0001803914FALSE00018039142025-02-112025-02-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 11, 2025

PLBY GROUP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39312 | | 37-1958714 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

10960 Wilshire Blvd., Suite 2200 Los Angeles, California | | 90024 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (310) 424-1800

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | PLBY | Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

The information set forth in Item 5.02 of this Current Report on Form 8-K is incorporated by reference into this Item 3.01.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Board Expansion & Appointment of New Non-Employee Director

As previously disclosed in a Current Report on Form 8-K filed by PLBY Group, Inc. (the “Company”) with the Securities and Exchange Commission (the “SEC”) on October 31, 2024, the Company entered into a securities purchase agreement, dated October 30, 2024 (the “Initial SPA”), with Byborg Enterprises S.A. (“Byborg”). Pursuant to the Initial SPA, the Company agreed to increase the size of its board of directors (the “Board”) to seven directors from five directors, with the two new directors to be an individual nominated by Byborg and a new independent director to be mutually agreed by Byborg and the Company. Byborg, together with its affiliates, became a significant stockholder of the Company on November 5, 2024, when the Company completed the sale of 14,900,000 shares of the Company’s common stock to a wholly owned subsidiary of Byborg pursuant to the Initial SPA.

On February 11, 2025, the Board expanded the size of the Board from five to seven directors (the “Board Expansion”) and appointed Gyorgy Gattyan, Byborg’s designee to the Board, as a new Class II director. Mr. Gattyan’s initial term will expire at the Company’s 2025 annual meeting of stockholders, or his earlier resignation or removal. As a result of the Board Expansion and the appointment of Mr. Gattyan, the Board is currently comprised of six directors and has one vacant seat to be filled by a new independent director to be mutually agreed by the Board and Byborg.

Mr. Gattyan, age 54, currently serves as the Class A Manager and Chief Executive Officer of Docler Holding S.a.r.l. (“Docler Holding”), a multinational information technology, media and entertainment company he founded in 2013 and is headquartered in Luxembourg. Docler Holding is the parent company of Byborg, which is primarily focused on the development and operation of live streaming websites, including the webcam platform LiveJasmin, which Mr. Gattyan founded in 2001. Since 2016, he has also served as the joint owner, co-founder and Vice President of Federation Internationale de Teqball (FITEQ), the governing body presiding over teqball, a sport Mr. Gattyan co-created in 2014. In addition, since 2021, Mr. Gattyan has served as the Chairman of the Board of Trustees of each of the Gattyan Foundation and Docler Foundation, which provide support to disadvantaged children living in state care and engage in a range of other philanthropic endeavors, respectively. Since 2011, he has been the Co- Founder and Patron of the Junior Prima Primissima Foundation, which gives out the Junior Prima Award for Hungarian folk art and public education, and the founder of the “Docler Holding New Generation” Gábor Dénes Award, sponsoring young talents with singular achievements and quality works in the field of science. Mr. Gattyan holds degrees from Kodolányi János University and Semmelweis University.

The Company believes Mr. Gattyan’s experience as an entrepreneur, digital technology executive and as a director and chairperson of multiple organizations qualifies him to serve on the Board and to provide management and operational advice to the Board. Mr. Gattyan will be compensated in accordance with the Company’s standard compensation policies and practices for non-employee directors of the Board, which is described in the Company’s Definitive Proxy Statement on Schedule 14A, filed with the SEC on April 29, 2024. The Company will also enter into its standard form of indemnification agreement for Board members (the “Indemnification Agreement”) with Mr. Gattyan. The form of Indemnification Agreement is attached as Exhibit 10.26 to the Company’s Current Report on Form 8-K filed with the SEC on February 16, 2021.

The Board has determined that Mr. Gattyan does not qualify as an “independent director” as defined under Rule 5605(a)(2) of the listing rules of The Nasdaq Stock Market LLC (“Nasdaq”), in connection with his control of over 10% of the outstanding shares of common stock of the Company and his control over Byborg, which is the Company’s largest licensee.

In addition to the Initial SPA, on December 14, 2024, the Company entered into a second securities purchase agreement (the “Additional SPA”) with The Million S.a.r.l. (the “Purchaser”), the wholly owned subsidiary of Byborg which completed the stock purchase pursuant to the Initial SPA, pursuant to which the Company agreed to sell to the Purchaser an additional 16,956,842 shares of the Company’s common stock at a price of $1.50 per share, subject to the approval of such sale and issuance of shares by the Company’s stockholders.

