding and authentication needs, and built on diverse operational datasets from around the world. Strong global customer base and partner-centric model provide leverage and significant room for expansion. 1. MarketsandMarkets, November 8, 2022 Investment Highlights Growing Markets Proven Products Partner Leveraged

B2G Biometric Capture, Search & Workflow Management B2B Identity Verification Simple Biometrics for complex Identity Challenges Mobile and Web-based �onboarding & authentication Web-based enrollment & Standards compliance Forensic Investigation

CATALYST FOR CHANGE: CURRENT �DIGITAL ONBOARDING METHODS 2.2 million fraud reports in 20202 47% of Americans financial identity theft in 20203 9 in 10 Americans encountered a fraud attempt in the past year4 (1 in 6) Americans lost money to identity theft last year4 33 MILLION to identity theft and fraud in 20205 56 $ BILLION Consumers lost more than CUSTOMERS ARE DEMANDING A FRICTIONLESS, SECURE USER EXPERIENCE 1 in 5 users abandoned the process because it took too long 1/2 1/3 Less likely to �use in the future Will tell their friends �to do the same Poor onboarding harms brand reputation. 23% abandonment rates since 2016 of customers consider onboarding �process too difficult 25% A Growing Need for Authentication 1. Signicat Battle to Onboard 2020 | 2. FTC | 3. US Identity Theft the Stark Reality 4. AARP’s Fraud Victim Susceptibility Study | 5. Javelin Strategy

Compelling Addressable Market 2027 2020 Market drivers are universal across industry verticals. Consumer demand for convenience Need for business efficiencies Consumer biometric adoption New government regulations Instances of identity fraud Occurrence of data breaches 1. MarketsandMarkets, November 8, 2022 CAGR = 20.4%1 $23.3B $70.7B Government Financial Services Payment Processing Law Enforcement Consumer Services Data/Network Security Healthcare Retail Workforce Management Shared Economy Access Control Personal Security

Expansive portfolio simplifies biometrics to solve complex challenges Once complex solutions are now simplified through biometrics. COMPLETE SOLUTIONS FOR THOSE LOOKING FOR TURN-KEY: AwareID® is lightning-fast identity verification, MFA & multi-modal biometrics pre-configured in a single, low-code platform. AwareABIS™ is enterprise-scale identification & deduplication system pre-configured for civil & criminal applications with fingerprint and face-based search. FRAMEWORKS FOR THOSE LOOKING FOR A STARTING POINT: Knomi® framework provides proven, secure and convenient facial and speaker recognition with liveness for mobile, multi-factor authentication. CONNECTORS FOR THOSE LOOKING TO CONNECT SYSTEMS: BioSP™ is modular, agnostic middleware, pre-configured to enable advanced biometric data processing, management and orchestration between separate systems while giving customers complete control. BUILDING BLOCKS FOR THOSE LOOKING TO DIY: Aware’s SDKs, APIs, applications, and subsystems are hardened and proven to fulfill critical functions within biometric ID and authentication systems. Aware leads in balancing security and user experience through technology—for the few and at scale.

A true global presence with strong foundations: Growing Markets, Proven Products, Partner Leverage $27.5M in cash, cash equivalents & marketable securities $0 Debt 38% Insider Ownership ~80 Patents and numerous trade secrets 4 Cutting-edge technology offerings 50+ Industry-leading technology building blocks 30 Years in the industry >90% customer retention rate in 2022 TRUSTED BY: All 3 �Branches of U.S. Gov’t. 60+ �Partners 20+ �Countries 20+ �Financial Institutions 150+ �Law Enforcement Agencies All numbers as of Sep. 30, 2023.

Go-to-market Leverages our Ecosystem VALUE ADDED RESELLERS Local & regional integrated resellers address global identity use cases with specialized expertise. TECHNOLOGY PARTNERS Our offerings are integrated with strategic technology partners to address broader opportunities. CONSULTING PARTNERS These partners introduce, recommend or add our services and solutions in a larger ecosystem/infrastructure to expand reach at scale. DIRECT SALES Select opportunities are strategically served directly by Aware. EXISTING CUSTOMERS Dedicated customer success team drives adoption and expansion (cross-sell and upsell) of existing customers. Focus on new logos through partners and expansion with existing customers

