0001141103FALSE00011411032025-03-052025-03-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) March 5, 2025

Cross Country Healthcare, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 0-33169 | 13-4066229 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

6551 Park of Commerce Boulevard, N.W., Boca Raton, FL 33487

(Address of Principal Executive Office) (Zip Code)

(561) 998-2232

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Trading Symbol Name of each exchange on which registered

Common stock, par value $0.0001 per share CCRN The Nasdaq Stock Market LLC

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Section 2 – Financial Information

Item 2.02 Results of Operations and Financial Condition

(a) On March 5, 2025, Cross Country Healthcare, Inc. (“the Company”) issued a press release announcing results for the fourth quarter and full year ended December 31, 2024, a copy of which is attached as Exhibit 99.1 to this Current Report on Form 8-K. This information is being furnished under Item 2.02 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of such section.

Section 7 – Regulation FD

Item 7.01 Regulation FD Disclosure.

Incorporated by reference is a press release issued by the Company on March 5, 2025, which is attached hereto as Exhibit 99.1. This information is being furnished under Item 7.01 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of such section.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | | | | |

| Exhibit | | Description |

| | | |

| | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | CROSS COUNTRY HEALTHCARE, INC. |

| | | | |

| | | | |

| Dated: | March 5, 2025 | By: | /s/ William J. Burns | |

| | | | Name: William J. Burns |

| | | | Title: Executive Vice President & Chief Financial Officer |

| | | | |

CROSS COUNTRY HEALTHCARE ANNOUNCES FOURTH QUARTER AND FULL YEAR

2024 FINANCIAL RESULTS

BOCA RATON, Fla., March 5, 2025--Cross Country Healthcare, Inc. (the “Company”) (Nasdaq: CCRN) today announced financial results for its fourth quarter and full year ended December 31, 2024.

SELECTED FINANCIAL INFORMATION:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dollars are in thousands, except per share amounts | Q4 2024 | Variance Q4 2024 vs Q4 2023 | Variance Q4 2024 vs Q3 2024 | Full Year 2024 | Variance 2024 vs 2023 |

|

| Revenue | $ | 309,940 | | | (25) | | % | (2) | | % | $ | 1,344,004 | | | (33) | | % |

| Gross profit margin* | 20.0 | | % | (190) | | bps | (40) | | bps | 20.4 | | % | (190) | | bps |

| Net loss attributable to common stockholders | $ | (3,753) | | | (142) | | % | (247) | | % | $ | (14,556) | | | (120) | | % |

| Diluted EPS | $ | (0.12) | | | $ | (0.38) | | | $ | (0.20) | | | $ | (0.44) | | | $ | (2.49) | | |

| Adjusted EBITDA* | $ | 9,271 | | | (55) | | % | (10) | | % | $ | 49,073 | | | (66) | | % |

| Adjusted EBITDA margin* | 3.0 | | % | (200) | | bps | (30) | | bps | 3.7 | | % | (350) | | bps |

| Adjusted EPS* | $ | 0.04 | | | $ | (0.25) | | | $ | (0.08) | | | $ | 0.46 | | | $ | (1.77) | | |

| Cash flows provided by operations | $ | 24,234 | | | 101 | | % | 224 | | % | $ | 120,116 | | | (52) | | % |

* Represents amounts that are not calculated in accordance with U.S. generally accepted accounting principles (GAAP) and are referred to as non-GAAP measures. Please refer to the accompanying discussion below of how these non-GAAP financial measures are calculated and used under “Non-GAAP Financial Measures” and the tables reconciling these measures to the closest GAAP measure.

Fourth Quarter and Full Year Business Highlights

•Fourth quarter Revenue was at the high end of our guidance range

•Physician and Homecare Staffing experienced sequential and year-over-year revenue growth

•Cross Country Education experienced double-digit sequential revenue growth

•Secured a three-year contract renewal with our largest managed service program

•Continued strong balance sheet with $82 million of cash on hand and no debt as of December 31, 2024

•Repurchased over 2.4 million shares of common stock for $36.8 million in 2024

“Our fourth quarter top line performance was driven by continued strength in our non-travel businesses such as Physician Staffing, Education and Homecare,” said John A. Martins, President and Chief Executive Officer of Cross Country Healthcare. He continued, “As we await the closing of the pending transaction with Aya Healthcare, which we currently expect to occur in the second half of the year, we continue on our path of delivering clinical excellence in order to meet our clients’ needs in this dynamic and highly competitive market.”

Fourth quarter consolidated revenue was $309.9 million, a decrease of 25% year-over-year and 2% sequentially. Consolidated gross profit margin was 20.0%, down 190 basis points year-over-year and 40 basis points sequentially. Net loss attributable to common stockholders was $3.8 million, as compared to net income of $9.0 million in the prior year and $2.6 million in the prior quarter. Diluted earnings per share (EPS) was a net loss of $0.12, as compared to net income of $0.26 in the prior year and $0.08 in the prior quarter. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) was $9.3 million, or 3.0% of revenue, as compared with $20.6 million, or 5.0% of revenue, in the prior year, and $10.3 million, or 3.3% of revenue, in the prior quarter. Adjusted EPS was $0.04, as compared to $0.29 in the prior year and $0.12 in the prior quarter.

