KVH Industries, Inc., (Nasdaq: KVHI), reported financial results

for the quarter and full year ended December 31, 2024 today.

The company will hold a conference call to discuss these results at

9:00 a.m. ET today, which can be accessed at investors.kvh.com.

Following the call, a replay of the webcast will be available

through the company’s website.

Fourth Quarter 2024

Highlights

- Total revenues decreased by 14% in the fourth quarter of 2024

to $26.9 million from $31.5 million in the fourth quarter of

2023.

- Airtime revenue decreased by $5.1 million to

$20.8 million, or 20% in the fourth quarter of 2024 compared

to the fourth quarter of 2023.

- Net loss in the fourth quarter of 2024 was $4.3 million, or

$0.22 per share, compared to a net loss of $12.2 million, or $0.63

per share, in the fourth quarter of 2023.

- Non-GAAP adjusted EBITDA was $0.5 million in the fourth quarter

of 2024, compared to $2.3 million in the fourth quarter of 2023.

The U.S. Coast Guard contract downgrade reduced non-GAAP adjusted

EBITDA by $2.2 million year over year.

Commenting on the company’s fourth quarter and

full year results, Brent C. Bruun, KVH’s Chief Executive Officer,

said, “Our recent results validate our strategic decision to

integrate Starlink fully into our product and service portfolio. We

shipped more than 1,000 Starlink terminals in the fourth quarter

and, with more than 2,300 activations in 2024, Starlink is now the

fastest growing product line in our history. At the same time, we

have strengthened our multi-orbit, multi-channel portfolio with the

addition of OneWeb, CommBox Edge, and the TracNet Coastal global 5G

and Wi-Fi communication system.

“Fourth quarter airtime and service revenue was

$22.3 million, a $5.4 million reduction from the fourth quarter of

2023. Of this reduction, $2.2 million was related to the U.S. Coast

Guard contract downgrade, while the remaining decline was driven by

overall softness in the VSAT airtime market primarily due to the

impact of customer demand for Starlink services. Our Starlink

airtime margins continue to be strong, though overall airtime gross

margins declined due in part to fixed costs for VSAT services. Our

subscriber base increased by 4% in the fourth quarter, CommBox Edge

activations doubled, and we achieved a fourth consecutive quarter

of record terminal shipments. We are in a stronger position now

than a year ago, and I believe we are on the path toward renewed

growth and profitability. With this in mind, for full year 2025 we

anticipate that revenue will be in the range of $115 million to

$125 million, and adjusted EBITDA in the range of $9 million to $15

million.”

| Financial

Highlights (in millions, except per share data) |

| |

|

|

|

|

| |

|

Three Months Ended |

|

Year Ended |

| |

|

December 31, |

|

December 31, |

| |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| GAAP

Results |

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

26.9 |

|

|

$ |

31.5 |

|

|

$ |

113.8 |

|

|

$ |

132.4 |

|

| Loss from operations |

|

$ |

(3.2 |

) |

|

$ |

(12.2 |

) |

|

$ |

(11.9 |

) |

|

$ |

(17.3 |

) |

| Net loss |

|

$ |

(4.3 |

) |

|

$ |

(12.2 |

) |

|

$ |

(11.0 |

) |

|

$ |

(15.4 |

) |

| Net loss per share |

|

$ |

(0.22 |

) |

|

$ |

(0.63 |

) |

|

$ |

(0.57 |

) |

|

$ |

(0.81 |

) |

| |

|

|

|

|

|

|

|

|

| Non-GAAP Adjusted

EBITDA |

|

$ |

0.5 |

|

|

$ |

2.3 |

|

|

$ |

8.1 |

|

|

$ |

14.3 |

|

Fourth Quarter Financial

Summary

Revenue was $26.9 million for the fourth

quarter of 2024, a decrease of 14% compared to $31.5 million

in the fourth quarter of 2023.

