UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

|

|

Filed by the Registrant |

☒ |

|

|

Filed by a Party other than the Registrant |

☐ |

|

|

Check the appropriate box: |

|

|

|

|

☐ |

|

Preliminary Proxy Statement |

|

|

|

☐ |

|

Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

|

|

|

☒ |

|

Definitive Proxy Statement |

|

|

|

☐ |

|

Definitive Additional Materials |

|

|

|

☐ |

|

Soliciting Material Under Rule 14a-12 |

AWARE, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

|

Payment of Filing Fee (Check the appropriate box): |

☒ |

|

No fee required. |

☐ |

|

Fee paid previously with preliminary materials. |

☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|

|

|

|

|

* * * * *

November 30, 2023

Dear Fellow Stockholder:

You are cordially invited to attend a Special Meeting of Stockholders of Aware, Inc. ("Aware") to be held at Aware’s corporate office, located at 76 Blanchard Road in Burlington, Massachusetts 01803 on January 17, 2024 at 10:00 a.m. local time. The attached notice and proxy statement (the “Proxy Statement”) describe the formal business to be transacted at the meeting.

We are furnishing proxy materials to our stockholders over the Internet. You may read, print and download our Proxy Statement at www.proxydocs.com/AWRE. On November 30, 2023 we mailed our stockholders a notice containing instructions on how to access these materials and how to vote their shares. The notice provides instructions on how you can request a paper copy of these materials by mail, by telephone or by email. If you requested your materials via email, the email contains voting instructions and links to the materials on the Internet.

You may vote your shares by proxy or in person at the Special Meeting. The Special Meeting is being held for the following purposes:

•to approve a stock option exchange program for certain eligible employees, including executive officers, to exchange certain outstanding stock options for stock options with a lower exercise price; and

•to approve the Aware, Inc. 2023 Equity and Incentive Plan, which will replace the 2001 Nonqualified Stock Plan.

The board of directors of Aware has determined that the matters to be considered at the Special Meeting are in the best interests of Aware and its stockholders. For the reasons set forth in the Proxy Statement, the board of directors unanimously recommends a vote “FOR” the stock option exchange program and "FOR" the Aware, Inc. 2023 Equity and Incentive Plan.

On behalf of the board of directors and the officers and employees of Aware, I would like to take this opportunity to thank our stockholders for their continued support of Aware. We look forward to seeing you at the meeting.

|

Sincerely, |

|

/s/ Robert A. Eckel |

Robert A Eckel Chief Executive Officer and President |

Aware, Inc.

Notice of Special Meeting of Stockholders

to be held on January 17, 2024

Aware, Inc. hereby gives notice that it will hold a Special Meeting of Stockholders (the “Special Meeting”) at the offices of Aware, Inc., 76 Blanchard Road, Burlington, Massachusetts on January 17, 2024 beginning at 10:00 a.m., local time, for the following purposes:

1.to approve a stock option exchange program for certain eligible employees, including executive officers, to exchange certain outstanding stock options for stock options with a lower exercise price;

2.to approve the Aware, Inc. 2023 Equity and Incentive Plan, which will replace the 2001 Nonqualified Stock Plan; and

3.to transact such other business as may properly come before the Special Meeting and any adjournments or postponements of the Special Meeting.

The board of directors has fixed the close of business on November 8, 2023 as the record date for the determination of the stockholders of Aware entitled to receive notice of the Special Meeting and to vote at the Special Meeting. Only stockholders of record on that date are entitled to receive notice of the Special Meeting and to vote at the Special Meeting or any adjournment thereof.

We are pleased to take advantage of Securities and Exchange Commission rules that allow companies to furnish their proxy materials over the Internet. We are mailing to our stockholders a Notice of Internet Availability of Proxy Materials instead of a paper copy of our proxy materials. The notice contains instructions on how to access those documents and to cast your vote via the Internet. The notice also contains instructions on how to request a paper copy of our proxy materials. This process allows us to provide our stockholders with the information they need on a more timely basis, while reducing the environmental impact and lowering the costs of printing and distributing our proxy materials.

By order of the board of directors,

Robert A. Eckel

Chief Executive Officer and President

November 30, 2023

Burlington, Massachusetts

YOUR VOTE IS IMPORTANT

Please sign and return the enclosed proxy or vote your proxy over the Internet or by telephone, whether or not you plan to attend the meeting.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Stockholders to Be Held on January 17, 2024. The Proxy Statement is available on the following website: www.proxydocs.com/AWRE.

This website does not use “cookies” to track or identify visitors.

Aware, Inc.

76 Blanchard Road

Burlington, Massachusetts 01803

(781) 687-0300

PROXY STATEMENT

SPECIAL MEETING OF STOCKHOLDERS

to be held on January 17, 2024

This proxy statement relates to a special meeting of stockholders (the “Special Meeting”) of Aware, Inc. (“Aware”). The Special Meeting will take place as follows:

Date: January 17, 2024

Time: 10:00 a.m.

Place: Aware, Inc.

76 Blanchard Road

Burlington, Massachusetts 01803

Our board of directors is soliciting proxies for the Special Meeting and adjournments of the Special Meeting. If a stockholder returns a properly executed proxy or votes his, her or its proxy over the Internet or by telephone, the shares represented by the proxy will be voted in accordance with the stockholder’s directions. If a stockholder does not specify a vote on any proposal, the shares covered by his, her or its proxy will be voted on that proposal as management recommends. We encourage stockholders to vote on all proposals. A stockholder may revoke his, her or its proxy at any time before it has been exercised.

We are mailing this proxy statement and the enclosed form of proxy to stockholders on or about November 30, 2023.

TABLE OF CONTENTS

GENERAL INFORMATION

Purpose of the Special Meeting

At the Special Meeting, we will submit two proposals to our stockholders:

Proposal One: Approve a stock option exchange program for certain eligible employees, including executive officers, to exchange certain outstanding stock options for stock options with a lower exercise price (the “Option Exchange Program”); and

Proposal Two: Approve the Aware, Inc. 2023 Equity and Incentive Plan (the “2023 Plan”), which will replace the 2001 Nonqualified Stock Plan, as amended (the “2001 Plan”).

We do not intend to submit any other proposals to the stockholders at the Special Meeting. Our board of directors was not aware, a reasonable time before mailing this proxy statement to stockholders, of any other business that may be properly presented for action at the Special Meeting. If any other business comes before the Special Meeting, the persons present will have discretionary authority to vote the shares they own or represent by proxy in accordance with their judgment, to the extent authorized by applicable regulations.

Record date

Our board of directors has fixed the close of business on November 8, 2023 as the record date for the Special Meeting. Only stockholders of record at the close of business on that date are entitled to receive notice of the meeting and to vote at the meeting or any adjournment of the meeting. At the close of business on the record date, there were issued and outstanding 20,990,819 shares of our common stock, each of which is entitled to cast one vote. A list of stockholders entitled to notice of the Special Meeting is available for inspection by any stockholder during the period from two business days after the date hereof through the Special Meeting at our principal office at 76 Blanchard Road, Burlington, MA.

Methods of voting

The shares represented by your properly signed proxy card will be voted in accordance with your directions. If you do not specify a choice with respect to a proposal for which our board of directors has made a recommendation, the shares covered by your signed proxy card will be voted as recommended in this proxy statement. We encourage you to vote on all matters to be considered.

