UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of November 2024

Commission File Number: 001-40875

NUVEI CORPORATION

(Exact name of registrant as specified in its charter)

1100 René-Lévesque Boulevard West,

Suite 900

Montreal, Quebec H3B 4N4

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F ☐

Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

This Report on Form 6-K (the “Report”) and Exhibits

99.2, 99.3 and 99.4 to this Report are incorporated by reference into the Registration Statement on Form S-8 of the Registrant, which

was originally filed with the Securities and Exchange Commission on October 18, 2021 (File No. 333-260308), and the Registration Statement

on Form S-8 of the Registrant, which was originally filed with the Securities and Exchange Commission on February 22, 2023 (File No. 333-269901)

and the Registration Statement on Form S-8 of the Registrant, which was originally filed with the Securities and Exchange Commission on

August 9, 2023 (File No. 333-273832).

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Nuvei Corporation

|

| |

|

|

| |

|

|

| Date: November 15, 2024 |

By: |

/s/ Lindsay Matthews |

| |

|

Name: |

Lindsay Matthews |

| |

|

Title: |

General Counsel |

Exhibit 99.1

NUVEI ANNOUNCES COMPLETION

OF

GOING PRIVATE TRANSACTION

Montréal, November

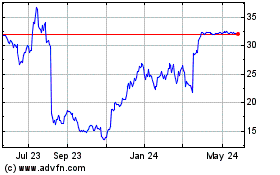

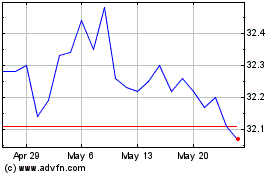

15, 2024 – Nuvei Corporation (“Nuvei” or the “Company”) (Nasdaq: NVEI)(TSX: NVEI),

the Canadian fintech company, announced today the completion of the previously announced plan of arrangement under the Canada Business

Corporations Act (the “Plan of Arrangement”) pursuant to which Neon Maple Purchaser Inc. (the “Purchaser”),

an entity formed by Advent International (“Advent”), acquired, directly or indirectly, all the issued and outstanding

subordinate voting shares (the “Subordinate Voting Shares”) and multiple voting shares (the “Multiple

Voting Shares” and together with the Subordinate Voting Shares, the “Shares”) of the Company for a price

of US$34.00 per Share (the “Arrangement”).

As part of the Arrangement,

Philip Fayer, certain investment funds managed by Novacap Management Inc. (collectively, “Novacap”) and Caisse de dépôt

et placement du Québec (“CDPQ”) (together with entities they control directly or indirectly, collectively, the

“Rollover Shareholders”) sold their Shares (the “Rollover Shares”) in exchange for a combination

of cash and shares in the capital of the Purchaser or an affiliate thereof, in accordance with the terms of the Plan of Arrangement and

the applicable rollover agreement entered into with each Rollover Shareholder in connection with the Arrangement. As a result of the Arrangement,

the Company became a wholly-owned subsidiary of the Purchaser, of which Advent, Philip Fayer, Novacap and CDPQ hold or exercise control

or direction over, directly or indirectly, approximately 46%, 24%, 18% and 12%, respectively.

Nuvei Founder & CEO

Philip Fayer rolled approximately 95% of his Shares and will continue to be one of the largest shareholders in the Company. He will also

continue to serve as Nuvei’s Chair and Chief Executive Officer, leading the business in all aspects of its operations, along with

Nuvei’s current leadership team who have continued in their roles.

“We

are excited to embark on a new chapter with Advent, Novacap and CDPQ, one focused on our long-term strategy and commitment to accelerating

the revenue of our customers globally,” said Fayer. “For more than 20 years we have provided customers with mission-critical

solutions they need to execute on their growth journeys. This commitment will remain the same as we continue to build deeper partnerships

with our customers by providing them modern, flexible and purpose-built technology. A key part of

this next phase will be the implementation of our Value Creation Plan, a comprehensive strategic

exercise designed to optimize our operations as we execute on various opportunities for accelerated growth. Advent joins our long-standing

investors, Novacap and CDPQ, who remain meaningful investors and believe in a dynamic and successful future for Nuvei,” concluded

Fayer.

“Since 2017, we have been privileged to support

Nuvei’s management in executing its ambitious global growth strategy. Together with a leadership team that continually drives innovation

and builds meaningful partnerships across industries, Nuvei has established itself as a fintech leader in key verticals with sustainable,

long-term growth potential. As the Company embarks on an exciting new chapter of expansion, we look forward to strengthening our collaboration

and unlocking new opportunities to create lasting value for all stakeholders," said David Lewin, Lead Senior Partner at Novacap.

“Ever since

our first investment in Nuvei in 2017, CDPQ is proud to have supported this Québec fintech leader at every stage of its growth,

particularly through acquisitions on a global scale. We are delighted to accompany Nuvei once again as it embarks on this new chapter

of its history, alongside recognized partners such as Advent, as well as existing shareholders Philip Fayer and Novacap,” said Kim

Thomassin, Executive Vice-President and Head of Québec at CDPQ.

Bo Huang, Managing Director

at Advent, said: “We are excited to begin this partnership and support Nuvei’s growth through investments and acquisitions

to best serve its customers globally as a modern payments partner.”

Consideration for the

Shares has been remitted by or on behalf of the Purchaser to TSX Trust Company as depositary under the Arrangement, and will be paid to

former shareholders of the Company as soon as reasonably practicable after the date hereof (or, in the case of registered shareholders,

as soon as reasonably practicable after a properly completed and signed letter of transmittal is received by the depositary together with

the share certificate(s) and/or DRS Advice(s) representing Shares formerly held by them).

As a result of the completion

of the Arrangement, it is expected that the Subordinate Voting Shares will be de-listed from the Toronto Stock Exchange on or about November

18, 2024 and from the Nasdaq Global Select Market on or about November 25, 2024. The Company has applied to cease to be a reporting issuer

under Canadian securities laws in all Canadian jurisdictions. The Company will also deregister the Subordinate Voting Shares under the

U.S. Securities Exchange Act of 1934, as amended.

Early Warning Reporting

Further to the requirements

of National Instrument 62-104 Take-Over Bids and Issuer Bids and National Instrument 62-103 The Early Warning System and Related

Take-Over Bid and Insider Reporting Issues, the Purchaser or an affiliate thereof and Philip Fayer and certain entities controlled

by Philip Fayer will file an early warning report in accordance with applicable securities laws. A copy of each of the early warning reports

will be made available under Nuvei's profile on SEDAR+ at www.sedarplus.ca.

Immediately prior to closing

of the Arrangement and the related transactions, AI Maple Aggregator, L.P. ("Maple Aggregator"), an entity formed by

Advent with an indirect interest in the Purchaser, did not own, or exercise control or direction over, directly or indirectly, any Shares.

Upon the completion of the Arrangement, Maple Aggregator, through its indirect interest in the Purchaser, controls 46% of the 66,096,274

Subordinate Voting Shares and 76,064,619 Multiple Voting Shares issued and outstanding in the capital of the Company. The consideration

paid by the Purchaser for the Shares (excluding any Rollover Shares exchanged for shares in the capital of the Purchaser or an affiliate

thereof) was US$34.00 per Share (equivalent to C$47.69). The Rollover Shares exchanged for shares in the capital of the Purchaser or an

affiliate thereof had an implied value of US$34.00 (equivalent to C$47.69). All figures in this press release have been calculated using

a US$:C$ exchange rate of 1.4027, being the daily US$:C$ exchange rate published by the Bank of Canada for November 14, 2024.