Service revenues for the fourth quarter of 2024

were $22.3 million, a decrease of 20%. The decrease in service

sales was primarily due to a $5.1 million decrease in our

airtime service sales, of which $2.2 million was related to the

U.S. Coast Guard contract downgrade.

Product revenues for the fourth quarter of 2024

were $4.6 million, an increase of 24% from the fourth quarter

of 2023. The increase in product sales was primarily due to a $1.2

million increase in Starlink product sales, partially offset by a

$0.3 million decrease in TracVision product sales.

Our operating expenses decreased $2.7 million to $10.3 million

for the fourth quarter of 2024 compared to $13.0 million for the

fourth quarter of 2023. This decrease was primarily due to the $2.1

million charge incurred in 2023 for the discontinuation of a

project for implementing a manufacturing-centric accounting system

and a $0.8 million decrease in recurring salaries, benefits and

taxes, partially offset by $0.9 million of restructuring severance

charges.

Full Year Financial Summary

Revenue was $113.8 million for the year

ended December 31, 2024, a decrease of 14% compared to $132.4

million for the year ended December 31, 2023.

Service revenues for the year ended December 31,

2024, were $96.4 million, a decrease of 16% compared to the year

ended December 31, 2023. The decrease in service sales was

primarily due to a $17.1 million decrease in our airtime service

sales, driven primarily by a decrease in VSAT-only subscribers,

partially offset by an increase in Starlink service sales. $2.7

million of this decrease was related to the U.S. Coast Guard

contract downgrade.

Product revenues for the year ended December 31,

2024, were $17.4 million, a decrease of 2% compared to the

year ended December 31, 2023. The decrease in product sales was

primarily the result of a $2.2 million decrease in VSAT

Broadband product sales, a $2.0 million decrease in TracVision

product sales and a $1.3 million decrease in accessory and

service product sales, partially offset by a $5.0 million

increase in Starlink product sales and a $0.5 million increase

in CommBox Edge product sales.

Our operating expenses decreased $8.1 million to

$47.1 million in the year ended December 31, 2024, compared to

$55.2 million in the year ended December 31, 2023. This

decrease in operating expenses was primarily due to a $4.9 million

decrease in aggregate non-cash impairment charges against goodwill

and long-lived assets, a $2.1 million charge incurred in 2023 for

the discontinuation of a project for implementing a

manufacturing-centric accounting system, a $2.0 million decrease in

salaries, benefits and taxes, excluding costs related to the

reduction in workforce, a $1.0 million decrease in professional

fees, a $0.4 million decrease in external commissions, a $0.4

million decrease in computer expenses, a $0.4 million decrease in

depreciation and amortization, and a $0.3 million decrease in

expensed materials. These decreases in expenses were partially

offset by $2.9 million of costs related to the reductions in our

workforce and a $0.7 million reduction in reimbursements made by

EMCORE for expenses incurred under the transition services

agreement relating to the sale of the inertial navigation business

in August 2022. The $8.1 million improvement in operating expenses

reflects a reduction in non-cash impairment charges of $4.9 million

from 2023 to 2024.

Other Recent Announcements

- December 10, 2024 – Seaspan Selects KVH to Equip Fleet with

OneWeb Low Earth Orbit Solution

- December 5, 2024 – Vroon and KVH Complete Deployment of

Starlink/VSAT Hybrid Connectivity on 58 Vessels

- December 3, 2024 – KVH Introduces TracNet™ Coastal and TracNet

Coastal Pro 5G/Wi-Fi Terminals and Cellular Data Plans

Conference Call Details

KVH Industries will host a conference call today

at 9:00 a.m. ET through the company’s website. The conference call

can be accessed at investors.kvh.com and listeners are welcome to

submit questions pertaining to the earnings release and conference

call to ir@kvh.com. The audio archive will be available on the

company website within three hours of the completion of the

call.