For the year ended December 31, 2024, consolidated revenue was $1.3 billion, a decrease of 33% year-over-year. Consolidated gross profit margin was 20.4%, down 190 basis points year-over-year. Net loss attributable to common stockholders was $14.6 million, or $0.44 per diluted share, as compared to net income of $72.6 million, or $2.05 per diluted share, in the prior year. Adjusted EBITDA was $49.1 million, or 3.7% of revenue, as compared to $144.4 million, or 7.2% of revenue, in the prior year. Adjusted EPS was $0.46, as compared to $2.23 in the prior year.

Quarterly Business Segment Highlights

Nurse and Allied Staffing

Revenue was $256.9 million, a decrease of 30% year-over-year and 3% sequentially. Contribution income was $20.3 million, a decrease from $33.9 million in the prior year and an increase from $19.3 million sequentially. Average field contract personnel on a full-time equivalent (FTE) basis was 7,621, as compared with 9,570 in the prior year and 7,660 in the prior quarter. Revenue per FTE per day was $363, as compared to $414 in the prior year and $373 in the prior quarter.

Physician Staffing

Revenue was $53.0 million, an increase of 13% year-over-year and 5% sequentially. Contribution income was $3.5 million, an increase from $1.9 million in the prior year and a decrease from $4.6 million sequentially. Total days filled were 25,427, as compared with 23,578 in the prior year and 24,424 in the prior quarter. Revenue per day filled was $2,085, as compared with $1,988 in the prior year and $2,058 in the prior quarter.

Cash Flow and Balance Sheet Highlights

Net cash provided by operating activities for the three months ended December 31, 2024 was $24.2 million, as compared to $12.1 million for the three months ended December 31, 2023 and $7.5 million for the three months ended September 30, 2024. We experienced an 11 day year-over-year improvement in days’ sales outstanding. For the year ended December 31, 2024, net cash provided by operating activities was $120.1 million, as compared to $248.5 million in the prior year.

During the fourth quarter, the Company repurchased and retired a total of 0.3 million shares of its common stock for an aggregate price of $3.6 million, at an average market price of $12.18 per share. As of December 31, 2024, the Company had 32.3 million unrestricted shares outstanding and $40.5 million remaining for share repurchase.

At December 31, 2024, the Company had $81.6 million in cash and cash equivalents with no debt outstanding. There were no borrowings drawn under its revolving senior secured asset-based credit facility (ABL). As of December 31, 2024, borrowing base availability under the ABL was $146.9 million, with $132.0 million of availability net of $14.9 million of letters of credit.

CONFERENCE CALL

As previously disclosed, on December 3, 2024, the Company entered into a merger agreement with Aya Healthcare, Inc. and certain of its subsidiaries (Aya Merger, and such agreement, the Merger Agreement). In light of the pending transaction, the Company will not host an earnings conference call to review fourth quarter and full year 2024 financial results, nor will it provide forward-looking guidance. This press release is also posted on the Company's website at ir.crosscountry.com.

ABOUT CROSS COUNTRY HEALTHCARE

Cross Country Healthcare, Inc. is a market-leading, tech-enabled workforce solutions and advisory firm with 38 years of industry experience and insight. We help clients tackle complex labor-related challenges and achieve high-quality outcomes, while reducing complexity and improving visibility through data-driven insights.

Copies of this and other press releases, as well as additional information about the Company, can be accessed online at ir.crosscountry.com. Stockholders and prospective investors can also register to automatically receive the Company’s press releases, filings with the Securities and Exchange Commission (SEC), and other notices by e-mail.

NON-GAAP FINANCIAL MEASURES

This press release and the accompanying financial statement tables reference non-GAAP financial measures, such as gross profit margin, adjusted EBITDA, and adjusted EPS. Such non-GAAP financial measures are provided as additional information and should not be considered substitutes for, or superior to, financial measures calculated in accordance with GAAP. Such non-GAAP financial measures are provided for consistency and comparability to prior year results; furthermore, management believes such non-GAAP financial measures are useful to investors when evaluating the Company's performance, as such non-GAAP financial measures exclude certain items that management believes are not indicative of the Company's future operating performance. Pro forma measures, if applicable, are adjusted to include the results of our acquisitions, and exclude the results of divestments, as if the transactions occurred in the beginning of the periods mentioned. Such non-GAAP financial measures may differ materially from the non-GAAP financial measures used by other companies. The financial statement tables that accompany this press release include a reconciliation of each non-GAAP financial measure to the most directly comparable GAAP financial measure and a more detailed discussion of each financial measure; as such, the financial statement tables should be read in conjunction with the presentation of these non-GAAP financial measures.