The ware dvantage Key Points of Differentiation PROVEN RESPONSIBLE TRUSTED Well-capitalized, government and commercially chosen, and hardened and trusted since 1993. Technology uses AI & ML to create software that ethically achieves demographic neutrality and equity. Entire portfolio prevents threats and asserts the integrity of identity in a future-proof way. Government Chosen | Commercially Chosen On NASDAQ | Certified/Compliant Consent-based Infrastructure| Powerful Biometric Data Orchestration | Lightning-Fast Performance Enhancements| Out-of-the-Box User ready Functionality In-House Expertise| Zero Outsourced Biometrics| Robust Portfolio| Flexible Deployment Options | Recognized Verification, Identification, & Liveness Experts | Future-Proof Infrastructure

Financial Foundation For Growth 21% CAGR Recurring Revenue FY22 HIGHLIGHTS: 92% Gross Margins 14% Subscription Growth > 300 Customers FY23 GUIDANCE: 15% ARR Growth >$0 Operating Cashflow1 exiting 2023 Growing revenue while converting to higher quality, recurring revenue. (in millions) 1. Neutral to positive Q4’23 operating cashflow taking into consideration seasonal timing of cash outlays.

Growing Markets Proven Products Partner Leverage Great Potential + + KEY TAKEAWAYS A leading authentication company applying proven and trusted adaptive authentication to solve everyday business challenges with biometrics Attractive market opportunity supported by robust industry tailwinds and drivers Expanded partner-centric sales strategy gaining traction and building pipeline Strong outlook for growth - total revenue and ARR expected to grow 15%+ in 2023 Solid balance sheet with $27.3M (~$1.30/share1) in cash and cash equivalents and marketable securities 1. As of 3/31/2023

Aware 76 Blanchard Road, Suite 200 Burlington, Massachusetts 01803 Tel: (781) 687-0300 Email: ir@aware.com Gateway Investor Relations Tel: (949) 574-3860 Email: AWRE@gatewayir.com

Appendix: Case Studies

CUSTOMER CASE STUDY: �Partner THE CHALLENGE A leading air transport communications and IT company wanted to streamline the process of welcoming travelers to a country because the process was costly and not user-friendly. THE SOLUTION So, we worked together to implement Aware’s technology to allow visitors to start the process from home without embassy assistance. They are now using our solution to vet 1/5 of all visitors. THE RESULTS Reduced costs by 10x. If adopted for all international travel, they could reduce costs by 20x.

CUSTOMER CASE STUDY: �Commercial Application THE CHALLENGE A leading bank in Latin America was experiencing a new, highly sophisticated form of attack that was penetrating the security layers it had in place, resulting in sky-rocketing rates of fraud. THE SOLUTION So, in near real-time, our in-house R&D team worked together on a solution to enhance Aware’s technology so it’s able to detect and prevent this type of attack. And, the team consulted on how to strengthen additional security layers in the system. THE RESULTS An 87% reduction in �fraud over the course �of 6 months.

CUSTOMER CASE STUDY: �Government Application THE CHALLENGE A US government department wanted to deploy a global web-based employee and contractor background check system that would not store any PII (Personally Identifiable Information), but at the time there was no widely available system on the market which met their needs. THE SOLUTION So, we worked together to deploy Aware's technology to 4,300 sites worldwide. The customers have since shared with Aware that our technology is viewed within the department as a shining example of a solid investment which has supported their mission through the years. THE RESULTS The program was so effective in meeting the department’s security needs, it was also introduced at an adjacent government agency.

CUSTOMER CASE STUDY: �Law Enforcement Application THE CHALLENGE A large FL Police Department wanted to solve more cold cases but did not have the technology or bandwidth to effectively check existing evidence against new arrestee records. THE SOLUTION So, we worked together to develop a program to help new users effectively use Aware’s technology, resulting in latent fingerprint and palm print matches. THE RESULTS More than 45 previously unsolved cold cases have been closed.

