Barfresh Food Group Inc. (the “Company” or “Barfresh”) (Nasdaq:

BRFH), a provider of frozen, ready-to-blend and ready-to-drink

beverages, is providing a business update for the third quarter

ended September 30, 2024.

Management Comments

Riccardo Delle Coste, the Company’s Chief

Executive Officer, stated, "Our strategic investments and

operational enhancements have driven exceptional results, with

record quarterly third quarter revenue exceeding $3.6 million, a

40% year-over-year increase. Notably, this robust performance was

achieved without any revenue contribution from our new Pop &

Go™ product, reflecting the growing market adoption of our existing

product lines and the effectiveness of our expanded sales and

distribution network. We're excited about the recent launch of Pop

& Go™ in the education channel. This product has the potential

to significantly expand our presence in schools by targeting lunch

menus, which typically offer higher volume opportunities compared

to the breakfast menus where our legacy products have traditionally

performed well. As we move forward, we remain on track for record

annual revenue in fiscal year 2024 and continued margin

improvements. Our expanded co-manufacturing capacity, broader

product line, and coverage of over 95% of the country position us

for sustained, long-term growth. I'm more confident than ever in

our ability to deliver substantial value to our customers and

shareholders."

Third Quarter of 2024 Financial

Results

Revenue for the third quarter of 2024 increased

40% to $3.6 million, compared to $2.6 million in the third quarter

of 2023. Revenue in 2024 benefitted from improvements in Twist

& Go bottled smoothie sales from inventory built ahead of its

seasonally high third quarter, and improvements in smoothie carton

and bulk sales. The Company expects expanded capacity for its

bottled smoothie to become available in the fourth quarter of 2024,

subject to the risks and uncertainties associated with

pre-production activities. Gross Margin for the third quarter of

2024 was comparable to prior year period at 35%. Adjusted Gross

Margin for the third quarter of 2024 was 38%, compared to 35% in

the prior year period. A reconciliation of Gross Profit to Adjusted

Gross Profit is provided below. The improvement in Adjusted Gross

Margin was a result of favorable product mix, pricing actions, and

a slight improvement in the cost of supply chain components.

Selling, marketing and distribution expenses for

the third quarter of 2024 increased to $990,000, compared to

$697,000 for the third quarter of 2023. The increase is a result of

higher personnel cost, travel and broker commissions due to

expansion of the Company’s broker network. G&A expenses in the

third quarter of 2024 increased to $705,000 compared to $577,000 in

the third quarter of 2023. The increase in G&A was primarily

due to the non-recurrence of recognizing Employee Retention Tax

Credit benefits in 2023.

Net loss in the third quarter of 2024 was

$513,000, as compared to a loss of $476,000 in the third quarter of

2023. The increase is a result of increased headcount and the

non-recurrence of tax benefits in 2023, partially offset by the

contribution margin from increased sales.

Adjusted EBITDA was approximately a loss of

$124,000 for the third quarter of 2024, compared to a loss of

approximately $89,000 for the third quarter of 2023. A

reconciliation of net loss to Adjusted EBITDA is provided

below.

First Nine Months of 2024 Financial

Results

Revenue for the first nine months of 2024

increased 28% to $7.9 million, compared to $6.2 million in the same

period of 2023. The increase in revenue is the result of

improvements in Twist & Go bottled smoothie sales from

inventory built ahead of its seasonally high third quarter and

improvements in smoothie carton and bulk sales. Gross margin for

the first nine months of 2024 was 37%, compared to 36% for the same

period of 2023. Excluding production relocation costs, Adjusted

Gross Margin for the first nine months of 2024 was 39% compared to

36% in the prior year. A reconciliation of Gross Profit to Adjusted

Gross Profit is provided below. The improvement in Gross Margin and

Adjusted Gross Margin is a result of favorable product mix, pricing

actions, and a slight improvement in the cost of supply chain

components.