FORWARD LOOKING STATEMENTS

This press release contains “forward-looking statements” within the Private Securities Litigation Reform Act of 1995. Any statements contained in this press release that are not statements of historical fact, including statements relating to our future results (including business trends); statements regarding the proposed Aya Merger; the expected timing and closing of the proposed Aya Merger; the Company’s ability to consummate the proposed Aya Merger; the expected benefits of the proposed Aya Merger and other considerations taken into account by the Board in approving the proposed Aya Merger; the amounts to be received by stockholders; and expectations for the Company prior to and following the closing of the proposed Aya Merger, may be deemed to be forward-looking statements. All such forward-looking statements are intended to provide management’s current expectations for the future of the Company based on current expectations and assumptions relating to the Company’s business, the economy and other future conditions. Forward-looking statements generally can be identified through the use of words such as “believes,” “anticipates,” “may,” “should,” “will,” “plans,” “projects,” “expects,” “expectations,” “estimates,” “forecasts,” “predicts,” “targets,” “prospects,” “strategy,” “signs,” and other words of similar meaning in connection with the discussion of future performance, plans, actions or events. Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties and changes in circumstances that are difficult to predict. Such risks and uncertainties include, among others: (i) the timing to consummate the proposed Aya Merger, (ii) the risk that a condition of closing of the proposed Aya Merger may not be satisfied or that the closing of the proposed Aya Merger might otherwise not occur, (iii) the risk that a regulatory approval that may be required for the proposed Aya Merger is not obtained or is obtained subject to conditions that are not anticipated, (iv) the diversion of management time on transaction-related issues, (v) risks related to disruption of management time from ongoing business operations due to the proposed Aya Merger, (vi) the risk that any announcements relating to the proposed Aya Merger could have adverse effects on the market price of the common stock of the Company, (vii) the risk that the proposed Aya Merger and its announcement could have an adverse effect on the ability of the Company to retain customers and retain and hire key personnel and maintain relationships with its suppliers and customers, (viii) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the Merger Agreement, including in circumstances requiring the Company to pay a termination fee, (ix) the risk that competing offers will be made, (x) unexpected costs, charges or expenses resulting from the Aya Merger, (xi) potential litigation relating to the Aya Merger that could be instituted against the parties to the Merger Agreement or their respective directors, managers or officers, including the effects of any outcomes related thereto, (xii) worldwide economic or political changes that affect the markets that the Company’s businesses serve which could have an effect on demand for the Company’s services and impact the Company’s profitability, (xiii) effects from global pandemics, epidemics or other public health crises, (xiv) changes in marketplace conditions, such as alternative modes of healthcare delivery, reimbursement and customer needs, and (xv) disruptions in the global credit and financial markets, including diminished liquidity and credit availability, changes in international trade agreements, including tariffs and trade restrictions, cyber-security vulnerabilities, foreign currency volatility, swings in consumer confidence and spending, costs of providing services, retention of key employees, and outcomes of legal proceedings, claims and investigations. Accordingly, actual results may differ materially from those contemplated by these forward-looking statements. Investors, therefore, are cautioned against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Additional information regarding the factors that may cause actual results to differ materially from these forward-looking statements is available in the Company’s filings with the SEC, including the risks and uncertainties identified in Part I, Item 1A - Risk Factors of the Company’s Annual

Report on Form 10-K for the year ended December 31, 2023 and in the Company’s other filings with the SEC. The list of factors is not intended to be exhaustive.

These forward-looking statements speak only as of the date of this press release, and the Company does not assume any obligation to update or revise any forward-looking statement made in this press release or that may from time to time be made by or on behalf of the Company.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cross Country Healthcare, Inc. |

| Consolidated Statements of Operations |

| (Unaudited, amounts in thousands, except per share data) |

|

| Three Months Ended | | Year Ended |

| December 31, | | December 31, | | September 30, | | December 31, | | December 31, |

| 2024 | | 2023 | | 2024 | | 2024 | | 2023 |

| | | |

| Revenue from services | $ | 309,940 | | | $ | 414,035 | | | $ | 315,119 | | | $ | 1,344,004 | | | $ | 2,019,728 | |

| Operating expenses: | | | | | | | | | |

| Direct operating expenses | 247,948 | | | 323,546 | | | 250,961 | | | 1,069,752 | | | 1,569,318 | |

| Selling, general and administrative expenses | 55,573 | | | 67,566 | | | 54,297 | | | 233,377 | | | 300,332 | |

| Credit loss (income) expense | (228) | | | 4,165 | | | 1,512 | | | 21,432 | | | 14,562 | |

| Depreciation and amortization | 4,341 | | | 4,471 | | | 4,498 | | | 18,200 | | | 18,347 | |

| | | | | | | | | |

| | | | | | | | | |

| Acquisition and integration-related costs | 4,216 | | | — | | | — | | | 4,219 | | | 59 | |

| | | | | | | | | |

| Restructuring costs | 281 | | | 863 | | | 998 | | | 4,333 | | | 2,553 | |

| Legal and other (gains) losses | (928) | | | — | | | — | | | 6,668 | | | 1,125 | |

| Impairment charges | 2,170 | | | — | | | — | | | 2,888 | | | 719 | |

| Total operating expenses | 313,373 | | | 400,611 | | | 312,266 | | | 1,360,869 | | | 1,907,015 | |

