false

0001034842

0001034842

2024-09-03

2024-09-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): September 3, 2024

RIGEL PHARMACEUTICALS, INC.

(Exact name of registrant as specified in

its charter)

Delaware

(State or other jurisdiction of incorporation)

| 0-29889 |

|

94-3248524 |

| (Commission File No.) |

|

(IRS Employer Identification No.) |

| |

|

|

| 611

Gateway Boulevard, Suite 900 |

|

|

| South San Francisco, CA |

|

94080 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (650) 624-1100

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| Title of Each Class |

|

Trading

Symbol(s) |

|

Name of

Each Exchange on Which

Registered |

| Common Stock, par value $0.001 per share |

|

RIGL |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material Definitive Agreement.

On September 3, 2024,

Rigel Pharmaceuticals, Inc. (“Rigel”) entered into a collaboration and license agreement (the “License

Agreement”) and a supply agreement (the “Supply Agreement”) with Kissei Pharmaceutical Co., Ltd. (“Kissei”).

Pursuant to the terms of the License Agreement, Kissei received exclusive rights to develop and commercialize olutasidenib in all human

diseases in Japan, the Republic of Korea (Korea) and Taiwan (the “Kissei Territory”). The parties’ collaboration

is governed through a joint steering committee and appropriate subcommittees.

Kissei is responsible for

performing and funding the development activities for olutasidenib in the Kissei Territory and Rigel retained the co-exclusive right to

conduct development activities in the Kissei Territory solely for the purpose of supporting and obtaining regulatory approval of and commercializing

olutasidenib in the world outside the Kissei Territory. Rigel retained the global rights, excluding the Kissei Territory, to commercialize

olutasidenib.

Under the terms of the License

Agreement, Rigel will receive an upfront cash payment of $10.0 million, with the potential for an additional $152.5 million in development,

regulatory and commercial milestone payments, and will receive mid twenty to lower thirty percent, tiered, escalated net sales-based payments

for the supply of olutasidenib, subject to certain customary reductions and offsets. Pursuant

to the License Agreement, Kissei is responsible for companion diagnostic development in Japan, for which Rigel will share fifty percent

of the costs incurred by Kissei, up to $3.0 million, which are creditable against future milestones and transfer price payments owed to

Rigel.

In August 2022, Rigel

and Forma Therapeutics, Inc., now Novo Nordisk (“Forma”) announced an exclusive, worldwide license agreement to

develop, manufacture and commercialize olutasidenib. Forma is entitled to a certain portion of Rigel’s sublicensing revenue for

olutasidenib from Kissei, including $2.3 million upon Rigel’s receipt of the upfront cash payment of $10.0 million.

Rigel remains responsible

for the manufacture and supply of olutasidenib for all development and commercialization activities under the License Agreement. Pursuant

to the concurrently executed Supply Agreement, Rigel will supply Kissei with bulk drug product for use under the License Agreement.

Pursuant to the License Agreement,

Kissei will make transfer price payments to Rigel for a term that continues, on a product-by-product and country-by-country basis, until

the latter of (i) the expiration of certain patent claims related to olutasidenib, (ii) expiration of regulatory exclusivity

in such country, and (iii) ten years after the first commercial sale of olutasidenib (the “Commercialization Term”).

The Commercialization Term may continue if Kissei elects to continue commercializing olutasidenib in Japan, Korea or Taiwan and obtain

its supply of olutasidenib for such purpose from Rigel. In such event, Rigel would continue to supply olutasidenib to Kissei at our cost

to supply plus a markup.

The License Agreement commences

today and shall continue until terminated. The License Agreement may be terminated for cause by either party based on uncured material

breach of the other party, bankruptcy of the other party, or for safety reasons. Rigel may terminate the License Agreement if Kissei challenges

or opposes any patent licensed under the License Agreement. Kissei may terminate the License Agreement for failure of local regulatory

approval of the product or the companion diagnostic, or the companion diagnostic company’s breach or termination of the agreement

with such company. Prior to the first commercial sale of olutasidenib, Kissei may terminate the License Agreement without cause upon certain

prior written notice to Rigel following the four-year anniversary of the License Agreement, and following the first commercial sale of

olutasidenib, Kissei may terminate the License Agreement upon certain prior written notice to Rigel. Either party may terminate the License

Agreement, on a product-by-product and country-by-country basis, without cause upon certain prior written notice to the other party

so long as such termination becomes effective on or after the end of the Commercialization Term for such product in such country.

