false

0001533998

0001533998

2025-01-21

2025-01-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of

Earliest Event Reported): January 21, 2025

DARIOHEALTH CORP.

(Exact name of registrant as specified in its charter)

| Delaware | |

001-37704 | |

45-2973162 |

(State or other jurisdiction

of incorporation) | |

(Commission

File Number) | |

(IRS Employer

Identification No.) |

18 W. 18th St, 5th Floor

New

York, New York 10011

(Address of Principal Executive Offices)

972- 4-770-4055

(Issuer’s telephone

number)

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of exchange on which

registered |

| Common Stock, par value $0.0001 per share |

|

DRIO |

|

The Nasdaq Capital Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On

January 21, 2025, DarioHealth Corp. (the “Company”) issued a press release titled “DarioHealth Announces $25.6M Private

Placement Positioning the Company to Execute on Strategy Aiming to Reach Operational Cash Flow Positive Run Rate by the End of 2025.”

A copy of the press release is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant

has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: January 22, 2025 |

DARIOHEALTH CORP. |

| |

|

| |

By: |

/s/ Zvi Ben David |

| |

|

Name: |

Zvi Ben David |

| |

|

Title: |

Chief Financial Officer, Treasurer and Secretary |

Exhibit 99.1

DarioHealth Announces

$25.6M Private Placement Positioning the Company to Execute on

Strategy Aiming to Reach Operational Cash Flow Positive Run Rate by the

End of 2025

| · | Significant participation from existing shareholders and accredited healthcare

investors, which the company believes underscores confidence in its strategy |

| · | Financing supports execution of long-term growth initiatives focused on

high-margin, scalable recurring revenues across B2B (Business-to-Business) and pharma channels |

NEW YORK, January 21, 2025 – DarioHealth

Corp. (Nasdaq: DRIO) (“Dario” or the “Company”), a prominent leader in the global digital health industry, announced

today the successful closing of a $25.6 million private placement of convertible preferred stock, priced in accordance with Nasdaq

market rules. The majority of the funds were secured from existing shareholders, with the remainder contributed by a network of leading

accredited healthcare investors and executives from the healthcare sector.

The result of this offering is expected to extend

Dario's cash runway and bolster its financial position enabling the Company to continue executing its current strategic plan which includes

achieving an operational cash flow positive run rate by the end of 2025 while continuing to build high-margin, scalable recurring revenues

across B2B and pharma channels. As a result, the Company’s proforma cash balance, inclusive of the proceeds from the private placement,

is $40.6 million as of the end of the third quarter of 2024. The private placement closed on December 18, 2024, and January 14,

2025.

"Through the end of 2024, we demonstrated

the strong execution of our multi-year strategic plan to become a profitable provider of comprehensive chronic care management solutions.

Today, we are happy to announce the completion of a major milestone in this strategic plan that we believe can secure our projected operational

cash flow positive run rate by the end of 2025. I believe that the ongoing cost optimization efforts following the Twill merger, coupled

with steady revenue growth across multiple channels, have set us on a path to success. We are particularly pleased that more than half

of the newly issued convertible preferred shares were purchased by our existing shareholders, which we believe is a strong vote of confidence

in our strategy and performance. The remaining funds came from prominent accredited healthcare investors that we are thrilled to have

onboard as shareholders as well," commented Erez Raphael, Chief Executive Officer of Dario.

“I believe that this financing will empower

us to execute on our long-term growth strategy, which is centered on high-margin, scalable recurring revenues across our B2B and pharma

channels. I believe that these steps will enable us to maintain our growth trajectory and strengthen our position in the digital health

market,” Commented Steven Nelson, Chief Commercial Officer of Dario.

Transaction Details

Pursuant to the equity

offering, the Company issued shares of newly designated convertible preferred stock (the "Preferred Stock"). 18,805 shares of

Preferred Stock were sold at $1,000 per share, with a conversion price of $0.73 and 6,800 shares of Preferred Stock

were sold at $1,000 per share, with a conversion price of $0.83.

The Preferred Stock provides

that upon conversion to common stock, holders will be entitled to receive a 10% dividend payable in common stock each quarter for the

first four quarters, for an aggregate stock dividend of up to 40%. Each share of Preferred Stock will automatically convert into shares

of the Company's common stock at the applicable conversion price upon the 12-month anniversary of the respective closings. The conversion

of the Preferred Stock is subject to stockholder approval.