| (Loss) income from operations | (3,433) | | | 13,424 | | | 2,853 | | | (16,865) | | | 112,713 | |

| Other expenses (income): | | | | | | | | | |

| | | | | | | | | |

| Interest expense | 608 | | | 586 | | | 550 | | | 2,188 | | | 8,094 | |

| | | | | | | | | |

| Loss on early extinguishment of debt | — | | | — | | | — | | | — | | | 1,723 | |

| Interest income | (535) | | | (71) | | | (1,107) | | | (2,050) | | | (83) | |

| Other expense (income), net | 408 | | | (60) | | | 21 | | | (605) | | | 85 | |

| (Loss) income before income taxes | (3,914) | | | 12,969 | | | 3,389 | | | (16,398) | | | 102,894 | |

| Income tax (benefit) expense | (161) | | | 3,931 | | | 834 | | | (1,842) | | | 30,263 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net (loss) income attributable to common stockholders | $ | (3,753) | | | $ | 9,038 | | | $ | 2,555 | | | $ | (14,556) | | | $ | 72,631 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net (loss) income per share attributable to common stockholders - Basic | $ | (0.12) | | | $ | 0.26 | | | $ | 0.08 | | | $ | (0.44) | | | $ | 2.07 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net (loss) income per share attributable to common stockholders - Diluted | $ | (0.12) | | | $ | 0.26 | | | $ | 0.08 | | | $ | (0.44) | | | $ | 2.05 | |

| | | | | | | | | |

| Weighted average common shares outstanding: | | | | | | | | | |

| Basic | 32,338 | | | 34,481 | | | 33,016 | | | 33,379 | | | 35,158 | |

| Diluted | 32,338 | | | 34,685 | | | 33,058 | | | 33,379 | | | 35,476 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cross Country Healthcare, Inc. |

| Reconciliation of Non-GAAP Financial Measures |

| (Unaudited, amounts in thousands) |

|

| Three Months Ended | | Year Ended |

| December 31, | | December 31, | | September 30, | | December 31, | | December 31, |

| 2024 | | 2023 | | 2024 | | 2024 | | 2023 |

Adjusted EBITDA:a | | | | | | | | | |

| Net (loss) income attributable to common stockholders | $ | (3,753) | | | $ | 9,038 | | | $ | 2,555 | | | $ | (14,556) | | | $ | 72,631 | |

| Interest expense | 608 | | | 586 | | | 550 | | | 2,188 | | | 8,094 | |

Income tax (benefit) expenseb | (161) | | | 3,931 | | | 834 | | | (1,842) | | | 30,263 | |

| Depreciation and amortization | 4,341 | | | 4,471 | | | 4,498 | | | 18,200 | | | 18,347 | |

| | | | | | | | | |

| | | | | | | | | |

Acquisition and integration-related costsc | 4,216 | | | — | | | — | | | 4,219 | | | 59 | |

| | | | | | | | | |

Restructuring costsd | 281 | | | 863 | | | 998 | | | 4,333 | | | 2,553 | |

Legal, bankruptcy, and other (gains) lossese | (928) | | | — | | | — | | | 26,041 | | | 1,125 | |

Impairment chargesf | 2,170 | | | — | | | — | | | 2,888 | | | 719 | |

| | | | | | | | | |

| Loss on disposal of fixed assets | 86 | | | 44 | | | — | | | 86 | | | 87 | |

Loss on early extinguishment of debtg | — | | | — | | | — | | | — | | | 1,723 | |

| Loss on lease termination | — | | | — | | | — | | | — | | | 104 | |

| Interest income | (535) | | | (71) | | | (1,107) | | | (2,050) | | | (83) | |

| Other expense (income), net | 322 | | | (104) | | | 21 | | | (691) | | | (106) | |

| | | | | | | | | |

| Equity compensation | 1,698 | | | 1,166 | | | 870 | | | 6,025 | | | 6,579 | |

| | | | | | | | | |

System conversion costsh | 926 | | | 668 | | | 1,120 | | | 4,232 | | | 2,326 | |

| | | | | | | | | |

Adjusted EBITDAa | $ | 9,271 | | | $ | 20,592 | | | $ | 10,339 | | | $ | 49,073 | | | $ | 144,421 | |

Adjusted EBITDA margina | 3.0 | % | | 5.0 | % | | 3.3 | % | | 3.7 | % | | 7.2 | % |

| | | | | | | | | |

Adjusted EPS:i | | | | | | | | | |

| Numerator: | | | | | | | | | |

| Net (loss) income attributable to common stockholders | $ | (3,753) | | | $ | 9,038 | | | $ | 2,555 | | | $ | (14,556) | | | $ | 72,631 | |

| Non-GAAP adjustments - pretax: | | | | | | | | | |

| | | | | | | | | |

Acquisition and integration-related costsc | 4,216 | | | — | | | — | | | 4,219 | | | 59 | |

| | | | | | | | | |

Restructuring costsd | 281 | | | 863 | | | 998 | | | 4,333 | | | 2,553 | |

Legal, bankruptcy, and other (gains) lossese | (928) | | | — | | | — | | | 26,041 | | | 1,125 | |

