UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

10-K

(Mark

One)

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended June 30, 2024

or

☐

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from ___________ to ___________

Commission

file number 001-34024

SINGULARITY

FUTURE TECHNOLOGY LTD.

(Exact name of registrant as specified in its charter)

| Virginia | | 11-3588546 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

98

Cutter Mill Road

Suite

311

Great

Neck, New York 11021

(Address of principal executive offices) (Zip Code)

(718)

888-1814

(Registrant’s telephone number, including area code)

Securities

Registered Pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, no par value | | SGLY | | The Nasdaq Stock Market LLC |

Securities

Registered Pursuant to Section 12(g) of the Act: None.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files). Yes ☐ No ☒

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ | | |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of voting common stock

held by non-affiliates of the registrant as of June 30, 2024, the last business day of the registrant’s fiscal 2024, was approximately

$17,447,390.16.

The number of shares of common stock outstanding

as of October 15, 2024 was 3,503,492.

DOCUMENTS

INCORPORATED BY REFERENCE:

None.

SINGULARITY

FUTURE TECHNOLOGY LTD.

FORM

10-K

INDEX

INTRODUCTION

Unless

the context otherwise requires, in this annual report on Form 10-K (this “Report”):

| ● | “We,”

“us,” “our,” and “our Company” refer to Singularity Future Technology Ltd., a Virginia company incorporated

in September 2007, and all of its direct and indirect consolidated subsidiaries; |

| ● | “Singularity”

refers to Singularity Future Technology, Ltd; |

| ● | “Sino-China”

refers to Sino-Global Shipping Agency Ltd., a Chinese legal entity; |

| ● | “PRC”

refers to the People’s Republic of China, excluding Taiwan for the purpose of this Report; |

| ● | “US”

or “U.S.” refers to the United States of America; |

| ● | “RMB”

or “Renminbi” refers to the legal currency of China, and “$” or “U.S. dollars” refers to the legal

currency of the United States. |

Names

of certain PRC companies provided in this Report are translated or transliterated from their original PRC legal names. Discrepancies,

if any, in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Report contains certain statements that constitute “forward-looking statements” within the meaning of Section 27A of the

Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”). Such forward-looking statements, including but not limited to statements regarding our projected growth,

trends and strategies, future operating and financial results, financial expectations and current business indicators are based upon

current information and expectations and are subject to change based on factors beyond our control. Forward-looking statements typically

are identified by the use of terms such as “look,” “may,” “will,” “should,” “might,”

“believe,” “plan,” “expect,” “anticipate,” “estimate” and similar words,

although some forward-looking statements are expressed differently. The accuracy of such statements may be impacted by a number of business

risks and uncertainties we face that could cause our actual results to differ materially from those projected or anticipated, including

but not limited to the following:

| ● | our

ability to timely and properly deliver our services; |

| ● | our

dependence on a limited number of major customers and suppliers; |

| ● | current

and future political and economic factors in the United States and China and the relationship between the two countries; the Chinese

government exerts substantial influence over the manner in which we conduct our business activities in the PRC and may intervene or influence

our operations at any time with little advance notice, which could result in a material change in our operations and the value of our

common stock |

| ● | unanticipated

changes in general market conditions or other factors which may result in cancellations or reductions in the need for our services; |

| ● | demand

for warehouse, shipping and logistics services; |

| ● | foreign

currency exchange rate fluctuations; |

| ● | possible

disruptions in commercial activities caused by events such as natural disasters, health epidemics, terrorist activity and armed conflict; |

| ● | our

ability to identify and successfully execute cost control initiatives; |

| ● | the

impact of quotas, tariffs or safeguards on our customer’s products; |

| ● | our

ability to attract, retain and motivate qualified management team members and skilled personnel; |

| |

● |

relevant

governmental policies and regulations relating to our businesses; |

| |

|

|

| |

● |

developments

in, or changes to, laws, regulations, governmental policies, incentives and taxation affecting our operations; |

| |

|

|

| |

● |

our

reputation and ability to do business may be impacted by the improper conduct of our employees, agents or business partners; and |

| |

|

|

| |

● |

the

outcome of litigation or investigations in which we are involved is unpredictable, and an adverse decision in any such matter could

have a material adverse effect on our financial condition, results of operations, cash flows and equity. |