Net loss for the first nine months of 2024 was

$2.0 million, as compared to a loss of $2.1 million in the same

period of 2023. Selling, marketing and distribution for the first

nine months of 2024 increased to $2.3 million, compared to $2.0

million in the same period of 2023. The increase is a result of

increased sales and marketing personnel costs and outbound freight

as a result of increased shipments. G&A expenses for the first

nine months of 2024 increased to $2.4 million, compared to $2.1

million in the same period of 2023. The increase in G&A was

driven by an increase to management headcount, an increase in

stock-based compensation resulting from adoption of an equity-only

structure for Board of Director compensation and management

incentives, and the non-recurrence of recognizing Employee

Retention Tax Credit benefits in 2023.

Adjusted EBITDA was approximately a loss of

$752,000 for the first nine months of 2024, as compared to a loss

of $1.2 million in the same period of 2023. A reconciliation of net

loss to Adjusted EBITDA is provided below.

Non-GAAP Financial Measures

The above information is presented in conformity

with accounting principles generally accepted in the United States.

In order to aid in the understanding of the Company’s business

performance, the Company has also presented below certain non-GAAP

measures, including Adjusted Gross Profit, EBITDA and Adjusted

EBITDA, which are reconciled in the table below to comparable GAAP

measures, and certain calculations based on its results including

Gross Margin and Adjusted Gross Margin. Management believes that

Adjusted Gross Profit and Adjusted EBITDA provide useful

information to the investor because they are directly reflective of

the performance of the Company. The exclusion of certain items

including manufacturing relocation costs in calculating Adjusted

Gross Profit and stock compensation, and other non-recurring costs

such as those associated with the product withdrawal, the related

dispute, and certain manufacturing relocation costs in calculating

Adjusted EBITDA can provide a useful measure for period-to-period

comparisons of the Company’s core business performance. Adjusted

Gross Profit and Adjusted EBITDA are not recognized measurements

under GAAP and should not be considered as an alternative to Gross

Profit, loss from operations, net loss or any other performance

measure derived in accordance with GAAP.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months

ended September 30, |

|

For the nine months

ended September 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Revenue |

|

$ |

3,637,000 |

|

|

$ |

2,603,000 |

|

|

$ |

7,929,000 |

|

|

$ |

6,205,000 |

|

| Cost of

revenue |

|

|

2,377,000 |

|

|

|

1,690,000 |

|

|

|

4,991,000 |

|

|

|

3,963,000 |

|

| Gross

profit |

|

|

1,260,000 |

|

|

|

913,000 |

|

|

|

2,938,000 |

|

|

|

2,242,000 |

|

|

Manufacturing relocation (1) |

|

|

126,000 |

|

|

|

- |

|

|

|

176,000 |

|

|

|

- |

|

|

Adjusted Gross Profit |

|

$ |

1,386,000 |

|

|

$ |

913,000 |

|

|

$ |

3,114,000 |

|

|

$ |

2,242,000 |

|

|

Gross Margin |

|

|

35 |

% |

|

|

35 |

% |

|

|

37 |

% |

|

|

36 |

% |

|

Adjusted Gross Margin |

|

|

38 |

% |

|

|

35 |

% |

|

|

39 |

% |

|

|

36 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Represents costs incurred to relocate single-serve

