Fluence Energy, Inc. (Nasdaq: FLNC) (“Fluence” or the “Company”), a

global market leader delivering intelligent energy storage,

operational services, and asset optimization software, today

announced its results for the three months and full fiscal year

ended September 30, 2024.

Fiscal Year 2024 Financial

Highlights

- Record revenue for fiscal year 2024

of approximately $2.7 billion and revenue for the fourth quarter of

approximately $1.2 billion, representing an increase of

approximately 22% from fiscal year 2023 and an increase of

approximately 82% from the same quarter last year,

respectively.

- GAAP gross profit margin improved

to approximately 12.6% and 12.8% for fiscal year 2024 and the

fourth quarter, respectively, compared to approximately 6.4% and

11.3% for fiscal year 2023 and the same quarter last year,

respectively, reflecting the Company's continued focus on ongoing

profit improvement strategies.

- Net income of approximately $30.4

million and $67.7 million for fiscal year 2024 and the fourth

quarter, respectively, improved from a net loss of approximately

$104.8 million and net income of approximately $4.8 million,

for fiscal year 2023 and the same quarter last year,

respectively.

- Adjusted EBITDA1 of approximately

$78.1 million and $86.9 million for fiscal year 2024 and the fourth

quarter, respectively, improved from approximately negative $61.4

million and $19.8 million for fiscal year 2023 and the same quarter

last year, respectively.

- Quarterly order intake of

approximately $1.2 billion, compared to approximately $737 million

for the same quarter last year.

- Backlog2 increased to approximately

$4.5 billion as of September 30, 2024, compared to

approximately $2.9 billion as of September 30, 2023.

Financial Position

- Total Cash3 of approximately $518.7

million as of September 30, 2024, representing an increase of

approximately $56.0 million from September 30, 2023.

- Net cash provided by operating

activities was approximately $79.7 million, compared to

approximately negative $111.9 million for fiscal year

2023.

- Free cash flow1 was approximately

$71.6 million, compared to approximately negative $114.9

million for fiscal year 2023.

Fiscal Year 2025 Outlook

The Company is initiating fiscal year 2025

guidance as follows:

- Revenue of approximately $3.6

billion to $4.4 billion with a midpoint of $4.0 billion. Presently,

approximately 65% of the midpoint of the Company's revenue guidance

is covered by the Company's current backlog, in line with our

fiscal 2024 revenue coverage at the same time period last

year.

- Adjusted EBITDA4 of approximately

$160 million to $200 million with a midpoint of $180 million.

- Annual recurring revenue ("ARR") of

about $145 million by the end of fiscal year 2025.

The foregoing Fiscal Year 2025 Outlook

statements represent management's current best estimate as of the

date of this release. Actual results may differ materially

depending on a number of factors. Investors are urged to read the

Cautionary Note Regarding Forward-Looking Statements included in

this release. Management does not assume any obligation to update

these estimates.

"Our record financial results for 2024 are a

testament to our team's dedication, operational efficiency, and

commitment to delivering value to our stakeholders as we achieved

our highest ever revenue and profitability, marking a significant

milestone in the Company's growth trajectory. Furthermore, we had

our second consecutive quarter of signing more than $1 billion of

new orders, which brought our backlog to $4.5 billion, underscoring

the market's strong confidence in our energy storage solutions,"

said Julian Nebreda, the Company’s President and Chief Executive

Officer. "As we look forward, we see unprecedented demand for

battery energy storage solutions across the world, driven

principally by the U.S. market. We believe we are well positioned

to continue capturing this market with our best-in-class domestic

content offering which utilizes U.S. manufactured battery

cells."

"We are pleased with our strong fiscal year-end

performance, achieving record revenue growth, robust margin

expansion and free cash flow. We also generated positive net income

for the first time," said Ahmed Pasha, Chief Financial Officer.

"With backlog and development pipeline at record levels, we enter

fiscal 2025 poised for sustained profitable growth."

Share Count

The shares of the Company’s common stock as of

September 30, 2024 are presented below:

|

|

Common Shares |

|

Class B-1 common stock held by AES Grid Stability, LLC |

51,499,195 |

|

Class A common stock held by Siemens AG |

39,738,064 |

|

Class A common stock held by SPT Invest Management, Sarl |

11,761,131 |

|

Class A common stock held by Qatar Holding LLC |

14,668,275 |

|

Class A common stock held by public |

63,254,327 |

|

Total Class A and Class B-1 common stock outstanding |

180,920,992 |

| |

|

Conference Call Information

The Company will conduct a teleconference

starting at 8:30 a.m. EST on Tuesday, November 26, 2024, to discuss

the fourth quarter and full fiscal year 2024 financial results. To

participate, analysts are required to register by clicking Fluence

Energy Inc. Q4 Earnings Call Registration Link. Once registered,

analysts will be issued a unique PIN number and dial-in number.

Analysts are encouraged to register at least 15 minutes before the

scheduled start time.

General audience participants, and non-analysts

are encouraged to join the teleconference in a listen-only mode at:

Fluence Energy Inc. Q4 Listen Only - Webcast, or on

http://fluenceenergy.com by selecting Investors, News & Events,

and Events & Presentations. Supplemental materials that may be

referenced during the teleconference will be available at:

http://fluenceenergy.com, by selecting Investors, News &

Events, and Events & Presentations.

A replay of the conference call will be

available after 1:00 p.m. EST on Tuesday, November 26, 2024. The

replay will be available on the Company’s website at

http://fluenceenergy.com by selecting Investors, News & Events,

and Events & Presentations.

Non-GAAP Financial Measures

We present our operating results in accordance

with accounting principles generally accepted in the U.S. (“GAAP”).

We believe certain financial measures, such as Adjusted EBITDA,

Adjusted Gross Profit, Adjusted Gross Profit Margin, and Free Cash

Flow, which are non-GAAP measures, provide users of our financial

statements with supplemental information that may be useful in

evaluating our operating performance. We believe that such non-GAAP

measures, when read in conjunction with our operating results

presented under GAAP, can be used to better assess our performance

from period to period and relative to performance of other

companies in our industry, without regard to financing methods,

historical cost basis or capital structure. Such non-GAAP measures

should be considered as a supplement to, and not as a substitute

for, financial measures prepared in accordance with GAAP. These

measures have limitations as analytical tools, including that other

companies, including companies in our industry, may calculate these

measures differently, reducing their usefulness as comparative

measures.

Adjusted EBITDA is calculated from the

consolidated statements of operations using net income (loss)

adjusted for (i) interest income, net, (ii) income taxes,

(iii) depreciation and amortization, (iv) stock-based

compensation, and (v) other non-recurring income or expenses.

