FALSE000132611000013261102025-03-032025-03-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 3, 2025

ImmunityBio, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-37507 | | 43-1979754 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

3530 John Hopkins Court

San Diego, California 92121

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (844) 696-5235

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | IBRX | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section13(a) of the Exchange Act. ☐

Section 2 – Financial Information

Item 2.02 Results of Operations and Financial Condition.

On March 3, 2025, ImmunityBio, Inc. (the Company) issued a press release providing a business update and announcing its financial results for the fourth quarter and year ended December 31, 2024, and its financial position as of December 31, 2024. The full text of the Company’s press release is furnished as Exhibit 99.1 hereto.

The information furnished pursuant to Item 2.02 of this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act) or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference into any filings of the Company made under the Exchange Act or the Securities Act of 1933, as amended, whether made before or after the date of this Current Report, regardless of any general incorporation language of such filing, except as shall be expressly set forth by specific reference in such filing.

Section 9 – Financial Statements and Exhibits.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

Exhibit

Number | | Description of Exhibit |

| | |

| 99.1** | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

_______________

** Furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | IMMUNITYBIO, INC. |

| | | Registrant |

| | | |

Date: March 3, 2025 | By: | | /s/ David C. Sachs |

| | | David C. Sachs |

| | | Chief Financial Officer |

ImmunityBio Reports Sales Momentum & Unit Growth Since Permanent J-code Issuance (J9028) in January 2025 and Financial Results for Year End 2024

•With a permanent J-code (J9028) awarded in January 2025, ImmunityBio’s February 2025 ANKTIVA® unit sales volume grew 97% over unit sales volume in December 2024

•ANKTIVA sales momentum continues to trend upward quarter to date 2025, with sales volume in February representing a 67% increase month-over-month from January

•Sales volume in the 2 months in 2025 to date shows a 69% increase over the sales volume in the 2 months prior (November and December 2024) and already exceeds the total units for all of Q4 2024

•For the three-month period ending December 31, 2024 prior to permanent J-code approval, ImmunityBio achieved net product revenue of approximately $7.2 million, surpassing net product revenue of $6.0 million in the prior quarter, a 21% quarter over quarter increase

•FDA authorization of expanded access of an alternative source of BCG in February 2025 is expected to address the issue of BCG shortage with over 45,000 doses available

•Over 60 sites are now being activated to receive recombinant BCG (rBCG) under the Expanded Access Program

•Global submission of marketing authorization applications (MAAs) for the treatment of patients with BCG-unresponsive NMIBC with CIS with or without papillary tumors for ANKTIVA in combination with BCG to the Medicines and Healthcare products Regulatory Agency (MHRA) and to the European Medicines Agency (EMA) in the European Union (EU) have been accepted for review in February 2025

•Regenerative Medicine Advanced Therapy (RMAT) designation granted by the FDA in February 2025 for ANKTIVA and CAR-NK (PD-L1 t-haNK) in combination with standard-of-care chemotherapy/radiotherapy indicated for:

◦the reversal of lymphopenia and

◦treatment of multiply relapsed locally advanced or metastatic pancreatic cancer

•Over 100 participants have now received ANKTIVA in cancer prevention trial with goal to prevent colon cancer in subjects with Lynch Syndrome

•Analyst Investor Day Conference planned for April 2025 (invitations to follow)

CULVER CITY, Calif. — March 3, 2025 — ImmunityBio, Inc. (NASDAQ: IBRX), a leading immunotherapy company, today announced certain operational results following approval of the permanent J-code (J9028) in January 2025, as well as its financial results for the fourth-quarter and full year ended December 31, 2024.

With the issuance of the permanent J-code in January 2025, ImmunityBio has seen increased sales momentum supporting a trend of increases month-over-month as well as quarter-over-quarter, with February unit sales volume increasing 67% over January, and February and January unit sales combined exceeding unit sales achieved for all of Q4 2024. ImmunityBio earned net product revenue of approximately $7.2 million during the three month period ending December 31, 2024, which represented an increase of 21% over the $6.0 million of net revenue earned during the third quarter of 2024.

