Kandi Technologies Group, Inc. (NASDAQ: KNDI) (“Kandi” or the

“Company”), a leader in all-electric personal transportation and

utility vehicles, today announced that on October 6, 2024, its

Board of Directors approved several significant corporate

decisions. During this meeting, the Board accepted the resignation

of Mr. Xiaoming Hu as Chairman of the Board and appointed Dr.

Xueqin Dong as his successor. Additionally, Dr. Dong stepped down

as CEO, and Mr. Feng Chen has been appointed as the new CEO.

As autonomous driving technologies continue to

advance due to increasing demand and desire for more

technologically advanced mobility, China’s ride-hailing market is

expected to experience substantial growth. Kandi seeks to expand

its presence within the smart mobility solutions business industry.

The Board has approved management's proposal to acquire Hangzhou

Honghu Zhixing Technology Co., Ltd. (“Hangzhou Honghu”), a company

with an established position in this industry, at a fair market

value and in accordance with applicable regulations. Furthermore,

the Board has authorized the Company to pursue a potential Initial

Public Offering (IPO) of Kandi America, its subsidiary in the

United States, following SEC requirements. The Board also reviewed

and approved the new management’s growth plan for 2025-2029.

The highlights of Kandi’s 2025-2029 strategic plan

include the Company’s primary focus on expanding its two main

business lines over the next five years: (1) all-electric off-road

vehicles and (2) lithium battery production in North America,

Europe and Southeast Asia. The domestic strategy in China includes

three core areas: (1) Kandi will leverage any future relationship

with Hangzhou Honghu as a foundation to further expand its smart

mobility solutions business; (2) with the rapid growth of China’s

electric vehicle market, Kandi strongly believes that battery

swapping is the most effective way to harness off-peak electricity

for genuine energy savings and environmental benefits. The Company

aims to capitalize on its expertise in battery swapping equipment

by partnering with industry leaders to drive innovation and

expansion in this area; and (3) Kandi will seek to advance

operations in the battery-swapping industry to extend the value

chain.

Projected Annual Production and Sales for

2025-2029:

1. Expected

production and sales of various off-road electric vehicles:

annual units of 36,000, 44,000, 56,300, 65,060, and 77,472 from

2025 to 2029, respectively. These sales are expected to generate

annual revenue of $185 million, $248 million, $357 million, $423

million, and $526 million, with gross margins expected to exceed

30%. Kandi anticipates that approximately two-thirds of these

vehicles will be sold in North America, with the remaining third

distributed across Europe and Southeast Asia.

2. In 2025,

Kandi plans to invest $100 million in the United States to

establish a lithium battery manufacturing and battery pack facility

with an initial annual capacity of 1 GWh. This facility is

projected to take 18 months to complete and is anticipated to

generate approximately $230 million in annual revenue upon reaching

full capacity, with a gross margin expected to be above 30%. The

entire project is designed to achieve a total capacity of 3 GWh,

constructed in three phases. The timing of the second and third

phases will depend on the progress made during the initial

phase.

3.

Additionally, in 2025, the Company plans to invest $30 million to

establish a production line in the United States for all-terrain

vehicles, including golf carts and utility vehicles. The

construction is expected to take 12 months, and once fully

operational, the facility will have an annual production capacity

of 50,000 units, with products for the North American market

transitioning to this U.S.-based facility.

4. The

Company’s smart mobility solutions business projections: annual

revenue of $24.37 million, $31.68 million, $41.93 million, $53.55

million, and $69.61 million from 2025 to 2029, respectively, with

corresponding net profits of $3.9 million, $5.07 million, $6.59

million, $8.56 million, and $11.13 million.

5.

Production and sales of the battery swapping equipment business:

Kandi anticipates 100, 200, 300, 400, and 500 units annually from

2025 to 2029, generating revenue projected to be $20 million, $40

million, $60 million, $80 million, and $100 million, respectively,

with gross margins anticipated to exceed 30%. Kandi aims to

establish itself as a strategic supplier and leading force in this

sector.

