0000730708false00007307082024-10-242024-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 24, 2024

SEACOAST BANKING CORPORATION OF FLORIDA

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

| Florida | 000-13660 | 59-2260678 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 815 COLORADO AVENUE, | STUART | FL | | 34994 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code (772) 287-4000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

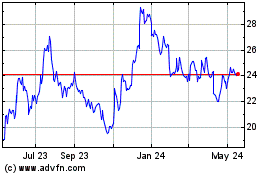

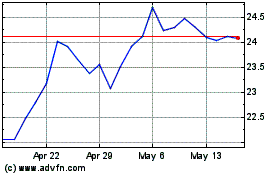

| Common Stock, $0.10 par value | SBCF | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SEACOAST BANKING CORPORATION OF FLORIDA

Item 2.02 Results of Operations and Financial Condition

On October 24, 2024, Seacoast Banking Corporation of Florida ("Seacoast or the "Company") announced its financial results for the quarter ended September 30, 2024. A copy of the press release announcing Seacoast’s results for the quarter ended September 30, 2024, is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 7.01 Regulation FD Disclosure

On October 25, 2024, Seacoast will hold an investor conference call to discuss its financial results for the quarter ended September 30, 2024. Attached as Exhibit 99.2 are charts (available on the Company’s website at www.seacoastbanking.com) containing information used in the conference call and incorporated herein by reference. All information included in the charts is presented as of September 30, 2024, and the Company does not assume any obligation to correct or update said information in the future.

The information in Items 2.02 and 7.01, as well as Exhibits 99.1 and 99.2 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933.

Item 8.01 Other Events

In October 2024, Seacoast repositioned a portion of its available for sale ("AFS") securities portfolio. The company sold securities with an average book yield of 2.8%, resulting in a pre-tax loss of approximately $8.0 million. The proceeds, approximately $113 million, were reinvested in agency mortgage-backed securities with an average book yield of 5.4%, for an estimated earnback of less than 3 years.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Exhibits 99.1 and 99.2 referenced herein, contain “forward-looking statements” within the meaning, and protections, of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, without limitation, statements about future financial and operating results, cost savings, enhanced revenues, economic and seasonal conditions in the Company’s markets, and improvements to reported earnings that may be realized from cost controls, tax law changes, new initiatives and for integration of banks that the Company has acquired or expects to acquire, as well as statements with respect to Seacoast's objectives, strategic plans, expectations and intentions and other statements that are not historical facts. Actual results may differ from those set forth in the forward-looking statements.

Forward-looking statements include statements with respect to the Company’s beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates and intentions about future performance and involve known and

unknown risks, uncertainties and other factors, which may be beyond the Company’s control, and which may cause the actual results, performance or achievements of Seacoast Banking Corporation of Florida or its wholly-owned banking subsidiary, Seacoast National Bank, to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. You should not expect the Company to update any forward-looking statements.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

SEACOAST BANKING CORPORATION OF FLORIDA

| | | | | |

| Dated: October 24, 2024 | /s/ Tracey L. Dexter |

| | Tracey L. Dexter |

| | Chief Financial Officer |

SEACOAST REPORTS THIRD QUARTER 2024 RESULTS

Strong Growth in Loans and Deposits

Annualized 20% Increase in Tangible Book Value Per Share

Well-Positioned Balance Sheet with Strong Capital and Liquidity

STUART, Fla., October 24, 2024 /GLOBE NEWSWIRE/ -- Seacoast Banking Corporation of Florida ("Seacoast" or the "Company") (NASDAQ: SBCF) today reported net income in the third quarter of 2024 of $30.7 million, or $0.36 per diluted share, compared to $30.2 million, or $0.36 per diluted share in the second quarter of 2024 and $31.4 million, or $0.37 per diluted share in the third quarter of 2023.

Pre-tax pre-provision earnings1 were $46.1 million in the third quarter of 2024, an increase of 3% compared to the second quarter of 2024 and an increase of 6% compared to the third quarter of 2023. Adjusted pre-tax pre-provision earnings1 were $46.4 million in the third quarter of 2024, an increase of 4% compared to the second quarter of 2024 and a decrease of 2% compared to the third quarter of 2023.

For the third quarter of 2024, return on average tangible assets was 0.99% and return on average tangible shareholders' equity was 10.31%, compared to 1.00% and 10.75%, respectively, in the prior quarter, and 1.04% and 11.90%, respectively, in the prior year quarter.

Charles M. Shaffer, Chairman and CEO of Seacoast, stated, "I would like to thank all of the Seacoast associates for their unwavering dedication during the challenging impact of back-to-back significant hurricanes. Your commitment to our customers and the well-being of our communities is commendable. I am very proud to serve alongside such an amazing and dedicated group of bankers. Furthermore, our hearts and sympathy go out to all those in our communities who lost loved ones and experienced catastrophic outcomes as a result of the storms."

Shaffer added, "Turning to third quarter results, this marks the turn in organic growth we had anticipated, with nearly 7% annualized loan growth and 7% annualized customer deposit growth, clearly showcasing the results of our previous investments in banking teams across the state. Additionally, this quarter demonstrated continued growth in net interest income, noninterest income and, when removing accretion on acquired loans, expansion in the net interest margin. Our competitive transformation is taking shape as we build Seacoast into Florida’s leading regional bank. We expect to continue to see positive results from recent talent acquisitions, which will drive further organic growth in the coming periods."

Shaffer concluded, "We remain committed to a disciplined approach to credit, and our balance sheet is one of the strongest in the industry, with a Tier 1 capital ratio of 14.8%2 as of September 30, 2024. The ratio of tangible common equity to tangible assets has increased to a strong 9.64%. Our liquidity position is also robust, with a loan-to-deposit ratio of 83%, providing us with balance sheet flexibility as we continue to work towards stronger earnings in the coming periods."

Update on Hurricane Recovery

In late September and early October 2024, communities across our corporate footprint were impacted by Hurricanes Helene and Milton. We maintained uninterrupted digital and telephone access for our customers and, having experienced minimal impacts to our branch properties, we fully reopened to serve our communities shortly after each storm passed. Recovery efforts in many areas continue and the full impacts on people and businesses in the most hard-hit regions are not fully known. We do not expect a significant impact from Hurricane Helene, but an additional provision for credit losses may be warranted in the fourth quarter of 2024 for Hurricane Milton, in a range between approximately $5 million and $10 million.

1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and for a reconciliation to GAAP.

2Estimated.

Financial Results

Income Statement

•Net income in the third quarter of 2024 was $30.7 million, or $0.36 per diluted share, compared to $30.2 million, or $0.36 per diluted share in the prior quarter and $31.4 million, or $0.37 per diluted share in the prior year quarter. For the nine months ended September 30, 2024, net income was $86.9 million, or $1.02 per diluted share, compared to $74.5 million, or $0.89 per diluted share, for the nine months ended September 30, 2023. Adjusted net income1 for the third quarter of 2024 was $30.5 million, or $0.36 per diluted share, compared to $30.3 million, or $0.36 per diluted share, for the prior quarter, and $34.2 million, or $0.40 per diluted share, for the prior year quarter. For the nine months ended September 30, 2024, adjusted net income1 was $91.9 million, or $1.08 per diluted share, compared to $101.9 million, or $1.21 per diluted share, for the nine months ended September 30, 2023.

•Net revenues were $130.3 million in the third quarter of 2024, an increase of $3.7 million, or 3%, compared to the prior quarter, and a decrease of $6.8 million, or 5%, compared to the prior year quarter. For the nine months ended September 30, 2024, net revenues were $382.5 million, a decrease of $56.7 million, or 13%, compared to the nine months ended September 30, 2023. Adjusted net revenues1 were $130.5 million in the third quarter of 2024, an increase of $3.6 million, or 3%, compared to the prior quarter, and a decrease of $7.2 million, or 5%, compared to the prior year quarter. For the nine months ended September 30, 2024, adjusted net revenues1 were $382.9 million, a decrease of $55.2 million, or 13%, compared to the nine months ended September 30, 2023.

•Pre-tax pre-provision earnings1 were $46.1 million in the third quarter of 2024, an increase of $1.5 million, or 3%, compared to the second quarter of 2024 and an increase of $2.7 million, or 6%, compared to the third quarter of 2023. For the nine months ended September 30, 2024, pre-tax pre-provision earnings1 were $126.3 million, a decrease of $5.5 million, or 4%, compared to the nine months ended September 30, 2023. Adjusted pre-tax pre-provision earnings1 were $46.4 million in the third quarter of 2024, an increase of $1.9 million, or 4%, compared to the second quarter of 2024 and a decrease of $1.0 million, or 2%, compared to the third quarter of 2023. For the nine months ended September 30, 2024, adjusted pre-tax pre-provision earnings1 were $133.4 million, a decrease of $35.5 million, or 21%, compared to the nine months ended September 30, 2023.

•Net interest income totaled $106.7 million in the third quarter of 2024, an increase of $2.2 million, or 2%, compared to the prior quarter, and a decrease of $12.6 million, or 11%, compared to the prior year quarter. For the nine months ended September 30, 2024, net interest income was $316.2 million, a decrease of $61.3 million, or 16%, compared to the nine months ended September 30, 2023. In the loan portfolio, higher interest income from new loan production was partially offset by lower accretion of purchase discount on acquired loans. Included in loan interest income was accretion on acquired loans of $9.2 million in the third quarter of 2024, $10.2 million in the second quarter of 2024, and $14.8 million in the third quarter of 2023. For the nine months ended September 30, 2024, accretion on acquired loans totaled $30.0 million, compared to $45.4 million for the nine months ended September 30, 2023. Recent purchases in the securities portfolio contributed to higher securities yields. Higher interest expense on deposits reflects the impact of higher rates, with cuts to the federal funds rate late in the quarter not yet fully impacting the third quarter 2024 results.

