Company Provides First Quarter 2024 Results of Operations

16 May 2024 - 10:00PM

The Singing Machine Company, Inc. ("Singing Machine") (NASDAQ:

MICS) – the worldwide leader in consumer karaoke

products, today announced its results of operations for the

three-months ended March 31, 2024.

"We are pleased to report our first quarter

results of operations," commented Gary Atkinson, CEO of the Singing

Machine. "We have focused on three core areas of operations, which

we believe will lead to overall improved profitability in the

coming quarters:

1) Improved product

sales mix. We are focused on selling more of our higher

price-point, best-in-class karaoke products that support our music

subscription model. This is expected to improve sell-through rates,

reduce marketing expenses, and improve gross margins going

forward.

2) Reduce fixed

overhead. With the closure of our California warehouse lease and

our shift to a fully outsourced 3PL model, we were able to reduce

headcount, eliminate our occupancy costs in California, and switch

to a more variable operating structure.

3) Strict Cost

Control. We have aggressively worked to identify areas where we can

reduce recurring operating expenses, particularly in the areas of

IT infrastructure, headcount, and occupancy.

"With three aggressive financial initiatives, we

are actively looking to optimize our immediate financial profile.

We have sought to eliminate virtually all non-working capital

liabilities. We have streamlined our operations. At this point, our

Board of Directors is asking us to consider all strategic options

and we are open to this path as a management team. We anticipate

providing meaningful updates on this development in the near term,"

concluded Mr. Atkinson.

Results of operations for the first quarter are

summarized as follows:

- Revenues: Net

sales of approximately $2.43 million for the three-months ended

March 31, 2024. This represents a $1.0 million (29%) decrease from

approximately $3.38 million in sales for the same period in 2023.

Primary factors for the decline are as follows:

- Holiday sell through results at our

largest customer were lower in Q4 2023 than in the same period in

2022. As a result, restocking demand in Q1 2024 was negatively

impacted.

- The Company has also shifted its

sales focus to dedicate more resources to its higher margin

top-tier product lines. This is expected to lower overall unit

sales but improve gross margins and operating margins over the next

year.

- Gross Profits:

Gross profits were approximately $0.50 million for the first

quarter of 2024, as compared to approximately $0.82 million for the

same period in 2023. This represents a decrease of $0.3 million, or

39% for the three months ended March 31, 2024 as compared to March

31, 2023.

- Gross margins were 20.7% for Q1

2024, as compared to 24.2% for Q1 2023.

- Margins in Q1 2024 were negatively

impacted by approximately $0.7 million in allowances for repairs

under the Companies new outsourced logistics model. In prior years,

repairs were handled in house at the Company’s in-house logistics

hub in Ontario, CA. Since September of 2023, all repairs are now

the responsibility of our contract manufacturers in China.

- Operating

Expenses: Total operating expenses were approximately

$2.79 million for the three months ended March 31, 2024, as

compared to approximately $2.97 million for the same period in

2023.

- Selling expenses were approximately

$0.63 million in Q1 2024, as compared to approximately $0.81

million in Q1 2023.

- General and administrative expenses

were approximately $2.2 million for Q1 2024, which was flat

compared to the same period in 2023.

- General and administrative expenses

are expected to decrease modestly going forward. The Company has

taken steps to reduce payroll, reduce IT expenses, and reduce

certain aspects of occupancy costs.

- Net Income: The

Company reported a net loss of approximately $2.37 million, which

represents approximately a $0.62 million improvement year over

year.

About The Singing Machine

The Singing Machine Company, Inc. (NASDAQ: MICS)

is the worldwide leader in consumer karaoke products. Based in Fort

Lauderdale, Florida, and founded over forty years ago, the Company

designs and distributes the industry's widest assortment of at-home

and in-car karaoke entertainment products. Their portfolio is

marketed under both proprietary brands and popular licenses,

including Carpool Karaoke and Sesame Street. Singing Machine

products incorporate the latest technology and provide access to

over 100,000 songs for streaming through its mobile app and select

WiFi-capable products and is also developing the world's first

globally available, fully integrated in-car karaoke system. The

Company also has a new philanthropic initiative, CARE-eoke by

Singing Machine, to focus on the social impact of karaoke for

children and adults of all ages who would benefit from singing.