Immediately prior to closing

of the Arrangement and the related transactions, Philip Fayer and certain entities controlled by Philip Fayer beneficially owned and controlled

27,857,328 Multiple Voting Shares (representing 36.62% of the issued and outstanding Multiple Voting Shares) and 124,986 Subordinate Voting

Shares (representing 0.2% of the issued and outstanding Subordinate Voting Shares). In connection with the Arrangement, Philip Fayer and

such entities sold their Shares directly or indirectly to the Purchaser at an implied value of US$34.00 per Share (equivalent to C$47.69)

for aggregate cash proceeds of US$75,096,573 and common shares of the Purchaser or an affiliate thereof at an aggregate implied value

of US$876,302,102. Following completion of the Arrangement, Philip Fayer and an entity controlled by him became shareholders of the Purchaser’s

indirect parent company and no longer beneficially own or control any Shares. Mr. Fayer now indirectly owns or controls approximately

24% of the equity in the resulting private company. Further information and a copy of the early warning report of Philip Fayer may be

obtained by contacting:

Chris Mammone

Head of Investor Relations

Nuvei Corporation

IR@nuvei.com

310.654.4212

About Nuvei

Nuvei (Nasdaq: NVEI) (TSX:

NVEI) is the Canadian fintech company accelerating the business of clients around the world. Nuvei's modular, flexible and scalable technology

allows leading companies to accept next-gen payments, offer all payout options and benefit from card issuing, banking, risk and fraud

management services. Connecting businesses to their customers in more than 200 markets, with local acquiring in 50 markets, 150 currencies

and 720 alternative payment methods, Nuvei provides the technology and insights for customers and partners to succeed locally and globally

with one integration.

Forward-Looking Statements

This press release contains

“forward-looking information” and “forward-looking statements” (collectively, “Forward-looking information”)

within the meaning of applicable securities laws. This Forward-looking information is identified by the use of terms and phrases such

as “may”, “would”, “should”, “could”, “expect”, “intend”, “estimate”,

“anticipate”, “plan”, “foresee”, “believe”, or “continue”, the negative of

these terms and similar terminology, including references to assumptions, although not all Forward-looking information contains these

terms and phrases. Particularly, statements with respect to the delisting of the Subordinate Voting Shares from the Toronto Stock Exchange

and from the Nasdaq Global Select Market, the Company ceasing to be a reporting issuer under applicable Canadian securities laws and the

deregistration of the Subordinate Voting Shares under the U.S. Securities Exchange Act of 1934, as amended, are Forward-looking information.

In addition, any statements

that refer to expectations, intentions, projections or other characterizations of future events or circumstances contain Forward-looking

information. Statements containing Forward-looking information are not historical facts but instead represent management’s expectations,

estimates and projections regarding future events or circumstances.

Forward-looking information

is based on management’s beliefs and assumptions and on information currently available to management, and although the Forward-looking

information contained herein is based upon what management believes are reasonable assumptions, readers are cautioned against placing

undue reliance on this information since actual results may vary from the Forward-looking information.

Forward-looking information

involves known and unknown risks and uncertainties, many of which are beyond the Company’s control, that could cause actual results

to differ materially from those that are disclosed in or implied by such Forward-looking information. These risks and uncertainties include,

but are not limited to, the possibility that the Subordinate Voting Shares will not be delisted from the Toronto Stock Exchange or the

Nasdaq Global Select Market within the timing currently contemplated, that the Subordinate Voting Shares may not be delisted at all, due

to failure to satisfy, in a timely manner or otherwise, conditions necessary for the delisting of the Subordinate Voting Shares or for

other reasons, and that the Company’s application to cease to be a reporting issuer under applicable Canadian securities laws may

not be accepted or may be delayed.

Consequently, all of the

Forward-looking information contained herein is qualified by the foregoing cautionary statements. Unless otherwise noted or the context

otherwise indicates, the Forward-looking information contained herein represents the Company’s expectations as of the date hereof

or as of the date it is otherwise stated to be made, as applicable, and is subject to change after such date. However, the Company disclaims

any intention or obligation or undertaking to update or amend such Forward-looking information whether as a result of new information,

future events or otherwise, except as may be required by applicable law.

For further information

please contact:

Investors

Chris Mammone, Head of

Investor Relations

IR@nuvei.com

Media

alex.hammond@nuvei.com

NVEI-IR

Exhibit 99.2

form

51-102F3

MATERIAL

CHANGE REPORT

Section 7.1 of National Instrument 51-102

Continuous Disclosure Obligations

| Item 1: | Name and Address of Company |

Nuvei Corporation (“Nuvei” or the “Company”)

1100 René-Lévesque W., suite 900

Montréal, Québec

H3B 4N4

| Item 2: | Date of Material Change |

November 15, 2024.

A news release was disseminated

over PR Newswire and filed on SEDAR+ at www.sedarplus.com and on EDGAR at www.sec.gov on November 15, 2024.

| Item 4: | Summary of Material Change |

On November 15, 2024, Nuvei completed the

previously announced plan of arrangement under the Canada Business Corporations Act (the “Plan of Arrangement”)

pursuant to which Neon Maple Purchaser Inc. (the “Purchaser”), an entity formed by Advent International, L.P. (“Advent”),

acquired, directly or indirectly, all the issued and outstanding subordinate voting shares (the “Subordinate Voting Shares”)

and multiple voting shares (the “Multiple Voting Shares” and together with the Subordinate Voting Shares, the

“Shares”) of the Company (the “Arrangement”).

| Item 5: | Full Description of Material Change |

On November 15, 2024, Nuvei completed the

Arrangement under the Canada Business Corporations Act pursuant to which the Purchaser acquired, directly or indirectly, all the

issued and outstanding Shares of Nuvei (other than the Rollover Shares, as defined below) for a price of US$34.00 per Share.

As part of the Arrangement, Philip Fayer,

certain investment funds managed by Novacap Management Inc. (collectively, “Novacap”) and Caisse de dépôt

et placement du Québec (“CDPQ”) (together with entities they control directly or indirectly, collectively, the

“Rollover Shareholders”) sold their Shares (the “Rollover Shares”) in exchange for a combination

of cash and shares in the capital of the Purchaser or an affiliate thereof, in accordance with the terms of the Plan of Arrangement and

the applicable rollover agreement entered into with each Rollover Shareholder in connection with the Arrangement. As a result of the Arrangement,

the Company became a wholly-owned subsidiary of the Purchaser of which Advent, Philip Fayer, Novacap and CDPQ hold or exercise control

or direction over, directly or indirectly, approximately 46%, 24%, 18% and 12%, respectively, of the common equity.

The Subordinate Voting Shares will be

de-listed from the Toronto Stock Exchange on or about November 18, 2024 and from the Nasdaq Global Select Market on or about November

25, 2024. The Company has applied to cease to be a reporting issuer under Canadian securities laws in all Canadian jurisdictions.

The Company will also deregister the Subordinate Voting Shares under the U.S. Securities Exchange Act of 1934, as amended.

Further details regarding the Arrangement

are provided in the management information circular of Nuvei dated May 13, 2024, mailed to former Nuvei shareholders in connection with

the Arrangement, a copy of which is available under the Company’s profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

Forward-Looking Information

This material change report contains “forward-looking

information” and “forward-looking statements” (collectively, “Forward-looking information”) within

the meaning of applicable securities laws. This Forward-looking information is identified by the use of terms and phrases such as “may”,

“would”, “should”, “could”, “expect”, “intend”, “estimate”, “anticipate”,

“plan”, “foresee”, “believe”, or “continue”, the negative of these terms and similar terminology,

including references to assumptions, although not all Forward-looking information contains these terms and phrases. Particularly, statements

with respect to the delisting of the Subordinate Voting Shares from the Toronto Stock Exchange and from the Nasdaq Global Select Market,

the Company ceasing to be a reporting issuer under applicable Canadian securities laws and the deregistration of the Subordinate Voting

Shares under the U.S. Securities Exchange Act of 1934, as amended, are Forward-looking information.

In addition, any statements that refer

to expectations, intentions, projections or other characterizations of future events or circumstances contain Forward-looking information.

Statements containing Forward-looking information are not historical facts but instead represent management’s expectations, estimates

and projections regarding future events or circumstances.

Forward-looking information is based on

management’s beliefs and assumptions and on information currently available to management, and although the Forward-looking information

contained herein is based upon what management believes are reasonable assumptions, readers are cautioned against placing undue reliance

on this information since actual results may vary from the Forward-looking information.