Adjusted EBITDA also includes amounts impacting net income related

to estimated payments due to related parties pursuant to the Tax

Receivable Agreement, dated October 27, 2021, by and among Fluence

Energy, Inc., Fluence Energy, LLC, Siemens Industry, Inc. and AES

Grid Stability, LLC (the “Tax Receivable Agreement”).

Adjusted Gross Profit is calculated using gross

profit, adjusted to exclude (i) stock-based compensation expenses,

(ii) amortization, and (iii) other non-recurring income or

expenses. Adjusted Gross Profit Margin is calculated using Adjusted

Gross Profit divided by total revenue.

Free Cash Flow is calculated from the

consolidated statements of cash flows and is defined as net cash

provided by (used in) operating activities, less purchase of

property and equipment made in the period. We expect our Free Cash

Flow to fluctuate in future periods as we invest in our business to

support our plans for growth. Limitations on the use of Free Cash

Flow include (i) it should not be inferred that the entire Free

Cash Flow amount is available for discretionary expenditures (for

example, cash is still required to satisfy other working capital

needs, including short-term investment policy, restricted cash, and

intangible assets); (ii) Free Cash Flow has limitations as an

analytical tool, and it should not be considered in isolation or as

a substitute for analysis of other GAAP financial measures, such as

net cash provided by operating activities; and (iii) this metric

does not reflect our future contractual commitments.

Please refer to the reconciliations of the

non-GAAP financial measures to their most directly comparable GAAP

financial measures included in this press release and the

accompanying tables contained at the end of this release.

The Company is not able to provide a

quantitative reconciliation of full fiscal year 2025 Adjusted

EBITDA to GAAP Net Income (Loss) on a forward-looking basis within

this press release because of the uncertainty around certain items

that may impact Adjusted EBITDA, including stock compensation and

restructuring expenses, that are not within our control or cannot

be reasonably predicted without unreasonable effort.

About Fluence

Fluence Energy, Inc. (Nasdaq: FLNC) is a global

market leader delivering intelligent energy storage and

optimization software for renewables and storage. The Company's

solutions and operational services are helping to create a more

resilient grid and unlock the full potential of renewable

portfolios. With gigawatts of projects successfully contracted,

deployed and under management across nearly 50 markets, the Company

is transforming the way we power our world for a more sustainable

future.

For more information, visit our website, or

follow us on LinkedIn or X. To stay up to date on the latest

industry insights, sign up for Fluence's Full Potential Blog.

Cautionary Note Regarding Forward-Looking

Statements

The statements contained in this press release

and statements that are made on our earnings call that are not

historical facts are forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, Section

21E of the Securities Exchange Act of 1934, as amended, and the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, without limitation, statements

set forth above under “Fiscal Year 2025 Outlook,” and other

statements regarding the Company's future financial and operational

performance, future market and industry growth and related

opportunities for the Company, anticipated Company growth and

business strategy, including future incremental working capital and

capital opportunities, liquidity and access to capital and cash

flows, demand for electricity and impact to energy storage, demand

for the Company's energy storage solutions, services, and digital

applications offerings, our positioning to capture market share

with domestic content offering and future offerings, expected

impact and benefits from the Inflation Reduction Act of 2022 and

U.S. Treasury domestic content guidelines on us and on our

customers, anticipated timeline of U.S. battery module production

and timing of our domestic content offering, expectations relating

to our contracting manufacturing capacity, potential impact to

tariffs, related policies, and regulations from the change in

political administration, new products and solutions and product

innovation, relationships with new and existing customers and

suppliers, expectations relating to backlog, pipeline, and

contracted backlog, future revenue recognition, future results of

operations, future capital expenditures and debt service

obligations, and projected costs, beliefs, assumptions, prospects,

plans and objectives of management. Such statements can be

identified by the fact that they do not relate strictly to

historical or current facts. When used in this press release, words

such as “may,” “possible,” “will,” “should,” “expects,” “plans,”

“anticipates,” “could,” “intends,” “targets,” “projects,”

“contemplates,” "commits", “believes,” “estimates,” “predicts,”

“potential” or “continue” or the negative of these terms or other

similar expressions and variations thereof and similar words and

expressions are intended to identify such forward-looking

statements, but the absence of these words does not mean that a

statement is not forward-looking.

The forward-looking statements contained in this

press release are based on our current expectations and beliefs

concerning future developments, as well as a number of assumptions

concerning future events, and their potential effects on our

business. These forward-looking statements are not guarantees of

performance, and there can be no assurance that future developments

affecting our business will be those that we have anticipated.

These forward-looking statements involve a number of risks,

uncertainties (some of which are beyond our control) or other

assumptions that may cause actual results or performance to be

materially different from those expressed or implied by these

forward-looking statements, which include, but are not limited to,

our relatively limited operating and revenue history as an

independent entity and the nascent clean energy industry;

anticipated increasing expenses in the future and our ability to

maintain prolonged profitability; fluctuations of our order intake

and results of operations across fiscal periods; potential

difficulties in maintaining manufacturing capacity and establishing

expected mass manufacturing capacity in the future; risks relating

to delays, disruptions, and quality control problems in our

manufacturing operations; risks relating to quality and quantity of

components provided by suppliers; risks relating to our status as a

relatively low-volume purchaser as well as from supplier

concentration and limited supplier capacity; risks relating to

operating as a global company with a global supply chain; changes

in the global trade environment; changes in the cost and

availability of raw materials and underlying components; failure by

manufacturers, vendors, and suppliers to use ethical business

practices and comply with applicable laws and regulations;

significant reduction in pricing or order volume or loss of one or

more of our significant customers or their inability to perform

under their contracts; risks relating to competition for our

offerings and our ability to attract new customers and retain

existing customers; ability to maintain and enhance our reputation

and brand recognition; ability to effectively manage our recent and

future growth and expansion of our business and operations; our

growth depends in part on the success of our relationships with

third parties; ability to attract and retain highly qualified

personnel; risks associated with engineering and construction,

utility interconnection, commissioning and installation of our

energy storage solutions and products, cost overruns, and delays;

risks relating to lengthy sales and installation cycle for our

energy storage solutions; risks related to defects, errors,

vulnerabilities and/or bugs in our products and technology; risks

relating to estimation uncertainty related to our product

warranties; fluctuations in currency exchange rates; risks related

to our current and planned foreign operations; amounts included in

our pipeline and contracted backlog may not result in actual

revenue or translate into profits; risks related to acquisitions we

have made or that we may pursue; events and incidents relating to

storage, delivery, installation, operation, maintenance and

shutdowns of our products; risks relating to our impacts to our

customer relationships due to events and incidents during the

project lifecycle of an energy storage solution; actual or

threatened health epidemics, pandemics or similar public health

threats; ability to obtain financial assurances for our projects;