Voting by mail:

By signing and returning the proxy card in the enclosed envelope, you are enabling the individuals named on the proxy card (known as “proxies”) to vote your shares at the meeting in the manner you indicate. We encourage you to sign and return the proxy card even if you plan to attend the meeting. In this way, your shares will be voted even if you are unable to attend the meeting. If you received more than one proxy card, it is an indication that your shares are held in multiple accounts. Please sign and return all proxy cards to ensure that all of your shares are voted.

1

Voting by telephone:

To vote by telephone, please follow the instructions included on your proxy card or notice. If you vote by telephone, you do not need to complete and mail your proxy card.

Voting on the Internet:

To vote on the Internet, please follow the instructions included on your proxy card or notice. If you vote on the Internet, you do not need to complete and mail your proxy card.

Voting in person at the meeting:

If you plan to attend the meeting and vote in person, we will provide you with a ballot at the meeting. If your shares are registered directly in your name, you are considered the stockholder of record and you have the right to vote in person at the meeting. If your shares are held in the name of your broker or other nominee, also known as "street name," you will need to bring with you to the meeting a legal proxy from your broker or other nominee authorizing you to vote your shares.

If any other matters are properly presented for consideration at the Special Meeting, including, among other things, consideration of a motion to adjourn the Special Meeting to another time or place (including, without limitation, for the purpose of soliciting additional proxies), the persons named in your proxy and acting thereunder will have discretion to vote on those matters in accordance with their best judgment. We do not currently anticipate that any other matters will be raised at the Special Meeting.

Shares Held by Brokers or Nominees

If the shares you own are held in “street name” by a brokerage firm, your brokerage firm, as the record holder of your shares, is required to vote your shares according to your instructions. In order to vote your shares, you will need to follow the directions your brokerage firm provides you. Many brokers also offer the option of providing voting instructions to them over the Internet or by telephone, directions for which would be provided by your brokerage firm on your vote instruction form.

"Broker non-votes" are shares that are held in street name by a bank or brokerage firm that indicates on its proxy that, while voting in its discretion on one matter, it does not have or did not exercise discretionary authority to vote on another matter. Under stock exchange rules applicable to most brokerage firms, if you do not give instructions to your broker, your broker will be permitted to vote any shares it holds for your account in its discretion with respect to “routine” proposals, but will not be allowed to vote your shares with respect to “non-routine” proposals. Proposal 1, regarding the approval of the Option Exchange Program, and Proposal 2, regarding the approval of the 2023 Plan, are each “non-routine” proposals. If you do not instruct your broker how to vote with respect to these proposals, your broker will not vote your shares on them and your shares will be recorded as “broker non-votes” that will not affect the outcome of the vote on those proposals

2

If a broker or nominee holds shares of common stock in “street name” for your account, then this proxy statement may have been forwarded to you with a voting instruction card, which allows you to instruct the broker or nominee how to vote your shares on the proposals described herein. To vote by proxy or instruct your broker how to vote, you should follow the directions provided with the voting instruction card. In order to have your vote counted on Proposal 1 and Proposal 2, you must either provide timely voting instructions to your broker or obtain a properly executed proxy from the broker or other record holder of the shares that authorizes you to act on behalf of the record holder with respect to the shares held for your account.

Quorum

Our Amended and Restated By-Laws provide that a quorum at the Special Meeting will be a majority in interest of all stock issued, outstanding and entitled to vote at the meeting. We will treat shares of common stock represented by a properly signed and returned proxy or a proxy properly delivered over the Internet or by telephone as present at the meeting for purposes of determining the existence of a quorum at the meeting. We will count abstentions and broker “non-votes” as present or represented for purposes of determining the existence of a quorum at the Special Meeting.

Vote required; tabulation of votes

A majority of the votes present or represented and voting on such matter at the Special Meeting will be necessary to approve the Option Exchange Program and the 2023 Plan. Abstentions and broker non-votes will not count as votes cast for or against Proposal 1 or Proposal 2 and accordingly will not affect the outcome of the vote on any proposal.

An automated system administrated by Mediant, Inc. will tabulate the votes at the Special Meeting. Mediant, Inc. will tabulate separately the vote on each matter submitted to stockholders.

Dissenter’s rights of appraisal

No action will be taken in connection with the proposal described in this proxy statement for which Massachusetts law, our Amended and Restated Articles of Organization, as amended, or our Amended and Restated By-Laws provide a right of a stockholder to dissent and obtain appraisal of or payment for such stockholder’s shares.

Revocation of proxies

A stockholder who has executed a proxy card may revoke the proxy at any time before it is exercised at the Special Meeting using any one of three ways:

•by giving written notice of revocation to the Secretary of Aware at the following address:

Aware, Inc.

76 Blanchard Road

3

Burlington, Massachusetts 01803

Attention: Secretary

•by signing and returning another proxy card with a later date; or

•by attending the Special Meeting and informing the Secretary of Aware in writing that he or she wishes to vote in person.

Mere attendance at the Special Meeting will not in and of itself revoke the proxy. Accordingly, stockholders who have delivered proxy cards in advance of the Special Meeting and wish to change their votes must utilize one of the above methods before or at the Special Meeting.

If a broker, bank, or other nominee holds your shares, you must contact such broker, bank, or nominee in order to find out how to change your vote.

Solicitation of proxies

We will bear all costs incurred in connection with the solicitation of proxies for the Special Meeting. We will reimburse brokers, banks, fiduciaries, nominees and others for the out-of-pocket expenses and other reasonable clerical expenses they incur in forwarding proxy materials to beneficial owners of common stock held in their names. In addition to this solicitation by mail, our directors, officers and employees may solicit proxies, without additional remuneration, by telephone, facsimile, electronic mail, telegraph and in person. We expect that the expenses of any special solicitation will be nominal. At present, we do not expect to pay any compensation to any other person or firm for the solicitation of proxies.

Internet access to proxy materials

The notice of Special Meeting and this proxy statement are available on the Internet at www.proxydocs.com/AWRE.

Directions to Special Meeting

If you are planning to attend our Special Meeting, below are directions to Aware, Inc., 76 Blanchard Road, Burlington, Massachusetts:

From Boston

Take I-93 North to Exit 28B toward Woburn (I-95/Route 128 South). Take exit 51A toward US3 S/Winchester and merge onto Cambridge Street. Turn right onto Wayside Road and then turn left onto S Bedford Street. Turn right onto Blanchard Road and Aware, Inc. is on the right.

From Manchester

Take I-93 South to exit 28B toward I-95 S/Waltham and merge onto I-95 S. Take exit 51A toward US3 S/Winchester and then merge onto Cambridge Street. Turn right onto Wayside Road and then turn left onto S Bedford Street. Turn right onto Blanchard Road and Aware, Inc. is on the right.

4

From Worcester

Take I-90 E/Massachusetts Turnpike and take exit 123 to merge onto I-95 N toward Portsmouth. Take exit 50-A/B for US-3 toward Middlesex Turnpike/Burlington/Lowell. Keep right to continue onto Exit 50B and follow signs for Middlesex Turnpike/Burlington. Turn left onto Middlesex Turnpike and then turn left onto Wheeler Road. Continue onto Blanchard Road and Aware, Inc. is on the left.

5

PROPOSAL 1: APPROVAL OF THE AWARE, INC. STOCK OPTION EXCHANGE PROGRAM

Introduction

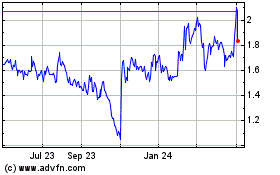

We are seeking stockholder approval of an Option Exchange Program that would allow all of our current employees who hold outstanding options, which primarily consist of our executive officers and our senior management, to exchange significantly out-of-the-money stock options, meaning outstanding stock options that have an exercise price that is greater than the market price for our stock, for the issuance of new stock options (“New Options”) that will be exercisable for fewer shares of our common stock, with an exercise price per share equal to the greater of (i) $2.21 per share (the “New Option Price”) or (ii) the closing price of our common stock on the date the new option is issued, and with new vesting terms and a new expiration date.

