UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed

by the Registrant x

Filed

by a Party other than the Registrant ¨

Check the Appropriate Box:

| x |

Preliminary Proxy Statement |

| |

|

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ¨ |

Definitive Proxy Statement |

| |

|

| ¨ |

Definitive Additional Materials |

| |

|

| ¨ |

Soliciting Material Pursuant to § 240.14a-12 |

DARIOHEALTH CORP.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check the appropriate

box):

| ¨ |

Fee paid previously with preliminary materials |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

DarioHealth Corp.

322 W. 57th St.

New York, New York 10019

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held On Monday, April 28, 2025

You are cordially invited to attend a special

meeting of the stockholders (the “Meeting”) of DarioHealth Corp. (the “Company”), which will be

held at 9:00 a.m. at the Company’s Israeli offices located at 5 Tarshish St. Caesarea Industrial Park 3088900, Israel 2nd

Floor for the following purposes:

| |

1. |

To approve, for purposes of Nasdaq Listing Rule 5635(d) (A) (i) the conversion of 25,605 shares of the Company’s Series D, D-1, D-2 and D-3 Preferred Stock into an aggregate of 33,956,850 shares of common stock, $0.0001 par value per share (the “Common Stock”), which were issued pursuant to private placement transactions that closed on December 18, 2024 and January 14, 2025 (the “Private Placement”), (ii) the issuance of up to 13,582,740 shares of Common Stock issuable as dividends to the shares of the Company’s Series D, D-1, D-2 and D-3 Preferred Stock; and (iii) to approve the issuance of up to 1,670,028 shares of Common Stock issuable as share consideration provided under the lock up agreements executed between the Company and certain purchasers in the Private Placement that are holders of the Company’s various Series B Preferred Stock and various Series C Preferred Stock, (the “Lock Up Agreements”), pursuant to which the Company agreed to issue, up to forty percent (40%) of the shares of Common Stock underlying the Series B Preferred Stock and the Series C Preferred Stock held by such purchaser, including dividend shares of Common Stock due upon conversion of these shares into shares of Common Stock, over the course of twelve (12) months (the “Additional Shares”) and (B) (i) reduce the exercise price of certain warrants to purchase 584,882 shares of Common Stock issued to Avenue Venture Opportunities Fund II, L.P. and Avenue Venture Opportunities Fund, L.P. (collectively “Avenue”) to $0.7208 per share, and (ii) to permit the conversion of up to two million dollars of the principal amount of the loan issued by Avenue to the Company at a conversion price of $0.8650 per share, and |

| |

|

|

| |

2. |

To transact any other business as may properly come before the Meeting or any adjournments thereof. |

All stockholders are cordially

invited to attend the Meeting. If your shares are registered in your name, please bring the admission ticket attached to your

proxy card. If your shares are registered in the name of a broker, trust, bank or other nominee, you will need to bring a proxy

or a letter from that broker, trust, bank or other nominee or your most recent brokerage account statement, that confirms that you are

the beneficial owner of those shares. If you do not have either an admission ticket or proof that you own shares of the Company, you will

not be admitted to the meeting.

The Board of Directors has

fixed the close of business on March 7, 2025, as the record date for the Meeting. Only stockholders on the record date are entitled to

notice of and to vote at the meeting and at any adjournment or postponement thereof.

Your vote is important regardless

of the number of shares you own. The Company requests that you complete, sign, date and return the enclosed proxy card without

delay in the enclosed postage-paid return envelope, even if you now plan to attend the Meeting. You may revoke your proxy at

any time prior to its exercise by delivering written notice or another duly executed proxy bearing a later date to the Secretary of the

Company, or by attending the Meeting and voting in person.

|

Important Notice Regarding the Availability

of Proxy Materials for the Meeting to be held on April 28, 2025

The proxy statement, proxy card and Annual

Report are also available at

http://www.dariohealth.com/DH2025Proxy.pdf

Stockholders may also obtain additional

paper or e-mail copies of these materials at no cost by writing to

DarioHealth Corp., 322 W. 57th St.

New York, New York 10019, and/or via electronic

mail to ir@dariohealth.com,

Attention: Secretary. |

Securities and Exchange Commission

rules allow us to furnish proxy materials to our stockholders over the internet. You may also have access to the materials for the Meeting

by visiting the website: http://mydario.investorroom.com. You may also cast your vote by visiting www.proxyvote.com if you hold your shares

in “street name,” or www.vstocktransfer.com/proxy if you are a registered stockholder. You may also authorize a proxy to vote

your shares over the internet. In order to vote over the internet you must have your stockholder identification number, which is set forth

in the Notice of Internet Availability of Proxy Materials mailed to you. You may also request a paper proxy card to submit your vote by

mail. If you have any questions regarding the completion of the enclosed proxy card or would like directions to the Meeting, please call

+(972)-(4) 770 6377. You may also find directions at http://mydario.investorroom.com/SECFilings.

| |

By order of the Board of Directors, |

| |

|

| |

/s/ Erez Raphael |

| |

Erez Raphael |

| |

Chief Executive Officer |

Caesarea, Israel

, 2025

IMPORTANT: In order to secure a quorum and

to avoid the expense of additional proxy solicitation, please either vote by internet or sign, date and return your proxy promptly in

the enclosed envelope even if you plan to attend the meeting personally. Your cooperation is greatly appreciated.

IF YOU RETURN YOUR PROXY CARD WITHOUT AN INDICATION

OF HOW YOU WISH TO VOTE, YOUR SHARES WILL BE VOTED IN FAVOR OF THE PROPOSAL.

TABLE OF CONTENTS

PROXY STATEMENT

DARIOHEALTH CORP.

SPECIAL MEETING OF STOCKHOLDERS

to be held at 9:00 a.m. on April 28, 2025

5 Tarshish St. 2nd Floor

Caesarea Industrial Park 3088900, Israel

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS

Why am I receiving this Proxy Statement?

