false

0001705012

0001705012

2025-01-24

2025-01-24

0001705012

FAT:ClassCommonStockMember

2025-01-24

2025-01-24

0001705012

FAT:ClassBCommonStockMember

2025-01-24

2025-01-24

0001705012

FAT:SeriesBCumulativePreferredStockMember

2025-01-24

2025-01-24

0001705012

FAT:WarrantsToPurchaseClassCommonStockMember

2025-01-24

2025-01-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 24, 2025

FAT

Brands Inc.

(Exact

name of Registrant as Specified in Its Charter)

| Delaware |

|

001-38250 |

|

82-1302696 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

9720

Wilshire Blvd., Suite 500

Beverly

Hills, CA |

|

90212 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

Telephone Number, Including Area Code: (310) 319-1850

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instructions A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class

A Common Stock |

|

FAT |

|

The

Nasdaq Stock Market LLC |

| Class

B Common Stock |

|

FATBB |

|

The

Nasdaq Stock Market LLC |

| Series

B Cumulative Preferred Stock |

|

FATBP |

|

The

Nasdaq Stock Market LLC |

| Warrants

to purchase Class A Common Stock |

|

FATBW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

On

January 29, 2025, FAT Brands Inc. (the “Company”) completed the previously announced distribution

(“Spin-Off”) of approximately 5.0% of the fully-diluted shares of Class A Common Stock, par value $0.0001 per

share (“Twin Common Stock”), of its subsidiary, Twin Hospitality Group Inc., a Delaware corporation (“Twin

Hospitality”), as a pro rata dividend (the “Distribution”) to holders of Class A common stock and Class

B common stock of the Company (the “FAT Brands Common Stockholders”) of record as of January 27, 2025 (the “Record

Date”). Pursuant to the Distribution, the FAT Brands Common Stockholders received 0.1520207 shares of Twin Common Stock for

each share of Class A common stock or Class B common stock of the Company held as of the close of business on the Record Date. Following

the completion of the Spin-Off, Twin Hospitality became an independent, publicly traded company, and the Twin Common Stock began trading

on the Nasdaq Global Market under the ticker symbol “TWNP”.

In

connection with the Spin-Off, on January 24, 2025, the Company entered into a Master Separation and Distribution Agreement (the “Master

Separation Agreement”) and Tax Matters Agreement (the “Tax Matters Agreement”) with Twin Hospitality, which

provide a framework for Twin Hospitality’s on-going relationship with FAT Brands following the Spin-Off.

Master

Separation Agreement

Pursuant

to the Master Separation Agreement, on January 24, 2025, the Company exchanged its initial founder’s shares in Twin Hospitality

(representing 100% of the issued and outstanding capital stock of Twin Hospitality) for 47,298,271 shares of Twin Hospitality’s

Class A Common Stock and 2,870,000 shares of Twin Hospitality’s Class B Common Stock. In connection with the Spin-Off, on January

29, 2025, FAT Brands distributed 2,659,412 of its shares of Twin Hospitality Class A Common Stock to the FAT Brands Common Stockholders

in the Distribution.

Under

the Master Separation Agreement, Twin Hospitality also agreed to provide to the Company, beginning 180 days after the Spin-Off, certain

registration rights to register the shares of Twin Hospitality Class A Common Stock and Class B Common Stock that were retained by the

Company. At the request of the Company, Twin Hospitality agreed to use its commercially reasonable efforts to register the shares of

its Class A Common Stock and Class B Common Stock held by the Company for public sale under the Securities Act of 1933, as amended (“Securities

Act”), on a registration statement on Form S-1 or similar long form registration statement (“Long-Form Registration”),

or on a registration statement on Form S-3 or similar short form registration statement if eligible (“Short-Form Registration”).