Forward-looking information involves known

and unknown risks and uncertainties, many of which are beyond the Company’s control, that could cause actual results to differ materially

from those that are disclosed in or implied by such Forward-looking information. These risks and uncertainties include, but are not limited

to, the possibility that the Subordinate Voting Shares will not be delisted from the Toronto Stock Exchange or the Nasdaq Global Select

Market within the timing currently contemplated, and that the Subordinate Voting Shares may not be delisted at all, due to failure to

satisfy, in a timely manner or otherwise, conditions necessary for the delisting of the Subordinate Voting Shares or for other reasons.

Consequently, all of the Forward-looking

information contained herein is qualified by the foregoing cautionary statements. Unless otherwise noted or the context otherwise indicates,

the Forward-looking information contained herein represents the Company’s expectations as of the date hereof or as of the date it

is otherwise stated to be made, as applicable, and is subject to change after such date. However, the Company disclaims any intention

or obligation or undertaking to update or amend such Forward-looking information whether as a result of new information, future events

or otherwise, except as may be required by applicable law.

| Item 6: | Reliance on subsection 7.1(2) of National Instrument 51-102 |

Not applicable.

| Item 7: | Omitted Information |

None.

For further information, please contact:

David Schwartz, Chief Financial Officer

david.schwartz@nuvei.com

(514) 313-1190

November 15, 2024.

Exhibit 99.3

Notice of Change in Corporate

Structure

Pursuant to Section 4.9 of

National Instrument 51-

102 Continuous Disclosure Obligations

| Item 1: | Name of Parties to the Transaction |

Nuvei Corporation

Neon Maple Purchaser Inc.

| Item 2: | Description of the Transaction |

On November 15, 2024, Nuvei Corporation

(“Nuvei” or the “Company”) completed the previously announced plan of arrangement under the Canada

Business Corporations Act (the “Plan of Arrangement”) pursuant to which Neon Maple Purchaser Inc. (the “Purchaser”),

an entity formed by Advent International, L.P. (“Advent”), acquired, directly or indirectly, all the issued and outstanding

subordinate voting shares (the “Subordinate Voting Shares”) and multiple voting shares (the “Multiple

Voting Shares” and together with the Subordinate Voting Shares, the “Shares”) of the Company for a price

of US$34.00 per Share (the “Arrangement”).

As part of the Arrangement, Philip Fayer,

certain investment funds managed by Novacap Management Inc. (collectively, “Novacap”) and Caisse de dépôt

et placement du Québec (“CDPQ”) (together with entities they control directly or indirectly, collectively, the

“Rollover Shareholders”) sold their Shares (the “Rollover Shares”) in exchange for a combination

of cash and shares in the capital of the Purchaser or an affiliate thereof, the whole in accordance with the terms of the Plan of Arrangement

and the applicable rollover agreement entered into with each Rollover Shareholder in connection with the Arrangement. As a result of the

Arrangement, the Company became a wholly-owned subsidiary of the Purchaser of which Advent, Philip Fayer, Novacap and CDPQ hold or exercise

control or direction over, directly or indirectly, approximately 46%, 24%, 18% and 12%, respectively, of the common equity.

The Subordinate Voting Shares will be de-listed

from the Toronto Stock Exchange on or about November 18, 2024 and from the Nasdaq Global Select Market on or about November 25, 2024.

The Company has applied to cease to be a reporting issuer under Canadian securities laws in all Canadian jurisdictions. The Company will

also deregister the Subordinate Voting Shares under the U.S. Securities Exchange Act of 1934, as amended.

Further details regarding the Arrangement

are provided in the management information circular of Nuvei dated May 13, 2024, mailed to former Nuvei shareholders in connection with

the Arrangement, a copy of which is available under the Company's profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

| Item 3: | Effective Date of the Transaction |

November 15, 2024.

| Item 4: | Name of Each Party, if any, that Ceased to be a Reporting Issuer after

the Transaction and of each Continuing Entity |

Nuvei will

apply to cease to be a reporting issuer under Canadian securities laws in each province and territory in Canada. Nuvei will also deregister

the Subordinate Voting Shares under the U.S. Securities Exchange Act of 1934, as amended.

| Item 5: | Date of the Reporting Issuer’s First Financial Year-End Subsequent

to the Transaction |

Not

applicable.

| Item 6: | Periods, Including Comparative Periods, if any, of the Interim and

Annual Financial Statements required to be Filed for the Reporting Issuer’s First Financial Year Subsequent to the Transaction |

Not

applicable.

| Item 7: | Documents filed under National Instrument 51-102 that described the

transaction and where they can be found in electronic format, if paragraph (a) or subparagraph (b)(ii) of Section 4.9 applies. |

Not applicable.

Dated:

November 15, 2024.

Exhibit 99.4

|

Innovation,

Science and

Economic

Development Canada |

Innovation,

Sciences et

Developpement

economique Canada

|

| |

Corporations

Canada |

Corporations Canada |

Certificate

of Arrangement

|

|

Certificat

d'arrangement |

Canada

Business Corporations Act

|

|

Loi

canadienne sur /es societes par actions

|

| |

|

|

NUVEI

CORPORATION

CORPORATION NUVEI

|

|

1235004-1 |

| |

|

|

| |

|

|

Corporate

name(s) of CBCA applicants/ Denomination(s)

sociale(s) de la ou des societes LCSA requerantes

|

|

Corporation

number(s) / Numero(s) de la ou

des societes

|

| |

|

|

| |

|

|

| |

|

|

I

HEREBY CERTIFY that the arrangement set out in the attached articles of arrangement has been effected

under section 192 of the Canada Business Corporations Act.

|

|

JE

CERTIFIE que l’arrangement mentionne dans les clauses d'arrangement annexees a pris effet en vertu

de l’article 192 de la Loi canadienne sur /es societes par actions. |

| |

|

|

| |

Hantz

Prosper

|

|

| |

Director/

Directeur

|

|

| |

2024-11-15

|

|

| |

Date

of Arrangement (YYYY-MM-DD)

Date

de l’arrangement (AAAA-MM-JJ)

|

|

|

Innovation,

Science and Economic Development Canada |

Innovation, Sciences et

Developpement economique Canada |

| |

Corporations

Canada |

Corporations

Canada |

Canada

Business Corporations Act (CBCA)

FORM 14.1

ARTICLES

OF ARRANGEMENT

(Section

192)

1- Name of the

applicant corporation(s)

|

|

|

Corporation

number

|

NUVEI

CORPORATION/ CORPORATION NUVEI

|

|

|

1235004-1

|

2 - Name of the corporation(s) the

articles of which are amended, if applicable

|

|

|

Corporation number |

NUVEI

CORPORATION/ CORPORATION NUVEI

|

|

|

1235004-1

|

3 - Name of the corporation(s) created

by amalgamation, if applicable

|

|

|

Corporation number |

| |

|

|

|

4 - Name of the dissolved corporation(s),

if applicable

|

|

|

Corporation number |

| |

|

|

|

5 - Name of the other bodies corporate

involved, if applicable

|

|

|

Corporation number or jurisdiction

|

(i)

Neon Maple Purchaser Inc. (1589174-4), (ii) Neon Maple Parent Inc.,(iii) Neon Maple Holdings Inc.,

(iv)Neon Maple US Debt Mergersub Inc., (v) PPI Holdings U.S. Inc., (vi) 16028195 Canada Inc. (1602819-5)

and (vii) 12990202 Canada Inc. (1299020-2 |

|

|

(i) 1589174-4

(vi)

1602819-5 (vii) 1299020-2.

|

| 6

- In accordance with the order approving the arrangement, the plan of arrangement attached hereto, involving the above named body(ies)

corporate, is hereby effected. |

In accordance with the plan of arrangement,

| ☒ | a. the

articles of the corporation(s) indicated in item 2, are amended. |

If the amendment includes a name change, indicate the change

below:

| |

☐ |

b. the following

bodies corporate and/or corporations are amalgamated (for CBCA corporations include the corporation number): |

| |

☐ |

c. the

corporation(s) indicated in item 4 is(are) liquidated and dissolved: |

| 7

- I hereby certify that I am director or an authorized officer of one of the applicant corporations.

|

|

Signature:

|

| Print

name: David Schwartz |

| Note:

Misrepresentation constitutes an offence and, on summary conviction, a person is liable to a fine not exceeding $5,000 or to

imprisonment for a term not exceeding six months or to both (subsection 250(1) of the CBCA). |

ISED-ISDE 3189E (2020/01) Page 1 of

| | November 15, 2024 |  |

SCHEDULE A

The articles

o f Nuvei Corporation are hereby amended by deleting the definition of “Permitted Holders” that appears in section 1.1 of

Schedule 1 to the articles of amalgamation of Nuvei Corporation dated September 22, 2020 (as amended by the articles of amendment dated

September 22, 2020 and as further amended by the articles of arrangement dated June 1, 2022) in its entirety and replacing it with the

following:

(18) “Permitted

Holders” means any of (a) the Fayer Group Permitted Holders, (b) the Novacap Group Permitted Holders, (c) the Caisse Group

Permitted Holders and (d) Neon Maple Purchaser Inc., Neon Maple Parent Inc. and any of their affiliates.

