Kymera Therapeutics Announces Pricing of $275 Million Public Offering

05 January 2024 - 10:00PM

Kymera Therapeutics, Inc. (NASDAQ: KYMR), a clinical-stage

biopharmaceutical company advancing a new class of small molecule

medicines using targeted protein degradation (TPD), today announced

the pricing of its underwritten public offering of $275 million of

shares of its common stock and, in lieu of common stock to certain

investors, pre-funded warrants to purchase shares of its common

stock. Kymera is selling 2,250,495 shares of common stock and, in

lieu of common stock to certain investors, pre-funded warrants to

purchase 8,640,594 shares of common stock in the offering. The

shares of common stock are being sold at a public offering price of

$25.25 per share and the pre-funded warrants are being sold at a

public offering price of $25.2499 per pre-funded warrants, which

represents the per share public offering price of each share of

common stock less the $0.0001 per share exercise price for each

pre-funded warrant. The gross proceeds to Kymera from the offering

are expected to be approximately $275 million, before deducting

underwriting discounts and commissions and estimated offering

expenses payable by Kymera, excluding the exercise of any

pre-funded warrants and assuming no exercise of the underwriters’

option to purchase additional shares. In addition, Kymera has

granted the underwriters a 30-day option to purchase up to an

additional $41.25 million of shares of its common stock at the

public offering price per share, less underwriting discounts and

commissions. All of the securities being sold in this offering are

being offered by Kymera. The offering is expected to close on

January 9, 2024, subject to the satisfaction of customary

conditions.

Kymera intends to use the net proceeds from the offering to

continue to advance its pipeline of preclinical and clinical

degrader programs that are designed to address large patient

populations with significant need and clear commercial opportunity,

and for working capital and other general corporate purposes.

Kymera may also use a portion of the net proceeds to in-license,

acquire or invest in complementary businesses or technologies to

continue to build its pipeline, research and development

capabilities and its intellectual property position.

Morgan Stanley, J.P. Morgan and TD Cowen are acting as joint

lead bookrunning managers for the offering. UBS Investment Bank is

also acting as a bookrunning manager.

The securities described above are being offered pursuant to an

automatically effective shelf registration statement on Form S-3

(No. 333-259955) that was filed with the U.S. Securities and

Exchange Commission (the “SEC”) on October 1, 2021. This offering

is being made only by means of a prospectus supplement and an

accompanying prospectus that form a part of the registration

statement.

A final prospectus supplement related to and describing the

terms of the offering will be filed with the SEC and will be

available on the SEC’s website located at www.sec.gov. Copies of

the final prospectus supplement and an accompanying prospectus

related to the offering may also be obtained, when available, from

Morgan Stanley & Co. LLC, Attention: Prospectus Department, 180

Varick Street, 2nd Floor, New York, NY 10014, or by email at

prospectus@morganstanley.com; J.P. Morgan Securities LLC, c/o

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

NY 11717, by telephone at (866) 803-9204, or via email at

prospectus-eq_fi@jpmchase.com; Cowen and Company, LLC, 599

Lexington Avenue, New York, NY 10022, by telephone at (833)

297-2926, or by email at Prospectus_ECM@cowen.com.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of that state or

jurisdiction.

About Kymera TherapeuticsKymera is a

clinical-stage biotechnology company pioneering the field of

targeted protein degradation (TPD) to develop medicines that

address critical health problems and have the potential to

dramatically improve patients’ lives. Kymera is deploying TPD to

address disease targets and pathways inaccessible with conventional

therapeutics. Having advanced the first degrader into the clinic

for immunological diseases, Kymera is focused on delivering oral

small molecule degraders to provide a new generation of convenient,

highly effective therapies for patients with these conditions.

Kymera is also progressing degrader oncology programs that target

undrugged or poorly drugged proteins to create new ways to fight

cancer. Founded in 2016, Kymera has been recognized as one of

Boston’s top workplaces for the past several years.

Cautionary Note Regarding Forward-Looking

StatementsStatements in this press release may contain

“forward-looking statements” that are subject to substantial risks

and uncertainties. Forward-looking statements contained in this

press release may be identified by the use of words such as “may,”

“will,” “should,” “expect,” “plan,” “anticipate,” “could,”

“intend,” “target,” “project,” “contemplate,” “believe,”

“estimate,” “predict,” “potential” or “continue” or the negative of

these terms or other similar expressions, and include, but are not

limited to, statements regarding the expected gross proceeds from

the offering, the anticipated use of proceeds from the offering and

completion and timing of the public offering. Any forward-looking

statements are based on Kymera’s current expectations, forecasts,

and assumptions and are subject to a number of risks and

uncertainties that could cause actual outcomes and results to

differ materially and adversely from those set forth in or implied

by such forward-looking statements. These risks and uncertainties

include, but are not limited to, risks and uncertainties related to

market conditions and satisfaction of customary closing conditions

related to the public offering. For a discussion of other risks and

uncertainties, and other important factors, any of which could

cause our actual results to differ from those contained in the

forward-looking statements, see the section entitled “Risk Factors”

in Kymera’s Annual Report on Form 10-K for the year ended December

31, 2022 and its Quarterly Report on Form 10-Q for the quarterly

period ended September 30, 2023, as well as in the prospectus

supplement related to the public offering. Forward-looking

statements contained in this announcement are based on information

available to Kymera as of the date hereof and are made only as of

the date of this release. Kymera undertakes no obligation to update

such information except as required under applicable law. These

forward-looking statements should not be relied upon as

representing Kymera’s views as of any date subsequent to the date

of this press release. In light of the foregoing, investors are

urged not to rely on any forward-looking statement in reaching any

conclusion or making any investment decision about any securities

of Kymera.

|

Investor Contact:Justine KoenigsbergVice

President, Investor

Relationsinvestors@kymeratx.com857-285-5300 |

Media Contact:Todd Cooper Senior Vice

President, Corporate

Affairs media@kymeratx.com 857-285-5300 |

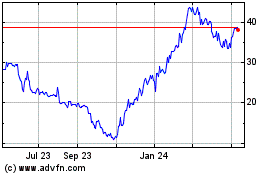

Kymera Therapeutics (NASDAQ:KYMR)

Historical Stock Chart

From Dec 2024 to Jan 2025

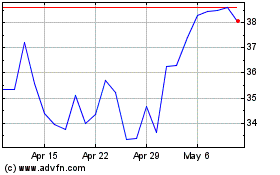

Kymera Therapeutics (NASDAQ:KYMR)

Historical Stock Chart

From Jan 2024 to Jan 2025