The RealReal (Nasdaq: REAL), the world’s largest online marketplace

for authenticated, resale luxury goods, today announced that its

Board of Directors (the “Board”) has appointed Rati Sahi Levesque,

The RealReal’s President and Chief Operating Officer (COO), as

President and Chief Executive Officer (CEO) and as a member of the

Board, effective immediately. Ms. Levesque succeeds John Koryl, who

has departed from the Company and no longer serves on the Board.

Ms. Levesque helped found The RealReal in 2011 and most recently

served as the Company’s President and COO. She has held leadership

roles across multiple areas of the business including sales,

merchandising, product and technology, operations, and marketing.

Over the course of her 13-year tenure, Ms. Levesque has been

instrumental in setting the Company’s strategy and positioning The

RealReal as the leader in luxury resale.

“I am thrilled to announce Rati as The RealReal’s next CEO,”

said Karen Katz, Chairperson of the Board. “Rati has been pivotal

in formulating and executing the recent strategic shifts that have

propelled the Company on its path to profitability. Rati’s

commitment to the brand, along with her comprehensive understanding

of the Company, its market opportunity, and the luxury resale

landscape, make her the right leader to take The RealReal into our

next stage of profitable growth. She has worked in every aspect of

the business and brings a proven track record of operational

excellence.”

Ms. Levesque commented, “I am honored to lead The RealReal as

its next CEO. The luxury resale market is vibrant and growing, and

there is a significant opportunity to leverage our powerful brand

and our valued community of consignors and buyers to enhance the

client experience and accelerate profitable growth. I am a

passionate believer in our vision to fuel a more sustainable and

circular fashion industry by providing outstanding luxury goods to

our customers. I look forward to working with our Board and our

talented team to further grow our business and shareholder

value.”

Ms. Katz continued, “Rati and the leadership team have the full

confidence of the Board and are well-positioned to drive the

business forward. We wish John well as he begins his next chapter

and takes time to focus on his family.”

Prior to serving as President and COO, Ms. Levesque served as

Chief Merchant. As The RealReal’s first employee, Ms. Levesque has

an unmatched understanding of the Company, buyer and consignor

preferences, and our employee experience. Prior to joining The

RealReal, Ms. Levesque was an entrepreneur in the fashion-tech

industry. Her experience successfully launching a luxury

consignment company laid the groundwork for her early contributions

to The RealReal. Ms. Levesque previously worked in the financial

industry and graduated from the University of California, Santa

Cruz with a degree in Economics. Ms. Levesque’s thought leadership

has been featured in prominent fashion publications including

Vogue, ELLE, Fashionista, Glossy, and Coveteur.

Preliminary Third Quarter 2024 Financial Results and

Updated Full Year 2024 Guidance

In connection with today’s announcement, the Company is also

providing preliminary financial results for the third quarter,

ended September 30, 2024, as well as updated full year 2024

guidance. Gross Merchandise Value (GMV), Total Revenue and Adjusted

EBITDA for the third quarter are expected to exceed previously

issued guidance ranges, as outlined in the table below.

|

|

Q3 2024 Preliminary Results |

Prior Q3 2024 Guidance |

|

GMV |

$433.1 million |

$410 - $430 million |

|

Total Revenue |

$147.8 million |

$135 - $142 million |

|

Adjusted EBITDA* |

$2.3 million |

$(2) - $1 million |

|

|

Updated FY 2024 Guidance |

Prior FY 2024 Guidance |

|

GMV |

$1.810 - $1.826 billion |

$1.790 - $1.820 billion |

|

Total Revenue |

$595 - $602 million |

$580 - $595 million |

|

Adjusted EBITDA |

$4.5 - $7.5 million |

$0 - $6 million |

*Adjusted EBITDA is based on preliminary Net Loss of $(17.938)

million for the three months ended September 30, 2024.

“We are pleased to report strong preliminary third quarter

financial results enabling us to raise our full year guidance

ranges,” commented Ms. Levesque. “Based on our preliminary results,

GMV, Revenue and Adjusted EBITDA exceeded our expectations for the

quarter, increasing our confidence in the momentum of our

business.”