•Net interest margin decreased one basis point to 3.17% in the third quarter of 2024 compared to 3.18% in the second quarter of 2024. Excluding the effects of accretion on acquired loans, net interest margin increased three basis points to 2.90% in the third quarter of 2024 compared to 2.87% in the second quarter of 2024. Loan yields were 5.94%, an increase of one basis point from the prior quarter. Securities yields increased six basis points to 3.75%, compared to 3.69% in the prior quarter. The cost of deposits increased three basis points from 2.31% in the prior quarter, to 2.34% in the third quarter of 2024. We expect the cost of deposits to decline in the fourth quarter of 2024.

•Noninterest income totaled $23.7 million in the third quarter of 2024, an increase of $1.5 million, or 7%, compared to the prior quarter, and an increase of $5.9 million, or 33%, compared to the prior year quarter. For the nine months ended September 30, 2024, noninterest income totaled $66.4 million, an increase of $4.5 million, or 7%, compared to the nine months ended September 30, 2023. Results in the third quarter of 2024 included:

1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and for a reconciliation to GAAP.

•Service charges on deposits totaled $5.4 million, an increase of $0.1 million, or 1%, from the prior quarter and an increase of $0.8 million, or 16%, from the prior year quarter. Our investments in talent and significant market expansion across the state have resulted in continued growth in treasury management services to commercial customers.

•Wealth management income totaled $3.8 million, an increase of $0.1 million, or 2%, from the prior quarter and an increase of $0.7 million, or 22%, from the prior year quarter. The wealth management division continues to grow and add new relationships, with assets under management increasing 26% year over year to $2.0 billion at September 30, 2024.

•Insurance agency income totaled $1.4 million, an increase of 3% from the prior quarter and an increase of 18% from the prior year quarter, reflecting continued growth and expansion of services.

•SBA gains totaled $0.4 million, a decrease of $0.3 million, or 44%, from the prior quarter and a decrease of $0.2 million, or 36%, from the prior year quarter, due to lower saleable originations.

•Other income totaled $7.5 million, an increase of $1.5 million, or 26%, from the prior quarter and an increase of $3.2 million, or 74% from the prior year quarter. Increases in the third quarter of 2024 include gains on SBIC investments and higher swap-related fees.

•The provision for credit losses was $6.3 million in the third quarter of 2024, compared to $4.9 million in the second quarter of 2024 and $2.7 million in the third quarter of 2023.

•Noninterest expense was $84.8 million in the third quarter of 2024, an increase of $2.3 million, or 3%, compared to the prior quarter, and a decrease of $9.1 million, or 10%, compared to the prior year quarter. Noninterest expense for the nine months ended September 30, 2024, totaled $257.7 million, a decrease of $51.5 million, or 17%, compared to the nine months ended September 30, 2023. With significant cost-saving initiatives now complete, Seacoast has prudently managed expenses while strategically investing to support continued growth. Results in the third quarter of 2024 included:

•Salaries and wages totaled $40.7 million, an increase of $1.8 million, or 5%, compared to the prior quarter and a decrease $5.7 million, or 12%, from the prior year quarter. The third quarter of 2024 reflects continued additions to the banking team as the Company focuses on organic growth.

•Outsourced data processing costs totaled $8.0 million, a decrease of $0.2 million, or 3%, compared to the prior quarter and a decrease of $0.7 million, or 8%, from the prior year quarter, reflecting the benefit of lower negotiated rates with key service providers.

•Marketing expenses totaled $2.7 million, a decrease of $0.5 million, or 16%, compared to the prior quarter and an increase of $0.9 million, or 45%, from the prior year quarter, primarily associated with the timing of various campaigns. We will continue to invest in marketing and branding supporting customer growth.

•Legal and professional fees totaled $2.7 million, an increase of $0.7 million, or 37%, compared to the prior quarter and an increase of $29 thousand, or 1%, from the prior year quarter. Professional services engaged in connection with contract negotiations contributed to the increase in the third quarter of 2024.

•Seacoast recorded $8.6 million of income tax expense in the third quarter of 2024, compared to $8.9 million in the second quarter of 2024, and $9.1 million in the third quarter of 2023. Tax benefits related to stock-based compensation totaled $0.1 million in the third quarter of 2024, compared to tax expense of $0.2 million in the second quarter of 2024 and a nominal tax benefit in the third quarter of 2023.

•The efficiency ratio was 59.84% in the third quarter of 2024, compared to 60.21% in the second quarter of 2024 and 62.60% in the prior year quarter. The adjusted efficiency ratio1 was 59.84% in the third quarter of 2024, compared to 60.21% in the second quarter of 2024 and 60.19% in the prior year quarter. The Company continues to remain keenly focused on disciplined expense control, while making investments for growth.

1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and for a reconciliation to GAAP.

Balance Sheet

•At September 30, 2024, the Company had total assets of $15.2 billion and total shareholders' equity of $2.2 billion. Book value per share was $25.68 as of September 30, 2024, compared to $24.98 as of June 30, 2024, and $24.06 as of September 30, 2023. Tangible book value per share increased 20% annualized from the prior quarter to $16.20 as of September 30, 2024, compared to $15.41 as of June 30, 2024, and $14.26 as of September 30, 2023.

•Debt securities totaled $2.8 billion as of September 30, 2024, an increase of $180.8 million compared to June 30, 2024. Debt securities include approximately $2.2 billion in securities classified as available for sale and recorded at fair value.

•During the third quarter of 2024, net unrealized losses associated with available for sale securities declined by $59.6 million due to changes in the interest rate environment. This contributed $0.53 to the increase in tangible book value per share during the quarter. The unrealized loss on available for sale securities is fully reflected in the value presented on the balance sheet.

•The portfolio also includes $646.1 million in securities classified as held to maturity with a fair value of $538.5 million. Held-to-maturity securities consist solely of mortgage-backed securities and collateralized mortgage obligations guaranteed by U.S. government agencies, each of which is expected to recover any price depreciation over its holding period as the debt securities move to maturity. The Company has significant liquidity and available borrowing capacity and has the intent and ability to hold these investments to maturity.

•In October, we took advantage of favorable market conditions and repositioned a portion of the available for sale securities portfolio. We sold securities with an average book yield of 2.8%, resulting in a pre-tax loss of approximately $8.0 million impacting fourth quarter results. The proceeds, approximately $113 million, were reinvested in agency mortgage-backed securities with an average book yield of 5.4%, for an estimated earnback of less than three years.

•Loans increased $166.8 million, or 6.6% annualized, totaling $10.2 billion as of September 30, 2024. Loan originations increased 22% to $657.9 million in the third quarter of 2024, compared to $538.0 million in the second quarter of 2024. The Company continues to exercise a disciplined approach to lending and is benefiting from the investments made in recent years to attract talent from large regional banks across its markets. This talent is onboarding significant new relationships, resulting in increased loan production.

•Loan pipelines (loans in underwriting and approval or approved and not yet closed) totaled $831.1 million as of September 30, 2024, compared to $834.4 million at June 30, 2024 and $353.0 million at September 30, 2023.

•Commercial pipelines were $744.5 million as of September 30, 2024, compared to $743.8 million at June 30, 2024, and $259.4 million at September 30, 2023.

•SBA pipelines were $28.9 million as of September 30, 2024, compared to $29.3 million at June 30, 2024, and $41.4 million at September 30, 2023.

•Residential saleable pipelines were $11.2 million as of September 30, 2024, compared to $12.1 million at June 30, 2024, and $6.8 million at September 30, 2023. Retained residential pipelines were $21.9 million as of September 30, 2024, compared to $24.7 million at June 30, 2024, and $20.9 million at September 30, 2023.

•Consumer pipelines were $24.4 million as of September 30, 2024, compared to $24.5 million at both June 30, 2024 and September 30, 2023.

•Total deposits were $12.2 billion as of September 30, 2024, an increase of $127.5 million, or 4.2% annualized, when compared to June 30, 2024. Excluding brokered balances, total deposits increased $195.9 million, or 6.6% annualized, in the third quarter of 2024.

•Commercial deposits increased $133.0 million, or 2%, compared to the prior quarter. Of note, commercial noninterest bearing deposits increased $67.2 million, or 3%, from the prior quarter, the result of onboarding new clients.

1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and for a reconciliation to GAAP.

•Total noninterest bearing deposits increased $45.5 million, or 5.3% annualized, from the prior quarter.

•At September 30, 2024, customer transaction account balances represented 49% of total deposits.

•The Company benefits from a granular deposit franchise, with the top ten depositors representing approximately 3% of total deposits.

•Average deposits per banking center were $159 million at September 30, 2024, compared to $157 million at June 30, 2024.

•Uninsured deposits represented only 36% of overall deposit accounts as of September 30, 2024. This includes public funds under the Florida Qualified Public Depository program, which provides loss protection to depositors beyond FDIC insurance limits. Excluding such balances, the uninsured and uncollateralized deposits were 31% of total deposits. The Company has liquidity sources including cash and lines of credit with the Federal Reserve and Federal Home Loan Bank that represent 145% of uninsured deposits, and 167% of uninsured and uncollateralized deposits.

•Consumer deposits represent 43% of overall deposit funding with an average consumer customer balance of $26 thousand. Commercial deposits represent 57% of overall deposit funding with an average business customer balance of $117 thousand.

•Federal Home Loan Bank advances totaled $245.0 million at September 30, 2024 with a weighted average interest rate of 4.19%.