The Option Exchange Program has been designed to reinstate, as of a current date, the retention and motivational value of our equity compensation program and to balance the interests of Eligible Participants (as defined below) and our stockholders, by offering Eligible Participants an opportunity to exchange options for New Options. The exchange ratios that will determine the number of New Options to be issued were calculated using a Black-Scholes option pricing model, based on the 90-day average price of our common stock as of September 21, 2023 of $1.60 per share, and increasing such Black-Scholes valuation by 10%, thereby reducing by 10% the number of shares underlying New Options (the “10% Option Reduction”) , such that participating employees will receive 90% of the options that they would have received if the Option Exchange Program was a value-neutral exchange. We believe that these exchange ratios will provide a benefit to our stockholders, and the new exercise price will allow employees to exercise options at an exercise price more in line with the current market price.

As of November 1, 2023, the date that our board of directors approved the Option Exchange Program, we had outstanding stock options held by eligible employees to purchase over 2.2 million shares of our common stock with a weighted average exercise price of $4.88 per share, including stock options to purchase over 1.9 million shares held by our executive officers.

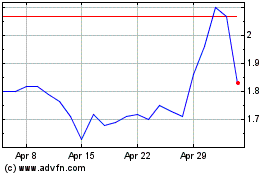

The Option Exchange Program, if approved by stockholders, is anticipated to commence as soon as practical after receipt of stockholder approval. The closing price of our common stock on the Nasdaq Market on November 8, 2023 was $1.50 per share, and the 52-week high of our shares of common stock through September 21, 2023 (the date used to determine the New Option Price) was $2.01 per share, which is approximately 67% and 55%, respectively, below the lowest exercise price for our outstanding options of $4.50 per share, and approximately 69% and 59%, respectively, below $4.88 per share, the weighted average exercise price of all outstanding options. In addition, the weighted average exercise price of $4.88 per share is approximately 465% above the closing price of $1.05 per share of our common stock on the Nasdaq Global Market on November 1, 2023, the date on which our board of directors authorized the Option Exchange Program. All of our outstanding stock options will have been granted more than two and a half years prior to the commencement of the Option Exchange Program.

6

Our board of directors believes that the Option Exchange Program is preferable to other alternatives considered as it will address the overhang of eligible stock options, particularly in light of the 10% Option Reduction. Based on the number of outstanding stock options as of November 8, 2023, and assuming that all Eligible Options (defined below) are exchanged for New Options, we estimate a reduction of approximately 1.3 million shares to our overhang of outstanding stock options, or approximately 6% of the fully diluted number of shares of our common stock outstanding as of November 8, 2023 and reduction in option overhang from 12% of shares outstanding to 6% of shares outstanding as of November 8, 2023. Additionally, the New Options will include extended vesting terms, vesting with respect to 50% of the shares of common stock underlying such New Option on the first anniversary of the grant date and in twelve equal monthly installments thereafter. These new vesting terms are intended to incentivize retention of Eligible Participants, as all of the options currently outstanding have vested with respect to at least 70% of the underlying options or vested in full.

Stockholder-Friendly Design

In discussing strategies to address our out-of-the-money stock options, we focused on creating a strategy that is compatible with the interests of our stockholders and Aware. In particular, the proposed Option Exchange will:

•Reduce overhang, which is the number of shares issuable upon the exercise of outstanding stock options and other stock awards, by reducing the total number of outstanding stock options by approximately 1.3 million shares (this amount is an estimate only; the actual overhang reduction will depend upon a number of factors, including the number of Eligible Options exchanged and the applicable exchange ratios);

•Provide a “value for value” exchange reduced by the 10% Option Reduction, meaning that the accounting fair value of the replacement options granted will be approximately equal to the fair value of the options that are surrendered less an additional 10% reduction in the number of New Options to be issued, such that the exchange does not result in a windfall to the participants;

•Enhance long-term stockholder value by restoring competitive incentives to the participants so they are further motivated to complete and deliver the important strategic and operational initiatives of our company, as exercise prices significantly in excess of market price undermine the effectiveness of options as performance and retention incentives;

•Incentivize growth by having an exercise price that we anticipate will be at $2.21 per share (or the closing price of our common stock on the date the new option is issued, if greater), representing an approximately 10% premium to the 52-week high of our shares of common stock through September 21, 2023; and

•Add retention value by including two-year vesting terms for New Options.

Overview

7

In the spring of 2023, our compensation committee began considering whether an option exchange program would assist with our retention efforts of our employees who hold outstanding options. We evaluated alternatives to the Option Exchange Program, including granting additional stock options. However, granting additional stock options could cause dilution to our current stockholders and would not reduce our current overhang. We also considered who would be eligible to participate in the Option Exchange Program. Non-employee members of our board of directors do not hold any outstanding options, so are not eligible to participate in the Option Exchange Program. In order to reduce the overhang and provide retention and motivation to all employees, though, we have decided that executive officers should be eligible to participate in the Option Exchange Program, as they currently hold approximately 85% of the outstanding options held by our current employees. As such, if we were to exclude them from participating, we may not fully achieve the objectives of the program with respect to retention and dilution. On September 21, 2023, our compensation committee approved the Option Exchange Program and, on November 1, 2023, our board of directors, upon the recommendation of our compensation committee, authorized the Option Exchange Program. Under the listing rules of Nasdaq and our 2023 Plan, stockholder approval is required to implement the Option Exchange Program. If our stockholders approve this proposal, our board of directors intends to commence the exchange offer as soon as practicable following the special meeting. If we do not obtain stockholder approval of this proposal, we will not be able to implement the Option Exchange Program.

Pursuant to the Option Exchange Program, stock options will be eligible for the program ("Eligible Options") if they are outstanding as of the closing of the Option Exchange Program and are held by current employees, including officers, at the date of the closing of the Option Exchange Program ("Eligible Participants"). We expect that there will be 11 employees, including three executive officers, who will be Eligible Participants. None of our non-employee directors have any options outstanding, so our non-employee directors will not have the opportunity to participate in the Option Exchange Program. If any Eligible Options are exchanged in the Option Exchange Program, the New Options will be granted under and be subject to the 2023 Plan, if the 2023 Plan is approved by our stockholders or, in the alternative, our 2001 Plan. The net shares underlying the Eligible Options granted under the 2001 Plan in excess of the shares underlying the New Options will be returned to the pool available for issuance under the 2023 Plan, if the 2023 Plan is approved by our stockholders or, in the alternative, the 2001 Plan. All other Eligible Options that are exchanged for New Options will not be returned to any pool of shares available under our equity incentive plans.

Under the proposed Option Exchange Program, if approved by our stockholders, each New Option will: (i) be treated as a nonstatutory stock option, (ii) have a term of 10 years, and (iii) vest and become exercisable, with respect to 50% of the shares of common stock underlying such New Option on the first anniversary of the grant date and, with respect to the remaining shares of common stock underlying such New Option, in twelve equal monthly installments thereafter, subject to the continuous service of the Eligible Participant.

The New Options will be exercisable for fewer shares of our common stock than the Eligible Options in accordance with an exchange ratio as described below, which provides for a “value for value” exchange reduced by the 10% Option Reduction. Except as described herein, the New Options will otherwise have substantially the same terms and conditions as the corresponding exchanged Eligible Options.