Ms. Levesque continued, “Our growth playbook, which is centered

on unlocking supply, is working with proof points in both top line

and margin metrics. The RealReal is positioned well as the leader

in luxury resale with significant room to grow. Our strong third

quarter results are an important step as we focus on growing our

business profitably. We look forward to reporting actual third

quarter results and discussing our fourth quarter and full year

outlook in more detail during our earnings conference call next

week.”

The Company’s preliminary financial results are based on the

Company’s current estimate of its results for the quarter ended

September 30, 2024, and remain subject to change based on the

completion of closing and review procedures and the execution of

the Company’s internal controls over financial reporting.

The Company plans to release its actual third quarter financial

results after the market closes on November 4, 2024. The RealReal

will host a conference call at 2:00 p.m. Pacific Time (5:00 p.m.

Eastern Time) to review its financial results. A live webcast of

the conference call will be available online at

investor.therealreal.com. The archived webcast will be available

shortly after the call at the same location.

About The RealReal Inc.

The RealReal is the world’s largest online marketplace for

authenticated, resale luxury goods, with 37 million members. With a

rigorous authentication process overseen by experts, The RealReal

provides a safe and reliable platform for consumers to buy and sell

their luxury items. We have hundreds of in-house gemologists,

horologists and brand authenticators who inspect thousands of items

each day. As a sustainable company, we give new life to pieces by

thousands of brands across numerous categories—including women’s

and men’s fashion, fine jewelry and watches, art and home—in

support of the circular economy. We make selling effortless with

free virtual appointments, in-home pickup, drop-off and direct

shipping. We handle all of the work for consignors, including

authenticating, using AI and machine learning to determine optimal

pricing, photographing and listing their items, as well as shipping

and customer service.

Investor Relations Contact:Caitlin

HoweIR@therealreal.com

Press

Contact:TheRealReal@edelmansmithfield.com

Forward-Looking StatementsThis press release

contains forward-looking statements relating to, among other

things, the future performance of The RealReal that are based on

the Company's current expectations, forecasts and assumptions and

involve risks and uncertainties. In some cases, you can identify

forward-looking statements by terminology such as “may,” “will,”

“should,” “could,” “expect,” “plan,” “anticipate,” “target,”

“contemplate,” “project,” “believe,” “estimate,” “predict,”

“intend,” “potential,” “continue,” “ongoing” or the negative of

these terms or other comparable terminology. These statements

include, but are not limited to, statements about future operating

and financial results, including our strategies, plans,

commitments, objectives and goals, in particular in the context of

the impacts of recent geopolitical events, including the conflict

between Russia and Ukraine and the Israel-Hamas war, and

uncertainty surrounding macro-economic trends, the debt exchange,

financial guidance, anticipated growth in 2024, the anticipated

impact of generative AI, and long-range financial targets and

projections. Actual results could differ materially from those

predicted or implied and reported results should not be considered

as an indication of future performance. Other factors that could

cause or contribute to such differences include, but are not

limited to, inflation, macroeconomic uncertainty, geopolitical

instability, any failure to generate a supply of consigned goods,

pricing pressure on the consignment market resulting from

discounting in the market for new goods, failure to efficiently and

effectively operate our merchandising and fulfillment operations,

labor shortages and other reasons.

More information about factors that could affect the company's

operating results is included under the captions “Risk Factors” and

“Management's Discussion and Analysis of Financial Condition and

Results of Operations” in the Company's most recent Annual Report

on Form 10-K for the year ended December 31, 2023 and subsequent

Quarterly Reports on Form 10-Q, copies of which may be obtained by

visiting the company's Investor Relations website at

https://investor.therealreal.com or the SEC's website at

www.sec.gov. Undue reliance should not be placed on the

forward-looking statements in this press release, which are based

on information available to the company on the date hereof. The

Company assumes no obligation to update such statements.

Non-GAAP Financial MeasuresTo supplement our

unaudited and condensed financial statements presented in

accordance with generally accepted accounting principles (“GAAP”),

this release contains certain non-GAAP financial measures,

including GMV and Adjusted EBITDA. We have provided a

reconciliation of adjusted EBITDA to the most directly comparable

GAAP financial measure in this release.