Asset Quality

•Nonperforming loans were $80.9 million at September 30, 2024, compared to $59.9 million at June 30, 2024, and $41.5 million at September 30, 2023. New nonperforming loans in the third quarter of 2024 have collateral values well in excess of balances outstanding, and therefore, no loss is expected. Nonperforming loans to total loans outstanding were 0.79% at September 30, 2024, 0.60% at June 30, 2024, and 0.41% at September 30, 2023.

•Accruing past due loans were $50.7 million, or 0.50% of total loans, at September 30, 2024, compared to $39.6 million, or 0.39% of total loans, at June 30, 2024, and $35.5 million, or 0.33% of total loans, at September 30, 2023. A limited number of larger-balance residential mortgage loans, which returned to current status in October, comprise the majority of the increase from the prior quarter.

•Nonperforming assets to total assets were 0.58% at September 30, 2024, compared to 0.45% at June 30, 2024, and 0.33% at September 30, 2023.

•The ratio of allowance for credit losses to total loans was 1.38% at September 30, 2024, 1.41% at June 30, 2024, and 1.49% at September 30, 2023.

•Net charge-offs were $7.4 million in the third quarter of 2024, compared to $9.9 million in the second quarter of 2024 and $12.7 million in the third quarter of 2023. Charge-offs during the quarter primarily reflect specifically identified reserves previously established in the allowance for credit losses.

•Portfolio diversification, in terms of asset mix, industry, and loan type, has been a critical element of the Company's lending strategy. Exposure across industries and collateral types is broadly distributed. Seacoast's average loan size is $360 thousand, and the average commercial loan size is $789 thousand, reflecting an ability to maintain granularity within the overall loan portfolio.

•Construction and land development and commercial real estate loans remain well below regulatory guidance at 36% and 241% of total bank-level risk-based capital2, respectively, compared to 36% and 235%, respectively, at June 30, 2024. On a consolidated basis, construction and land development and commercial real estate loans represent 34% and 227%, respectively, of total consolidated risk-based capital2.

1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and for a reconciliation to GAAP.

2Estimated.

Capital and Liquidity

•The Company continues to operate with a fortress balance sheet with a Tier 1 capital ratio at September 30, 2024 of 14.8%2 compared to 14.8% at June 30, 2024, and 14.0% at September 30, 2023. The Total capital ratio was 16.2%2, the Common Equity Tier 1 capital ratio was 14.1%2, and the Tier 1 leverage ratio was 11.2%2 at September 30, 2024. The Company is considered “well capitalized” based on applicable U.S. regulatory capital ratio requirements.

•Cash and cash equivalents at September 30, 2024 totaled $637.1 million.

•The Company’s loan to deposit ratio was 83.4% at September 30, 2024, which should provide liquidity and flexibility moving forward.

•Tangible common equity to tangible assets was 9.64% at September 30, 2024, compared to 9.30% at June 30, 2024, and 8.68% at September 30, 2023. If all held-to-maturity securities were adjusted to fair value, the tangible common equity ratio would have been 9.11% at September 30, 2024.

•At September 30, 2024, in addition to $637.1 million in cash, the Company had $5.6 billion in available borrowing capacity, including $4.1 billion in available collateralized lines of credit, $1.2 billion of unpledged debt securities available as collateral for potential additional borrowings, and available unsecured lines of credit of $0.3 billion. These liquidity sources as of September 30, 2024, represented 167% of uninsured and uncollateralized deposits.

1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and for a reconciliation to GAAP.

2Estimated

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FINANCIAL HIGHLIGHTS | | | | | | | | | |

| (Amounts in thousands except per share data) | | (Unaudited) | |

| | Quarterly Trends | |

| | | | | | | | | | | |

| | 3Q'24 | | 2Q'24 | | 1Q'24 | | 4Q'23 | | 3Q'23 | |

| Selected balance sheet data: | | | | | | | | | | | |

| Gross loans | | $ | 10,205,281 | | | $ | 10,038,508 | | | $ | 9,978,052 | | | $ | 10,062,940 | | | $ | 10,011,186 | | |

| Total deposits | | 12,243,585 | | | 12,116,118 | | | 12,015,840 | | | 11,776,935 | | | 12,107,834 | | |

| Total assets | | 15,168,371 | | | 14,952,613 | | | 14,830,015 | | | 14,580,249 | | | 14,823,007 | | |

| | | | | | | | | | | |

| Performance measures: | | | | | | | | | | | |

| Net income | | $ | 30,651 | | | $ | 30,244 | | | $ | 26,006 | | | $ | 29,543 | | | $ | 31,414 | | |

| Net interest margin | | 3.17 | % | | 3.18 | % | | 3.24 | % | | 3.36 | % | | 3.57 | % | |

Pre-tax pre-provision earnings1 | | $ | 46,086 | | | $ | 44,555 | | | $ | 35,674 | | | $ | 42,006 | | | $ | 43,383 | | |

| Average diluted shares outstanding | | 85,069 | | | 84,816 | | | 85,270 | | | 85,336 | | | 85,666 | | |

| Diluted earnings per share (EPS) | | 0.36 | | | 0.36 | | | 0.31 | | | 0.35 | | | 0.37 | | |

| Return on (annualized): | | | | | | | | | | | |

| Average assets (ROA) | | 0.81 | % | | 0.82 | % | | 0.71 | % | | 0.80 | % | | 0.84 | % | |

Average tangible assets (ROTA)2 | | 0.99 | | | 1.00 | | | 0.89 | | | 0.99 | | | 1.04 | | |

Average tangible common equity (ROTCE)2 | | 10.31 | | | 10.75 | | | 9.55 | | | 11.22 | | | 11.90 | | |

Tangible common equity to tangible assets2 | | 9.64 | | | 9.30 | | | 9.25 | | | 9.31 | | | 8.68 | | |

Tangible book value per share2 | | $ | 16.20 | | | $ | 15.41 | | | $ | 15.26 | | | $ | 15.08 | | | $ | 14.26 | | |

| Efficiency ratio | | 59.84 | % | | 60.21 | % | | 66.78 | % | | 60.32 | % | | 62.60 | % | |

| | | | | | | | | | | |

Adjusted operating measures1: | | | | | | | | | | | |

Adjusted net income4 | | $ | 30,511 | | | $ | 30,277 | | | $ | 31,132 | | | $ | 31,363 | | | $ | 34,170 | | |

Adjusted pre-tax pre-provision earnings4 | | 46,390 | | | 44,490 | | | 42,513 | | | 45,016 | | | 47,349 | | |

Adjusted diluted EPS4 | | 0.36 | | | 0.36 | | | 0.37 | | | 0.37 | | | 0.40 | | |

Adjusted ROTA2 | | 0.98 | % | | 1.00 | % | | 1.04 | % | | 1.04 | % | | 1.12 | % | |

Adjusted ROTCE2 | | 10.27 | | | 10.76 | | | 11.15 | | | 11.80 | | | 12.79 | | |

| Adjusted efficiency ratio | | 59.84 | | | 60.21 | | | 61.13 | | | 60.32 | | | 60.19 | | |

Net adjusted noninterest expense as a percent of average tangible assets2 | | 2.19 | % | | 2.19 | % | | 2.23 | % | | 2.25 | % | | 2.34 | % | |

| | | | | | | | | | | |

| Other data: | | | | | | | | | | | |

Market capitalization3 | | $ | 2,277,003 | | $ | 2,016,472 | | $ | 2,156,529 | | $ | 2,415,158 | | $ | 1,869,891 | |

| Full-time equivalent employees | | 1,493 | | | 1,449 | | | 1,445 | | | 1,541 | | | 1,570 | | |

| Number of ATMs | | 96 | | | 95 | | | 95 | | | 96 | | | 97 | | |

| Full-service banking offices | | 77 | | | 77 | | | 77 | | | 77 | | | 77 | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP. |

2The Company defines tangible assets as total assets less intangible assets, and tangible common equity as total shareholders' equity less intangible assets. |

3Common shares outstanding multiplied by closing bid price on last day of each period. |

4As of 1Q’24, amortization of intangibles is excluded from adjustments to noninterest expense; prior periods have been updated to reflect the change. | |

OTHER INFORMATION

Conference Call Information

Seacoast will host a conference call October 25, 2024, at 10:00 a.m. (Eastern Time) to discuss the third quarter of 2024 earnings results and business trends. Investors may call in (toll-free) by dialing (800) 715-9871 (Conference ID: 6787376). Charts will be used during the conference call and may be accessed at Seacoast’s website at www.SeacoastBanking.com by selecting “Presentations” under the heading “News/Events.” Additionally, a recording of the call will be made available to individuals shortly after the conference call and can be accessed via a link at www.SeacoastBanking.com under the heading “Corporate Information.” The recording will be available for one year.

About Seacoast Banking Corporation of Florida (NASDAQ: SBCF)

Seacoast Banking Corporation of Florida (NASDAQ: SBCF) is one of the largest community banks headquartered in Florida with approximately $15.2 billion in assets and $12.2 billion in deposits as of September 30, 2024. Seacoast provides integrated financial services including commercial and consumer banking, wealth management, and mortgage services to customers at 77 full-service branches across Florida, and through advanced mobile and online banking solutions. Seacoast National Bank is the wholly-owned subsidiary bank of Seacoast Banking Corporation of Florida. For more information about Seacoast, visit www.SeacoastBanking.com.

Cautionary Notice Regarding Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning, and protections, of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, without limitation, statements about future financial and operating results, cost savings, enhanced revenues, economic and seasonal conditions in the Company’s markets, and improvements to reported earnings that may be realized from cost controls, tax law changes, new initiatives and for integration of banks that the Company has acquired, or expects to acquire, as well as statements with respect to Seacoast's objectives, strategic plans, expectations and intentions and other statements that are not historical facts. Actual results may differ from those set forth in the forward-looking statements.

