EzFill Holdings, Inc. Announces Strategic Transactions and Debt Restructuring

20 August 2024 - 10:45PM

EzFill Holdings, Inc. (“EzFill” or the “Company”) (NASDAQ: EZFL), a

pioneer and emerging leader in the mobile fueling industry, today

announced a series of strategic transactions aimed at bolstering

its financial position and regaining compliance with Nasdaq listing

requirements, subject to Nasdaq confirmation. The transactions,

which have closed, leave the Company essentially debt free except

for a small outstanding loan, current payables, and certain vehicle

financing; and augment the Company’s cash position. The debt

conversions alone are expected to eliminate an estimated $1.2

million in annual interest expense.

EzFill has entered into a Stock Purchase

Agreement with NextNRG Holding Corp (“Next”). Under this agreement,

Next purchased 140,000 shares of EzFill’s Series B Convertible

Preferred Stock for $10.00 per share, resulting in a total

investment of $1,400,000.

Separately, EzFill has executed two significant

debt-to-equity conversion agreements which converted approximately

$13.5 million of debt into equity. In the first, certain promissory

notes issued by EzFill to Next were exchanged and converted into

3,525,341 shares of common stock of EzFill at the Nasdaq minimum

price of $2.78 per share. In addition, certain promissory notes

issued by EzFill to AJB Capital Investments, were exchanged and

converted into 363,000 shares of Series A Preferred stock in

EzFill.

In conjunction with these agreements, EzFill has

filed certificates of designation for 513,000 shares of Series A

Preferred Stock and 150,000 shares of Series B Convertible

Preferred Stock with the Delaware Department of State.

Commenting on these corporate actions, CEO

Yehuda Levy stated, “We are pleased to have successfully secured

the $1.4 million investment from Next and to have executed the two

debt-to-equity conversions. We believe that the elimination of

nearly all our debt and adding cash to our balance sheet will lay

the groundwork for future growth and profitability. We also believe

these steps will help EzFill regain compliance with Nasdaq’s

minimum equity requirement and helps put the company in a position

to close the acquisition of NextNRG. Additionally, with these

actions and others, we look forward to continuing to execute our

strategic business plan.”

NextNRG CEO and Executive Chairman, Michael D.

Farkas, commented, “These transactions have created an ideal

foundation for EzFill to proceed with the acquisition of NextNRG

and enhance the Company’s growth. EzFill is at a key inflection

point. With fewer and fewer gas stations, and consumers demanding

on-time delivery more and more, EzFill is providing the right

service at the right time. Their growth to date has been

impressive, posting revenue growth of more than 100% in 2022, and

more than 50% in 2023. We believe that EzFill’s public valuation is

misaligned with its private competitors such as Booster and Yoshi

which have been valued significantly higher than EzFill in private

market transactions and we believe that ultimately bodes well for

EzFill’s valuation.”

About EzFill

EzFill is a leader in the fast-growing mobile

fuel industry, with the largest market share in its home state of

Florida. Its mission is to disrupt the gas station fueling model by

providing consumers and businesses with the convenience, safety,

and touch-free benefits of on-demand fueling services brought

directly to their locations. For commercial and specialty

customers, at-site delivery during downtimes enables operators to

begin their daily operations with fully fueled vehicles. For more

information, visit www.ezfl.com

With the number of gas stations in the U.S.

continuing to decline, corporate giants such as Shell, Exxon, GM,

Bridgestone, Enterprise, and Mitsubishi have recognized the

increasing shift in consumer behavior and are investing in the fast

growing on-demand mobile fueling industry, in companies such as

Booster and Yoshi. As the only company to provide fuel delivery in

three verticals – consumer, commercial, and specialty including

marine and construction equipment, we believe EzFill is well

positioned to capitalize on the growing demand for convenient and

cost-efficient mobile fueling options.

Forward Looking Statements

This press release contains “forward-looking

statements” Forward-looking statements reflect our current view

about future events. When used in this press release, the words

“anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,”

“plan,” or the negative of these terms and similar expressions, as

they relate to us or our management, identify forward-looking

statements. Such statements, include, but are not limited to,

statements contained in this press release relating to our business

strategy, our future operating results and liquidity and capital

resources outlook. Forward-looking statements are based on our

current expectations and assumptions regarding our business, the

economy and other future conditions. Because forward–looking

statements relate to the future, they are subject to inherent

uncertainties, risks and changes in circumstances that are

difficult to predict. Our actual results may differ materially from

those contemplated by the forward-looking statements. They are

neither statements of historical fact nor guarantees of assurance

of future performance. We caution you therefore against relying on

any of these forward-looking statements. Important factors that

could cause actual results to differ materially from those in the

forward-looking statements include, without limitation, our ability

to raise capital to fund continuing operations; our ability to

protect our intellectual property rights; the impact of any

infringement actions or other litigation brought against us;

competition from other providers and products; our ability to

develop and commercialize products and services; changes in

government regulation; our ability to complete capital raising

transactions; and other factors relating to our industry, our

operations and results of operations. Actual results may differ

significantly from those anticipated, believed, estimated,

expected, intended or planned. Factors or events that could cause

our actual results to differ may emerge from time to time, and it

is not possible for us to predict all of them. We cannot guarantee

future results, levels of activity, performance or achievements.

The Company assumes no obligation to update any forward-looking

statements in order to reflect any event or circumstance that may

arise after the date of this release except as may be required

under applicable securities law.

For further information, please

contact:

Investor Contact

TraDigital IRJohn

McNamarajohn@tradigitalir.com

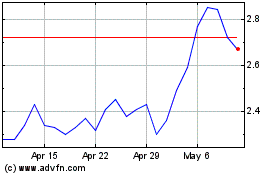

EzFill (NASDAQ:EZFL)

Historical Stock Chart

From Oct 2024 to Nov 2024

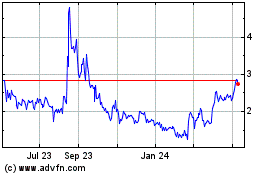

EzFill (NASDAQ:EZFL)

Historical Stock Chart

From Nov 2023 to Nov 2024