ready-to-blend beverage pack production lines owned by Barfresh at

the conclusion of a multi-year manufacturing agreement. |

|

|

|

For the three months

ended September 30, |

|

For the nine months

ended September 30, |

|

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Net loss |

|

$ |

(513,000 |

) |

|

$ |

(476,000 |

) |

|

$ |

(1,973,000 |

) |

|

$ |

(2,123,000 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation

and amortization |

|

|

71,000 |

|

|

|

120,000 |

|

|

|

217,000 |

|

|

|

325,000 |

|

|

| Interest

expense |

|

|

13,000 |

|

|

|

1,000 |

|

|

|

24,000 |

|

|

|

3,000 |

|

|

|

EBITDA |

|

|

(429,000 |

) |

|

|

(355,000 |

) |

|

|

(1,732,000 |

) |

|

|

(1,795,000 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock based

compensation, employees and board of directors |

|

|

179,000 |

|

|

|

240,000 |

|

|

|

696,000 |

|

|

|

430,000 |

|

|

| Operating

expense related to withdrawn product and related dispute (1) |

|

|

- |

|

|

|

26,000 |

|

|

|

108,000 |

|

|

|

118,000 |

|

|

|

Manufacturing relocation (2) |

|

|

126,000 |

|

|

|

- |

|

|

|

176,000 |

|

|

|

- |

|

|

|

Adjusted EBITDA |

|

$ |

(124,000 |

) |

|

$ |

(89,000 |

) |

|

$ |

(752,000 |

) |

|

$ |

(1,247,000 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Barfresh experienced a quality issue with product manufactured

by one of its contract manufacturers, which is the subject of a

legal dispute as to the source of complaints received. Operating

expense in 2023 and 2024 primarily includes legal expense incurred

with respect to the dispute. |

|

|

|

(2) Represents costs incurred to relocate single-serve

ready-to-blend beverage pack production lines owned by Barfresh at

the conclusion of a multi-year manufacturing agreement. |

Balance Sheet

As of September 30, 2024, the Company had

approximately $2.1 million of cash and accounts receivable, and

approximately $770,000 of inventory on its balance sheet. In the

first half of the year, the Company deployed a significant amount

of cash to build up inventory in preparation for its seasonally

high third quarter. The inventory build allowed the Company to

generate a 40% year-over-year increase in revenue for the third

quarter of 2024. The Company expects expanded capacity to become

available in the fourth quarter of 2024, subject to the risks and

uncertainties associated with pre-production activities.

Additionally, the Company has taken other measures to reduce its

liquidity requirements, including compensating its directors and

employees with equity to reduce cash compensation requirements,

obtaining non-recourse litigation financing, and securing

receivables financing.

In August 2024, the Company secured a $1.5

million receivables financing facility with a one-year term that

renews annually and is secured by accounts receivable and

inventory. This provides the Company with extra coverage to fund

inventory should it need to flex up production further. This

proactive approach ensures the Company has the flexibility to

respond quickly to market demands while maintaining a strong

financial position. In addition, the Company also received

non-recourse litigation financing to allow vigorous pursuit of its

legal complaint without further expense to the company.

Commentary and Outlook for

2024

The Company continues to expect to achieve

record fiscal year revenue for fiscal year 2024.

The Company continues to expect to achieve

higher gross profit in 2024 compared to 2023 with Gross Margin and

Adjusted Gross Margin for 2024 expected to be in the mid to high

30’s.

The Company expects positive adjusted EBITDA in

the fourth quarter of fiscal year 2024.

Supplier Dispute

During the third quarter of 2022, Barfresh

received customer complaints related to the textural consistency of

some of the Company’s Twist & Go™ bottle product, which was

isolated to one manufacturer. The product was found to be safe for

consumption but did not meet the textural standards as outlined in

the supply agreement with the manufacturer. In response, Barfresh

withdrew product from the market and destroyed on-hand inventory.

Barfresh attempted to resolve the issues by informal negotiation,

as contractually required prior to filing suit; however, such

negotiations were unsuccessful. Barfresh filed a complaint on

November 10, 2022, in the Federal District Court in Los Angeles

against the manufacturer. In response, the manufacturer terminated

the supply agreement. On January 20, 2023, Barfresh filed a

voluntary dismissal of the complaint which allows the parties to

reach a potential resolution outside of the court system. However,

as the parties were once again unable to come to an agreement,

Barfresh re-filed the complaint in California State Court in August

2023 and the case continues to progress through the court system.