risks relating to whether renewable energy technologies are

suitable for widespread adoption or if sufficient demand for our

offerings do not develop or takes longer to develop than we

anticipate; estimates on size of our total addressable market;

risks relating to the cost of electricity available from

alternative sources; macroeconomic uncertainty and market

conditions; risk relating to interest rates or a reduction in the

availability of tax equity or project debt capital in the global

financial markets and corresponding effects on customers’ ability

to finance energy storage systems and demand for our energy storage

solutions; decline in public acceptance of renewable energy, or

delay, prevent, or increase in the cost of customer projects;

severe weather events; increased attention to ESG matters;

restrictions set forth in our current credit agreement and future

debt agreements; uncertain ability to raise additional capital to

execute on business opportunities; ability to obtain, maintain and

enforce proper protection for our intellectual property, including

our technology; threat of lawsuits by third parties alleging

intellectual property violations; adequate protection for our

trademarks and trade names; ability to enforce our intellectual

property rights; risks relating to our patent portfolio; ability to

effectively protect data integrity of our technology infrastructure

and other business systems; use of open-source software; failure to

comply with third party license or technology agreements; inability

to license rights to use technologies on reasonable terms; risks

relating to compromises, interruptions, or shutdowns of our

systems; barriers arising from current electric utility industry

policies and regulations and any subsequent changes; reduction,

elimination, or expiration of government incentives or regulations

regarding renewable energy; potential changes in tax laws or

regulations; risks relating to environmental, health, and safety

laws and potential obligations, liabilities and costs thereunder;

failure to comply with data privacy and data security laws,

regulations and industry standards; risks relating to potential

future legal proceedings, regulatory disputes, and governmental

inquiries; risks related to ownership of our Class A common stock;

risks related to us being a “controlled company” within the meaning

of the NASDAQ rules; risks relating to the terms of our amended and

restated certificate of incorporation and amended and restated

bylaws; risks relating to our relationship with our Founders and

Continuing Equity Owners; risks relating to conflicts of interest

by our officers and directors due to positions with Continuing

Equity Owners; risks related to short-seller activists; we depend

on distributions from Fluence Energy, LLC to pay our taxes and

expenses and Fluence Energy, LLC’s ability to make such

distributions may be limited or restricted in certain scenarios;

risks arising out of the Tax Receivable Agreement; unanticipated

changes in effective tax rates or adverse outcomes resulting from

examination of tax returns; risks relating to improper and

ineffective internal control over reporting to comply with

Sarbanes-Oxley Act; risks relating to changes in accounting

principles or their applicability to us; risks relating to

estimates or judgments relating to our critical accounting

policies; and other factors set forth under Item 1A.“Risk Factors”

in our Annual Report on Form 10-K for the fiscal year ended

September 30, 2024, to be filed with the Securities and Exchange

Commission (“SEC”), and in other filings we make with the SEC from

time to time. New risks and uncertainties emerge from time to time

and it is not possible for us to predict all such risk factors, nor

can we assess the effect of all such risk factors on our business

or the extent to which any factor or combination of factors may

cause actual results to differ materially from those contained in

any forward-looking statements. Should one or more of these risks

or uncertainties materialize, or should any of the assumptions

prove incorrect, actual results may vary in material respects from

those projected in these forward-looking statements. You are

cautioned not to place undue reliance on any forward-looking

statements made in this press release. Each forward-looking

statement speaks only as of the date of the particular statement,

and we undertake no obligation to publicly update or revise any

forward-looking statements to reflect events or circumstances that

occur, or which we become aware of, after the date hereof, except

as otherwise may be required by law.

|

|

|

|

FLUENCE ENERGY, INC. CONSOLIDATED BALANCE

SHEETS (U.S. Dollars in Thousands, except share

and per share amounts) |

|

|

|

|

|

September 30, |

|

|

2024 |

|

2023 |

|

Assets |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

448,685 |

|

|

$ |

345,896 |

|

|

Restricted cash |

|

46,089 |

|

|

|

106,835 |

|

|

Trade receivables, net |

|

216,458 |

|

|

|

103,397 |

|

|

Unbilled receivables |

|

172,115 |

|

|

|

192,064 |

|

|

Receivables from related parties |

|

362,523 |

|

|

|

58,514 |

|

|

Advances to suppliers |

|

174,532 |

|

|

|

107,947 |

|

|

Inventory, net |

|

182,601 |

|

|

|

224,903 |

|

|

Current portion of notes receivable - pledged as collateral |

|

30,921 |

|

|

|

24,330 |

|

|

Other current assets |

|

46,519 |

|

|

|

31,074 |

|

|

Total current assets |

|

1,680,443 |

|

|

|

1,194,960 |

|

|

Non-current assets: |

|

|

|

|

Property and equipment, net |

|

15,350 |

|

|

|

12,771 |

|

|

Intangible assets, net |

|

60,002 |

|

|

|

55,752 |

|

|

Goodwill |

|

27,482 |

|

|

|

26,020 |

|

|

Deferred income tax asset, net |

|

8,880 |

|

|

|

86 |

|

|

Note receivable - pledged as collateral |

|

— |

|

|

|

30,921 |

|

|

Other non-current assets |

|

110,031 |

|

|

|

31,639 |

|

|

Total non-current assets |

|

221,745 |

|

|

|

157,189 |

|

|

Total assets |

$ |

1,902,188 |

|

|

$ |

1,352,149 |

|

|

Liabilities, and stockholders’ equity |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

$ |

436,744 |

|

|

$ |

65,376 |

|

|

Deferred revenue |

|

274,499 |

|

|

|

273,164 |

|

|

Deferred revenue with related parties |

|

38,162 |

|

|

|

110,274 |

|

|

Current portion of borrowings against note receivable - pledged as

collateral |

|

30,360 |

|

|

|

22,539 |

|

|

Personnel related liabilities |

|

58,584 |

|

|

|

52,174 |

|

|

Accruals and provisions |

|

338,311 |

|

|

|

175,960 |

|

|

Taxes payable |

|

57,929 |

|

|

|

29,465 |

|

|

Other current liabilities |

|

24,246 |

|

|

|

16,711 |

|

|

Total current liabilities |

|

1,258,835 |

|

|

|

745,663 |

|

|

Non-current liabilities: |

|

|

|

|

Deferred income tax liability |

|

7,114 |

|

|

|

4,794 |

|

|

Borrowings against note receivable - pledged as collateral |

|

— |

|

|

|

28,024 |

|

|

Other non-current liabilities |

|

29,100 |

|

|

|

17,338 |

|

|

Total non-current liabilities |

|

36,214 |

|

|

|

50,156 |

|

|

Total liabilities |

|

1,295,049 |

|

|

|

795,819 |

|

|

Commitments and Contingencies (Note 14) |

|

|

|

|

Stockholders’ equity: |

|

|

|

|

Preferred stock, $0.00001 per share, 10,000,000 share authorized;