We do not, nor do we suggest that investors should, consider

such non-GAAP financial measures in isolation from, or as a

substitute for, financial information prepared in accordance with

GAAP. Investors should also note that non-GAAP financial measures

we use may not be the same non-GAAP financial measures, and may not

be calculated in the same manner, as that of other companies,

including other companies in our industry.

Adjusted EBITDA is a key performance

measure that our management uses to assess our operating

performance. Because Adjusted EBITDA facilitates internal

comparisons of our historical operating performance on a more

consistent basis, we use this measure as an overall assessment of

our performance, to evaluate the effectiveness of our business

strategies and for business planning purposes. Adjusted EBITDA may

not be comparable to similarly titled metrics of other

companies.

We calculate Adjusted EBITDA as net

loss before interest income, interest expense, other (income)

expense net, provision (benefit) for income taxes, depreciation and

amortization, further adjusted to exclude stock-based compensation,

employer payroll tax expense on employee stock transactions, change

in fair value of warrant liabilities and certain one-time expenses.

The employer payroll tax expense related to employee stock

transactions are tied to the vesting or exercise of underlying

equity awards and the price of our common stock at the time of

vesting, which may vary from period to period independent of the

operating performance of our business. Adjusted EBITDA has

certain limitations as the measure excludes the impact of certain

expenses that are included in our statements of operations that are

necessary to run our business and should not be considered as an

alternative to net loss or any other measure of financial

performance calculated and presented in accordance with GAAP.

In particular, the exclusion of certain expenses in calculating

Adjusted EBITDA facilitates operating performance comparisons on a

period-to-period basis and, in the case of exclusion of the impact

of stock-based compensation and the related employer payroll tax

expense on employee stock transactions, excludes an item that we do

not consider to be indicative of our core operating performance.

Investors should, however, understand that stock-based compensation

and the related employer payroll tax expense will be a significant

recurring expense in our business and an important part of the

compensation provided to our employees. Accordingly, we believe

that Adjusted EBITDA provides useful information to investors and

others in understanding and evaluating our operating results in the

same manner as our management and Board.

|

The following table provides a reconciliation of net loss to

Adjusted EBITDA (in thousands): |

| |

|

| |

Three Months Ended September 30, |

|

|

|

2024 |

|

| Adjusted EBITDA

Reconciliation: |

|

| Net loss |

$ |

(17,938 |

) |

|

Depreciation and amortization |

|

8,270 |

|

|

Interest income |

|

(1,940 |

) |

|

Interest expense |

|

5,948 |

|

|

Provision for income taxes |

|

72 |

|

| EBITDA |

|

(5,588 |

) |

|

Stock-based compensation |

|

7,758 |

|

|

Payroll taxes expense on employee stock transactions |

|

76 |

|

|

Change in fair value of warrant liability (1) |

|

(744 |

) |

|

One time expenses (2) |

|

822 |

|

|

Adjusted EBITDA |

$ |

2,324 |

|

|

|

|

|

|

(1) The change in fair value of warrant liability for the three

and nine months ended September 30, 2024 reflects the

remeasurement of the warrants issued by the Company in connection

with the Note Exchange in February 2024.

(2) One time expenses for the three ended September 30,

2024 consists of vendor services settlements and estimated losses,

net of estimated insurance recoveries related to the fire at one of

our New Jersey authentication centers.

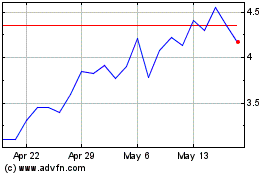

RealReal (NASDAQ:REAL)

Historical Stock Chart

From Nov 2024 to Dec 2024

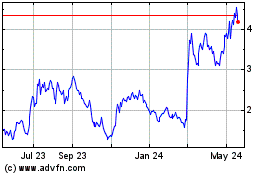

RealReal (NASDAQ:REAL)

Historical Stock Chart

From Dec 2023 to Dec 2024