Their products are sold in over 25,000 locations worldwide,

including Amazon, Costco, Sam’s Club, Target, and Walmart. To learn

more, go to www.singingmachine.com.

Investor Relations

Contact:investors@singingmachine.comwww.singingmachine.comwww.singingmachine.com/investors

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995, Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Words such as "may", "could", "expects", "projects,"

"intends", "plans", "believes", "predicts", "anticipates", "hopes",

"estimates" and variations of such words and similar expressions

are intended to identify forward-looking statements. These

statements involve known and unknown risks and are based upon

several assumptions and estimates, which are inherently subject to

significant uncertainties and contingencies, many of which are

beyond the Company's control. Actual results may differ materially

from those expressed or implied by such forward-looking statements.

Factors that could cause actual results to differ materially

include, but are not limited to, the risk factors described in the

Company's filings with the Securities and Exchange Commission. The

forward-looking statements are applicable only as of the date on

which they are made, and the Company does not assume any obligation

to update any forward-looking statements.

The Singing Machine Company,

Inc.CONDENSED CONSOLIDATED BALANCE

SHEETS

| |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| |

|

(Unaudited) |

|

|

|

|

| |

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

| Current

Assets |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

4,125,000 |

|

|

$ |

6,703,000 |

|

|

Accounts receivable, net of allowances of $275,000 and $174,000,

respectively |

|

|

3,305,000 |

|

|

|

7,308,000 |

|

|

Accounts receivable related parties |

|

|

133,000 |

|

|

|

269,000 |

|

|

|

|

|

|

|

|

|

|

|

|

Inventory |

|

|

6,493,000 |

|

|

|

6,871,000 |

|

|

Returns asset |

|

|

1,262,000 |

|

|

|

1,919,000 |

|

|

Prepaid expenses and other current assets |

|

|

214,000 |

|

|

|

136,000 |

|

|

Total Current Assets |

|

|

15,532,000 |

|

|

|

23,206,000 |

|

| |

|

|

|

|

|

|

|

|

| Property and

equipment, net |

|

|

352,000 |

|

|

|

404,000 |

|

| Operating leases -

right of use assets |

|

|

3,841,000 |

|

|

|

3,926,000 |

|

| Other non-current

assets |

|

|

179,000 |

|

|

|

179,000 |

|

|

Total Assets |

|

$ |

19,904,000 |

|

|

$ |

27,715,000 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and

Shareholders’ Equity |

|

|

|

|

|

|

|

|

| Current

Liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

3,947,000 |

|

|

$ |

7,616,000 |

|

|

Accrued expenses |

|

|

2,315,000 |

|

|

|

2,614,000 |

|

|

Refund due to customer |

|

|

1,443,000 |

|

|

|

1,743,000 |

|

|

Customer prepayments |

|

|

408,000 |

|

|

|

687,000 |

|

|

Reserve for sales returns |

|

|

2,419,000 |

|

|

|

3,390,000 |

|

|

Other current liabilities |

|

|

58,000 |

|

|

|

75,000 |

|

|

Current portion of operating lease liabilities |

|

|

55,000 |

|

|

|

84,000 |

|

|

Total Current Liabilities |

|

|

10,645,000 |

|

|

|

16,209,000 |

|

| |

|

|

|

|

|

|

|

|

| Other liabilities, net

of current portion |

|

|

- |

|

|

|

3,000 |

|

| Operating lease

liabilities, net of current portion |

|

|

4,029,000 |

|

|

|

3,925,000 |

|

|

Total Liabilities |

|

|

14,674,000 |

|

|

|

20,137,000 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

Contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Shareholders’