Impairment chargesf | 2,170 | | | — | | | — | | | 2,888 | | | 719 | |

| Other expense (income), net | 311 | | | — | | | — | | | (804) | | | — | |

System conversion costsh | 926 | | | 668 | | | 1,120 | | | 4,232 | | | 2,326 | |

| | | | | | | | | |

| | | | | | | | | |

Loss on early extinguishment of debtg | — | | | — | | | — | | | — | | | 1,723 | |

| | | | | | | | | |

| Tax impact of non-GAAP adjustments | (1,843) | | | (400) | | | (552) | | | (10,867) | | | (2,167) | |

| Adjusted net income attributable to common stockholders - non-GAAP | $ | 1,380 | | | $ | 10,169 | | | $ | 4,121 | | | $ | 15,486 | | | $ | 78,969 | |

| | | | | | | | | |

| Denominator: | | | | | | | | | |

| Weighted average common shares - basic, GAAP | 32,338 | | | 34,481 | | | 33,016 | | | 33,379 | | | 35,158 | |

| Dilutive impact of share-based payments | 68 | | | 204 | | | 42 | | | 133 | | | 318 | |

| Adjusted weighted average common shares - diluted, non-GAAP | 32,406 | | | 34,685 | | | 33,058 | | | 33,512 | | | 35,476 | |

| | | | | | | | | |

| Reconciliation: | | | | | | | | | |

| Diluted EPS, GAAP | $ | (0.12) | | | $ | 0.26 | | | $ | 0.08 | | | $ | (0.44) | | | $ | 2.05 | |

| Non-GAAP adjustments - pretax: | | | | | | | | | |

| | | | | | | | | |

Acquisition and integration-related costsc | 0.13 | | | — | | | — | | | 0.13 | | | — | |

| | | | | | | | | |

Restructuring costsd | 0.01 | | | 0.02 | | | 0.03 | | | 0.13 | | | 0.07 | |

Legal, bankruptcy, and other (gains) lossese | (0.03) | | | — | | | — | | | 0.77 | | | 0.03 | |

Impairment chargesf | 0.07 | | | — | | | — | | | 0.09 | | | 0.02 | |

| Other expense (income),net | 0.01 | | | — | | | — | | | (0.02) | | | — | |

System conversion costsh | 0.03 | | | 0.03 | | | 0.03 | | | 0.13 | | | 0.07 | |

| | | | | | | | | |

| | | | | | | | | |

Loss on early extinguishment of debtg | — | | | — | | | — | | | — | | | 0.05 | |

| | | | | | | | | |

| | | | | | | | | |

| Tax impact of non-GAAP adjustments | (0.06) | | | (0.02) | | | (0.02) | | | (0.33) | | | (0.06) | |

Adjusted EPS, non-GAAPi | $ | 0.04 | | | $ | 0.29 | | | $ | 0.12 | | | $ | 0.46 | | | $ | 2.23 | |

| | | | | | | | | | | | |

| Cross Country Healthcare, Inc. | |

| Consolidated Balance Sheets | |

| (Unaudited, amounts in thousands) | |

| |

| December 31, | | December 31, | |

| 2024 | | 2023 | |

| | | | |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | $ | 81,633 | | | $ | 17,094 | | |

| Accounts receivable, net | 223,238 | | | 372,352 | | |

| | | | |

Income taxes receivablej | 10,389 | | | 8,620 | | |

| Prepaid expenses | 7,848 | | | 7,681 | | |

| Insurance recovery receivable | 9,255 | | | 9,097 | | |

| | | | |

| | | | |

| Other current assets | 2,637 | | | 2,031 | | |

| Total current assets | 335,000 | | | 416,875 | | |

| Property and equipment, net | 28,850 | | | 27,339 | | |

| Operating lease right-of-use assets | 2,468 | | | 2,599 | | |

| Goodwill | 135,060 | | | 135,430 | | |

| | | | |

| Other intangible assets, net | 42,186 | | | 54,468 | | |

| | | | |

Deferred tax assetsj | 8,104 | | | 5,979 | | |

| Insurance recovery receivable | 20,928 | | | 25,714 | | |

| Cloud computing | 10,846 | | | 5,987 | | |

| Other assets | 5,809 | | | 6,673 | | |

| | | | |

| Total assets | $ | 589,251 | | | $ | 681,064 | | |

| | | | |

| Liabilities and Stockholders' Equity | | | | |

| Current liabilities: | | | | |

Accounts payable and accrued expensesj | $ | 64,946 | | | $ | 92,822 | | |

| Accrued compensation and benefits | 47,646 | | | 52,297 | | |

| | | | |

| | | | |

| Operating lease liabilities | 2,089 | | | 2,604 | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Earnout liability | 4,411 | | | 6,794 | | |