This Proxy Statement describes

the proposals on which our Board of Directors (the “Board”) would like you, as a stockholder, to vote at a special

meeting of the Stockholders (the “Meeting”), which will take place at 9:00 a.m. on April 28, 2025, at the Company’s

Israeli offices located at 5 Tarshish St. Caesarea Industrial Park 3088900, Israel 2nd Floor.

This Proxy Statement also

gives you information on these proposals so that you can make an informed decision. We intend to mail this Proxy Statement and accompanying

proxy card on or about March 20, 2025, to all stockholders of record entitled to vote at the Meeting.

In this proxy statement, we

refer to DarioHealth Corp. as the “Company”, “we”, “us” or “our” or similar terminology.

Website addresses included

in this proxy statement are textual references only, and the information in any website is not incorporated by reference into this proxy

statement.

How many shares must be present in order to

hold the special meeting of stockholders?

Our Bylaws provide that a

quorum shall consist of the holders of thirty-three and one-third (33 1/3rd) of the stock issued and outstanding and entitled

to vote thereat, present in person or represented by proxy at the Meeting. A quorum will be present if stockholders holding at least a

majority of the outstanding shares entitled to vote are present at the meeting in person or represented by proxy. On March 7, 2025 (the

“Record Date”), there were shares of our common stock, $0.0001 par value per share (the “Common Stock”),

3,557 shares of Series A-1 Convertible Preferred Stock (convertible into 878,273 shares of Common Stock), with a conversion price of $4.05

per share (the “Series A-1 Preferred Stock”), 4,946 shares of Series B-1 Convertible Preferred Stock (convertible into

1,483,503 shares of Common Stock), with a conversion price of $3.334 per share (the “Series B-1 Preferred Stock”),

17,037 shares of Series C Convertible Preferred Stock (convertible into 8,450,352 shares of Common Stock), with a conversion price of

$2.02 per share (the “Series C Preferred Stock”), 4,000 shares of Series C-1 Convertible Preferred Stock (convertible

into 1,984,000 shares of Common Stock), with a conversion price of $2.02 per share (the “Series C-1 Preferred Stock”),

1,115 shares of Series C-2 Convertible Preferred Stock (convertible into 521,820 shares of Common Stock), with a conversion price of $2.14

per share (the “Series C-2 Preferred Stock”), 7,055 shares of Series D Preferred Stock (convertible into 9,665,350

shares of Common Stock), with a conversion price of $0.73 per share (the “Series D Preferred Stock”), 11,750 shares

of Series D-1 Preferred Stock (convertible into 16,097,500 shares of Common Stock), with a conversion price of $0.73 per share (the “Series

D-1 Preferred Stock”), 4,950 shares of Series D-2 Preferred Stock (convertible into 5,964,750 shares of Common Stock), with

a conversion price of $0.83 per share (the “Series D-2 Preferred Stock”) and 1,850 shares of Series D-3 Preferred Stock

(convertible into 2,229,250 shares of Common Stock), with a conversion price of $0.83 per share (the “Series D-3 Preferred Stock”).

Each share of Common Stock

and preferred stock, except for the Series A-1 Preferred Stock, Series B-1 Preferred Stock, and Series C-1 Preferred Stock, is entitled

to one vote per share on an as-converted basis. The Series A-1 Preferred Stock, Series B-1 Preferred Stock, Series C-1 Preferred Stock

do not possess any voting rights. In addition, the Series D Preferred Stock, Series D-1 Preferred Stock, Series D-2 Preferred Stock and

Series D-3 Preferred Stock are not entitled to vote until we receive stockholder approval.

Thus, the holders of the aggregate

number of shares of Common Stock, inclusive of the shares of Common Stock issuable upon conversion of the Series C Preferred Stock, and

Series C-2 Preferred Stock (on an as-converted basis) must be present in person or represented by proxy at the meeting to have a quorum.

If such quorum shall not be present or represented, the stockholders entitled to vote thereat, present in person or represented by proxy,

shall have the power to adjourn the Meeting, without notice other than announcement at the meeting, until a quorum shall be present or

represented. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your

broker, bank or other nominee) or if you vote in person at the Meeting. Abstentions may be specified on all proposals. Abstentions and

broker non-votes will be counted towards the quorum requirement. Submitted proxies which are left blank will also be counted as present

for purposes of determining a quorum but are not counted for purposes of determining whether a proposal has been approved in matters where

the proxy does not confer the authority to vote on such proposal, and thus have no effect on its outcome.

Who can vote at the special meeting of stockholders?

Between December 16, 2024

and January 7, 2025, we executed two forms of securities purchase agreements (together, the “Securities Purchase Agreements”)

with accredited and non-U.S. investors relating to two concurrent placement offerings (collectively, the “Offering”)

of 7,055 shares of Series D Preferred Stock, 11,750 shares of Series D-1 Preferred Stock, 4,950 shares of Series D-2 Preferred Stock and

1,850 shares of Series D-3 Preferred Stock. The closings of the Offering took place on December 18, 2024, and January 14, 2025, respectively.

The shares of Common Stock issuable upon conversion of the Series D, D-1, D-2 and D-3 Preferred Stock are not entitled to vote at the

Meeting.

Stockholders

who owned shares of our Common Stock, Series C Preferred Stock and Series C-2 Preferred Stock on the Record Date may attend and vote at

the Meeting, provided, however, that the vote of all shares of our Series D, D-1, D-2 and D-3 Preferred Stock issued in the Offering will

not be counted in determining whether or not the Private Placement Proposal (as hereinafter defined) is approved. There were shares of

Common Stock, 17,037 shares of Series C Preferred Stock (convertible into 8,450,352 shares of Common Stock), 1,115 shares of Series C-2

Preferred Stock (convertible into 521,820 shares of Common Stock), outstanding on the Record Date. All shares of Common Stock and preferred

stock, aside from the Series A-1 Preferred Stock, Series B-1 Preferred Stock and Series C-1 Preferred Stock, have one vote per share and

vote together as a single class. The Series A-1 Preferred Stock, Series B-1 Preferred Stock and Series C-1 Preferred Stock do not possess

any voting rights. Information about the stockholdings of our directors and executive officers is contained in the section of this Proxy

Statement entitled “Beneficial Ownership of Principal Stockholders, Officers and Directors” on page 9 of

this Proxy Statement.