Readers

are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes

no obligation to update the forward-looking statements. Nonetheless, the Company may make such updates from time to time by press release,

periodic report or other method of public disclosure without the need for specific reference to this Report. No such update shall be

deemed to indicate that other statements not addressed by such update remain correct or create an obligation to provide any other updates.

PART

I

Item

1. Business.

Overview

We

are a global logistics integrated solution provider that was founded in the United States in 2001. On September 18, 2007, the Company

merged into a new corporation, Sino-Global Shipping America, Ltd. in Virginia. On January 3, 2022, the Company changed its corporate

name to Singularity Future Technology Ltd. to reflect its expanded operations into the digital assets business. Currently, we primarily

focus on providing freight logistics services, which mainly include shipping, warehouse services and other logistical support to steel

companies.

In

2017, we began exploring new opportunities to expand our business and generate more revenue. These opportunities ranged from complementary

businesses to other new service and product initiatives. In the fiscal year 2022, while we continued to provide our traditional freight

logistics business, we expanded our services to include warehousing services provided by our U.S. subsidiary Brilliant Warehouse Service

Inc.

We

are currently engaged in providing freight logistics services including warehouse services, which are operated by our subsidiaries Trans

Pacific Shipping Limited in China and Gorgeous Trading Ltd. and Brilliant Warehouse Service Inc in the United States. Our range of services

include transportation, warehouse, collection, last-mile delivery, drop shipping, customs clearance, and overseas transit delivery.

As

a holding company with no material operations, conduct substantially all of our operations through subsidiaries established in the United

States, the People’s Republic of China (the “PRC” or “China”) and Hong Kong. However, neither the holding

company nor any of the Company’s Chinese subsidiaries conduct any operations through contractual arrangements with a variable interest

entity based in China. Investors in our common stock should be aware that they may never directly hold equity interests in the PRC operating

entities, but rather equity interests solely in Singularity, our Virginia holding company. Furthermore, shareholders may face difficulties

enforcing their legal rights under United States securities laws against our directors and officers who are located outside of the United

States.

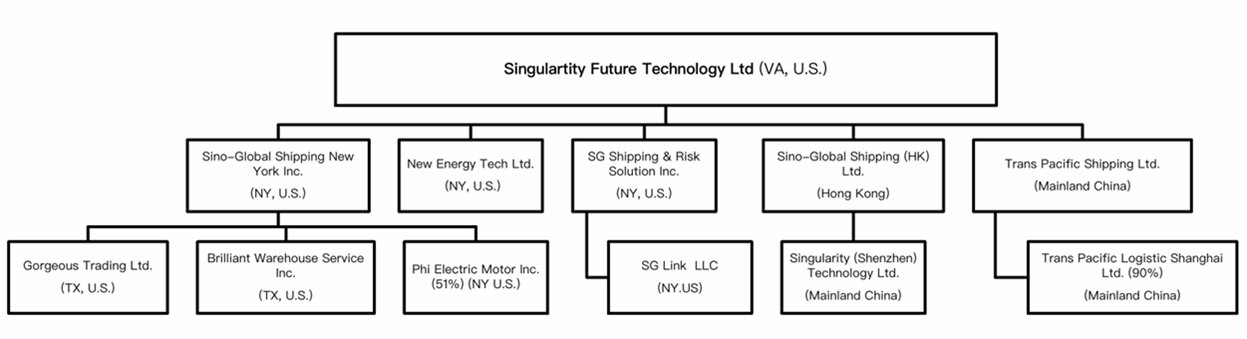

The

diagram below shows our corporate structure as of the date of this report.

