- With a permanent J-code (J9028) awarded in January 2025,

ImmunityBio’s February 2025 ANKTIVA® unit sales volume grew 97%

over unit sales volume in December 2024

- ANKTIVA sales momentum continues to trend upward quarter to

date 2025, with sales volume in February representing a 67%

increase month-over-month from January

- Sales volume in the 2 months in 2025 to date shows a 69%

increase over the sales volume in the 2 months prior (November and

December 2024) and already exceeds the total units for all of Q4

2024

- For the three-month period ending December 31, 2024 prior to

permanent J-code approval, ImmunityBio achieved net product revenue

of approximately $7.2 million, surpassing net product revenue of

$6.0 million in the prior quarter, a 21% quarter over quarter

increase

- FDA authorization of expanded access of an alternative source

of BCG in February 2025 is expected to address the issue of BCG

shortage with over 45,000 doses available

- Over 60 sites are now being activated to receive recombinant

BCG (rBCG) under the Expanded Access Program

- Global submission of marketing authorization applications

(MAAs) for the treatment of patients with BCG-unresponsive NMIBC

with CIS with or without papillary tumors for ANKTIVA in

combination with BCG to the Medicines and Healthcare products

Regulatory Agency (MHRA) and to the European Medicines Agency (EMA)

in the European Union (EU) have been accepted for review in

February 2025

- Regenerative Medicine Advanced Therapy (RMAT) designation

granted by the FDA in February 2025 for ANKTIVA and CAR-NK (PD-L1

t-haNK) in combination with standard-of-care

chemotherapy/radiotherapy indicated for:

- the reversal of lymphopenia and

- treatment of multiply relapsed locally advanced or metastatic

pancreatic cancer

- Over 100 participants have now received ANKTIVA in cancer

prevention trial with goal to prevent colon cancer in subjects with

Lynch Syndrome

- Analyst Investor Day Conference planned for April 2025

(invitations to follow)

ImmunityBio, Inc. (NASDAQ: IBRX), a leading immunotherapy

company, today announced certain operational results following

approval of the permanent J-code (J9028) in January 2025, as well

as its financial results for the fourth-quarter and full year ended

December 31, 2024.

With the issuance of the permanent J-code in January 2025,

ImmunityBio has seen increased sales momentum supporting a trend of

increases month-over-month as well as quarter-over-quarter, with

February unit sales volume increasing 67% over January, and

February and January unit sales combined exceeding unit sales

achieved for all of Q4 2024. ImmunityBio earned net product revenue

of approximately $7.2 million during the three-month period ending

December 31, 2024, which represented an increase of 21% over the

$6.0 million of net revenue earned during the third quarter of

2024.

The TICE BCG shortage was addressed with the FDA authorization

to ImmunityBio of Expanded Access of the recombinant BCG (rBCG)

supplied by the Serum Institute of India (SII). With the

authorization in February 2025, over 60 sites in the United States

are being activated to receive rBCG. The first patient dosed with

rBCG in the United States is anticipated in March 2025. ImmunityBio

anticipates that over 45,000 vials of rBCG will be available for

the United States in 2025 to address the overall BCG shortage.

Global submission of marketing authorization applications (MAAs)

for the treatment of patients with BCG-unresponsive NMIBC with CIS

with or without papillary tumors for ANKTIVA in combination with

BCG to the Medicines and Healthcare products Regulatory Agency

(MHRA) and to the European Medicines Agency (EMA) in the European

Union (EU) have been accepted for review in February 2025.

In January 2025, the Company announced a collaboration and

supply agreement with BeiGene, Ltd. (to be renamed to BeOne

Medicines, Ltd.), a global oncology company, to conduct a

confirmatory randomized Phase 3 clinical trial (ResQ201A-NSCLC),

combining BeOne’s tislelizumab, a PD-1 checkpoint inhibitor (CPI),

and our ANKTIVA (nogapendekin alfa inbakicept-pmln) product. The

Phase 3 ResQ201A-NSCLC study aims to confirm the efficacy and

safety of combination ANKTIVA plus CPI therapy previously

demonstrated in the QUILT 3.055 trial and provide evidence of the

potential for these two immunotherapeutic agents to improve overall

survival in patients with advanced or metastatic non-small cell

lung cancer who have acquired resistance to immune CPI therapy.