What is the proxy card?

The proxy card enables you

to appoint Erez Raphael, our Chief Executive Officer, and/or Zvi Ben-David, our Secretary, Treasurer and Chief Financial Officer, as your

representative at the Meeting. By completing and returning the proxy card or voting online as described herein, you are authorizing these

persons to vote your shares at the Meeting in accordance with your instructions on the proxy card. This way, your shares will be voted

whether or not you attend the Meeting. Even if you plan to attend the Meeting, please complete and return your proxy card before the Meeting

date just in case your plans change. If a proposal comes up for vote at the Meeting that is not on the proxy card, the proxies will vote

your shares, under your proxy, according to their best judgment.

What am I voting on?

You are being asked to vote:

| |

1. |

To approve, for purposes of Nasdaq Listing Rule 5635(d) (A) (i) the conversion of 25,605 shares of the Company’s Series D, D-1, D-2 and D-3 Preferred Stock into an aggregate of 33,956,850 shares of common stock, $0.0001 par value per share (the “Common Stock”), which were issued pursuant to private placement transactions that closed on December 18, 2024 and January 14, 2025 (the “Private Placement”), (ii) the issuance of up to 13,582,740 shares of Common Stock issuable as dividends to the shares of the Company’s Series D, D-1, D-2 and D-3 Preferred Stock; and (iii) to approve the issuance of up to 1,670,028 shares of Common Stock issuable as share consideration provided under the lock up agreements executed between the Company and certain purchasers in the Private Placement that are holders of the Company’s Series B Preferred Stock and Series C Preferred Stock, (the “Lock Up Agreements”), pursuant to which the Company agreed to issue, up to forty percent (40%) of the shares of Common Stock underlying the Series B Preferred Stock and the Series C Preferred Stock held by such purchaser, including dividend shares of Common Stock due upon conversion of these shares into shares of Common Stock, over the course of twelve (12) months (the “Additional Shares”), and (B) (i) reduce the exercise price of certain warrants to purchase 584,882 shares of Common Stock issued to Avenue Venture Opportunities Fund II, L.P. and Avenue Venture Opportunities Fund, L.P. (collectively “Avenue”) to $0.7208 per share, and (ii) to permit the conversion of up to two million dollars of the principal amount of the loan issued by Avenue to the Company at a conversion price of $0.8650 per share (collectively, the “Private Placement Proposal”); and |

| |

2. |

To transact any other business as may properly come before the Meeting or any adjournments thereof. |

How does the Board recommend that I vote?

Our Board unanimously recommends

that the stockholders vote “FOR” the Private Placement Proposal.

What is the difference between holding shares

as a stockholder of record and as a beneficial owner?

Most of our stockholders hold

their shares in an account at a brokerage firm, bank or other nominee holder, rather than holding share certificates in their own name.

As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record

If, on the Record Date, your

shares were registered directly in your name with our transfer agent, VStock Transfer LLC, you are a “stockholder of record”

who may vote at the Meeting, and we are sending these proxy materials directly to you. As the stockholder of record, you have the right

to direct the voting of your shares by returning the enclosed proxy card to us or to vote in person at the Meeting. Whether or not you

plan to attend the Meeting, please complete, date and sign the enclosed proxy card to ensure that your vote is counted.

Beneficial Owner

If, on the Record Date, your

shares were held in an account at a brokerage firm or at a bank or other nominee holder, you are considered the beneficial owner of shares

held “in street name,” and these proxy materials are being forwarded to you by your broker or nominee who is considered the

stockholder of record for purposes of voting at the Meeting. As the beneficial owner, you have the right to direct your broker on how

to vote your shares and to attend the Meeting. However, since you are not the stockholder of record, you may not vote these shares in

person at the Meeting unless you receive a valid proxy from your brokerage firm, bank or other nominee holder. To obtain a valid proxy,

you must make a special request of your brokerage firm, bank or other nominee holder. If you do not make this request, you can still vote

by using the voting instruction card enclosed with this proxy statement; however, you will not be able to vote in person at the Meeting.

How do I vote?

(1) You

may vote by mail. You may vote by mail by completing, signing and dating your proxy card and returning it in the enclosed, postage-paid

and addressed envelope. If we receive your proxy card prior to the Meeting and if you mark your voting instructions on the proxy card,

your shares will be voted:

| |

· |

as you instruct, and |

| |

|

|

| |

· |

according to the best judgment of the proxies if a proposal comes up for a vote at the Meeting that is not on the proxy card. |

If you return a signed card, but do not provide

voting instructions, your shares will be voted:

| |

· |

for the Private Placement Proposal; and |

| |

|

|

| |

· |

according to the best judgment of either Mr. Raphael or Mr. Ben-David if a proposal comes up for a vote at the Meeting that is not on the proxy card. |

(2) You

may vote in person at the Meeting. We will pass out written ballots to anyone who wants to vote at the Meeting. However, if you

hold your shares in street name, you must bring to the Meeting a valid proxy from the broker, bank or other nominee holding your shares

that confirms your beneficial ownership of the shares and gives you the right to vote your shares. Holding shares in street name means

you hold them through a brokerage firm, bank or other nominee, and therefore the shares are not held in your individual name. We encourage

you to examine your proxy card closely to make sure you are voting all of your shares in the Company.

(3) You

may vote online. You may also have access to the materials for the Meeting by visiting the website: http://mydario.investorroom.com.

You may also cast your vote by visiting www.proxyvote.com if you hold your shares in “street name,” or www.vstocktransfer.com/proxy

if you are a registered stockholder.

What does it mean if I receive more than one

proxy card?

You may have multiple accounts

at the transfer agent and/or with brokerage firms. Please sign and return all proxy cards to ensure that all of your shares are voted.

What if I change my mind after I return my

proxy?