| * |

Unless

otherwise indicated in the diagram, all the subsidiaries of the Company are wholly owned. |

As

of June 30, 2024, the Company’s subsidiaries were as follows:

| Name |

|

Background |

|

Ownership |

| Sino-Global

Shipping New York Inc. (“SGS NY”) |

|

● |

A

New York corporation |

|

100%

owned by the Company |

| |

●

|

Incorporated

on May 03, 2013 |

|

|

| |

● |

Primarily

engaged in freight logistics services |

|

|

| |

|

|

|

|

|

| Sino-Global

Shipping HK Ltd. (“SGS HK”) |

|

● |

A

Hong Kong corporation |

|

100%

owned by the Company |

| |

● |

Incorporated

on September 22, 2008 |

|

|

| |

● |

No

material operations |

|

|

| |

|

|

|

|

|

| Trans

Pacific Shipping Ltd. (“Trans Pacific Beijing”) |

|

● |

A

PRC limited liability company |

|

100%

owned by the Company |

| |

● |

Incorporated

on November 13, 2007. |

|

|

| |

● |

Primarily

engaged in freight logistics services |

|

|

| |

|

|

|

|

| Trans

Pacific Logistic Shanghai Ltd. (“Trans Pacific Shanghai”) |

|

● |

A

PRC limited liability company |

|

90%

owned by Trans Pacific Beijing |

| |

● |

Incorporated

on May 31, 2009 |

|

|

| |

● |

Primarily

engaged in freight logistics services |

|

|

| |

● |

No

material operations |

|

|

| |

|

|

|

|

|

| Gorgeous

Trading Ltd (“Gorgeous Trading”) |

|

● |

A

Texas corporation |

|

100%

owned by SGS NY |

| |

● |

Incorporated

on July 01, 2021 |

|

|

| |

● |

Primarily

engaged in warehouse related services |

|

|

| |

|

|

|

|

|

| Brilliant

Warehouse Service Inc. (“Brilliant Warehouse”) |

|

● |

A

Texas corporation |

|

51%

owned by SGS NY |

| |

● |

Incorporated

on April 19, 2021 |

|

|

| |

● |

Primarily

engaged in warehouse house related services |

|

|

| |

|

|

|

|

|

| Phi

Electric Motor In. (“Phi”) |

|

●

●

● |

A

New York Corporation

Incorporated

on August 30, 2021

No operations |

|

51%

owned by SGS NY |

| |

|

|

|

|

|

| SG

Shipping & Risk Solution Inc, (“SGSR”) |

|

● |

A

New York corporation |

|

100%

owned by the Company |

| |

● |

Incorporated

on September 29, 2021 |

|

|

| |

● |

No

material operations |

|

|

| |

|

|

|

|

|

| SG

Link LLC (“SG Link”) |

|

● |

A

New York corporation |

|

100%

owned by SG Shipping & Risk Solution Inc |

| |

● |

Incorporated

on December 23, 2021 |

|

| |

● |

No

material operations |

|

| |

|

|

|

|

|

| New

Energy Tech Limited (“New Energy”) |

|

● |

A

New York corporation |

|

100%

owned by the Company |

| |

|

● |

Incorporated

on September 19, 2023 |

|

|

| |

|

● |

No

material operations |

|

|

| |

|

|

|

|

|

| Singularity

(Shenzhen) Technology Ltd. |

|

● |

A

Mainland China corporation |

|

100%

owned by the Company |

| (“SGS Shenzhen”) |

|

● |

Incorporated

on September 4, 2023 |

|

|

| |

|

● |

No

material operations |

|

|

Our

equity structure is a direct holding structure. Within our direct holding structure, the cross-border transfer of funds within our corporate

entities is legal and compliant with the laws and regulations of the PRC. After the foreign investors’ funds enter Singularity,

the funds can be directly transferred to the PRC operating companies through its subsidiaries. Specifically, Singularity is permitted

under the Virginia laws to provide funding to our subsidiaries in the PRC and Hong Kong through loans or capital contributions without

restrictions on the amount of the funds, subject to satisfaction of applicable government registration, approval and filing requirements.