ImmunityBio Reports Operational and Financial Results

Page 2

The TICE BCG shortage was addressed with the FDA authorization to ImmunityBio of Expanded Access of the recombinant BCG (rBCG) supplied by the Serum Institute of India (SII). With the authorization in February 2025, over 60 sites in the United States are being activated to receive rBCG. The first patient dosed with rBCG in the United States is anticipated in March 2025. ImmunityBio anticipates that over 45,000 vials of rBCG will be available for the United States in 2025 to address the overall BCG shortage.

Global submission of marketing authorization applications (MAAs) for the treatment of patients with BCG-unresponsive NMIBC with CIS with or without papillary tumors for ANKTIVA in combination with BCG to the Medicines and Healthcare products Regulatory Agency (MHRA) and to the European Medicines Agency (EMA) in the European Union (EU) have been accepted for review in February 2025.

In January 2025, the Company announced a collaboration and supply agreement with BeiGene, Ltd. (to be renamed to BeOne Medicines, Ltd.), a global oncology company, to conduct a confirmatory randomized Phase 3 clinical trial (ResQ201A-NSCLC), combining BeOne’s tislelizumab, a PD-1 checkpoint inhibitor (CPI), and our ANKTIVA (nogapendekin alfa inbakicept-pmln) product. The Phase 3 ResQ201A-NSCLC study aims to confirm the efficacy and safety of combination ANKTIVA plus CPI therapy previously demonstrated in the QUILT 3.055 trial and provide evidence of the potential for these two immunotherapeutic agents to improve overall survival in patients with advanced or metastatic non-small cell lung cancer who have acquired resistance to immune CPI therapy.

In February 2025, ImmunityBio received an important authorization from the FDA designating ANKTIVA plus PD-L1 t-haNK as Regenerative Medicine Advanced Therapies (RMAT). The significance of a RMAT designation, which was established under the 21st Century Cures Act, is to expedite the development and review of promising therapeutic candidates, including cell therapies, that are intended to treat, modify, reverse or cure a serious or life-threatening disease. RMAT designation includes benefits, such as early interactions with the FDA, including discussions on surrogate or intermediate endpoints that could potentially support accelerated approval and satisfy post-approval requirements, and potential priority review of a product’s biologics license application (BLA). The RMAT designation was granted for ANKTIVA and CAR-NK (PD-L1 t-haNK) in combination with standard-of-care chemotherapy/radiotherapy indicated for:

•the reversal of lymphopenia and

•the treatment of multiply relapsed locally advanced or metastatic pancreatic cancer

“The first quarter of 2025 has been an inflection point for the Company with multiple milestones achieved. The approval of ANKTIVA and the permanent J-code, the trajectory of adoption of ANKTIVA by urologists for BCG unresponsive non-muscle invasive bladder cancer CIS, the authorization of expanded access of recombinant BCG to address the TICE BCG shortage, the acceptance of our global marketing submission to EMA and MHRA, the collaboration with BeOne for checkpoint inhibitor supply, and most importantly the potentially transformative RMAT designation by the FDA of ANKTIVA + PD-L1 t-haNK for the reversal of lymphopenia, all occurring at a rapid pace and demonstrating excellent execution are a testament to the strength of the organization and its ability to continue to execute on its ambitious growth plans for this year,” said Dr. Patrick Soon-Shiong, Founder, Executive Chairman, Global Chief Scientific & Medical Officer of ImmunityBio. Dr. Soon-Shiong continued, “the RMAT designation positions ANKTIVA to be the backbone of our strategy for Immunotherapy 2.0 beyond checkpoints and the potential foundation of this first-in-class IL-15 receptor superagonist as a therapeutic cancer vaccine with over 100 participants enrolled in the Lynch Syndrome trial to evaluate cancer prevention in this high-risk population.”

