Filed

pursuant to Rule 424(b)(5)

Registration

No. 333-272066

PROSPECTUS

SUPPLEMENT

(To

prospectus dated June 1, 2023)

Up

to $1,061,162.33

Ordinary

Shares

We

have entered into an At The Market Offering Agreement (the “Sales Agreement”), with H.C. Wainwright & Co., LLC (“Wainwright”

or the “sales agent”), dated May 18, 2023, relating to the sale of our ordinary shares, no par value per share, having an

aggregate offering price of up to $1,061,162.33 from time to time through Wainwright, acting as sales agent.

Sales

of our ordinary shares, if any, under this prospectus supplement and the accompanying prospectus will be made by any method permitted

that is deemed an “at the market offering” as defined in Rule 415 under the Securities Act of 1933, as amended (the “Securities

Act”), including sales made directly on or through the Nasdaq Capital Market (“Nasdaq”) or any other existing trading

market in the United States for our ordinary shares, sales made to or through a market maker other than on an exchange or otherwise,

directly to Wainwright as principal, in negotiated transactions at market prices prevailing at the time of sale or at prices related

to such prevailing market prices and/or in any other method permitted by law. If we and Wainwright agree on any method of distribution

other than sales of our ordinary shares on or through Nasdaq or another existing trading market in the United States at market prices,

we will file a further prospectus supplement providing all information about such offering as required by Rule 424(b) under the Securities

Act. Wainwright is not required to sell any specific number or dollar amount of securities, but Wainwright will act as our sales agent

using commercially reasonable efforts consistent with its normal trading and sales practices. There is no arrangement for funds to be

received in any escrow, trust or similar arrangement.

Wainwright

will be entitled to compensation at a commission rate of 3.0% of the gross sales price per share sold under the Sales Agreement. See

“Plan of Distribution” beginning on page S-10 for additional information regarding the compensation to be paid to Wainwright.

In connection with the sale of the ordinary shares on our behalf, Wainwright will be deemed to be an “underwriter” within

the meaning of the Securities Act, and the compensation of Wainwright will be deemed to be underwriting commissions or discounts. We

have also agreed to provide indemnification and contribution to Wainwright with respect to certain liabilities, including liabilities

under the Securities Act.

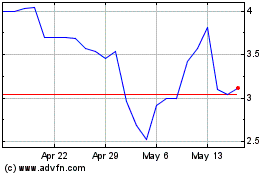

Our

ordinary shares are listed on Nasdaq under the symbol “LCFY” and our warrants to purchase our ordinary shares issued pursuant

to our initial public offering (the “IPO Warrants”) are listed on Nasdaq under the symbol “LCFYW”. On July 20,

2023, the closing price of our ordinary shares and IPO Warrants as reported on Nasdaq was $7.1501 and $7.20, respectively.

On

July 21, 2023, the aggregate market value worldwide of our outstanding voting and non-voting common equity held by non-affiliates was

approximately $9.89 million, based on 989,920 ordinary shares outstanding held by non-affiliates and a per share price

of $10.00 based on the closing sale price of the ordinary shares on Nasdaq on May 24, 2023. Pursuant to General Instruction I.B.5 of

Form F-3, in no event will we sell securities pursuant to the registration statement of which this prospectus supplement forms a part

in a public primary offering with a value exceeding one-third of our outstanding voting and non-voting common equity held by non-affiliates

(the “public float”) in any 12-month period so long as our public float remains below $75.0 million. We have offered $2,238,571

of securities pursuant to General Instruction I.B.5 of Form F-3 during the 12 calendar months prior to and including the date of this

prospectus supplement.

After

giving effect to these limitations and the current public float, we currently may offer and sell ordinary shares having an aggregate

offering price of up to $1,061,162.33 under this prospectus supplement and the accompanying prospectus. If our public float increases

such that we may sell additional amounts under the Sales Agreement and the registration statement of which this prospectus supplement

is a part, we will file an additional prospectus supplement prior to making additional sales.

We

are an “emerging growth company” and a “foreign private issuer” under applicable Securities and Exchange Commission

rules, and will be subject to reduced public company reporting requirements for this prospectus supplement and future filings. See the

section entitled “Prospectus Supplement Summary—Implications of Being an Emerging Growth Company and a Foreign Private Issuer”

for additional information.

You

should rely only on the information contained herein or incorporated by reference in this prospectus supplement, the accompanying prospectus

and any applicable prospectus supplement. We have not authorized any other person to provide you with different information.

Investing

in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described in this prospectus

supplement under “Risk Factors” beginning on page S-3 of this prospectus supplement, on page 2 of the accompanying prospectus

and under the heading “Risk Factors” contained under similar headings in the other documents that are incorporated by reference

into this prospectus supplement and the accompanying prospectus as described on page S-18 of this prospectus supplement and page 14 of

the accompanying prospectus.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

H.C.

Wainwright & Co.

The

date of this prospectus supplement is July 21, 2023

TABLE

OF CONTENTS

PROSPECTUS

SUPPLEMENT

PROSPECTUS

BASIS

OF PRESENTATION

Unless

otherwise indicated, references in this prospectus supplement and the accompanying prospectus to “Locafy,” “the Company,”

“we,” “us” and “our” refer to Locafy Limited, a company incorporated under the laws of Australia,

and its directly owned subsidiary on a consolidated basis unless the context requires otherwise.

We

express all amounts in this prospectus supplement and the accompanying prospectus in U.S. dollars, except where otherwise indicated.

References to “$” and “US$” are to U.S. dollars and references to “A$” are to Australian dollars.

We

have made rounding adjustments to some of the figures included in this prospectus. Accordingly, numerical figures shown as totals in

some tables may not be an arithmetic aggregation of the figures that preceded them.

PRESENTATION

OF FINANCIAL INFORMATION

We

report under International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board

(“IASB”). None of the financial statements incorporated by reference in this prospectus supplement and the accompanying prospectus

were prepared in accordance with generally accepted accounting principles in the United States. We present our financial statements in

Australian dollars.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement and the accompanying prospectus, including the information incorporated by reference to this prospectus supplement

and the accompanying prospectus, contain forward-looking statements that relate to our current expectations and views of future events.

Forward-looking statements can often be identified by the use of terminology such as “subject to”, “believe,”

“anticipate,” “plan,” “expect,” “intend,” “estimate,” “project,”

“may,” “will,” “should,” “would,” “could,” “can,” the negatives

thereof, variations thereon and similar expressions, or by discussions of strategy. Forward-looking statements are any statements that

look to future events and include, but are not limited to, statements regarding our business strategy; trends, opportunities and risks

affecting our business, industry and financial results; future expansion or growth plans and potential for future growth; our ability

to attract new clients to purchase our solution; our strategy of expanding our business through strategic acquisitions and to integrate

such acquisitions with our business and personnel; our ability to retain customer base and induce them to license additional products;

our ability to accurately forecast future revenues and appropriately plan our expenses; market acceptance of our solutions; our expectations

regarding implementation of remedial measures; our expectations regarding future revenues generated by our solutions; our ability to

attract and retain qualified employees and key personnel; and the impact of the novel coronavirus (COVID-19) pandemic on our business,

results of operations, cash flows, financial condition and liquidity.