In February 2025, ImmunityBio received an important

authorization from the FDA designating ANKTIVA plus PD-L1 t-haNK as

Regenerative Medicine Advanced Therapies (RMAT). The significance

of a RMAT designation, which was established under the 21st Century

Cures Act, is to expedite the development and review of promising

therapeutic candidates, including cell therapies, that are intended

to treat, modify, reverse or cure a serious or life-threatening

disease. RMAT designation includes benefits, such as early

interactions with the FDA, including discussions on surrogate or

intermediate endpoints that could potentially support accelerated

approval and satisfy post-approval requirements, and potential

priority review of a product’s biologics license application (BLA).

The RMAT designation was granted for ANKTIVA and CAR-NK (PD-L1

t-haNK) in combination with standard-of-care

chemotherapy/radiotherapy indicated for:

- the reversal of lymphopenia and

- the treatment of multiply relapsed locally advanced or

metastatic pancreatic cancer

“The first quarter of 2025 has been an inflection point for the

Company with multiple milestones achieved. The approval of ANKTIVA

and the permanent J-code, the trajectory of adoption of ANKTIVA by

urologists for BCG unresponsive non-muscle invasive bladder cancer

CIS, the authorization of expanded access of recombinant BCG to

address the TICE BCG shortage, the acceptance of our global

marketing submission to EMA and MHRA, the collaboration with BeOne

for checkpoint inhibitor supply, and most importantly the

potentially transformative RMAT designation by the FDA of ANKTIVA +

PD-L1 t-haNK for the reversal of lymphopenia, all occurring at a

rapid pace and demonstrating excellent execution are a testament to

the strength of the organization and its ability to continue to

execute on its ambitious growth plans for this year,” said Dr.

Patrick Soon-Shiong, Founder, Executive Chairman, Global Chief

Scientific & Medical Officer of ImmunityBio. Dr. Soon-Shiong

continued, “The RMAT designation positions ANKTIVA to be the

backbone of our strategy for Immunotherapy 2.0 beyond checkpoints

and the potential foundation of this first-in-class IL-15 receptor

superagonist as a therapeutic cancer vaccine with over 100

participants enrolled in the Lynch Syndrome trial to evaluate

cancer prevention in this high-risk population.”

Fourth-Quarter Ended December 31, 2024 Financial Summary and

Comparison to Prior Year Quarter

Product Revenue, Net

Product revenue, net increased $7.2 million during the three

months ended December 31, 2024, as compared to the three months

ended December 31, 2023. The increase was driven by sales of

ANKTIVA after FDA approval in April 2024.

Research and Development Expenses

Research and development (R&D) expenses decreased $16.3

million to $35.2 million during the three months ended December 31,

2024, as compared to $51.5 million during the three months ended

December 31, 2023. The decrease was primarily driven by lower

research agreement expenses, inventory capitalization, less

contract manufacturing organization activities, and lower

consulting costs.

Selling, General and Administrative Expenses

Selling, general and administrative expense increased $8.6

million to $41.7 million during the three months ended December 31,

2024, as compared to $33.1 million during the three months ended

December 31, 2023. The increase was due to higher costs related to

post-commercialization activities and a litigation settlement.

Net Loss Attributable to ImmunityBio Common

Stockholders

Net loss attributable to ImmunityBio common stockholders was

$59.2 million during the three months ended December 31, 2024,

compared to $233.4 million during the three months ended December

31, 2023. The reduction of loss was primarily driven by product

revenue and changes in the fair value of related-party convertible

notes and warrant liabilities.

Fiscal Year Ended December 31, 2024 Financial Summary and

Comparison to Prior Year

Cash and Marketable Securities Position

As of December 31, 2024, the Company had consolidated cash and

cash equivalents, and marketable securities of $149.8 million.

Product Revenue, Net

Product revenue, net increased $14.1 million during the year

ended December 31, 2024, as compared to the year ended December 31,

2023. The increase was driven by sales of ANKTIVA after FDA

approval in April 2024.

Research and Development Expenses

R&D expenses decreased $42.2 million to $190.1 million

during the year ended December 31, 2024, as compared to $232.3

million during the year ended December 31, 2023. The decrease was

mainly due to less contract manufacturing organization activities,

inventory capitalization, lower research agreement expenses, and

lower consulting costs.