ImmunityBio Reports Operational and Financial Results

Page 3

Fourth-Quarter Ended December 31, 2024 Financial Summary and Comparison to Prior Year Quarter

Product Revenue, Net

Product revenue, net increased $7.2 million during the three months ended December 31, 2024, as compared to the three months ended December 31, 2023. The increase was driven by sales of ANKTIVA after FDA approval in April 2024.

Research and Development Expenses

Research and development (R&D) expenses decreased $16.3 million to $35.2 million during the three months ended December 31, 2024, as compared to $51.5 million during the three months ended December 31, 2023. The decrease was primarily driven by lower research agreement expenses, inventory capitalization, less contract manufacturing organization activities, and lower consulting costs.

Selling, General and Administrative Expenses

Selling, general and administrative expense increased $8.6 million to $41.7 million during the three months ended December 31, 2024, as compared to $33.1 million during the three months ended December 31, 2023. The increase was due to higher costs related to post-commercialization activities and a litigation settlement.

Net Loss Attributable to ImmunityBio Common Stockholders

Net loss attributable to ImmunityBio common stockholders was $59.2 million during the three months ended December 31, 2024, compared to $233.4 million during the three months ended December 31, 2023. The reduction of loss was primarily driven by product revenue and changes in the fair value of related-party convertible notes and warrant liabilities.

Fiscal Year Ended December 31, 2024 Financial Summary and Comparison to Prior Year

Cash and Marketable Securities Position

As of December 31, 2024, the Company had consolidated cash and cash equivalents, and marketable securities of $149.8 million.

Product Revenue, Net

Product revenue, net increased $14.1 million during the year ended December 31, 2024, as compared to the year ended December 31, 2023. The increase was driven by sales of ANKTIVA after FDA approval in April 2024.

Research and Development Expenses

R&D expenses decreased $42.2 million to $190.1 million during the year ended December 31, 2024, as compared to $232.3 million during the year ended December 31, 2023. The decrease was mainly due to less contract manufacturing organization activities, inventory capitalization, lower research agreement expenses, and lower consulting costs.

Selling, General and Administrative Expenses

Selling, general and administrative expenses increased $39.2 million to $168.8 million during the year ended December 31, 2024, as compared to $129.6 million during the year ended December 31, 2023. The increase was primarily driven by higher legal expenses, higher consulting fees and other operating costs related to post-commercialization marketing activities and higher salary and benefits expenses, partially offset by lower stock-based compensation expenses.

Net Loss Attributable to ImmunityBio Common Stockholders

Net loss attributable to ImmunityBio common stockholders was $413.6 million during the year ended December 31, 2024, compared to $583.2 million during the year ended December 31, 2023. This reduction of loss was primarily driven by product revenue and changes in the fair value of related-party convertible notes and warrant liabilities.

ImmunityBio Reports Operational and Financial Results

Page 4

ImmunityBio, Inc.

Condensed Consolidated Statements of Operations

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| (in thousands, except per share amounts) | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Revenue | | | | | | | |

| Product revenue, net | $ | 7,206 | | | $ | — | | | $ | 14,150 | | | $ | — | |

| Other revenues | 346 | | | 139 | | | 595 | | | 622 | |

| Total revenue | 7,552 | | | 139 | | | 14,745 | | | 622 | |

| Operating costs and expenses | | | | | | | |

| Cost of product revenue | — | | | — | | | — | | | — | |

| Research and development (including amounts with related parties) | 35,221 | | | 51,532 | | | 190,144 | | | 232,366 | |

| Selling, general and administrative (including amounts with related parties) | 41,731 | | | 33,110 | | | 168,783 | | | 129,620 | |

| Impairment of intangible assets | — | | | 886 | | | — | | | 886 | |

| Total operating costs and expenses | 76,952 | | | 85,528 | | | 358,927 | | | 362,872 | |

| Loss from operations | (69,400) | | | (85,389) | | | (344,182) | | | (362,250) | |

| Other income (expense), net: | | | | | | | |

| Interest and investment income, net | 1,187 | | | 484 | | | 7,975 | | | 1,131 | |