8

Reasons for the Option Exchange Program

We believe that an effective and competitive employee incentive program is in the best interests of our stockholders and imperative for the future growth and success of our business. We rely on our employees, including our officers and other Eligible Participants, to implement our strategic initiatives, expand and develop our business and satisfy customer needs. Stock options constitute a key part of our incentive and retention programs because our board of directors believes that equity compensation encourages our officers and other employees to act like owners of the business, motivating them to work toward our success and rewarding their contributions by allowing them to benefit from increases in the value of our shares.

When our compensation committee approves the grant of a stock option, it establishes the exercise price that the optionee must pay to purchase shares of our common stock when the option is exercised. The per share exercise price is generally set at the closing price of our common stock as reported by Nasdaq on the date the New Option is granted. In connection with the engagement of certain executive officers, including Robert A. Eckel, our chief executive officer and president, and Mohamed Lazzouni, our chief technology officer, we granted certain options in connection with such officer’s engagement with exercise prices set at $4.50 per share, $5.50 per share, $6.50 per share and $7.50 per share, which represented premiums above the closing prices of our common stock as reported by Nasdaq on the dates the options were granted, September 19, 2019 and November 19, 2019, respectively, of $2.75 per share and $3.09 per share, respectively. In each case, an optionee receives value only if he or she exercises an option and sells the purchased shares at a price that exceeds the stock option's exercise price.

Our stock price has experienced a significant decline since our outstanding options were granted between 2019 and 2021. As a result, all of our options are out of the money, and the Eligible Participants now hold stock options with exercise prices significantly higher than the current market price of our common stock. For example, the lowest exercise price for our options currently outstanding is $4.50 per share, which is significantly greater than the closing price of our common stock as reported by Nasdaq on November 8, 2023 of $1.50 per share. As of November 8, 2023, Eligible Participants held options to purchase 2,260,000 shares of our common stock with exercise prices ranging from $4.50 per share to $7.50 per share. We believe that our employees, including officers, who hold options view these existing stock options as having little or no value due to the difference between the exercise prices and the current market price of our common stock. As a result, our board of directors believes that these options are ineffective at providing the incentives and retention value necessary to motivate our employees who hold outstanding options to increase long-term stockholder value. We believe the Option Exchange Program will provide us with an opportunity to restore for Eligible Participants an incentive to remain with us and contribute to the future growth and success of our business.

When considering how best to continue to incentivize and reward our employees who hold out-of-the-money stock options, which primarily consist of our executive officers and senior management, our board of directors reviewed and evaluated strategies to address this issue. We determined that a program under which current employees could exchange out-of-the-money stock options was most attractive for a number of reasons, including the following:

9

•Reduction of Overhang. Our options, all of which are out of the money, will not reduce our stock option overhang until they are exercised or expire unexercised. As of November 8, 2023, there were approximately 2,560,000 outstanding stock options with an exercise price equal to or greater than $4.50 per share, of which 2,260,000 are Eligible Options (the outstanding options that are not Eligible Options are held by David Barcelo, our former chief financial officer, who is not a current employee), and such Eligible Options have a weighted average exercise price of $4.88 per share. If approved by our stockholders, the Option Exchange Program is expected to reduce our overhang of outstanding stock options by eliminating the ineffective options that are currently outstanding and issued to our employees. Under the proposed Option Exchange Program, Eligible Participants will receive stock options covering fewer shares than the exchanged Eligible Options, further reduced by the 10% Option Reduction. Based on the number of outstanding stock options as of November 8, 2023, and assuming that all Eligible Options are exchanged in the Option Exchange Program, we estimate Eligible Options to purchase approximately 2,260,000 shares would be exchanged and cancelled, while New Options covering approximately 965,000 shares would be issued. This could result in a net reduction in the overhang of our equity awards by approximately 1,295,000 shares, or approximately 6% of the fully diluted number of shares of our common stock outstanding as of November 8, 2023. The actual reduction in our overhang that may result from the Option Exchange Program could vary significantly and is dependent upon the actual level of participation in the Option Exchange Program. All Eligible Options that are not exchanged will remain outstanding and in effect in accordance with their existing terms.

•Reasonable, Balanced Incentives. We believe that the opportunity to exchange Eligible Options for New Options to be granted with fewer shares, together with a new vesting requirement, represents a reasonable and balanced exchange program with the potential for a significant positive impact on retention, motivation and performance. We also believe that providing for an exercise price of $2.21 per share (or the closing price of our common stock on the date the new option is issued, if greater), which represents an approximately 10% premium to the 52-week high of our shares of common stock through September 21, 2023, will incentivize our employees to support our growth, potentially creating value for our stockholders.

•Impact on Accounting Expense. Under the applicable accounting rules, a total of approximately $3.8 million in non-cash compensation expense will be recognized related to eligible underwater stock options, $1.2 million of which we will continue to be obligated to recognize over the vesting period of the new stock options as non-cash compensation expense, even if these stock options are never exercised because they remain underwater, except to the extent any such options are cancelled due to termination of service of any eligible employee prior to vesting. Replacing current stock options that have little or no retention or incentive value with new stock options that will provide both retention and

10

incentive value while not creating significant additional compensation expense will make efficient use of our resources.

Description of the Material Terms of the Option Exchange Program

Implementing the Option Exchange Program. We will not commence the Option Exchange Program unless our stockholders approve this proposal. If our stockholders approve this proposal, and our board of directors determines to implement the Option Exchange Program, we expect the Option Exchange Program to commence as soon as practicable after stockholder approval. Even if the Option Exchange Program is approved by our stockholders, our board of directors will retain the authority, in its sole discretion, to terminate or postpone the Option Exchange Program at any time prior to the closing of the tender offer described below or to exclude certain Eligible Options or Eligible Participants from participating in the Option Exchange Program due to tax, regulatory or accounting reasons or because participation would be inadvisable or impractical.

Upon the offer date, Eligible Participants will receive a written offer setting forth the terms of the Option Exchange Program and may voluntarily elect to participate. The written offer will be governed by the tender offer rules of the Securities and Exchange Commission (the “SEC”). At or before the offer date, we will file the offer to exchange and other related documents with the SEC as part of a tender offer statement on Schedule TO. Pursuant to the SEC tender offer rules, we will give Eligible Participants at least 20 business days to elect to surrender Eligible Options in exchange for a lesser amount of New Options. Eligible Participants may choose which eligible option grants they wish to exchange and may choose not to exchange portions of eligible option grants.

Outstanding Options Eligible for the Option Exchange Program. To be eligible for exchange under the Option Exchange Program, an option must be outstanding as of the closing of the Option Exchange Program. As of November 8, 2023, options to purchase a total of 2,560,000 shares of our common stock were outstanding, of which options to purchase 2,260,000 shares would be eligible for exchange under the Option Exchange Program (the outstanding options that are not Eligible Options are held by David Barcelo, our former chief financial officer, who is not a current employee).

Eligibility. The Option Exchange Program will be open to all of our current employees, officers, and directors. To be eligible, an Eligible Participant must be providing services to the company at the time the tender offer commences. Additionally, to receive the New Options, an Eligible Participant who exchanges his or her Eligible Options must be an employee, officer, or director on the Grant Date. As of November 8, 2023, approximately 11 employees, including our chief executive officer and director, and two additional executive officers, held Eligible Options. None of our non-employee directors have any options outstanding, so our non-employee directors will not have the opportunity to participate in the Option Exchange Program. The remaining outstanding options are held by our former chief financial officer.