Current PRC regulations permit our PRC subsidiaries to pay dividends to the Company only out of their accumulated profits, if any, determined

in accordance with Chinese accounting standards and regulations. As of the date hereof, there have not been any transfers, dividends

or distributions made between the holding company, its subsidiaries, and to investors. Furthermore, as of the date hereof, no cash generated

from one subsidiary is used to fund another subsidiary’s operations and we do not anticipate any difficulties or limitations on

our ability to transfer cash between subsidiaries. We have also not installed any cash management policies that dictate the amount of

such funds and how such funds are transferred. For the foreseeable future, we intend to use the earnings for our business operations

and as a result, we do not intend to distribute earnings or pay any cash dividends.

To

address persistent capital outflows and the RMB’s depreciation against the U.S. dollar in the fourth quarter of 2016, the People’s

Bank of China and the State Administration of Foreign Exchange, or SAFE, have implemented a series of capital control measures in the

subsequent months, including stricter vetting procedures for China-based companies to remit foreign currency for overseas acquisitions,

dividend payments and shareholder loan repayments. The PRC government may continue to strengthen its capital controls and our PRC subsidiaries’

dividends and other distributions may be subject to tightened scrutiny in the future. The PRC government also imposes controls on the

conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Therefore, we may experience difficulties

in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from our profits,

if any. Furthermore, if our subsidiaries in the PRC incur debt on their own in the future, the instruments governing the debt may restrict

their ability to pay dividends or make other payments.

In

addition, the Enterprise Income Tax Law and its implementation rules provide that a withholding tax at a rate of 10% will be applicable

to dividends payable by Chinese companies to non-PRC-resident enterprises unless reduced under treaties or arrangements between the PRC

central government and the governments of other countries or regions where the non-PRC resident enterprises are tax resident. Pursuant

to the tax agreement between Mainland China and the Hong Kong Special Administrative Region, the withholding tax rate in respect to the

payment of dividends by a PRC enterprise to a Hong Kong enterprise may be reduced to 5% from a standard rate of 10%. However, if the

relevant tax authorities determine that our transactions or arrangements are for the primary purpose of enjoying a favorable tax treatment,

the relevant tax authorities may adjust the favorable withholding tax in the future. Accordingly, there is no assurance that the reduced

5% withholding rate will apply to dividends received by our Hong Kong subsidiary from our PRC subsidiaries. This withholding tax will

reduce the amount of dividends we may receive from our PRC subsidiaries.

Because

some of our operations are located in the PRC through our subsidiaries, we are subject to certain legal and operational risks associated

with our operations in China, including changes in the legal, political and economic policies of the Chinese government, the relations

between China and the U.S, or Chinese or U.S regulations may materially and adversely affect our business, financial condition and results

of operations. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and therefore, these

risks may result in a material change in our operations and the value of our common stock, or could significantly limit or completely

hinder our ability to offer or continue to offer our securities to investors and cause the value of such securities to significantly

decline or be worthless. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations

in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over

China-based companies listed overseas using a variable interest entity structure, adopting new measures to extend the scope of cybersecurity

reviews, and expanding the efforts in anti-monopoly enforcement.