CANADA |

|

SUPERIOR

COURT

(Commercial Division)

|

PROVINCE OF QUEBEC

DISTRICT

OF MONTREAL

|

|

|

| |

|

|

File:

No: 500-11-064091-248

|

|

Montreal,

June 20, 2024

|

| |

|

|

| |

|

Present: The Honourable Celine Legendre, J.S.C

|

| |

|

|

|

|

IN THE

MATTER OF THE PROPOSED

ARRANGEMENT PURSUANT TO

SECTION 192

OF THE CANADA

BUSINESS CORPORATIONS ACT,

R.C.S. 1985, c. C-44 AS AMENDED (THE

“CBCA”)

|

| |

|

|

| |

|

NUVEI CORPORATION

|

| |

|

|

| |

|

|

| |

|

Applicant

|

| |

|

|

| |

|

-and- |

| |

|

|

| |

|

NEON

MAPLE PURCHASER INC.

|

| |

|

|

| |

|

|

| |

|

-and-

|

| |

|

|

| |

|

|

| |

|

THE

DIRECTOR

|

| |

|

|

| |

|

lmpleaded

Parties

|

FINAL

ORDER1

GIVEN

Nuvei Corporation (the "Applicant" or the "Company")'s Application for Interim and Final Orders

with Respect to an Arrangement pursuant to the Canada Business Corporations Act, R.S.C.

1985, c. C-44 (as amended, the "CBCA"), the exhibits, the sworn statement of David Schwartz dated May 10, 2024, the

sworn statement of Shabana

1

Puisqu'il est presenteinent impossible pour !es juges de la Gour superieure de soumettre leurs projets de jugement au Service

de traduction en raison de coritraintes techniques et operationnelles, une traduction du present jugement ne peut etre jointe immediatement

et sans delai conformement a !'article 1O de la Charte de la langue franr;aise (RLRQ, c. C-11).

Saidali

dated May 21, 2024, and the supplemental sworn statement of David Schwartz dated June 19, 2024 filed in support thereof (the "Application");

GIVEN

that this Court is satisfied that the Director appointed pursuant to the CBCA has been duly served with the Application and has

confirmed in writing that he would not appear or be heard on the Application;

GIVEN

the provisions of the CBCA;

GIVEN

the representations of counsel for the Applicant;

GIVEN

the Interim Order rendered by this Court on May 13, 2024;

GIVEN

that this Court is satisfied that the Arrangement conforms with the requirements of the CBCA, has a valid business purpose, resolves

in a fair and balanced way the objections of those whose legal rights are being arranged, and is fair and reasonable;

FOR

THESE REASONS THE COURT:

| [1] | GRANTS the Final Order

sought in the Application. |

| [2] | DECLARES that service of the Application

has been made in accordance with the Interim Order, is valid and sufficient, and amounts to valid service of same; |

| [3] | DISPENSES the Applicant from describing

at length the names of the holders of the Company's issued and outstanding shares (the "Shareholders")

and the holders of the Company's options, PSUs, RSUs and the DSUs (collectively the "Incentive

Securities") in the description of the lmpleaded Parties; |

| [4] | DECLARES that the terms and conditions of

the Arrangement, as more particularly described in the Plan of Arrangement attached to the Final Order as Appendix "A", have

been duly adopted in accordance with the Interim Order ; |

| [5] | DECLARES that the Arrangement conforms

with the requirements of the CBCA, has a valid business purpose, resolves in a fair and balanced way the objections of those whose legal

rights are being arranged, and is fair and reasonable; |

| [6] | DECLARES that the Arrangement, as contemplated in

the Plan of Arrangement, is hereby approved and ratified and ORDERS that the Arrangement, as it may be amended in accordance

with the Interim Order, shall take effect in accordance with the terms of the Plan of Arrangement on the Effective Date,

as defined therein; |

| [7] | ORDERS provisional execution of this Final Order notwithstanding

any appeal therefrom and without the necessity of furnishing any security; |

| [8] | DECLARES that this Court shall remain seized

of this matter to resolve any difficulty which may arise in relation to, or in connection with the implementation of the Arrangement; |

| [9] | THE

WHOLE without costs. |

| |

|

MONTREAL, June 20, 2024 |

| |

|

|

|

|

|

| |

|

The

Honourable Celine

Legendre

|

| |

|

J.S.C. |

PLAN OF ARRANGEMENT

PLAN OF ARRANGEMENT UNDER SECTION

192

OF THE CANADA BUSINESS CORPORATIONS ACT

ARTICLE 1

INTERPRETATION

Unless indicated

otherwise, where used in this Plan of Arrangement, capitalized terms used but not defined shall have the meanings specified in the Arrangement

Agreement and the following terms shall have the following meanings (and grammatical variations of such terms shall have corresponding

meanings):

"Arrangement"

means the arrangement under Section 192 of the CBCA in accordance with the terms and subject to the conditions set out in this Plan of

Arrangement, subject to any amendments or variations to this Plan of Arrangement made in accordance with its terms, the terms of the

Arrangement Agreement or made at the direction of the Court in the Final Order with the prior written consent of the Company and the

Purchaser, each acting reasonably.

"Arrangement

Agreement" means the arrangement agreement dated as of April 1, 2024 among the Purchaser and the Company.

"Arrangement

Resolution" means the special resolution approving this Plan of Arrangement to be considered at the Meeting, substantially in

the form of Schedule B to the Arrangement Agreement.

"Articles

of Arrangement" means the articles of arrangement of the Company in respect of the Arrangement required by the CBCA to be sent

to the Director after the Final Order is made, which shall include this Plan of Arrangement and otherwise be in a form and content satisfactory

to the Company and the Purchaser, each acting reasonably.

"Business

Day" means any day of the year, other than a Saturday, Sunday or any day on which major banks are closed for business in Montreal,

Québec or New York, New York.

"Canada

Holdco" means Neon Maple Holdings Inc. "Canada Parent" means Neon Maple Parent Inc. "CBCA"

means the Canada Business Corporations Act.

"CDPQ"

means Caisse de dépôt et placement du Québec.

"Certificate

of Arrangement" means the certificate giving effect to the Arrangement issued by the Director pursuant to Subsection 192(7)

of the CBCA in respect of the Articles of Arrangement.

"Circular"

means the notice of the Meeting and accompanying management information circular, including all schedules, appendices and exhibits thereto,

to be sent to each Shareholder and other Persons as required by the Interim Order and Law in connection with the Meeting, as amended,

modified or supplemented from time to time in accordance with the terms of the Arrangement Agreement.

"Code"

means the Internal Revenue Code of 1986.

"Company"

means Nuvei Corporation, a corporation existing under the federal laws of Canada.

"Consideration"

means the consideration to be received by the Shareholders (other than the Rollover Shareholders in respect of the Rollover Shares) pursuant

to this Plan of Arrangement consisting of $34.00 in cash per Share.

"Court"

means the Superior Court of Québec.

"Depositary"

means TSX Trust Company or such other Person as the Company may appoint to act as depositary for the Arrangement, in each case with the

prior written approval of the Purchaser, acting reasonably.

"Director"

means the Director appointed pursuant to Section 260 of the CBCA. "Dissent Rights" has the meaning specified in Section

3.1.

"Dissenting

Holder" means a registered Shareholder (other than a Rollover Shareholder) who has validly exercised its Dissent Rights in strict

compliance with Article 3 and has not withdrawn or been deemed to have withdrawn such exercise of Dissent Rights.