Equity |

|

|

|

|

|

|

|

|

|

Preferred stock, $1.00 par value; 1,000,000 shares authorized; no

shares issued and outstanding |

|

|

- |

|

|

|

- |

|

|

Common stock $0.01 par value; 100,000,000 shares authorized;

6,418,061 issued and outstanding at March 31, 2024 and December 31,

2023, respectively |

|

|

64,000 |

|

|

|

64,000 |

|

|

Additional paid-in capital |

|

|

33,448,000 |

|

|

|

33,429,000 |

|

|

Accumulated deficit |

|

|

(28,282,000 |

) |

|

|

(25,915,000 |

) |

|

Total Shareholders’ Equity |

|

|

5,230,000 |

|

|

|

7,578,000 |

|

|

Total Liabilities and Shareholders’ Equity |

|

$ |

19,904,000 |

|

|

$ |

27,715,000 |

|

See notes to the condensed consolidated

financial statements

The Singing Machine Company,

Inc.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(Unaudited)

|

|

|

Three Months Ended |

|

|

|

|

March 31, 2024 |

|

|

March 31, 2023 |

|

|

|

|

|

|

|

|

|

| Net

Sales |

|

$ |

2,426,000 |

|

|

$ |

3,383,000 |

|

| |

|

|

|

|

|

|

|

|

| Cost of Goods

Sold |

|

|

1,924,000 |

|

|

|

2,564,000 |

|

| |

|

|

|

|

|

|

|

|

| Gross

Profit |

|

|

502,000 |

|

|

|

819,000 |

|

| |

|

|

|

|

|

|

|

|

| Operating

Expenses |

|

|

|

|

|

|

|

|

|

Selling expenses |

|

|

630,000 |

|

|

|

812,000 |

|

|

General and administrative expenses |

|

|

2,159,000 |

|

|

|

2,153,000 |

|

| Total Operating

Expenses |

|

|

2,789,000 |

|

|

|

2,965,000 |

|

| |

|

|

|

|

|

|

|

|

| Loss from

Operations |

|

|

(2,287,000 |

) |

|

|

(2,146,000 |

) |

| |

|

|

|

|

|

|

|

|

| Other (Expenses)

Income |

|

|

|

|

|

|

|

|

|

Gain from Employee Retention Credit Program refund |

|

|

- |

|

|

|

704,000 |

|

|

Other Expense |

|

|

- |

|

|

|

(1,000 |

) |

|

Interest expense |

|

|

(28,000 |

) |

|

|

(40,000 |

) |

| Total Other (Expenses)

Income, net |

|

|

(28,000 |

) |

|

|

663,000 |

|

| |

|

|

|

|

|

|

|

|

| Loss Before Income Tax

Provision |

|

|

(2,315,000 |

) |

|

|

(1,483,000 |

) |

| |

|

|

|

|

|

|

|

|

| Income Tax

Provision |

|

|

(52,000 |

) |

|

|

(1,502,000 |

) |

| |

|

|

|

|

|

|

|

|

| Net Loss |

|

$ |

(2,367,000 |

) |

|

$ |

(2,985,000 |

) |

| |

|

|

|

|

|

|

|

|

| Loss per Common

Share |

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

$ |

(0.37 |

) |

|

$ |

(0.96 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted Average

Common and Common Equivalent Shares: |

|

|

|

|

|

|

|

|

|

Basic and Diluted |

|

|

6,418,061 |

|

|

|

3,114,397 |

|

See notes to the condensed consolidated

financial statements

The Singing Machine Company,

Inc.CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS(Unaudited)

| |

|

For the Three Months Ended |

|

|

For the Three Months Ended |

|

| |

|

March 31, 2024 |

|

|

March 31, 2023 |

|

| |

|

|

|

|

|

|

| Cash flows from

operating activities |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(2,367,000 |