Exchange Ratios; Exercise Price of New Options.

11

The Option Exchange Program is not a one-for-one exchange. We designed an approach to exchange ratios for the Option Exchange Program to result in a fair value of the new stock options that will be approximately equivalent, on an aggregate basis, to 90% of the fair value of the eligible stock options that employees would surrender (which includes the 10% Option Reduction). The total number of shares of our common stock underlying a New Option that an Eligible Participant will receive with respect to an exchanged Eligible Option will be determined by multiplying the number of shares of our common stock underlying the exchanged Eligible Option by the applicable exchange ratio and rounding down to the nearest whole number.

The exchange ratios will be applied on a grant-by-grant basis and were calculated using a Black-Scholes option pricing model to determine the fair value of the Eligible Options, based on the 90-day average price of our common stock as of September 21, 2023 of $1.60 per share, and then reduced by the 10% Option Reduction.

All New Options will be granted with an exercise price per share equal to the greater of (i) the New Option Price of $2.21 per share or (ii) the closing price of our common stock as reported by Nasdaq on the date the New Option is granted. The New Option Price was calculated by adding an approximately 10% premium, or $0.20 per share, to the 52-week high of our shares of common stock through September 21, 2023 of $2.01 per share.

The table below sets forth the applicable exchange ratio for each of the Eligible Options, rounded to the nearest percent as well as the number of outstanding Eligible Options at each exercise price point.

|

|

|

|

|

|

|

Exercise Price of Existing Option |

|

Number of Outstanding Eligible Options |

|

Weighted Average Remaining Life (In Years) |

|

Exchange Ratio |

$4.50 |

|

68,750 |

|

6 |

|

47% |

$4.73 |

|

1,985,000 |

|

7 |

|

44 |

$5.50 |

|

68,750 |

|

6 |

|

37 |

$6.50 |

|

68,750 |

|

6 |

|

29 |

$7.50 |

|

68,750 |

|

6 |

|

25 |

As an example, if an Eligible Participant elected to exchange an Eligible Option to purchase 1,000 shares with an exercise price of $4.73 per share, that Eligible Participant would receive a New Option to purchase 440 shares (that is, 1,000 multiplied by 44%, rounded down to the nearest whole number).

Election to Participate. Participation in the Option Exchange Program will be voluntary. Eligible Participants will be permitted to exchange all or none of their Eligible Options for New Options on a grant-by-grant basis.

Vesting of New Options. The New Options will not be exercisable on the date they are granted, even if the corresponding exchanged Eligible Options had previously become exercisable. The New Options will vest and become exercisable (a) with respect to 50% of the shares of common stock underlying such New Option on the first anniversary of the grant date and, (b) with respect to the remaining shares of common stock underlying such New Option, in

12

twelve equal monthly installments thereafter, in each case subject to the continuous service of the Eligible Participant.

Term of the New Options. The New Options will expire on the tenth anniversary of the grant date of such options.

Other Terms and Conditions of the New Options. The other terms and conditions of the New Options will be set forth in an option agreement to be entered into as of the date that such New Options are granted. Any additional terms and conditions will be comparable to the other terms and conditions of the Eligible Options. All New Options will be treated as nonstatutory stock options. The shares of our common stock for which the New Options may be exercised are currently registered on a registration statement filed with the SEC.

Treatment of Net Shares. The Eligible Options exchanged for New Options will be cancelled. The net shares underlying the Eligible Options granted under the 2001 Plan in excess of the shares underlying the New Options will be returned to the pool available for issuance under the 2023 Plan, if the 2023 Plan is approved by our stockholders or, in the alternative, the 2001 Plan. All other Eligible Options that are exchanged for New Options will not be returned to any pool of shares available under our equity incentive plans.

Accounting Treatment. The incremental compensation expense associated with the Option Exchange Program will be measured as the excess, if any, of the fair value of each new stock option granted to participants in the Option Exchange Program, measured as of the date the new stock options are granted, over the fair value of the stock options surrendered in exchange for the new stock options, measured immediately prior to the cancellation. We do not expect the incremental compensation expense, if any, to be material. We will recognize any such incremental compensation expense ratably over the vesting period of the New Options.

Material United States Federal Income Tax Consequences. The following is a summary of the anticipated material United States federal income tax consequences of participating in the Option Exchange Program. A more detailed summary of the applicable tax considerations to participants will be provided in the tender offer. Each participant is advised to consult his or her personal tax advisor concerning the application of the United States federal income tax laws to such participant’s particular situation, as well as the applicability and effect of any state, local or non-United States tax laws before taking any actions with respect to his or her stock options eligible for the Option Exchange Program.

We believe the exchange of Eligible Options for New Options pursuant to the Option Exchange Program should be treated as a non-taxable option exchange, and no income should be recognized for United States federal income tax purposes by us or our employees or consultants upon the grant of the New Options. However, the Internal Revenue Service is not precluded from adopting a contrary position, and the laws and regulations themselves are subject to change. A more detailed summary of the applicable tax considerations to Eligible Participants will be provided in the tender offer.

Potential Modifications to Terms to Comply with Governmental Requirements. The terms of the Option Exchange Program will be described in a tender offer that we will file with the

13

SEC. Although we do not anticipate that the SEC will require us to modify the terms significantly, it is possible we will need to alter the terms of the Option Exchange Program to comply with comments from the SEC. Changes in the terms of the Option Exchange Program may also be required for tax purposes as the laws and regulations are subject to change.

Effect on Stockholders

We are not able to predict the impact that the Option Exchange Program will have on your interests as a stockholder, as we are unable to predict how many participants will exchange their Eligible Options or what the fair market value of our common stock, or the closing price of our common stock as reported by Nasdaq, on the date the New Options are granted. If the Option Exchange Program is approved, the exchange ratios will result in the issuance of fewer shares subject to the New Options than were subject to the exchanged Eligible Options and may result in an incremental compensation expense for financial reporting purposes. In addition, the Option Exchange Program is intended to reduce both our existing stock option overhang and provide the incentives and retention value necessary to motivate our employees who hold outstanding options to increase long-term stockholder value. While we cannot predict how many Eligible Options will be exchanged, based on the number of outstanding stock options as of November 8, 2023, we estimate a reduction of approximately 965,000 shares to our overhang of outstanding stock options, or approximately 6% of the fully diluted number of shares of our common stock outstanding as of November 8, 2023. The actual reduction in our overhang that could result from the Option Exchange Program could vary significantly and is dependent upon the actual level of participation in the Option Exchange Program. Based on these assumptions and following the issuance of the New Options, a net of approximately 1,295,000 shares will be returned to the share reserve of the 2023 Plan (or the 2001 Plan, if the 2023 Plan is not approved by our stockholders).

Interests of Executive Officers in the Option Exchange Program

Our executive officers will be permitted to participate in the Option Exchange Program to the extent they are employed by us at the time the Option Exchange Program starts and on the date on which the surrendered Eligible Options are canceled and the New Options are granted to replace them. Eligible Options held by our executive officers constitute approximately 85% of all Eligible Options and approximately 75% of all of our options that are currently outstanding. None of our non-employee directors have any options outstanding, so our non-employee directors will not have the opportunity to participate in the Option Exchange Program. The following table shows the number of shares of our common stock underlying Eligible Options held by our executive officers as of November 8, 2023, and the number of New Options that such executive officers may receive assuming, for purposes of illustration only, that each executive officer remains eligible and decides to exchange all of his Eligible Options.