Change in fair value of warrant and derivative

liabilities, and related-party convertible notes | 46,598 | | | (116,352) | | | 76,904 | | | (83,803) | |

Interest expense (including amounts

with related parties) | (26,071) | | | (31,862) | | | (114,670) | | | (128,934) | |

Interest expense related to revenue interest

liability | (11,503) | | | (264) | | | (39,657) | | | (264) | |

Other income (expense), net (including

amounts with related parties) and

loss on equity method investment | 10 | | | (71) | | | (15) | | | (9,772) | |

| Total other income (expense), net | 10,221 | | | (148,065) | | | (69,463) | | | (221,642) | |

Loss before income taxes and noncontrolling

interests | (59,179) | | | (233,454) | | | (413,645) | | | (583,892) | |

| Income tax expense | — | | | 40 | | | — | | | 40 | |

| Net loss | (59,179) | | | (233,414) | | | (413,645) | | | (583,852) | |

Net loss attributable to noncontrolling interests,

net of tax | (17) | | | (22) | | | (81) | | | (656) | |

Net loss attributable to ImmunityBio common

stockholders | $ | (59,162) | | | $ | (233,392) | | | $ | (413,564) | | | $ | (583,196) | |

| | | | | | | |

| Net loss per ImmunityBio common share – basic | $ | (0.08) | | | $ | (0.35) | | | $ | (0.59) | | | $ | (1.15) | |

| Net loss per ImmunityBio common share – diluted | $ | (0.09) | | | $ | (0.35) | | | $ | (0.62) | | | $ | (1.15) | |

Weighted-average number of common shares used

in computing net loss per share – basic | 733,204 | | | 667,811 | | | 697,312 | | | 508,636 | |

Weighted-average number of common shares used

in computing net loss per share – diluted | 734,542 | | | 667,811 | | | 700,443 | | | 508,636 | |

ImmunityBio Reports Operational and Financial Results

Page 5

ImmunityBio, Inc.

Selected Balance Sheet Data

| | | | | | | | | | | |

| As of December 31, |

| (in thousands) | 2024 | | 2023 |

| | | |

| | | |

| Cash and cash equivalents, and marketable securities | $ | 149,809 | | | $ | 267,353 | |

| Total assets | 382,933 | | | 504,452 | |

| Total related-party debt | 461,877 | | | 681,537 | |

| Revenue interest liability | 284,404 | | | 155,415 | |

| Total liabilities | 871,062 | | | 1,090,389 | |

| Total ImmunityBio stockholders’ deficit | (489,098) | | | (586,987) | |

| Total liabilities and stockholders’ deficit | 382,933 | | | 504,452 | |

ImmunityBio, Inc.

Summary Reconciliations of Cash Flows

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| (in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Cash (used in) provided by: | | | | | | | |

| Net cash used in operating activities | $ | (85,144) | | | $ | (115,271) | | | $ | (391,236) | | | $ | (366,757) | |

| Net cash provided by (used in) investing activities | 9,834 | | | 2,249 | | | (12,246) | | | (30,470) | |

| Net cash provided by financing activities | 106,929 | | | 200,539 | | | 281,630 | | | 558,341 | |

Effect of exchange rate changes on cash and cash

equivalents, and restricted cash | (7) | | | (27) | | | (23) | | | (292) | |

Net change in cash and cash equivalents, and

restricted cash | 31,612 | | | 87,490 | | | (121,875) | | | 160,822 | |

Cash and cash equivalents, and restricted cash,

beginning of period | 112,300 | | | 178,297 | | | 265,787 | | | 104,965 | |

Cash and cash equivalents, and restricted cash,

end of period | $ | 143,912 | | | $ | 265,787 | | | $ | 143,912 | | | $ | 265,787 | |

ImmunityBio Reports Operational and Financial Results

Page 6

About ANKTIVA

Cytokine fusion proteins, such as ANKTIVA, represent a novel class of biologics that improve immune responses by enhancing the therapeutic potential of cytokines and promoting lymphocyte infiltration at a site of disease. The cytokine interleukin-15 (IL-15) plays a crucial role in the immune system by affecting the development, maintenance, and function of key immune cells—NK and CD8+ killer T cells—that are involved in killing cancer cells.

