Immedica Pharma AB (Immedica), a leading global rare disease

company, and Marinus Pharmaceuticals, Inc. (Nasdaq: MRNS), a

pharmaceutical company committed to improving the lives of patients

with seizure disorders, today announced that they have entered into

an agreement and plan of merger under which Immedica has agreed to

acquire Marinus, by means of a tender offer and subsequent

merger.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241230307666/en/

The acquisition complements and further strengthens Immedica’s

global rare disease business by adding ZTALMY® (ganaxalone) oral

suspension, CV, a neuroactive steroid gamma-aminobutyric acid

(GABA)-A receptor positive modulator, approved by the U.S. Food and

Drug Administration (FDA) in March 2022 for the treatment of

seizures associated with cyclin-dependent kinase-like 5 (CDKL5)

deficiency disorder (CDD) in patients two years of age and

older.

Transaction rationale and details in brief:

- Adds global rights to ZTALMY, a commercial-stage rare neurology

medicine approved by FDA, the European Commission (EC), the UK

Medicines and Healthcare products Regulatory Agency (MHRA) and the

National Medicines Product Administration (NMPA) in China with

potential for further approvals worldwide.

- Accelerates Immedica’s growth into the North American market,

providing an immediate revenue-generating rare disease product and

an experienced commercial team upon closing of the

transaction.

- Acquisition is expected to accelerate Immedica’s revenue

growth, adding a commercial-stage asset in the United States, with

the potential for further expansion globally.

- Immedica to commence a cash tender offer to acquire all issued

and outstanding shares of Marinus for USD 0.55 per share,

corresponding to an implied enterprise value of approximately USD

151 Million.

- Transaction is expected to close in Q1 2025.

“The acquisition of Marinus represents a transformative step in

Immedica’s journey to further strengthen our position as a leading

rare disease company. By adding ZTALMY to our portfolio, we

significantly strengthen our capabilities and expand our presence

in the United States, marking a new chapter in our mission to

deliver impactful therapies for underserved patient populations,”

said Anders Edvell, M.D. Ph.D. and Chief Executive Officer of

Immedica.

“Immedica is dedicated to addressing significant unmet medical

needs in rare diseases, ensuring patients receive the innovative

treatments they deserve. Within CDD, patients with refractory

seizures face particularly challenging circumstances due to

insufficiently effective existing therapies. The addition of ZTALMY

allows us to offer a differentiated solution, with the potential to

improve care and outcomes for these patients,” he concluded.

“I am proud of the dedication and passion of our team at

Marinus, which allowed us to deliver the first and only

FDA-approved treatment for seizures associated with CDKL5

deficiency disorder in patients two years of age and older,” said

Scott Braunstein, M.D., Chairman and Chief Executive Officer of

Marinus. “With a shared commitment to improving the lives of rare

disease patients, this acquisition is expected to enable ZTALMY to

make an even greater impact on patients, while providing meaningful

value for Marinus’ stockholders.”

Transaction details

Under the terms of the merger agreement, Immedica, through a

wholly owned, direct subsidiary, will initiate a tender offer to

acquire all the outstanding shares of Marinus common stock for a

cash purchase price of USD 0.55 per share, representing a premium

of 48% based on Marinus’ closing share price as of December 27th

and a premium of 97%, based on the 30-day volume-weighted average

price of USD 0.28 per share preceding the announcement of the

transaction. The Board of Directors of Marinus has unanimously

approved the transaction and recommended that the stockholders of

Marinus tender their shares in the tender offer. Immedica has

received an undertaking from each director and named executive

officer of Marinus to tender their respective shares in favor of

the transaction.

The transaction represents the culmination of Marinus’ review of

strategic alternatives, which it announced on October 24, 2024,

with the goal of maximizing value for its stockholders.

The closing of the tender offer will be subject to customary

conditions, including the tender of shares which represent at least

a majority of the total number of Marinus’ outstanding shares of

common stock. Upon the successful completion of the tender offer,

Immedica would acquire any shares of Marinus’ common stock not

tendered through a second-step merger effected for the same per

share consideration. The transaction is expected to close in Q1

2025.

