Enstar to Enter $376 Million Loss Portfolio Transfer with QBE

09 August 2024 - 9:00AM

Enstar Group Limited (NASDAQ: ESGR) announced today that one of its

wholly owned subsidiaries has reached an agreement to provide a

ground-up Loss Portfolio Transfer (“LPT”) with certain subsidiaries

of QBE Insurance Group Limited (“QBE”). The transaction involves a

diversified portfolio of US commercial liability and workers’

compensation business, largely underwritten on recently

discontinued programs. Enstar is familiar with the majority of the

business and has existing exposure to the programs through a

previous transaction with QBE in 2023.

Under the terms of the agreement, Enstar’s

subsidiary will assume net loss reserves from QBE of $376 million,

as of the effective date of July 1, 2024, and will provide

approximately $175 million of cover in excess of the ceded

reserves.

The transaction is expected to complete in the

fourth quarter of 2024 upon receipt of regulatory approvals and

satisfaction of other customary closing conditions.

Dominic Silvester, Enstar’s Chief Executive

Officer, said: “We are extremely pleased to build upon a valuable

relationship with our long-standing partner, QBE. This transaction

demonstrates our commitment to developing deep partnerships with

global, leading insurers, and enables us to apply our best-in-class

claims handling capabilities in the US to a portfolio where we hold

significant expertise and experience.”

About Enstar

Enstar is a NASDAQ-listed leading global

insurance group that offers innovative capital release solutions

through its network of group companies in Bermuda, the United

States, the United Kingdom, Continental Europe, Australia, and

other international locations. A market leader in completing legacy

acquisitions, Enstar has acquired more than 117 companies and

portfolios since its formation in 2001. For further information

about Enstar, see www.enstargroup.com.

Cautionary Statement

This press release contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. These statements include statements regarding the intent,

belief or current expectations of Enstar and its management team.

Investors can identify these statements by the fact that they do

not relate strictly to historical or current facts. They use words

such as ‘aim’, ‘ambition’, ‘anticipate’, ‘estimate’, ‘expect’,

‘intend’, ‘will’, ‘project’, ‘plan’, ‘believe’, ‘target’ and other

words and terms of similar meaning in connection with any

discussion of future events or performance. Investors are cautioned

that any such forward-looking statements speak only as of the date

they are made, are not guarantees of future performance and involve

risks and uncertainties, and that actual results may differ

materially from those projected in the forward-looking statements

as a result of various factors. In particular, Enstar may not be

able to complete the proposed transaction on the terms summarised

above or other acceptable terms, or at all, due to a number of

factors, including but not limited to the failure to obtain

regulatory approvals or to satisfy other closing conditions.

Important risk factors regarding Enstar can be found under the

heading "Risk Factors" in Enstar’s Form 10-K for the year

ended December 31, 2023 and Enstar’s Form 10-Q for the

quarter ended June 30, 2024 and are incorporated herein by

reference. Furthermore, Enstar undertakes no obligation to update

any written or oral forward-looking statements or publicly announce

any updates or revisions to any of the forward-looking statements

contained herein, to reflect any change in its expectations with

regard thereto or any change in events, conditions, circumstances

or assumptions underlying such statements, except as required by

law.

Contact:

For Enstar:For Investors: Matthew

Kirk (investor.relations@enstargroup.com)For Media: Jenna

Kerr (communications@enstargroup.com)

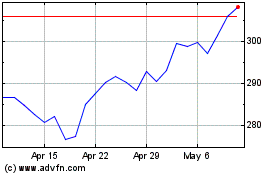

Enstar (NASDAQ:ESGR)

Historical Stock Chart

From Oct 2024 to Nov 2024

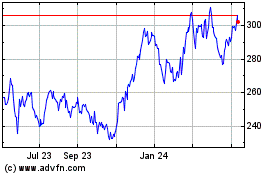

Enstar (NASDAQ:ESGR)

Historical Stock Chart

From Nov 2023 to Nov 2024