no shares issued and outstanding as of September 30, 2024 and

2023 |

|

— |

|

|

|

— |

|

|

Class A common stock, $0.00001 par value per share, 1,200,000,000

shares authorized; 130,207,845 shares issued and 129,421,797 shares

outstanding as of September 30, 2024; 119,593,409 shares

issued and 118,903,435 shares outstanding as of September 30,

2023 |

|

1 |

|

|

|

1 |

|

|

Class B-1 common stock, $0.00001 par value per share, 134,325,805

shares authorized; 51,499,195 shares issued and outstanding as of

September 30, 2024; $0.00001 par value per share, 200,000,000

shares authorized; 58,586,695 shares issued and outstanding as of

September 30, 2023 |

|

— |

|

|

|

— |

|

|

Class B-2 common stock, $0.00001 par value per share, 200,000,000

shares authorized; no shares issued and outstanding as of

September 30, 2024 and 2023 |

|

— |

|

|

|

— |

|

|

Treasury stock, at cost |

|

(9,460 |

) |

|

|

(7,797 |

) |

|

Additional paid-in capital |

|

634,851 |

|

|

|

581,104 |

|

|

Accumulated other comprehensive (loss) income |

|

(1,840 |

) |

|

|

3,202 |

|

|

Accumulated deficit |

|

(151,448 |

) |

|

|

(174,164 |

) |

|

Total stockholders’ equity attributable to Fluence Energy,

Inc. |

|

472,104 |

|

|

|

402,346 |

|

|

Non-controlling interest |

|

135,035 |

|

|

|

153,984 |

|

|

Total stockholders’ equity |

|

607,139 |

|

|

|

556,330 |

|

|

Total liabilities, stockholders’ equity |

$ |

1,902,188 |

|

|

$ |

1,352,149 |

|

| |

|

|

|

|

|

|

|

|

FLUENCE ENERGY, INC. CONSOLIDATED

STATEMENTS OF OPERATIONS (U.S. Dollars in

Thousands, except share and per share amounts) |

|

|

|

|

|

Fiscal Year Ended September 30, |

|

|

2024 |

|

2023 |

|

2022 |

|

Revenue |

$ |

1,601,563 |

|

|

$ |

1,564,169 |

|

|

$ |

552,271 |

|

|

Revenue from related parties |

|

1,096,999 |

|

|

|

653,809 |

|

|

|

646,332 |

|

|

Total revenue |

|

2,698,562 |

|

|

|

2,217,978 |

|

|

|

1,198,603 |

|

|

Cost of goods and services |

|

2,357,482 |

|

|

|

2,077,023 |

|

|

|

1,260,957 |

|

|

Gross profit (loss) |

|

341,080 |

|

|

|

140,955 |

|

|

|

(62,354 |

) |

|

Operating expenses: |

|

|

|

|

|

|

Research and development |

|

66,195 |

|

|

|

66,307 |

|

|

|

60,142 |

|

|

Sales and marketing |

|

63,842 |

|

|

|

41,114 |

|

|

|

37,207 |

|

|

General and administrative |

|

172,996 |

|

|

|

136,308 |

|

|

|

116,710 |

|

|

Depreciation and amortization |

|

11,426 |

|

|

|

9,835 |

|

|

|

7,108 |

|

|

Interest income, net |

|

(5,676 |

) |

|

|

(5,388 |

) |

|

|

(326 |

) |

|

Other (income) expense, net |

|

(7,276 |

) |

|

|

(6,952 |

) |

|

|

4,625 |

|

|

Income (loss) before income taxes |

|

39,573 |

|

|

|

(100,269 |

) |

|

|

(287,820 |

) |

|

Income tax expense |

|

9,206 |

|

|

|

4,549 |

|

|

|

1,357 |

|

|

Net income (loss) |

$ |

30,367 |

|

|

$ |

(104,818 |

) |

|

$ |

(289,177 |

) |

|

Net income (loss) attributable to non-controlling interest |

$ |

7,651 |

|

|

$ |

(35,198 |

) |

|

$ |

(184,692 |

) |

|

Net income (loss) attributable to Fluence Energy, Inc. |

$ |

22,716 |

|

|

$ |

(69,620 |

) |

|

$ |

(104,485 |

) |

|

|

|

|

|

|

|

|

Weighted average number of Class A common shares outstanding |

|

|

|

|

|

|

Basic |

|

126,180,011 |

|

|

|

116,448,602 |

|

|

|

69,714,054 |

|

|

Diluted |

|

184,034,832 |

|

|

|

116,448,602 |

|

|

|

69,714,054 |

|

|

Income (loss) per share of Class A common stock |

|

|

|

|

|

|

Basic |

$ |

0.18 |

|

|

$ |

(0.60 |

) |

|

$ |

(1.50 |

) |

|

Diluted |

$ |

0.13 |

|

|

$ |

(0.60 |

) |

|

$ |

(1.50 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

FLUENCE ENERGY, INC. CONSOLIDATED

STATEMENTS OF OPERATIONS (U.S. Dollars in

Thousands, except share and per share amounts)