Selling, General and Administrative Expenses

Selling, general and administrative expenses increased $39.2

million to $168.8 million during the year ended December 31, 2024,

as compared to $129.6 million during the year ended December 31,

2023. The increase was primarily driven by higher legal expenses,

higher consulting fees and other operating costs related to

post-commercialization marketing activities and higher salary and

benefits expenses, partially offset by lower stock-based

compensation expenses.

Net Loss Attributable to ImmunityBio Common

Stockholders

Net loss attributable to ImmunityBio common stockholders was

$413.6 million during the year ended December 31, 2024, compared to

$583.2 million during the year ended December 31, 2023. This

reduction of loss was primarily driven by product revenue and

changes in the fair value of related-party convertible notes and

warrant liabilities.

ImmunityBio, Inc.

Condensed Consolidated Statements of

Operations

Three Months Ended

December 31,

Year Ended December

31,

(in thousands, except per share

amounts)

2024

2023

2024

2023

Revenue

Product revenue, net

$

7,206

$

—

$

14,150

$

—

Other revenues

346

139

595

622

Total revenue

7,552

139

14,745

622

Operating costs and expenses

Cost of product revenue

—

—

—

—

Research and development (including

amounts with related parties)

35,221

51,532

190,144

232,366

Selling, general and administrative

(including amounts with related parties)

41,731

33,110

168,783

129,620

Impairment of intangible assets

—

886

—

886

Total operating costs and expenses

76,952

85,528

358,927

362,872

Loss from operations

(69,400

)

(85,389

)

(344,182

)

(362,250

)

Other income (expense), net:

Interest and investment income, net

1,187

484

7,975

1,131

Change in fair value of warrant and

derivative liabilities, and related-party convertible notes

46,598

(116,352

)

76,904

(83,803

)

Interest expense (including amounts with

related parties)

(26,071

)

(31,862

)

(114,670

)

(128,934

)

Interest expense related to revenue

interest liability

(11,503

)

(264

)

(39,657

)

(264

)

Other income (expense), net (including

amounts with related parties) and loss on equity method

investment

10

(71

)

(15

)

(9,772

)

Total other income (expense), net

10,221

(148,065

)

(69,463

)

(221,642

)

Loss before income taxes and

noncontrolling interests

(59,179

)

(233,454

)

(413,645

)

(583,892

)

Income tax expense

—

40

—

40

Net loss

(59,179

)

(233,414

)

(413,645

)

(583,852

)

Net loss attributable to noncontrolling

interests, net of tax

(17

)

(22

)

(81

)

(656

)

Net loss attributable to ImmunityBio

common stockholders

$

(59,162

)

$

(233,392

)

$

(413,564

)

$

(583,196

)

Net loss per ImmunityBio common share –

basic

$

(0.08

)

$

(0.35

)

$

(0.59

)

$

(1.15

)

Net loss per ImmunityBio common share –

diluted

$

(0.09

)

$

(0.35

)

$

(0.62

)

$

(1.15

)

Weighted-average number of common shares

used in computing net loss per share – basic

733,204

667,811

697,312

508,636

Weighted-average number of common shares

used in computing net loss per share – diluted

734,542

667,811

700,443

508,636

ImmunityBio, Inc.

Selected Balance Sheet Data

As of December 31,

(in thousands)

2024

2023

Cash and cash equivalents, and marketable

securities

$

149,809

$

267,353

Total assets

382,933

504,452

Total related-party debt

461,877

681,537

Revenue interest liability

284,404

155,415

Total liabilities

871,062

1,090,389

Total ImmunityBio stockholders’

deficit

(489,098

)

(586,987

)

Total liabilities and stockholders’

deficit

382,933

504,452

ImmunityBio, Inc.

