Form SCHEDULE 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

24 December 2024 - 12:00AM

Edgar (US Regulatory)

Exhibit 99.1

Fund 1 Investments

LLC

100 Carr 115 Unit 1900

Rincon, Puerto Rico 00677

December 19, 2024

Destination XL Group, Inc.

555 Turnpike Street

Canton, MA 02021

Attn: Lionel F. Conacher, Chairman of the Board

Lionel:

Fund 1 Investments LLC (together with its affiliates,

“Fund 1”, or “we”) appreciates the time we have spent speaking with you, members of Board of Directors (the “Board”)

of Destination XL Group, Inc. (the “Company” or “DXLG”), and management. We have utilized significant internal

resources to understand and underwrite DXLG’s business considering our substantial investment in the Company. Our analysis and considerable

time spent together has only further heightened our belief that the Company’s underlying business is quite resilient and can generate

significant free cash flow into the foreseeable future.

Fund 1 is pleased to submit this non-binding

proposal to acquire all of the outstanding shares of common stock of DXLG that are not owned by Fund 1 or its affiliates for cash consideration

of $3.00 per share, subject to our completion of confirmatory due diligence and negotiation of the terms of a definitive agreement (our

“Proposal”). The terms of our Proposal, described more fully below, are attractive to DXLG stockholders, represent a 34% premium

to the closing price of the Company’s common stock on December 18, 2024, and do not include a financing condition.

We are submitting this Proposal to facilitate

constructive discussions with the Board because we believe this is the best path forward for all Company stakeholders – and we are

prepared to move quickly to execute on this opportunity together.

Why Fund 1 is the Ideal Partner for

DXLG

As you know, Fund 1 is a global long/short

equity firm that makes both public and private investments primarily focused on the consumer, telecom, media, and technology sectors.

We possess significant consumer and retail expertise and have a history of constructive engagement working with retailers to position

these companies for future growth and efficiency in a heightened competitive landscape. More recently, we have grown increasingly focused

on advancing the private equity side of our business. We participated in the notable ~€6.4 billion take-private of Hong Kong-listed

retailer, L’Occitane International (“L’Occitane”), a global cosmetics company with three primary brands: its namesake

(retail presence), Sol de Janeiro (wholesale), and Elemis (wholesale) this past summer.

We believe DXLG, similar to L’Occitane,

would be far better served outside of the public markets, with the ability to focus on free cash flow generation without the overwhelming

pressure of reporting quarterly results and satisfying the needs of short-term public market investors. DXLG stands to benefit even more

because as a micro-cap stock, it lacks trading liquidity and is unable to attract a quality institutional investor base.

Although the Company is a leading retailer

in the space, the issues noted above are hindering DXLG’s ability to maximize its potential value for stockholders. We believe the

Company would be better served outside of the public markets, and believe that our Proposal offers stockholders an opportunity to derisk

their investment at a premium valuation, providing an attractive liquidity option and certainty of value.

Additional Offer Details

As you have clearly seen through our dialogue

thus far, we have been closely following the Company’s operational and financial performance. We have conducted substantial research

on DXLG’s current position in the big and tall retailing industry, its operations, and its opportunities. Based on the work completed

and the information provided to date, we would seek to move forward on discussing a transaction with the following general terms and conditions:

| 1. | Capital Structure of the Transaction. Subject to review by tax and legal advisors, we would expect

the transaction to be structured as a merger in which we would acquire all of the issued and outstanding capital stock of the Company. |

| 2. | Due Diligence Process. We are deeply familiar with the Company from our existing equity investment,

and have reviewed the publicly available information regarding the Company. As a result, and given our significant experience in this

sector, we expect to be able to conduct an expedited due diligence review focused on our gaining a better understanding of DXLG beyond

the publicly available information we have reviewed to date: detailed financial performance, competitive positioning, and growth plan

and execution to date. We are prepared to enter into an appropriate confidentiality agreement and commence our due diligence immediately. |

| 3. | Management and Employees. Fund 1 views the management team and employees of any organization as

a vital component of the organization’s ability to compete and succeed. Fund 1 would endeavor to motivate and retain the key personnel

of the Company through competitive compensation, strong benefits package and an equity or equity-like incentive plan. |

| 4. | Operational Support. We have the experience and expertise to assist the Company in its go-forward

business plan, both operational and growth, as appropriate. In this regard, we would be able to work with the Company to assist in strategy

formation, analysis, and execution. Fund 1 has a deep bench of operating partners with direct and relevant retail experience necessary

to guide the success of the Company, post-transaction. We pride ourselves on being a valuable partner and resource and are excited to

collaborate with the Company to help it achieve its short and long-term goals and build an even more successful future. |

| 5. | Sources of Financing. While we would like to have the flexibility to finance this acquisition with

a combination of equity and debt, we have committed and have available equity capital to fully fund our Proposal and confirm that the

definitive transaction agreements would not include a financing condition. |

| 6. | Timing. In order to maximize the efficiency of the investment process and in order to achieve the

transaction goals of the Company, we are prepared to move quickly to consummate the purchase of the Company and have the necessary resources

to conduct our due diligence process concurrently with the negotiation of the terms and conditions of a definitive purchase agreement.

We also would be interested in discussing an exclusivity period to consummate a transaction. From the date that we are able to enter into

an appropriate confidentiality agreement and commence due diligence, we would anticipate the completion of all due diligence and execution

of the definitive purchase agreement within 45 days. |

| 7. | Commitment. It is specifically understood that the Proposal is non-binding, and any transaction

would be subject to negotiation and entry into a definitive agreement, subject to, among other things, Fund 1’s satisfactory completion

of its due diligence. Accordingly, neither party shall have any obligation to the other until such time as, and as provided in, a definitive

agreement regarding the proposed transaction, agreeable both as to form and substance to each party, has been executed and delivered. |

Our Proposal is based entirely on publicly

available information. If after completing further due diligence we become aware of some component or aspect of the business and its prospects

that provides evidence of additional value, we are prepared to increase our proposed price to reflect this new information.

We are ready to meet with the Board and

its representatives as soon as possible to discuss our Proposal in further detail. Importantly, we are prepared to dedicate the necessary

resources to quickly negotiate a definitive agreement. As a well-capitalized acquiror, we have the ability to consummate the transaction

on an accelerated basis to deliver significant value to DXLG stockholders and set the Company up for continued success as a privately

held company.

We have submitted our Proposal with the

intention of working with the Board on executing a transaction that will benefit the Company’s stockholders, employees and customers.

We hope that you will swiftly engage with us and work toward a mutually agreeable transaction, and look forward to continuing our dialogue

with the Board and management team.

Best Regards,

Fund 1 Investments LLC

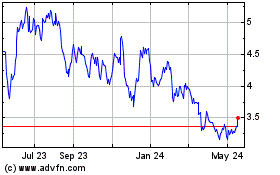

Destination XL (NASDAQ:DXLG)

Historical Stock Chart

From Jan 2025 to Feb 2025

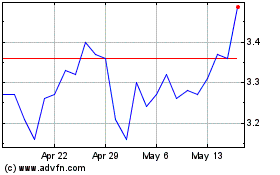

Destination XL (NASDAQ:DXLG)

Historical Stock Chart

From Feb 2024 to Feb 2025