Forward-looking statements include statements with respect to the Company’s beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates and intentions about future performance and involve known and unknown risks, uncertainties and other factors, which may be beyond the Company’s control, and which may cause the actual results, performance or achievements of Seacoast Banking Corporation of Florida (“Seacoast” or the “Company”) or its wholly-owned banking subsidiary, Seacoast National Bank (“Seacoast Bank”), to be materially different from results, performance or achievements expressed or implied by such forward-looking statements. You should not expect the Company to update any forward-looking statements.

All statements other than statements of historical fact could be forward-looking statements. You can identify these forward-looking statements through the use of words such as "may", "will", "anticipate", "assume", "should", "support", "indicate", "would", "believe", "contemplate", "expect", "estimate", "continue", "further", "plan", "point to", "project", "could", "intend", "target" or other similar words and expressions of the future. These forward-looking statements may not be realized due to a variety of factors, including, without limitation: the impact of current and future economic and market conditions generally (including seasonality) and in the financial services industry, nationally and within Seacoast’s primary market areas, including the effects of inflationary pressures, changes in interest rates, slowdowns in economic growth, and the potential for high unemployment rates, as well as the financial stress on borrowers and changes to customer and client behavior and credit risk as a result of the foregoing; potential impacts of adverse developments in the banking industry, including those highlighted by high-profile bank failures, and including impacts on customer confidence, deposit outflows, liquidity and the regulatory response thereto (including increases in the cost of our deposit insurance assessments), the Company's ability to effectively manage its liquidity risk and any growth plans, and the availability of capital and funding; governmental monetary and fiscal policies, including interest rate policies of the Board of Governors of the Federal Reserve, as

well as legislative, tax and regulatory changes including proposed overdraft and late fee caps, including those that impact the money supply and inflation; the risks of changes in interest rates on the level and composition of deposits (as well as the cost of, and competition for, deposits), loan demand, liquidity and the values of loan collateral, securities, and interest rate sensitive assets and liabilities; interest rate risks (including the impacts of interest rates on macroeconomic conditions, customer and client behavior, and on our net interest income), sensitivities and the shape of the yield curve; changes in accounting policies, rules and practices; changes in retail distribution strategies, customer preferences and behavior generally and as a result of economic factors, including heightened inflation; changes in the availability and cost of credit and capital in the financial markets; changes in the prices, values and sales volumes of residential and commercial real estate, especially as they relate to the value of collateral supporting the Company’s loans; the Company’s concentration in commercial real estate loans and in real estate collateral in Florida; Seacoast’s ability to comply with any regulatory requirements and the risk that the regulatory environment may not be conducive to or may prohibit or delay the consummation of future mergers and/or business combinations, may increase the length of time and amount of resources required to consummate such transactions, and may reduce the anticipated benefit; inaccuracies or other failures from the use of models, including the failure of assumptions and estimates, as well as differences in, and changes to, economic, market and credit conditions; the impact on the valuation of Seacoast’s investments due to market volatility or counterparty payment risk, as well as the effect of a decline in stock market prices on our fee income from our wealth management business; statutory and regulatory dividend restrictions; increases in regulatory capital requirements for banking organizations generally; the risks of mergers, acquisitions and divestitures, including Seacoast’s ability to continue to identify acquisition targets, successfully acquire and integrate desirable financial institutions and realize expected revenues and revenue synergies; changes in technology or products that may be more difficult, costly, or less effective than anticipated; the Company’s ability to identify and address increased cybersecurity risks, including those impacting vendors and other third parties which may be exacerbated by developments in generative artificial intelligence; fraud or misconduct by internal or external parties, which Seacoast may not be able to prevent, detect or mitigate; inability of Seacoast’s risk management framework to manage risks associated with the Company’s business; dependence on key suppliers or vendors to obtain equipment or services for the business on acceptable terms; reduction in or the termination of Seacoast’s ability to use the online- or mobile-based platform that is critical to the Company’s business growth strategy; the effects of war or other conflicts, acts of terrorism, natural disasters, including hurricanes in the Company’s footprint, health emergencies, epidemics or pandemics, or other catastrophic events that may affect general economic conditions and/or increase costs, including, but not limited to, property and casualty and other insurance costs; Seacoast’s ability to maintain adequate internal controls over financial reporting; potential claims, damages, penalties, fines, costs and reputational damage resulting from pending or future litigation, regulatory proceedings and enforcement actions; the risks that deferred tax assets could be reduced if estimates of future taxable income from the Company’s operations and tax planning strategies are less than currently estimated, the results of tax audit findings, challenges to our tax positions, or adverse changes or interpretations of tax laws; the effects of competition from other commercial banks, thrifts, mortgage banking firms, consumer finance companies, credit unions, non-bank financial technology providers, securities brokerage firms, insurance companies, money market and other mutual funds and other financial institutions; the failure of assumptions underlying the establishment of reserves for expected credit losses; risks related to, and the costs associated with, environmental, social and governance matters, including the scope and pace of related rulemaking activity and disclosure requirements; a deterioration of the credit rating for U.S. long-term sovereign debt, actions that the U.S. government may take to avoid exceeding the debt ceiling, and uncertainties surrounding the federal budget and economic policy; the risk that balance sheet, revenue growth, and loan growth expectations may differ from actual results; and other factors and risks described under “Risk Factors” herein and in any of the Company's subsequent reports filed with the SEC and available on its website at www.sec.gov.

All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, including, without limitation, those risks and uncertainties described in the Company’s annual report on Form 10-K for the year ended December 31, 2023 and in other periodic reports that the Company files with the SEC. Such reports are available upon request from the Company, or from the Securities and Exchange Commission, including through the SEC's Internet website at www.sec.gov.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FINANCIAL HIGHLIGHTS | (Unaudited) | | | | | |

| SEACOAST BANKING CORPORATION OF FLORIDA AND SUBSIDIARIES | | | | |

| | | |

| Quarterly Trends | | Nine months ended |

| | | | | | | | | | | | | |

| (Amounts in thousands, except ratios and per share data) | 3Q'24 | | 2Q'24 | | 1Q'24 | | 4Q'23 | | 3Q'23 | | 3Q'24 | | 3Q'23 |

| | | | | | | | | | | | | |

| Summary of Earnings | | | | | | | | | | | | | |

| Net income | $ | 30,651 | | | $ | 30,244 | | | $ | 26,006 | | | $ | 29,543 | | | $ | 31,414 | | | $ | 86,901 | | | $ | 74,490 | |

Adjusted net income1,6 | 30,511 | | | 30,277 | | | 31,132 | | | 31,363 | | | 34,170 | | | 91,920 | | | 101,878 | |

Net interest income2 | 106,975 | | | 104,657 | | | 105,298 | | | 111,035 | | | 119,505 | | | 316,930 | | | 378,009 | |

Net interest margin2,3 | 3.17 | % | | 3.18 | % | | 3.24 | % | | 3.36 | % | | 3.57 | % | | 3.19 | % | | 3.91 | % |

Pre-tax pre-provision earnings1 | 46,086 | | | 44,555 | | | 35,674 | | | 42,006 | | | 43,383 | | | 126,315 | | | 131,807 | |

Adjusted pre-tax pre-provision earnings1,6 | 46,390 | | | 44,490 | | | 42,513 | | | 45,016 | | | 47,349 | | | 133,393 | | | 168,905 | |

| | | | | | | | | | | | | |

| Performance Ratios | | | | | | | | | | | | | |

Return on average assets-GAAP basis3 | 0.81 | % | | 0.82 | % | | 0.71 | % | | 0.80 | % | | 0.84 | % | | 0.78 | % | | 0.68 | % |

Return on average tangible assets-GAAP basis3,4 | 0.99 | | | 1.00 | | | 0.89 | | | 0.99 | | | 1.04 | | | 0.96 | | | 0.88 | |

Adjusted return on average tangible assets1,3,4 | 0.98 | | | 1.00 | | | 1.04 | | | 1.04 | | | 1.12 | | | 1.01 | | | 1.15 | |

Pre-tax pre-provision return on average tangible assets1,3,4,6 | 1.46 | | | 1.45 | | | 1.22 | | | 1.39 | | | 1.43 | | | 1.38 | | | 1.49 | |

Adjusted pre-tax pre-provision return on average tangible assets1,3,4 | 1.47 | | | 1.45 | | | 1.42 | | | 1.48 | | | 1.55 | | | 1.44 | | | 1.85 | |

Net adjusted noninterest expense to average tangible assets1,3,4 | 2.19 | | | 2.19 | | | 2.23 | | | 2.25 | | | 2.34 | | | 2.20 | | | 2.40 | |

Return on average shareholders' equity-GAAP basis3 | 5.62 | | | 5.74 | | | 4.94 | | | 5.69 | | | 6.01 | | | 5.44 | | | 4.94 | |

Return on average tangible common equity-GAAP basis3,4 | 10.31 | | | 10.75 | | | 9.55 | | | 11.22 | | | 11.90 | | | 10.21 | | | 10.09 | |

Adjusted return on average tangible common equity1,3,4 | 10.27 | | | 10.76 | | | 11.15 | | | 11.80 | | | 12.79 | | | 10.72 | | | 13.14 | |

Efficiency ratio5 | 59.84 | | | 60.21 | | | 66.78 | | | 60.32 | | | 62.60 | | | 62.24 | | | 65.19 | |

Adjusted efficiency ratio1 | 59.84 | | | 60.21 | | | 61.13 | | | 60.32 | | | 60.19 | | | 60.39 | | | 56.47 | |

| Noninterest income to total revenue (excluding securities gains/losses) | 18.05 | | | 17.55 | | | 16.17 | | | 15.14 | | | 13.22 | | | 17.27 | | | 14.16 | |