Non-GAAP Financial Measures

This release provides non-GAAP financial

information as a supplement to our condensed consolidated financial

statements, which are prepared in accordance with generally

accepted accounting principles (“GAAP”). Management uses these

non-GAAP financial measures internally in analyzing financial

results to assess operational performance. The presentation of this

financial information is not intended to be considered in isolation

or as a substitute for the financial information prepared in

accordance with GAAP. The non-GAAP financial measures used in this

press release adjust for specified items that can be highly

variable or difficult to predict. Management generally uses these

non-GAAP financial measures to facilitate financial and operational

decision-making, including evaluation of our historical operating

results and comparison to competitors’ operating results. These

non-GAAP financial measures reflect an additional way of viewing

aspects of our operations that, when viewed with GAAP results and

the reconciliations to corresponding GAAP financial measures, may

provide a more complete understanding of factors and trends

affecting our business.

Some limitations of non-GAAP adjusted EBITDA

include the following: non-GAAP adjusted EBITDA represents net

income (loss) before, as applicable, interest income, net, income

tax expense (benefit), depreciation, amortization, stock-based

compensation expense, goodwill impairment charges, long-lived

assets impairment charges, charges for disposal of discontinued

projects, loss on unfavorable future contracts, employee

termination and other variable costs, executive separation costs,

transaction-related and other variable legal and advisory fees,

irregular inventory write-downs, excess purchase order obligations,

gains and losses on sale of subsidiaries, and foreign exchange

transaction gains and losses.

Other companies, including companies in KVH’s

industry, may calculate these non-GAAP financial measures

differently or not at all, which will reduce their usefulness as a

comparative measure.

Because non-GAAP financial measures exclude the

effect of items that increase or decrease our reported results of

operations, management strongly encourages investors to review our

consolidated financial statements and publicly filed reports in

their entirety. Reconciliations of the non-GAAP financial measures

to the most directly comparable GAAP financial measures are

included in the tables accompanying this release.

About KVH Industries, Inc.

KVH Industries, Inc. is a global leader in

maritime and mobile connectivity delivered via the KVH ONE network.

The company, founded in 1982, is based in Middletown, RI, with

research, development, and manufacturing operations in Middletown,

RI, and more than a dozen offices around the globe. KVH provides

connectivity solutions for commercial maritime, leisure marine,

military/government, and land mobile applications on vessels and

vehicles, including the TracNet, TracPhone, and TracVision product

lines, the KVH ONE OpenNet Program for non-KVH antennas, AgilePlans

Connectivity as a Service (CaaS), and the KVH Link crew wellbeing

content service.

This press release contains forward-looking

statements that involve risks and uncertainties. For example,

forward-looking statements include statements regarding projected

financial results, the anticipated benefits of our restructuring

and other initiatives, anticipated cost savings, our investment

plans, our development goals, and the potential impact of our

future initiatives on revenue, competitive positioning,

profitability, and orders. Actual results could differ materially

from the results projected in or implied by the forward-looking

statements made in this press release. Factors that might cause

these differences include, but are not limited to: continued

increasing competition, particularly from lower-cost providers, low

earth orbit satellite systems and other telecommunications systems,

especially in the global leisure market, which is reducing demand

for geosynchronous satellite services, including ours; the impact

of lower revenue from the U.S. Coast Guard; potentially lower

product and service margins from reseller arrangements; the risk

that sales of Starlink terminals will slow down or decrease;

potential hardware and software competition for our new CommBox

product offerings; unanticipated obstacles to implementation of our

manufacturing wind-down; unanticipated costs and expenses arising

from the wind-down; unanticipated effects of the wind-down on our

ongoing business; the risks associated with increased customer

reliance on third-party hardware; the lack of future product

differentiation; new service offerings from hardware providers;

potential customer delays in selecting our services; the uncertain

impact of continuing industry consolidation; the risk that our

OpenNet program will lead to further reductions in sales of our

satellite products; the risk that our current and future

non-exclusive arrangements with Starlink and OneWeb will not

provide material benefits; contingencies and termination rights

applicable to pending and future property and asset sales;

uncertainty regarding customer responses to new product and service

introductions; challenges and potential additional expenses in

retaining our employees, particularly in the current competitive

labor market characterized by rising wages; the challenges of

meeting customer expectations with a smaller employee base;

uncertainties created by our new business strategy, which may

impact customer recruitment and retention; the uncertain impact of

ongoing disruptions in our supply chain and associated increases in

our costs; the uncertain impact of inflation, particularly with

respect to fuel costs, and fears of recession; the uncertain impact

of the wars in Ukraine and the Middle East and international

tensions in Asia, including the impact of dramatic shifts in U.S.