ANKTIVA is a first-in-class IL-15 receptor superagonist IgG1 fusion complex, consisting of an IL-15 mutant (IL-15N72D) fused with an IL-15Rα, which binds with high affinity to IL-15 receptors on NK, CD4+, and CD8+ T cells. This fusion complex of ANKTIVA, which confers stability and longer half-life than recombinant or native IL-15, mimics the natural biological properties of the membrane-bound IL-15Rα, delivering IL-15 by dendritic cells and drives the activation and proliferation of NK cells with the generation of memory killer T cells that have retained immune memory against these tumor clones. By activating NK cells, ANKTIVA overcomes the tumor escape phase of clones resistant to T cells without stimulating immunosuppressive T-reg cells and restores memory T cell activity with resultant prolonged duration of complete response. Further, by stimulating the release of interferon-γ, ANKTIVA restores MHC-I expression, making more tumor cells targets for T-cell killing. As evidenced by its ability to increase lymphocyte counts in healthy adults in Phase 1 testing, ANKTIVA also has the potential to rescue lymphopenia, which is associated with poor prognosis in cancer before treatment or as a consequence of chemo- or radiation therapy.

ANKTIVA was approved by the FDA in 2024 for use in the United States with BCG for the treatment of adult patients with BCG-unresponsive non-muscle invasive bladder cancer with CIS with or without papillary tumors. For more information, visit ImmunityBio.com (Founder’s Vision) and Anktiva.com.

About ImmunityBio

ImmunityBio is a vertically-integrated commercial stage biotechnology company developing next-generation therapies that bolster the natural immune system to defeat cancers and infectious diseases. The Company’s range of immunotherapy platforms, alone and together, act to drive an immune response with the goal of creating durable immune memory generating safe protection against disease. We are applying our science and platforms to treating cancers, including the development of potential cancer vaccines, as well as developing immunotherapies and cell therapies that we believe sharply reduce or eliminate the need for standard high-dose chemotherapy. These platforms and their associated product candidates are designed to be more effective, accessible, and easily administered than current standards of care in oncology and infectious diseases. For more information, visit ImmunityBio.com (Founder’s Vision) and connect with us on X (Twitter), Facebook, LinkedIn, and Instagram.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, such as statements regarding future operating results and prospects, commercialization activities, momentum and market data, market access initiatives and coverage under medical reimbursement policies, the timing of shipments under the rBCG EAP, expected available doses of rBCG supply, anticipated patient enrollment and timing of dosing, the expectation that the rBCG EAP will enable ImmunityBio to reliably bring an alternative source of BCG to patients in the U.S., the utility of rBCG to improve immunogenicity and safety in comparison to earlier strains and formulations of BCG, the RMAT designation referenced herein and potential results therefrom, the related anticipated EAP submission and timing thereof, the related anticipated BLA submission and timing thereof, global expansion efforts and anticipated timeline of regulatory review of our pending MAAs by the MHRA and EMA, clinical trial enrollment, data and potential results to be drawn therefrom, the development of therapeutics for cancer and infectious diseases, potential benefits to patients, potential treatment outcomes for patients, the described mechanism of action and results and contributions therefrom, potential future uses and applications of ANKTIVA for the reversal of lymphopenia and use in combination with checkpoint inhibitors or in cancer vaccines and across multiple tumor types, and ImmunityBio’s approved product and investigational agents as compared to existing treatment options, among