14

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Shares Underlying All Eligible Options |

|

|

Weighted Average Exercise Price ($) |

|

|

Weighted Average Remaining Life (in years) |

|

|

New Options to be Granted Assuming All Eligible Options are Exchanged |

|

Robert A. Eckel |

|

|

1,450,000 |

|

|

|

4.91 |

|

|

|

7 |

|

|

|

619,000 |

|

Mohamed Lazzouni |

|

|

375,000 |

|

|

|

4.98 |

|

|

|

7 |

|

|

157,875 |

|

David K. Traverse |

|

|

100,000 |

|

|

|

4.73 |

|

|

|

7 |

|

|

44,000 |

|

If you are both a stockholder and an employee holding Eligible Options, please note that voting to approve the Option Exchange Program does not constitute an election to participate in the Option Exchange Program.

New Plan Benefits

The decision to participate in the Option Exchange Program is completely voluntary. Therefore, we are not able to predict who or how many employees, including executive officers, will elect to participate, how many options will be surrendered for exchange or the number of shares of our common stock which will be issued in exchange for canceled options.

Financial Statements

Our financial statements and other information required by Item 13(a) are incorporated by reference from our Quarterly Reports on Form 10-Q filed with the SEC on November 3, 2023, August 2, 2023 and May 3, 2023 and our Annual Report on Form 10-K filed with the SEC on March 15, 2023, as amended on March 17, 2023.

Vote Required

The affirmative vote of the holders of a majority of the shares of our common stock present or represented and voting at the Special Meeting is required to approve the Option Exchange Program.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" THE APPROVAL OF THE OPTION EXCHANGE PROGRAM

15

PROPOSAL NO. 2: APPROVAL OF THE AWARE, INC. 2023 EQUITY AND

INCENTIVE PLAN

We are asking stockholders to approve the 2023 Plan. The 2023 Plan is intended to update and replace our existing 2001 Plan in order to modernize the plan in light of current market standards. If the 2023 Plan is approved by our stockholders, no further awards will be granted under the 2001 Plan. The new 2023 Plan will provide 1,277,130 shares of common stock for equity awards to our employees, directors and consultants, which is equal to the number of shares that currently remain available for issuance under the 2001 Plan, plus certain shares underlying awards previously issued under the 2001 Plan, if those awards are subsequently forfeited or expire or terminate without being exercised. If Proposal 2 is approved by the requisite vote of stockholders, we intend to register subsequently the additional shares reserved for issuance under the 2023 Plan by filing a registration statement on Form S-8.

Our board of directors approved the 2023 Plan on November 1, 2023, subject to approval by our stockholders. If the 2023 Plan is approved by our stockholders, then the 2023 Plan will be effective immediately following such approval.

The following is a summary of the material features of the 2023 Plan. This summary is qualified in its entirety by the full text of the 2023 Plan, a copy of which is attached as Annex A to this proxy statement.

Key Plan Provisions

•The 2023 Plan will continue until terminated by our board of directors.

•The 2023 Plan provides for the grant of stock options, both incentive stock options and nonstatutory stock options, stock appreciation rights, restricted stock, unrestricted stock, restricted stock units, dividend equivalent rights, and cash awards.

•An aggregate of 1,277,130 shares of our common stock will be authorized for issuance pursuant to awards under the 2023 Plan, plus an additional number of shares equal to the number of shares of our common stock subject to awards granted under the 2001 Plan that expire or terminate without having been exercised, are forfeited or otherwise repurchased by us at the grantee’s original purchase price, or are withheld in payment of the exercise price of an option under the 2001 Plan or to satisfy tax withholding obligations with respect to such exercise, up to a maximum of 2,590,000 shares. For the avoidance of doubt, shares underlying options surrendered under the 2001 Plan pursuant to the Option Exchange Program will be treated as terminated without being exercised under the 2001 Plan, and such shares will be added back to the shares available for issuance under the 2023 Plan (provided that the 2023 Plan is approved). Shares underlying New Options issued pursuant to the Option Exchange Program will reduce the number of shares available for issuance under the 2023 Plan.

16

•The 2023 Plan will be administered by our board of directors or, if designated by our board of directors, our compensation committee.

Reasons for the 2023 Plan

The primary reason for adopting the 2023 Plan is to put into place a modernized plan in light of current market standards, while maintaining the same number of shares reserved for issuance under our existing 2001 Plan. For example, the 2023 Plan allows for the grant of incentive stock options and certain other types of derivative awards, as well as grants of both cash and stock-settled awards, as described below, which gives us greater flexibility in the forms of awards that we can issue. The 2023 Plan also includes provisions reflecting intervening changes to the tax code and securities law and certain “best practices” provisions with respect to corporate governance. Our board of directors believes that, similar to the 2001 Plan that the 2023 Plan will replace, the 2023 Plan will be a vital component of our employee and director compensation programs, since it will allow us the ability to compensate our employees, officers, consultants and non-employee directors whose contributions are important to our success by offering them the opportunity to participate in our future performance while at the same time providing an incentive to build long-term stockholder value. We operate in a competitive market and equity awards are essential in helping us attract talented individuals. Likewise, annual grants are essential in helping us retain and motivate our most valuable employees. Both new hire grants and annual grants help keep employees’ interests aligned with the interests of our stockholders.

The 2023 Plan has been adopted by our board of directors, subject to the approval of our stockholders, and will become effective immediately following such approval. The 2023 Plan allows us to make equity and equity-based incentive awards, as well as cash awards, to employees, directors and consultants. Our board of directors anticipates that providing such persons with a direct stake in our company will assure a closer alignment of the interests of such individuals with those of our company and our stockholders, thereby stimulating their efforts on our behalf and strengthening their desire to remain with us.

Plan Share Reserve

As of November 8, 2023 an aggregate of 1,277,130 shares remained available for future grants under our 2001 Plan. We used this number in determining the number of shares to reserve under the 2023 Plan. If the 2023 Plan is approved, no further awards will be granted under the 2001 Plan.

Our board of directors believes that the request to authorize 1,277,130 shares for issuance pursuant to the 2023 Plan (in addition to the up to 2,590,000 shares of our common stock subject to awards granted under the 2001 Plan that may become issuable under the 2023 Plan, as described below) is reasonable and prudent. This number of shares should allow us to continue our current granting practices in the future.

The closing market price of our common stock on November 8, 2023 was $1.50.

Summary of the 2023 Plan

17

Purposes. The purposes of the 2023 Plan will be to provide long-term incentives and rewards to our and our subsidiaries’ employees, officers, directors and other key persons, to assist in attracting and retaining persons with the requisite experience and ability, and to more closely align the interests of such employees, officers, directors and other key persons with the interests of our stockholders. These incentives will be provided through the grant of stock options, stock appreciation rights, restricted stock, unrestricted stock, restricted stock units, dividend equivalent rights, and cash awards as the administrator of the 2023 Plan may determine.

Eligibility. As of November 8, 2023, approximately 78 individuals would be eligible to participate in the 2023 Plan, which includes approximately five non-employee directors, four executive officers, and 69 employees who are not officers.