6. Battery

swapping operations: projected annual revenue of $1 million, $4

million, $8 million, $13 million, and $17 million, with gross

margins above 20%.

7. Other

product lines, including motors and batteries: projected annual

revenue of $18 million, with approximate gross margins of 25%.

Dr. Xueqin Dong, the newly-appointed Chairman of

Kandi Technologies, stated, “I am deeply honored by the Board's

trust in electing me as Chairman. I extend my heartfelt

gratitude to Mr. Hu for his outstanding leadership, which has laid

a solid foundation for our Company. Although Mr. Hu has stepped

down as Chairman, he will remain an integral member of the Board,

and I am confident he will continue to play an essential role in

the Company’s future. Assuming this role represents both an

exciting new beginning and a significant challenge. I am fully

committed to meeting the expectations of our Board and shareholders

as we work together to advance the Company’s growth. With a united

team and a shared vision, I believe we will reach our goals and

continue to build on Kandi's success.”

Mr. Feng Chen, the newly-appointed CEO, added, “I’m

deeply grateful for the Board’s trust and the opportunity to assume

this significant responsibility. As CEO, I feel a profound sense of

duty. Over the past few days, I have worked closely with the

management team to develop the Company’s 2025-2029 plan, which has

received overwhelming Board approval. While I recognize that

challenges lie ahead, I am confident that, with unity and effective

execution, we will overcome any obstacles and achieve our strategic

objectives.”

About Kandi Technologies Group,

Inc.

Kandi Technologies Group, Inc. (KNDI),

headquartered in Jinhua New Energy Vehicle Town,Zhejiang Province,

is engaged in the research, development, manufacturing, and sales

of various vehicular products. Kandi conducts its primary business

operations through its wholly-owned subsidiary, Zhejiang Kandi

Technologies Group Co., Ltd. (“Zhejiang Kandi Technologies”),

formerly, Zhejiang Kandi Vehicles Co., Ltd. and its subsidiaries

including Kandi Electric Vehicles (Hainan) Co., Ltd. and SC

Autosports, LLC (d/b/a Kandi America), the wholly-owned subsidiary

of Kandi in the United States, and its wholly-owned subsidiary,

Kandi America Investment, LLC. Zhejiang Kandi Technologies has

established itself as one of China’s leading manufacturers of pure

electricvehicle parts and off-road vehicles.

Safe Harbor Statement

This press release contains certain statements that

may include “forward-looking statements.” All statements other than

statements of historical fact included herein are “forward-looking

statements.” These forward-looking statements are often identified

by the use of forward-looking terminology such as “believes,”

“expects” or similar expressions, involving known and unknown risks

and uncertainties. Although the Company believes that the

expectations reflected in these forward-looking statements are

reasonable, they do involve assumptions, risks and uncertainties,

and these expectations may prove to be incorrect. You should not

place undue reliance on these forward-looking statements, which

speak only as of the date of this press release. The Company’s

actual results could differ materially from those anticipated in

these forward-looking statements as a result of a variety of

factors, including the risk factors discussed in the Company’s

periodic reports that are filed with the Securities and Exchange

Commission and available on the SEC’s website (http://www.sec.gov).

All forward-looking statements attributable to the Company or

persons acting on its behalf are expressly qualified in their

entirety by these risk factors. Other than as required under the

applicable securities laws, the Company does not assume a duty to

update these forward-looking statements.

Follow us on Twitter: @ Kandi_Group

Contacts:

Kandi Technologies Group, Inc.Ms. Kewa Luo+1 (212)

551-3610IR@kandigroup.com

The Blueshirt GroupMr. Gary Dvorchak,

CFAgary@blueshirtgroup.co

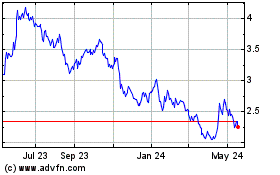

Kandi Technolgies (NASDAQ:KNDI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Kandi Technolgies (NASDAQ:KNDI)

Historical Stock Chart

From Dec 2023 to Dec 2024