(UNAUDITED) |

|

|

|

|

|

Three Months Ended September 30 |

|

|

2024 |

|

2023 |

|

2022 |

|

Revenue |

$ |

745,438 |

|

|

$ |

521,802 |

|

|

$ |

293,420 |

|

|

Revenue from related parties |

|

482,710 |

|

|

|

151,180 |

|

|

|

148,562 |

|

|

Total revenue |

|

1,228,148 |

|

|

|

672,982 |

|

|

|

441,982 |

|

|

Cost of goods and services |

|

1,070,679 |

|

|

|

596,699 |

|

|

|

431,242 |

|

|

Gross profit |

|

157,469 |

|

|

|

76,283 |

|

|

|

10,740 |

|

|

Operating expenses: |

|

|

|

|

|

|

Research and development |

|

18,352 |

|

|

|

14,676 |

|

|

|

17,915 |

|

|

Sales and marketing |

|

22,571 |

|

|

|

11,815 |

|

|

|

9,559 |

|

|

General and administrative |

|

46,094 |

|

|

|

35,118 |

|

|

|

32,938 |

|

|

Depreciation and amortization |

|

2,837 |

|

|

|

2,475 |

|

|

|

2,216 |

|

|

Interest income, net |

|

(1,122 |

) |

|

|

(1,137 |

) |

|

|

(1,175 |

) |

|

Other (income) expense, net |

|

(6,865 |

) |

|

|

1,912 |

|

|

|

3,622 |

|

|

Income (loss) before income taxes |

|

75,602 |

|

|

|

11,424 |

|

|

|

(54,335 |

) |

|

Income tax expense |

|

7,878 |

|

|

|

6,607 |

|

|

|

1,850 |

|

|

Net income (loss) |

$ |

67,724 |

|

|

$ |

4,817 |

|

|

$ |

(56,185 |

) |

|

Net income (loss) attributable to non-controlling interest |

|

19,881 |

|

|

|

1,588 |

|

|

|

(19,036 |

) |

|

Net income (loss) attributable to Fluence Energy, Inc. |

$ |

47,843 |

|

|

$ |

3,229 |

|

|

$ |

(37,149 |

) |

|

|

|

|

|

|

|

|

Weighted average number of Class A common shares outstanding |

|

|

|

|

|

|

Basic |

|

128,879,394 |

|

|

|

118,599,185 |

|

|

|

114,452,470 |

|

|

Diluted |

|

184,492,220 |

|

|

|

183,693,827 |

|

|

|

114,452,470 |

|

|

Income (loss) per share of Class A common stock |

|

|

|

|

|

|

Basic |

$ |

0.37 |

|

|

$ |

0.03 |

|

|

$ |

(0.32 |

) |

|

Diluted |

$ |

0.34 |

|

|

$ |

0.02 |

|

|

$ |

(0.32 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FLUENCE ENERGY, INC. CONSOLIDATED

STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (U.S.