Summary Reconciliations of Cash

Flows

Three Months Ended

December 31,

Year Ended December

31,

(in thousands)

2024

2023

2024

2023

Cash (used in) provided by:

Net cash used in operating activities

$

(85,144

)

$

(115,271

)

$

(391,236

)

$

(366,757

)

Net cash provided by (used in) investing

activities

9,834

2,249

(12,246

)

(30,470

)

Net cash provided by financing

activities

106,929

200,539

281,630

558,341

Effect of exchange rate changes on cash

and cash equivalents, and restricted cash

(7

)

(27

)

(23

)

(292

)

Net change in cash and cash equivalents,

and restricted cash

31,612

87,490

(121,875

)

160,822

Cash and cash equivalents, and restricted

cash, beginning of period

112,300

178,297

265,787

104,965

Cash and cash equivalents, and restricted

cash, end of period

$

143,912

$

265,787

$

143,912

$

265,787

About ANKTIVA

Cytokine fusion proteins, such as ANKTIVA, represent a novel

class of biologics that improve immune responses by enhancing the

therapeutic potential of cytokines and promoting lymphocyte

infiltration at a site of disease. The cytokine interleukin-15

(IL-15) plays a crucial role in the immune system by affecting the

development, maintenance, and function of key immune cells—NK and

CD8+ killer T cells—that are involved in killing cancer cells.

ANKTIVA is a first-in-class IL-15 receptor superagonist IgG1

fusion complex, consisting of an IL-15 mutant (IL-15N72D) fused

with an IL-15Rα, which binds with high affinity to IL-15 receptors

on NK, CD4+, and CD8+ T cells. This fusion complex of ANKTIVA,

which confers stability and longer half-life than recombinant or

native IL-15, mimics the natural biological properties of the

membrane-bound IL-15Rα, delivering IL-15 by dendritic cells and

drives the activation and proliferation of NK cells with the

generation of memory killer T cells that have retained immune

memory against these tumor clones. By activating NK cells, ANKTIVA

overcomes the tumor escape phase of clones resistant to T cells

without stimulating immunosuppressive T-reg cells and restores

memory T cell activity with resultant prolonged duration of

complete response. Further, by stimulating the release of

interferon-γ, ANKTIVA restores MHC-I expression, making more tumor

cells targets for T-cell killing. As evidenced by its ability to

increase lymphocyte counts in healthy adults in Phase 1 testing,

ANKTIVA also has the potential to rescue lymphopenia, which is

associated with poor prognosis in cancer before treatment or as a

consequence of chemo- or radiation therapy.

ANKTIVA was approved by the FDA in 2024 for use in the

United States with BCG for the treatment of adult patients with

BCG-unresponsive non-muscle invasive bladder cancer with CIS with

or without papillary tumors. For more information, visit

ImmunityBio.com (Founder’s Vision) and

Anktiva.com.

About ImmunityBio

ImmunityBio is a vertically-integrated commercial stage

biotechnology company developing next-generation therapies that

bolster the natural immune system to defeat cancers and infectious

diseases. The Company’s range of immunotherapy platforms, alone and

together, act to drive an immune response with the goal of creating

durable immune memory generating safe protection against disease.

We are applying our science and platforms to treating cancers,

including the development of potential cancer vaccines, as well as

developing immunotherapies and cell therapies that we believe

sharply reduce or eliminate the need for standard high-dose

chemotherapy. These platforms and their associated product

candidates are designed to be more effective, accessible, and

easily administered than current standards of care in oncology and

infectious diseases. For more information, visit

ImmunityBio.com (Founder’s Vision) and connect with us on

X (Twitter), Facebook, LinkedIn, and

Instagram.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, such as statements regarding future operating results and

prospects, commercialization activities, momentum and market data,

market access initiatives and coverage under medical reimbursement

policies, the timing of shipments under the rBCG EAP, expected

available doses of rBCG supply, anticipated patient enrollment and

timing of dosing, the expectation that the rBCG EAP will enable

ImmunityBio to reliably bring an alternative source of BCG to

patients in the U.S., the utility of rBCG to improve immunogenicity

and safety in comparison to earlier strains and formulations of

BCG, the RMAT designation referenced herein and potential results

therefrom, the related anticipated EAP submission and timing

thereof, the related anticipated BLA submission and timing thereof,

global expansion efforts and anticipated timeline of regulatory

review of our pending MAAs by the MHRA and EMA, clinical trial

enrollment, data and potential results to be drawn therefrom, the

development of therapeutics for cancer and infectious diseases,

potential benefits to patients, potential treatment outcomes for

patients, the described mechanism of action and results and

contributions therefrom, potential future uses and applications of

ANKTIVA for the reversal of lymphopenia and use in combination with

checkpoint inhibitors or in cancer vaccines and across multiple

tumor types, and ImmunityBio’s approved product and investigational

agents as compared to existing treatment options, among others.