Forward-looking

statements are neither historical facts nor assurances of future performance, and are based only on our current beliefs, expectations

and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy

and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks

and changes in circumstances that are difficult to predict and many of which are outside of our control. Therefore, you should not rely

on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially

from those indicated in the forward-looking statements include, among others, the following:

| |

● |

our expenses, future revenues,

capital requirements and our needs for financing; |

| |

● |

our ability to successfully

commercialize, develop, market or sell new products or adopt new technology platforms; |

| |

● |

the possibility that our

customers may not renew maintenance agreements or purchase additional professional services; |

| |

● |

our ability to attract

and retain qualified personnel; |

| |

● |

our ability to adequately

manage our growth; |

| |

● |

our ability to maintain

good relations with our partners; |

| |

● |

our reliance on relationships

with third parties; |

| |

● |

our ability to adequately

protect our intellectual property and proprietary rights; |

| |

● |

our ability to regain and

maintain compliance with continued listing requirements of Nasdaq; |

| |

● |

our ability to compete

effectively; |

| |

● |

the availability of suitable

acquisition targets; |

| |

● |

our ability to maintain

effective internal controls; and |

| |

● |

the other factors set forth

under the heading “Risk Factors” of this prospectus supplement, the accompanying prospectus, and in the Company’s

Annual Report on Form 20-F for the most recent year incorporated by reference to this prospectus supplement and the accompanying

prospectus (together with any material changes thereto contained in subsequent furnished Reports on Form 6-K). |

The

forward-looking statements contained in this prospectus supplement, the accompanying prospectus and the information incorporated by reference

herein and therein, are based on current expectations, assumptions, and beliefs concerning future developments and their potential effects

on us. There can be no assurance that future developments will be those that have been assumed or anticipated. These forward-looking

statements are subject to a number of risks and uncertainties (some of which are beyond our control) that may cause actual results or

performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties

include, but are not limited to, those factors described under the heading “Risk Factors” in this prospectus supplement and

the accompanying prospectus, any issuer free writing prospectus and prospectus supplement related to this offering or any other documents

incorporated by reference in this prospectus supplement, including in the Company’s Annual Report on Form 20-F for the most recent

year (together with any material changes thereto contained in subsequent furnished reports on Form 6-K). Should one or more of these

risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from

those projected in these forward-looking statements. We may not actually achieve the plans, intentions or expectations disclosed in our

forward-looking statements, and you should not place undue reliance on our forward-looking statements.

The

forward-looking statements made in this prospectus supplement, the accompanying prospectus and the information incorporated by reference

herein and therein, relate only to events or information as of the date on which the statements are made in such document. Except as

required by U.S. federal securities law, we undertake no obligation to update or revise publicly any forward-looking statements, whether

as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence

of unanticipated events. You should read this prospectus supplement, the accompanying prospectus, and the information incorporated by

reference herein and therein, along with any exhibits thereto, completely and with the understanding that our actual future results may

be materially different from what we expect. Other sections of this prospectus supplement, the accompanying prospectus and the documents

incorporated by reference herein and therein include additional factors which could adversely impact our business and financial performance.

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying prospectus are part of the registration statement on Form F-3 that we filed with the Securities

and Exchange Commission (the “SEC”) utilizing a “shelf” registration process. This prospectus supplement relates

to the offering of our ordinary shares. Before buying any of the ordinary shares that we are offering, we urge you to carefully read

this prospectus supplement, together with the accompanying prospectus and the information incorporated by reference as described under

the heading “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.” These

documents contain important information that you should consider when making your investment decision.

This

document is in two parts. The first part is this prospectus supplement, which describes the specific terms of the ordinary shares we

are offering and also adds to and updates information contained in accompanying prospectus and the documents incorporated by reference

into this prospectus supplement and the accompanying prospectus. References in this prospectus supplement to the “accompanying

prospectus” are to the accompanying prospectus, dated June 1, 2023. The second part, the accompanying prospectus, provides more

general information. Generally, when we refer to the prospectus, we are referring to both parts combined. To the extent there is a conflict

between the information contained in this prospectus supplement, on the one hand, and the accompanying prospectus or information contained

in any document incorporated by reference in this prospectus supplement filed prior to the date of this prospectus supplement, on the

other hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent

with a statement in another document having a later date—for example, a document incorporated by reference into this prospectus

supplement—the statement in the document having the later date modifies or supersedes the earlier statement.

You

should only rely on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus,

and incorporated by reference herein or therein, and any issuer free writing prospectus or prospectus supplement that we may authorize

for use in connection with this offering. No person has been authorized to give any information or make any representations in connection

with this offering other than those contained or incorporated by reference in this prospectus supplement, the accompanying prospectus

and any related issuer free writing prospectus or prospectus supplement in connection with the offering described herein and therein,

and, if given or made, such information or representations must not be relied upon as having been authorized by us. Neither this prospectus

supplement, the accompanying prospectus, nor any related issuer free writing prospectus nor prospectus supplement shall constitute an

offer to sell or a solicitation of an offer to buy offered securities in any jurisdiction in which it is unlawful for such person to

make such an offering or solicitation. This prospectus supplement does not contain all of the information included in the registration

statement. For a more complete understanding of the offering of the securities, you should refer to the registration statement, including

its exhibits.

You

should read the entire prospectus supplement, the accompanying prospectus, including the financial statements and related notes and other

financial data incorporated by reference in this prospectus supplement and the accompanying prospectus, and any related issuer free writing

prospectus and prospectus supplement, as well as the documents incorporated by reference into this prospectus, before making an investment

decision. Neither the delivery of this prospectus supplement, the accompanying prospectus or any issuer free writing prospectus or prospectus

supplement nor any sale made hereunder shall under any circumstances imply that the information contained or incorporated by reference

herein or in any issuer free writing prospectus or prospectus supplement is correct as of any date subsequent to the date hereof or of

such issuer free writing prospectus or prospectus supplement. You should assume that the information appearing in this prospectus supplement,

the accompanying prospectus, any issuer free writing prospectus, prospectus supplement, or any document incorporated by reference is

accurate only as of the date of the applicable documents, regardless of the time of delivery of this prospectus supplement or any sale

of securities. Our business, financial condition, results of operations and prospects may have changed since that date. This summary

contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from the results

discussed in the forward-looking statements. Factors that might cause or contribute to such differences include those discussed in “Risk

Factors” and “Cautionary Note Regarding Forward-Looking Statements.”

On

December 7, 2022, our shareholders approved at a general meeting of shareholders a 1-for-20 reverse share split of the Company’s

outstanding ordinary shares and the IPO Warrants (the “Reverse Share Split”), effective as of 11:00 a.m. (Australia time).

Except as otherwise indicated, all share and per share information in this prospectus supplement gives effect to the Reverse Share Split.

However, ordinary share and per share amounts in the documents incorporated by reference herein filed prior to December 7, 2022, do not

give effect to the Reverse Share Split.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights information contained elsewhere in this prospectus supplement and the accompanying prospectus and incorporated by

reference herein and therein and does not contain all of the information that you should consider in making your investment decision.