"DRS

Advice" has the meaning specified in Section 4.1(2).

"DSU"

means a deferred share unit of the Company granted to eligible participants under the Omnibus Incentive Plan.

"Effective

Date" means the date shown on the Certificate of Arrangement giving effect to the Arrangement.

"Effective

Time" means 10:00 a.m. (Montréal time) on the Effective Date, or such other time as specified in writing by the Purchaser

to the Company.

"Exchanges"

means the Toronto Stock Exchange and the Nasdaq Global Select Market.

"Exercise

Price" means, in respect of each Option that (a) has an exercise price denominated in US$, such US$ denominated exercise price;

or (b) has an exercise price denominated in Canadian dollars, the

U.S. Equivalent

of such Canadian dollar denominated exercise price.

"Final

Order" means the final order of the Court in a form acceptable to the Company and the Purchaser, each acting reasonably, approving

the Arrangement under Section 192 of the CBCA, as such order may be amended by the Court (with the consent of both the Company and the

Purchaser, each acting reasonably) at any time prior to the Effective Time or, if appealed, then, unless such appeal is withdrawn or

denied, as affirmed or as amended on appeal (provided that any such amendment is acceptable to both the Company and the Purchaser, each

acting reasonably).

"Governmental

Entity" means (a) any international, multinational, national, federal, provincial, state, regional, tribal, municipal, local

or other government, governmental or public department, central bank, court, tribunal, arbitral body, commission, commissioner, cabinet,

board, bureau, minister, ministry, agency or instrumentality, (b) any subdivision, agent or authority of any of the foregoing, (c) any

quasi-governmental or private body including any tribunal, commission, arbitrator or arbitral body, regulatory agency or self- regulatory

organization exercising any regulatory, expropriation or taxing authority under or for the account of any of the foregoing, and (d) any

Securities Authority or stock exchange, including the Exchanges.

"Incentive

Plans" means, collectively, (a) the Omnibus Incentive Plan, (b) the Legacy Option Plan, and

(c) the Paya

Equity Plan.

"Incentive

Securities" means, collectively, (a) the Options, (b) the PSUs, (c) the RSUs, and (d) the DSUs.

"Interim

Order" means the interim order of the Court pursuant to Section 192 of the CBCA, in a form acceptable to the Company and the

Purchaser, each acting reasonably, providing for, among other things, the calling and holding of the Meeting, as such order may be amended,

modified, supplemented or varied by the Court (provided that any such amendment, modification, supplement or variation is acceptable

to both the Company and the Purchaser, each acting reasonably).

"Law"

means, with respect to any Person, any and all national, federal, provincial, state, tribal, municipal or local law (statutory, common

or civil), act, constitution, treaty, convention, ordinance, code, rule, regulation, Order, injunction, judgment, award, decree or ruling,

enacted, adopted, promulgated or applied by a Governmental Entity that is binding upon or applicable to such Person or its business,

undertaking, property or securities, and to the extent that they have the force of law or are binding on the Person to which they purport

to apply, published policies, guidelines, bulletins and enforcement advisories, standards, notices and protocols of any Governmental

Entity, as amended.

"Legacy

Option Plan" means the Incentive Stock Option Plan of the Company effective as of September 22, 2020, as amended and in effect

as of the date of the Arrangement Agreement.

"Letter

of Transmittal" means the letter of transmittal sent to the Shareholders for use in connection with the Arrangement.

"Lien"

means any mortgage, charge, pledge, hypothec, security interest, international interest, prior claim, encroachments, option, right of

first refusal or first offer, occupancy right, covenant, assignment, lien (statutory or otherwise), defect of title, or restriction or

adverse right or claim, or other third-party interest or encumbrance of any kind, in each case, whether contingent or absolute.

"Meeting"

means the special meeting of the Shareholders, including any adjournment or postponement of such special meeting in accordance with the

terms of the Arrangement Agreement, to be called and held in accordance with the Interim Order to consider the Arrangement Resolution

and for any other purpose as may be set out in the Circular and agreed to in writing by the Purchaser, acting reasonably.

"Merger"

means the merger of Merger Sub with and into PPI Holdings US Inc. upon the terms and subject to the conditions set forth in the Merger

Agreement, with PPI Holdings US Inc. continuing as the surviving corporation of the merger.

"Merger

Agreement" means the merger agreement to be entered into by and between Merger Sub and PPI Holdings US Inc.

"Merger

Effective Time" has the meaning specified in the Merger Agreement.

"Merger

Sub" means a Delaware corporation to be formed as a Subsidiary of Canada Holdco. "Multiple Voting Shares" means

the multiple voting shares in the capital of the Company.

"Novacap"

means the limited partnerships managed by Novacap Management Inc. that are holders of Multiple Voting Shares immediately prior to the

Effective Time.

"Novacap

Holdco" means 16028195 Canada Inc., which entity will directly hold the Shares previously held by Novacap.

"Omnibus

Incentive Plan" means the Omnibus Incentive Plan of the Company effective as of February 3, 2021, as amended on April 13, 2022,

May 26, 2023 and August 8, 2023 and as in effect as of the date of the Arrangement Agreement.

"Options"

means all outstanding options to purchase Subordinate Voting Shares issued pursuant to the Omnibus Incentive Plan, the Legacy Option

Plan or the Paya Equity Plan.

"Paya

Equity Plan" means the Equity Incentive Plan of Paya Holdings Inc., as amended and reaffirmed effective May 31, 2022, which

was assumed by the Company and thereafter amended, as in effect as of the date of the Arrangement Agreement.

"Person"

includes any individual, partnership, association, body corporate, organization, trust, estate, trustee, executor, administrator, legal

representative, government (including Governmental Entity), syndicate or other entity, whether or not having legal status.

"PF"

means Philip Fayer.

"PF

Holdco" means 12990202 Canada Inc., which entity will directly hold the Shares previously held directly by WPF.

"Plan

of Arrangement" means this plan of arrangement proposed under Section 192 of the CBCA, and any amendments or variations to this

plan of arrangement made in accordance with its terms, the terms of the Arrangement Agreement or made at the direction of the Court in

the Final Order with the prior written consent of the Company and the Purchaser, each acting reasonably.

"PSUs"

means the performance share units of the Company granted to eligible participants under the Omnibus Incentive Plan.

"Purchaser"

means Neon Maple Purchaser Inc., a corporation existing under the laws of Canada and, in accordance with Section 8.11 of the Arrangement

Agreement, any of its successors or permitted assigns.

"Rollover

Agreement" means each of the agreements entered into prior to Closing among, inter alia, the Purchaser and the Rollover Shareholders,

for the transfer of Rollover Shares to the Purchaser in connection with the Arrangement.

"Rollover

Award Agreement" means each of the agreements entered into prior to Closing among, inter alia, the Canada Parent and the Rollover

Awardee, for the treatment of Rollover Awards in connection with the Arrangement.

"Rollover

Awardees" means the holders of Options, RSUs and/or PSUs (as applicable) having entered into the Rollover Award Agreements as

of Closing.

"Rollover

Awards" means the Options, RSUs and/or PSUs (as applicable) held by a Rollover Awardee that are the subject of a Rollover Award

Agreement.

"Rollover

Consideration" means the consideration described in an applicable Rollover Agreement and payable to a Rollover Shareholder for

the transfer of such Rollover Shareholder's Rollover Shares.

"Rollover

Shareholders" means the Shareholders having entered into the Rollover Agreements with the Purchaser.

"Rollover

Shares" means the Shares or the shares of PF Holdco or Novacap Holdco, as applicable, held by a Rollover Shareholder that are

the subject of a Rollover Agreement and that are to be exchanged, directly or indirectly, for the consideration set out therein pursuant

to a Rollover Agreement as of the Effective Date.

"RSUs"

means the restricted share units of the Company granted to eligible participants under the Omnibus Incentive Plan and the Paya Equity

Plan.

"S2P"

means Smart2Pay.

"S2P

Employees" means the actively-employed employees of S2P as at immediately prior to the Effective Time who are party to the S2P

Option Entitlements.

"S2P

Employment Agreements" means the applicable employment agreement between each S2P Employee and S2P.