Statements in this press release that are not statements of

historical fact are considered forward-looking statements, which

are usually identified by the use of words such as “anticipates,”

“believes,” “continues,” “goal,” “could,” “estimates,” “scheduled,”

“expects,” “intends,” “may,” “plans,” “potential,” “predicts,”

“indicate,” “projects,” “is,” “seeks,” “should,” “will,”

“strategy,” and variations of such words or similar expressions.

Statements of past performance, efforts, or results of our

preclinical and clinical trials, about which inferences or

assumptions may be made, can also be forward-looking statements and

are not indicative of future performance or results.

Forward-looking statements are neither forecasts, promises nor

guarantees, and are based on the current beliefs of ImmunityBio’s

management as well as assumptions made by and information currently

available to ImmunityBio. Such information may be limited or

incomplete, and ImmunityBio’s statements should not be read to

indicate that it has conducted a thorough inquiry into, or review

of, all potentially available relevant information. Such statements

reflect the current views of ImmunityBio with respect to future

events and are subject to known and unknown risks, including

business, regulatory, economic and competitive risks,

uncertainties, contingencies and assumptions about ImmunityBio,

including, without limitation, (i) risks and uncertainties

regarding commercial launch execution, success and timing, (ii)

risks and uncertainties related to the regulatory submission,

filing and review process and the timing thereof with respect to

the FDA, EMA, MHRA and other regulatory agencies, (iii) risks and

uncertainties regarding the timing of shipments under the rBCG EAP

and ImmunityBio’s ability to establish and maintain a reliable

source of BCG under the EAP, (iv) whether the RMAT designation will

lead to an accelerated review or approval, of which there can be no

assurance, (v) ImmunityBio’s ability to submit the regulatory

submissions referenced herein on the anticipated timeline or at

all, (vi) the ability of ImmunityBio to fund its ongoing and

anticipated clinical trials, (vii) whether clinical trials will

result in registrational pathways, (viii) whether clinical trial

data will be accepted by regulatory agencies, (ix) the ability of

ImmunityBio to continue its planned preclinical and clinical

development of its development programs through itself and/or its

investigators, and the timing and success of any such continued

preclinical and clinical development, patient enrollment and

planned regulatory submissions, (x) potential delays in product

availability and regulatory approvals, (xi) the risks and

uncertainties associated with third-party collaborations and

agreements, including that with Serum Institute of India, (xii)

ImmunityBio’s ability to retain and hire key personnel, (xiii)

ImmunityBio’s ability to obtain additional financing to fund its

operations and complete the development and commercialization of

its various product candidates, (xiv) potential product shortages

or manufacturing disruptions that may impact the availability and

timing of product, (xv) ImmunityBio’s ability to successfully

commercialize its approved product and product candidates, (xvi)

ImmunityBio’s ability to scale its manufacturing and commercial

supply operations for its approved product and future approved

products, and (xvii) ImmunityBio’s ability to obtain, maintain,

protect, and enforce patent protection and other proprietary rights

for its product candidates and technologies. More details about

these and other risks that may impact ImmunityBio’s business are

described under the heading “Risk Factors” in the Company’s Form

10-K filed with the U.S. Securities and Exchange Commission (SEC)

on March 19, 2024 and the Company’s Form 10-Q filed with the SEC on

November 12, 2024, and in subsequent filings made by ImmunityBio

with the SEC, which are available on the SEC’s website at

www.sec.gov. ImmunityBio cautions you not to place undue

reliance on any forward looking statements, which speak only as of

the date hereof. ImmunityBio does not undertake any duty to update

any forward-looking statement or other information in this press

release, except to the extent required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250303380017/en/

Investors Hemanth Ramaprakash, PhD, MBA

ImmunityBio, Inc. +1 858-746-9289

Hemanth.Ramaprakash@ImmunityBio.com

Media ImmunityBio, Inc. Sarah Singleton +1

415-290-8045 Sarah.Singleton@ImmunityBio.com

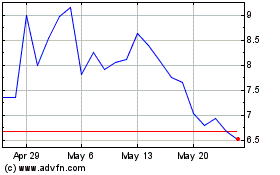

ImmunityBio (NASDAQ:IBRX)

Historical Stock Chart

From Feb 2025 to Mar 2025

ImmunityBio (NASDAQ:IBRX)

Historical Stock Chart

From Mar 2024 to Mar 2025