false

2024

FY

0000722572

0000722572

2023-07-01

2024-06-30

0000722572

2023-12-31

0000722572

2024-09-30

0000722572

2022-07-01

2023-06-30

0000722572

2024-04-01

2024-06-30

0000722572

2024-06-30

0000722572

2023-06-30

0000722572

us-gaap:CommonStockMember

2022-06-30

0000722572

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0000722572

us-gaap:RetainedEarningsMember

2022-06-30

0000722572

us-gaap:TreasuryStockCommonMember

2022-06-30

0000722572

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-06-30

0000722572

us-gaap:NoncontrollingInterestMember

2022-06-30

0000722572

2022-06-30

0000722572

us-gaap:CommonStockMember

2023-06-30

0000722572

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0000722572

us-gaap:RetainedEarningsMember

2023-06-30

0000722572

us-gaap:TreasuryStockCommonMember

2023-06-30

0000722572

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-06-30

0000722572

us-gaap:NoncontrollingInterestMember

2023-06-30

0000722572

us-gaap:CommonStockMember

2022-07-01

2023-06-30

0000722572

us-gaap:AdditionalPaidInCapitalMember

2022-07-01

2023-06-30

0000722572

us-gaap:RetainedEarningsMember

2022-07-01

2023-06-30

0000722572

us-gaap:TreasuryStockCommonMember

2022-07-01

2023-06-30

0000722572

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-07-01

2023-06-30

0000722572

us-gaap:NoncontrollingInterestMember

2022-07-01

2023-06-30

0000722572

us-gaap:CommonStockMember

2023-07-01

2024-06-30

0000722572

us-gaap:AdditionalPaidInCapitalMember

2023-07-01

2024-06-30

0000722572

us-gaap:RetainedEarningsMember

2023-07-01

2024-06-30

0000722572

us-gaap:TreasuryStockCommonMember

2023-07-01

2024-06-30

0000722572

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-07-01

2024-06-30

0000722572

us-gaap:NoncontrollingInterestMember

2023-07-01

2024-06-30

0000722572

us-gaap:CommonStockMember

2024-06-30

0000722572

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0000722572

us-gaap:RetainedEarningsMember

2024-06-30

0000722572

us-gaap:TreasuryStockCommonMember

2024-06-30

0000722572

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-06-30

0000722572

us-gaap:NoncontrollingInterestMember

2024-06-30

0000722572

FKWL:NoncontrollingInterestsMember

2024-06-30

0000722572

FKWL:NoncontrollingInterestsMember

2023-06-30

0000722572

us-gaap:TransferredAtPointInTimeMember

us-gaap:SalesRevenueNetMember

us-gaap:ProductConcentrationRiskMember

2023-07-01

2024-06-30

0000722572

us-gaap:TransferredAtPointInTimeMember

us-gaap:SalesRevenueNetMember

us-gaap:ProductConcentrationRiskMember

2022-07-01

2023-06-30

0000722572

us-gaap:TransferredAtPointInTimeMember

us-gaap:SalesRevenueNetMember

FKWL:EngineeringProjectsMember

2023-07-01

2024-06-30

0000722572

us-gaap:TransferredAtPointInTimeMember

us-gaap:SalesRevenueNetMember

FKWL:EngineeringProjectsMember

2022-07-01

2023-06-30

0000722572

FKWL:CapitalizedProductDevelopmentCostsMember

FKWL:AmortizationExpenseMember

2023-07-01

2024-06-30

0000722572

FKWL:CapitalizedProductDevelopmentCostsMember

FKWL:AmortizationExpenseMember

2022-07-01

2023-06-30

0000722572

FKWL:CapitalizedProductDevelopmentCostsMember

2024-06-30

0000722572

FKWL:CapitalizedProductDevelopmentCostsMember

2023-06-30

0000722572

us-gaap:ShippingAndHandlingMember

2023-07-01

2024-06-30

0000722572

us-gaap:ShippingAndHandlingMember

2022-07-01

2023-06-30

0000722572

FKWL:Customer1Member

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2023-07-01

2024-06-30

0000722572

FKWL:Customer2Member

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2023-07-01

2024-06-30

0000722572

FKWL:Customer1Member

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-07-01

2024-06-30

0000722572

FKWL:Customer2Member

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2023-07-01

2024-06-30

0000722572

FKWL:Customer1Member

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2022-07-01

2023-06-30

0000722572

FKWL:Customer2Member

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2022-07-01

2023-06-30

0000722572

FKWL:Customer1Member

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2022-07-01

2023-06-30

0000722572

FKWL:Customer2Member

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

2022-07-01

2023-06-30

0000722572

FKWL:WirelessDataProductsMember

2023-07-01

2024-06-30

0000722572

us-gaap:CostOfGoodsProductLineMember

us-gaap:SupplierConcentrationRiskMember

FKWL:WirelessDataProductsMember

2023-07-01

2024-06-30

0000722572

FKWL:WirelessDataProductsMember

2024-06-30

0000722572

FKWL:WirelessDataProductsMember

2022-07-01

2023-06-30

0000722572

us-gaap:CostOfGoodsProductLineMember

us-gaap:SupplierConcentrationRiskMember

FKWL:WirelessDataProductsMember

2022-07-01

2023-06-30

0000722572

FKWL:WirelessDataProductsMember

2023-06-30

0000722572

srt:NorthAmericaMember

2023-07-01

2024-06-30

0000722572

srt:NorthAmericaMember

2022-07-01

2023-06-30

0000722572

srt:AsiaMember

2023-07-01

2024-06-30

0000722572

srt:AsiaMember

2022-07-01

2023-06-30

0000722572

srt:NorthAmericaMember

2024-06-30

0000722572

srt:NorthAmericaMember

2023-06-30

0000722572

srt:AsiaMember

2024-06-30

0000722572

srt:AsiaMember

2023-06-30

0000722572

FKWL:MachineryMember

2023-07-01

2024-06-30

0000722572

us-gaap:OfficeEquipmentMember

2023-07-01

2024-06-30

0000722572

us-gaap:ToolsDiesAndMoldsMember

2023-07-01

2024-06-30

0000722572

us-gaap:VehiclesMember

2023-07-01

2024-06-30

0000722572

us-gaap:ComputerEquipmentMember

2023-07-01

2024-06-30

0000722572

us-gaap:FurnitureAndFixturesMember

2023-07-01

2024-06-30

0000722572

us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember

2023-07-01

2024-06-30

0000722572

FKWL:CompleteTechnologyMember

2024-06-30

0000722572

FKWL:TechnologyInProgessMember

2024-06-30

0000722572

us-gaap:ComputerSoftwareIntangibleAssetMember

2024-06-30

0000722572

FKWL:PatentMember

2024-06-30

0000722572

FKWL:CertificationAndLicensesMember

2024-06-30

0000722572

FKWL:CompleteTechnologyMember

2023-06-30

0000722572

FKWL:TechnologyInProgessMember

2023-06-30

0000722572

us-gaap:ComputerSoftwareIntangibleAssetMember

2023-06-30

0000722572

FKWL:PatentMember

2023-06-30

0000722572

FKWL:CertificationAndLicensesMember

2023-06-30

0000722572

2020-07-01

2021-06-30

0000722572

us-gaap:DomesticCountryMember

2024-06-30

0000722572

us-gaap:StateAndLocalJurisdictionMember

2024-06-30

0000722572

FKWL:AdministrativeOfficeSanDiegoCAMember

2023-07-01

2024-06-30

0000722572

FKWL:AdministrativeOfficeSanDiegoCAMember

2022-07-01

2023-06-30

0000722572

FKWL:HunsakerAndampAssociatesMember

2024-04-01

2024-06-30

0000722572

FKWL:HunsakerAndampAssociatesMember

2023-07-01

2024-06-30

0000722572

FKWL:HunsakerAndampAssociatesMember

2024-06-30

0000722572

FKWL:FTIOfficeSpaceMember

2023-07-01

2024-06-30

0000722572

FKWL:FTIOfficeSpaceMember

2022-07-01

2023-06-30

0000722572

FKWL:SeoulKoreaCorporateHousingFacilityMember

2023-07-01

2024-06-30

0000722572

FKWL:SeoulKoreaCorporateHousingFacilityMember

2022-07-01

2023-06-30

0000722572

FKWL:CaliforniaMember

2023-12-31

0000722572

FKWL:CaliforniaMember

2024-01-02

0000722572

FKWL:AliMember

2023-07-01

2024-06-30

0000722572

FKWL:AliMember

2023-05-05

2024-05-06

0000722572

2022-03-21

0000722572

FKWL:Plan2020Member

2020-07-31

0000722572

us-gaap:StockOptionMember

2022-06-30

0000722572

us-gaap:StockOptionMember

2021-07-01

2022-06-30

0000722572

us-gaap:StockOptionMember

2022-07-01

2023-06-30

0000722572

us-gaap:StockOptionMember

2023-06-30

0000722572

us-gaap:StockOptionMember

2023-07-01

2024-06-30

0000722572

us-gaap:StockOptionMember

2024-06-30

0000722572

us-gaap:CommonStockMember

2022-12-21