Dollars in Thousands, except share and per share

amounts) |

|

|

|

|

|

Fiscal Year Ended September 30, |

|

|

2024 |

|

2023 |

|

2022 |

|

Net income (loss) |

$ |

30,367 |

|

|

$ |

(104,818 |

) |

|

$ |

(289,177 |

) |

|

|

|

|

|

|

|

|

(Loss) gain on foreign currency translation, net of tax |

|

(598 |

) |

|

|

586 |

|

|

|

5,091 |

|

|

Loss on cash flow hedges, net of tax |

|

(6,276 |

) |

|

|

— |

|

|

|

— |

|

|

Actuarial (loss) gain on pension liabilities, net of tax |

|

(211 |

) |

|

|

15 |

|

|

|

251 |

|

|

Total other comprehensive (loss) income |

|

(7,085 |

) |

|

|

601 |

|

|

|

5,342 |

|

|

Total comprehensive income (loss) |

$ |

23,282 |

|

|

$ |

(104,217 |

) |

|

$ |

(283,835 |

) |

|

Comprehensive income (loss) attributable to non-controlling

interest |

$ |

5,608 |

|

|

$ |

(35,015 |

) |

|

$ |

(182,345 |

) |

|

Total comprehensive income (loss) attributable to Fluence Energy,

Inc. |

$ |

17,674 |

|

|

$ |

(69,202 |

) |

|

$ |

(101,490 |

) |

| |

Three Months Ended September

30, |

| |

2024 |

|

2023 |

|

2022 |

|

Net income (loss) |

$ |

67,724 |

|

|

$ |

4,817 |

|

|

$ |

(56,185 |

) |

| |

|

|

|

|

|

|

|

| (Loss) gain

on foreign currency translation, net of tax |

(170 |

) |

|

|

562 |

|

|

3,181 |

|

| Loss on cash

flow hedges, net of tax |

(4,393 |

) |

|

|

— |

|

|

— |

|

| Actuarial

(loss) gain on pension liabilities, net of tax |

(211 |

) |

|

|

15 |

|

|

251 |

|

| Total other

comprehensive (loss) income |

(4,774 |

) |

|

|

577 |

|

|

3,432 |

|

| Total

comprehensive income (loss) |

$ |

62,950 |

|

|

$ |

5,394 |

|

|

$ |

(52,753 |

) |

|

Comprehensive income (loss) attributable to non-controlling

interest |

$ |

18,519 |

|

|

$ |

1,778 |

|

|

$ |

(17,875 |

) |

| Total

comprehensive income (loss) attributable to Fluence Energy,

Inc. |

$ |

44,431 |

|

|

$ |

3,616 |

|

|

$ |

(34,878 |

) |

| |

|

|

|

|

|

|

|

|

FLUENCE ENERGY, INC. CONSOLIDATED

STATEMENTS OF CASH FLOWS (U.S. Dollars in

Thousands) |

|

|

|

|

|

Fiscal Year Ended September 30, |

|

|

2024 |

|

2023 |

|

2022 |

|

Operating activities |

|

|

|

|

|

|

Net income (loss) |

$ |

30,367 |

|

|

$ |

(104,818 |

) |

|

$ |

(289,177 |

) |

|

Adjustments to reconcile net income (loss) to net cash provided by

(used in) operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

14,482 |

|

|

|

10,665 |

|

|

|

7,108 |

|

|

Amortization of debt issuance costs |

|

3,091 |

|

|

|

914 |

|

|

|

778 |

|

|

Inventory provision (recovery) |

|

23,972 |

|

|

|

(1,029 |

) |

|

|

2,529 |

|

|

Stock-based compensation |

|

23,855 |

|

|

|

26,920 |

|

|

|

44,131 |

|

|

Deferred income taxes |

|

(6,719 |

) |

|

|

2,542 |

|

|

|

516 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Trade receivables |

|

(114,577 |

) |

|

|

(13,397 |

) |

|

|

(29,161 |

) |

|

Unbilled receivables |

|

24,747 |

|

|

|

(50,503 |

) |

|

|

(36,550 |

) |

|

Receivables from related parties |

|

(303,963 |

) |

|

|

53,611 |

|

|

|

(78,666 |

) |

|

Advances to suppliers |

|

(64,258 |

) |

|

|

(36,490 |

) |

|

|

(45,024 |

) |

|

Inventory |

|

21,731 |

|

|

|

432,767 |

|

|

|

(265,477 |

) |

|

Other current assets |

|

(10,986 |

) |

|

|

(36,828 |

) |

|

|

1,364 |

|

|

Other non-current assets |

|

(28,100 |

) |

|

|

(16,632 |

) |

|

|

(35,208 |

) |

|

Accounts payable |

|

370,124 |

|

|

|

(242,268 |

) |

|

|

150,507 |

|

|

Deferred revenue with related parties |

|

(72,201 |

) |

|

|

(191,431 |

) |

|

|

80,575 |

|

|

Deferred revenue |

|

(9,796 |

) |

|

|

(6,934 |

) |

|

|

201,028 |

|

|

Current accruals and provisions |

|

160,206 |

|

|

|

(12,360 |

) |

|

|

(2,522 |

) |

|

Taxes payable |

|

22,799 |

|

|

|

15,753 |

|

|

|

(1,779 |

) |

|

Other current liabilities |

|

18,185 |

|

|

|

39,467 |

|

|

|

6,362 |

|

|

Other non-current liabilities |

|

(23,274 |

) |

|

|

18,124 |

|

|

|

(3,719 |

) |

|

Insurance proceeds received |

|

— |

|

|

|

— |

|

|

|

10,000 |

|

|

Net cash provided by (used in) operating activities |

|

79,685 |

|

|

|

(111,927 |

) |

|

|

(282,385 |

) |

|

Investing activities |

|

|

|

|

|

|

Purchase of equity securities |

|

— |

|

|

|

— |

|

|

|

(1,124 |

) |

|

Proceeds from maturities of short-term investments |

|

— |

|

|

|

111,674 |

|

|

|

— |

|

|

Purchases of short-term investments |

|

— |

|

|

|

— |

|

|

|

(110,144 |

) |

|

Payments for purchase of investment in joint venture |

|

— |

|

|

|

(5,013 |

) |

|

|

— |

|

|

Capital expenditures on software |

|

(10,860 |

) |

|

|

(9,235 |

) |

|

|

— |

|

|

Payments for acquisition of businesses, net of cash acquired |

|

— |

|

|

|

— |

|

|

|

(29,215 |

) |

|

Purchase of property and equipment |

|

(8,115 |

) |

|

|

(2,989 |

) |

|

|

(7,934 |

) |

|

Net cash (used in) provided by investing activities |

|

(18,975 |

) |

|

|

94,437 |

|

|

|

(148,417 |

) |

|

Financing activities |

|

|

|

|

|

|

Repayment of promissory notes – related parties |

|

— |

|

|

|

— |

|

|

|

(50,000 |

) |

|

Repayment of line of credit |

|

— |

|

|

|

— |

|

|

|

(50,000 |

) |

|

Proceeds from borrowing against note receivable - pledged as

collateral |

|

— |

|

|

|

48,176 |

|

|

|

— |

|

|

Class A common stock withheld related to settlement of employee

taxes for stock-based compensation awards |

|

(1,663 |

) |

|

|

(2,784 |

) |

|

|

(5,013 |

) |

|

Proceeds from exercise of stock options |

|

5,335 |

|

|

|

7,203 |

|

|

|

3,103 |

|

|

Payment of transaction costs related to issuance of Class B

membership units |

|

— |

|

|

|

— |

|

|

|

(6,320 |

) |

|

Payments of debt issuance costs |

|

(8,456 |

) |

|

|

— |

|

|

|

(3,375 |

) |

|

Proceeds from issuance of Class A common stock sold in an IPO, net

of underwriting discounts and commissions |

|

— |

|

|

|

— |

|

|

|

935,761 |

|

|

Payments of deferred equity issuance cost |

|

— |

|

|

|

— |

|

|

|

(7,103 |

) |

|

Payments for acquisitions |

|

(3,892 |

) |

|

|

— |

|

|

|

— |

|

|

Net cash (used in) provided by financing activities |

|

(8,676 |

) |

|

|

52,595 |

|

|

|

817,053 |

|

|

Effect of exchange rate changes on cash and cash equivalents |

|

3,941 |

|

|

|

(2,095 |

) |

|

|

5,401 |

|

|

Net increase (decrease) in cash and cash equivalents |

|

55,975 |

|

|

|

33,010 |

|

|

|

391,652 |

|

|

Cash, cash equivalents, and restricted cash as of the beginning of

the period |

|

462,731 |

|

|

|

429,721 |

|

|

|

38,069 |

|

|

Cash, cash equivalents, and restricted cash as of the end of the

period |

$ |

518,706 |

|

|

$ |

462,731 |

|

|

$ |

429,721 |

|

|

Supplemental disclosure of cash flow

information |

|

|

|

|

|

|

Interest paid |

$ |

3,022 |

|

|

$ |

2,336 |

|

|

$ |

1,127 |

|

|

Cash paid for income taxes |

$ |

2,661 |

|

|

$ |

1,240 |

|

|

$ |

2,068 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reclassifications

Certain prior period amounts have been

reclassified to conform to the current period presentation.

Accounts payable with related parties of

$2.5 million and Accruals with related parties of

$3.7 million as of September 30, 2023, were reclassified

from Deferred revenue and payables with related parties to Accounts

payable and Accruals and provisions, respectively, on the

consolidated balance sheet. The reclassification had no impact on

the total current liabilities for any period presented.

Corresponding reclassifications were also reflected on the

consolidated statement of cash flows for the fiscal year ended

September 30, 2023 and 2022. The reclassifications had no

impact on cash provided by (used in) operations for the period

presented.

Provision on loss contracts, net of

$6.1 million and $30.0 million for the fiscal years ended

September 30, 2023 and 2022, respectively, was reclassified to

current accruals and provisions on the consolidated statement of

cash flows. The reclassification had no impact on cash provided by

(used in) operations for the period presented.

|

FLUENCE ENERGY, INC. KEY OPERATING METRICS

(UNAUDITED) |

|

|

The following tables present our key operating

metrics for the fiscal years ended September 30, 2024 and

2023. The tables below present the metrics in either Gigawatts (GW)

or Gigawatt hours (GWh). Our key operating metrics focus on project

milestones to measure our performance and designate each project as

either “deployed”, “assets under management”, “contracted backlog”,

or “pipeline”.

|

|

Fiscal Year Ended September 30, |

|

|

|

|

|

|

|

|

|

|

2024 |

|

2023 |

|

Change |

|

Change % |

|

Energy Storage Products |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deployed (GW) |

|

5.0 |

|

|

|

3.0 |

|

|

|

2.0 |

|

|

|

66.7 |

% |

| Deployed (GWh) |

|

12.8 |

|

|

|

7.2 |

|

|

|

5.6 |

|

|

|

77.8 |

% |

| Contracted backlog (GW) |

|

7.5 |

|

|

|

4.6 |

|

|

|

2.9 |

|

|

|

63.0 |

% |

| Pipeline (GW) |

|

25.8 |

|

|

|

12.2 |

|

|

|

13.6 |

|

|

|

111.5 |

% |

|

Pipeline (GWh) |

|

80.5 |

|

|

|

34.2 |

|

|

|

46.3 |

|

|

|

135.4 |

% |

|

|

Fiscal Year Ended September 30, |

|

|

|

|

|

|

|

|

|

(amounts in GW) |

2024 |

|

2023 |

|

Change |

|

Change % |

|

Service Contracts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Assets under management |

|

4.3 |

|

|

|

2.8 |

|

|

|

1.5 |

|

|

|

53.6 |

% |

| Contracted backlog |

|

4.1 |

|

|

|

2.9 |

|

|

|

1.2 |

|

|

|

41.4 |

% |

|

Pipeline |

|

25.6 |

|

|

|

13.7 |

|

|

|

11.9 |

|

|

|

86.9 |

% |

|

|

Fiscal Year Ended September 30, |

|

|

|

|

|

|

|

|

|

(amounts in GW) |

2024 |

|

2023 |

|

Change |

|

Change % |

|

Digital Contracts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Assets under management |