You may revoke your proxy

and change your vote at any time before the polls close at the Meeting. You may do this by:

| |

· |

sending a written notice to Zvi Ben-David, our corporate Secretary, stating that you would like to revoke your proxy of a particular date; |

| |

|

|

| |

· |

signing another proxy card with a later date and returning it before the polls close at the Meeting; or |

| |

|

|

| |

· |

attending the Meeting and voting in person. |

Please note, however, that

if your shares are held of record by a brokerage firm, bank or other nominee, you must instruct your broker, bank or other nominee that

you wish to change your vote by following the procedures on the voting form provided to you by the broker, bank or other nominee. If your

shares are held in street name, and you wish to attend and vote at the Meeting, you must bring to the Meeting a legal proxy from the broker,

bank or other nominee holding your shares, confirming your beneficial ownership of the shares and giving you the right to vote your shares.

Will my shares be voted if I do not sign and

return my proxy card?

If your shares are held in

street name or in your name and you do not sign and return your proxy card, your shares will not be voted unless you vote in person at

the Meeting.

How are votes counted?

You may vote “for,”

“against,” or “abstain” on each of the proposals being placed before our stockholders. Abstentions and broker

non-votes (i.e., shares held by brokers on behalf of their customers, which may not be voted on certain matters because the brokers

have not received specific voting instructions from their customers with respect to such matters) will be counted solely for the purpose

of determining whether a quorum is present at the Meeting.

What are broker non-votes?

Broker non-votes occur when

a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares

as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the

shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting

instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,”

but not with respect to “non-routine” matters. In the event that a broker, bank, or other agent indicates on a proxy that

it does not have discretionary authority to vote certain shares on a non-routine proposal, then those shares will be treated as broker

non-votes. The Private Placement Proposal is a non-routine proposal; therefore, your broker, bank or other agent is not entitled to vote

your shares on the Private Placement Proposal without your instructions.

How many votes are required to approve the Private Placement Proposal?

The affirmative vote of a

majority of the votes cast at the Meeting by the holders of Common Stock (or preferred stock eligible to vote on an as-converted basis)

represented in person or by proxy and entitled to vote is required for approval of the Private Placement Proposal. Abstentions are considered

present for purposes of establishing a quorum but will have no effect on the approval of the Private Placement Proposal. Broker non-votes

will not affect the outcome of the vote on this matter.

What happens if I don’t indicate how

to vote my proxy?

If you just sign your proxy

card without providing further instructions, your shares will be counted as a “for” vote for the Private Placement Proposal.

Is my vote kept confidential?

Proxies, ballots and voting

tabulations identifying stockholders are kept confidential and will not be disclosed except as may be necessary to meet legal requirements.

Where do I find the voting results of the Meeting?

We will announce preliminary

voting results at the Meeting and file a Current Report on Form 8-K announcing the final voting results of the Meeting.

Who can help answer my questions?

You can contact our Chief

Financial Officer, Secretary and Treasurer, Zvi Ben-David, at (972) 4770-6377 or by sending a letter to Mr. Ben-David at offices of the

Company at 322 W. 57th St. New York, New York 10019, with any questions about proposals described in this Proxy Statement or how to execute

your vote.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting

proxies. In addition to these mailed proxy materials, our directors and employees may also solicit proxies in person, by telephone or

by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. In addition,

we have retained Laurel Hill Advisory Group, LLC to assist in the solicitation of proxies for a fee of $6,500 plus customary expenses.

No Right of Appraisal

None of Delaware law, our

Certificate of Incorporation or our Bylaws provides for appraisal or other similar rights for dissenting stockholders in connection with

any of the proposals to be voted upon at this Meeting. Accordingly, our stockholders will have no right to dissent and obtain payment

for their shares.

ALL PROXIES RECEIVED WILL

BE VOTED IN ACCORDANCE WITH THE CHOICES SPECIFIED ON SUCH PROXIES. PROXIES WILL BE VOTED IN FAVOR OF A PROPOSAL IF NO CONTRARY SPECIFICATION

IS MADE. ALL VALID PROXIES OBTAINED WILL BE VOTED AT THE DISCRETION OF THE PERSONS NAMED IN THE PROXY WITH RESPECT TO ANY OTHER BUSINESS

THAT MAY COME BEFORE THE MEETING. THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR THE Private Placement

Proposal.

PROPOSAL 1

PRIVATE PLACEMENT PROPOSAL

Background

Series D Offering

Between December 16, 2024

and January 7, 2025, we executed two forms of Securities Purchase Agreements with accredited and non-U.S. investors relating to an offering

of an aggregate of 25,605 shares of the Company’s Series D, D-1, D-2 and D-3 Convertible Preferred Stock. The shares of Series D,

D-1, D-2 and D-3 Convertible Preferred Stock were issued pursuant to private placement transactions that closed on December 18, 2024 and

January 14, 2025.

Pursuant to the Certificates

of Designation of Preferences, Rights and Limitations of the Series D, D-1, D-2 and D-3 Convertible Preferred Stock (the “Certificates

of Designation”), the shares of Series D, D-1, D-2 and D-3 Convertible Preferred Stock are convertible into an aggregate of

33,956,850 shares of Common Stock based on conversion prices of $0.73 and $0.83 per share. In addition, the shares of Series D, D-1, D-2

and D-3 Convertible Preferred Stock are eligible to receive dividends of up to 13,582,740 shares of Common Stock. Following the elapse

of the dilutive issuance provisions included in the Certificates of Designation, such conversion prices are not subject to any future

price-based anti-dilution adjustments but do carry customary anti-dilution protection. The holders of the Series D, D-1, D-2, and D-3

Preferred Stock will not be entitled to vote or convert such preferred stock into shares of Common Stock until we obtain stockholder approval

for such conversion. The holders of the Series D-1 and D-3 Preferred Stock do not possess any voting rights. The Series D, D-1, D-2 D-3

Preferred Stock carries a liquidation preference for each holder equal to the investment made by such holder in the Series D, D-1, D-2

and D-3 Preferred Stock issued in the Offering, and such liquidation preference applies in certain deemed liquidation events such as a

change in control of the Company. In addition, the holders of Series D, D-1, D-2 and D-2 Preferred Stock are eligible to participate in

dividends and other distributions by us on an as-converted basis.