geopolitical priorities; unanticipated changes or disruptions in

our markets; technological breakthroughs by competitors; changes in

customer priorities or preferences; increasing customer

terminations; unanticipated liabilities, charges and write-offs;

the potential that competitors will design around or invalidate our

intellectual property rights; a history of losses; continued

fluctuations in quarterly results; the uncertain impact of recent

dramatic changes in both U.S. and foreign trade policy, including

actual and potential new or higher tariffs and trade barriers, as

well as trade wars with other countries; potentially inflationary

impacts of tariffs and budget deficits; unanticipated obstacles in

our product and service development, cost engineering and

manufacturing efforts; adverse impacts of currency fluctuations;

our ability to successfully commercialize our new initiatives

without unanticipated additional expenses or delays; reduced sales

to companies in or dependent upon the turbulent oil and gas

industry; the impact of extended economic weakness on the sale and

use of marine vessels and recreational vehicles; continued

challenges of maintaining our market share in the market for

airtime services; the risk that declining sales of the TracNet

H-series and TracPhone V-HTS series products and related services

will continue to reduce airtime gross margins; the risk that

reduced product sales will continue to erode product gross margins

and lead to increased losses; potential continuing declines or

changes in customer demand, due to economic, weather-related,

seasonal, and other factors, particularly with respect to the

TracNet H-series and TracPhone V-HTS series; exposure for potential

intellectual property infringement; changes in tax and accounting

requirements or assessments; and export restrictions, delays in

procuring export licenses, and other international risks. These and

other factors are discussed in more detail in our Quarterly Report

on Form 10-Q filed with the Securities and Exchange Commission on

November 7, 2024. Copies are available through our Investor

Relations department and website, investors.kvh.com. We do not

assume any obligation to update our forward-looking statements to

reflect new information and developments.

KVH Industries, Inc., has used, registered, or

applied to register its trademarks in the USA and other countries

around the world, including but not limited to the following marks:

KVH, KVH ONE, TracPhone, TracVision, AgilePlans, CommBox, and

TracNet. Other trademarks are the property of their respective

companies.

|

KVH INDUSTRIES, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(in thousands, except per share amounts,

unaudited) |

| |

| |

|

Three months ended December 31, |

|

Year ended December 31, |

| |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Sales: |

|

|

|

|

|

|

|

|

|

Service |

|

$ |

22,324 |

|

|

$ |

27,739 |

|

|

$ |

96,446 |

|

|

$ |

114,622 |

|

|

Product |

|

|

4,593 |

|

|

|

3,716 |

|

|

|

17,382 |

|

|

|

17,757 |

|

|

Net sales |

|

|

26,917 |

|

|

|

31,455 |

|

|

|

113,828 |

|

|

|

132,379 |

|

| Costs and

expenses: |

|

|

|

|

|

|

|

|

|

Costs of service sales |

|

|

15,506 |

|

|

|

17,514 |

|

|

|

60,002 |

|

|

|

65,362 |

|

|

Costs of product sales |

|

|

4,286 |

|

|

|

13,107 |

|

|

|

18,607 |

|

|

|

29,149 |

|

|

Research and development |

|

|

1,668 |

|

|

|

2,020 |

|

|

|

8,439 |

|

|

|

9,399 |

|

|

Sales, marketing and support |

|

|

5,363 |

|

|

|

5,252 |

|

|

|

21,013 |

|

|

|

20,925 |

|

|

General and administrative |

|

|

3,299 |

|

|

|

5,760 |

|

|

|

16,513 |

|

|

|

18,899 |

|

|

Goodwill impairment charge |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5,333 |