Before deciding to invest in our ordinary shares, you should read this entire prospectus supplement and the accompanying prospectus carefully,

including the sections entitled “Risk Factors”, “Cautionary Note Regarding Forward-Looking Statements”, the section

entitled “Risk Factors” in our Annual Report on Form 20-F for the most recent year incorporated by reference herein (together

with any material changes thereto contained in subsequent furnished Reports on Form 6-K), our consolidated financial statements and the

related notes incorporated by reference in the accompanying prospectus and all other information included or incorporated by reference

in this prospectus supplement and the accompanying prospectus.

Our

Company

We

are an Australian company currently focused on commercializing our Software as a Service (SaaS) online publishing technology platform.

Key aspects of our platform are patented in the United States. Central to our platform is the ability to publish almost any type of content

to almost any device that uses a web browser to display web content. Once data is integrated with our platform, the production of pages

is largely automated which enables the publication of large volumes of web pages. Further to that, our platform programmatically applies

our proprietary search engine optimization technology that greatly enhances the search engine results page rankings for targeted keywords.

We

also operate a Publishing division, which includes ownership of the global Hotfrog directory, and three additional Australian directories,

AussieWeb.com.au, PinkPages.com.au and SuperPages.com.au.

Implications

of Being an Emerging Growth Company and a Foreign Private Issuer

Emerging

Growth Company

We

are an emerging growth company as defined in the Jumpstart Our Business Startups Act of 2012. We will remain an emerging growth company

until the earliest to occur of: the last day of the fiscal year in which we have more than $1.235 billion in annual revenues; the date

we qualify as a “large accelerated filer,” with at least $700 million of equity securities held by non-affiliates; the issuance,

in any three-year period, by us of more than $1.0 billion in non-convertible debt securities; and the last day of the fiscal year ending

after the fifth anniversary of our first sale of common equity securities pursuant to a U.S. registration.

As

an emerging growth company, we may take advantage of certain exemptions from various reporting requirements that are applicable to other

publicly traded entities that are not emerging growth companies. These exemptions include: (i) the option to present only two years of

audited financial statements and related discussion in the section titled “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” in our filings with the SEC; (ii) not being required to comply with the auditor attestation

requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002; (iii) not being required to comply with any requirement that may be

adopted by the Public Company Accounting Oversight Board, or PCAOB, regarding mandatory audit firm rotation or a supplement to the auditor’s

report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); (iv)

not being required to submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay,”

“say-on-frequency,” and “say-on-golden parachutes”; and (v) not being required to disclose certain executive

compensation related items such as the correlation between executive compensation and performance and comparisons of the chief executive

officer’s compensation to median employee compensation.

Foreign

Private Issuer

We

report under the Exchange Act of 1934, as amended (the “Exchange Act”) as a non-U.S. company with foreign private issuer

status. Even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange

Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

(i) the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered

under the Exchange Act; (ii) the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and

trading activities and liability for insiders who profit from trades made in a short period of time; and (iii) the rules under the Exchange

Act requiring the filing with the SEC of Quarterly Reports on Form 10-Q containing unaudited financial and other specific information,

and Current Reports on Form 8-K upon the occurrence of specified significant events.

Nasdaq

Minimum Stockholders’ Equity Requirement

On

June 21, 2023, we received a letter from the Listing Qualifications Staff of Nasdaq indicating that, based upon our continued non-compliance

with Nasdaq’s minimum stockholders’ equity requirement of at least $2.5 million under Nasdaq Listing Rule 5550(b)(1), as

of June 30, 2023, our securities would be subject to delisting unless we timely request a hearing before the Nasdaq Hearings Panel (the

“Panel”). Further, as of June 21, 2023, we did not meet the alternative compliance standards relating to the market value

of listed securities of $35 million or net income from continuing operations of $500,000 in the most recently completed fiscal year or

in two of the last three most recently completed fiscal years. On June 28, 2023, we requested a hearing before the Panel, which request

will stay any further action by the Staff at least pending the issuance of the Panel’s decision following the hearing and the expiration

of any extension that may be granted by the Panel. The Company’s hearing before the Panel is scheduled to be held on August 17,

2023.

Company

Information

We

were incorporated on April 23, 2009 in Australia under the name Gumiyo Australia Pty Ltd. On January 14, 2021 we changed our name to

Locafy Limited. Our principal executive offices are located at 246A Churchill Avenue, Subiaco, Western Australia 6008, Australia and

our telephone number is +61 409 999 339. Our website address is www.locafy.com. The information contained on, or that can be accessed

through, our website is not a part of this prospectus supplement or the accompanying prospectus. We have included our website address

in this prospectus supplement solely as an inactive textual reference.

| THE OFFERING |

| |

|

|

| Ordinary shares offered by us |

|

Ordinary

shares having an aggregate offering price of up to $1,061,162.33.

|

| |

|

|

| Ordinary shares to be outstanding after the offering(1) |

|

Up

to 164,521 ordinary shares, assuming a sales price of $6.45 per share, which was the closing price of our ordinary shares

as reported on Nasdaq on June 26, 2023. The actual number of ordinary shares issued will vary depending on the sales price at which

shares may be sold from time to time during this offering. |

| |

|

|

| Manner of offering |

|

“At the market offering”

as defined in Rule 415(a)(4) under the Securities Act, that may be made from time to time on Nasdaq, the existing trading market

for our ordinary shares, through Wainwright, as sales agent. See section titled “Plan of Distribution” on page S-10 of

this prospectus supplement. |

| |

|

|

| Use of proceeds |

|

We intend to use the net

proceeds from this offering hereunder to reduce a portion of debts outstanding under our ASX Convertible Notes which have a fixed

repayment amount, are not incurring further interest and have already matured, as well as for working capital and other general corporate

purposes. Please see “Use of Proceeds” on page S-7 of this prospectus supplement. |

| |

|

|

| Risk factors |

|

Investing in our securities

involves a high degree of risk. You should read the “Risk Factors” section beginning on page S-3 of this prospectus supplement

and page 2 of the accompanying prospectus and in the documents incorporated by reference herein and therein for a discussion of factors

to consider before deciding to invest in our ordinary shares. |

| |

|

|

| Nasdaq Capital Market symbol |

|

LCFY |

(1)

Based on 1,276,248 ordinary shares outstanding as of June 30, 2023, and excludes the following securities as of that date:

| |

● |

166,708 ordinary shares

issuable upon the settlement of certain unvested and contingent performance rights; |

| |

● |

72,800 ordinary shares

issuable upon the exercise of the IPO Warrants at an exercise price of $82.50 per share; and |

| |

● |

4,365 ordinary shares issuable

upon the exercise of the warrants issued to Wainwright in connection with our initial public offering at an exercise price of $103.12

per share. |

RISK

FACTORS

An

investment in our ordinary shares involves a high degree of risk. Before deciding whether to invest in our ordinary shares, you should

carefully consider the risks and uncertainties described below, together with the information under the heading “Risk Factors”

in our most recent Annual Report on Form 20-F or any updates in our Reports on Form 6-K, all of which are incorporated herein by reference,

as updated or superseded by the risks and uncertainties described under similar headings in the other documents that are filed after

the date hereof and incorporated by reference into this prospectus supplement and the accompanying prospectus, together with all of the

other information contained or incorporated by reference in this prospectus. The risks and uncertainties we have described are not the

only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect

our operations. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be

used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, business prospects, financial

condition or results of operations could be seriously harmed. This could cause the trading price of our ordinary shares to decline, resulting

in a loss of all or part of your investment. Please also read carefully the section entitled “Cautionary Note Regarding Forward-Looking

Statements.”