We have agreed to file a registration

statement covering the resale of the shares of Common Stock issuable upon conversion of the Series D, D-1, D-2 D-3 Preferred Stock, thirty

(30) calendar days following the receipt of shareholder approval.

Avenue Warrant and Loan Amendment

On December 16, 2024, we and

our subsidiaries, PsyInnovations, Inc. and LabStyle Innovation Ltd., entered into the Second Amendment to Loan and Security Agreement

and Supplement (the “Avenue Amendment”) with Avenue. Pursuant to the Avenue Amendment, the parties agreed to (i) amend

the potential interest only period under the loan facility such that the existing interest only period ending on April 30, 2024 was extended

by a period of six months provided the Company certain net proceeds from an equity financing on or before March 31, 2025 in the aggregate;

(ii) an additional sixth month interest only extension period was added, which is conditioned on the Company achieving a multi-million

dollar net revenue milestone, with cash burn not to exceed a certain multi-million dollar level, for the trailing six month period ending

September 30, 2025; (iii) the interest only period may not exceed a total of 36 months from the closing of the loan as of May 1, 2023;

and (iv) the maturity date of the loan was extended from May 1, 2027 to November 1, 2027, provided that the Company meets the foregoing

amended milestones.

In addition, the Avenue Amendment

provides (i) that the Company will seek stockholder approval to reprice the warrants issued to the lenders on May 1, 2023 to purchase

up to 584,882 shares of Common Stock (the “Avenue Warrants”) from an exercise price of $2.02 per share to a price equal

to the “minimum price” as defined by Nasdaq rules as of the closing of the Avenue Amendment (or $0.7208 per share) and (ii)

permit Avenue, subject to Nasdaq rules, to convert up to two million of the principal amount of its loan to the Company at a conversion

price of $0.8650 per share.

In consideration for the Avenue

Amendment, the Company agreed to pay a certain amendment fee at closing, and the exit payment due under the loan was increased by a certain

amount, in addition to accrued interest and then outstanding principal.

Description of the Series D, D-1, D-2 and D-3

Preferred Stock

Conversion Price. The

Series D and D-1 Preferred Stock entitles the holders thereof to convert their shares of Series D and D-1 Preferred Stock into Common

Stock at a conversion price of $0.73 per share, subject to adjustment. The Series D-2 and D-3 Preferred Stock entitles the holders thereof

to convert their shares of Series D-2 and D-3 Preferred Stock into Common Stock at a conversion price of $0.83 per share, subject to adjustment.

Automatic Conversion. Each

outstanding share of Series D, D-1, D-2 and D-3 Preferred Stock, will automatically convert (subject to the beneficial ownership limitation

described below) on the twelve (12) month anniversary of the original issuance date.

Beneficial Ownership Limitation.

The holder will not have the right to convert its Series D, D-1, D-2 and D-3 Preferred Stock if the holder (together with its affiliates

and any other persons whose beneficial ownership of shares of Common Stock would be aggregated with the holder’s for purposes of

Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) would beneficially own in excess

of 19.99% of the number of shares of Common Stock outstanding immediately after giving effect to the conversion, as such percentage ownership

is determined in accordance with the terms of the Certificates of Designation.

Adjustments. The conversion

price of the Series D, D-1, D-2 and D-3 Preferred Stock and the number of shares of Common Stock issuable upon the conversion of the Series

D, D-1, D-2 and D-3 Preferred Stock are subject to adjustment in certain circumstances.

Rights Upon Distribution

of Assets. If we declare or makes any dividend or other distribution of its assets to holders of shares of Common Stock, the exercise

price in effect immediately prior to the record date fixed for determination of holders entitled to receive the distribution shall be

reduced pursuant to a formula set forth in the Warrants and the number of Warrant Shares shall be adjusted accordingly.

Listing. There is no

established public trading market for the Series D, D-1, D-2 and D-3 Preferred Stock, and we do not expect a market to develop. In addition,

we do not intend to apply for listing of the Series D, D-1, D-2 and D-3 Preferred Stock on any national securities exchange or other nationally

recognized trading system.

Fundamental Transactions.

In the event of any fundamental transaction, as described in the Certificates of Designation and generally including any merger with or

into another entity, sale of all or substantially all of the our assets, tender offer or exchange offer, or reclassification of the Common

Stock, we shall make appropriate provision so that Series D, D-1, D-2 and D-3 Preferred Stock shall thereafter be convertible for shares

of the successor entity based upon the conversion ratio or other consideration payable in the fundamental transaction. In connection with

a fundamental transaction that constitutes a corporate event, we shall make appropriate provision to ensure that the holder will thereafter

have the right to receive, upon conversion of Series D, D-1, D-2 and D-3 Preferred Stock in lieu of the shares of Common Stock (or other

securities, cash, assets or other property) purchasable upon the conversion of Series D, D-1, D-2 and D-3 Preferred Stock prior to such

fundamental transaction, such shares of stock, securities, cash, assets or any other property whatsoever which the holder would have been

entitled to receive upon the happening of such fundamental transaction had the Series D, D-1, D-2 and D-3 Preferred Stock been converted

immediately prior to such fundamental transaction.

Voting Rights. The

holders of the Series D and D-2 Preferred Stock will vote together with the Common Stock as a single class on an as-converted basis on

any matter presented to the shareholders of the Company. The holders of the Series D-1 and D-3 Preferred Stock do not have any voting

rights, until they convert such shares into Common Stock.

The information provided in

this proxy statement contains summaries of the Certificates of Designation and is subject to, and qualified in its entirety by reference

to, the Certificates of Designation which are filed as Exhibit 3.1 and Exhibit 3.2 to our Current Report on Form 8-K filed with the SEC

on December 18, 2024 and the Certificates of Designation which are filed as Exhibit 3.1 and Exhibit 3.2 to our Current Report on Form

8-K filed with the SEC on January 10, 2025.