2022-12-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For fiscal year ended June 30, 2024

OR

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

to .

Commission file number: 001-14891

FRANKLIN WIRELESS CORP.

(Exact name of Registrant as specified in its charter)

|

Nevada

(State or other jurisdiction of incorporation or organization) |

|

95-3733534

(I.R.S. Employer Identification Number) |

| |

|

|

|

3940 Ruffin Road

Suite C

San Diego, California

(Address of principal executive offices) |

|

92123

(Zip code) |

(858) 623-0000

Registrant’s telephone number,

including area code

Indicate by check mark if the Registrant is a well-known seasoned issuer,

as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports

pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such

shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the

past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically

every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate

by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously

issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements

that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during

the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large

accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company”

in Rule 12b-2 of the Exchange Act. (Check one)

| |

Large accelerated filer ☐ |

Accelerated filer ☐ |

| |

Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

Emerging growth company ☐ |

|

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has

filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting

under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its

audit report. Yes ☐ No ☒

Indicate by check mark whether the Registrant is a

shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting common

stock held by non-affiliates of the Registrant, based on the closing price of the Registrant’s common stock on December 31,

2023, as reported by the NASDAQ, was approximately $27,520,000.

For the purpose of this calculation only, shares owned by officers, directors (and their affiliates) and 5% or greater stockholders

have been excluded. The Registrant does not have any non-voting stock issued or outstanding.

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $.001 per share |

FKWL |

The Nasdaq Stock Market LLC |

The Registrant has 11,784,280 shares of common stock

outstanding as of September 30, 2024.

FRANKLIN WIRELESS CORP.

INDEX TO ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED JUNE 30, 2024

NOTE ON FORWARD LOOKING STATEMENTS

You should keep in mind the following points as you

read this Report on Form 10-K:

| |

o |

the terms “we,” “us,” “our,” “Franklin,” “Franklin Wireless,” or the “Company” refer to Franklin Wireless Corp. |

| |

o |

our fiscal year ends on June 30; references to fiscal 2024 and fiscal 2023 and similar constructions refer to the fiscal year ended on June 30 of the applicable year. |

This Annual Report on Form 10-K

contains statements which, to the extent they do not recite historical fact, constitute “forward looking” statements within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

Forward looking statements are used under the captions “Business,” “Management’s Discussion and Analysis of Financial Condition

and Results of Operations,” and elsewhere in this Annual Report on Form 10-K. You can identify these statements by the use of words

like “may,” “will,” “could,” “should,” “project,” “believe,” “anticipate,”

“expect,” “plan,” “estimate,” “forecast,” “potential,” “intend,” “continue,”

and variations of these words or comparable words. Forward looking statements do not guarantee future performance and involve risks and

uncertainties. Actual results may differ substantially from the results that the forward looking statements suggest for various reasons,

including those discussed under the caption “Risk Factors.” These forward looking statements are made only as of the date of

this Annual Report on Form 10-K. We do not undertake to update or revise the forward looking statements, whether as a result of new information,

future events or otherwise.

PART I

ITEM 1. BUSINESS.

BUSINESS OVERVIEW

Doing business

as “FranklinAccess”, we are a leading global provider of integrated wireless solutions utilizing the latest 5G (fifth generation)

and 4G LTE (fourth generation long-term evolution) technologies including mobile hotspots, fixed wireless routers, and mobile device management

(MDM) solutions. We are a leading enabler of the Digital Divide initiative, and our expertise extends to innovation in Internet of Things

(IOT) and machine-to-machine (M2M) applications, driving forward seamless communication and connectivity for both individuals and enterprises.

We have

majority ownership of Franklin Technology Inc. (FTI), a research and development company based in Seoul, South Korea. FTI primarily provides

design and development services for our wireless products.

Our products are generally

marketed and sold directly to wireless operators and indirectly through strategic partners and distributors. Our primary markets are in

North America and Asia.

OUR STRUCTURE

We incorporated in 1982 in California

and reincorporated in Nevada on January 2, 2008. The reincorporation had no effect on the nature of our business or our management. Our

headquarters are located in San Diego, California. This office provides marketing, sales, operations, finance and administrative support.

It is also responsible for all customer-related activities, such as marketing communications, product planning, product management and

customer support, along with sales and business development activities worldwide.

Our consolidated financial statements

include accounts for the Company and its subsidiary, Franklin Technology Inc. (“FTI”). We have a majority voting interest

of approximately 66.3% (approximately 33.7% is owned by non-controlling interests) in FTI as of June 30, 2024, and 2023. In the preparation

of consolidated financial statements of the Company, intercompany transactions and balances are eliminated and net earnings (loss) are

reduced by the portion of the net earnings (loss) of the subsidiary applicable to non-controlling interests.

Accounting Standards Codification

(“ASC”) 280, “Segment Reporting,” requires public companies to report financial and descriptive information about

their reportable operating segments. We identify our operating segments based on how our chief operating decision maker internally evaluates

separate financial information, business activities and management responsibility. We have one reportable segment, consisting

of the sale of wireless access products. We generate revenues from three geographic areas, consisting of North America and Asia. The following

enterprise-wide disclosure is prepared on a basis consistent with the preparation of the consolidated financial statements. The following

table contains certain financial information by geographic area:

| | |

Fiscal Year Ended June 30, | |

| Net sales: | |

2024 | | |

2023 | |

| North America | |

$ | 30,699,727 | | |

$ | 45,782,084 | |

| Asia | |

| 96,963 | | |

| 166,432 | |

| Totals | |

$ | 30,796,690 | | |

$ | 45,948,516 | |

| Long-lived assets, net (property and equipment and intangible assets): | |

June 30, 2024 | | |

June 30, 2023 | |

| North America | |

$ | 1,218,139 | | |

$ | 2,083,902 | |

| Asia | |

| 206,426 | | |

| 198,070 | |

| Totals | |

$ | 1,424,565 | | |

$ | 2,281,972 | |

OUR PRODUCTS

We offer a wide variety of innovative

integrated wireless solutions utilizing the latest 5G and 4G LTE technologies including mobile hotspots, fixed wireless routers, and mobile

device management (MDM) solutions.

5G/4G Wireless Broadband Products

5G/4G LTE Wi-Fi Mobile Hotspot

| |

o |

Portable Wi-Fi hotspot routers that provide wireless Internet access with 5G/4G support for multiple simultaneously connected devices including laptops, tablets, and smart phones. Our Mobile Hotspot products help remote workers be productive while on the go and help students and educational institutions support remote learning activities. |

5G/4G Fixed Wireless Routers

| |

o |

Enhanced routing gateway that can provide support for both wired and wireless connectivity, offering solutions for consumers looking to replace Cable or DSL service ensuring a reliable and high-speed internet access. |

5G/4G Enterprise Gateway CPE

| |

o |

Enhanced routing gateway equipped with enterprise features offering solutions for enterprise customers looking to replace wired service, or wireless back-up for wired connections in a mission-critical environment or instant wireless connection in temporal locations. |

Smart Box Solutions (In Development)

4G/5G M2M Gateway

| o | Enhanced gateway supports both 4G and 5G networks, enabling reliable and secure machine-to-machine communication,

essential for industrial applications and remote monitoring systems. |

On-Device Artificial

Intelligence (AI)

| o | Integrating advanced AI capabilities directly into the devices, we provide real-time data processing and

decision-making at the edge, enhancing efficiency and reducing latency for critical IoT applications. |

Quvo Family Guardian Solutions

Parental Controls

| o | Comprehensive parental control features, ensuring a safe and secure online environment for children by

managing and monitoring their internet and application usage. |

Senior Care

| o | Enhancing senior care solutions for the safety and well-being of elderly family members through monitoring

and assistance features tailored to their needs. |

JEXtream MDM/NMS Solutions

“JEXtream” is Franklin’s

Cloud based telecom grade server platform for 5G devices and routers, enables enhanced remote management of device functionality.

Mobile

Device Management (MDM)

| o | Comprehensive management of mobile devices, ensuring security, compliance, and efficient operation across

various mobile environments |

Network Management

System (NMS)

| o | Robust tools for monitoring, managing, and optimizing network performance, ensuring reliable connectivity

and operational excellence. |

CUSTOMERS

Our global customer base is comprised

of wireless operators, strategic partners and distributors located primarily in North America and Asia.

SALES AND MARKETING

We market and sell our products

primarily to wireless operators located in North America and Asia regions mainly through our internal, direct sales organization and,

to a lesser degree, indirectly through strategic partners and distributors. The sales process is supported with a range of marketing activities,

including trade shows, product marketing and public relations.

All of our wireless devices must

pass Federal Communications Commission (FCC) testing in order to be sold in United States markets. Global Certification Forum (“GCF”)

test certifications are required in order to launch any wireless data products with wireless operators in North America. PCS Type Certification

Review Board (“PTCRB”) test certifications also are required for all LTE and HSPA/GSM wireless data products. Other LTE and

5G test certifications, as defined by the 3GPP governing body, are required for LTE and 5G wireless data products. Certifications are

issued as being a qualifier of GCF, PTCRB, IEEE, CE, UL, Wi-Fi alliance certification and 3GPP standards.

PRODUCTION AND MANUFACTURING OPERATIONS

For the fiscal year ended June

30, 2024, the manufacturing of the majority of our products was performed by two independent companies located in Asia.

EMPLOYEES

As of June 30, 2024, we had 69

total employees at Franklin and FTI combined. We also use the services of consultants and contract workers from time to time. Our employees

are not represented by any collective bargaining organization, and we have never experienced a work stoppage.

ITEM 1A: RISK FACTORS.

The following risk factors do

not purport to be a complete explanation of the risks involved in our business.

WE MAY NEED ADDITIONAL FINANCING

FOR PRODUCT DEVELOPMENT. Our financial resources are sufficient for our current operational needs; however, the amount of funding required

to develop and commercialize our products and technologies is highly uncertain. Adequate funds may not be available when needed or on

terms satisfactory to us. Lack of funds may cause us to delay, reduce and/or abandon certain or all aspects of our development and commercialization

programs. We may seek additional financing through the issuance of equity or convertible debt securities. In such event, the percentage

ownership of our stockholders would be reduced, stockholders may experience additional dilution, and such securities may have rights,

preferences, and privileges senior to those of our Common Stock. There can be no assurance that additional financing will be available

on terms favorable to us or at all. If adequate funds are not available or are not available on acceptable terms, we may not be able to

fund our expansion, take advantage of desirable acquisition opportunities, develop, or enhance services or products or respond to competitive

pressures. Such inability could have a materially adverse effect on our business, results of operations and financial conditions.

WE MAY INFRINGE THE INTELLECTUAL

PROPERTY RIGHTS OF OTHERS. The industry in which we operate has many participants that own, or claim to own, proprietary intellectual

property. In the past we have received, and in the future may receive, claims from third parties alleging that we, and possibly our customers,

violate their intellectual property rights. Rights to intellectual property can be difficult to verify and litigation may be necessary

to establish whether or not we have infringed the intellectual property rights of others. In many cases, these third parties are companies

with substantially greater resources than us, and they may be able to, and may choose to, pursue complex litigation to a greater degree

than we could. Regardless of whether these infringement claims have merit or not, we may be subject to the following:

| |

o |

We may be liable for potentially substantial damages, liabilities, and litigation costs, including attorneys’ fees; |

| |

|

|

| |

o |

We may be prohibited from further use of the intellectual property and may be required to cease selling our products that are subject to the claim; |

| |

|

|

| |

o |

We may have to license third-party intellectual property, incurring royalty fees that may or may not be on commercially reasonable terms. In addition, there is no assurance that we will be able to successfully negotiate and obtain such a license from the third party; |

| |

|

|

| |

o |

We may have to develop a non-infringing alternative, which could be costly and delay or result in the loss of sales. In addition, there is no assurance that we will be able to develop such a non-infringing alternative; |

| |

|

|

| |

o |

The diversion of management’s attention and resources; |

| |

|

|

| |

o |

Our relationships with customers may be adversely affected; and |

| |

|

|

| |

o |

We may be required to indemnify our customers for certain costs and damages they incur in such a claim. |

In the event of an unfavorable

outcome in such a claim and our inability to either obtain a license from the third party or develop a non-infringing alternative, then

our business, operating results and financial condition may be materially adversely affected and we may have to restructure our business.

Absent a specific claim for infringement

of intellectual property, from time to time we have and expect to continue to license technology, intellectual property, and software

from third parties. There is no assurance that we will be able to maintain our third-party licenses or obtain new licenses when required

and this inability could materially adversely affect our business and operating results and the quality and functionality of our products.

In addition, there is no assurance that third party licenses we execute will be on commercially reasonable terms.

Under purchase orders and contracts

for the sale of our products we may provide indemnification to our customers for potential intellectual property infringement claims for

which we may have no corresponding recourse against our third-party licensors. This potential liability, if realized, could materially

adversely affect our business, operating results, and financial condition.

WE OPERATE IN AN INTENSIVELY COMPETITIVE

MARKET. The wireless broadband data access market is highly competitive, and we may be unable to compete effectively. Many of our competitors

or potential competitors have significantly greater financial, technical, and marketing resources than we do. To survive and be competitive,

we will need to continuously invest in research and development, sales and marketing, and customer support. Increased competition could

result in price reductions, and smaller customer orders. Our failure to compete effectively could seriously impair our business.