The Company may request up to two Long-Form Registrations and up to two Short-Form Registrations in any calendar year, though no Long-Form

Registrations may be requested after such time as Twin Hospitality is eligible to use Form S-3 or any similar short form registration

statement at such time. The Company may also request that Twin Hospitality file a resale shelf registration statement to register under

the Securities Act the resale of all of its registrable shares after such time as Twin Hospitality is eligible to use Form S-3 or any

similar short form registration statement at such time. Additionally, Twin Hospitality will also provide the Company with “piggy-back”

registration rights to include its shares of Class A Common Stock and Class B Common Stock in future registrations under the Securities

Act of offers and sales of securities by Twin Hospitality. The Company’s registration rights will remain in effect until the earliest

of the date on which the shares of Twin Hospitality’s Class A Common Stock and Class B Common Stock held by the Company (i) have

been disposed of in accordance with an effective registration statement, (ii) have been distributed to the public in accordance with

Rule 144 under the Securities Act, or may be sold without restriction pursuant to Rule 144, (iii) have been otherwise transferred to

a non-affiliated entity, or (iv) have ceased to be outstanding. All expenses payable in connection with such registrations will be paid

by Twin Hospitality, except that the Company will pay all its own internal administrative, legal and similar costs and expenses, as well

as the underwriting discounts and commissions applicable to the sale of its Twin Hospitality shares.

Under

the Master Separation Agreement, Twin Hospitality also granted the Company a continuing right to purchase shares of Twin Hospitality’s

Common Stock as is necessary for the Company to maintain an aggregate ownership interest of Twin Hospitality Class A Common Stock or

Class B Common Stock representing at least 80.1% of the outstanding shares (the “Anti-Dilution Option”). If Twin Hospitality

sells and issues shares of its Class A Common Stock for cash consideration, and if the Company exercises the Anti-Dilution Option, the

Company will pay a price per share of Class A Common Stock equal to the closing price of the Class A Common Stock as quoted on the Nasdaq

Global Market on the date such offering is publicly announced (or the next business day if such offering is publicly announced after

the close of trading on the Nasdaq Global Market). If Twin Hospitality (i) issues shares of its Class A Common Stock pursuant to any

stock option or other equity incentive award, or (ii) sells and issues shares of its Class A Common Stock for consideration other than

cash, and if the Company exercises the Anti-Dilution Option, the Company will pay a price per share of Class A Common Stock equal to

the closing price of its Class A Common Stock as quoted on the Nasdaq Global Market on the date of such issuance (which triggered the

Anti-Dilution Option).

Under

the Master Separation Agreement, Twin Hospitality and the Company have cross-indemnities that generally place on Twin Hospitality and

its subsidiaries the financial responsibility for all liabilities associated with the historical and current businesses and operations

of the Twin Group (as such term is defined in the Master Separation Agreement), and generally place on the Company the financial responsibility

for liabilities associated with all of the Company’s other historical and current businesses and operations (not including the

businesses and operations of the Twin Group), in each case regardless of the time such liabilities arise. Each of Twin Hospitality and

the Company will also indemnify the other with respect to any breaches of the Master Separation Agreement and the Tax Matters Agreement.

Under

the Master Separation Agreement, Twin Hospitality agreed to use its commercially reasonable efforts to enable its auditors to complete

a sufficient portion of its audit, and to provide on a timely basis to the Company any and all financial and other information that the

Company may need to in connection with the preparation of its annual and quarterly financial statements. In addition, under the Master

Separation Agreement, for a period of two years following the completion of the Spin-Off, Twin Hospitality and the Company agreed not

to, directly or indirectly, solicit the other’s active employees without the prior consent by the other.

Under

the Master Separation Agreement, for so long as the Company or its affiliates beneficially owns at least 10% of the outstanding shares

of Twin Hospitality’s Class A Common Stock or Class B Common Stock, the Company will have the right to appoint two individuals

(the “Board Observers”) to observe and participate in meetings of Twin Hospitality’s Board of Directors, provided,

that the Board Observers will not have any voting rights.

The

foregoing description of the Master Separation Agreement does not purport to be complete and

is qualified in its entirety by reference to the complete terms and conditions of the Master Separation Agreement, which is filed as

Exhibit 2.1 to this Current Report on Form 8-K and incorporated by reference into this Item 1.01.

