false

0001267813

0001267813

2024-12-23

2024-12-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): December 23, 2024

Marinus

Pharmaceuticals, Inc.

(Exact name of registrant as specified

in its charter)

| Delaware |

001-36576 |

20-0198082 |

(State

or other jurisdiction of

incorporation) |

(Commission File Number) |

(IRS

Employer Identification

No.) |

|

5 Radnor Corporate Center, Suite 500

100

Matsonford Rd, Radnor, PA |

19087 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s

telephone number, including area code: (484) 801-4670

__________________________________________________________________

(Former name or former address,

if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.001 |

MRNS |

Nasdaq Global Market |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item

1.01. Entry into a Material Definitive Agreement.

On December 23, 2024

(the “Termination Effective Date”), Marinus Pharmaceuticals, Inc. (the “Company”) and Orion Corporation (“Orion”)

entered into a Termination and Release Agreement (the “Termination Agreement”) to terminate, as of the Termination Effective

Date, (i) that certain Collaboration Agreement by and between Orion and the Company, dated as of July 30, 2021 (the “Collaboration

Agreement”); (ii) that certain Manufacturing and Supply Agreement by and between Orion and the Company, dated as of October 24,

2022 (the “Supply Agreement”); and (iii) a number of ancillary agreements related to the Collaboration Agreement and

the Supply Agreement. The Termination Agreement also provided a mutual release of claims. The Termination Agreement was entered into in

connection with the Company’s review of its strategic alternatives.

Under

the terms of the Termination Agreement, Orion is not required to pay to the Company the five hundred thousand Euros

(€500,000) development costs payment associated with the

Collaboration Agreement which would otherwise have been due for the fourth quarter of 2024 under the Collaboration Agreement. In

addition, the Company will pay to Orion one million five hundred thousand Euros (€1,500,000)

within ten (10) business days after the first to occur of (i) the closing of a transaction between the Company and a third

party transferring or selling all or substantially all of the Company’s assets or business that relate to a

biopharmaceutical product which incorporates ganaxolone as the sole active ingredient or in combination with one or more other

active ingredients (in the same formulation) for any of the indications for which Orion was granted commercialization rights

pursuant to the Collaboration Agreement; or (ii) the Company’s merger or consolidation or similar transaction

constituting a change of control of the Company; or (iii) June 30, 2025.

The

foregoing description of the Termination Agreement does not purport to be

complete and is qualified in its entirety by reference to the Termination Agreement, a copy of which is filed as Exhibit 10.1 to

this Current Report on Form 8-K and is incorporated by reference into this Item 1.01.

Item

1.02. Termination of a Material Definitive Agreement.

The information regarding the termination of the

Collaboration Agreement included under Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 1.02.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

MARINUS PHARMACEUTICALS, INC. |

| |

|

| Date: December 30, 2024 |

/s/ Steven Pfanstiel |

| |

Steven Pfanstiel |

| |

Chief Operating Officer, Chief Financial Officer and Treasurer |

Exhibit 10.1

EXECUTION

VERSION

TERMINATION AND RELEASE AGREEMENT

THIS

TERMINATION AND RELEASE AGREEMENT (“Agreement”) is made and entered into on this 23rd day of December, 2024 (the

“Termination Effective Date”) by and between Orion Corporation

("Orion"), a corporation incorporated and existing under the laws of Finland, business identity code 1999212-6 (“Licensee”),

having a principal place of business at Orionintie 1, 02200 Espoo, Finland,

and Marinus Pharmaceuticals, Inc. (“Marinus”), a Delaware corporation with an office address at 5 Radnor Corporate

Center, Suite 500, 100 Matsonford Road, Radnor, PA 19087 USA. Marinus and Licensee are referred to in this Agreement individually

as a “Party” and collectively as the “Parties”.