Additional

Risks Related to our Ordinary Shares and this Offering

The

ordinary shares offered hereby will be sold in “at-the-market” offerings, and investors who buy shares at different times

will likely pay different prices.

Investors

who purchase ordinary shares in this offering at different times will likely pay different prices, and so may experience different outcomes

in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold,

and there is no minimum or maximum sales price. Investors may experience a decline in the value of their shares as a result of share

sales made at prices lower than the prices they paid.

The

actual number of ordinary shares we will issue under the Sales Agreement, at any one time or in total, is uncertain.

Subject

to certain limitations in the Sales Agreement and compliance with applicable law, we have the discretion to deliver placement notices

to Wainwright at any time throughout the term of the Sales Agreement. The number of shares that are sold by Wainwright after delivering

a placement notice will fluctuate based on the market price of the ordinary shares during the sales period and limits we set with Wainwright.

Because the price per share of each share sold will fluctuate based on the market price of our ordinary shares during the sales period,

it is not possible at this stage to predict the number of shares that will be ultimately issued.

The

market price of our securities may be volatile, which could result in substantial losses.

Securities

markets worldwide have experienced, and are likely to continue to experience, significant price and volume fluctuations. This market

volatility, as well as general economic, market or political conditions, could subject the market price of our securities to wide price

fluctuations regardless of our operating performance. Some of the factors that may cause the market price of our securities to fluctuate

include:

| |

● |

price and volume fluctuations

in the global stock markets from time to time; |

| |

● |

changes in operating performance

and stock market valuations of other companies in our industry; |

| |

● |

sales of our ordinary shares

by us or any significant shareholder; |

| |

● |

failure of securities analysts

and credit rating agencies to initiate or maintain coverage of us, changes in financial estimates by securities analysts and credit

rating agencies who follow us, or our failure to meet these estimates or the expectations of investors; |

| |

● |

the financial projections

we may provide to the public (in the event we decide to provide any such projections), any changes in those projections or our failure

to meet those projections; |

| |

● |

rumors and market speculation

involving us or other companies in our industry; |

| |

● |

actual or anticipated changes

in our results of operations or fluctuations in our results of operations; |

| |

● |

litigation involving us,

our industry or both, or investigations by regulators into our operations or those of our competitors; |

| |

● |

announced or completed

acquisitions of businesses or technologies by us or our competitors; |

| |

● |

new laws or regulations

or new interpretations of existing laws or regulations applicable to our business; |

| |

● |

changes in tax laws and

regulations as well as accounting standards, policies, guidelines, interpretations or principles; |

| |

● |

any significant change

in our management team; |

| |

● |

general economic conditions

and slow or negative growth of our markets; and |

| |

● |

other risk factors described

in this section of this prospectus supplement, under the heading “Risk Factors” in the accompanying prospectus, and under

similar headings in the other documents that are incorporated by reference into this prospectus supplement and the accompanying prospectus. |

In

addition, stock markets have historically experienced substantial price and volume fluctuations. Broad market and industry factors may

harm the market price of our securities. Hence, the market price of our securities could fluctuate based upon factors that have little

or nothing to do with us, and these fluctuations could materially reduce the market price of our securities regardless of our operating

performance. In the past, following periods of volatility in the market price of a company’s securities, securities class action

litigation has been instituted against that company. If we were involved in any similar litigation, we could incur substantial costs,

our management’s attention and resources could be diverted and it could harm our business, operating results and financial condition.

Ordinary

Shares representing a substantial percentage of our outstanding ordinary shares may be sold in this offering, which could cause the price

of our ordinary shares to decline.

Pursuant

to this offering, and subject to limits we set with Wainwright, as well as any limits under applicable law or exchange listing rules,

we may sell up to 164,521 ordinary shares, assuming an offering price of $6.45 per share, which was the last reported sale price

of our ordinary shares on Nasdaq on June 26, 2023, representing approximately 12.8% of our outstanding ordinary shares as of June

26, 2023, if we sell all of the approximately $1.06 million of ordinary shares that could be offered pursuant to this prospectus

supplement and the accompanying prospectus. These sales and any future sales of a substantial number of ordinary shares in the public

market, or the perception that such sales may occur, could materially adversely affect the price of our ordinary shares. We cannot predict

the effect, if any, that market sales of such ordinary shares or the availability of such ordinary shares for sale will have on the market

price of our ordinary shares.

Our

management team may invest or spend the proceeds of this offering in ways with which you may not agree or in ways which may not yield

a significant return.

Our

management will have broad discretion over the use of proceeds from this offering. We currently intend to use the net proceeds from this

offering to reduce a portion of debts outstanding under our ASX Convertible Notes which have a fixed repayment amount, are not incurring

further interest and have already matured, as well as for working capital and other general corporate purposes. For more information,

see “Use of Proceeds” on page 3. However, our management will have broad discretion in the application of the net proceeds

from this offering and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our ordinary

shares. You will not have the opportunity, as part of your investment decision, to assess whether these proceeds are being used appropriately.

The

amount and timing of our actual expenditures will depend upon numerous factors, including the amount of cash generated by our operations,

the amount of competition, a change in business plan or strategy, our ability to select and negotiate definitive agreements with acquisition

candidates, the need or desire on our part to accelerate, increase or eliminate existing initiatives due to, among other things, changing

market conditions and competitive developments, the availability of other sources of cash including cash flow from operations and new

bank debt financing arrangements, if any, and other operational factors, all of which are highly uncertain, subject to substantial risks

and can often change. Depending on these factors and other unforeseen events, our plans and priorities may change, and we may apply the

net proceeds of this offering in different proportions than we currently anticipate.

The

failure by management to apply these funds effectively could have a material adverse effect on our business and cause the price of our

ordinary shares to decline.

We

may not sell the maximum amount of ordinary shares offered by this prospectus supplement, and even if we sell the maximum amount of ordinary

shares offered by this prospectus supplement, we will need additional capital in the future. If additional capital is not available,

we may not be able to continue to operate our business pursuant to our business plan or we may have to discontinue our operations entirely.

Wainwright

is not required to sell any specific number of securities but will offer the securities using commercially reasonable efforts upon our

delivery of sales notices, meaning that we may raise substantially less than the total maximum offering amount. We have incurred losses

in each year since our inception. More recently, we have implemented changes to our operations to reduce costs, however, if we continue

to use cash at our historical rates of use and proceed with possible acquisitions or in-licensing transactions, we will need significant

additional financing, which we may seek to raise through, among other things, public and private equity offerings and debt financing.