Advisors

MTS Health Partners LP is acting as Immedica’s exclusive

financial advisor in connection with the transaction. Gibson, Dunn

& Crutcher LLP is acting as legal counsel to Immedica and Fuchs

Patentanwälte Partnerschaft mbB is acting as intellectual property

counsel on this transaction, Barclays Capital Inc. is acting as

Marinus´ exclusive financial advisor in connection with the

transaction. Hogan Lovells LLP is acting as legal counsel to

Marinus on this transaction.

About ZTALMY® (ganaxolone) oral suspension

ZTALMY (ganaxolone) is a neuroactive steroid GABAA receptor

modulator that acts on a well-characterized target in the brain

known to have anti-seizure effects. It is a prescription medicine

that has been approved by the U.S. FDA, EC, the MHRA, and the China

NMPA for appropriate patients with CDKL5 deficiency disorder.

U.S. Prescribing Information for ZTALMY® (ganaxolone)

oral suspension CV.

European Union Summary of Product Characteristics for

ZTALMY.

About Marinus Pharmaceuticals

Marinus is a commercial-stage pharmaceutical company dedicated

to the development of innovative therapeutics for seizure

disorders. The Company’s product, ZTALMY® (ganaxolone) oral

suspension CV, is an FDA-approved prescription medication

introduced in the U.S. in 2022. For more information, please visit

www.marinuspharma.com and follow us on Facebook, LinkedIn and

X.

About Immedica

Immedica is a pharmaceutical company, headquartered in

Stockholm, Sweden, focused on the commercialization of medicines

for rare diseases and specialty care products. Immedica’s

capabilities cover marketing and sales, compliance,

pharmacovigilance, quality assurance, regulatory, medical affairs

and market access, as well as a global distribution network serving

patients in more than 50 countries. Immedica is fully dedicated to

helping those living with diseases which have a large unmet medical

need. Immedica’s therapeutic areas are within genetic &

metabolic diseases, hematology & oncology and specialty

care.

Immedica was founded in 2018 and employs today around 130 people

across Europe, the Middle East and the United States. Immedica is

backed by the investment firms KKR and Impilo. For more information

visit www.immedica.com

Important information

The tender offer for the outstanding shares of common stock of

Marinus Pharmaceuticals, Inc. referenced in this press release has

not yet commenced. This document is for informational purposes

only, is not a recommendation and is neither an offer to purchase

nor a solicitation of an offer to sell any securities of Marinus’,

nor is it a substitute for the tender offer materials that Immedica

and Matador Subsidiary, Inc., a Delaware corporation and direct,

wholly owned subsidiary of Immedica (“Purchaser”) will file with

the U.S. Securities and Exchange Commission (the “SEC”), upon

commencement of the tender offer. The solicitation and offer to buy

the shares of Marinus’ common stock will only be made pursuant to

an Offer to Purchase and related tender offer materials that Parent

and the Purchaser intend to file with the SEC. At the time the

tender offer is commenced, Immedica and Purchaser will file a

Tender Offer Statement on Schedule TO and related materials,

including, an offer to purchase, a letter of transmittal and other

related documents with the SEC, and thereafter Marinus will file a

Tender Offer Solicitation/Recommendation Statement on Schedule

14D-9 with the SEC with respect to the tender offer. Marinus,

Immedica and Purchaser intend to mail these documents to the

stockholders of Marinus. Marinus’ stockholders and other investors

are urged to read carefully the tender offer materials (including

an Offer to Purchase, a related letter of transmittal and certain

other tender offer documents) and the Tender Offer

Solicitation/Recommendation Statement on Schedule 14D-9, and any

amendments or supplements thereto, when they become available

because they will contain important information that holders of

Marinus’ securities and other investors should consider before

making any decision with respect to the tender offer. The Offer to

Purchase, the related letter of transmittal, and certain other

tender offer documents, as well as the Tender Offer

Solicitation/Recommendation Statement on Schedule 14D-9, will be

made available to all stockholders of Marinus at no expense to them

and will also be made available for free at the SEC’s website at

www.sec.gov. Copies of the documents filed with the SEC by Marinus

will be available free of charge on Marinus’ website at

https://ir.marinuspharma.com/investors/ or by contacting Marinus’

investor relations by email at Investors@marinuspharma.com.

