Haynes International (NASDAQ GS: HAYN), a leading developer,

manufacturer and marketer of technologically advanced

high-performance alloys, today announced Marlin (Marty) C. Losch

III has been named Chief Operating Officer of Haynes International,

effective July 1st.

In this newly created position, Losch will have

responsibility for all commercial and operational activities for

the Company. Losch will report directly to Michael Shor, President

and Chief Executive Officer of Haynes.

“For more than 35 years, Marty has been a true

cornerstone at Haynes, playing a crucial role in helping to develop

and execute our strategy and cementing Haynes’ success as a leader

in our industry,” said Michael Shor, President and Chief Executive

Officer of Haynes. “As someone with decades of extensive knowledge

of our business and operations, the trust of our dedicated

customers and support of our workforce, I am confident that Marty

is uniquely suited to take on this expanded leadership position at

this important time for our company as we continue to work towards

closing our previously announced transaction with North American

Stainless, a division of Acerinox.”

Haynes has initiated a search to identify

candidates to fill Mr. Losch’s prior role as Vice President of

Sales and Distribution. The Company expects to fill this role in

the coming months and in the meantime, Mr. Losch will continue to

lead and support the Sales and Distribution team to ensure a smooth

transition.

“It is an honor to step into this role as we

embark on this exciting next phase of growth for our company,” said

Mr. Losch. “I am immensely proud of Haynes and our people, and the

success we’ve achieved together. I am confident in our ability to

continue providing our customers with the high-quality products and

services they have come to expect. In this new capacity, I look

forward to working with our talented group of employees at

Haynes.”

Having joined Haynes in 1988, Mr. Losch brings

nearly four decades of experience from various operational roles of

increasing responsibility, most recently as Vice President of Sales

and Distribution. In this capacity he was responsible for sales and

distribution worldwide and transformed the department into a

world-class service-oriented organization. Prior to that, he was

the Vice President of North American Sales for three years after

serving as the Regional Manager of the Company’s Midwest

operations. He has also held various marketing, quality

engineering, and production positions. Marty received his B.S.

Material Engineering from Virginia Tech in 1983 and a Masters in

Manufacturing Management from GMI in 1996.

The Company also announced that David L.

Strobel, Vice President of Kokomo Operations will be retiring in

early 2025. Mr. Strobel has been serving as the Company’s Vice

President of Kokomo Operations since September 2018, leading the

operations team’s safety, quality, and process improvement

initiatives. Prior to Haynes, Mr. Strobel served as a consultant to

manufacturing companies and held various executive positions at

Carpenter Technology Corporation.

Michael Shor, President and Chief Executive

Officer of Haynes, added, “I want to thank Dave Strobel, who will

be retiring from the Company in early 2025 after six years of

incredible service. Dave brought immense knowledge, expertise, and

industry insights to Haynes, having spent over 40 years in the

specialty alloy industry. He will be missed by his team, the

company and myself.”

Haynes has begun a search to identify a

replacement for Mr. Strobel, which the Company expects to fill in

the coming months. Until his retirement, Mr. Strobel will work

alongside his successor to ensure a smooth transition and

successful integration with NAS and Acerinox.

About Haynes International

Haynes International, Inc. is a leading

developer, manufacturer, and marketer of technologically advanced,

high-performance alloys, primarily for use in the aerospace,

industrial gas turbine and chemical processing industries.

Cautionary Statement Regarding

Forward-Looking Statements

This press release contains statements that

constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995, Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, each as amended. All statements other than

statements of historical fact, including statements regarding

market and industry prospects and future results of operations or

financial position, made in this press release are forward-looking.

In many cases, you can identify forward-looking statements by

terminology, such as “may”, “should”, “expects”, “intends”,

“plans”, “anticipates”, “believes”, “estimates”, “predicts”,

“potential” or “continue” or the negative of such terms and other

comparable terminology. Statements in this communication that are

forward looking may include, but are not limited to, statements

regarding the benefits of the proposed acquisition of the Company

by Parent and the associated integration plans, expected synergies

and capital expenditure commitments, anticipated future operating

performance and results of the Company, the expected management and

governance of the Company following the acquisition and expected

timing of the closing of the proposed acquisition and other

transactions contemplated by the Merger Agreement.