Any equity financings will likely be dilutive to existing shareholders, and any debt financings will likely involve covenants restricting

our business activities. Additional financing may not be available on acceptable terms, or at all.

Purchasers

in this offering will likely experience immediate and substantial dilution in the book value of their investment.

The

ordinary shares sold in this offering, if any, will be sold from time to time at various prices. However, the expected offering price

per ordinary shares may be substantially higher than the net tangible book value per ordinary share. If you purchase ordinary shares

in this offering, your interest will be diluted to the extent of the difference between the price per share you pay and the net tangible

book value per ordinary share. Assuming that the sale of an aggregate amount of $1,061,162.33 ordinary shares in this offering

at an assumed offering price of $6.45 per share, which was the last reported sale price of our ordinary shares on Nasdaq on June 26,

2023, and based on our net tangible book value as of March, 31, 2023 and our pro forma net tangible book value per share of $0.35, giving

effect to the June 2023 ATM Sales (as defined below), completed subsequent to March 31, 2023, and after deducting commissions and estimated

offering expenses, if you purchase ordinary shares in this offering you will suffer substantial and immediate dilution of $5.50

per share in the net tangible book value of the ordinary shares. The future exercise of outstanding options or warrants and other instruments

that are convertible or exercisable into ordinary shares, if any, will result in further dilution of your investment. See the section

entitled “Dilution” on page S-9 for a more detailed discussion of the dilution you will incur if you purchase our ordinary

shares in this offering.

Sales

of a substantial number of our ordinary shares, or the perception that such sales may occur, may adversely impact the price of our ordinary

shares.

Sales

of a substantial number of our ordinary shares in the public markets could depress the market price of our ordinary shares and impair

our ability to raise capital through the sale of additional equity securities. We cannot predict the effect that future sales of our

ordinary shares would have on the market price of our ordinary shares.

You

may experience future dilution as a result of future equity offerings.

To

raise additional capital, we may in the future offer additional ordinary shares or other securities convertible into or exchangeable

for our ordinary shares at prices that may not be the same as the price per share in this offering. We may sell ordinary shares or other

securities in any other offering at a price per share that is less than the price per share paid by investors in this offering, and investors

purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which

we sell additional ordinary shares, or securities convertible or exchangeable into ordinary shares, in future transactions may be higher

or lower than the price per share paid by investors in this offering.

Our

failure to meet the continued listing requirements of Nasdaq could result in a delisting of our securities.

On

March 21, 2023, we received a letter from the Listing Qualifications Department of Nasdaq indicating that we did not meet the minimum

of $2,500,000 in stockholders’ equity required for continued listing on Nasdaq pursuant to Nasdaq Listing Rule 5550(b)(1) or the

alternative compliance standards relating to the market value of listed securities or net income from continuing operations. The letter

also indicated that we will be provided with a period of 45 calendar days to submit a plan to regain compliance, and if such plan is

accepted by Nasdaq, we may be granted up to 180 calendar days from March 21, 2023 in which to regain compliance. On June 21, 2023, we

received a letter from the Listing Qualifications Staff of Nasdaq indicating that, based upon our continued non-compliance with Nasdaq’s

minimum stockholders’ equity requirement of at least $2.5 million under Nasdaq Listing Rule 5550(b)(1), as of June 30, 2023, our

securities would be subject to delisting unless we timely request a hearing before the Panel. Further, as of June 21, 2023, we did not

meet the alternative compliance standards relating to the market value of listed securities of $35 million or net income from continuing

operations of $500,000 in the most recently completed fiscal year or in two of the last three most recently completed fiscal years. The

Company’s hearing before the Panel is scheduled to be held on August 17, 2023. However, there can be no assurance that we will

receive a favorable decision from the Panel. Even if we do receive a favorable decision from the Panel, there can be no assurance that

we will be able to continue to satisfy our continued listing requirements of the Nasdaq going forward.

We

have in the past, and may in the future, be unable to comply with certain of the listing standards that we are required to meet to maintain

the listing of our ordinary shares on Nasdaq. For instance, on June 30, 2022, we received a letter from the Listing Qualifications Department

of Nasdaq indicating that, based upon the closing bid price of our ordinary shares for the 30 consecutive business day period, we did

not meet the minimum bid price of $1.00 per share required for continued listing on Nasdaq pursuant to Nasdaq Listing Rule 5550(a)(2).

Effective as of December 7, 2022, we effected the Reverse Share Split. On December 22, 2022 we received notice from Nasdaq indicating

that the Company had regained compliance with the minimum bid price requirement under Nasdaq Listing Rule 5550(a)(2), and the matter

was closed.

If

we fail to satisfy the continued listing requirements of Nasdaq, such as minimum stockholders’ equity requirements or minimum bid

price requirements, Nasdaq may take steps to delist our ordinary shares. Such a delisting would have a negative effect on the price of

our ordinary shares, impair the ability to sell or purchase our ordinary shares when persons wish to do so, and any delisting materially

adversely affect our ability to raise capital or pursue strategic restructuring, refinancing or other transactions on acceptable terms,

or at all. Delisting from Nasdaq could also have other negative results, including the potential loss of institutional investor interest

and fewer business development opportunities, as well as a limited amount of news and analyst coverage of us. Delisting could also result

in a determination that our ordinary shares are a “penny stock,” which would require brokers trading in our ordinary shares

to adhere to more stringent rules, possibly resulting in a reduced level of trading activity in the secondary market for our ordinary

shares. In the event of a delisting, we would attempt to take actions to restore our compliance with Nasdaq’s listing requirements,

but we can provide no assurance that any such action taken by us would allow our securities to become listed again, stabilize the market

price or improve the liquidity of our securities, prevent our ordinary shares from dropping below the Nasdaq minimum bid price requirement

or prevent future non-compliance with Nasdaq’s listing requirements.

USE

OF PROCEEDS

We

may issue and sell ordinary shares having aggregate sales proceeds of up to $1,061,162.33 from time to time, before deducting

sales agent commissions and expenses. The amount of proceeds from this offering will depend upon the number of our ordinary shares sold

and the market price at which they are sold. There can be no assurance that we will be able to sell any ordinary shares under or fully

utilize the Sales Agreement with Wainwright.

We

currently intend to use the net proceeds from the sale of our ordinary shares offered hereunder to reduce a portion of debts outstanding

under our ASX Convertible Notes which have a fixed repayment amount, are not incurring further interest and have already matured, as

well as for working capital and other general corporate purposes. As of March 31, 2023, $301,600 remained outstanding under our ASX Convertible

Notes.

Investors

are cautioned that expenditures may vary substantially from these uses. Investors will be relying on the judgment of our management,

who will have broad discretion regarding the application of the proceeds of this offering. The amounts and timing of our actual expenditures

will depend upon numerous factors, including the amount of cash generated by our operations, the amount of competition and other operational

factors. We may find it necessary or advisable to use portions of the proceeds from this offering for other purposes.