|

|

Intangible asset impairment charge |

|

|

— |

|

|

|

— |

|

|

|

1,137 |

|

|

|

657 |

|

|

Total costs and expenses |

|

|

30,122 |

|

|

|

43,653 |

|

|

|

125,711 |

|

|

|

149,724 |

|

|

Loss from operations |

|

|

(3,205 |

) |

|

|

(12,198 |

) |

|

|

(11,883 |

) |

|

|

(17,345 |

) |

|

Interest income |

|

|

623 |

|

|

|

986 |

|

|

|

3,039 |

|

|

|

3,646 |

|

|

Interest expense |

|

|

— |

|

|

|

1 |

|

|

|

2 |

|

|

|

1 |

|

|

Other expense, net |

|

|

(1,433 |

) |

|

|

(821 |

) |

|

|

(1,781 |

) |

|

|

(1,404 |

) |

|

Loss before income tax expense |

|

|

(4,015 |

) |

|

|

(12,034 |

) |

|

|

(10,627 |

) |

|

|

(15,104 |

) |

| Income tax expense |

|

|

295 |

|

|

|

159 |

|

|

|

421 |

|

|

|

318 |

|

|

Net loss |

|

$ |

(4,310 |

) |

|

$ |

(12,193 |

) |

|

$ |

(11,048 |

) |

|

$ |

(15,422 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss per common

share |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.22 |

) |

|

$ |

(0.63 |

) |

|

$ |

(0.57 |

) |

|

$ |

(0.81 |

) |

|

Diluted |

|

$ |

(0.22 |

) |

|

$ |

(0.63 |

) |

|

$ |

(0.57 |

) |

|

$ |

(0.81 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted average

number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

19,453 |

|

|

|

19,250 |

|

|

|

19,389 |

|

|

|

19,130 |

|

|

Diluted |

|

|

19,453 |

|

|

|

19,250 |

|

|

|

19,389 |

|

|

|

19,130 |

|

|

KVH INDUSTRIES, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(in thousands, unaudited) |