| Other current liabilities | 1,310 | | | 1,559 | | |

| Total current liabilities | 120,402 | | | 156,076 | | |

| | | | |

| Operating lease liabilities | 1,782 | | | 2,663 | | |

| | | | |

| Accrued claims | 34,425 | | | 34,853 | | |

| Earnout liability | — | | | 5,000 | | |

| | | | |

| Uncertain tax positions | 10,117 | | | 10,603 | | |

| Other liabilities | 3,566 | | | 4,218 | | |

| Total liabilities | 170,292 | | | 213,413 | | |

| | | | |

| Commitments and contingencies | | | | |

| | | | |

| Stockholders' equity: | | | | |

| Common stock | 3 | | | 4 | | |

| Additional paid-in capital | 202,338 | | | 236,417 | | |

| Accumulated other comprehensive loss | (1,441) | | | (1,385) | | |

Retained earningsj | 218,059 | | | 232,615 | | |

| | | | |

| | | | |

| Total stockholders' equity | 418,959 | | | 467,651 | | |

| Total liabilities and stockholders' equity | $ | 589,251 | | | $ | 681,064 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cross Country Healthcare, Inc. |

Segment Datak |

| (Unaudited, amounts in thousands) |

|

| Three Months Ended | | Year-over-Year | | Sequential |

| December 31, | % of | | December 31, | % of | | September 30, | % of | | % change | | % change |

| 2024 | Total | | 2023 | Total | | 2024 | Total | | Fav (Unfav) | | Fav (Unfav) |

| | | | | | | | | | | | |

| Revenue from services: | | | | | | | | | | | | |

| Nurse and Allied Staffing | $ | 256,929 | | 83 | % | | $ | 367,155 | | 89 | % | | $ | 264,853 | | 84 | % | | (30) | % | | (3) | % |

| Physician Staffing | 53,011 | | 17 | % | | 46,880 | | 11 | % | | 50,266 | | 16 | % | | 13 | % | | 5 | % |

| | | | | | | | | | | | |

| $ | 309,940 | | 100 | % | | $ | 414,035 | | 100 | % | | $ | 315,119 | | 100 | % | | (25) | % | | (2) | % |

| | | | | | | | | | | | |

Contribution income:l | | | | | | | | | | | | |

| Nurse and Allied Staffing | $ | 20,347 | | | | $ | 33,901 | | | | $ | 19,251 | | | | (40) | % | | 6 | % |

| Physician Staffing | 3,549 | | | | 1,947 | | | | 4,629 | | | | 82 | % | | (23) | % |

| | | | | | | | | | | | |

| 23,896 | | | | 35,848 | | | | 23,880 | | | | (33) | % | | — | % |

| | | | | | | | | | | | |

Corporate overheadm | 17,249 | | | | 17,090 | | | | 15,531 | | | | (1) | % | | (11) | % |

| Depreciation and amortization | 4,341 | | | | 4,471 | | | | 4,498 | | | | 3 | % | | 3 | % |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Restructuring costsd | 281 | | | | 863 | | | | 998 | | | | 67 | % | | 72 | % |

Legal and other (gains) lossesn | (928) | | | | — | | | | — | | | | 100 | % | | 100 | % |

Impairment chargesf | 2,170 | | | | — | | | | — | | | | (100) | % | | (100) | % |

Acquisition and integration-related costsc | 4,216 | | | | — | | | | — | | | | (100) | % | | (100) | % |

| (Loss) income from operations | $ | (3,433) | | | | $ | 13,424 | | | | $ | 2,853 | | | | (126) | % | | (220) | % |

| | | | | | | | | | | | |

| Year Ended | | | | | Year-over-Year | | |

| December 31, | % of | | December 31, | % of | | | | | % change | | |

| 2024 | Total | | 2023 | Total | | | | | Fav (Unfav) | | |

| | | | | | | | | | | | |

| Revenue from services: | | | | | | | | | | | | |

| Nurse and Allied Staffing | $ | 1,145,419 | | 85 | % | | $ | 1,841,428 | | 91 | % | | | | | (38) | % | | |

| Physician Staffing | 198,585 | | 15 | % | | 178,300 | | 9 | % | | | | | 11 | % | | |

| | | | | | | | | | | | |

| $ | 1,344,004 | | 100 | % | | $ | 2,019,728 | | 100 | % | | | | | (33) | % | | |

| | | | | | | | | | | | |

Contribution income:l | | | | | | | | | | | | |

| Nurse and Allied Staffing | $ | 72,601 | | | | $ | 196,777 | | | | | | | (63) | % | | |

| Physician Staffing | 15,349 | | | | 9,788 | | | | | | | 57 | % | | |

| | | | | | | | | | | | |

| 87,950 | | | | 206,565 | | | | | | | (57) | % | | |

| | | | | | | | | | | | |

Corporate overheadm | 68,507 | | | | 71,049 | | | | | | | 4 | % | | |

| Depreciation and amortization | 18,200 | | | | 18,347 | | | | | | | 1 | % | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Restructuring costsd | 4,333 | | | | 2,553 | | | | | | | (70) | % | | |