In addition, the

Company and certain purchasers in the offering that are holders of the Company’s Series B Preferred Stock and Series C

Preferred Stock, executed lock up agreements (the “Lock Up Agreement”), pursuant to which the Company agreed to issue,

subject to stockholder approval, up to forty percent (40%) of the shares of Common Stock

underlying the Series B Preferred Stock and the Series C Preferred Stock held by such purchaser, including dividend shares of Common

Stock due upon conversion of these shares into shares of Common Stock, over the course of twelve (12) months (the “Additional

Shares”). Each holder shall be entitled to receive 10% of the Additional Shares for each three (3) month period each holder

agrees not to transfer or otherwise sell (subject to certain limitations) the shares of Common Stock issuable upon conversion of the

Series B Preferred Stock and Series C Preferred Stock and the dividend shares of Common Stock due upon conversion.

The securities described

herein have not been registered under the Securities Act of 1933, as amended, and may not be sold in the United States absent

registration or an applicable exemption from the registration requirements.

This press release shall

not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state or

other jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of any such state or other jurisdiction.

About

DarioHealth Corp.

DarioHealth

Corp. (Nasdaq: DRIO) is a leading digital health company revolutionizing how people with chronic conditions manage their health through

a user-centric, multi-chronic condition digital therapeutics platform. Dario's platform and suite of solutions deliver personalized and

dynamic interventions driven by data analytics and one-on-one coaching for diabetes, hypertension, weight management, musculoskeletal

pain and behavioral health.

Dario's

user-centric platform offers people continuous and customized care for their health, disrupting the traditional episodic approach to healthcare.

This approach empowers people to holistically adapt their lifestyles for sustainable behavior change, driving exceptional user satisfaction,

retention and results and making the right thing to do the easy thing to do.

Dario

provides its highly user-rated solutions globally to health plans and other payers, self-insured employers, providers of care and consumers.

To learn more about Dario and its digital health solutions, or for more information, visit http://dariohealth.com.

Cautionary

Note Regarding Forward-Looking Statements

This

news release and the statements of representatives and partners of DarioHealth Corp. related thereto contain or may contain

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not

statements of historical fact may be deemed to be forward-looking statements. For example, the Company is using forward-looking

statements in this press release when it discusses the Company’s anticipated cash runway following the private placement, the

belief that the result of the offering is a major milestone in its strategic plan and that it believes it can secure its

projected operational cash flow positive run rate by the end of 2025, and the belief that the financing

will empower it to execute on its long-term growth strategy, which is centered on high-margin, scalable recurring revenues

across our B2B and pharma channels, which will enable it to maintain its growth trajectory and strengthen its position in the

digital health market. Without limiting the generality of the foregoing, words such as

"plan," "project," "potential," "seek," "may," "will,"

"expect," "believe," "anticipate," "intend," "could," "estimate" or

"continue" are intended to identify forward-looking statements. Readers are cautioned that certain important factors may

affect the Company's actual results and could cause such results to differ materially from any forward-looking statements that may

be made in this news release. Factors that may affect the Company's results include, but are not limited to, regulatory approvals,

product demand, market acceptance, impact of competitive products and prices, product development, commercialization or

technological difficulties, the success or failure of negotiations and trade, legal, social and economic risks, and the risks

associated with the adequacy of existing cash resources. Additional factors that could cause or contribute to differences between

the Company's actual results and forward-looking statements include, but are not limited to, those risks discussed in the

Company's filings with the U.S. Securities and Exchange Commission. Readers are cautioned that actual results (including, without

limitation, the timing for and results of the Company's commercial and regulatory plans for Dario™ as described herein) may

differ significantly from those set forth in the forward-looking statements. The Company undertakes no obligation to publicly update

any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable

law.

DarioHealth Corporate Contact

Mary Mooney

VP Marketing

mary@dariohealth.com

+1-312-593-4280

DarioHealth Investor Relations Contact

Kat Parrella

Investor Relations Manager

kat@dariohealth.com

+315-378-6922

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

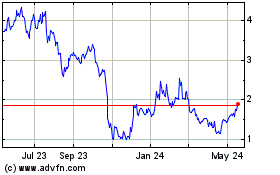

DarioHealth (NASDAQ:DRIO)

Historical Stock Chart

From Feb 2025 to Mar 2025

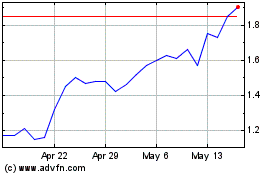

DarioHealth (NASDAQ:DRIO)

Historical Stock Chart

From Mar 2024 to Mar 2025