|

18.3 |

|

|

|

15.5 |

|

|

|

2.8 |

|

|

|

18.1 |

% |

| Contracted backlog |

|

10.6 |

|

|

|

6.8 |

|

|

|

3.8 |

|

|

|

55.9 |

% |

|

Pipeline |

|

64.5 |

|

|

|

24.4 |

|

|

|

40.1 |

|

|

|

164.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following table presents our order intake for

the three months and fiscal years ended September 30, 2024 and

2023. The table is presented in Gigawatts (GW):

|

|

|

Three Months Ended September |

|

|

|

|

|

|

|

|

|

Fiscal Year Ended September |

|

|

|

|

|

|

|

|

| (amounts in GW) |

|

2024 |

|

2023 |

|

Change |

|

Change % |

|

2024 |

|

2023 |

|

Change |

|

Change % |

|

Energy Storage Products |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contracted |

|

|

1.4 |

|

|

|

0.6 |

|

|

|

0.8 |

|

|

|

133 |

% |

|

|

5.2 |

|

|

|

2.2 |

|

|

|

3.0 |

|

|

|

136.4 |

% |

|

Service Contracts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contracted |

|

|

1.0 |

|

|

|

0.6 |

|

|

|

0.4 |

|

|

|

67 |

% |

|

|

3.0 |

|

|

|

1.8 |

|

|

|

1.2 |

|

|

|

66.7 |

% |

|

Digital Contracts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contracted |

|

|

4.5 |

|

|

|

1.8 |

|

|

|

2.7 |

|

|

|

150 |

% |

|

|

8.6 |

|

|

|

6.2 |

|

|

|

2.4 |

|

|

|

38.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deployed

Deployed represents cumulative energy storage

products and solutions that have achieved substantial completion

and are not decommissioned. Deployed is monitored by management to

measure our performance towards achieving project milestones.

Assets Under Management

Assets under management for service contracts

represents our long-term service contracts with customers

associated with our completed energy storage system products and

solutions. We start providing maintenance, monitoring, or other

operational services after the storage product projects are

completed. In some cases, services may be commenced for energy

storage solutions prior to achievement of substantial completion.

This is not limited to energy storage solutions delivered by

Fluence. Assets under management for digital software represents

contracts signed and active (post go live). Assets under management

serves as an indicator of expected revenue from our customers and

assists management in forecasting our expected financial

performance.

Contracted Backlog

For our energy storage products and solutions

contracts, contracted backlog includes signed customer orders or

contracts under execution prior to when substantial completion is

achieved. For service contracts, contracted backlog includes signed

service agreements associated with our storage product projects

that have not been completed and the associated service has not

started. For digital applications contracts, contracted backlog

includes signed agreements where the associated subscription has

not started.

We cannot guarantee that our contracted backlog

will result in actual revenue in the originally anticipated period

or at all. Contracted backlog may not generate margins equal to our

historical operating results. We have only recently begun to track

our contracted backlog on a consistent basis as performance

measures, and as a result, we do not have significant experience in

determining the level of realization that we will achieve on these

contracts. Our customers may experience project delays or cancel

orders as a result of external market factors and economic or other

factors beyond our control. If our contracted backlog fails to

result in revenue as anticipated or in a timely manner, we could

experience a reduction in revenue, profitability, and

liquidity.

Contracted/Order Intake

Contracted, which we use interchangeably with

“order intake”, represents new energy storage product and solutions

contracts, new service contracts and new digital contracts signed

during each period presented. We define “Contracted” as a firm and

binding purchase order, letter of award, change order or other

signed contract (in each case an “Order”) from the customer that is

received and accepted by Fluence. Our order intake is intended to

convey the dollar amount and gigawatts (operating measure)

contracted in the period presented. We believe that order intake

provides useful information to investors and management because the

order intake provides visibility into future revenue and enables

evaluation of the effectiveness of the Company’s sales activity and

the attractiveness of its offerings in the market.

Pipeline

Pipeline represents our uncontracted, potential

revenue from energy storage products and solutions, service, and

digital software contracts, which have a reasonable likelihood of

contract execution within 24 months. Pipeline is an internal

management metric that we construct from market information

reported by our global sales force. Pipeline is monitored by

management to understand the anticipated growth of our Company and

our estimated future revenue related to customer contracts for our

battery-based energy storage products and solutions, services and

digital software.

We cannot guarantee that our pipeline will

result in actual revenue in the originally anticipated period or at

all. Pipeline may not generate margins equal to our historical

operating results. We have only recently begun to track our

pipeline on a consistent basis as performance measures, and as a

result, we do not have significant experience in determining the

level of realization that we will achieve on these contracts. Our

customers may experience project delays or cancel orders as a

result of external market factors and economic or other factors

beyond our control. If our pipeline fails to result in revenue as

anticipated or in a timely manner, we could experience a reduction

in revenue, profitability, and liquidity.

Annual Recurring Revenue

(ARR)

ARR represents the net annualized contracted

value including software subscriptions including initial trial,

licensing, long term service agreements, and extended warranty

agreements as of the reporting period. ARR excludes one-time fees,

revenue share or other revenue that is non-recurring and variable.

The Company believes ARR is an important operating metric as it

provides visibility to future revenue. It is important to

management to increase this visibility as we continue to expand.

ARR is not a forecast of future revenue and should be viewed

independently of revenue and deferred revenue as ARR is an

operating metric and is not intended to replace these items.

|

FLUENCE ENERGY, INC.RECONCILIATION OF GAAP

TO NON-GAAP MEASURES (UNAUDITED) |

|

|

The following tables present our non-GAAP

measures for the periods indicated.