Legal and other lossesn | 6,668 | | | | 1,125 | | | | | | | (493) | % | | |

Impairment chargesf | 2,888 | | | | 719 | | | | | | | (302) | % | | |

Acquisition and integration-related costsc | 4,219 | | | | 59 | | | | | | | NM | | |

| (Loss) income from operations | $ | (16,865) | | | | $ | 112,713 | | | | | | | (115) | % | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

NM - Not meaningful

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cross Country Healthcare, Inc. |

| Summary Condensed Consolidated Statements of Cash Flows |

| (Unaudited, amounts in thousands) |

| | | | | | | | | | | | |

| Three Months Ended | | | Year Ended |

| December 31, | | | December 31, | | | September 30, | | | December 31, | | December 31, |

| 2024 | | | 2023 | | | 2024 | | | 2024 | | 2023 |

| | | | | | | | | | | | |

| Net cash provided by operating activities | $ | 24,234 | | | | $ | 12,074 | | | | $ | 7,470 | | | | $ | 120,116 | | | $ | 248,498 | |

| Net cash used in investing activities | (2,531) | | | | (2,875) | | | | (1,124) | | | | (8,714) | | | (13,775) | |

| Net cash used in financing activities | (4,077) | | | | (6,416) | | | | (11,926) | | | | (46,849) | | | (221,241) | |

| Effect of exchange rate changes on cash | (14) | | | | 10 | | | | — | | | | (14) | | | 8 | |

| Change in cash and cash equivalents | 17,612 | | | | 2,793 | | | | (5,580) | | | | 64,539 | | | 13,490 | |

| Cash and cash equivalents at beginning of period | 64,021 | | | | 14,301 | | | | 69,601 | | | | 17,094 | | | 3,604 | |

| Cash and cash equivalents at end of period | $ | 81,633 | | | | $ | 17,094 | | | | $ | 64,021 | | | | $ | 81,633 | | | $ | 17,094 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cross Country Healthcare, Inc. |

| Other Financial Data |

| (Unaudited) |

| | | | | | | | | | | | |

| Three Months Ended | | | Year Ended |

| December 31, | | | December 31, | | | September 30, | | | December 31, | | December 31, |

| 2024 | | | 2023 | | | 2024 | | | 2024 | | 2023 |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Revenue from services | $ | 309,940 | | | | $ | 414,035 | | | | $ | 315,119 | | | | $ | 1,344,004 | | | $ | 2,019,728 | |

| Less: Direct operating expenses | 247,948 | | | | 323,546 | | | | 250,961 | | | | 1,069,752 | | | 1,569,318 | |

| Gross profit | $ | 61,992 | | | | $ | 90,489 | | | | $ | 64,158 | | | | $ | 274,252 | | | $ | 450,410 | |

Consolidated gross profit margino | 20.0 | % | | | 21.9 | % | | | 20.4 | % | | | 20.4 | % | | 22.3 | % |

| | | | | | | | | | | | |

| Nurse and Allied Staffing statistical data: | | | | | | | | | | | | |

FTEsp | 7,621 | | | | 9,570 | | | | 7,660 | | | | 8,205 | | | 10,831 | |

Average Nurse and Allied Staffing revenue per FTE per dayq | $ | 363 | | | | $ | 414 | | | | $ | 373 | | | | $ | 378 | | | $ | 462 | |

| | | | | | | | | | | | |

| Physician Staffing statistical data: | | | | | | | | | | | | |

Days filledr | 25,427 | | | | 23,578 | | | | 24,424 | | | | 97,888 | | | 92,504 | |

Revenue per day filleds | $ | 2,085 | | | | $ | 1,988 | | | | $ | 2,058 | | | | $ | 2,029 | | | $ | 1,927 | |

(a) Adjusted EBITDA, a non-GAAP financial measure, is defined as net income (loss) attributable to common stockholders before interest expense, income tax expense (benefit), depreciation and amortization, acquisition and integration-related (benefits) costs, restructuring (benefits) costs, legal and other losses, customer bankruptcy loss, impairment charges, gain or loss on derivative, loss on early extinguishment of debt, gain or loss on disposal of fixed assets, gain or loss on lease termination, gain or loss on sale of business, interest income, other expense (income), net, equity compensation, and system conversion costs. Adjusted EBITDA is not and should not be considered a measure of financial performance under GAAP. Management presents Adjusted EBITDA because it believes that Adjusted EBITDA is a useful supplement to net income (loss) attributable to common stockholders as an indicator of operating performance. Management uses Adjusted EBITDA for planning purposes and as one performance measure in its incentive programs for certain members of its management team. Adjusted EBITDA, as defined, closely matches the operating measure as defined by the Company's credit facilities. Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA by the Company's consolidated revenue.

(b) The decrease in income tax expense for the 2024 periods related to a decrease in book income primarily driven by credit loss expense.

(c) Acquisition and integration costs relate primarily to fees associated with the pending Aya Merger.

(d) Restructuring costs were primarily comprised of employee termination costs, lease-related exit costs, and reorganization costs as part of planned cost savings initiatives.