Tangible common equity to tangible assets4 | 9.64 | | | 9.30 | | | 9.25 | | | 9.31 | | | 8.68 | | | 9.64 | | | 8.68 | |

| Average loan-to-deposit ratio | 83.79 | | | 83.11 | | | 84.50 | | | 83.38 | | | 82.63 | | | 83.80 | | | 82.86 | |

| End of period loan-to-deposit ratio | 83.44 | | | 82.90 | | | 83.12 | | | 85.48 | | | 82.71 | | | 83.44 | | | 82.71 | |

| | | | | | | | | | | | | |

| Per Share Data | | | | | | | | | | | | | |

| Net income diluted-GAAP basis | $ | 0.36 | | | $ | 0.36 | | | $ | 0.31 | | | $ | 0.35 | | | $ | 0.37 | | | $ | 1.02 | | | $ | 0.89 | |

| Net income basic-GAAP basis | 0.36 | | | 0.36 | | | 0.31 | | | 0.35 | | | 0.37 | | | 1.03 | | | 0.89 | |

Adjusted earnings1,6 | 0.36 | | | 0.36 | | | 0.37 | | | 0.37 | | | 0.40 | | | 1.08 | | | 1.21 | |

| | | | | | | | | | | | | |

| Book value per share common | 25.68 | | | 24.98 | | | 24.93 | | | 24.84 | | | 24.06 | | | 25.68 | | | 24.06 | |

| Tangible book value per share | 16.20 | | | 15.41 | | | 15.26 | | | 15.08 | | | 14.26 | | | 16.20 | | | 14.26 | |

| Cash dividends declared | 0.18 | | | 0.18 | | | 0.18 | | | 0.18 | | | 0.18 | | | 0.54 | | | 0.53 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

1Non-GAAP measure - see "Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP. | | |

2Calculated on a fully taxable equivalent basis using amortized cost. | | |

3These ratios are stated on an annualized basis and are not necessarily indicative of future periods. | | |

4The Company defines tangible assets as total assets less intangible assets, and tangible common equity as total shareholders' equity less intangible assets. | | |

5Defined as noninterest expense less amortization of intangibles and gains, losses, and expenses on foreclosed properties divided by net operating revenue (net interest income on a fully taxable equivalent basis plus noninterest income excluding securities gains and losses). |

6As of 1Q’24, amortization of intangibles is excluded from adjustments to noninterest expense; prior periods have been updated to reflect the change. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME | (Unaudited) | | | | | |

| SEACOAST BANKING CORPORATION OF FLORIDA AND SUBSIDIARIES | | | | |

| | |

| | Quarterly Trends | | Nine months ended |

| | | | | | | | | | | | | | |

| (Amounts in thousands, except per share data) | | 3Q'24 | | 2Q'24 | | 1Q'24 | | 4Q'23 | | 3Q'23 | | 3Q'24 | | 3Q'23 |

| | | | | | | | | | | | | | |

| Interest and dividends on securities: | | | | | | | | | | | | | | |

| Taxable | | $ | 25,963 | | | $ | 24,155 | | | $ | 22,393 | | | $ | 21,383 | | | $ | 21,401 | | | $ | 72,511 | | | $ | 61,543 | |

| Nontaxable | | 34 | | | 33 | | | 34 | | | 55 | | | 97 | | | 101 | | | 299 | |

| Interest and fees on loans | | 150,980 | | | 147,292 | | | 147,095 | | | 147,801 | | | 149,871 | | | 445,367 | | | 433,304 | |

| Interest on interest bearing deposits and other investments | | 7,138 | | | 8,328 | | | 6,184 | | | 7,616 | | | 8,477 | | | 21,650 | | | 16,974 | |

| Total Interest Income | | 184,115 | | | 179,808 | | | 175,706 | | | 176,855 | | | 179,846 | | | 539,629 | | | 512,120 | |

| | | | | | | | | | | | | | |

| Interest on deposits | | 51,963 | | | 51,319 | | | 47,534 | | | 44,923 | | | 38,396 | | | 150,816 | | | 81,612 | |

| Interest on time certificates | | 19,002 | | | 17,928 | | | 17,121 | | | 15,764 | | | 16,461 | | | 54,051 | | | 36,490 | |

| Interest on borrowed money | | 6,485 | | | 6,137 | | | 5,973 | | | 5,349 | | | 5,683 | | | 18,595 | | | 16,597 | |

| Total Interest Expense | | 77,450 | | | 75,384 | | | 70,628 | | | 66,036 | | | 60,540 | | | 223,462 | | | 134,699 | |

| | | | | | | | | | | | | | |

| Net Interest Income | | 106,665 | | | 104,424 | | | 105,078 | | | 110,819 | | | 119,306 | | | 316,167 | | | 377,421 | |

| Provision for credit losses | | 6,273 | | | 4,918 | | | 1,368 | | | 3,990 | | | 2,694 | | | 12,559 | | | 33,528 | |

| Net Interest Income After Provision for Credit Losses | | 100,392 | | | 99,506 | | | 103,710 | | | 106,829 | | | 116,612 | | | 303,608 | | | 343,893 | |

| | | | | | | | | | | | | | |

| Noninterest income: | | | | | | | | | | | | | | |

| Service charges on deposit accounts | | 5,412 | | | 5,342 | | | 4,960 | | | 4,828 | | | 4,648 | | | 15,714 | | | 13,450 | |

| Interchange income | | 1,911 | | | 1,940 | | | 1,888 | | | 2,433 | | | 1,684 | | | 5,739 | | | 11,444 | |

| Wealth management income | | 3,843 | | | 3,766 | | | 3,540 | | | 3,261 | | | 3,138 | | | 11,149 | | | 9,519 | |

| Mortgage banking fees | | 485 | | | 582 | | | 381 | | | 378 | | | 410 | | | 1,448 | | | 1,412 | |

| Insurance agency income | | 1,399 | | | 1,355 | | | 1,291 | | | 1,066 | | | 1,183 | | | 4,045 | | | 3,444 | |

| SBA gains | | 391 | | | 694 | | | 739 | | | 921 | | | 613 | | | 1,824 | | | 1,184 | |

| BOLI income | | 2,578 | | | 2,596 | | | 2,264 | | | 2,220 | | | 2,197 | | | 7,438 | | | 6,181 | |

| Other | | 7,473 | | | 5,953 | | | 5,205 | | | 4,668 | | | 4,307 | | | 18,631 | | | 15,636 | |

| | 23,492 | | | 22,228 | | | 20,268 | | | 19,775 | | | 18,180 | | | 65,988 | | | 62,270 | |

| | | | | | | | | | | | | | |

| Securities gains (losses), net | | 187 | | | (44) | | | 229 | | | (2,437) | | | (387) | | | 372 | | | (456) | |

| Total Noninterest Income | | 23,679 | | | 22,184 | | | 20,497 | | | 17,338 | | | 17,793 | | | 66,360 | | | 61,814 | |

| | | | | | | | | | | | | | |

| Noninterest expense: | | | | | | | | | | | | | | |

| Salaries and wages | | 40,697 | | | 38,937 | | | 40,304 | | | 38,435 | | | 46,431 | | | 119,938 | | | 139,202 | |

| Employee benefits | | 6,955 | | | 6,861 | | | 7,889 | | | 6,678 | | | 7,206 | | | 21,705 | | | 23,240 | |

| Outsourced data processing costs | | 8,003 | | | 8,210 | | | 12,118 | | | 8,609 | | | 8,714 | | | 28,331 | | | 43,489 | |

| Occupancy | | 7,096 | | | 7,180 | | | 8,037 | | | 7,512 | | | 7,758 | | | 22,313 | | | 24,360 | |

| Furniture and equipment | | 2,060 | | | 1,956 | | | 2,011 | | | 2,028 | | | 2,052 | | | 6,027 | | | 6,664 | |

| Marketing | | 2,729 | | | 3,266 | | | 2,655 | | | 2,995 | | | 1,876 | | | 8,650 | | | 6,161 | |

| Legal and professional fees | | 2,708 | | | 1,982 | | | 2,151 | | | 3,294 | | | 2,679 | | | 6,841 | | | 14,220 | |

| FDIC assessments | | 1,882 | | | 2,131 | | | 2,158 | | | 2,813 | | | 2,258 | | | 6,171 | | | 5,817 | |

| Amortization of intangibles | | 6,002 | | | 6,003 | | | 6,292 | | | 6,888 | | | 7,457 | | | 18,297 | | | 21,838 | |

| Other real estate owned expense and net loss (gain) on sale | | 491 | | | (109) | | | (26) | | | 573 | | | 274 | | | 356 | | | 412 | |

| Provision for credit losses on unfunded commitments | | 250 | | | 251 | | | 250 | | | — | | | — | | | 751 | | | 1,239 | |

| Other | | 5,945 | | | 5,869 | | | 6,532 | | | 6,542 | | | 7,210 | | | 18,346 | | | 22,613 | |

| Total Noninterest Expense | | 84,818 | | | 82,537 | | | 90,371 | | | 86,367 | | | 93,915 | | | 257,726 | | | 309,255 | |

| | | | | | | | | | | | | | |

| Income Before Income Taxes | | 39,253 | | | 39,153 | | | 33,836 | | | 37,800 | | | 40,490 | | | 112,242 | | | 96,452 | |

| Provision for income taxes | | 8,602 | | | 8,909 | | | 7,830 | | | 8,257 | | | 9,076 | | | 25,341 | | | 21,962 | |

| | | | | | | | | | | | | | |

| Net Income | | $ | 30,651 | | | $ | 30,244 | | | $ | 26,006 | | | $ | 29,543 | | | $ | 31,414 | | | $ | 86,901 | | | $ | 74,490 | |