Lock Up Consideration

In addition, the Company and

certain purchasers in the Offering that are holders of the Company’s Series B Preferred Stock and Series C Preferred Stock, and

invested an amount of at least $250,000 in the two classes of securities executed Lock Up Agreement, pursuant to which the Company agreed

to issue, subject to stockholder approval, up to an aggregate of 1,670,028 shares of Common Stock, representing forty percent (40%) of the

shares of Common Stock underlying the Series B Preferred Stock and the Series C Preferred Stock held by such purchaser, including dividend

shares of Common Stock due upon conversion of these shares into shares of Common Stock, over the course of twelve (12) months. Each holder

shall be entitled to receive 10% of the Additional Shares for each three (3) month period each holder agrees not to transfer or otherwise

sell (subject to certain limitations) the shares of Common Stock issuable upon conversion of the Series B Preferred Stock and Series C

Preferred Stock and the dividend shares of Common Stock due upon conversion.

The information provided in

this proxy statement contains a summary of the terms of the Series D Preferred Stock, Series D-1 Preferred Stock, Series D-2 Preferred

Stock, Series D-3 Preferred Stock, and the Lock Up agreements and are subject to, and qualified in its entirety by reference to the Certificate

of Designation of Preferences, Rights and Limitations of the Series D Preferred Stock, the Certificate of Designation of Preferences,

Rights and Limitations of the Series D-1 Preferred Stock, the Certificate of Designation of Preferences, Rights and Limitations of the

Series D-2 Preferred Stock, the Certificate of Designation of Preferences, Rights and Limitations of the Series D-3 Preferred Stock and

the form of Lock Up Agreement are qualified by reference to the full text of these documents, copies of which are filed as Exhibit 3.1

and Exhibit 3.2, respectively, to our Current Report on Form 8-K filed with the SEC on December 18, 2024, and to Exhibit 3.1, Exhibit

3.2 and Exhibit 10.2, respectively, to our Current Report on Form 8-K filed with the SEC on January 10, 2025.

Why We Need Stockholder Approval

Our Common Stock is listed

on the Nasdaq Capital Market LLC under the symbol “DRIO”, and as such, we are subject to the Nasdaq listing standards set

forth in Marketplace Rules. Nasdaq listing Rule 5635(d), (the “Nasdaq 20% rule”), requires stockholder approval prior

to the issuance of securities in connection with a transaction (other than a public offering) involving the sale, issuance or potential

issuance of Common Stock (or securities convertible into or exercisable for Common Stock), at a price less than market value, equal to

20% or more of the Common Stock outstanding prior to the transaction. In order to (A) permit the conversion of the Series D, D-1, D-2

D-3 Preferred Stock, the issuance of 33,956,850 shares of Common Stock upon conversion of the preferred stock and the issuance of up to

13,582,740 shares issuable as dividends to holders of the preferred stock and (B) to permit the repricing of certain warrants to purchase

584,882 shares of Common Stock issued to Avenue and to permit the conversion of up to two million dollars of the principal amount of the

loan issued by Avenue to the Company at a conversion price of $0.8650 per share, we are seeking stockholder approval as required by the

Nasdaq 20% rule.

Consequences of Not Approving this Proposal

If we do not obtain stockholder

approval, the holders of Series D, D-1, D-2 and D-3 Preferred Stock will be unable to vote their shares or convert an aggregate of 25,605

shares of our Series D, D-1, D-2 and D-3 Preferred Stock into 33,956,850 shares of Common Stock or receive up to 13,582,740 shares of

Common Stock issuable as dividends. In addition, if we do not obtain stockholder approval, the Avenue Warrants will not have their exercise

price reduced to $0.7208 per share and Avenue will not be permitted to convert up to two million dollars of the principal amount of the

loan issued by Avenue to the Company at a conversion price of $0.8650 per share.

Required Vote

The affirmative vote of a

majority of the votes cast at the Meeting by the holders of Common Stock represented in person or by proxy and entitled to vote is required

for the Private Placement Proposal, provided, however, that the vote of all shares of our common stock issued in the Private Placement

Offering will not be countered in determining whether or not the Private Placement Proposal is approved. Abstentions and broker non-votes

will not be counted “for” or “against” the proposal and will have no effect on the outcome of the vote.

Recommendation of the Board

THE BOARD OF DIRECTORS

UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE PRIVATE PLACEMENT PROPOSAL.

BENEFICIAL

OWNERSHIP OF PRINCIPAL STOCKHOLDERS, OFFICERS AND DIRECTORS

The following table sets forth

information regarding the beneficial ownership of our Common Stock as of February 27, 2025, by each person known by us to be the beneficial

owner of more than 5% of our outstanding shares of Common Stock, each of our named executive officers and directors; and all of our executive

officers and directors as a group.

The

following table shows the amount of our Common Stock beneficially owned as of February 27, 2025 by (i) each person or group as those terms

are used in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, believed by us to beneficially own

more than 5% of our Common Stock, (ii) each of our named executive officers and directors, and (iii) all our executive officers and directors

as a group. Except as otherwise noted, each person named in the table has sole voting and investment power with respect to all shares

shown as beneficially owned by them, subject to applicable community property laws.

| | |

| | |

Percent of | |

| | |

Shares of

Common | | |

Common

Stock | |

| | |

Beneficially | | |

Beneficially | |

| Name of Beneficial Owner | |

Stock Owned | | |

Owned (1) | |

| Officers and Directors | |

| | | |

| | |

| Erez Raphael (2) | |

| 1,813,593 | | |

| 4.4 | % |

| Zvi Ben David (3) | |

| 692,732 | | |

| 1.7 | % |

| Richard Anderson (4) | |

| 976,779 | | |

| 2.3 | % |

| Steven Nelson (5) | |

| 55,000 | | |

| * | |

| Tomer Ben Kiki (6) | |

| 504,846 | | |

| 1.2 | % |

| Dennis McGrath (7) | |

| 116,411 | | |

| * | |

| Lawrence Leisure (8) | |

| 287,500 | | |

| * | |

| Hila Karah (9) | |

| 199,499 | | |

| * | |

| Yoav Shaked (10) | |

| 250,032 | | |

| * | |

| Adam Stern (11) | |

| 1,033,565 | | |

| 2.4 | % |

| Dennis Mathies (12) | |

| 206,493 | | |

| * | |

| | |

| | | |

| | |

| All Executive Officers and Directors as a group (11 persons) | |

| 6,136,450 | | |

| 14.7 | % |

| 5% Stockholders | |

| | | |

| | |

| Nantahala Capital Management LLC (13) | |

| 4,231,786 | | |

| 9.9 | % |

| Solid Financial, LLC(14) | |

| 2,139,642 | | |

| 5.2 | % |

| Tasso Partners, LLC(15) | |

| 3,394,043 | | |

| 8.1 | % |

| (1) | Percentage ownership is based on 41,537,016 shares of our Common Stock outstanding as of February 27, 2025 and, for each person or

entity listed above, warrants or options to purchase shares of our Common Stock which exercisable within 60 days of such date. |

| (2) | Includes 1,315,242 vested restricted shares. Also includes 37,876 shares of our Common Stock, held by Dicilyon Consulting and Investment

