Cyclacel Pharmaceuticals, Inc. (NASDAQ: CYCC, NASDAQ: CYCCP;

"Cyclacel" or the "Company") today announced that the Company

entered into a securities purchase agreement (“Agreement”) with

investor David Lazar (“Lazar”), pursuant to which he agreed to

purchase from the Company 1,000,000 shares of Series C Convertible

Preferred Stock (the “C Preferred Stock”) and 2,100,000 shares of

Series D Convertible Preferred Stock (the “D Preferred Stock”) of

Cyclacel at a purchase price of $1.00 per share for aggregate gross

proceeds of $3.1 million, subject to the terms and conditions of

the Agreement. The proceeds of the transaction will be used to

settle outstanding liabilities of the Company and other general

corporate and operating purposes.

Lazar is purchasing 1,000,000 shares of C

Preferred Stock for $1,000,000 at an initial closing to occur on or

about January 3, 2025. Each share of C Preferred Stock is

convertible into 2.65 shares of Company common stock. The aggregate

number of shares of common stock issuable upon conversion of the C

Preferred Stock is subject to a 5% beneficial ownership limitation

prior to stockholder approval of the transaction. Subject to the

satisfaction of certain closing conditions and within two business

days of the date that the Company’s stockholders approve the

issuance of all the shares of Common Stock upon conversion of the C

Preferred Stock and D Preferred Stock, as required by the

applicable rules and regulations of the Nasdaq Stock Market (the

“Preferred Stock Stockholder Approval”), Lazar will pay an

additional $2,100,000 in exchange for 2,100,000 shares of D

Preferred Stock at a second closing. Each share of D Preferred

Stock shall be convertible into 110 shares of common stock.

In connection with the Agreement, the Company’s

Board of Directors will be reconstituted. Dr. Samuel Barker will

continue to serve as Chairman, and Paul McBarron and Spiro Rombotis

will continue as directors. David Natan, a seasoned financial

executive with biopharmaceutical industry experience, will join the

Board and will chair the audit committee. In addition, Spiro

Rombotis stepped down from his position as Chief Executive Officer

of the Company and David Lazar was appointed as interim Chief

Executive Officer. Dr. Kenneth Ferguson, Dr. Christopher Henney,

Dr. Brian Schwartz, Dr. Robert Spiegel and Ms. Karin Walker

have resigned from the Board. The Company wishes to express its

gratitude to the departing directors for their long and dedicated

service and their support of Cyclacel’s efforts to serve the unmet

medical needs of cancer patients.

On January 2, 2025, the Company also entered

into a Warrant Exchange Agreement (the “Exchange Agreement”) with

the holder (the “Holder”) of certain existing warrants (the

“Exchanged Warrants”) to purchase an aggregate of 24,844,725 shares

of the Company’s common stock. Pursuant to the Exchange Agreement,

on the closing date and subject to the receipt of approval of the

Company’s stockholders as required by the applicable rules and

regulations of the Nasdaq Stock Market with respect to the issuance

of all of the shares of common stock to be issued pursuant to the

Exchange Agreement (the “Warrant Exchange Stockholder Approval”),

the Company agreed to exchange with the Holder the Exchanged

Warrants for an aggregate of 24,844,725 shares of Common Stock (the

“New Shares”) and $1,100,000 in cash (collectively, the

“Exchange”). To the extent the Holder would otherwise beneficially

own in excess of any beneficial ownership limitation applicable to

the Holder after giving effect to the Exchange, the Exchanged

Warrants shall be exchanged for a number of New Shares issuable to

the Holder without violating the beneficial ownership limitation

and the remainder of the Holder’s Exchanged Warrants shall be

issued as pre-funded warrants to purchase the number of shares of

Common Stock equal to the number of shares of Common Stock in

excess of the beneficial ownership limitation. The closing of the

Exchange is expected to take place substantially concurrently with

the date on which the Warrant Exchange Stockholder Approval is

received, subject to the receipt by the Company of the Preferred

Stock Stockholder Approval. The Company also agreed to register the

New Shares for resale pursuant to certain registration rights set

forth in the Exchange Agreement.