From

time to time, we evaluate these and other factors and we anticipate continuing to make such evaluations to determine if the existing

allocation of resources, including the proceeds of this offering, is being optimized. Circumstances that may give rise to a change in

the use of proceeds include:

●

a change in business plan or strategy;

●

our ability to select and negotiate definitive agreements with acquisition candidates;

●

the need or desire on our part to accelerate, increase or eliminate existing initiatives due to, among other things, changing market

conditions and competitive developments; and

●

the availability of other sources of cash including cash flow from operations and new bank debt financing arrangements, if any.

We

may temporarily invest the net proceeds in a variety of capital preservation instruments, including short-term, investment-grade, interest-

bearing instruments and U.S. government securities, or may hold such proceeds as cash, until they are used for their stated purpose.

We have not determined the amount of net proceeds to be used specifically for such purposes.

CONSOLIDATED

CAPITALIZATION

The

following table sets forth our consolidated unaudited capitalization as of March 31, 2023, in accordance IFRS

| |

● |

on an actual basis; |

| |

● |

on a pro forma basis to

give effect to the sale of an aggregate of 245,010 ordinary shares for an aggregate consideration of approximately $2,238,571 pursuant

to the Sales Agreement subsequent to March 31, 2023 (the “June 2023 ATM Sales”), and the partial repayment of ASX Convertible

Notes in the amount of A$65,000 subsequent to March 31, 2023; and |

| |

● |

on

a pro forma as adjusted basis to give further effect to the sale of 164,521 ordinary shares in this offering at an assumed

offering price of $6.45, which was the closing price of our ordinary shares as reported on Nasdaq on June 26, 2023, after deducting

the estimated sales commissions and estimated offering expenses payable by us. |

The

amounts shown below are unaudited. Other than to give effect to the June 2023 ATM Sales, there have been no material changes in our capitalization,

on a consolidated basis, since March 31, 2023, the date of our most recently filed interim financial statements. The information in the

following table should be read in conjunction with and is qualified in its entirety by reference to the audited financial statements

and notes thereto included in our most recent Annual Report on Form 20-F and the other financial information incorporated by reference

into this prospectus supplement. For the pro forma and pro forma as adjusted information, conversions between Australian Dollars and

U.S. Dollars were made at the rate of A$1.0000 to US$0.6683, which was the daily exchange rate published by Federal Reserve System on

June 26, 2023.

| | |

As of March 31, 2023 | |

| | |

Actual (A$) | | |

Pro Forma (A$) | | |

Pro Forma As Adjusted (A$) | |

| | |

| | |

| | |

| |

| Cash and cash equivalents | |

| 611,273 | | |

| 3,551,097 | | |

| 4,861,718 | |

| | |

| | | |

| | | |

| | |

| Liabilities: | |

| | | |

| | | |

| | |

| ASX Convertible Notes | |

| 301,600 | | |

| 301,600 | | |

| 236,600 | |

| Total current debt | |

| 301,600 | | |

| 301,600 | | |

| 236,600 | |

| | |

| | | |

| | | |

| | |

| Equity: | |

| | | |

| | | |

| | |

| Issued capital | |

| 45,038,037 | | |

| 47,977,861 | | |

| 49,353,482 | |

| Reserves | |

| 1,854,460 | | |

| 1,854,460 | | |

| 1,854,460 | |

| Accumulated losses | |

| (46,518,609 | ) | |

| (46,518,609 | ) | |

| (46,518,609 | ) |

| Total surplus | |

| 373,888 | | |

| 3,313,712 | | |

| 4,689,333 | |

| Total Capitalization | |

| 901,130 | | |

| 3,840,954 | | |

| 5,216,575 | |

Dilution

If

you invest in our ordinary shares, your interest will be diluted to the extent of the difference between the price per share you pay

in this offering and the net tangible book value (deficit) per ordinary shares immediately after this offering. The net tangible book

value of our ordinary shares as of March 31, 2023, was approximately $(1,519,969), or approximately $(1.47) per share based on 1,031,238

ordinary shares outstanding at that time. “Net tangible book value” is total assets minus the sum of liabilities and intangible

assets. “Net tangible book value per share” is net tangible book value divided by the total number of ordinary shares outstanding.

After

giving effect to the June 2023 ATM Sales and the partial repayment of ASX Convertible Notes in the amount of A$65,000 subsequent to March

31, 2023, our pro forma net tangible book value as of March 31, 2023 would have been approximately $444,716, or approximately $0.35 per

ordinary share.

After

giving further effect to the sale of our ordinary shares in the aggregate amount of $1,061,162.33 in this offering at an assumed

offering price of $6.45 per share, the last reported sale price of our ordinary shares on Nasdaq on June 26, 2023, and after deducting

the commissions and estimated offering expenses payable by us, our pro forma as adjusted net tangible book value as of March 31, 2023,

would have been approximately $1,364,043, or approximately $0.95 per share. This represents an immediate increase in net

tangible book value of $0.60 per share to our existing shareholders and an immediate dilution of approximately $5.50 per

share to new investors participating in this offering, as illustrated by the following table:

| Assumed offering price per ordinary share | |

| | | |

$ | 6.45 | |

| | |

| | | |

| | |

| Net tangible book value per ordinary share as of March 31, 2023 | |

$ | (1.47 | ) | |

| | |

| | |

| | | |

| | |

| Increase in net tangible book value per ordinary share attributable to the June 2023 ATM Sales and the partial repayment of ASX Convertible Notes in the amount of A$65,000 | |

$ | 1.82 | | |

| | |

| | |

| | | |

| | |

| Pro forma net tangible book value per ordinary share as of March 31, 2023 | |

$ | 0.35 | | |

| | |

| | |

| | | |

| | |

| Increase in pro forma net tangible book value per ordinary share attributable to this offering | |

$ | 0.59 | | |

| | |

| | |

| | | |

| | |

| Pro forma as adjusted net tangible book value per ordinary share as of March 31, 2023 after giving effect to this offering | |

| | | |

$ | 0.95 | |

| | |

| | | |

| | |

| Dilution in net tangible book value per ordinary share to new investors in the offering | |

| | | |

$ | 5.50 | |

The

as adjusted information is illustrative only and will adjust based on the actual price sold, the actual number of shares sold and other

terms of the offering determined at the time our ordinary shares are sold pursuant to this prospectus supplement. The as adjusted information

assumes that all of our ordinary shares in the aggregate amount of $1,061,162.33 are sold at the assumed offering price of $6.45

per share, the last reported sale price of our ordinary shares on Nasdaq on June 26, 2023. The shares sold in this offering, if any,

will be sold from time to time at various prices.

The

discussion and table above are based on 1,031,238 ordinary shares outstanding as of March 31, 2023, and excludes the following securities

as of that date:

| |

● |

107,687 ordinary shares

issuable upon the settlement of certain unvested and contingent performance rights; |

| |

|

|

| |

● |

72,800 ordinary shares

issuable upon the exercise of the IPO Warrants at an exercise price of $82.50 per share; and |

| |

|

|

| |

● |

4,365 ordinary shares issuable

upon the exercise of the warrants issued to Wainwright in connection with our initial public offering at an exercise price of $103.12

per share. |

To

the extent that any of these options or warrants are exercised, new options and awards are issued under our equity incentive plans and

subsequently exercised or we issue additional ordinary shares or securities convertible or exercisable into ordinary shares in the future,

there may be further dilution to new investors participating in this offering.