| | | | | | | | | | | | | | |

| Share Data | | | | | | | | | | | | | | |

| Net income per share of common stock | | | | | | | | | | | | | | |

| Diluted | | $ | 0.36 | | | $ | 0.36 | | | $ | 0.31 | | | $ | 0.35 | | | $ | 0.37 | | | $ | 1.02 | | | $ | 0.89 | |

| Basic | | 0.36 | | | 0.36 | | | 0.31 | | | 0.35 | | | 0.37 | | | 1.03 | | | 0.89 | |

| Cash dividends declared | | 0.18 | | | 0.18 | | | 0.18 | | | 0.18 | | | 0.18 | | | 0.54 | | | 0.53 | |

| | | | | | | | | | | | | | |

| Average common shares outstanding | | | | | | | | | | | | | | |

| Diluted | | 85,069 | | | 84,816 | | | 85,270 | | | 85,336 | | | 85,666 | | | 84,915 | | | 83,993 | |

| Basic | | 84,434 | | | 84,341 | | | 84,908 | | | 84,817 | | | 85,142 | | | 84,319 | | | 83,457 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED BALANCE SHEETS | (Unaudited) | |

| SEACOAST BANKING CORPORATION OF FLORIDA AND SUBSIDIARIES |

| | | |

| | | September 30, | | June 30, | | March 31, | | December 31, | | September 30, |

| (Amounts in thousands) | | | 2024 | | 2024 | | 2024 | | 2023 | | 2023 |

| | | | | | | | | | | |

| Assets | | | | | | | | | | | |

| Cash and due from banks | | | $ | 182,743 | | | $ | 168,738 | | | $ | 137,850 | | | $ | 167,511 | | | $ | 182,036 | |

| Interest bearing deposits with other banks | | | 454,315 | | | 580,787 | | | 544,874 | | | 279,671 | | | 513,946 | |

| Total cash and cash equivalents | | | 637,058 | | | 749,525 | | | 682,724 | | | 447,182 | | | 695,982 | |

| | | | | | | | | | | |

| Time deposits with other banks | | | 5,207 | | | 7,856 | | | 7,856 | | | 5,857 | | | 4,357 | |

| | | | | | | | | | | |

| Debt Securities: | | | | | | | | | | | |

| Securities available for sale (at fair value) | | | 2,160,055 | | | 1,967,204 | | | 1,949,463 | | | 1,836,020 | | | 1,841,845 | |

| Securities held to maturity (at amortized cost) | | | 646,050 | | | 658,055 | | | 669,896 | | | 680,313 | | | 691,404 | |

| Total debt securities | | | 2,806,105 | | | 2,625,259 | | | 2,619,359 | | | 2,516,333 | | | 2,533,249 | |

| | | | | | | | | | | |

| Loans held for sale | | | 11,039 | | | 5,975 | | | 9,475 | | | 4,391 | | | 2,979 | |

| | | | | | | | | | | |

| Loans | | | 10,205,281 | | | 10,038,508 | | | 9,978,052 | | | 10,062,940 | | | 10,011,186 | |

| Less: Allowance for credit losses | | | (140,469) | | | (141,641) | | | (146,669) | | | (148,931) | | | (149,661) | |

| Loans, net of allowance for credit losses | | | 10,064,812 | | | 9,896,867 | | | 9,831,383 | | | 9,914,009 | | | 9,861,525 | |

| | | | | | | | | | | |

| Bank premises and equipment, net | | | 108,776 | | | 109,945 | | | 110,787 | | | 113,304 | | | 115,749 | |

| Other real estate owned | | | 6,421 | | | 6,877 | | | 7,315 | | | 7,560 | | | 7,216 | |

| Goodwill | | | 732,417 | | | 732,417 | | | 732,417 | | | 732,417 | | | 731,970 | |

| Other intangible assets, net | | | 77,431 | | | 83,445 | | | 89,377 | | | 95,645 | | | 102,397 | |

| Bank owned life insurance | | | 306,379 | | | 303,816 | | | 301,229 | | | 298,974 | | | 296,763 | |

| Net deferred tax assets | | | 94,820 | | | 108,852 | | | 111,539 | | | 113,232 | | | 131,602 | |

| Other assets | | | 317,906 | | | 321,779 | | | 326,554 | | | 331,345 | | | 339,218 | |

| Total Assets | | | $ | 15,168,371 | | | $ | 14,952,613 | | | $ | 14,830,015 | | | $ | 14,580,249 | | | $ | 14,823,007 | |

| | | | | | | | | | | |

| Liabilities | | | | | | | | | | | |

| Deposits | | | | | | | | | | | |

| Noninterest demand | | | $ | 3,443,455 | | | $ | 3,397,918 | | | $ | 3,555,401 | | | $ | 3,544,981 | | | $ | 3,868,132 | |

| Interest-bearing demand | | | 2,487,448 | | | 2,821,092 | | | 2,711,041 | | | 2,790,210 | | | 2,800,152 | |

| Savings | | | 524,474 | | | 566,052 | | | 608,088 | | | 651,454 | | | 721,558 | |

| Money market | | | 4,034,371 | | | 3,707,761 | | | 3,531,029 | | | 3,314,288 | | | 3,143,897 | |

| Time deposits | | | 1,753,837 | | | 1,623,295 | | | 1,610,281 | | | 1,476,002 | | | 1,574,095 | |

| Total Deposits | | | 12,243,585 | | | 12,116,118 | | | 12,015,840 | | | 11,776,935 | | | 12,107,834 | |

| | | | | | | | | | | |

| Securities sold under agreements to repurchase | | | 210,176 | | | 262,103 | | | 326,732 | | | 374,573 | | | 276,450 | |

| Federal Home Loan Bank borrowings | | | 245,000 | | | 180,000 | | | 110,000 | | | 50,000 | | | 110,000 | |

| Long-term debt, net | | | 106,800 | | | 106,634 | | | 106,468 | | | 106,302 | | | 106,136 | |

| Other liabilities | | | 168,960 | | | 157,377 | | | 153,225 | | | 164,353 | | | 174,193 | |

| Total Liabilities | | | 12,974,521 | | | 12,822,232 | | | 12,712,265 | | | 12,472,163 | | | 12,774,613 | |

| | | | | | | | | | | |

| Shareholders' Equity | | | | | | | | | | | |

| Common stock | | | 8,614 | | | 8,530 | | | 8,494 | | | 8,486 | | | 8,515 | |

| Additional paid in capital | | | 1,821,050 | | | 1,815,800 | | | 1,811,941 | | | 1,808,883 | | | 1,813,068 | |

| Retained earnings | | | 508,036 | | | 492,805 | | | 478,017 | | | 467,305 | | | 453,117 | |

| Less: Treasury stock | | | (18,680) | | | (18,744) | | | (16,746) | | | (16,710) | | | (14,035) | |

| | | 2,319,020 | | | 2,298,391 | | | 2,281,706 | | | 2,267,964 | | | 2,260,665 | |

| Accumulated other comprehensive loss, net | | | (125,170) | | | (168,010) | | | (163,956) | | | (159,878) | | | (212,271) | |

| Total Shareholders' Equity | | | 2,193,850 | | | 2,130,381 | | | 2,117,750 | | | 2,108,086 | | | 2,048,394 | |

| Total Liabilities & Shareholders' Equity | | | $ | 15,168,371 | | | $ | 14,952,613 | | | $ | 14,830,015 | | | $ | 14,580,249 | | | $ | 14,823,007 | |

| | | | | | | | | | | |

| Common shares outstanding | | | 85,441 | | | 85,299 | | | 84,935 | | | 84,861 | | | 85,150 | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED QUARTERLY FINANCIAL DATA | (Unaudited) | |

| SEACOAST BANKING CORPORATION OF FLORIDA AND SUBSIDIARIES |

| |

| |

| | | | | | | | | |

| (Amounts in thousands) | 3Q'24 | | 2Q'24 | | 1Q'24 | | 4Q'23 | | 3Q'23 |

| | | | | | | | | |

| Credit Analysis | | | | | | | | | |

| Net charge-offs | $ | 7,445 | | | $ | 9,946 | | | $ | 3,630 | | | $ | 4,720 | | | $ | 12,748 | |

| Net charge-offs to average loans | 0.29 | % | | 0.40 | % | | 0.15 | % | | 0.19 | % | | 0.50 | % |

| | | | | | | | | |

| Allowance for credit losses | $ | 140,469 | | | $ | 141,641 | | | $ | 146,669 | | | $ | 148,931 | | | $ | 149,661 | |

| | | | | | | | | |

| Non-acquired loans at end of period | $ | 7,178,186 | | | $ | 6,834,059 | | | $ | 6,613,763 | | | $ | 6,571,454 | | | $ | 6,343,121 | |

| Acquired loans at end of period | 3,027,095 | | | 3,204,449 | | | 3,364,289 | | | 3,491,486 | | | 3,668,065 | |

| Total Loans | $ | 10,205,281 | | | $ | 10,038,508 | | | $ | 9,978,052 | | | $ | 10,062,940 | | | $ | 10,011,186 | |

| | | | | | | | | |

| Total allowance for credit losses to total loans at end of period | 1.38 | % | | 1.41 | % | | 1.47 | % | | 1.48 | % | | 1.49 | % |

| Purchase discount on acquired loans at end of period | 4.48 | | | 4.51 | | | 4.63 | | | 4.75 | | | 4.86 | |

| | | | | | | | | |

| End of Period | | | | | | | | | |

| Nonperforming loans | $ | 80,857 | | | $ | 59,927 | | | $ | 77,205 | | | $ | 65,104 | | | $ | 41,508 | |

| Other real estate owned | 933 | | | 1,173 | | | 309 | | | 221 | | | 221 | |

| Properties previously used in bank operations included in other real estate owned | 5,488 | | | 5,704 | | | 7,006 | | | 7,339 | | | 6,995 | |