"S2P

Option Entitlements" means the entitlement of the S2P Employees to be granted Options by the Company under the Omnibus Incentive

Plan in June 2025, pursuant to the terms and conditions of each applicable S2P Employment Agreement.

"S2P

Vesting Date" has the meaning specified in Section 2.3(18). "SEC" means the United States Securities and Exchange

Commission.

"Securities

Authorities" means the applicable securities commissions or securities regulatory authorities of the provinces and territories

of Canada and the SEC and the Exchanges.

"Shareholders"

means the registered or beneficial holders of the Shares, as the context requires. "Shares" means, collectively, the

Multiple Voting Shares and the Subordinate Voting Shares.

"Subject

RSUs" means the RSUs identified in Section 2.7 of the Company Disclosure Letter to the Arrangement Agreement, the vesting of

which will be accelerated in accordance with their terms in connection with the consummation of the Arrangement, without any exercise

of discretion or other action having to be taken by the Board.

"Subordinate

Voting Shares" means the subordinate voting shares in the capital of the Company. "Tax Act" means the Income

Tax Act (Canada).

"U.S.

Equivalent" means, in respect of each Option that has an exercise price denominated in Canadian dollars, the amount of such

exercise price expressed in U.S. dollars calculated on the basis of the daily exchange rate posted by the Bank of Canada for conversions

of Canadian dollars to U.S. dollars on the Business Day immediately preceding the Effective Date.

"WPF"

means Whiskey Papa Fox Inc.

| Section 1.2 | Certain Rules of Interpretation |

In this Plan

of Arrangement, unless otherwise specified:

| (1) | Headings, etc. The division of this Plan of Arrangement

into Articles and Sections and the insertion of headings are for convenient reference only and do not affect the construction or interpretation

of this Plan of Arrangement. |

| (2) | Currency. All references to dollars or to $ are references

to U.S. dollars, unless specified otherwise. |

| (3) | Gender and Number. Any reference to gender includes all genders. Words importing

the singular number only include the plural and vice versa. |

| (4) | Certain Phrases and References, etc. The words (i) "including",

"includes" and "include" mean "including (or includes or include) without limitation,"

(ii) "the aggregate of", "the total of", "the sum of", or

a phrase of similar meaning means "the aggregate (or total or sum), without duplication, of," and (iii) unless stated

otherwise, "Article" and "Section", followed by a number |

or letter

mean and refer to the specified Article or Section of this Plan of Arrangement. The terms "Plan of Arrangement", "hereof",

"herein" and similar expressions refer to this Plan of Arrangement (as it may be amended, modified or supplemented from time

to time) and not to any particular article, section or other portion hereof and include any instrument supplementary or ancillary hereto.

| (5) | Statutory and Agreement References. Except as otherwise provided in this Plan

of Arrangement, any reference in this Plan of Arrangement to a statute refers to such statute and all rules and regulations made under

it as they may have been or may from time to time be amended, re-enacted or replaced; and |

| (6) | The term "Agreement" and any reference in this Plan of Arrangement

to the Arrangement Agreement or any other agreement or document includes, and is a reference to, the Arrangement Agreement or such other

agreement or document as it may have been, or may from time to time be, amended, restated or replaced and includes all schedules, annexes,

appendices and other attachments to it. |

| (7) | Computation of Time. If any action may be taken within, or any right or obligation

is to expire at the end of, a period of days under this Plan of Arrangement, then the first day of the period is not counted, but the

day of its expiry is counted. Whenever payments are to be made or an action is to be taken on a day which is not a Business Day, such

payment will be made or such action will be taken on or not later than the next succeeding Business Day. |

| (8) | Time References. References to time are to local time, Montréal, Québec. |

ARTICLE 2

THE ARRANGEMENT

| Section 2.1 | Arrangement Agreement |

This Plan

of Arrangement constitutes an arrangement under Section 192 of the CBCA and is made pursuant to, and is subject to the provisions of,

the Arrangement Agreement.

| Section 2.2 | Binding Effect |

This Plan

of Arrangement and the Arrangement, upon the filing of the Articles of Arrangement and the issuance of the Certificate of Arrangement,

will become effective, and be binding on the Purchaser, the Company, Canada Holdco, Canada Parent, all Shareholders (including Rollover

Shareholders and Dissenting Holders), all holders of Incentive Securities, the registrar and transfer agent of the Company, the Depositary

and all other Persons at and after the Effective Time, in each case without any further act or formality required on the part of any

Person, except as expressly provided in this Plan of Arrangement.

Pursuant

to the Arrangement, each of the following events shall occur and shall be deemed to occur sequentially as set out below without any further

authorization, act or formality, starting immediately following the Effective Time and effective as at five (5) minute intervals (in

each case, unless otherwise specified):

| (1) | Amendment of Company Articles. The articles the Company will be amended by

deleting the definition of “Permitted Holders” that appears in section 1.1 of Schedule 1 to the articles of amalgamation of

the Company dated September 22, 2020 (as amended by the articles of amendment of the Company dated September 22, 2020 and as further amended

by the articles of arrangement of the Company dated June 1, 2022) in its entirety and replacing it with the following: |

| (18) | “Permitted Holders” means any of (a) the

Fayer Group Permitted Holders, (b) the Novacap Group Permitted Holders, (c) the Caisse Group Permitted Holders and (d) Neon Maple Purchaser

Inc., Neon Maple Parent Inc. and any of their affiliates. |

| (2) | Purchaser Advance for Incentive Securities. If requested by the Company at least

five (5) Business Days prior to the Effective Date, the Purchaser shall advance, or shall cause to be advanced, to the Company, or as

directed by the Company, in the form of a loan to the Company or as otherwise determined by the Purchaser and the Company in accordance

with the Arrangement Agreement, an amount equal to the aggregate amount required to be paid to the holders of Incentive Securities in

accordance with this Plan of Arrangement (including any payroll Taxes in respect thereof); |

| (3) | Purchaser Advance for Credit Facility Terminations. Unless otherwise agreed in

writing by the Purchaser and the Company prior to the Effective Date, the Purchaser shall advance, or shall cause to be advanced, to or

on behalf of the Company or its Subsidiaries, as applicable and as directed by the Company or any such Subsidiary, in the form of a loan

to the Company, or as otherwise determined by the Purchaser and the Company in accordance with the Arrangement Agreement, or otherwise

fund Merger Sub, with an amount equal to the aggregate amount set forth in the executed payoff letter (and similar instruments) with respect

to the Existing BMO Credit Facility in order to effect the Credit Facility Terminations as of the Effective Time less any amounts available

to the Company and its Subsidiaries to effect such Credit Facility Terminations; |

| (4) | Options other than Rollover Awards. |

| (a) | Each Option (other than an Option that is a Rollover Award) outstanding immediately

prior to the Effective Time that has not yet vested in accordance with its terms shall be accelerated so that such Option becomes exercisable,

notwithstanding the terms of the Omnibus Incentive Plan, the Legacy Option Plan and the Paya Equity Plan (as applicable) or any award

or similar agreement pursuant to which such Option was granted or awarded. |

| (b) | Each Option (other than an Option that is a Rollover Award) outstanding immediately

prior to the Effective Time and that has not been duly exercised shall, without any further action, authorization or formality by or on

behalf of the holder thereof, be deemed to be surrendered by such holder to the Company in exchange for, in respect of each Option for

which the Consideration exceeds the Exercise Price, the right to receive from the Company an amount in cash from the Company to be paid

in accordance with Section 4.1(3) equal to the number of Shares into which such Option is then exercisable multiplied by the amount

by which the Consideration exceeds the applicable Exercise Price in respect of such Option, less any applicable withholdings pursuant

to Section 4.3, and such Option shall immediately be cancelled and, following such payment, all of the Company's obligations with respect

to such Option shall be deemed to be fully satisfied. |

| (c) | For greater certainty, where the Exercise Price of any such Option is greater than

or equal to the Consideration, neither the Company nor the Purchaser shall be obligated to pay the holder of such Option the Consideration

or any other amount in respect of such Option, and the Option shall be immediately cancelled for no consideration. |

| (5) | PF Holdco. Each outstanding share of PF Holdco, held, directly or indirectly,

by WPF shall, pursuant to the terms and conditions of the Rollover Agreement and related share purchase agreement entered into between

the Purchaser and WPF, be deemed to be transferred (in one or more steps) without any further action, authorization or formality by or

on behalf of the holder thereof, to the Purchaser in exchange for the Rollover Consideration, and: |

| (a) | the holder of each such share shall cease to be the holder thereof and to have any

rights as a shareholder of PF Holdco, other than the right to be paid the Rollover Consideration in accordance with the applicable Rollover