Authorized Shares. We will reserve 1,277,130 shares of our common stock for issuance under the 2023 Plan, plus an additional number of shares equal to the number of shares of our common stock subject to awards granted under the 2001 Plan that expire or terminate without having been exercised, are forfeited or otherwise repurchased by us at the grantee’s original purchase price, or are withheld in payment of the exercise price of an option under the 2001 Plan or to satisfy tax withholding obligations with respect to such exercise, up to a maximum of 2,590,000 shares. Shares underlying any awards under the 2023 Plan that are forfeited, cancelled, held back upon exercise of an option or settlement of an award to cover the exercise price or tax withholding, reacquired by us prior to vesting, satisfied without the issuance of stock or otherwise terminated (other than by exercise) will be added back to the shares available for issuance under the 2023 Plan and, to the extent permitted under Section 422 of the Internal Revenue Code, as amended (the “Code”) and the regulations promulgated thereunder, the shares may be issued as incentive stock options. For the avoidance of doubt, shares underlying options surrendered under the 2001 Plan pursuant to the Option Exchange Program will be treated as terminated without being exercised under the 2001 Plan, and such shares will be added back to the shares available for issuance under the 2023 Plan (provided that the 2023 Plan is approved). Shares underlying New Options issued pursuant to the Option Exchange Program will reduce the number of shares available for issuance under the 2023 Plan. In addition, to the extent consistent with the requirements of Section 422 of the Code, awards granted or stock issued upon assumption of, or in substitution or exchange for, awards previously granted by an entity that we acquire or merges with or into, shall not reduce the shares available for issuance under the 2023 Plan, nor will the shares underlying such awards be added back to the shares available for issuance under the 2023 Plan in the event of any forfeiture, cancellation, reacquisition, expiration, termination, cash settlement or non-issuance of such shares.

The 2023 Plan contains a limitation whereby the value of all awards under the 2023 Plan and all other cash compensation that we pay to any non-employee director may not exceed $750,000 in any calendar year, except that the limit will be $1,000,000 for the first calendar year a non-employee director is initially appointed to our board of directors. The foregoing limitation will be calculated without regard to amounts paid to any non-employee director (including retirement benefits and severance payments) in respect of any services provided in any capacity (including employee or consultant) other than as a non-employee director. Our board of directors may make exceptions to this limit for individual non-employee directors in extraordinary circumstances, as our board of directors may determine in its discretion, provided that the non-employee director receiving such additional compensation may not participate in the decision to

18

award such compensation or in other contemporaneous compensation decisions involving such non-employee director.

Administration; No Repricing. The 2023 Plan will be administered by our compensation committee, our board of directors or another board committee pursuant to the terms of the 2023 Plan. The plan administrator will have full power to select, from among the individuals eligible for awards, the individuals to whom awards will be granted, to make awards to participants, and to determine the specific terms and conditions of each award, subject to the provisions of the 2023 Plan. The plan administrator’s determinations under the 2023 Plan need not be uniform. The plan administrator may delegate to one or more officers the authority to grant stock options and other awards to employees who are not subject to the reporting and other provisions of Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), subject to certain limitations and guidelines. Persons eligible to participate in the 2023 Plan will be our and our subsidiaries’ directors, officers, current and prospective employees and consultants.

The 2023 Plan requires the plan administrator to make appropriate adjustments to the number of shares of our common stock that are subject to the 2023 Plan, to certain limits in the 2023 Plan, and to any outstanding awards to reflect stock dividends, stock splits, extraordinary cash dividends and similar events.

The plan administrator may not, without the approval of our stockholders, amend or modify any outstanding stock option or stock appreciation right, including, without limitation, by replacement of such stock option or stock appreciation right with cash or other award type, in a manner that would be treated as a repricing under the rules of the securities exchange or market system constituting the primary market for our common stock. However, appropriate adjustments may be made to outstanding stock options or stock appreciation rights to reflect stock dividends, stock splits, extraordinary cash dividends and similar events, and may be made to make changes to achieve compliance with applicable law. See “Proposal 1: Approval of the Aware, Inc. Stock Option Exchange Program” for a description of the Option Exchange Program for which we are seeking stockholder approval.

Payments by Participants. Participants in the 2023 Plan are responsible for the payment of any federal, state, local or foreign taxes that we or our subsidiaries are required by law to withhold upon the exercise of options or stock appreciation rights or vesting of other awards. The plan administrator may cause any of our or our subsidiaries’ tax withholding obligations to be satisfied, in whole or in part, by the applicable entity withholding from shares of our common stock to be issued pursuant to an award a number of shares with an aggregate fair market value that would satisfy the withholding amount due. The plan administrator may also require any of our or our subsidiaries’ tax withholding obligations to be satisfied, in whole or in part, by an arrangement whereby a certain number of shares issued pursuant to any award are immediately sold and proceeds from such sale are remitted to us or our subsidiaries in an amount that would satisfy the withholding amount due.

Non-Transferability of Awards. The 2023 Plan generally does not allow for the transfer or assignment of awards, other than by will or by the laws of descent and distribution or pursuant to a domestic relations order; however, the plan administrator may permit the transfer of awards (other than incentive stock options) by holders to an immediate family member, to trusts for the

19

benefit of family members, or to partnerships in which such family members are the only partners.

Merger or Change in Control. The 2023 Plan provides that upon the effectiveness of a “change in control transaction,” as defined in the 2023 Plan, an acquirer or successor entity may assume, continue or substitute for the outstanding awards under the 2023 Plan. To the extent that awards granted under the 2023 Plan are not assumed, continued or substituted by the successor entity, all awards granted under the 2023 Plan shall terminate and, in such case (except as may be otherwise provided in the relevant award agreement), all stock options and stock appreciation rights with time-based vesting conditions or restrictions that are not vested and/or exercisable immediately prior to the effective time of the change in control transaction shall become fully vested and exercisable as of the closing, all other awards with time-based vesting conditions or restrictions shall become fully vested and nonforfeitable as of the closing, and all awards with conditions and restrictions relating to the attainment of performance goals may become vested and nonforfeitable in connection with the change in control transaction in the plan administrator’s discretion or to the extent specified in the relevant award agreement. In the event of such termination, individuals holding options and stock appreciation rights will, for each such award, either (a) receive a payment in cash or in kind for each share subject to such award that is exercisable in an amount equal to the per share value of the consideration payable to stockholders in the change in control transaction less the applicable per share exercise price (provided that, in the case of an option or stock appreciation right with an exercise price equal to or greater than the per share cash consideration payable to stockholders in the transaction, such option or stock appreciation right shall be cancelled for no consideration) or (b) be permitted to exercise such options and stock appreciation rights (to the extent exercisable) within a period of time prior to the transaction as specified by the plan administrator. The plan administrator shall also have the option (in its sole discretion) to make or provide for a payment, in cash or in kind, to participants holding other awards in an amount equal to the per share value of the consideration payable to stockholders in the change in control transaction multiplied by the number of vested shares under such awards.

General. The plan administrator may establish subplans and modify exercise procedures and other terms and procedures in order to facilitate grants of awards subject to the laws and/or stock exchange rules of countries outside of the United States. All awards will be subject to any clawback policy that we may have in effect from time to time.

Amendment or Termination. Our board of directors may amend or discontinue the 2023 Plan and the plan administrator may amend or cancel outstanding awards for purposes of satisfying changes in law or any other lawful purpose, but no such action may materially and adversely affect rights under an award without the holder’s consent. Certain amendments to the 2023 Plan will require the approval of our stockholders.