| Total Nonperforming Assets | $ | 87,278 | | | $ | 66,804 | | | $ | 84,520 | | | $ | 72,664 | | | $ | 48,724 | |

| | | | | | | | | |

| Nonperforming Loans to Loans at End of Period | 0.79 | % | | 0.60 | % | | 0.77 | % | | 0.65 | % | | 0.41 | % |

| | | | | | | | | |

| Nonperforming Assets to Total Assets at End of Period | 0.58 | | | 0.45 | | | 0.57 | | | 0.50 | | | 0.33 | |

| | | | | | | | | |

| September 30, | | June 30, | | March 31, | | December 31, | | September 30, |

| Loans | 2024 | | 2024 | | 2024 | | 2023 | | 2023 |

| | | | | | | | | |

| Construction and land development | $ | 595,753 | | | $ | 593,534 | | | $ | 623,246 | | | $ | 767,622 | | | $ | 793,736 | |

| Commercial real estate - owner occupied | 1,676,814 | | | 1,656,391 | | | 1,656,131 | | | 1,670,281 | | | 1,675,881 | |

| Commercial real estate - non-owner occupied | 3,573,076 | | | 3,423,266 | | | 3,368,339 | | | 3,319,890 | | | 3,285,974 | |

| Residential real estate | 2,564,903 | | | 2,555,320 | | | 2,521,399 | | | 2,445,692 | | | 2,418,903 | |

| Commercial and financial | 1,575,228 | | | 1,582,290 | | | 1,566,198 | | | 1,607,888 | | | 1,588,152 | |

| Consumer | 219,507 | | | 227,707 | | | 242,739 | | | 251,567 | | | 248,540 | |

| Total Loans | $ | 10,205,281 | | | $ | 10,038,508 | | | $ | 9,978,052 | | | $ | 10,062,940 | | | $ | 10,011,186 | |

| | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

AVERAGE BALANCES, INTEREST INCOME AND EXPENSES, YIELDS AND RATES 1 | | (Unaudited) |

| SEACOAST BANKING CORPORATION OF FLORIDA AND SUBSIDIARIES |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| 3Q'24 | | 2Q'24 | | 3Q'23 | |

| Average | | | | Yield/ | | Average | | | | Yield/ | | Average | | | | Yield/ | |

| (Amounts in thousands) | Balance | | Interest | | Rate | | Balance | | Interest | | Rate | | Balance | | Interest | | Rate | |

| | | | | | | | | | | | | | | | | | |

| Assets | | | | | | | | | | | | | | | | | | |

| Earning assets: | | | | | | | | | | | | | | | | | | |

| Securities: | | | | | | | | | | | | | | | | | | |

| Taxable | $ | 2,756,502 | | | $ | 25,963 | | | 3.75 | % | | $ | 2,629,716 | | | $ | 24,155 | | | 3.69 | % | | $ | 2,575,002 | | | $ | 21,401 | | | 3.32 | % | |

| Nontaxable | 5,701 | | | 42 | | | 2.93 | | | 5,423 | | | 40 | | | 2.97 | | | 15,280 | | | 119 | | | 3.11 | | |

| Total Securities | 2,762,203 | | | 26,005 | | | 3.75 | | | 2,635,139 | | | 24,195 | | | 3.69 | | | 2,590,282 | | | 21,520 | | | 3.32 | | |

| | | | | | | | | | | | | | | | | | |

| Federal funds sold | 433,423 | | | 5,906 | | | 5.42 | | | 510,401 | | | 6,967 | | | 5.49 | | | 547,576 | | | 7,415 | | | 5.37 | | |

| Interest bearing deposits with other banks and other investments | 102,700 | | | 1,232 | | | 4.77 | | | 98,942 | | | 1,361 | | | 5.53 | | | 90,039 | | | 1,062 | | | 4.68 | | |

| | | | | | | | | | | | | | | | | | |

Total Loans, net2 | 10,128,822 | | | 151,282 | | | 5.94 | | | 10,005,122 | | | 147,518 | | | 5.93 | | | 10,043,611 | | | 150,048 | | | 5.93 | | |

| | | | | | | | | | | | | | | | | | |

| Total Earning Assets | 13,427,148 | | | 184,425 | | | 5.46 | | | 13,249,604 | | | 180,041 | | | 5.47 | | | 13,271,508 | | | 180,045 | | | 5.38 | | |

| | | | | | | | | | | | | | | | | | |

| Allowance for credit losses | (141,974) | | | | | | | (146,380) | | | | | | | (158,440) | | | | | | |

| Cash and due from banks | 167,103 | | | | | | | 168,439 | | | | | | | 168,931 | | | | | | |

| Bank premises and equipment, net | 109,699 | | | | | | | 110,709 | | | | | | | 116,704 | | | | | | |

| Intangible assets | 812,761 | | | | | | | 818,914 | | | | | | | 839,787 | | | | | | |

| Bank owned life insurance | 304,703 | | | | | | | 302,165 | | | | | | | 295,272 | | | | | | |

| Other assets including deferred tax assets | 317,406 | | | | | | | 336,256 | | | | | | | 372,241 | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Total Assets | $ | 14,996,846 | | | | | | | $ | 14,839,707 | | | | | | | $ | 14,906,003 | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Liabilities and Shareholders' Equity | | | | | | | | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | |

| Interest-bearing demand | $ | 2,489,674 | | | $ | 12,905 | | | 2.06 | % | | $ | 2,670,569 | | | $ | 14,946 | | | 2.25 | % | | $ | 2,804,243 | | | $ | 15,013 | | | 2.12 | % | |

| Savings | 546,473 | | | 601 | | | 0.44 | | | 584,490 | | | 560 | | | 0.39 | | | 770,503 | | | 465 | | | 0.24 | | |

| Money market | 3,942,357 | | | 38,457 | | | 3.88 | | | 3,665,858 | | | 35,813 | | | 3.93 | | | 2,972,495 | | | 22,918 | | | 3.06 | | |

| Time deposits | 1,716,720 | | | 19,002 | | | 4.40 | | | 1,631,290 | | | 17,928 | | | 4.42 | | | 1,619,572 | | | 16,461 | | | 4.03 | | |

| Securities sold under agreements to repurchase | 241,083 | | | 2,044 | | | 3.37 | | | 293,603 | | | 2,683 | | | 3.68 | | | 327,711 | | | 2,876 | | | 3.48 | | |

| Federal Home Loan Bank borrowings | 237,935 | | | 2,549 | | | 4.26 | | | 149,234 | | | 1,592 | | | 4.29 | | | 111,087 | | | 888 | | | 3.17 | | |

| Long-term debt, net | 106,706 | | | 1,892 | | | 7.05 | | | 106,532 | | | 1,862 | | | 7.03 | | | 106,036 | | | 1,919 | | | 7.18 | | |

| | | | | | | | | | | | | | | | | | |

| Total Interest-Bearing Liabilities | 9,280,948 | | | 77,450 | | | 3.32 | | | 9,101,576 | | | 75,384 | | | 3.33 | | | 8,711,647 | | | 60,540 | | | 2.76 | | |

| | | | | | | | | | | | | | | | | | |

| Noninterest demand | 3,393,110 | | | | | | | 3,485,603 | | | | | | | 3,987,761 | | | | | | |

| Other liabilities | 154,344 | | | | | | | 134,900 | | | | | | | 133,846 | | | | | | |

| Total Liabilities | 12,828,402 | | | | | | | 12,722,079 | | | | | | | 12,833,254 | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Shareholders' equity | 2,168,444 | | | | | | | 2,117,628 | | | | | | | 2,072,747 | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Total Liabilities & Equity | $ | 14,996,846 | | | | | | | $ | 14,839,707 | | | | | | | $ | 14,906,003 | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Cost of deposits | | | | | 2.34 | % | | | | | | 2.31 | % | | | | | | 1.79 | % | |

| Interest expense as a % of earning assets | | | | | 2.29 | % | | | | | | 2.29 | % | | | | | | 1.81 | % | |

| Net interest income as a % of earning assets | | | $ | 106,975 | | | 3.17 | % | | | | $ | 104,657 | | | 3.18 | % | | | | $ | 119,505 | | | 3.57 | % | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

1On a fully taxable equivalent basis. All yields and rates have been computed using amortized cost. | | | | | |

2Fees on loans have been included in interest on loans. Nonaccrual loans are included in loan balances. | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