WE OPERATE IN THE HIGH-RISK TELECOM

SECTOR. We are in a volatile industry. In addition, our revenue model is evolving and relies substantially on the assumption that we will

be able to successfully complete the development and sales of our products and services in the marketplace. Our prospects must be considered

in the light of the risk, uncertainties, expenses, and difficulties frequently encountered by companies in the early stages of development

and marketing of new products. To be successful in the market we must, among other things:

| |

o |

Complete development and introduction of functional and attractive products and services; |

| |

|

|

| |

o |

Attract and maintain customer loyalty; |

| |

|

|

| |

o |

Establish and increase awareness of our brand and develop customer loyalty; |

| |

|

|

| |

o |

Provide desirable products and services to customers at attractive prices; |

| |

|

|

| |

o |

Establish and maintain strategic relationships with strategic partners and affiliates; |

| |

|

|

| |

o |

Rapidly respond to competitive and technological developments; |

| |

|

|

| |

o |

Build operations and customer service infrastructure to support our business; and |

| |

|

|

| |

o |

Attract, retain, and motivate qualified personnel. |

We cannot guarantee that we will

be able to achieve these goals, and our failure to achieve them could adversely affect our business, results of operations, and financial

condition. We expect that revenues and operating results will fluctuate in the future. There is no assurance that any or all our efforts

will produce a successful outcome.

WE OPERATE IN THE HIGH-RISK HARDWARE

DESIGN INDUSTRY. We are in a volatile industry. In this industry it should be expected that:

| |

o |

Latent design flaws can be discovered, even after a device has been certified; |

| |

|

|

| |

o |

Latent component defects can be discovered in critical systems, including batteries, LCDs, chargers, and other systems; |

| |

|

|

| |

o |

Manufacturing defects and flaws will occur during device production. |

WE OPERATE IN THE HIGH-RISK SOFTWARE

INDUSTRY. This industry has numerous and significant known risks. In this industry it should be expected that:

| |

o |

Latent design flaws and security defects will be discovered, even after a device has been tested and approved; |

| |

|

|

| |

o |

Code within a program will fail to operate as intended due to updates or changes in other systems; |

| |

|

|

| |

o |

Hacking and malicious actions by outside parties can damage or alter coding and system integrity. |

POTENTIAL DESIGN AND MANUFACTURING

DEFECTS COULD OCCUR. Our product and service offerings may have quality issues from time to time, due to defects in software design, hardware

design or component manufacturing. As a result, our products and services may not perform as anticipated and may not meet customer expectations.

Component defects could make our products unsafe and create a risk of environmental or property damage and personal injury. There can

be no assurance we will be able to detect and address all issues and defects in the hardware, software, and services we offer. Failure

to do so could result in widespread technical and performance issues affecting our products and services. In addition, we may be exposed

to product liability claims, recalls, product replacements or modifications, write-offs of inventory, property, plant and equipment, and/or

intangible assets, and significant warranty and other expenses, including litigation costs and regulatory fines.

WE OPERATE IN A FIELD WITH RAPIDLY

CHANGING TECHNOLOGY. We cannot be certain that our products and services will function as anticipated or be desirable to our intended

markets. Our current or future products and services may fail to function properly, and if our products and services do not achieve and

sustain market acceptance, our business, results of operations and profitability may suffer. If we are unable to predict and comply with

evolving wireless standards, our ability to introduce and sell new products will be adversely affected. If we fail to develop and introduce

products on time, we may lose customers and potential product orders.

WE DEPEND ON THE DEMAND FOR WIRELESS

NETWORK CAPACITY. The demand for our products is completely dependent on the demand for broadband wireless access to networks. If wireless

operators do not deliver acceptable wireless service, our product sales may dramatically decline. Thus, if wireless operators experience

financial or network difficulties, it will likely reduce demand for our products. These are beyond our ability to control and can either

increase or decrease demand for our products.

PANDEMIC OUTBREAKS CAN CAUSE VOLATILE

CHANGES IN THE MARKET. Demand for wireless access can rise and fall greatly during times of pandemic outbreaks, such as COVID-19, as more

people may be required to work remotely, and schools may be required to operate remote classrooms. When an outbreak ends, or becomes more

controlled, demand for wireless devices could decline rapidly, decreasing demand for our products. Pandemic outbreaks can also disrupt

supply chains, manufacturing operations, and shipping. These disruptions can make product fulfilment difficult, delayed, or impossible.

All these changes are beyond our ability to control and can cause revenue and income to change dramatically.

WE DEPEND ON COLLABORATIVE ARRANGEMENTS.

The development and commercialization of our products and services depend in large part upon our ability to selectively enter and maintain

collaborative arrangements with developers, distributors, service providers, network systems providers, core wireless communications technology

providers and manufacturers, among others.

THE LOSS OF ANY OF OUR

MATERIAL CUSTOMERS COULD ADVERSELY AFFECT OUR REVENUES AND PROFITABILITY, AND THEREFORE SHAREHOLDER VALUE. We depend on a small

number of customers for a significant portion of our revenues. For the year ended June 30, 2024, net revenues from our two largest

customers represented 68% and 23% of our consolidated net sales, respectively. We have a written agreement with each of these

customers that governs the sale of products to them, but the agreements do not obligate them to purchase any quantity of

products from us. If these customers were to reduce their business with us, our revenues and profitability could materially

decline.

OUR PRODUCT DELIVERIES ARE

SUBJECT TO LONG LEAD TIMES. We often experience long lead times to ship products, often more than 45 days. This could cause us to

lose customers, who may be able to secure faster delivery times from our competitors and require us to maintain higher levels of

working capital.

OUR PRODUCT-TO-MARKET CHALLENGE

IS CRITICAL. Our success depends on our ability to quickly enter the market and establish an early mover advantage. We must implement

an aggressive sales and marketing campaign to solicit customers and strategic partners. Any delay could seriously affect our ability to

establish and exploit effectively an early-to-market strategy.

AS OUR BUSINESS EXPANDS INTERNATIONALLY,

WE WILL BE EXPOSED TO ADDITIONAL RISKS RELATING TO INTERNATIONAL OPERATIONS. Our expansion into international operations exposes us to

additional risks unique to such international markets, including the following:

| |

o |

Increased credit management risks and greater difficulties in collecting accounts receivable; |

| |

|

|

| |

o |

Unexpected changes in regulatory requirements, wireless communications standards, exchange rates, trading policies, tariffs, and other barriers; |

| |

|

|

| |

o |

Uncertainties of laws and enforcement relating to the protection of intellectual property; |

| |

|

|

| |

o |

Language barriers; and |

| |

|

|

| |

o |

Potential adverse tax consequences. |

Furthermore, if we are unable

to further develop distribution channels in countries in North America, the Caribbean and South America, EMEA (Europe, the Middle East

and Africa), and Asia, we may not be able to grow our international operations, and our ability to increase our revenue will be negatively

impacted.

We believe that our products are

currently exempt from international tariffs. If this were to change at any point, a tariff of 10%-25% of the purchase price could be imposed.

If such tariffs are imposed, they could have a materially adverse effect on sales and operating results.

GOVERNMENT REGULATION COULD RESULT

IN INCREASED COSTS AND INABILITY TO SELL OUR PRODUCTS. Our products are subject to certain mandatory regulatory approvals in the United

States and other regions in which we operate. In the United States, the Federal Communications Commission regulates many aspects of communications

devices. Although we have obtained all the necessary Federal Communications Commission and other required approvals for the products we

currently sell, we may not obtain approvals for future products on a timely basis, or at all. In addition, regulatory requirements may

change, or we may not be able to obtain regulatory approvals from countries other than the United States in which we may desire to sell

products in the future.

EVENTS THAT COULD REDUCE OR IMPAIR

OUR ABILITY TO GENERATE REVENUES.

| o | The marketability of our products may suffer if wireless telecommunications operators do not deliver acceptable wireless services. |

| | | |

| o | If customers do not adopt our software, we may not be able to monetize these software assets and realize a key part of our growth

and profitability strategy. |

| | | |

| o | The market for the products and services that we offer is rapidly evolving and highly competitive. We may be unable to compete effectively. |

| | | |

| o | If we fail to develop and maintain strategic relationships, we may not be able to penetrate new markets. |

| | | |

| o | If we fail to develop and timely introduce new products and services or enter new markets for our products and services successfully,

we may not achieve our revenue targets, or we may lose key customers or sales, and our business could be harmed. |

EVENTS THAT COULD IMPAIR OUR ABILITY TO

DEVELOP, MANUFACTURE AND DELIVER OUR SOLUTIONS.

| o | We rely on third parties to manufacture and warehouse many of our products, which exposes us to a number of risks and uncertainties

outside our control. |

| | | |

| o | We depend on sole source suppliers for some components used in our products. The availability and sale of those services would be

harmed if any of these suppliers is not able to meet our demand and alternative suitable products are not available on acceptable terms,

or at all. |

| | | |

| o | Natural disasters, public health crises, political crises and other catastrophic events or other events outside of our control could

damage our facilities or the facilities of third parties on which we depend, and could impact consumer spending. |

| | | |

| o | If disruptions in our transportation network occur or our shipping costs substantially increase, we may be unable to sell or timely

deliver our products, and our operating expenses could increase. |

| | | |

| o | We may be unable to adequately control the costs or maintain adequate supply of components and raw materials associated with our operations. |

| | | |

| o | If we do not effectively manage our sales channel inventory and product mix, we may incur costs associated with excess inventory or

lose sales from having too few products. |

| | | |

| o | Product liability, product replacement or recall costs could adversely affect our business and financial performance. |

| | | |

| o | We rely on third-party software and other intellectual property to develop and provide our solutions and significant increases in

licensing costs or defects in third-party software could harm our business. |

| | | |

| o | Our solutions integrate with third-party technologies and if our solutions become incompatible with these technologies, our solutions

would lose functionality, and our customer acquisition and retention could be adversely affected. |

LEGAL AND REGULATORY CHANGES THAT COULD

REDUCE OR IMPAIR OUR ABILITY TO OPERATE.

| o | Evolving regulations and changes in applicable laws relating to data privacy may increase our expenditures related to compliance efforts

or otherwise limit the solutions we can offer, which may harm our business and adversely affect our financial condition. |

| | | |

| o | Enhanced United States fiscal, tax and trade restrictions and executive and legislative actions could adversely affect our business,

financial condition, and results of operations. |

| | | |

| o | The increasing focus on environmental sustainability and social initiatives could increase our costs, harm our reputation and adversely

impact our financial results. |

| | | |

| o | An assertion by a third party that we are infringing its intellectual property could subject us to costly and time-consuming litigation

or expensive licenses and our business could be harmed. |

| | | |

| o | If we are unable to protect our intellectual property and proprietary rights, our competitive position and our business could be harmed. |

POTENTIAL NEGATIVE IMPACTS RELATED TO INTERNATIONAL

OPERATIONS.

| o | Due to the global nature of our operations, we are subject to political and economic risks of doing business internationally. |

| | | |

| o | Weakness or deterioration in global economic conditions or jurisdictions where we have significant foreign operations could have a

material adverse effect on our results of operations and financial condition. |

| | | |

| o | Weakness or deterioration in global political conditions where we have significant business interests could have a material adverse

effect on our business, results of operations and financial condition. |

| | | |

| o | Fluctuations in foreign currency exchange rates could adversely affect our results of operations. |

| | | |

| o | Unionization efforts in certain countries in which we operate could materially increase our costs or limit our flexibility. |

| | | |

| o | Our international operations may increase our exposure to potential liability under anti-corruption, trade protection, tax and other

laws and regulations. |

| | | |

| o | A governmental challenge to our transfer pricing policies or practices could impose significant costs on us. |

EVENTS THAT COULD HARM BUSINESS DEVELOPMENT ACTIVITIES AND

IMPAIR OR REDUCE REVENUE.

| o | We may acquire companies and businesses, and/or divest assets or businesses. The completion of acquisition or divestiture transactions

could have an adverse effect on our financial condition. |

| | | |

| o | If our goodwill and acquired intangible assets become impaired, we may be required to record a significant charge to earnings. |

POTENTIAL EVENTS THAT COULD NEGATIVELY IMPACT

THE VALUE OF OUR SECURITIES.

| o | Our share price has been highly volatile in the past and could be highly volatile in the future. |

| | | |

| o | Our ability to use our net operating loss carryforwards and certain other tax attributes may be limited |

| | | |

| o | The price of our stock may be vulnerable to manipulation, including through short sales. |

| | | |

| o | Ownership of our common stock is concentrated, and as a result, certain stockholders may exercise significant influence over the Company. |

| | | |

| o | We do not currently intend to pay dividends on our common stock, and, consequently, your ability to achieve a return on your investment

will depend on appreciation, if any, in the price of our common stock. |

| | | |

| o | If financial or industry analysts do not publish research or reports about our business, or if they issue negative or misleading evaluations

of our stock, our stock price and trading volume could decline. |

| | | |

| o | If we fail to maintain an effective system of internal controls over financial reporting, we may not be able to report our financial

results timely and accurately, which could adversely affect investor confidence in us, and in turn, our results of operations and our

stock price. |

| | | |

| o | If the accounting estimates we make, and the assumptions on which we rely, in preparing our financial statements prove inaccurate,

our actual results may be adversely affected. |

| | | |

| o | Changes to the accounting systems or new accounting system implementations may be ineffective or cause delays in our ability to record

transactions and/or provide timely financial results. |

| | | |

| o | Any changes to existing accounting pronouncements or taxation rules or practices may cause adverse fluctuations in our reported results

of operations or affect how we conduct our business. |

| | | |

| o | Our quarterly operating results have fluctuated in the past and may fluctuate in the future, which could cause declines or volatility

in the price of our common stock. |

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 1C. CYBERSECURITY.

Cybersecurity risk management

is an integral part of our overall enterprise risk management program. The Company manages cybersecurity and data protection through a

continuously evolving program. Our cybersecurity risk management program is designed to provide a framework for assessing, identifying

and managing cybersecurity threats and incidents, including threats and incidents associated with the use of services provided by third-party

service providers, and to facilitate coordination across different departments of our Company. Our processes include steps for assessing

the severity of a cybersecurity threat, identifying the source of a cybersecurity threat, including whether the cybersecurity threat is

associated with a third-party service provider, and implementing cybersecurity countermeasures and mitigation strategies and informing

management and the board of directors of material cybersecurity threats and incidents.

The Board of Directors has oversight

for the most significant risks facing us and for our processes to identify, prioritize, assess, manage and mitigate those risks. The Audit

Committee of the Board of Directors (the “Audit Committee”) has been designated to oversee cybersecurity risks. The Audit

Committee receives regular updates on cybersecurity and information technology matters and related risk exposures from our management.

The Board of Directors also receives periodic updates from management and the Audit Committee on cybersecurity risks. Management

is responsible for identifying, considering and assessing material cybersecurity risks on an ongoing basis, establishing processes designed

to ensure that such potential cybersecurity risk exposures are monitored, putting in place mitigation measures and maintaining cybersecurity

programs. Our cybersecurity programs are under the direction of our Chief Executive Officer. Management regularly updates the Audit Committee

on our cybersecurity programs, which includes cybersecurity risks and mitigation strategies, vulnerability management, and on-going cybersecurity

projects.

As of June 30, 2024, we did not

identify any cybersecurity incidents that materially affected or are reasonably likely to materially affect our business strategy, results

of operations, or financial condition. However, despite our efforts, we cannot eliminate all risks from cybersecurity threats, or provide

assurances that we have not experienced an undetected cybersecurity incident. It is possible that we may not implement appropriate controls

if we do not detect a particular risk. In addition, security controls, no matter how well designed or implemented, may only mitigate and

not fully eliminate the risks. Even when a risk is detected, disruptive events may not always be immediately and thoroughly interpreted

and acted upon.

ITEM 2. PROPERTIES.

We leased approximately 12,775

square feet of office space in San Diego, California, at a monthly rent of $25,754, pursuant to a lease that expired in December 2023.

On October 19, 2023, we signed a lease for office space consisting of approximately 11,400 square feet, located in San Diego, California,

at a monthly rent of $23,370, which commenced on January 1, 2024. In addition to monthly rent, the lease includes payment for certain

common area costs. The term of the lease for the office space is 65 months from the lease commencement date. Our facility is covered by

an appropriate level of insurance, and we believe it to be suitable for our use and adequate for our present needs. Rent expense related

to this property was $321,259 and $309,053 for the years ended June 30, 2024 and 2023.

On or about December 7,

2023, we received an invoice from our prior landlord, Hunsaker & Associates, requesting payment of additional rent on our completed

and expired lease of office space located at 9707 Waples Street, San Diego, CA as of December 31, 2023. This invoice of $142,978 purports

to represent charges for variable cost increases during the prior 7 years of the lease, which was discounted by $46,274 and adjusted down

to $96,704 for the three months ended June 30, 2024. We are currently reviewing these charges and will be requesting further validation

of these charges, in accordance with our rights granted under the lease. For the year ended June 30, 2024, we recorded an additional rent

expense of $96,704 and an accrued liability of $72,048 reflecting this pending invoice and a credit of $24,656 for our deposit on the

leasehold property.

Our Korea-based subsidiary, FTI,

leases approximately 10,000 square feet of office space, at a monthly rent of approximately $8,000, and additional office space consisting

of approximately 2,682 square feet at a monthly rent of approximately $2,700, both located in Seoul, Korea. These leases expired on August

31, 2024, and were extended for an additional 24 months to August 31, 2026. In addition to monthly rent, the leases provide for periodic

cost of living increases in the base rent and payment for certain common area costs. These facilities are covered by an appropriate level

of insurance, and we believe them to be suitable for our use and adequate for our present needs. Rent expense related to these leases

was approximately $112,206 and $128,400 for each of the years ended June 30, 2024 and 2023, respectively.

We lease one corporate housing

facility, located in Seoul, Korea, primarily for our employees who travel, under a non-cancelable operating lease that expired on September

4, 2024, and was extended for an additional twelve months to September 4, 2025. Rent expense related to this lease was $8,089 and $8,095

for the years ended June 30, 2024 and 2023, respectively.

ITEM 3. LEGAL PROCEEDINGS.

Refer to NOTE 6 - COMMITMENTS

AND CONTINGENCIES in the Consolidated Financial Statements.

ITEM 4. MINE SAFETY DISCLOSURES.

None.

PART II

ITEM 5. MARKET FOR REGISTRANT’S

COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

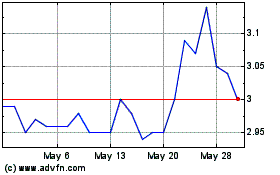

MARKET PRICE OF OUR COMMON STOCK

Shares of our Common Stock

are quoted and traded on the Nasdaq National Market System under the trading symbol “FKWL”. We have one class of common

stock. As of June 30, 2024, we had 715 shareholders of record. Since many of the shares of our common stock are held by brokers and

other institutions on behalf of shareholders, the total number of beneficial holders represented by these record holders is not

practicably determinable.

EQUITY COMPENSATION PLAN INFORMATION

The following table summarizes

share and exercise price information about our equity compensation plans as of June 30, 2024:

| Plan Category | |

Number of

securities to be

issued upon

exercise of

outstanding

options, warrants

and rights | | |

Weighted-average exercise price

of outstanding

options, warrants

and rights | | |

Number of

securities

remaining

available for

future issuance

under equity

compensation

plans | |

| | |

| | |

| | |

| |

| Equity compensation plans approved by security holders | |

| 627,001 | | |

$ | 4.22 | | |

| 587,003 | |

| | |

| | | |

| | | |

| | |

| Equity compensation plans not approved by security holders | |

| – | | |

| N/A | | |

| – | |

| | |

| | | |

| | | |

| | |

| Total | |

| 647,001 | | |

$ | 4.22 | | |

| 587,003 | |

ITEM 6. [RESERVED]

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS.

The following discussion and analysis

of our financial condition and results of operations should be read in conjunction with our financial statements and related notes included

elsewhere in this report. This report contains certain forward-looking statements relating to future events or our future financial performance.

These statements are subject to risks and uncertainties which could cause actual results to differ materially from those discussed in

this report. You are cautioned not to place undue reliance on this information which speaks only as of the date of this report. We are

not obligated to publicly update this information, whether as a result of new information, future events or otherwise, except to the extent

we are required to do so in connection with our obligation to file reports with the SEC. For a discussion of the important risks to our

business and future operating performance, see the discussion under the caption “Item 1A. Risk Factors” and under the caption

“Factors That May Influence Future Results of Operations” below. In light of these risks, uncertainties and assumptions, the

forward-looking events discussed in this report might not occur.

BUSINESS OVERVIEW

Doing business

as “FranklinAccess”, we are a leading global provider of integrated wireless solutions utilizing the latest 5G (fifth generation)

and 4G LTE (fourth generation long-term evolution) technologies including mobile hotspots, fixed wireless routers, and mobile device management

(MDM) solutions. We are a leading enabler of the Digital Divide initiative, and our expertise extends to innovation in Internet of Things

(IOT) and machine-to-machine (M2M) applications, driving forward seamless communication and connectivity for both individuals and enterprises.

We have

majority ownership of Franklin Technology Inc. (FTI), a research and development company based in Seoul, South Korea. FTI primarily provides

design and development services for our wireless products.

Our products are generally

marketed and sold directly to wireless operators and indirectly through strategic partners and distributors. Our primary markets are in

North America and Asia.

FACTORS THAT MAY INFLUENCE FUTURE RESULTS OF OPERATIONS

We believe that our revenue

growth will be influenced largely by (1) the successful maintenance of our existing customers, (2) the rate of increase in demand for

wireless data products, (3) customer acceptance of our new products, (4) new customer relationships and contracts, (5) our ability to

meet customers’ demands, (6) our ability to maintain good relationships with our manufacturing partners and suppliers, and (7) the

defect rates experienced by end users of our hardware and software products.

We have entered into and

expect to continue to enter into new customer relationships and contracts for the supply of our products, and this may require significant

demands on our resources, resulting in increased operating, selling, and marketing expenses associated with such new customers.

We continuously evaluate

the performance of our hardware and software products to discover defects that can adversely affect our revenue, income, and the price

of our stock. If defects occur that customers believe are either severe in nature or excessively frequent in occurrence, customers could

stop buying our products and services and the value of our stock may decrease.

We are also seeing that

demand from end-users has been shifting in the post-pandemic economy as remote education and work from home trends are declining. Current

demand for mobile device management (MDM) services has been declining. We are working to improve and further enhance our software service

offerings to address this change in the market.

CRITICAL ACCOUNTING POLICIES

Revenue Recognition

The Company accounts for its revenue

according to ASC 606, “Revenue from Contracts with Customers”, pursuant to which, revenue is recognized when the control of

the promised goods or services is transferred to the customers, and the performance obligations under the contract have been satisfied,

in an amount that reflects the consideration expected to be entitled to in exchange for those goods or services.

The Company determines revenue

recognition through the following steps: (1) identify the contract(s) with a customer, (2) identify the performance obligations

in the contract, (3) determine the transaction price, (4) allocate the transaction price to the performance obligations in the

contract, and (5) recognize revenue when (or as) the entity satisfies a performance obligation.

Contracts with Customers

Revenue from sales of products

and services is derived from contracts with customers. The products and services covered by contracts primarily consist of hot spot routers.

Contracts with each customer generally state the terms of the sale, including the description, quantity and price of each product or service.

Payment terms are stated in the contract, primarily in the form of a purchase order. Since the customer typically agrees to a stated rate

and price in the purchase order that does not vary over the life of the contract, the majority of our contracts do not contain variable

consideration. We establish a provision for estimated warranty and returns. Using historical averages, that provisions for the years ended

June 30, 2024, and 2023, were not material.

Disaggregation of Revenue

In accordance with Topic 606,

we disaggregate revenue from contracts with customers into geographical regions and by the timing of when goods and services are transferred.

We determined that disaggregating revenue into these categories meets the disclosure objective in Topic 606, which is to depict how the

nature, amount, timing and uncertainty of revenue and cash flows are affected by regional economic factors.

Contract Balances

We perform our obligations under

a contract with a customer by transferring products in exchange for consideration from the customer. We typically invoice our customers

as soon as control of an asset is transferred, and a receivable is established. However, we recognize contract liability when a customer

prepays for goods and/or services, or when we have not delivered goods under the contract since we have not yet transferred control of

the goods and/or services.

The balances of

our trade receivables are as follows:

| | |

June 30, 2024 | | |

June 30, 2023 | |

| Accounts Receivable, net | |

$ | 1,155,060 | | |

$ | 8,949,802 | |

The balance of contract assets

was immaterial as we did not have a significant amount of un-invoiced receivables in the periods ended June 30, 2024, and June 30, 2023.

Our contract liabilities and advance

from customers are as follows:

| | |

June 30, 2024 | | |

June 30, 2023 | |

| Undelivered products | |

$ | 158,771 | | |

$ | 146,488 | |

Performance Obligations

A performance obligation is a

promise in a contract to transfer a distinct good and/or service to the customer and is the unit of measurement in Topic 606. At contract

inception, we assess the products and/or services promised in our contracts with customers. We then identify performance obligations to

transfer distinct products and/or services to the customer. To identify performance obligations, we consider all the products or services

promised in the contract regardless of whether they are explicitly stated or are implied by customary business practices.

Our performance obligations are

satisfied at a point in time. Revenue from products transferred to customers at a single point in time accounted for over 99% of net sales

for the year ended June 30, 2024 and 2023. Revenue for non-recurring engineering projects is based on the percentage completion of a project

and accounted for under 1% of net sales for the years ended June 30, 2024 and 2023. Most of our revenue that is recognized at a point

in time is for the sale of hot-spot router products. Revenue from these contracts is recognized when the customer can direct the use of

and obtain substantially all of the benefits from the product, which generally coincides with title transfer at completion of the shipping

process.

As of June 30, 2024 and 2023,

our contracts do not contain any unsatisfied performance obligations, except for undelivered products.

Capitalized Product Development

Costs

Accounting Standards Codification

(“ASC”) Topic 350, “Intangibles - Goodwill and Other” includes software that is part of a product or process to

be sold to a customer and shall be accounted for under Subtopic 985-20. Our products contain embedded software internally developed by

FTI, which is an integral part of these products because it allows the various components of the products to communicate with each other

and the products are clearly unable to function without this coding.

The costs of product development

that are capitalized once technological feasibility is determined (noted as Technology in progress in the Intangible Assets table, in

Note 2 to Notes to Consolidated Financial Statements) include certifications, licenses, payroll, employee benefits, and other headcount-related

expenses associated with product development. We determine that technological feasibility for our products is reached after all high-risk

development issues have been resolved. Once the products are available for general release to our customers, we cease capitalizing the

product development costs and any additional costs, if any, are expensed. The capitalized product development costs are amortized on a

product-by-product basis using the straight-line amortization. The amortization begins when the products are available for general release

to our customers.

As of June 30, 2024, and June

30, 2023, capitalized product development costs in progress were $0 and $203,838, respectively, and these amounts are included in intangible

assets in our consolidated balance sheets. For the years ended June 30, 2024 and 2023, we incurred $123,359 and $1,631,376, respectively

in capitalized product development costs, and all costs incurred before technological feasibility is reached are expensed and included

in our consolidated statements of comprehensive income (loss).

Income Taxes

Deferred income tax assets and

liabilities are recorded for differences between the financial statement and tax basis of the assets and liabilities that will result

in taxable or deductible amounts in the future based on enacted laws and rates applicable to the periods in which the differences are

expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected

to be realized. As of June 30, 2024, we have federal and state net operating loss carryforwards of approximately $5.8 million and $0.5

million, respectively. As of June 30, 2023, we have federal and state net operating loss carryforwards of approximately $2.5 million and

$0.5 million, respectively.

Under the Tax Cuts and Jobs Act

(the “Act”), which was signed into law on December 22, 2017, the federal net operating loss of approximately $2.5 million,

which was recognized on or after January 1, 2018, will carry forward indefinitely. The state net operating loss of approximately $0.5

million will begin to expire through 2043. The utilization of net operating loss carryforwards may be subject to limitations under provisions

of the Internal Revenue Code Section 382 and similar state provisions.

Under the provision of ASC 740

“Application of the Uncertain Tax Position Provisions” related to accounting for uncertain tax positions, which prescribes

a recognition threshold and measurement process for recording in the financial statements, uncertain tax positions taken or expected to

be taken in a tax return, the impact of an uncertain income tax position on the income tax return must be recognized at the largest

amount that is more-likely-than-not to be sustained upon audit by the relevant taxing authority. Tax benefits of an uncertain tax position

will not be recognized if it has less than a 50% likelihood of being sustained based on technical merits.

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

Refer to NOTE 2 - SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES in the Consolidated Financial Statements.