Awards – Types of Awards

Stock Options. The 2023 Plan permits the granting of both options to purchase shares of our common stock intended to qualify as incentive stock options under Section 422 of the Code and options that do not so qualify. Options granted under the 2023 Plan will be non-qualified options if they fail to qualify as incentive stock options or exceed the annual limit on incentive

20

stock options. Incentive stock options may only be granted to our employees and employees of any of our subsidiaries that is a “subsidiary corporation” within the meaning of Section 424(f) of the Code. Non-qualified options may be granted to any persons eligible to receive awards under the 2023 Plan. The option exercise price of each option will be determined by the plan administrator but generally may not be less than 100% of the fair market value of our common stock on the date of grant or, in the case of an incentive stock option granted to a ten percent stockholder, 110% of such share’s fair market value on the date of grant. The term of each option will be fixed by the plan administrator and may not exceed ten years from the date of grant, subject to limited exceptions as described in the 2023 Plan. The plan administrator will determine at what time or times each option may be exercised, including the ability to accelerate the vesting of such options.

Upon exercise of an option, the option exercise price must be paid in full either in cash, by certified or bank check or other instrument acceptable to the plan administrator or by delivery (or attestation to the ownership) of shares of our common stock that are beneficially owned by the optionee free of restrictions or were purchased in the open market. The exercise price may also be delivered by a broker pursuant to irrevocable instructions to the broker from the optionee. In addition, the plan administrator may permit options to be exercised using a “net exercise” arrangement that reduces the number of shares issued to the optionee by the largest whole number of shares with a fair market value that does not exceed the aggregate exercise price.

Stock Appreciation Rights. The plan administrator may award stock appreciation rights subject to such conditions and restrictions as it may determine. Stock appreciation rights entitle the recipient to receive shares of our common stock, or cash to the extent provided for in an award agreement, equal to the value of the appreciation in our common stock price over the exercise price. The exercise price generally may not be less than 100% of the fair market value of our common stock on the date of grant. The term of each stock appreciation right will be fixed by the plan administrator and may not exceed ten years from the date of grant, subject to limited exceptions as described in the 2023 Plan. The plan administrator will determine at what time or times each stock appreciation right may be exercised.

Restricted Stock, Restricted Stock Units, Unrestricted Stock, Dividend Equivalent Rights. The plan administrator may award restricted shares of our common stock and restricted stock units subject to such conditions and restrictions as it may determine. These conditions and restrictions may include the achievement of certain performance goals and/or continued employment through a specified vesting period. The plan administrator may also grant shares of our common stock that are free from any restrictions under the 2023 Plan. Unrestricted stock may be granted or sold to participants in recognition of past services or for other valid consideration and may be issued in lieu of cash compensation due to such participant. The plan administrator may grant dividend equivalent rights to participants that entitle the recipient to receive credits for dividends that would have been paid if the recipient had held a specified number of shares of our common stock.

Cash Awards. The plan administrator may grant cash-based awards under the 2023 Plan to participants, subject to such vesting and other terms and conditions as the plan administrator may determine.

21

Summary of Material United States Federal Income Tax Considerations

The following is only a summary of the principal United States federal income tax consequences of certain transactions under the 2023 Plan. The summary does not discuss all federal tax consequences under the 2023 Plan, nor does it discuss the tax laws of any municipality, state or foreign country in which a participant may reside or otherwise be subject to tax.

PARTICIPANTS ARE URGED TO CONSULT THEIR OWN TAX ADVISORS WITH RESPECT TO THE PARTICULAR FEDERAL INCOME TAX CONSEQUENCES TO THEM OF PARTICIPATING IN THE 2023 PLAN, AS WELL AS WITH RESPECT TO ANY APPLICABLE STATE, LOCAL OR FOREIGN INCOME TAX OR OTHER TAX CONSIDERATIONS.

Incentive Stock Options. No taxable income is generally realized by the optionee upon the grant or exercise of an incentive stock option. If shares of our common stock issued to an optionee pursuant to the exercise of an incentive stock option are sold or transferred after two years from the date of grant and after one year from the date of option exercise, then generally (i) upon sale of such shares, any amount realized in excess of the option exercise price (the amount paid for the shares) will be taxed to the optionee as a long-term capital gain, and any loss sustained will be a long-term capital loss, and (ii) neither we nor our subsidiaries will be entitled to any deduction for federal income tax purposes; provided that such incentive stock option otherwise meets all of the technical requirements of an incentive stock option. The excess of the fair market value of shares received upon exercise of an incentive stock option over the option exercise price will give rise to an item of tax preference that may result in alternative minimum tax liability for the optionee.

If shares of our common stock acquired upon the exercise of an incentive stock option are disposed of prior to the expiration of the two-year and one-year holding periods described above, referred to as a disqualifying disposition, generally (i) the optionee will realize ordinary income in the year of disposition in an amount equal to the excess of the fair market value of the shares of our common stock at exercise (or, if less, the amount realized on a sale of such shares of our common stock) over the option exercise price, and (ii) we or our subsidiaries will be entitled to deduct such amount. Special rules will apply where all or a portion of the exercise price of the incentive stock option is paid by tendering shares of our common stock.

If an incentive stock option is exercised at a time when it no longer qualifies for the tax treatment described above, the option is treated as a non-qualified option. Generally, an incentive stock option will not be eligible for the tax treatment described above if it is exercised more than three months following termination of employment (or one year in the case of termination of employment by reason of disability). In the case of termination of employment by reason of death, the three-month rule does not apply.

Nonstatutory Stock Options. No income is generally realized by the optionee at the time a nonstatutory option is granted. Generally (i) at exercise, ordinary income is realized by the optionee in an amount equal to the difference between the option exercise price and the fair market value of the shares of our common stock on the date of exercise, and either we or our

22

subsidiaries will receive a tax deduction for the same amount, and (ii) at disposition of the shares, any gain or loss in value after the date of exercise is treated as either short-term or long-term capital gain or loss depending on how long the shares of our common stock have been held. A capital gain or loss will generally be long-term if the participant held the shares for more than 12 months after the option exercise date, or short-term if the participant held the shares for 12 months or less. Special rules will apply where all or a portion of the exercise price of the non-qualified option is paid by tendering shares of our common stock.

All Other Awards. For all other awards under the 2023 Plan, either we or our subsidiaries generally will be entitled to a tax deduction in connection with such awards in an amount equal to the ordinary income realized by the participant at the time the participant recognizes such income. Participants typically are subject to income tax and recognize such tax at the time that an award is exercised, vests or becomes non-forfeitable, unless the award provides for deferred settlement.

The vesting of any portion of an award that is accelerated due to the occurrence of a change in control may cause all or a portion of the payments with respect to such accelerated awards to be treated as “parachute payments” as defined in the Code. Any such parachute payments may be non-deductible to either us or our subsidiaries, in whole or in part, and may subject the recipient to a non-deductible 20% federal excise tax on all or a portion of such payment (in addition to other taxes ordinarily payable).

New Plan Benefits

No awards have been previously granted under the 2023 Plan and no awards have been granted that are contingent on stockholder approval of the 2023 Plan. The awards that are to be granted to any participant or group of participants are indeterminable at the date of this proxy statement because participation and the types of awards that may be granted under the 2023 Plan are subject to the discretion of the plan administrator. Consequently, no new plan benefits table is included in this proxy statement.

If the Option Exchange Program and the 2023 Plan are both approved by our stockholders, any New Options issued in exchange for surrendered Eligible Options will be issued from the 2023 Plan. The decision to participate in the Option Exchange Program is completely voluntary. Therefore, we are not able to predict who or how many employees, including executive officers, will elect to participate, how many options will be surrendered for exchange or the number of shares of our common stock which will be issued in exchange for canceled options.

Vote Required

The affirmative vote of the holders of a majority of the shares of our common stock present or represented and voting at the Special Meeting is required to approve the 2023 Plan.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" THE APPROVAL OF THE 2023 PLAN

23

Compensation of Executive Officers and Directors

Executive compensation