We

believe that we will not be subject to cybersecurity review with the Cyberspace Administration of China, or the “CAC,”, since

we currently do not have over one million users’ personal information and do not anticipate that we will be collecting over one

million users’ personal information in the foreseeable future, which we understand might otherwise subject us to the Cybersecurity

Review Measures. We do not believe that our subsidiaries are directly subject to these regulatory actions or statements, as we have not

implemented any monopolistic behavior and our business does not involve the collection of user data or implicate cybersecurity. As of

the date hereof, no relevant laws or regulations in the PRC explicitly require us to seek approval from the China Securities Regulatory

Commission, or the CSRC, or any other PRC governmental authorities for future offerings, nor has our Virginia holding company or any

of our subsidiaries received any inquiry, notice, warning or sanctions regarding previous offerings from the CSRC or any other PRC governmental

authorities. However, on February 17, 2023, the CSRC promulgated Trial Administrative Measures of the Overseas Securities Offering and

Listing by Domestic Companies (the “Overseas Listing Trial Measures”) and five relevant guidelines, which became effective

on March 31, 2023. According to the Overseas Listing Trial Measures, PRC domestic companies that seek to offer and list securities in

overseas markets, either in direct or indirect means, are required to fulfill the filing procedure with the CSRC and report relevant

information. The Overseas Listing Trial Measures provides that an overseas listing or offering is explicitly prohibited, if any of the

following: (1) such securities offering and listing is explicitly prohibited by provisions in laws, administrative regulations and relevant

state rules; (2) the intended securities offering and listing may endanger national security as reviewed and determined by competent

authorities under the State Council in accordance with law; (3) the domestic company intending to make the securities offering and listing,

or its controlling shareholder(s) and the actual controller, have committed relevant crimes such as corruption, bribery, embezzlement,

misappropriation of property or undermining the order of the socialist market economy during the latest three years; (4) the domestic

company intending to make the securities offering and listing is currently under investigations for suspicion of criminal offenses or

major violations of laws and regulations, and no conclusion has yet been made thereof; or (5) there are material ownership disputes over

equity held by the domestic company’s controlling shareholder(s) or by other shareholder(s) that are controlled by the controlling

shareholder(s) and/or actual controller.

The

Overseas Listing Trial Measures also provide that if the issuer meets both the following criteria, the overseas securities offering and

listing conducted by such issuer will be deemed as indirect overseas offering by PRC domestic companies: (1) 50% or more of any of the

issuer’s operating revenue, total profit, total assets or net assets as documented in its audited consolidated financial statements

for the most recent fiscal year is accounted for by domestic companies; and (2) the issuer’s main business activities are conducted

in China, or its main place(s) of business are located in China, or the majority of senior management staff in charge of its business

operations and management are PRC citizens or have their usual place(s) of residence located in China. Where an issuer submits an application

for initial public offering to competent overseas regulators, such issuer must file with the CSRC within three business days after such

application is submitted. In addition, the Overseas Listing Trial Measures provide that the direct or indirect overseas listings of the

assets of domestic companies through one or more acquisitions, share swaps, transfers or other transaction arrangements shall be subject

to filing procedures in accordance with the Overseas Listing Trial Measures. The Overseas Listing Trial Measures also requires subsequent

reports to be filed with the CSRC on material events, such as change of control or voluntary or forced delisting of the issuer(s) who

have completed overseas offerings and listings.

At

a press conference held for these new regulations (“Press Conference”), officials from the CSRC clarified that the domestic

companies that have already been listed overseas on or before March 31, 2023 shall be deemed as existing issuers (the “Existing

Issuers”). Existing Issuers are not required to complete the filling procedures immediately, and they shall be required to file

with the CSRC upon occurrences of certain subsequent matters such as follow-on offerings of securities. According to the Overseas Listing

Trial Measures and the Press Conference, the existing domestic companies that have completed overseas offering and listing before March