Agreement and this Plan of Arrangement; |

| (b) | such Rollover Shareholder's name shall be removed from the register of holders of shares

of PF Holdco maintained by or on behalf of PF Holdco; and |

| (c) | the Purchaser shall be recorded in the register of holders of shares of PF Holdco maintained

by or on behalf of PF Holdco as the holder of the shares so transferred, and shall be deemed to be the legal and beneficial owner thereof; |

| (6) | Novacap Holdco. Each outstanding share of Novacap Holdco, held, directly or indirectly,

by Novacap shall, pursuant to the terms and conditions of the Rollover Agreement and related share purchase agreement entered into between

the Purchaser and Novacap, be deemed to be transferred (in one or more steps) without any further action, authorization or formality by

or on behalf of the holder thereof, to the Purchaser in exchange for the Rollover Consideration, and: |

| (a) | the holder of each such share of Novacap Holdco shall cease to be the holder thereof

and to have any rights as a shareholder of Novacap Holdco, other than the right to be paid the Rollover Consideration in accordance with

the applicable Rollover Agreement and this Plan of Arrangement; |

| (b) | such Rollover Shareholder's name shall be removed from the register of holders of shares

of Novacap Holdco maintained by or on behalf of Novacap Holdco; and |

| (c) | the Purchaser shall be recorded in the register of holders of shares of Novacap Holdco

maintained by or on behalf of Novacap Holdco as the holder of the shares so transferred, and shall be deemed to be the legal and beneficial

owner thereof; |

| (7) | Transfer by WPF and Novacap. Each of WPF and Novacap shall, pursuant to the

terms and conditions of the applicable Rollover Agreement entered into with the Purchaser and the applicable Rollover Shareholder, transfer

its common shares of the Purchaser to Canada Parent; |

| (8) | Transfer by Canada Parent. Canada Parent shall transfer, or cause to be transferred

(in one or more steps), the common shares of the Purchaser acquired pursuant to Section 2.3(7) to Canada Holdco; |

| (9) | Rollover Shares held by CDPQ. Each outstanding Rollover Share held, directly

or indirectly, by CDPQ shall, pursuant to the terms and conditions of the Rollover Agreement entered into between the Purchaser and CDPQ,

be deemed to be transferred without any further action, authorization or formality by or on behalf of the holder thereof, to the Purchaser

in exchange for the Rollover Consideration, and |

| (a) | the holder of each such Rollover Share shall cease to be the holder thereof and to

have any rights as a Shareholder, other than the right to be paid the Rollover Consideration in accordance with the applicable Rollover

Agreement and this Plan of Arrangement; |

| (b) | such Rollover Shareholder's name shall be removed from the register of holders of

Shares maintained by or on behalf of the Company; and |

| (c) | the Purchaser shall be recorded in the register of holders of Shares maintained by

or on behalf of the Company as the holder of the Rollover Shares so transferred, and shall be deemed to be the legal and beneficial owner

thereof; |

| (10) | Vested RSUs other than RSUs that are Rollover Awards. Other than any RSU that

is a Rollover Award, each portion of a vested RSU (including any fractional vested RSU) outstanding immediately prior to the Effective

Time shall, without any further action, authorization or formality by or on behalf of the holder thereof, be deemed to be transferred

by such holder to the Company in exchange for an amount in cash from the Company to be paid in accordance with Section 4.1(3) |

equal to

the number of Shares underlying such vested RSU (or, in the case of fractional vested RSUs, the applicable fraction of a vested RSU held

by the applicable holder as of immediately prior to the Effective Time) multiplied by the Consideration, less any applicable withholdings

pursuant to Section 4.3, and each such vested RSU shall immediately be cancelled and all of the Company's obligations with respect to

such vested RSU shall be deemed to be fully satisfied;

| (11) | Subject RSUs. Each Subject RSU (including any fractional Subject RSU) outstanding

immediately prior to the Effective Time (whether vested or unvested) shall, without any further action, authorization or formality by

or on behalf of the holder thereof, be deemed to be transferred by such holder to the Company in exchange for an amount in cash from the

Company to be paid in accordance with Section 4.1(3) equal to the number of Shares underlying such Subject RSU (or, in the case of fractional

Subject RSUs, the applicable fraction of a Subject RSU held by the applicable holder as of immediately prior to the Effective Time) multiplied

by the Consideration, less any applicable withholdings pursuant to Section 4.3, and each such Subject RSU shall immediately be cancelled

and all of the Company's obligations with respect to such Subject RSU shall be deemed to be fully satisfied; |

| (12) | Unvested RSUs other than RSUs that are Rollover Awards. Other than any RSU that

is a Rollover Award or a Subject RSU, each unvested RSU (including any fractional unvested RSU) outstanding immediately prior to the Effective

Time shall remain outstanding and shall thereafter, for each Share underlying such unvested RSU, entitle the holder thereof to receive,

upon satisfaction of the applicable vesting conditions, an amount in cash from the Company equal to the Consideration (or, in the case

of fractional unvested RSUs, the Consideration multiplied by the applicable fract ion of an unvested RSU held by the applicable holder

as of immediately prior to the Effective Time), less any applicable withholdings pursuant to Section 4.3, and shall be subject to the

same terms and conditions applicable to such award of RSUs in accordance with the terms of the Omnibus Incentive Plan, the Paya Equity

Plan (as applicable) and any grant or similar agreement evidencing the terms of the corresponding award of RSUs prior to the Effective

Time (including for greater certainty vesting conditions and any terms governing the effect of termination of a holder's employment or

engagement), except for such terms and conditions that are rendered inoperative by the transactions contemplated by this Arrangement and

for those related to adjustments in connection with the payment of dividends or other distributions. For greater certainty, immediately

following the Effective Time, the holder of an RSU subject to this Section 2.3(12) shall have no right to receive any Shares based on

or in respect of such RSU and shall not be eligible to receive any dividends or other distributions (whether in cash or otherwise) in

respect thereof; |

| (13) | Vested PSUs other than PSUs that are Rollover Awards. Other than any PSU that

is a Rollover Award, each vested PSU (including any fractional vested PSU) outstanding immediately prior to the Effective Time shall,

without any further action, authorization or formality by or on behalf of the holder thereof, be deemed to be transferred by such holder

to the Company in exchange for an amount in cash from the Company to be paid in accordance with Section 4.1(3) equal to the number of

Shares underlying such vested PSU (or, in the case of fractional vested PSUs, the applicable fraction of a vested PSU held by the applicable

holder as of immediately prior to the Effective Time) multiplied by the Consideration, less any applicable withholdings pursuant

to Section 4.3, and each such vested PSU shall immediately be cancelled and all of the Company's obligations with respect to such vested

PSU shall be deemed to be fully satisfied; |

| (14) | Unvested PSUs other than PSUs that are Rollover Awards. Other than any PSU that

is a Rollover Award, each unvested PSU (including any fractional unvested PSU) outstanding immediately prior to the Effective Time shall

remain outstanding and shall thereafter, for each Share underlying such unvested PSU, entitle the holder thereof to receive, upon satisfaction

of the applicable vesting conditions, an amount in cash from the Company equal to the Consideration (or, in the case of fractional unvested

PSUs, the Consideration multiplied by the applicable fraction of an unvested PSU held by the applicable holder as of immediately prior

to the Effective Time), less any applicable withholdings pursuant to Section 4.3, and shall be subject to the same terms and conditions

(including any applicable performance criteria and/or other vesting conditions, but subject to such |

adjustments

thereto as the Board may deem fair and reasonable as a result of the completion of the Arrangement) applicable to such award of PSUs

in accordance with the terms of the Omnibus Incentive Plan, the Paya Equity Plan (as applicable) and any grant or similar agreement evidencing

the terms of the corresponding award of PSUs prior to the Effective Time (including, for greater certainty, any terms governing the effect

of termination of a holder's employment or engagement), except for such terms and conditions that are rendered inoperative by the transactions

contemplated by this Arrangement and for those related to adjustments in connection with the payment of dividends or other distributions.