Tax

Matters Agreement

The

Tax Matters Agreement governs the rights, responsibilities and obligations of the Company and Twin Hospitality with respect to tax liabilities,

tax attributes, tax returns, tax audits, and certain other tax matters following the completion of the Spin-Off. For so long as the Company

maintains at least 80% aggregate ownership of Twin Hospitality’s Common Stock, Twin Hospitality will continue to be included in

the income tax returns filed by the Company’ consolidated group for U.S. federal income tax purposes (“FAT Brands Consolidated

Group”), as well as in certain other consolidated, combined or unitary groups that include the Company and/or certain of its

subsidiaries (each such group, a “FAT Brands Tax Group”). Each member of a consolidated group during any part of a

consolidated return year is jointly and severally liable for the tax on the consolidated return of such year and for any subsequently

determined deficiency thereon. Similarly, in some jurisdictions, each member of a consolidated, combined or unitary group for state,

local or foreign income tax purposes is jointly and severally liable for the state, local or foreign income tax liability of each other

member of such consolidated, combined or unitary group. The Tax Matters Agreement allocates tax liabilities between Twin Hospitality

and the Company for any period in which Twin Hospitality or any of its subsidiaries (the “Twin Group”) was included

in the FAT Brands Consolidated Group.

Under

the Tax Matters Agreement, Twin Hospitality will generally make payments to the Company such that, with respect to tax returns for any

taxable period in which any of the Twin Group are included in the FAT Brands Consolidated Group or any FAT Brands Tax Group, the amount

of taxes to be paid by Twin Hospitality will be determined by computing the excess (if any) of any taxes due on any such tax return over

the amount that would otherwise be due if such return were recomputed by excluding the Twin Group. The Tax Matters Agreement also provides

that the Company will generally have the right to control audits or other tax proceedings with respect to any tax returns of the FAT

Brands Consolidated Group or a FAT Brands Tax Group. Twin Hospitality will generally have the right to control any audits or other tax

proceedings with respect to tax returns that include only the Twin Group, provided that, as long as the Company is required to consolidate

the results of operations and financial position of the Twin Group in its financial statements, the Company will have certain oversight

and participation rights with respect to such audits or other tax proceedings.

The

Tax Matters Agreement also addresses the rights, responsibilities and obligations of the Company and Twin Hospitality with respect to

potential additional distributions to the Company’s stockholders of all or a portion of the remaining shares of Twin Hospitality’s

Common Stock that the Company holds (“Additional Distributions”). If the Company were to undertake Additional Distributions,

Twin Hospitality has agreed to cooperate with the Company and to take any and all actions reasonably requested by the Company in connection

with the Additional Distributions, and agreed not to knowingly take or fail to take any actions that could reasonably be expected to

preclude the Company’s ability to undertake Additional Distributions, or result in the Additional Distribution failing to qualify

as a transaction that is generally tax-free, for U.S. federal income tax purposes, under Section 355 of the Code. In the event that the

Company completes Additional Distributions, Twin Hospitality has agreed not to take certain actions, during the two-year period following

the Additional Distribution, that are designed to preserve the tax-free nature of the Additional Distribution for U.S. federal income

tax purposes.

The

foregoing description of the Tax Matters Agreement does not purport to be complete and is

qualified in its entirety by reference to the complete terms and conditions of the Tax Matters Agreement, which is filed as Exhibit 10.1

to this Current Report on Form 8-K and incorporated by reference into this Item 1.01.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

January 30, 2025

| |

FAT

Brands Inc. |

| |

|

|

| |

By: |

/s/

Kenneth Kuick |

| |

|

Kenneth

Kuick |

| |

|

Chief

Financial Officer |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FAT_ClassCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FAT_ClassBCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FAT_SeriesBCumulativePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=FAT_WarrantsToPurchaseClassCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

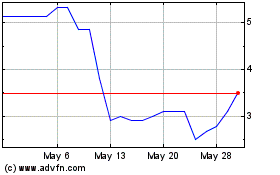

FAT Brands (NASDAQ:FATBW)

Historical Stock Chart

From Jan 2025 to Feb 2025

FAT Brands (NASDAQ:FATBW)

Historical Stock Chart

From Feb 2024 to Feb 2025