ImmunityBio Reports Operational and Financial Results

Page 7

others. Statements in this press release that are not statements of historical fact are considered forward-looking statements, which are usually identified by the use of words such as “anticipates,” “believes,” “continues,” “goal,” “could,” “estimates,” “scheduled,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “indicate,” “projects,” “is,” “seeks,” “should,” “will,” “strategy,” and variations of such words or similar expressions. Statements of past performance, efforts, or results of our preclinical and clinical trials, about which inferences or assumptions may be made, can also be forward-looking statements and are not indicative of future performance or results. Forward-looking statements are neither forecasts, promises nor guarantees, and are based on the current beliefs of ImmunityBio’s management as well as assumptions made by and information currently available to ImmunityBio. Such information may be limited or incomplete, and ImmunityBio’s statements should not be read to indicate that it has conducted a thorough inquiry into, or review of, all potentially available relevant information. Such statements reflect the current views of ImmunityBio with respect to future events and are subject to known and unknown risks, including business, regulatory, economic and competitive risks, uncertainties, contingencies and assumptions about ImmunityBio, including, without limitation, (i) risks and uncertainties regarding commercial launch execution, success and timing, (ii) risks and uncertainties related to the regulatory submission, filing and review process and the timing thereof with respect to the FDA, EMA, MHRA and other regulatory agencies, (iii) risks and uncertainties regarding the timing of shipments under the rBCG EAP and ImmunityBio’s ability to establish and maintain a reliable source of BCG under the EAP, (iv) whether the RMAT designation will lead to an accelerated review or approval, of which there can be no assurance, (v) ImmunityBio’s ability to submit the regulatory submissions referenced herein on the anticipated timeline or at all, (vi) the ability of ImmunityBio to fund its ongoing and anticipated clinical trials, (vii) whether clinical trials will result in registrational pathways, (viii) whether clinical trial data will be accepted by regulatory agencies, (ix) the ability of ImmunityBio to continue its planned preclinical and clinical development of its development programs through itself and/or its investigators, and the timing and success of any such continued preclinical and clinical development, patient enrollment and planned regulatory submissions, (x) potential delays in product availability and regulatory approvals, (xi) the risks and uncertainties associated with third-party collaborations and agreements, including that with Serum Institute of India, (xii) ImmunityBio’s ability to retain and hire key personnel, (xiii) ImmunityBio’s ability to obtain additional financing to fund its operations and complete the development and commercialization of its various product candidates, (xiv) potential product shortages or manufacturing disruptions that may impact the availability and timing of product, (xv) ImmunityBio’s ability to successfully commercialize its approved product and product candidates, (xvi) ImmunityBio’s ability to scale its manufacturing and commercial supply operations for its approved product and future approved products, and (xvii) ImmunityBio’s ability to obtain, maintain, protect, and enforce patent protection and other proprietary rights for its product candidates and technologies. More details about these and other risks that may impact ImmunityBio’s business are described under the heading “Risk Factors” in the Company’s Form 10-K filed with the U.S. Securities and Exchange Commission (SEC) on March 19, 2024 and the Company’s Form 10-Q filed with the SEC on November 12, 2024, and in subsequent filings made by ImmunityBio with the SEC, which are available on the SEC’s website at www.sec.gov. ImmunityBio cautions you not to place undue reliance on any forward looking statements, which speak only as of the date hereof. ImmunityBio does not undertake any duty to update any forward-looking statement or other information in this press release, except to the extent required by law.

Contacts:

Investors

Hemanth Ramaprakash, PhD, MBA

ImmunityBio, Inc.

+1 858-746-9289

Hemanth.Ramaprakash@ImmunityBio.com

Media

Sarah Singleton

ImmunityBio, Inc.

+1 415-290-8045

Sarah.Singleton@ImmunityBio.com

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

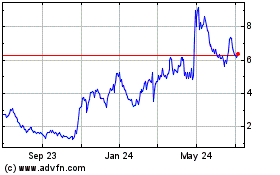

ImmunityBio (NASDAQ:IBRX)

Historical Stock Chart

From Feb 2025 to Mar 2025

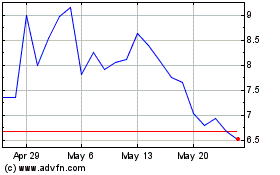

ImmunityBio (NASDAQ:IBRX)

Historical Stock Chart

From Mar 2024 to Mar 2025