) |

|

$ |

(2,985,000 |

) |

|

Adjustments to reconcile net loss to net cash (used in) provided by

operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

52,000 |

|

|

|

55,000 |

|

|

Provision for estimated cost of returns |

|

|

658,000 |

|

|

|

1,380,000 |

|

|

Provision for inventory obsolescence |

|

|

- |

|

|

|

139,000 |

|

|

Credit losses |

|

|

101,000 |

|

|

|

27,000 |

|

|

Loss from disposal of property and equipment |

|

|

- |

|

|

|

3,000 |

|

|

Stock based compensation |

|

|

19,000 |

|

|

|

74,000 |

|

|

Amortization of right of use assets |

|

|

84,000 |

|

|

|

87,000 |

|

|

Change in net deferred tax assets |

|

|

- |

|

|

|

1,399,000 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

3,902,000 |

|

|

|

4,922,000 |

|

|

Accounts receivable - related parties |

|

|

136,000 |

|

|

|

43,000 |

|

|

Inventories |

|

|

379,000 |

|

|

|

(175,000 |

) |

|

Prepaid expenses and other current assets |

|

|

(78,000 |

) |

|

|

40,000 |

|

|

Other non-current assets |

|

|

- |

|

|

|

(156,000 |

) |

|

Accounts payable |

|

|

(3,669,000 |

) |

|

|

(315,000 |

) |

|

Accrued expenses |

|

|

(299,000 |

) |

|

|

(970,000 |

) |

|

Refunds due to customer |

|

|

(300,000 |

) |

|

|

490,000 |

|

|

Prepaids from customers |

|

|

(279,000 |

) |

|

|

- |

|

|

Reserve for sales returns |

|

|

(971,000 |

) |

|

|

(2,035,000 |

) |

|

Operating lease liabilities |

|

|

75,000 |

|

|

|

(89,000 |

) |

|

Net cash (used in) provided by operating activities |

|

|

(2,557,000 |

) |

|

|

1,934,000 |

|

| Cash flows from

investing activities |

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

- |

|

|

|

(95,000 |

) |

|

Net cash used in investing activities |

|

|

- |

|

|

|

(95,000 |

) |

| Cash flows from

financing activities |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of stock, net of offering costs |

|

|

- |

|

|

|

36,000 |

|

|

Subscriptions receivable |

|

|

- |

|

|

|

(6,000 |

) |

|

Net payment on revolving lines of credit |

|

|

- |

|

|

|

(1,761,000 |

) |

|

Payments on installment notes |

|

|

(21,000 |

) |

|

|

(19,000 |

) |

|

Proceeds from exercise of common stock warrants |

|

|

- |

|

|

|

14,000 |

|

|

Payments on finance leases |

|

|

- |

|

|

|

(3,000 |

) |

|

Net cash used in financing activities |

|

|

(21,000 |

) |

|

|

(1,739,000 |

) |

| Net change in

cash |

|

|

(2,578,000 |

) |

|

|

100,000 |

|

| |

|

|

|

|

|

|

|

|

| Cash at beginning of

year |

|

|

6,703,000 |

|

|

|

2,795,000 |

|

| Cash at end of

period |

|

$ |

4,125,000 |

|

|

$ |

2,895,000 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental

disclosures of cash flow information: |

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

27,000 |

|

|

$ |

24,000 |

|

| Non-Cash investing and

financing cash flow information: |

|

|

|

|

|

|

|

|

|

Equipment purchased under capital lease |

|

$ |

- |

|

|

$ |

55,000 |

|

See notes to the condensed consolidated

financial statements

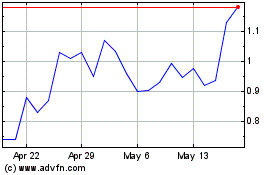

Singing Machine (NASDAQ:MICS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Singing Machine (NASDAQ:MICS)

Historical Stock Chart

From Jan 2024 to Jan 2025