Background

A. Orion

and Marinus entered into a Collaboration Agreement entered into as of July 30, 2021 (the “Collaboration Agreement”),

a Manufacturing and Supply Agreement entered into as of October 24, 2022 (the Supply Agreement”), and a number of ancillary

agreements related to the Collaboration Agreement and the Supply Agreement, including without limitation a Data Protection Agreement

entered into as of January 26, 2022, a Cooperation and Support Agreement for Individual Patient Expanded Access of Investigational

Drug entered into as of July 12, 2022, a Safety Data Exchange Agreement, as amended, entered into as of September 14, 2023

and a Quality Agreement entered into as of April 25, 2023 (previous version July 13, 2022) (collectively, the “Ancillary

Agreements”). Capitalized terms used but not defined in this Agreement shall have the respective meaning assigned to them in the

Collaboration Agreement, the Supply Agreement or the Ancillary Agreements, as applicable.

B. The

Parties desire to terminate the Collaboration Agreement, the Supply Agreement and the Ancillary Agreements on the terms and conditions

set forth in this Agreement that is made in reference to the Collaboration Agreement.

NOW, THEREFORE, in consideration of the mutual

covenants and obligations set forth below, and intending to be legally bound, the Parties agree as follows:

1. Termination

1.1. Termination

of Agreements. Orion and Marinus (each for itself and all of its Affiliates) hereby agree that the Collaboration Agreement,

the Supply Agreement and each of the Ancillary Agreements is terminated effective as of the Termination Effective Date.

1.2 Effect

of Termination. Orion and Marinus (each for itself and all of its Affiliates) hereby agree that the

termination of the Collaboration Agreement, the Supply Agreement and the Ancillary Agreements shall (i) not affect any rights or

obligations of either Party to the extent that such obligations or rights have accrued or matured prior to the Termination Effective

Date, (ii) post-termination obligations, including cooperation for wind down and transition activities shall be in accordance with

the applicable provisions as set forth in each of the terminated agreements, and (iii) survival of specific provisions of each terminated

agreement shall be governed by the terms set forth in that agreement.

1.3 Research

and Development Reimbursement. In consideration of entering into this Agreement, Marinus agrees that Orion shall not be required

to pay to Marinus the Development Costs for the fourth (4th) Calendar Quarter of 2024 that would otherwise be required pursuant

to Section 4.5 of the Collaboration Agreement.

EXECUTION VERSION

1.4 Termination

Payment. In consideration of the termination of the Collaboration Agreement, the Supply Agreement and the Ancillary Agreements, Marinus

shall pay to Orion, the amount of one million five hundred thousand Euros (€1,500,000 )

(“Termination Payment”), to be paid within ten Business Days after the first to occur of (i) closing of a transaction

between Marinus and a Third Party transferring or selling all or substantially all of Marinus’ assets or business that relate

to a biopharmaceutical product which incorporates Ganaxolone as sole Active Ingredient or in combination with one or more other Active

Ingredients (in the same formulation) for any of the Indications for which Orion is granted Commercialization rights pursuant to Article 4

of the Collaboration Agreement or (ii) Marinus’ merger or consolidation or similar transaction constituting a Change of Control

of Marinus or (iii) 30 June 2025.

1.5 Purchase

Orders of Licensed Product. The Parties agree that all purchase orders of Licensed Product placed by Orion prior to the Termination

Effective Date are hereby cancelled.

2. Mutual

Release.

2.1. Each

Party, for itself and its Affiliates, their respective successors and assigns, and the directors, officers, employees, shareholders,

members, partners and other equity owners and holders and representatives of each of the foregoing (collectively, the “Releasors”),

does hereby remise, release and forever discharge the other Party, the Affiliates of such other Party, their respective successors and

assigns, and the directors, officers, employees, shareholders, members, partners and other equity owners and holders and representatives

of each of the foregoing (collectively, the “Releasees”), of and from any and all causes of action, actions, suits, damages,

losses, liabilities, costs, expenses, fees, invoices, accounts receivable, interest, indebtedness, obligations, liens, claims and demands

of whatever kind, known or unknown, foreseeable or unforeseeable, liquidated or unliquidated, in law or in equity, which the Releasors

ever had, now have or hereafter can, shall or may have against the Releasees, for, by reason of, or arising out of, any performance,

breach or alleged breach of the Collaboration Agreement, the Supply Agreement or the Ancillary Agreements to and including the Termination

Effective Date; provided, however, that this release does not, and shall not be construed to, apply to any Surviving Claims (defined

below).