Ltd. Erez Raphael is the natural person with voting and dispositive power over our securities held by Dicilyon Consulting and Investment

Ltd. The address of Dicilyon Consulting and Investment Ltd. is 10 Nataf St., Ramat Hasharon 4704063, Israel. |

| (3) | Includes 27,827 vested options to purchase Common Stock and 523,312 vested restricted shares. Includes 1,786 shares owned by his spouse,

for which Mr. Ben David disclaims beneficial ownership except to the extent of his pecuniary interest therein. |

| (4) | Includes 867,902 vested options to purchase Common Stock and 93,695 vested restricted shares. Excludes 198,750 options which are not

vested. |

| (5) | Excludes 500,000 options which are not vested. |

| (6) | Includes 398,294 vested options to purchase Common Stock. Includes 106,552 vested warrant shares. Excludes 213,001 warrant shares

which are not vested. |

| (7) | Includes 116,411 vested restricted shares. |

| (8) | Includes 162,500 vested restricted shares. |

| (9) | Includes 150,356 vested restricted shares. |

| (10) | Includes 144,734 vested restricted shares. Includes 1,667 shares owned by his spouse, for which Mr. Shaked disclaims beneficial ownership

except to the extent of his pecuniary interest therein. |

| (11) | Includes 133,017 vested restricted shares. Includes warrants exercisable into 507,648 shares of Common Stock, Includes C preferred

shares and D preferred shares convertible into 244,500 of common stock, subject to a contractual beneficial ownership limitation of 4.99%. |

| (12) | Includes 82,084 vested options to purchase Common Stock and 70,120 vested restricted shares. Excludes 2,916 options which have not

vested. |

| (13) | Based solely on information contained in Form 13GA filed with the SEC on February 14, 2025, and data provided

by the holder. Includes 277,546 pre-funded warrants to purchase Common Stock issued in May 2019 and 930,214 preferred shares issued on

November 27, 2019, subject to a contractual beneficial ownership limitation of 9.99% and excludes preferred shares convertible into 13,396,027

shares of Common Stock, 386,129 pre-funded warrants issued on July 31, 2020, and 331,814 pre-funded warrants issued on February 28, 2022. |

| (14) | Based solely on information contained in Form 13G filed with the SEC on February 12, 2025. |

| (15) | Based solely on information contained in Form 13G filed with the SEC on December 13, 2024, and data provided

by the holder. Includes (i) 1,394,721 shares of Common Stock, (ii) shares of Preferred C Stock convertible into 1,222,772 shares of Common

Stock, and (iii) shares of Preferred C-2 Stock convertible into 23,364 shares of Common Stock, 385,000 warrants to purchase common stock

and Preferred D Stock convertible into 839,389 shares of Common Stock which are beneficially owned by Dana Carrera is the trustee of the

GCL Family Trust, and included pursuant to Rule 13d-3(d)(1)(i) of the Securities Exchange Act of 1934, as amended, subject to contractual

beneficial ownership limitation of 9.99% and excludes preferred shares convertible into 7,896,376. |

Stockholder Communications

Stockholders wishing to communicate

with the Board may direct such communications to the Board c/o the Company, Attn: Zvi Ben-David. Mr. Ben-David will present a summary

of all stockholder communications to the Board at subsequent Board meetings. The directors will have the opportunity to review the actual

communications at their discretion.

Additional Information

In addition, we are subject

to certain informational requirements of the Exchange Act and in accordance therewith files reports, proxy statements and other information

with the SEC. Such reports, proxy statements and other information are available on the SEC’s website at www.sec.gov. Stockholders

who have questions in regard to any aspect of the matters discussed in this Proxy Statement should contact Zvi Ben-David, Chief Financial

Officer of the Company, at 322 W. 57th St. New York, New York 10019.

STOCKHOLDER PROPOSALS

Proposals of stockholders

intended to be included in the Company’s proxy statement and form of proxy for use in connection with the Company’s 2025 Annual

Meeting of Stockholders must be received by the Company’s Secretary at the Company’s principal executive offices at 322 W.

57th St. New York, New York 10019 and/or via electronic mail to ir@dariohealth.com, not less than 90 days nor more than 120 days prior

to the annual meeting of stockholders and must otherwise satisfy the procedures contained in the Company’s Bylaws or as prescribed

by Rule 14a-8 under the Exchange Act.

Stockholder proposals with

respect to director nominees for use in connection with the Company’s 2025 Annual Meeting of Stockholders must be received by the

Company’s Secretary at the Company’s principal executive offices at not less than 60 days before the date of the annual meeting

of stockholders. A stockholder wishing to formally nominate an individual for election to the Board must do so by following the notice,

information and consent provisions described in the Company’s Bylaws. In that regard, the stockholder must set forth the (a) the

name, age, business address and the primary legal residence address of each nominee proposed in such notice, (b) the principal occupation

or employment of such nominee, (c) the number of shares of capital stock of the Company which are owned directly or indirectly of record

and directly or indirectly beneficially owned by the nominee and each of its affiliates (within the meaning of Rule 144 under the Securities

Act of 1933, as amended), including any shares of the Company owned or controlled via derivatives, hedged positions and other economic

and voting mechanisms, (d) any material agreements, understandings or relationships, including financial transactions and compensation,

between the nominating stockholder and the proposed nominees and (e) such other information concerning each such nominee as would be required,

under the rules of the Securities and Exchange Commission, in a proxy statement soliciting proxies in a contested election of such nominees.