PLAN

OF DISTRIBUTION

We

have entered into the Sales Agreement with Wainwright under which we may issue and sell our securities having an aggregate offering price

of up to $1,061,162.33 from time to time through or to Wainwright as our sales agent. Sales of our securities, if any, under this

prospectus supplement will be by any method that is deemed to be an “at the market offering,” as defined in Rule 415 under

the Securities Act. If authorized by us in writing, Wainwright may purchase our securities as principal.

Wainwright

will offer our securities subject to the terms and conditions of the Sales Agreement on a daily basis or as otherwise agreed upon by

us and Wainwright. We will designate the maximum amount of securities to be sold through Wainwright on a daily basis or otherwise determine

such maximum amount together with Wainwright. Subject to the terms and conditions of the Sales Agreement, Wainwright will use its commercially

reasonable efforts consistent with its normal trading and sales practices to sell on our behalf all of our securities requested to be

sold by us. We may instruct Wainwright not to sell our securities if the sales cannot be effected at or above the price designated by

us in any such instruction. Wainwright or we may suspend the offering of our securities being made through Wainwright under the Sales

Agreement upon proper notice to the other party. Wainwright and we each have the right, by giving written notice as specified in the

Sales Agreement, to terminate the Sales Agreement in each party’s sole discretion at any time. The offering of our securities pursuant

to the Sales Agreement will otherwise terminate upon the termination of the Sales Agreement as provided therein.

The

aggregate compensation payable to Wainwright as sales agent will be an amount equal to 3.0% of the gross proceeds of any shares sold

through it pursuant to the Sales Agreement. In addition, we reimbursed Wainwright $50,000 of Wainwright’s outside legal expenses

incurred by Wainwright upon filing of this prospectus supplement, pursuant to the Sales Agreement. We estimate that the total expenses

of the offering payable by us, excluding commissions payable and expenses being reimbursed to Wainwright under the Sales Agreement, will

be approximately $60,000.

The

remaining sales proceeds, after deducting any expenses payable by us and any transaction fees imposed by any governmental, regulatory,

or self-regulatory organization in connection with the sales, will equal our net proceeds for the sale of such securities.

Wainwright

will provide written confirmation to us following the close of trading on Nasdaq on each day in which the securities are sold through

it as sales agent under the Sales Agreement. Each confirmation will include the type and number of securities sold through it as sales

agent on that day, the volume weighted average price of the securities sold, the percentage of the daily trading volume and the net proceeds

to us.

Settlement

for sales of our securities will occur, unless the parties agree otherwise, on the second business day that is also a trading day following

the date on which any sales were made in return for payment of the net proceeds to us. There is no arrangement for funds to be received

in an escrow, trust or similar arrangement. We will report at least quarterly the number of securities sold through Wainwright under

the Sales Agreement, the net proceeds to us and the compensation paid by us to Wainwright in connection with the sales of securities

during the relevant period.

In

connection with the sales of securities on our behalf, Wainwright will be deemed to be an “underwriter” within the meaning

of the Securities Act, and the compensation paid to Wainwright will be deemed to be underwriting commissions or discounts. We have agreed

in the Sales Agreement to provide indemnification and contribution to Wainwright against certain liabilities, including liabilities under

the Securities Act. As sales agent, Wainwright will not engage in any transactions that stabilize our securities.

No

sales of our securities under this prospectus supplement will be made in Australia, to anyone known by the sales agent to be a resident

of Australia or over or through the facilities of any exchange or market in Australia.

Our

securities are listed on Nasdaq under the symbol “LCFY”.

The

transfer agent and registrar for our ordinary shares in the United States is Computershare Trust Company, N.A.

AUSTRALIAN

FOREIGN OWNERSHIP REGULATION AND OTHER LIMITATIONS

Takeovers

– Change of Control

Takeovers

of Australian public companies, such as Locafy, are regulated by the Corporations Act, which prohibits the acquisition of a “relevant

interest” in issued voting shares in a company if the acquisition will lead to that person’s or someone else’s voting

power in the company increasing from 20% or below to more than 20% or increasing from a starting point that is above 20% and below 90%,

subject to a range of exceptions.

Generally,

a person will have a relevant interest in securities if the person:

●

is the holder of the securities;

●

has power to exercise, or control the exercise of, a right to vote attached to the securities; or

●

has the power to dispose of, or control the exercise of a power to dispose of, the securities, including any indirect or direct power

or control.

If,

at a particular time, a person has a relevant interest in issued securities and the person:

●

has entered or enters into an agreement with another person with respect to the securities;

●

has given or gives another person an enforceable right, or has been or is given an enforceable right by another person, in relation to

the securities (whether the right is enforceable presently or in the future and whether or not on the fulfillment of a condition);

●

has granted or grants an option to, or has been or is granted an option by, another person with respect to the securities;

●

the other person would have a relevant interest in the securities if the agreement were performed, the right enforced or the option exercised;

or

●

the other person is taken to already have a relevant interest in the securities.

There

are a number of exceptions to the above prohibition on acquiring a relevant interest in issued voting shares above 20%. In general terms,

some of the more significant exceptions include:

●

acquisition relating to takeover bids;

●

when shareholders approve the takeover by resolution passed at general meeting;

●

an acquisition by a person of no more than 3% in any 6 month period; or

●

when the acquisition results from the issue of securities under a pro rata rights issue.

Breaches

of the takeovers provisions of the Corporations Act are criminal offenses. The Australian Securities and Investment Commission and the

Australian Takeovers Panel have a wide range of powers relating to breaches of takeover provisions, including the ability to make orders

canceling contracts, freezing transfers of, and rights attached to, securities, and forcing a party to dispose of securities. There are

certain defenses to breaches of the takeover provisions provided in the Corporations Act.

Foreign

Ownership Regulation

There

are no limitations on the rights to own securities imposed by our Constitution. However, the Foreign Acquisitions and Takeovers Act

1975 (Cth) and Foreign Acquisitions and Takeovers Regulation 2015 (Cth) (together, “Australia’s Foreign Investment

Regime”), regulates certain types of acquisitions by ‘foreign persons’ of equity interests in Australian companies

and unit trusts and of interests in Australian businesses and real property assets.

Under

Australia’s Foreign Investment Regime, as currently in effect, foreign persons must make a mandatory notification to the Australian

Treasurer through the Foreign Investment Review Board (“FIRB”) and obtain receipt of a no objections notification from the

Australian Treasurer in the following circumstances (among others):

●

all foreign persons acquiring a ‘direct interest’ (generally an interest of 10% or more) in an Australian company or business

that is a ‘national security business’, regardless of value;

●

‘foreign government investors’ acquiring a direct interest in an Australian company or business, regardless of value; and

●

‘foreign persons’ that are not ‘foreign government investors’ acquiring a substantial interest (generally 20%

or more) in an Australian company or business which has a total asset value of A$310 million or more (or A$1,339 million or more in the

case of investors incorporated in the US and ultimately owned by entities and persons within the US (and certain other countries who

are subject to free trade agreements with Australia) where the Australian company or business is not a sensitive business (which includes

media, telecommunications, transport, defense and military related industries among others)).