Upon early termination by

either party, all licenses granted by Rigel to Kissei will automatically terminate, and, except in the event of a termination by Kissei

for Rigel’s material breach, the licenses granted by Kissei to Rigel shall survive such termination and shall automatically become

worldwide. Following termination by Rigel for cause, Kissei is prohibited from competing with Rigel for a period of time.

The description of the License

Agreement and Supply Agreement in this Current Report on Form 8-K does not purport to be complete and is qualified in its entirety

by reference to the full text of such agreements, copies of which will be included as an exhibit to Rigel’ Quarterly Report on Form 10-Q

for the fiscal period ending September 30, 2024, to be filed with the Securities and Exchange Commission.

Forward-Looking Statements

This Current Report on Form 8-K contains

forward-looking statements relating to, among other things, Rigel’s receipt of payments from Kissei under the License Agreement

and the Supply Agreement. Any such statements that are not statements of historical fact may be deemed to be forward-looking statements.

Words such as “planned,” “may,” “expects,” “intends” and similar expressions are intended

to identify these forward-looking statements. These forward-looking statements are based on Rigel’s current expectations and inherently

involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in

such forward looking statements as a result of these risks and uncertainties, which include, without limitation, those risks and uncertainties

relating to that the FDA, EMA or other regulatory authorities may make adverse decisions regarding olutasidenib; that olutasidenib clinical

trials may not be predictive of real-world results or of results in subsequent clinical trials; the availability of resources to develop,

manufacture and commercialize olutasidenib; market competitions; Rigel’s partners’ ability to obtain marketing approval for

olutasidenib; and whether and when any of the milestone payments or product transfer price payments will ever be paid under these agreements,

as well as other risks detailed from time to time in Rigel’s reports filed with the Securities and Exchange Commission, including

its Annual Report on Form 10-K for the year ended December 31, 2023 and Quarterly Report on Form 10-Q for the quarter ended

June 30, 2024. Rigel does not undertake any obligation to update any forward-looking statements and expressly disclaims any obligation

or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein, except as required by law.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Dated: September 3, 2024 |

RIGEL PHARMACEUTICALS, INC. |

| |

|

|

| |

By: |

/s/ Raymond J. Furey |

| |

|

Raymond J. Furey |

| |

|

Executive Vice President, General Counsel, Chief Compliance Officer, and Corporate Secretary |

v3.24.2.u1

Cover

|

Sep. 03, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 03, 2024

|

| Entity File Number |

0-29889

|

| Entity Registrant Name |

RIGEL PHARMACEUTICALS, INC.

|

| Entity Central Index Key |

0001034842

|

| Entity Tax Identification Number |

94-3248524

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

611

Gateway Boulevard,

|

| Entity Address, Address Line Two |

Suite 900

|

| Entity Address, City or Town |

South San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94080

|

| City Area Code |

650

|

| Local Phone Number |

624-1100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

RIGL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

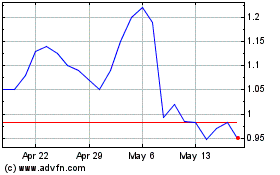

Rigel Pharmaceuticals (NASDAQ:RIGL)

Historical Stock Chart

From Nov 2024 to Dec 2024

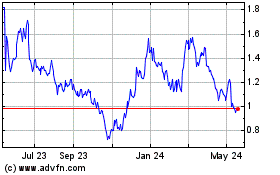

Rigel Pharmaceuticals (NASDAQ:RIGL)

Historical Stock Chart

From Dec 2023 to Dec 2024