Also on December 14, 2024, the Company’s wholly owned subsidiary, Playboy Enterprises, Inc. (“Playboy”), entered into a License & Management Agreement (the “LMA”) with Byborg, pursuant to which Byborg agreed to pay $20 million in annual minimum royalties and a portion of any net profits in order to operate the Company’s Playboy Plus, Playboy TV (digital and linear) and Playboy Club businesses and to license the right to use certain Playboy trademarks and other intellectual property for related businesses and certain other categories.

Neither the Initial SPA, the Additional SPA nor the LMA requires the Company to make any payments to Mr. Gattyan, Byborg, the Purchaser or any other affiliates of Mr. Gattyan. However, under the LMA, Byborg is entitled to retain the majority of any net profits generated through its business activities conducted pursuant to the LMA. As of the date of this Current Report on Form 8-K, other than with respect to the Initial SPA, the Additional SPA and the LMA, neither Mr. Gattyan nor any of his immediate family members is a party, either directly or indirectly, to any transaction that would be required to be reported under Item 404(a) of Regulation S-K. Mr. Gattyan does not have any family relationship with any director or executive officer of the Company.

Non-Compliance with Nasdaq Rule Following Appointment of Mr. Gattyan

On February 11, 2025, the Company notified Nasdaq of the Company’s temporary noncompliance with the continued listing requirements as set forth in Nasdaq Listing Rule 5605(b) regarding the composition of the Board, because there is no longer a majority of independent directors on the Board. On February 14, 2025, the Company received a deficiency letter (the “Nasdaq Letter”) from Nasdaq, notifying the Company that the Company is not in compliance with Nasdaq Listing Rule 5605. The Company will rely on the cure period set forth in Nasdaq Listing Rule 5605(b)(1)(A) with respect to the composition of its Board, which cure period is expected to expire as of August 11, 2025. The Company and Byborg are in the process of identifying a new independent director to appoint to the Board to fill the vacancy created by the Board Expansion, and the Company anticipates appointing such additional independent director within the cure period under the Nasdaq rules listed above.

Neither the Nasdaq Letter nor the Company’s noncompliance with the Nasdaq Listing Rule 5605 has an immediate effect on the listing or trading of the Company’s common stock, which will continue to trade on Nasdaq under the symbol “PLBY”.

The Company issued a press release, on February 14, 2025, announcing the appointment of Mr. Gattyan to the Board. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

Exhibit

No. | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Dated: February 14, 2025 | PLBY GROUP, INC. |

| |

| By: | /s/ Chris Riley |

| Name: | Chris Riley |

| Title: | General Counsel & Secretary |

Exhibit 99.1

PLBY Group Welcomes Gyorgy Gattyan to its Board of Directors

LOS ANGELES, February 14, 2025 (GLOBE NEWSWIRE) -- PLBY Group, Inc. (NASDAQ: PLBY) (the “Company” or “PLBY Group”), a leading pleasure and leisure lifestyle company and owner of Playboy, one of the most recognizable and iconic brands in the world, today announced the appointment of Gyorgy Gattyan to its Board of Directors (the “Board”). In connection with the appointment of Mr. Gattyan, the Board was expanded from five to seven directors, but is currently composed of six directors and has one vacant seat, which the Board is working to fill with a new independent director as soon as practicable.

Mr. Gattyan’s appointment follows the Company’s previously disclosed long-term license agreement with Byborg Enterprises S.A. (“Byborg”), a company controlled by Mr. Gattyan, and the November 2024, $22.35 million investment in the Company by a Byborg affiliate also controlled by Mr. Gattyan, as well as another $25.44 million investment in the Company by that same affiliate, which investment is currently pending PLBY Group stockholder approval. Mr. Gattyan brings to the Board over 10 years of experience as an entrepreneur, digital technology executive, and director and chairperson of multiple organizations.

“Gyorgy has established multiple successful, web-based businesses, making him a valuable addition to the Board, as Playboy continues to pursue a digital focused, asset-light business model,” said Ben Kohn, PLBY Group’s Chief Executive Officer. “I’m excited to welcome Gyorgy to PLBY Group and have his experience and support as the Company returns to growth.”