At

present, we do not have total assets of A$310 million and we are not a ‘national security business’.

An

entity is a ‘foreign government investor’ if it is:

●

a foreign government or separate government entity;

●

a corporation or trust in which a foreign government / separate government entity holds (directly or indirectly) an interest of 20% or

more (including through actual or potential voting power) or in which foreign governments / separate government entities of more than

one foreign country (or parts of more than one foreign country) hold (directly or indirectly) an aggregate interest of 40% or more (including

through actual or potential voting power); or

●

a limited partnership in which a foreign government / separate government entity holds (directly or indirectly) an interest of 20%

or more (including through actual or potential voting power) or in which foreign governments / separate government entities of more

than one foreign country (or parts of more than one foreign country) hold (directly or indirectly) an aggregate interest of 40% or

more (including through actual or potential voting power), unless, in respect of corporations, trusts or limited partnerships, the

entity meets certain passive investor requirements (which include, amongst other requirements, that the entity operates a scheme and

that an individual member of the entity is not able to influence any individual investment decisions, or the management of any

individual investments, of the entity under the scheme).

Acquisitions

thresholds take account of interests held by “associates” and there are tracing rules that can apply. “Associates”

is a broadly defined term under Australia’s Foreign Investment Regime as being, in relation to a person:

●

any relative of the person;

●

any person with whom the person is acting, or proposes to act, in concert in relation to an action to which Australia’s Foreign

Investment Regime may apply;

●

any person with whom the person carries on a business in partnership;

●

any entity of which the person is a senior officer;

●

any corporation in which the person holds an interest of 20% or more;

●

if the person is a corporation, a person who holds and interest 20% or more in the corporation;

●

the trustee of a trust in which the person holds an interest of 20% or more;

●

for foreign government investors, a separate government entity or a foreign government investor in relation to the same foreign country,

amongst others.

The

Australian Treasurer may prevent a proposed acquisition in the above categories or impose conditions on such acquisition if the Australian

Treasurer is satisfied that the acquisition would be contrary to the national interest or national security. If a foreign person acquires

shares or an interest in shares in an Australian company in contravention of Australia’s Foreign Investment Regime, the Australian

Treasurer may order the divestiture of such person’s shares or interest in shares in such company. The Australian Treasurer may

order divestiture pursuant to Australia’s Foreign Investment Regime if it is determined that the acquisition has resulted in that

foreign person, either alone or together with other non-associated or associated foreign persons, controlling the company and that such

control is contrary to the national interest. Criminal offences and civil penalties for breaches of Australia’s Foreign Investment

Regime can apply to failing to give notification of certain acquisitions, undertaking certain acquisitions without a no objection notification

or contravening a condition in a no objection notification.

Each

foreign person seeking to acquire holdings in excess of the above caps (including their Associates, as the case may be) would need to

complete an application form setting out the proposal and relevant particulars of the proposed acquisition/shareholding. The Australian

Treasurer then has 30 days to consider the application and a further 10 days to notify the applicant of that decision. The decision period

commences upon receipt of payment of the correct application fee. However, FIRB can request an extension of time. If the applicant does

not consent to the extension, FIRB can issue an interim order preventing the foreign person from carrying out the proposed transactions

and allowing FIRB a further 90 days to consider the application.

If

we become a ‘foreign person’ under Australia’s Foreign Investment Regime due to levels of foreign ownership of our

shares, we would be required to obtain the approval of the Australian Treasurer for us, together with our associates, to undertake certain

acquisitions of Australian entities, businesses and land if the relevant thresholds are met.

MATERIAL

U.S. FEDERAL INCOME TAX CONSIDERATIONS

The

following discussion describes the material U.S. federal income tax consequences relating to the ownership and disposition of ordinary

shares by U.S. Holders (as defined below). This discussion applies to U.S. Holders that purchase our ordinary shares pursuant to this

prospectus supplement and hold such ordinary shares as capital assets. This discussion is based on the U.S. Internal Revenue Code of

1986, as amended, or the Code, U.S. Treasury regulations promulgated thereunder and administrative and judicial interpretations thereof,

all as in effect on the date hereof and all of which are subject to change, possibly with retroactive effect. This discussion does not

address all of the U.S. federal income tax consequences that may be relevant to specific U.S. Holders in light of their particular circumstances

or to U.S. Holders subject to special treatment under U.S. federal income tax law (such as certain financial institutions, insurance

companies, broker-dealers and traders in securities or other persons that generally mark their securities to market for U.S. federal

income tax purposes, tax-exempt entities, retirement plans, regulated investment companies, real estate investment trusts, certain former

citizens or residents of the United States, persons who hold our ordinary shares as part of a “straddle”, “hedge”,

“conversion transaction”, “synthetic security” or integrated investment, persons that have a “functional

currency” other than the U.S. dollar, persons that own directly, indirectly or through attribution 10% or more of the voting power

of our ordinary shares, corporations that accumulate earnings to avoid U.S. federal income tax, persons subject to special tax accounting

rules under Section 451(b) of the Code, partnerships and other pass-through entities, and investors in such pass-through entities). This

discussion does not address any U.S. state or local or non-U.S. tax consequences or any U.S. federal estate, gift or alternative minimum

tax consequences.

As

used in this discussion, the term “U.S. Holder” means a beneficial owner of our ordinary shares that is, for U.S. federal

income tax purposes, (1) an individual who is a citizen or resident of the United States, (2) a corporation (or entity treated as a corporation

for U.S. federal income tax purposes) created or organized in or under the laws of the United States, any state thereof, or the District

of Columbia, (3) an estate the income of which is subject to U.S. federal income tax regardless of its source or (4) a trust (i) with

respect to which a court within the United States is able to exercise primary supervision over its administration and one or more United

States persons have the authority to control all of its substantial decisions or (ii) that has elected under applicable U.S. Treasury

regulations to be treated as a domestic trust for U.S. federal income tax purposes.

If

an entity treated as a partnership for U.S. federal income tax purposes holds our ordinary shares, the U.S. federal income tax consequences

relating to an investment in our ordinary shares will depend in part upon the status and activities of such entity and the particular

partner. Any such entity should consult its own tax advisor regarding the U.S. federal income tax consequences applicable to it and its

partners of the purchase, ownership and disposition of our ordinary shares. Persons considering an investment in our ordinary shares

should consult their own tax advisors as to the particular tax consequences applicable to them relating to the purchase, ownership and

disposition of our ordinary shares, including the applicability of U.S. federal, state and local tax laws and non-U.S. tax laws.

Passive

Foreign Investment Company Consequences

In

general, a corporation organized outside the United States will be treated as a passive foreign investment company, or PFIC, for any

taxable year in which either (1) at least 75% of its gross income is “passive income”, or the “PFIC income test”,

or (2) on average at least 50% of its assets, determined on a quarterly basis, are assets that produce passive income or are held for