2.2. As

used herein, the term “Surviving Claims” means any causes of action, actions, suits, damages, losses, liabilities, costs,

expenses, fees, invoices, accounts receivable, interest, indebtedness, obligations, liens, claims and demands arising out of: any of

the provisions of the Collaboration Agreement, the Supply Agreement or any of the Ancillary Agreements which survive the termination

of the Collaboration Agreement, the Supply Agreement or any of the Ancillary Agreements and the execution of this Agreement, including,

without limitation, arising out of any breach of, or any other failure to observe or perform, any of such surviving provisions thereof,

but only with respect to such breaches or failures that occur after the Termination Effective Date of this Agreement.

EXECUTION VERSION

2.3. Each

Party, for itself and its other Releasors, represents and warrants that no Releasor has assigned or transferred, or purported to assign

or transfer, voluntarily, involuntarily, or by operation of law, any claim herein released or any part or portion thereof.

2.4. Each

Party, for itself and its other Releasors, covenants and agrees never to commence, prosecute, or cause, permit, or advise to be commenced

or prosecuted on behalf of any of the Releasors, any action, suit or proceeding based upon any claim or other matter herein released or

any part or portion thereof.

3. No

Disparagement. Each Party agrees, for itself, its Affiliates, and its and their respective successors and assigns, and the directors,

officers, employees, shareholders, members, partners and other equity owners and holders within such Party’s control and representatives

of each of the foregoing, not to make any statements or comments of a disparaging nature to Third Parties (including any of their customers)

regarding the other Party, any Affiliates of the other Party, any of their respective successors or assigns, any director, officer or

employee of any of the foregoing, any current or planned product or service of any of the foregoing, or any prospects, condition or conduct

of any of the foregoing.

4. General

Provisions.

4.1. Amendments.

This Agreement may only be amended by a writing specifically referencing this Agreement, which has been signed by authorized representatives

of each Party.

4.2. Binding

Effect. This Agreement will be binding upon and inure to the benefit of the Parties hereto and their respective successors

and assigns.

4.3. Governing

Law and Dispute Resolution. This Agreement is made in reference to the Collaboration Agreement and therefore Section 14.4

(Governing Law; English Language) and Section 14.5 (Dispute Resolution) of the Collaboration Agreement shall apply to this Agreement.

4.4. Entire

Agreement. This Agreement, and the certain provisions of the Collaboration Agreement, the Supply Agreement and the Ancillary

Agreements that survive termination set forth the entire agreement and understandings between the Parties hereto with respect to the subject

matter hereof.

4.5. Further

Assurances. Orion and Marinus hereby covenant and agree, without the necessity of any further consideration, to execute, acknowledge

and deliver any and all documents and take any action as may be reasonably necessary to carry out the intent and purposes of this

Agreement. Orion acknowledges that Orion shall take all such actions as contemplated in the Collaboration Agreement, the Supply Agreement

and the Ancillary Agreements to effect an orderly termination of the foregoing agreements to effect the termination and transition of

the rights back to Marinus or to a third party as requested by Marinus.

4.6. Waivers.

An effective waiver under this Agreement must be in writing signed by the Party waiving its right. The failure of either Party to require

performance by the other Party of any provision hereof shall not affect the full right to require such performance at any time thereafter;

nor shall the waiver by either Party of a breach of any provision hereof be taken or held to be a waiver of subsequent breaches of that

or any other provision hereof.

EXECUTION VERSION

4.7. Severability.

If in any jurisdiction any one or more of the provisions of this Agreement should be for any reason be held by any court or

authority having jurisdiction over this Agreement or any of the Parties hereto to be invalid, illegal or unenforceable, such provision

or provisions shall be validly reformed so as to nearly approximate the intent of the Parties as possible and if not reformable, the Parties

shall meet to discuss what steps should be taken to remedy the situation; in other jurisdictions, this Agreement shall not be affected.