There may also be other statements of

expectations, beliefs, future plans and strategies, anticipated

events or trends and similar expressions concerning matters that

are not historical facts. Readers are cautioned that any such

forward-looking statements are not guarantees of future performance

and involve risks and uncertainties, many of which are difficult to

predict and are generally outside the Company’s control, that could

cause actual performance or results to differ materially from those

expressed in, or implied or projected by, the forward-looking

statements. Such risks and uncertainties include, but are not

limited to: the occurrence of any event, change or other

circumstance that could give rise to the right of the Company or

Parent or both of them to terminate the Merger Agreement, including

circumstances requiring a party to pay the other party a

termination fee pursuant to the Merger Agreement; the failure to

obtain applicable regulatory approvals in a timely manner or

otherwise; the risk that the acquisition may not close in the

anticipated timeframe or at all due to one or more of the other

closing conditions to the transaction not being satisfied or

waived; the risk that there may be unexpected costs, charges or

expenses resulting from the proposed acquisition; risks that the

proposed transaction disrupts the Company’s current plans and

operations; the risk that certain restrictions during the pendency

of the proposed transaction may impact the Company’s ability to

pursue certain business opportunities or strategic transactions;

risks related to disruption of each company’s management’s time and

attention from ongoing business operations due to the proposed

transaction; continued availability of capital and financing and

rating agency actions; the risk that any announcements relating to

the proposed transaction could have adverse effects on the market

price of the Company’s common stock, credit ratings or operating

results; the risk that the proposed transaction and its

announcement could have an adverse effect on the ability of the

Company to retain and hire key personnel, to retain customers and

to maintain relationships with each of their respective business

partners, suppliers and customers and on their respective operating

results and businesses generally; the risk of litigation that could

be instituted against the parties to the Merger Agreement or their

respective directors, managers or officers and/or regulatory

actions related to the proposed acquisition, including the effects

of any outcomes related thereto; risks related to unpredictable and

severe or catastrophic events, including but not limited to acts of

terrorism, war or hostilities, cyber attacks, or the impact of the

COVID-19 pandemic or any other pandemic, epidemic or outbreak of an

infectious disease in the United States or worldwide on the

Company’s business, financial condition and results of operations,

as well as the response thereto by each company’s management; and

other business effects, including the effects of industry, market,

economic, political or regulatory conditions.

Also, the Company’s actual results may differ

materially from those contemplated by the forward-looking

statements for a number of additional reasons as described in the

Company’s filings with the SEC, including those set forth in the

Risk Factors section and under any “Forward-Looking Statements” or

similar heading in the Company’s most recently filed Annual Report

on Form 10-K filed November 16, 2023, the Company’s Definitive

Proxy Statement filed March 18, 2024 and the Company’s Current

Reports on Form 8-K.

The Company has based these forward-looking

statements on its current expectations and projections about future

events. Although the Company believes that the assumptions on which

the forward-looking statements contained herein are based are

reasonable, any of those assumptions could prove to be inaccurate.

As a result, the forward-looking statements based upon those

assumptions also could be incorrect. Except to the extent required

by law, the Company undertakes no obligation to publicly update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise. These forward-looking

statements speak only as of the date hereof.

|

|

|

|

Contact: |

Susan Perry |

|

|

Vice President of Human Resources |

|

|

Haynes International, Inc. |

|

|

765-434-7654 |

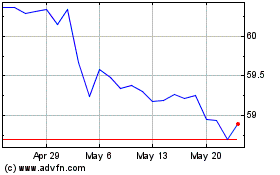

Haynes (NASDAQ:HAYN)

Historical Stock Chart

From Oct 2024 to Nov 2024

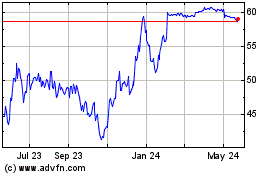

Haynes (NASDAQ:HAYN)

Historical Stock Chart

From Nov 2023 to Nov 2024