Due to the uncertainties surrounding the claim, Barfresh is not

able to predict either the outcome or a range of reasonably

possible recoveries that could result from its actions against the

manufacturer, and no gain contingencies have been recorded. The

total impact of the product withdrawal and loss of a manufacturer

of Twist & Go™ bottle product may be subject to change.

Conference Call

The conference call to discuss these results is scheduled for

today, Thursday, October 24, 2024, at 1:30 pm Pacific Time (4:30 pm

Eastern Time). Listeners can dial (877) 407-4018 in North America,

and international listeners can dial (201) 689-8471. A telephonic

playback will be available approximately two hours after the call

concludes and will be available through Thursday, November 7, 2024.

Listeners in North America can dial (844) 512-2921, and

international listeners can dial (412) 317-6671. Passcode is

13748982. Interested parties may also listen to a simultaneous

webcast of the conference call by clicking here or logging onto the

Company’s website at www.barfresh.com in the

Investors-Presentations section.

About Barfresh Food Group

Barfresh Food Group Inc. (Nasdaq: BRFH) is a

developer, manufacturer and distributor of ready-to-blend and

ready-to-drink beverages, including smoothies, shakes and frappes,

primarily for the education market, foodservice industry and

restaurant chains, delivered as fully prepared individual portions

or single serving and bulk formats for on-site preparation. The

Company’s single serving, on-site prepared product utilizes a

proprietary, patented system that uses portion-controlled

pre-packaged beverage ingredients, delivering a freshly made frozen

beverage that is quick, cost efficient, better for you and without

waste. For more information, please visit www.barfresh.com.

Forward Looking Statements

Except for historical information herein,

matters set forth in this press release are forward-looking,

including statements about the Company’s commercial progress,

success of its strategic relationship(s), and projections of future

financial performance. These forward-looking statements are

identified by the use of words such as “grow”, “expand,”

“anticipate,” “intend,” “estimate,” “believe,” “expect,” “plan,”

“should,” “hypothetical,” “potential,” “forecast” and “project,”

“continue,” “could,” “may,” “predict,” and “will” and variations of

such words and similar expressions are intended to identify such

forward-looking statements. All statements, other than statements

of historical fact, included in the press release that address

activities, events or developments that the Company believes or

anticipates will or may occur in the future are forward-looking

statements. These statements are based on certain assumptions made

based on experience, expected future developments and other factors

the Company believes are appropriate under the circumstances. Such

statements are subject to a number of assumptions, risks and

uncertainties, many of which are beyond the control of the Company.

Should one or more of these risks or uncertainties materialize, or

should underlying assumptions prove incorrect, actual results may

vary materially from those indicated or anticipated by such

forward-looking statements. Accordingly, you are cautioned not to

place undue reliance on these forward-looking statements, which

speak only as of the date they are made. The contents of this

release should be considered in conjunction with the Company’s

recent filings with the Securities and Exchange Commission,

including its Annual Report on Form 10-K, Quarterly Reports on Form

10-Q and Current Reports on Form 8-K, including any warnings, risk

factors and cautionary statements contained therein. Furthermore,

the Company expressly disclaims any current intention to update

publicly any forward-looking statements after the distribution of

this release, whether as a result of new information, future

events, changes in assumptions or otherwise.

Investor RelationsJohn

MillsICR646-277-1254John.Mills@icrinc.com

Deirdre

ThomsonICR646-277-1283Deirdre.Thomson@icrinc.com

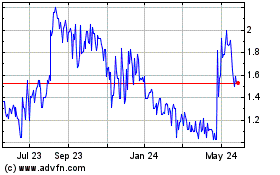

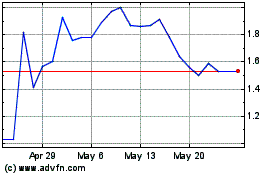

Barfresh Food (NASDAQ:BRFH)

Historical Stock Chart

From Nov 2024 to Dec 2024

Barfresh Food (NASDAQ:BRFH)

Historical Stock Chart

From Dec 2023 to Dec 2024