4.8. Notices.

All notices, consents or waivers under this Agreement shall be in writing and will be deemed to have been duly given when (a) scanned

and converted into a portable document format file (i.e., pdf file) and sent as an attachment to an e-mail message (and promptly confirmed

by registered letter or overnight courier by an internationally recognized overnight delivery service (receipt requested)), or (b) the

earlier of when received by the addressee or five (5) days after it was sent, if sent by registered letter or overnight courier by

an internationally recognized overnight delivery service (receipt requested), in each case to the appropriate addresses and e-mail addresses

set forth below (or to such other addresses and e-mail addresses as a Party may designate by notice):

If to Marinus: Marinus Pharmaceuticals, Inc.

5 Radnor Corporate Center,

100 Matsonford Road, Suite 500

Radnor, PA 19087

Attention: Martha Manning, Esq.

Tel: (610) 639-6174

with a copy to (which shall not constitute

notice):

Hogan Lovells US LLP

1735 Market Street, Floor 23

Philadelphia, PA 19103

Attention: Steve J. Abrams

Tel: (267) 675-4642

If to Orion: Orion

Corporation

Orionintie 1,

02200 Espoo,

Finland

Attn: Senior Vice President, Branded

Products

Tel: +358 10 426

1

with a copy to (which shall not constitute notice):

Orion Corporation Legal Affairs

Orionintie 1,

02200 Espoo, Finland

Attn: Head of

Legal Affairs

Tel: +358 10 426

1

EXECUTION

VERSION

4.9. Counterparts.

This Agreement may be executed in one or more counterparts, including without limitation electronic or facsimile, each of which shall

be deemed an original and all of which together shall constitute one and the same instrument. This Agreement shall become binding when

any one or more counterparts hereof, individually or taken together, bear the signatures of both Parties hereto.

4.10. Headings.

The section headings appearing in this Agreement are inserted only as a matter of convenience and are to be of no force or effect in construing

and interpreting the provisions of this Agreement.

4.11. Relationship

of the Parties. The Parties are independent contractors under this Agreement. Nothing herein contained shall be deemed to create

or establish an employment, agency, joint venture, or partnership relationship between the Parties, or any other legal arrangement that

would impose liability upon one Party for the act or failure to act of the other Party. Neither Party shall have any express or implied

power to enter into any contracts, commitments or negotiations or to incur any liabilities in the name of, or on behalf of, the other

Party, or to bind the other Party in any respect whatsoever.

IN WITNESS WHEREOF, the Parties have caused this

Agreement to be duly executed and delivered by their proper and duly authorized officers as of the day and year first written above.

| |

MARINUS PHARMACEUTICALS, INC. |

| |

|

| |

By: |

/s/ Steven Pfanstiel |

| |

Name: |

Steven Pfanstiel |

| |

Title: |

Chief Financial Officer |

| |

|

| |

ORION CORPORATION |

| |

|

| |

By: |

/s/ Liisa Hurme |

| |

Name: |

Liisa Hurme |

| |

Title: |

SVP Global Operations |

| |

|

| |

By: |

/s/ Outi Vaarala |

| |

Name: |

Outi Vaarala |

| |

Title: |

SVP R&D |

v3.24.4

Cover

|

Dec. 23, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 23, 2024

|

| Entity File Number |

001-36576

|

| Entity Registrant Name |

Marinus

Pharmaceuticals, Inc.

|

| Entity Central Index Key |

0001267813

|

| Entity Tax Identification Number |

20-0198082

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

5 Radnor Corporate Center

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, Address Line Three |

100

Matsonford Rd

|

| Entity Address, City or Town |

Radnor

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19087

|

| City Area Code |

484

|

| Local Phone Number |

801-4670

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001

|

| Trading Symbol |

MRNS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

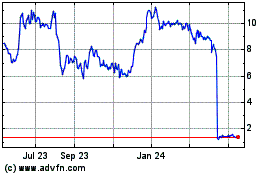

Marinus Pharmaceuticals (NASDAQ:MRNS)

Historical Stock Chart

From Dec 2024 to Jan 2025

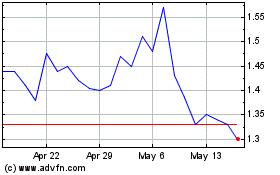

Marinus Pharmaceuticals (NASDAQ:MRNS)

Historical Stock Chart

From Jan 2024 to Jan 2025