The Board will use the same evaluation criteria and process for director nominees recommended by stockholders as it uses for other director

nominees. There has been no change to the procedures by which stockholders may recommend nominees to our Board.

It is suggested that

any such proposals be submitted by certified mail, return receipt requested.

If we do not receive

notice of a stockholder proposal within this timeframe, our management will use its discretionary authority to vote the shares they

represent, as the Board may recommend. We reserve the right to reject, rule out of order, or take other appropriate action

with respect to any proposal that does not comply with these requirements.

HOUSEHOLDING OF MEETING MATERIALS

Some banks, brokers and other

nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means

that only one copy of our proxy statement or annual report may have been sent to multiple stockholders in your household. We will promptly

deliver a separate copy of either document to you if you call or write us at the address shown on the first page of this proxy statement.

If you want to receive separate copies of the annual report and any proxy statement in the future or if you are receiving multiple copies

and would like to receive only one copy for your household, you should contact your bank, broker, or other nominee record holders, or

you may contact us at the address shown on the first page of this proxy statement or by phone at (646) 665-4667.

OTHER MATTERS

As of the date of this proxy

statement, our management knows of no matter not specifically described above as to any action which is expected to be taken at the Meeting.

The persons named in the enclosed proxy, or their substitutes, will vote the proxies, insofar as the same are not limited to the contrary,

in their best judgment, with regard to such other matters and the transaction of such other business as may properly be brought at the

Meeting.

IF YOU HAVE NOT VOTED BY

INTERNET, PLEASE DATE, SIGN AND RETURN THE PROXY CARD AT YOUR EARLIEST CONVENIENCE IN THE ENCLOSED RETURN ENVELOPE. A PROMPT RETURN

OF YOUR PROXY CARD WILL BE APPRECIATED AS IT WILL SAVE THE EXPENSE OF FURTHER MAILINGS.

| |

By order of the Board of Directors, |

| |

|

| |

/s/ Erez Raphael |

| |

Erez Raphael |

| |

Chief Executive Officer |

Caesarea, Israel

, 2025

PROXY

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD

OF DIRECTORS

THE UNDERSIGNED HEREBY APPOINTS,

EREZ RAPHAEL AND ZVI BEN-DAVID, AND EACH OF THEM, AS PROXIES OF THE UNDERSIGNED, WITH FULL POWER OF SUBSTITUTION, TO VOTE

ALL THE SHARES OF COMMON STOCK (OR EQUIVALENT) OF DARIOHEALTH CORP. HELD OF RECORD BY THE UNDERSIGNED ON MARCH 7, 2025,

AT THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 28, 2025 AT 9 AM EST, AT 5 TARSHISH St., CaESAREA 3088900, ISRAEL, 2ND

FLOOR, OR ANY ADJOURNMENT THEREOF.

1. To

approve, for purposes of Nasdaq Listing Rule 5635(d) (A) (i) the conversion of 25,605 shares of the Company’s Series D, D-1, D-2

and D-3 Preferred Stock into an aggregate of 33,956,350 shares of common stock, $0.0001 par value per share (the “Common Stock”),

which were issued pursuant to private placement transactions that closed on December 18, 2024 and January 14, 2025 (the “Private

Placement”), (ii) the issuance of up to 13,582,740 shares of Common Stock issuable as dividends to the shares of the Company’s

Series D, D-1, D-2 and D-3 Preferred Stock; and (iii) to approve the issuance of up to 1,670,028 shares of Common Stock issuable as share

consideration provided under the lock up agreements executed between the Company and certain purchasers in the Private Placement that

are holders of the Company’s Series B Preferred Stock and Series C Preferred Stock, pursuant to which the Company agreed to issue,

up to forty percent (40%) of the shares of Common Stock underlying the Series B Preferred Stock and the Series C Preferred Stock

held by such purchaser, including dividend shares of Common Stock due upon conversion of these shares into shares of Common Stock, over

the course of twelve (12) months, and (B) (i) reduce the exercise price of certain warrants to purchase 584,882 shares of Common Stock

issued to Avenue Venture Opportunities Fund II, L.P. and Avenue Venture Opportunities Fund, L.P. (collectively “Avenue”)

to $0.7208 per share, and (ii) to permit the conversion of up to two million dollars of the principal amount of the loan issued by Avenue

to the Company at a conversion price of $0.8650 per share.

| |

¨ FOR |

¨ AGAINST |

¨ ABSTAIN |

In their discretion, upon the transaction of any

other matters which may properly come before the meeting or any adjournment thereof.

The shares represented

by this proxy, when properly executed, will be voted as specified by the undersigned stockholder(s). If this card contains no specific

voting instructions, the shares will be voted FOR each of the proposals described on this card.

| |

|

| |

Signature of Stockholder(s) |

| |

|

| |

Date |

Please sign exactly as the

name appears below. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee

or guardian, please give full title as such. If a corporation, please sign the corporate name by the president or other authorized officer.

If a partnership, please sign in the partnership name by an authorized person.

VOTE BY INTERNET— if a registered holder

by visiting www.vstocktransfer.com/proxy; if a beneficial holder by visiting www.proxyvote.com

Use the Internet to transmit

your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the meeting date.

Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic

voting instruction form.

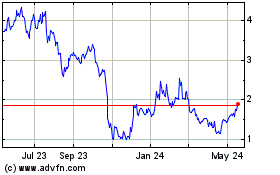

DarioHealth (NASDAQ:DRIO)

Historical Stock Chart

From Feb 2025 to Mar 2025

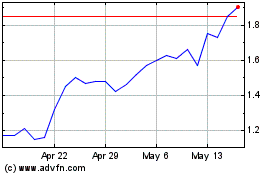

DarioHealth (NASDAQ:DRIO)

Historical Stock Chart

From Mar 2024 to Mar 2025