Mr. Gattyan is the Chief Executive Officer of Docler Holding S.a.r.l., a multinational information technology, media and entertainment company he founded in 2013 and is headquartered in Luxembourg. Docler Holding is the parent company of Byborg, which is primarily focused on the development and operation of live streaming websites, including the webcam platform LiveJasmin, which Mr. Gattyan founded in 2001. In addition, Mr. Gattyan serves as the Chairman of the Board of Trustees of multiple charitable foundations which support a variety of causes, primarily in his native Hungary.

About PLBY Group, Inc.

PLBY Group, Inc. is a global pleasure and leisure company connecting consumers with products, content, and experiences that help them lead more fulfilling lives. PLBY Group’s flagship consumer brand, Playboy, is one of the most recognizable brands in the world, with products and content available in approximately 180 countries. PLBY Group’s mission—to create a culture where all people can pursue pleasure — builds upon over 70 years of creating groundbreaking media and hospitality experiences and fighting for cultural progress rooted in the core values of equality, freedom of expression and the idea that pleasure is a fundamental human right. Learn more at http://www.plbygroup.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. The Company’s actual results may differ from their expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect”, “estimate”, “project”, “budget”, “forecast”, “anticipate”, “intend”, “plan”, “may”, “will”, “could”, “should”, “believes”, “predicts”, “potential”, “continue”, and similar expressions (or the negative versions of such words or expressions) are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company’s expectations with respect to future performance, growth plans and anticipated financial impacts of its strategic opportunities and corporate transactions.

These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from those discussed in the forward-looking statements. Factors that may cause such differences include, but are not limited to: (1) the inability to maintain the listing of the Company’s shares of common stock on Nasdaq; (2) the risk that the Company’s completed or proposed transactions disrupt the Company’s current plans and/or operations, including the risk that the Company does not complete any such proposed transactions or achieve the expected benefits from any transactions; (3) the ability to recognize the anticipated benefits of corporate transactions, commercial collaborations, commercialization of digital assets, cost reduction initiatives and proposed transactions, which may be affected by, among other things, competition, the ability of the Company to grow and manage growth profitably, and the Company’s ability to retain its key employees; (4) costs related to being a public company, corporate transactions, commercial collaborations and proposed transactions; (5) changes in applicable laws or regulations; (6) the possibility that the Company may be adversely affected by global hostilities, supply chain delays, inflation, interest rates, foreign currency exchange rates or other economic, business, and/or competitive factors; (7) risks relating to the uncertainty of the projected financial information of the Company, including changes in the Company’s estimates of cash flows and the fair value of certain of its intangible assets, including goodwill; (8) risks related to the organic and inorganic growth of the Company’s businesses, and the timing of expected business milestones; (9) changing demand or shopping patterns for the Company’s products and services; (10) failure of licensees, suppliers or other third-parties to fulfill their obligations to the Company; (11) the Company’s ability to comply with the terms of its indebtedness and other obligations; (12) changes in financing markets or the inability of the Company to obtain financing on attractive terms; and (13) other risks and uncertainties indicated from time to time in the Company’s annual report on Form 10-K, including those under “Risk Factors” therein, and in the Company’s other filings with the Securities and Exchange Commission. The Company cautions that the foregoing list of factors is not exclusive, and readers should not place undue reliance upon any forward-looking statements, which speak only as of the date which they were made. The Company does not undertake any obligation to update or revise any forward-looking statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based.

Contact:

Investors: FNK IR – Rob Fink / Matt Chesler, CFA – investors@plbygroup.com

Media: press@plbygroup.com

v3.25.0.1

Cover Page

|

Feb. 11, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 11, 2025

|

| Entity Registrant Name |

PLBY GROUP, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39312

|

| Entity Tax Identification Number |

37-1958714

|

| Entity Address, Address Line One |

10960 Wilshire Blvd.

|

| Entity Address, Address Line Two |

Suite 2200

|

| Entity Address, City or Town |

Los Angeles

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90024

|

| City Area Code |

310

|

| Local Phone Number |

424-1800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

PLBY

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001803914

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

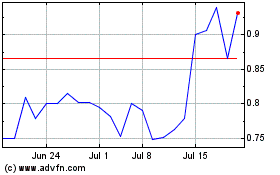

PLBY (NASDAQ:PLBY)

Historical Stock Chart

From Feb 2025 to Mar 2025

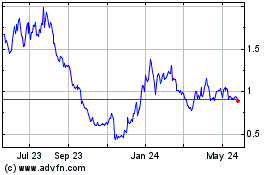

PLBY (NASDAQ:PLBY)

Historical Stock Chart

From Mar 2024 to Mar 2025