The Board has directed management to reduce

operating costs while strategic alternatives are being explored.

There can be no assurance that the exploration of strategic

alternatives will result in any agreement or transaction, or as to

the timing of any such agreement or transaction. Further, there can

be no assurance that the Company will receive the Preferred Stock

Stockholder Approval or the Warrant Exchange Stockholder

Approval.

The Company has received a written communication

from the Nasdaq Stock Market, and expects to receive formal

notification, that, in response to the Company’s request for an

extension, the new deadline to demonstrate compliance with Nasdaq’s

minimum stockholders’ equity requirement is February 6, 2025. If

the Company fails to regain compliance during the required

compliance period, its securities would be subject to

delisting.

About Cyclacel Pharmaceuticals,

Inc.

Cyclacel is a clinical-stage, biopharmaceutical

company developing innovative cancer medicines based on cell cycle,

transcriptional regulation and mitosis biology. The transcriptional

regulation program is evaluating fadraciclib, a CDK2/9 inhibitor,

currently in Phase 2 clinical trials, and the anti-mitotic program

plogosertib, a PLK1 inhibitor, currently in Phase 1 clinical

trials, in patients with both solid tumors and hematological

malignancies. For additional information, please visit

www.cyclacel.com.

Forward-looking Statements

This news release contains certain

forward-looking statements that involve risks and uncertainties

that could cause actual results to be materially different from

historical results or from any future results expressed or implied

by such forward-looking statements. Such forward-looking statements

include, among other things, statements related to the receipt of

stockholder approvals to issue the shares of common stock pursuant

to the contemplated transactions, the consummation of a second

closing pursuant to the Agreement, the Company’s exploration and

review of strategic alternatives, its ability to identify and

complete a transaction as a result of the strategic review process,

its plans to reduce costs and conserve cash and Cyclacel’s ability

to regain and maintain compliance with Nasdaq’s continued listing

requirements. You are urged to consider statements that include the

words "may," "will," "would," "could," "should," "believes,"

"estimates," "projects," "potential," "expects," "plans,"

"anticipates," "intends," "continues," "forecast," "designed,"

"goal," or the negative of those words or other comparable words to

be uncertain and forward-looking. These risks and uncertainties

include the risk that the Company may not be successful in

receiving the stockholder approvals contemplated and may not

consummate a second closing pursuant to the Agreement, the

uncertainty of whether the Company is able to regain and maintain

compliance with Nasdaq’s continued listing requirements, the

uncertainty of pursuing strategic alternatives and consummating one

or more strategic transactions on attractive terms, if at all; the

Company’s actual reductions in spending as compared to anticipated

cost reductions; the Company’s costs of continuing to operate as a

public company; and the other risks described more fully in

Cyclacel Pharmaceuticals’ filings with the Securities and Exchange

Commission, including the “Risk Factors” section of the Company’s

Annual Report on Form 10-K for the year ending December 31, 2023

and its other documents subsequently filed with or furnished to the

Securities and Exchange Commission, including its Form 10-Q for the

quarter ended September 30, 2024. For a further list and

description of the risks and uncertainties the Company faces,

please refer to our most recent Annual Report on Form 10-K and

other periodic filings we file with the Securities and

Exchange Commission that are available at www.sec.gov.

Such forward-looking statements are current only as of the date

they are made, and we assume no obligation to update any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Contacts

Company: Paul McBarron, (908) 517-7330,

IR@cyclacel.com

© Copyright 2025 Cyclacel Pharmaceuticals, Inc. All

Rights Reserved. The Cyclacel logo and Cyclacel® are trademarks of

Cyclacel Pharmaceuticals, Inc.

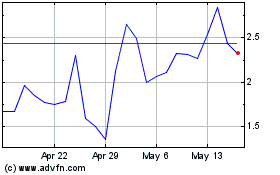

Cyclacel Pharmaceuticals (NASDAQ:CYCC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Cyclacel Pharmaceuticals (NASDAQ:CYCC)

Historical Stock Chart

From Jan 2024 to Jan 2025