RESULTS OF OPERATIONS

The following table sets forth,

for the years ended June 30, 2024, 2023, and 2022, our statements of operations including data expressed as a percentage of sales:

| | |

2024 | | |

2023 | | |

2022 | |

| | |

(as a percentage of sales) | |

| | |

| | |

| | |

| |

| Net sales | |

| 100.0% | | |

| 100.0% | | |

| 100.0% | |

| Cost of goods sold | |

| 88.6% | | |

| 84.7% | | |

| 84.1% | |

| Gross profit | |

| 11.4% | | |

| 15.3% | | |

| 15.9% | |

| Operating expenses | |

| 30.7% | | |

| 20.4% | | |

| 36.6% | |

| Loss from operations | |

| (19.3% | ) | |

| (5.1% | ) | |

| (20.7% | ) |

| Other income (expense), net | |

| 2.7% | | |

| (3.2% | ) | |

| 1.1% | |

| Net loss before income taxes | |

| (16.6% | ) | |

| (8.3% | ) | |

| (19.6% | ) |

| Income tax benefit | |

| (3.1% | ) | |

| (1.9% | ) | |

| (4.3% | ) |

| Net loss | |

| (13.5% | ) | |

| (6.4% | ) | |

| (15.3% | ) |

| Less: non-controlling interest in net (loss) income of subsidiary | |

| (0.6% | ) | |

| (0.2% | ) | |

| 0.4% | |

| Net loss attributable to Parent Company stockholders | |

| (12.9% | ) | |

| (6.2% | ) | |

| (15.7% | ) |

YEAR ENDED JUNE 30, 2024, COMPARED TO YEAR ENDED JUNE 30, 2023

NET SALES - Net sales

decreased by $15,151,826, or 33.0%, to $30,796,690 for the year ended June 30, 2024 from $45,948,516 for the corresponding period of 2023.

For the year ended June 30, 2024, net sales by geographic regions, consisting of North America and Asia, were $30,699,727 (99.7% of net

sales) and $96,963 (0.3% of net sales), respectively. For the year ended June 30, 2023, net sales by geographic regions, consisting of

North America and Asia, were $45,782,084 (99.6% of net sales) and $166,432 (0.4% of net sales), respectively.

Net sales in North America decreased

by $15,082,357, or 32.9%, to $30,699,727 for the year ended June 30, 2024, from $45,782,084 for the corresponding period of 2023. The

decrease in net sales in North America was primarily due to the reduced demand from two major carriers by approximately 50% and 26%, compared

to the corresponding period of 2023. Net sales in Asia decreased by $69,469, or 41.7%, to $96,963 for the year ended June 30, 2024, from

$166,432 for the corresponding period of 2023. The decrease in net sales was primarily due to the reduced demand (approximately 61%) for

a newly launched wireless product from a customer of FTI.

GROSS PROFIT- Gross profit

decreased by $3,512,392, or 50.0%, to $3,508,350 for the year ended June 30, 2024, from $7,020,742 for the corresponding period of 2023.

The gross profit in terms of net sales percentage was 11.4% for the year ended June 30, 2024, compared to 15.3% for the corresponding

period of 2023. The decrease in gross profit was primarily due to the change in net sales as described above. The decrease in gross profit

in terms of net sales was the mixed results of competitive selling prices and the increase in production costs as well as the increased

amortization expenses associated with the completed capitalized product development costs that are included in the cost of goods sold

compared to the corresponding period of 2023.

OPERATING EXPENSES - Operating

expenses increased by $77,788, or 0.8%, to $9,448,105 for the year ended June 30, 2024, from $9,370,317 for the corresponding period of

2023.

Selling, general, and administrative

expenses increased by $589,702 to $6,041,355 for the year ended June 30, 2024, from $5,451,653 for the corresponding period of 2023. The

increase in selling, general, and administrative expenses was primarily due to the increased legal expenses of approximately $540,000.

Research and development expenses decreased by $511,914 to $3,406,750 for the year ended June 30, 2024, from $3,918,664 for the corresponding

period of 2023. The decrease in research and development expense was primarily due to the decreased research and development costs and

the related payroll expense of approximately $250,000 and $260,000, respectively, which is the mixed result of the timing of research

and development activities and the number of active projects and typically vary from period to period.

OTHER INCOME (EXPENSE), NET

- Other income (expense), net increased by $2,305,527, or 155.6%, to $823,784 for the year ended June 30, 2024, from ($1,481,743) for

the corresponding period of 2023. The increase was primarily due to the decreased loss from the agreement in principle to settle a legal

action of $2,400,000, the increased loss from unfavorable changes in foreign currency exchange rates in FTI of approximately $360,000,

which were offset by the increased interest income earned from the money market accounts and certificates of deposit of approximately

$344,000.

YEAR ENDED JUNE 30, 2023, COMPARED TO YEAR ENDED JUNE 30, 2022

NET SALES - Net sales

increased by $21,950,754, or 91.5%, to $45,948,516 for the year ended June 30, 2023 from $23,997,762 for the corresponding period of 2022.

For the year ended June 30, 2023, net sales by geographic regions, consisting of North America, the Caribbean and South America, and Asia

were $45,782,084 (99.6% of net sales), $0 (0.0% of net sales), and $166,432 (0.4% of net sales), respectively. For the year ended June

30, 2022, net sales by geographic regions, consisting of North America, the Caribbean and South America, and Asia were $23,305,366 (97.1%

of net sales), $2,375 (0.0% of net sales), and $690,021 (2.9% of net sales), respectively.

Net sales in North America increased

by $22,476,718, or 96.4%, to $45,782,084 for the year ended June 30, 2023, from $23,305,366 for the corresponding period of 2022. The

increase in net sales in North America was primarily due to the new demand for two newly launched wireless products from a major carrier

customer (approximately $14M newly generated revenue) which did not purchase our products during the fiscal year 2022, and the increased

demand by approximately $11M, or 66%, for our wireless products from the existing major carrier customer compared to the fiscal year 2022,

which were offset by the decreased demands from other customers.

Net sales in the Caribbean and

South America decreased by $2,375, or 100%, to $0 for the year ended June 30, 2023, from $2,375 for the corresponding period of 2022.

Net sales in Asia decreased by $523,589, or 75.9%, to $166,432 for the year ended June 30, 2023, from $690,021 for the corresponding period

of 2022. The decrease in net sales was primarily due to the one-time revenue generated from the material sales by FTI for the fiscal year

2022, which was partially offset by the revenue generated from the demand for one newly launched wireless product by FTI (approximately

$160,000) for the year ended June 30, 2023.

GROSS PROFIT- Gross profit

increased by $3,204,159, or 84.0%, to $7,020,742 for the year ended June 30, 2023, from $3,816,583 for the corresponding period of 2022.

The gross profit in terms of net sales percentage was 15.3% for the year ended June 30, 2023, compared to 15.9% for the corresponding

period of 2022. The increase in gross profit was primarily due to the change in net sales as described above. The decrease in gross profit

in terms of net sales percentage was the mixed results of competitive selling prices and the increase in production costs of the launched

products.

OPERATING EXPENSES - Operating

expenses increased by $578,842, or 6.6%, to $9,370,317 for the year ended June 30, 2023, from $8,791,475 for the corresponding period

of 2022.

Selling, general, and administrative

expenses increased by $942,309 to $5,451,653 for the year ended June 30, 2023, from $4,509,344 for the corresponding period of 2022. The

increase in selling, general, and administrative expenses was primarily due to the increased payroll expenses (excluding payroll expense

for employees involved in research and development) and compensation expenses related to stock options granted for employees of approximately

$230,000 and $165,000, respectively, and the increased legal expenses of $195,000.

Research and development expenses

decreased by $363,467 to $3,918,664 for the year ended June 30, 2023, from $4,282,131 for the corresponding period of 2022. The decrease