For greater certainty, immediately following the Effective Time, the holder of a PSU subject to this Section 2.3(14) shall have no right

to receive any Shares based on or in respect of such PSU and shall not be eligible to receive any dividends or other distributions (whether

in cash or otherwise) in respect of thereof;

| (15) | Vested and unvested DSUs. Each DSU (including any fractional DSU) outstanding

immediately prior to the Effective Time (whether vested or unvested) shall, notwithstanding the terms of the Omnibus Incentive Plan or

any award or similar agreement pursuant to which any such DSUs were granted or awarded, as applicable, be deemed to have vested and be

deemed to be transferred by such holder to the Company in exchange for an amount in cash from the Company to be paid in accordance with

Section 4.1(3) equal to the number of Shares underlying such DSU (or, in the case of fractional DSUs, the applicable fraction of a DSU

held by the applicable holder as of immediately prior to the Effective Time) multiplied by the Consideration, less any applicable

withholdings pursuant to Section 4.3, and each such DSU shall immediately be cancelled and all of the Company's obligations with respect

to such DSU shall be deemed to be fully satisfied; |

| (16) | Treatment of Incentive Securities. (a) Each holder of Incentive Securities cancelled

pursuant to this Section 2.3 shall cease to be a holder of such Incentive Securities; (b) such holder's name shall be removed from each

applicable register; (c) each such holder shall cease to have any rights as a holder in respect of such Incentive Securities or under

the Incentive Plans and have only the right to receive the consideration, if any, to which it is entitled pursuant to this Section 2.3,

at the time and in the manner specified in this Plan of Arrangement; and (d) any and all option, award or similar agreements relating

to the Incentive Securities that are deemed to have been assigned and surrendered by such holder to the Company shall be terminated and

shall be of no further force and effect; |

| (17) | Options, RSUs and PSUs that are Rollover Awards. Each Option, RSU and PSU that

is a Rollover Award (in each case, vested or unvested) outstanding immediately prior to the Effective Time shall be subject to such treatment

as set out in the applicable Rollover Award Agreement, on such terms and conditions as are set out therein; |

| (18) | S2P Option Entitlements. The S2P Option Entitlements shall be extinguished

and of no further force and effect, without any further action by or on behalf of S2P, the S2P Employees, the Company, the Purchaser or

any other Person, in exchange for the right of each S2P Employee who is actively-employed by S2P as at immediately prior to the date on

which such S2P Option Entitlements would have otherwise vested in accordance with their terms (the "S2P Vesting Date"),

to receive from the Company (or any successor thereto) an amount in cash, payable on or shortly after the S2P Vesting Date, in such amount

as shall be determined by the board of directors of the Company (or any successor thereto) in good faith and in consultation with legal

counsel in accordance and compliance with, and subject in all respects to, the requirements of applicable Laws of the Netherlands; |

| (19) | Dissenting Holders. Each outstanding Share held by a Dissenting Holder in respect

of which Dissent Rights have been validly exercised and not withdrawn shall be deemed to have been transferred by such Dissenting Holder

without any further action, authorization or formality by or on behalf of the holder thereof to the Purchaser in consideration for the

right to receive an amount determined and payable in accordance with Section 3.1, and: |

| (a) | such Dissenting Holder shall cease to be the holder of such Share and to have any

rights as a Shareholder, other than the right to receive an amount determined and payable in accordance with Section 3.1; |

| (b) | such Dissenting Holder's name shall be removed from the register of holders of Shares

maintained by or on behalf of the Company; and |

| (c) | the Purchaser shall be recorded in the register of holders of Shares maintained by

or on behalf of the Company as the holder of the Shares so transferred, and shall be deemed to be the legal and beneficial owner thereof; |

| (20) | Shares. Concurrently with step in Section 2.3(17) above, each outstanding Share

(other than the Shares held by Dissenting Holders in respect of which Dissent Rights have been validly exercised and not withdrawn, the

Rollover Shares and Shares, if any, held by Canada Parent or any of its Subsidiaries other than the Purchaser) shall be transferred without

any further action, authorization or formality by or on behalf of the holder thereof, to the Purchaser in exchange for the Consideration,

less any applicable withholdings pursuant to Section 4.3, and: |

| (a) | the holder of each such Share shall cease to be the holder thereof and to have any

rights as a Shareholder, other than the right to be paid the Consideration in accordance with this Plan of Arrangement; |

| (b) | such holder's name shall be removed from the register of holders of Shares maintained

by or on behalf of the Company; and |

| (c) | the Purchaser shall be recorded in the register of holders of Shares maintained by

or on behalf of the Company as the holder of the Shares so transferred, and shall be deemed to be the legal and beneficial owner thereof,

such that following the transactions contemplated by Section 2.3(17) and this Section 2.3(20), the Purchaser shall be the legal and beneficial

owner of 100% of the Shares other than Shares, if any, held by Canada Parent or any of its Subsidiaries (other than the Purchaser); |

| (21) | Rollover Shares held by PF. Each outstanding Rollover Share held, directly,

by PF shall, pursuant to the terms and conditions of the Rollover Agreement entered into between the Purchaser and PF, be deemed to be

transferred without any further action, authorization or formality by or on behalf of the holder thereof, to the Purchaser in exchange

for the Rollover Consideration, and: |

| (a) | the holder of each such Rollover Share shall cease to be the holder thereof and to

have any rights as a Shareholder, other than the right to be paid the Rollover Consideration in accordance with the applicable Rollover

Agreement and this Plan of Arrangement; |

| (b) | such Rollover Shareholder's name shall be removed from the register of holders of

Shares maintained by or on behalf of the Company; and |

| (c) | the Purchaser shall be recorded in the register of holders of Shares maintained by

or on behalf of the Company as the holder of the Rollover Shares so transferred, and shall be deemed to be the legal and beneficial owner

thereof; |

| (22) | Transfer by CDPQ and PF. Each of CDPQ and PF shall, pursuant to the terms and

conditions of the applicable Rollover Agreement entered into between the Purchaser and the applicable Rollover Shareholder, transfer its

common shares of the Purchaser to Canada Parent; |

| (23) | Transfer by Canada Parent. Canada Parent shall transfer, or cause to be transferred

(in one or more steps), the common shares of the Purchaser acquired pursuant to Section 2.3(22) to Canada Holdco; |

| (24) | Merger. At the Merger Effective Time, the Merger shall become effective; and |

| (25) | Notwithstanding anything in this Section 2.3 to the contrary, to the extent the Company

determines that any treatment of any Option, RSU, PSU or DSU or payment pursuant to this Section 2.3 may trigger any tax or penalty under

Section 409A of the U.S. Internal Revenue Code of 1986, as amended, the Company shall be permitted to take any and all action the Company

in its sole discretion, after consultation with and approval by Purchaser, deems necessary or advisable to avoid such tax or penalty,

including by altering the treatment or payment terms or otherwise providing that such payment shall be made on the earliest date that

payment would not trigger such tax or penalty. |

ARTICLE

3

DISSENT RIGHTS

| Section 3.1 | Dissent Rights |

| (1) | Registered and beneficial holders of Shares as of the record date for the Meeting

and who are registered Shareholders prior to the deadline for exercising dissent rights may exercise dissent rights with respect to all

of the Shares held by such registered holders ("Dissent Rights") in connection with the Arrangement pursuant to and in

the manner set forth in Section 190 of the CBCA, as modified by the Interim Order, the Final Order, any other order of the Court and this

Section 3.1, provided that, notwithstanding Subsection 190(5) of the CBCA, the written objection to the Arrangement Resolution referred

to in Subsection 190(5) of the CBCA must be received by the Company no later than 5:00 p.m. (Montreal Time) two (2) Business Days immediately

preceding the date of the Meeting (as it may be adjourned or postponed from time to time). |