| |

| |

|

December 31, 2024 |

|

December 31, 2023 |

| ASSETS |

|

|

|

|

|

Cash, cash equivalents and marketable securities |

|

$ |

50,572 |

|

|

69,771 |

|

Accounts receivable, net |

|

|

21,624 |

|

|

25,670 |

|

Inventories, net |

|

|

22,953 |

|

|

19,046 |

|

Other current assets and contract assets |

|

|

16,016 |

|

|

4,331 |

|

Current assets held for sale |

|

|

11,410 |

|

|

— |

|

Total current assets |

|

|

122,575 |

|

|

118,818 |

|

Property and equipment, net |

|

|

27,014 |

|

|

47,680 |

|

Intangible assets, net |

|

|

828 |

|

|

1,194 |

|

Right of use assets |

|

|

1,361 |

|

|

1,068 |

|

Other non-current assets and contract assets |

|

|

3,146 |

|

|

3,618 |

|

Non-current deferred income tax asset |

|

|

157 |

|

|

256 |

|

Total assets |

|

$ |

155,081 |

|

$ |

172,634 |

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

14,173 |

|

|

22,412 |

|

Deferred revenue |

|

|

1,039 |

|

|

1,774 |

|

Current operating lease liability |

|

|

660 |

|

|

786 |

|

Total current liabilities |

|

|

15,872 |

|

|

24,972 |

|

Long-term operating lease liability |

|

|

569 |

|

|

289 |

|

Non-current deferred income tax liability |

|

|

15 |

|

|

1 |

|

Stockholders’ equity |

|

|

138,625 |

|

|

147,372 |

|

Total liabilities and stockholders’ equity |

|

$ |

155,081 |

|

$ |

172,634 |

|

KVH INDUSTRIES, INC. AND

SUBSIDIARIESRECONCILIATION OF GAAP NET LOSS TO

NON-GAAP EBITDA AND NON-GAAP ADJUSTED

EBITDA(in thousands, unaudited) |

| |

| |

|

Three months ended December 31, |

|

Year ended December 31, |

| |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net loss - GAAP

(1) |

|

$ |

(4,310 |

) |

|

$ |

(12,193 |

) |

|

$ |

(11,048 |

) |

|

$ |

(15,422 |

) |

|

Income tax expense |

|

|

295 |

|

|

|

159 |

|

|

|

421 |

|

|

|

318 |

|

|

Interest income, net |

|

|

(623 |

) |

|

|

(985 |

) |

|

|

(3,037 |

) |

|

|

(3,645 |

) |

|

Depreciation and amortization |

|

|

3,048 |

|

|

|

3,319 |

|

|

|

13,298 |

|

|

|

13,438 |

|

| Non-GAAP

EBITDA |

|

|

(1,590 |

) |

|

|

(9,700 |

) |

|

|

(366 |

) |

|

|

(5,311 |

) |

|

Stock-based compensation expense |

|

|

398 |

|

|

|

645 |

|

|

|

2,027 |

|

|

|

2,078 |

|

|

Goodwill impairment charge |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5,333 |

|

|

Long-lived assets impairment charge |

|

|

— |

|

|

|

— |

|

|

|

1,137 |

|

|

|

657 |

|

|

Disposal of a discontinued project |

|

|

— |

|

|

|

2,099 |

|

|

|

— |

|

|

|

2,099 |

|

|

Loss on an unfavorable future contract |

|

|

— |

|

|

|

337 |

|

|

|

— |

|

|

|

337 |

|

|

Employee termination and other variable costs |

|

|

926 |

|

|

|

— |

|

|

|

3,863 |

|

|

|

— |

|

|

Prior period Brazil tax settlement |

|

|

446 |

|

|

|

— |

|

|

|

446 |

|

|

|

— |

|

|

Transaction-related and other variable legal and advisory fees |

|

|

156 |

|

|

|

41 |

|

|

|

451 |

|

|

|

275 |

|

|

Irregular inventory write-down |

|

|

— |

|

|

|

5,225 |

|

|

|

— |

|

|

|

5,225 |

|

|

Excess purchase order obligations |

|

|

— |

|

|

|

3,569 |

|

|

|

— |

|

|

|

3,569 |

|

|

Loss on sale of a subsidiary |

|

|

— |

|

|

|

53 |

|

|

|

— |

|

|

|

53 |

|

|

Foreign exchange transaction loss |

|

|

176 |

|

|

|

15 |

|

|

|

493 |

|

|

|

33 |

|

| Non-GAAP adjusted

EBITDA |

|

$ |

512 |

|

|

$ |

2,284 |

|

|

$ |

8,051 |

|

|

$ |

14,348 |

|

(1) Net loss - GAAP includes a non-cash loss related to the

disposal of AgilePlans revenue-generating fixed assets, in which no

proceeds were received, of $819 and $333 for the three months ended

December 31, 2024 and 2023, respectively, and $900 and $667 for the

years ended December 31, 2024 and 2023, respectively.

| |

|

|

| Contact: |

|

KVH Industries, Inc.Chris

Watson401-845-2441IR@kvh.com |

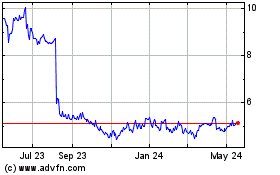

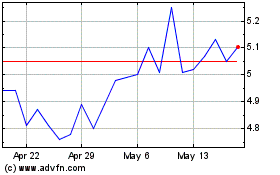

KVH Industries (NASDAQ:KVHI)

Historical Stock Chart

From Feb 2025 to Mar 2025

KVH Industries (NASDAQ:KVHI)

Historical Stock Chart

From Mar 2024 to Mar 2025