Forward-looking statements

This press release contains forward-looking statements related

to Immedica, Marinus and the proposed acquisition of Marinus by

Immedica (the “Transaction”) that involve risks and uncertainties

and reflect each of Immedica’s and Marinus’ judgment as of the date

of this press release. These forward-looking statements generally

are identified by words such as “believe,” “can,” “could”, “seek”,

“project,” “expect,” “anticipate,” “estimate,” “intend,”

“strategy,” “future,” “opportunity,” “plan,” “may,” “might”,

“should,” “will,” “would,” “will be,” “will continue,” “will likely

result” and similar expressions. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties, many of which are

outside of Immedica’s and Marinus’ control. These forward-looking

statements include, without limitation, statements regarding: the

timing of the Transaction and when and whether the Transaction

ultimately will close; the potential contributions the Transaction

is expected to bring to Immedica; the expected impact on Immedica’s

future financial and operating results; Marinus’ plans, objectives

and expectations and intentions; the financial condition, results

of operations and respective businesses of Marinus and Immedica;

and any potential strategic benefits, synergies or opportunities

expected as a result of the proposed Transaction. Many factors

could cause actual future events to differ materially from

Immedica’s and Marinus’ expectations, including, without

limitation: the risk that the conditions to the closing of the

Transaction are not satisfied, including the risk that Immedica may

not receive sufficient number of shares tendered from Marinus’

stockholders to complete the tender offer; the possibility that

competing offers will be made; litigation relating to the

Transaction; uncertainties as to the timing of the consummation of

the Transaction and the ability of each of Immedica, Purchaser or

Marinus to consummate the Transaction; the occurrence of any event,

change or other circumstance that could give rise to the

termination of the merger agreement entered into between the

companies; other business effects, including the effects of

industry, economic or political conditions outside of the

companies' control; the impact of competitive products and pricing;

the effect of the announcement or pendency of the Transaction on

Immedica’s or Marinus’ ability to retain and hire key personnel;

competitive responses to the Transaction; unexpected costs, charges

or expenses resulting from the Transaction; potential adverse

reactions or changes to business relationships resulting from the

announcement or completion of the Transaction; Immedica’s ability

to achieve the growth prospects and synergies expected from the

Transaction, as well as delays, challenges and expenses associated

with integrating Marinus with its existing businesses; legislative,

regulatory and economic developments; and other risks described in

Immedica’s and Marinus’ respective prior press releases and listed

under the heading "Risk Factors" in Marinus’ reports filed with the

U.S. Securities and Exchange Commission, including current reports

on Form 8-K, quarterly reports on Form 10-Q and annual reports on

Form 10-K, as well as the Schedule 14D-9 to be filed by Marinus and

the Schedule TO and related tender offer documents to be filed by

Immedica and Purchaser prior to the completion of the Transaction.

These filings identify and address other important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking statements.

Forward-looking statements speak only as of the date they are made.

Investors are cautioned not to put undue reliance on

forward-looking statements, and each of Immedica and Marinus

assumes no obligation and does not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events, or otherwise, except as required by law. Neither

Immedica nor Marinus gives any assurance that either Immedica or

Marinus will achieve its expectations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241230307666/en/

Immedica: Linda Holmstr�m Head of Communications

linda.holmstrom@immedica.com

Marinus: Molly Cameron Director, Corporate Communications

& Investor Relations Marinus Pharmaceuticals, Inc.

mcameron@marinuspharma.com

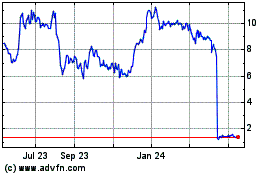

Marinus Pharmaceuticals (NASDAQ:MRNS)

Historical Stock Chart

From Dec 2024 to Jan 2025

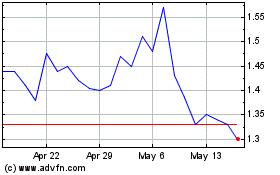

Marinus Pharmaceuticals (NASDAQ:MRNS)

Historical Stock Chart

From Jan 2024 to Jan 2025