0000750686false00007506862025-01-012025-01-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (date of earliest event reported): January 1, 2025

Camden National Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Maine | 001-13227 | 01-0413282 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| |

Two Elm Street | Camden | Maine | 04843 |

(Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (207) 236-8821

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, without par value | CAC | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

| | | | | |

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

On January 2, 2025, Camden National Corporation (the “Company”) completed its acquisition of Northway Financial, Inc., a New Hampshire corporation (“Northway”) pursuant to the previously announced Agreement and Plan of Merger, dated as of September 9, 2024 (the “Merger Agreement”), by and among the Company and Northway, whereby Northway was merged with and into Camden, with Camden surviving (the “Merger”). Additionally, Northway Bank, a wholly owned subsidiary of Northway and a New Hampshire state-chartered bank with its main office located in Berlin, New Hampshire (“Northway Bank”), merged with and into Camden National Bank, a wholly owned subsidiary of Camden (“CNB”), with CNB continuing as the surviving bank.

At the effective time of the Merger, each share of Northway’s common stock (the “Northway Common Stock”), other than shares of Treasury Stock (as defined in the Merger Agreement) was converted into the right to receive 0.83 shares of Camden’s common stock, with cash paid in lieu of any fractional shares. Each share of the Company’s common stock issued and outstanding immediately prior to the effective time of the Merger remained outstanding and was unchanged by the Merger. The total consideration payable by the Company consists of approximately $96.5 million in shares of the Company’s common stock based on the closing price of the Company’s common stock as reported on Nasdaq of $42.25 as of January 2, 2025.

This description of the Merger Agreement is not complete and is qualified in its entirety by reference to the Merger Agreement, a copy of which is filed as Exhibit 2.1 to Camden’s Current Report Form 8-K filed with the Securities and Exchange Commission on September 10, 2024, and is incorporated herein by reference.

| | | | | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On January 1, 2025, the Company's Board of Directors (the “Board”) increased the size of the Board by one seat and appointed Larry K. Haynes to the Board, effective upon completion of the Merger. The appointment of Mr. Haynes, who served as a director of Northway prior to the Merger, was contemplated by and made in accordance with the Merger Agreement. Mr. Haynes will serve as a director until the Company’s 2025 Annual Meeting of Shareholders or until his successor is elected and qualified. Mr. Haynes will serve as a member of the Audit Committee of the Board. Mr. Haynes was also appointed to the Board of Directors of CNB (the "CNB Board"). and will serve as a member of the Trust Committee of the CNB Board.

In connection with his service as a director, Mr. Haynes will receive the Company’s standard non-employee director cash compensation, which generally includes cash retainers and per-meeting fees, as applicable. Specifically, as a member of the Board, Mr. Haynes will receive the standard $20,000 annual cash retainer and an additional $1,000 per attended meeting of the Board, $825 per attended meeting of the Audit Committee of the Board, and $500 per attended meeting of the Trust Committee of the CNB Board. Upon appointment, Mr. Haynes will also receive a prorated portion of the 2024 annual independent director equity award grant equaling $14,583.

Mr. Haynes has no family relationship with any director or executive officer of the Company. Mr. Haynes has no direct or indirect material interest in any transaction with the Company that is reportable under Item 404(a) of Regulation S-K, nor have any such transactions been proposed.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

On January 2, 2025, the Company issued a press release announcing the completion of the Merger and the appointment of Mr. Haynes to the Board. A copy of the press release is furnished as Exhibit 99.1 to this report and is incorporated herein by reference.

The information furnished pursuant to this Item 7.01 and the related exhibits shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(a) Financial Statements of Business Acquired

The financial statements required by this item will be filed by amendment to this Current Report on Form 8-K no later than 71 days after the date on which this Current Report on Form 8-K is required to be filed.

(d) The following exhibits are filed with this Report:

| | | | | |

| Exhibit No. | Description |

| |

| 101 | Cover Page Interactive Data - the cover page XBRL tags are embedded within the Inline XBRL document. |

| 104 | Cover Page Interactive Data File - Included in Exhibit 101. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: January 2, 2025

| | | | | | | | |

| | CAMDEN NATIONAL CORPORATION

(Registrant) |

| | |

| | |

| By: | /s/ MICHAEL R. ARCHER |

| | | Michael R. Archer

Chief Financial Officer and Principal Financial & Accounting Officer |

FOR IMMEDIATE RELEASE

Media Inquiries:

Renée Smyth

Chief Experience and Marketing Officer

(207) 518-5607

rsmyth@CamdenNational.bank

Camden National Corp. Announces Successful Merger with Northway Financial

Appoints Larry Haynes to Board of Directors

Camden, ME, January 2, 2025 – Camden National Corporation (“Camden National”) (NASDAQ: CAC), the bank holding company for Camden National Bank, today announced the closing of its merger with Northway Financial, Inc. (“Northway”) (OTCQB: NWYF), the parent company of Northway Bank. The all-stock transaction was originally announced on September 10, 2024. The combined institution has total assets of approximately $7.0 billion and 73 branches in Maine and New Hampshire.