|

|

Three Months Ended September 30, |

|

|

|

|

Change |

|

Fiscal Year Ended September 30, |

|

|

|

|

Change |

|

($ in thousands) |

2024 |

|

2023 |

|

Change |

|

% |

|

2024 |

|

2023 |

|

Change |

|

% |

|

Net income (loss) |

$ |

67,724 |

|

|

$ |

4,817 |

|

|

$ |

62,907 |

|

|

|

1306 |

% |

|

$ |

30,367 |

|

|

$ |

(104,818 |

) |

|

$ |

135,185 |

|

|

|

129 |

% |

| Add (deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income, net |

(1,122 |

) |

|

(1,137 |

) |

|

15 |

|

|

|

(1 |

)% |

|

(5,676 |

) |

|

(5,388 |

) |

|

(288 |

) |

|

|

5 |

% |

| Income tax expense |

7,878 |

|

|

6,607 |

|

|

1,271 |

|

|

|

19 |

% |

|

9,206 |

|

|

4,549 |

|

|

4,657 |

|

|

|

102 |

% |

| Depreciation and

amortization |

4,088 |

|

|

2,814 |

|

|

1,274 |

|

|

|

45 |

% |

|

14,482 |

|

|

10,665 |

|

|

3,817 |

|

|

|

36 |

% |

| Stock-based

compensation(a) |

5,469 |

|

|

5,503 |

|

|

(34 |

) |

|

|

(1 |

)% |

|

23,875 |

|

|

26,920 |

|

|

(3,045 |

) |

|

|

(11 |

)% |

| Other

non-recurring expenses(b) |

2,835 |

|

|

1,245 |

|

|

1,590 |

|

|

|

128 |

% |

|

5,852 |

|

|

6,684 |

|

|

(832 |

) |

|

|

(12 |

)% |

|

Adjusted EBITDA |

$ |

86,872 |

|

|

$ |

19,849 |

|

|

$ |

67,023 |

|

|

|

338 |

% |

|

$ |

78,106 |

|

|

$ |

(61,388 |

) |

|

$ |

139,494 |

|

|

|

227 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Includes incentive awards that will be settled in shares and

incentive awards that will be settled in cash. (b) Amount for the

three months ended September 30, 2024 includes approximately $1.3

million in costs related to Amendment No. 3 to the ABL Credit

Agreement and $1.5 million in expenses related to the Tax

Receivable Agreement. Amount for the fiscal year ended September

30, 2024 includes approximately $2.5 million in costs related to

the termination of the Revolver and Amendment No. 3 to the ABL

Credit Agreement, $1.5 million in expenses related to the Tax

Receivable Agreement, $1.0 million in severance costs related to

restructuring and $0.8 million in costs related to the secondary

offering completed in December 2023. Amount for the three months

and the fiscal year ended September 30, 2023 includes

approximately $1.2 million and $6.7 million, respectively, in

severance costs and consulting fees related to the restructuring

plan from November 2022. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

|

|

Change |

|

Fiscal Year Ended September 30, |

|

|

|

|

Change |

| ($ in

thousands) |

2024 |

|

2023 |

|

Change |

|

% |

|

2024 |

|

2023 |

|

Change |

|

% |

|

Total revenue |

$ |

1,228,148 |

|

|

$ |

672,982 |

|

|

$ |

555,166 |

|

|

|

82 |

% |

|

$ |

2,698,562 |

|

|

$ |

2,217,978 |

|

|

$ |

480,584 |

|

|

|

22 |

% |

| Cost of

goods and services |

1,070,679 |

|

|

596,699 |

|

|

473,980 |

|

|

|

79 |

% |

|

2,357,482 |

|

|

2,077,023 |

|

|

280,459 |

|

|

|

14 |

% |

| Gross profit |

157,469 |

|

|

76,283 |

|

|

81,186 |

|

|

|

106 |

% |

|

341,080 |

|

|

140,955 |

|

|

200,125 |

|

|

|

142 |

% |

| Gross profit margin % |

12.8 |

% |

|

11.3 |

% |

|

|

|

|

|

|

|

|

12.6 |

% |

|

6.4 |

% |

|

|

|

|

|

|

|

| Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based

compensation(a) |

876 |

|

|

800 |

|

|

76 |

|

|

|

10 |

% |

|

4,080 |

|

|

4,164 |

|

|

(84 |

) |

|

|

(2 |

)% |

| Amortization(b) |

920 |

|

|

339 |

|

|

581 |

|

|

|

171 |

% |

|

2,696 |

|

|

830 |

|

|

1,866 |

|

|

|

225 |

% |

| Other

non-recurring expenses(c) |

— |

|

|

510 |

|

|

(510 |

) |

|

|

(100 |

)% |

|

— |

|

|

946 |

|

|

(946 |

) |

|

|

(100 |

)% |

|

Adjusted Gross Profit |

$ |

159,265 |

|

|

$ |

77,932 |

|

|

$ |

81,333 |

|

|

|

104 |

% |

|

$ |

347,856 |

|

|

$ |

146,895 |

|

|

$ |

200,961 |

|

|

|

137 |

% |

|

Adjusted Gross Profit Margin % |

13.0 |

% |

|

11.6 |

% |

|

|

|

|

|

|

|

|

12.9 |

% |

|

6.6 |

% |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Includes incentive awards that will be settled in shares and

incentive awards that will be settled in cash. (b) Amount related

to amortization of capitalized software included in cost of goods

and services. (c) Amount for the three months and the fiscal year

ended September 30, 2023 includes $0.5 million and $0.9

million, respectively, in severance costs related to the

restructuring plan from November 2022. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended September 30, |

|

|

|

|

|

($ in thousands) |

2024 |

|

2023 |

|

Change |

|

Change % |

| Net cash provided by (used in)

operating activities |

$79,685 |

|

$(111,927) |

|

$191,612 |

|

171% |

| Less:

Purchase of property and equipment |

(8,115) |

|

(2,989) |

|

(5,126) |

|

171% |

|

Free Cash Flow |

$71,570 |

|

$(114,916) |

|

$186,486 |

|

162% |

| |

|

|

|

|

|

|

|

____________________________ 1 Non-GAAP Financial Metric. See

the section below titled “Non-GAAP Financial Measures” for more

information regarding the Company's use of non-GAAP financial

measures, as well as a reconciliation to the most directly

comparable financials measure stated in accordance with GAAP.2

Backlog represents the unrecognized revenue value of our

contractual commitments, which include deferred revenue and amounts

that will be billed and recognized as revenue in future periods.

The Company’s backlog may vary significantly each reporting period

based on the timing of major new contractual commitments and the

backlog may fluctuate with currency movements. In addition, under

certain circumstances, the Company’s customers have the right to

terminate contracts or defer the timing of its services and their

payments to the Company.3 Total cash includes Cash and cash

equivalents + Restricted Cash + Short term investments.

Contacts

Analyst

Lexington May, Vice President, Finance & Investor Relations

+1 713-909-5629

Email : InvestorRelations@fluenceenergy.com

Media

Email: media.na@fluenceenergy.com

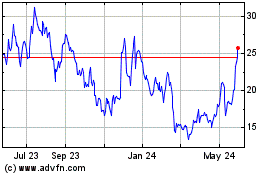

Fluence Energy (NASDAQ:FLNC)

Historical Stock Chart

From Oct 2024 to Nov 2024

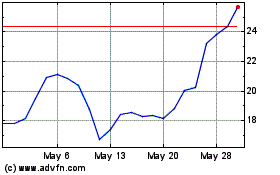

Fluence Energy (NASDAQ:FLNC)

Historical Stock Chart

From Nov 2023 to Nov 2024