AVERAGE BALANCES, INTEREST INCOME AND EXPENSES, YIELDS AND RATES 1 | (Unaudited) |

| SEACOAST BANKING CORPORATION OF FLORIDA AND SUBSIDIARIES | | | | | | | | | |

| | |

| Nine Months Ended September 30, 2024 | | Nine Months Ended September 30, 2023 | |

| Average | | | | Yield/ | | Average | | | | Yield/ | |

| (Amounts in thousands, except ratios) | Balance | | Interest | | Rate | | Balance | | Interest | | Rate | |

| | | | | | | | | | | | |

| Assets | | | | | | | | | | | | |

| Earning assets: | | | | | | | | | | | | |

| Securities: | | | | | | | | | | | | |

| Taxable | $ | 2,655,422 | | | $ | 72,511 | | | 3.65 | % | | $ | 2,649,127 | | | $ | 61,543 | | | 3.10 | % | |

| Nontaxable | 5,677 | | | 123 | | | 2.89 | | | 15,721 | | | 370 | | | 3.14 | | |

| Total Securities | 2,661,099 | | | 72,634 | | | 3.65 | | | 2,664,848 | | | 61,913 | | | 3.10 | | |

| | | | | | | | | | | | |

| Federal funds sold | 438,089 | | | 17,929 | | | 5.47 | | | 336,022 | | | 12,444 | | | 4.95 | | |

| Interest bearing deposits with other banks and other investments | 102,415 | | | 3,721 | | | 4.85 | | | 90,511 | | | 4,530 | | | 6.69 | | |

| | | | | | | | | | | | |

Total Loans, net2 | 10,056,466 | | | 446,108 | | | 5.93 | | | 9,840,484 | | | 433,821 | | | 5.89 | | |

| | | | | | | | | | | | |

| Total Earning Assets | 13,258,069 | | | 540,392 | | | 5.44 | | | 12,931,865 | | | 512,708 | | | 5.30 | | |

| | | | | | | | | | | | |

| Allowance for credit losses | (145,579) | | | | | | | (151,613) | | | | | | |

| Cash and due from banks | 167,424 | | | | | | | 185,426 | | | | | | |

| Bank premises and equipment, net | 110,929 | | | | | | | 116,840 | | | | | | |

| Intangible assets | 819,046 | | | | | | | 811,483 | | | | | | |

| Bank owned life insurance | 302,220 | | | | | | | 287,756 | | | | | | |

| Other assets including deferred tax assets | 330,898 | | | | | | | 402,175 | | | | | | |

| | | | | | | | | | | | |

| Total Assets | $ | 14,843,007 | | | | | | | $ | 14,583,932 | | | | | | |

| | | | | | | | | | | | |

| Liabilities and Shareholders' Equity | | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | |

| Interest-bearing demand | $ | 2,626,026 | | | $ | 43,117 | | | 2.19 | % | | $ | 2,642,180 | | | $ | 25,780 | | | 1.30 | % | |

| Savings | 586,285 | | | 1,701 | | | 0.39 | | | 909,184 | | | 1,292 | | | 0.19 | | |

| Money market | 3,673,493 | | | 105,998 | | | 3.85 | | | 2,831,747 | | | 54,540 | | | 2.58 | | |

| Time deposits | 1,646,285 | | | 54,051 | | | 4.39 | | | 1,288,736 | | | 36,490 | | | 3.79 | | |

| Securities sold under agreements to repurchase | 289,181 | | | 7,806 | | | 3.61 | | | 249,242 | | | 5,333 | | | 2.86 | | |

| Federal Home Loan Bank borrowings | 163,468 | | | 5,101 | | | 4.17 | | | 214,415 | | | 5,936 | | | 3.70 | | |

| Long-term debt, net | 106,538 | | | 5,688 | | | 7.13 | | | 103,469 | | | 5,328 | | | 6.88 | | |

| | | | | | | | | | | | |

| Total Interest-Bearing Liabilities | 9,091,276 | | | 223,462 | | | 3.28 | | | 8,238,973 | | | 134,699 | | | 2.19 | | |

| | | | | | | | | | | | |

| Noninterest demand | 3,468,790 | | | | | | | 4,204,389 | | | | | | |

| Other liabilities | 148,000 | | | | | | | 126,487 | | | | | | |

| Total Liabilities | 12,708,066 | | | | | | | 12,569,849 | | | | | | |

| | | | | | | | | | | | |

| Shareholders' equity | 2,134,941 | | | | | | | 2,014,083 | | | | | | |

| | | | | | | | | | | | |

| Total Liabilities & Equity | $ | 14,843,007 | | | | | | | $ | 14,583,932 | | | | | | |

| | | | | | | | | | | | |

| Cost of deposits | | | | | 2.28 | % | | | | | | 1.33 | % | |

| Interest expense as a % of earning assets | | | | | 2.25 | % | | | | | | 1.39 | % | |

| Net interest income as a % of earning assets | | | $ | 316,930 | | | 3.19 | % | | | | $ | 378,009 | | | 3.91 | % | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

1On a fully taxable equivalent basis. All yields and rates have been computed using amortized cost. |

2Fees on loans have been included in interest on loans. Nonaccrual loans are included in loan balances. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED QUARTERLY FINANCIAL DATA | (Unaudited) | |

| SEACOAST BANKING CORPORATION OF FLORIDA AND SUBSIDIARIES |

| | | | |

| | | | | | | | | | | | |

| | | | September 30, | | June 30, | | March 31, | | December 31, | | September 30, |

| (Amounts in thousands) | | | 2024 | | 2024 | | 2024 | | 2023 | | 2023 |

| | | | | | | | | | | | |

| Customer Relationship Funding | | | | | | | | | | | |

| Noninterest demand | | | | | | | | | | | |

| Commercial | | | | $ | 2,731,564 | | | $ | 2,664,353 | | | $ | 2,808,151 | | | $ | 2,752,644 | | | $ | 3,089,488 | |

| Retail | | | | 509,527 | | | 532,623 | | | 553,697 | | | 561,569 | | | 570,727 | |

| Public funds | | | | 139,072 | | | 142,846 | | | 145,747 | | | 173,893 | | | 134,649 | |

| Other | | | | 63,292 | | | 58,096 | | | 47,806 | | | 56,875 | | | 73,268 | |

| Total Noninterest Demand | | | 3,443,455 | | | 3,397,918 | | | 3,555,401 | | | 3,544,981 | | | 3,868,132 | |

| | | | | | | | | | | | |

| Interest-bearing demand | | | | | | | | | | | |

| Commercial | | | | 1,426,920 | | | 1,533,725 | | | 1,561,905 | | | 1,576,491 | | | 1,618,755 | |

| Retail | | | | 874,043 | | | 892,032 | | | 930,178 | | | 956,900 | | | 994,224 | |

| Brokered | | | | — | | | 198,337 | | | — | | | — | | | — | |

| Public funds | | | | 186,485 | | | 196,998 | | | 218,958 | | | 256,819 | | | 187,173 | |

| Total Interest-Bearing Demand | | | 2,487,448 | | | 2,821,092 | | | 2,711,041 | | | 2,790,210 | | | 2,800,152 | |

| | | | | | | | | | | | |

| Total transaction accounts | | | | | | | | | | | |

| Commercial | | | | 4,158,484 | | | 4,198,078 | | | 4,370,056 | | | 4,329,135 | | | 4,708,243 | |

| Retail | | | | 1,383,570 | | | 1,424,655 | | | 1,483,875 | | | 1,518,469 | | | 1,564,951 | |

| Brokered | | | | — | | | 198,337 | | | — | | | — | | | — | |

| Public funds | | | | 325,557 | | | 339,844 | | | 364,705 | | | 430,712 | | | 321,822 | |

| Other | | | | 63,292 | | | 58,096 | | | 47,806 | | | 56,875 | | | 73,268 | |

| Total Transaction Accounts | | | 5,930,903 | | | 6,219,010 | | | 6,266,442 | | | 6,335,191 | | | 6,668,284 | |

| | | | | | | | | | | | |

| Savings | | | | | | | | | | | |

| Commercial | | | | 44,151 | | | 53,523 | | | 52,665 | | | 58,562 | | | 79,731 | |

| Retail | | | | 480,323 | | | 512,529 | | | 555,423 | | | 592,892 | | | 641,827 | |

| Total Savings | | | 524,474 | | | 566,052 | | | 608,088 | | | 651,454 | | | 721,558 | |

| | | | | | | | | | | | |

| Money market | | | | | | | | | | | |

| Commercial | | | | 1,953,851 | | | 1,771,927 | | | 1,709,636 | | | 1,655,820 | | | 1,625,455 | |

| Retail | | | | 1,887,975 | | | 1,733,505 | | | 1,621,618 | | | 1,469,142 | | | 1,362,390 | |

| Public funds | | | | 192,545 | | | 202,329 | | | 199,775 | | | 189,326 | | | 156,052 | |

| Total Money Market | | | 4,034,371 | | | 3,707,761 | | | 3,531,029 | | | 3,314,288 | | | 3,143,897 | |

| | | | | | | | | | | | |

| Brokered time certificates | | | 256,536 | | | 126,668 | | | 142,717 | | | 122,347 | | | 307,963 | |

| Time deposits | | | 1,497,301 | | | 1,496,627 | | | 1,467,564 | | | 1,353,655 | | | 1,266,132 | |

| | | 1,753,837 | | | 1,623,295 | | | 1,610,281 | | | 1,476,002 | | | 1,574,095 | |

| Total Deposits | | | $ | 12,243,585 | | | $ | 12,116,118 | | | $ | 12,015,840 | | | $ | 11,776,935 | | | $ | 12,107,834 | |

| | | | | | | | | | | | |

| Securities sold under agreements to repurchase | | | $ | 210,176 | | | $ | 262,103 | | | $ | 326,732 | | | $ | 374,573 | | | $ | 276,450 | |

| | | | | | | | | | | | |

Total customer funding1 | | | $ | 12,197,225 | | | $ | 12,053,216 | | | $ | 12,199,855 | | | $ | 12,029,161 | | | $ | 12,076,321 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

1Total deposits and securities sold under agreements to repurchase, excluding brokered deposits. Securities sold under agreements to repurchase consists of customer sweep accounts. |

Explanation of Certain Unaudited Non-GAAP Financial Measures

This presentation contains financial information determined by methods other than Generally Accepted Accounting Principles (“GAAP”). Management uses these non-GAAP financial measures in its analysis of the Company’s performance and believes these presentations provide useful supplemental information, and a clearer understanding of the Company’s performance. The Company believes the non-GAAP measures enhance investors’ understanding of the Company’s business and performance and if not provided would be requested by the investor community. These measures are also useful in understanding performance trends and facilitate comparisons with the performance of other financial institutions. The limitations associated with operating measures are the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might define or calculate these measures differently. The Company provides reconciliations between GAAP and these non-GAAP measures. These disclosures should not be considered an alternative to GAAP.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |