Blue Star Foods Announces Closing of $5 Million Public Offering

12 September 2023 - 6:00AM

Blue Star Foods Corp., (“Blue Star,” the “Company,” “we,” “our” or

“us”) (NASDAQ: BSFC), today announced the closing of its

previously announced public offering of an aggregate of 10,741,139

shares of its common stock (or common stock equivalents), together

with accompanying common stock warrants, at a public offering price

of $0.4655 per share (or common stock equivalent) and accompanying

warrants. Each share of common stock (or common stock equivalent)

was offered in the offering together with a Series A-1 warrant to

purchase one share of common stock at an exercise price of $0.4655

per share and a Series A-2 warrant to purchase one share of common

stock at an exercise price of $0.4655 per share. The Series A-1

warrants will be exercisable beginning on the effective date of

stockholder approval of the issuance of the shares issuable upon

exercise of the warrants and will expire five years thereafter, and

the Series A-2 warrants will be exercisable beginning on the

effective date of stockholder approval of the issuance of the

shares issuable upon exercise of the warrants and will expire

eighteen months thereafter. Total gross proceeds from the offering,

before deducting the placement agent's fees and other offering

expenses, were approximately $5 million.

H.C. Wainwright & Co. acted as the exclusive

placement agent for the offering.

The Company intends to use the net proceeds from

this offering for general corporate purposes and repayment of

certain outstanding debt.

The securities described above were offered

pursuant to a registration statement on Form S-1 (File No.

333-273525), which was declared effective by the Securities and

Exchange Commission (the “SEC”) on September 7, 2023. The offering

was made only by means of a prospectus forming part of the

effective registration statement relating to the offering. A

preliminary prospectus relating to the offering has been filed with

the SEC and is available on the SEC’s website at

http://www.sec.gov. Electronic copies of the final prospectus may

be obtained on the SEC’s website at http://www.sec.gov and may also

be obtained by contacting H.C. Wainwright & Co., LLC at 430

Park Avenue, 3rd Floor, New York, NY 10022, by phone at (212)

856-5711 or e-mail at placements@hcwco.com.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

described herein, nor shall there be any sale of these securities

in any state or other jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such state or other

jurisdiction.

About Blue Star Foods Corp. (NASDAQ:

BSFC)Blue Star Foods Corp. is an integrated ESG seafood

company that processes, packages and sells high-value seafood

products. The Company believes it utilizes best-in-class

technology, in both resource sustainability management and

traceability, and ecological packaging. The Company also owns and

operates the oldest continuously operating RAS full grow-out salmon

farm in North America. The Company is based in Miami, Florida, and

its corporate website is: https://bluestarfoods.com.

Forward-Looking Statements:The

foregoing material may contain “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934, each as

amended. Forward-looking statements include all statements that do

not relate solely to historical or current facts, including without

limitation statements regarding the Company’s product development

and business prospects, and can be identified by the use of words

such as “may,” “will,” “expect,” “project,” “estimate,”

“anticipate,” “plan,” “believe,” “potential,” “should,” “continue”

or the negative versions of those words or other comparable words,

and include, among other things, statements relating the

anticipated use of proceeds from the offering and the receipt of

shareholder approval under Nasdaq rules in connection with the

warrants. Forward-looking statements are not guarantees of future

actions or performance. These forward-looking statements are based

on information currently available to the Company and its current

plans or expectations and are subject to a number of risks and

uncertainties that could significantly affect current plans,

including market and other conditions. Risks concerning the

Company’s business are described in detail in the Company’s Annual

Report on Form 10-K for the year ended December 31, 2022, and other

periodic and current reports filed with the Securities and Exchange

Commission. The Company is under no obligation, and expressly

disclaims any such obligation to, update or alter its

forward-looking statements, whether as a result of new information,

future events or otherwise.

Investor Contacts:Investors@bluestarfoods.com

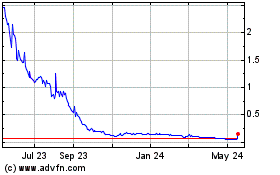

Blue Star Foods (NASDAQ:BSFC)

Historical Stock Chart

From Dec 2024 to Jan 2025

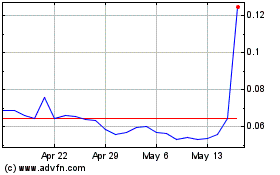

Blue Star Foods (NASDAQ:BSFC)

Historical Stock Chart

From Jan 2024 to Jan 2025