(e) Includes legal costs and other settlement charges as presented on the consolidated statements of operations and losses pertaining to matters outside the normal course of operations. The Company incurred a settlement expense of $1.2 million, and recorded a $1.8 million recovery related to a previous loss, in the fourth quarter of 2024, and incurred $19.4 million of credit loss expense, driven by a bankruptcy filing by a single MSP

customer, for the year ended December 31, 2024. There was no significant impact on operations from this MSP client as the majority of the business had been wound down in the prior year. For the year ended December 31, 2023, the Company incurred $1.1 million, including legal fees, to settle a wage and hour class action lawsuit.

(f) Impairment charges for the year ended December 31, 2024 were related to right-of-use assets and related property in connection with vacated leases during 2024, as well as the write-off of goodwill and intangible assets associated with the impairment of a previous asset acquisition. Impairment charges for the year ended December 31, 2023 primarily related to the write-off of an abandoned IT project.

(g) Loss on early extinguishment of debt for the year ended December 31, 2023 consisted of the write-off of debt issuance costs related to the payoff and termination of the term loan on June 30, 2023.

(h) System conversion costs include enterprise resource planning system costs related to the upgrading and integrating of our middle and back-office platforms, with certain development costs capitalized and amortized in accordance with the Company's policies, and applicant tracking system costs related to the Company's project to replace its legacy system supporting its travel nurse staffing business.

(i) Adjusted EPS, a non-GAAP financial measure, is defined as net income (loss) attributable to common stockholders per diluted share before the diluted EPS impact of acquisition and integration-related (benefits) costs, restructuring (benefits) costs, legal and other losses, customer bankruptcy loss, impairment charges, gain or loss on derivative, loss on early extinguishment of debt, gain or loss on sale of business, system conversion costs, and nonrecurring income tax adjustments. Adjusted EPS is not and should not be considered a measure of financial performance under GAAP. Management presents Adjusted EPS because it believes that Adjusted EPS is a useful supplement to its reported EPS as an indicator of operating performance. Management believes Adjusted EPS provides a more useful comparison of the Company's underlying business performance from period to period and is more representative of the future earnings capacity of the Company than EPS. Quarterly non-GAAP adjustment may vary due to rounding.

(j) Financial information included in the December 31, 2023 balance sheet includes immaterial revisions to the Company's previously-reported financial information. Please see the Company's Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, as filed with the SEC, for more information.

(k) Segment data is provided in accordance with the Segment Reporting Topic of the Financial Accounting Standards Board Accounting Standards Codification.

(l) Contribution income is defined as income (loss) from operations before depreciation and amortization, acquisition and integration-related (benefits) costs, restructuring (benefits) costs, legal and other (gains) losses, impairment charges, and corporate overhead. Contribution income is a financial measure used by management when assessing segment performance.

(m) Corporate overhead includes unallocated executive leadership and other centralized corporate functional support costs such as finance, IT, legal, human resources, and marketing, as well as public company expenses and Company-wide projects (initiatives).

(n) Legal and other losses includes legal costs and other settlement charges as presented on the consolidated statements of operations and losses pertaining to matters outside the normal course of operations.

(o) Gross profit is defined as revenue from services less direct operating expenses. The Company's gross profit excludes allocated depreciation and amortization expense. Gross profit margin is calculated by dividing gross profit by revenue from services.

(p) FTEs represent the average number of Nurse and Allied Staffing contract personnel on a full-time equivalent basis.

(q) Average revenue per FTE per day is calculated by dividing the Nurse and Allied Staffing revenue, excluding permanent placement, per FTE by the number of days worked in the respective periods.

(r) Days filled is calculated by dividing the total hours invoiced during the period, including an estimate for the impact of accrued revenue, by 8 hours.

(s) Revenue per day filled is calculated by dividing revenue as reported by days filled for the period presented.

Cross Country Healthcare, Inc.

William J. Burns, 561-237-2555

Executive Vice President & Chief Financial Officer

wburns@crosscountry.com

Source: Cross Country Healthcare, Inc.

v3.25.0.1

Cover

|

Mar. 05, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 05, 2025

|

| Entity Registrant Name |

Cross Country Healthcare, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

0-33169

|

| Entity Tax Identification Number |

13-4066229

|

| Entity Address, Address Line One |

6551 Park of Commerce Boulevard, N.W.

|

| Entity Address, City or Town |

Boca Raton

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33487

|

| City Area Code |

561

|

| Local Phone Number |

998-2232

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

CCRN

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001141103

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

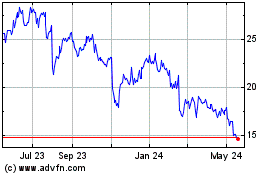

Cross Country Health (NASDAQ:CCRN)

Historical Stock Chart

From Feb 2025 to Mar 2025

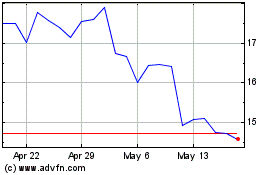

Cross Country Health (NASDAQ:CCRN)

Historical Stock Chart

From Mar 2024 to Mar 2025