Appendix: Further Detail on Aware Advantage

Government Chosen �Programs with core government agencies in the United States, Canada, UK, Germany, Australia, among others. | Worldwide leader in biometric data orchestration for immigration and border management. Commercially Chosen�Trusted by industry leaders for onboarding and authentication (e.g., largest banks in Brazil and Turkey, etc.) | Balanced security vs. user experience with demographic neutrality On NASDAQ�Publicly-traded | Debt free | Strong Cash Certified/Compliant�MINEX III, Biometric Subsystem Certification (21 CFR Part 1311.116), iBeta PAD I & II (ISO 30107-3), SOC 2 Type 1, Sarbanes-Oxley (SOX), GDPR, CMMC (Level 2), DFARS (NIST 800-171, Level 3) PROVEN Well-capitalized, government and commercially chosen, and hardened and trusted since 1993. Consent-based Infrastructure�Ethical & demographically neutral infrastructure supports face, voice, fingerprint, palmprint, iris and behavioral biometrics alone, in multiple combinations or as part of a streamlined MFA solution for consent-based applications. Powerful Biometric Data Orchestration (middleware)�Agnostic, modular middleware (any matcher, any capture, easily expanded) | Balanced security vs. user experience Lightning-Fast Performance Enhancements �New attack countermeasures within days | �In-house rapid response team (Attack » research » product cycle) Out-of-the-Box Functionality�Configurations and defined thresholds based on use case, risk, user profiles, and analytics | Step-up authentication based on environment and business requirements RESPONSIBLE Technology uses AI & ML to create software that ethically achieves demographic neutrality and equity. In-House Expertise�ZERO outsourced biometrics | Early adopters of AI and ML | Designed & developed in the United States | Technical emphasis on Data Science & R&D Robust Portfolio�Platforms, Applications, APIs, SDKs, Engines | Expansive IP portfolio | Configured for use cases Flexible Deployment Options�No-code, Full Code | SaaS, On-prem | Customer’s Cloud, Aware’s Cloud Recognized Verification, Identification & Liveness Experts�1:1 verification & 1:N identification | Set the bar for liveness | ML & AI anticipates attack vectors | Advisors to NIST | Members of IBIA, Biometrics Institute, Fido Alliance | Published Professionals Future-Proof Infrastructure�Address risk and environmental changes without “rip and replace” | Manage operational costs TRUSTED Entire portfolio prevents threats and �asserts the integrity of identity in a �future-proof way.

Government Chosen Programs w/ core government agencies in the �United States, Canada, UK, Germany, Australia, among others. Worldwide leader in biometric data orchestration �for immigration and border management. Trusted by law enforcement agencies around the world Commercially Chosen Trusted by industry leaders for onboarding and authentication (e.g., largest banks in Brazil, Mexico and Turkey, etc.) Balanced security vs. user experience with demographic neutrality On NASDAQ Publicly-traded Debt free Strong Cash Certified/Compliant MINEX III Biometric Subsystem Certification (21 CFR Part 1311.116) iBeta PAD II (ISO 30107-3) iBeta PAD I (ISO 30107-3) SOC 2 Type 1 Sarbanes-Oxley (SOX) GDPR CMMC (Level 2) DFARS (NIST 800-171, Level 3) PROVEN Well-capitalized, government and commercially chosen, and hardened and trusted since 1993.

Consent-based Infrastructure Ethical & demographically neutral infrastructure supports face, voice, fingerprint, palmprint, iris and behavioral biometrics alone, in multiple combinations or as part of streamlined & optimized MFA Solution for consent-based applications Powerful Biometric Data Orchestration (middleware) Agnostic, modular middleware (any matcher, any capture, easily expanded) Balanced security vs. user experience Lightning-Fast Performance Enhancements New attack countermeasures within days In-house rapid response team (Attack » research » product cycle) Out-of-the-Box, User-Ready Functionality Configurations and defined thresholds based on use case, risk, user profiles, and analysis Step-up authentication based on environment and business requirements Responsible Technology uses AI & ML to create software that ethically achieves demographic neutrality and equity.

In-House Expertise ZERO outsourced biometrics Early adopters of AI and ML Designed & developed in the United States Technical emphasis on Data Science & R&D Robust Portfolio Platforms, Applications, APIs, SDKs, Engines Expansive IP portfolio of patents & trade secrets Developer and Admin-Ready options Configured to specific use cases Flexible Deployment Options No-code, Full Code SaaS, On-prem Customer’s Cloud, Aware’s Cloud Recognized Verification, Identification & Liveness Experts 1:1 verification & 1:N identification Set the bar for liveness security and user experience performance ML & AI anticipates attack vectors Advisors to NIST Members of IBIA, Biometrics Institute, Fido Alliance Published Professionals Future-Proof Infrastructure Address risk and environmental changes without “rip and replace” Expand architecture through step-up and multi-modal security Manage operational costs TRUSTED Entire portfolio prevents threats and asserts the integrity of identity in a future-proof way.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

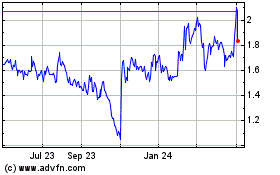

Aware (NASDAQ:AWRE)

Historical Stock Chart

From Dec 2024 to Jan 2025

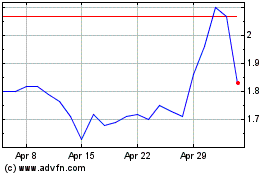

Aware (NASDAQ:AWRE)

Historical Stock Chart

From Jan 2024 to Jan 2025