“We are excited to have successfully completed Camden National’s merger with Northway and, in doing so, to strategically bolster our New Hampshire presence, creating a premier publicly-traded, northern New England bank,” said Simon Griffiths, president and chief executive officer of Camden National. “We remain committed to executing our long-term strategy of deepening customer relationships through advice-based conversations and exceptional customer service.”

The conversion of Northway’s banking products and services to Camden National systems is expected to occur in mid-March.

Griffiths continued, “We thank the extraordinary employees from both companies for helping to make this transaction possible and extend a warm welcome to our new team members, customers, and shareholders.”

At the effective time of the merger, each outstanding share of Northway common stock was converted into the right to receive 0.83 shares of Camden National common stock, with cash to be paid in lieu of fractional shares. Camden National issued approximately 2.3 million shares of its common stock as merger consideration.

Also today, in connection with, and effective upon, completion of the merger, Camden National announced the appointment of Larry K. Haynes to Camden National’s Board of Directors. Mr. Haynes has also been appointed to the board’s Audit Committee and to Camden National Bank’s Board of Directors and its Trust Committee. Mr. Haynes previously served as a member of Northway’s Board of Directors until the completion of the merger.

“We are extremely pleased to welcome Larry as a new independent director to our board,” said Larry Sterrs, chair of Camden National’s Board of Directors. “Larry is a thoughtful and highly esteemed leader, possessing an in-depth knowledge of New Hampshire’s growing market with a strong commitment to serving our shareholders, customers, team members, and local communities.”

As president and chief executive officer of the Grappone Automotive Group headquartered in Bow, New Hampshire, Mr. Haynes oversees the daily operation of the five retail auto stores and 380 team members. Mr. Haynes is also responsible for various dealership and non-dealership real estate holdings. Mr. Haynes joined Grappone Automotive in 1997 as its Chief Financial Officer. Mr. Haynes’ previous employment includes serving as Chief Financial Officer of MEG Asset Management, Inc. and Vice President and Controller of Hilco, Inc., a Bank of Ireland subsidiary that acquired First NH Banks Inc. Mr. Haynes began his public accounting career as an auditor for a firm which is now Deloitte.

Mr. Haynes is a Certified Public Accountant and Certified Financial Planner® and a graduate of Leadership New Hampshire. He earned his master’s degree in business administration from Southern New Hampshire University and his Bachelor of Science degree in accounting, with an economics minor, from Plymouth State University.

About Camden National Corporation

Camden National Corporation (NASDAQ: CAC) is Northern New England's largest publicly traded bank holding company, with approximately $7.0 billion in assets. Founded in 1875, Camden National Bank has 73 branches in Maine and New Hampshire, is a full-service community bank offering the latest digital banking, complemented by award-winning, personalized service. Additional information is available at CamdenNational.bank. Member FDIC. Equal Housing Lender.

Comprehensive wealth management, investment, and financial planning services are delivered by Camden National Wealth Management.

Forward Looking Statements

Certain statements contained in this press release that are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including certain plans, expectations, goals, projections, and other statements, which are subject to numerous risks, assumptions, and uncertainties. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words like "believe," "expect," "anticipate," "estimate," and "intend" or future or conditional verbs such as "will," "would," "should," "could," or "may." Certain factors that could cause actual results to differ materially from expected results include increased competitive pressures; inflation; ongoing competition in labor markets and employee turnover; deterioration in the value of Camden National's investment securities; changes in consumer spending and savings habits; changes in the interest rate environment; changes in general economic conditions; operational risks including, but not limited to, cybersecurity, fraud, pandemics and natural disasters; legislative and regulatory changes that adversely affect the business in which Camden National is engaged; turmoil and volatility in the financial services industry, including failures or rumors of failures of other depository institutions which could affect Camden National's ability to attract and retain depositors, and could affect the ability of financial services providers, including the Company, to borrow or raise capital; actions taken by governmental agencies to stabilize the financial system and the effectiveness of such actions; changes to regulatory capital requirements in response to recent developments affecting the banking sector; changes in the securities markets and other risks and uncertainties disclosed from time to time in Camden National's Annual Report on Form 10-K for the year ended December 31, 2023, as updated by other filings with the Securities and Exchange Commission ("SEC"). Further, statements regarding the potential effects of the war in Ukraine, conflict in the Middle East and other notable and global current events on the Company's business, financial condition, liquidity and results of operations may constitute forward-looking statements and are subject to the risk that the actual effects may differ, possible materially, from what is reflected in those forward-looking statements due to factors and future developments that are uncertain, unpredictable and in many cases beyond the Company's control. Camden National does not have any obligation to update forward-looking statements.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

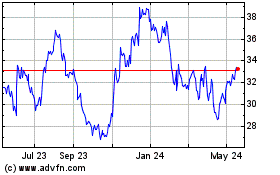

Camden National (NASDAQ:CAC)

Historical Stock Chart

From Jan 2025 to Feb 2025

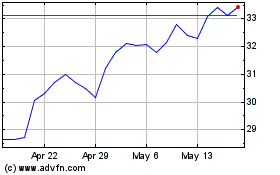

Camden National (NASDAQ:CAC)

Historical Stock Chart

From Feb 2024 to Feb 2025