31, 2023, such as us, will not be required to perform filing procedures for the completed overseas securities issuance and listing. However,

from the effective date of the regulation, any of our subsequent securities offering in the same overseas market or subsequent securities

offering and listing in other overseas markets shall be subject to the filing requirement with the CSRC within three working days after

the offering is completed or after the relevant application is submitted to the relevant overseas authorities, respectively. If it is

determined that any approval, filing or other administrative procedures from other PRC governmental authorities is required for any future

offering or listing, we cannot assure you that we can obtain the required approval or accomplish the required filings or other regulatory

procedures in a timely manner, or at all. If we fail to fulfill filing procedure as stipulated by the Trial Measures or offer and list

securities in an overseas market in violation of the Trial Measures, the CSRC may order rectification, issue warnings to us, and impose

a fine of between RMB1,000,000 and RMB10,000,000. Persons-in-charge and other persons that are directly liable for such failure shall

be warned and each imposed a fine from RMB500,000 to RMB5,000,000. Controlling shareholders and actual controlling persons of us that

organize or instruct such violations shall be imposed a fine from RMB1,000,000 and RMB10,000,000.

On

February 24, 2023, the CSRC published the Provisions on Strengthening the Confidentiality and Archives Administration Related to the

Overseas Securities Offering and Listing by Domestic Enterprises (the “Provisions on Confidentiality and Archives Administration”),

which came into effect on March 31, 2023. The Provisions on Confidentiality and Archives Administration requires that, in the process

of overseas issuance and listing of securities by domestic entities, the domestic entities, and securities companies and securities service

institutions that provide relevant securities service shall strictly implement the provisions of relevant laws and regulations and the

requirements of these provisions, establish and improve rules on confidentiality and archives administration. Where the domestic entities

provide or publicly disclose documents, materials or other items related to the state secrets and government work secrets to the relevant

securities companies, securities service institutions, overseas regulatory authorities, or other entities or individuals, the companies

shall apply for approval of competent departments with the authority of examination and approval in accordance with law and report the

matter to the secrecy administrative departments at the same level for record filing. Where there is unclear or controversial whether

or not the concerned materials are related to state secrets, the materials shall be reported to the relevant secrecy administrative departments

for determination. However, there remain uncertainties regarding the further interpretation and implementation of the Provisions on Confidentiality

and Archives Administration.

As

of the date of this report, our PRC subsidiaries have obtained the requisite licenses and permits from the PRC government authorities

that are material for the business operations of our PRC subsidiaries. In addition, as of the date of this annual report, we and our

PRC subsidiaries are not required to obtain approval or permission from the CSRC or the CAC or any other entity that is required to approve

our PRC subsidiaries’ operations or required for us to offer securities to foreign investors under any currently effective PRC

laws, regulations, and regulatory rules. If it is determined that we are subject to filing requirements imposed by the CSRC under the

Overseas Listing Regulations or approvals from other PRC regulatory authorities or other procedures, including the cybersecurity review

under the revised Cybersecurity Review Measures, for our future offshore offerings, it would be uncertain whether we can or how long

it will take us to complete such procedures or obtain such approval and any such approval could be rescinded. Any failure to obtain or

delay in completing such procedures or obtaining such approval for our offshore offerings, or a rescission of any such approval if obtained

by us, would subject us to sanctions by the CSRC or other PRC regulatory authorities for failure to file with the CSRC or failure to

seek approval from other government authorization for our offshore offerings. These regulatory authorities may impose fines and penalties

on our operations in China, limit our ability to pay dividends outside of China, limit our operating privileges in China, delay or restrict

the repatriation of the proceeds from our offshore offerings into China or take other actions that could materially and adversely affect

our business, financial condition, results of operations, and prospects, as well as the trading price of our common stock. The CSRC or

other PRC regulatory authorities also may take actions requiring us, or making it advisable for us, to halt our offshore offerings before

settlement and delivery of the securities offered. Consequently, if investors engage in market trading or other activities in anticipation

of and prior to settlement and delivery, they do so at the risk that settlement and delivery may not occur. In addition, if the CSRC

or other regulatory authorities later promulgate new rules or explanations requiring that we obtain their approvals or accomplish the

required filing or other regulatory procedures for our prior offshore offerings, we may be unable to obtain a waiver of such approval

requirements, if and when procedures are established to obtain such a waiver. Any uncertainties or negative publicity regarding such

approval requirement could materially and adversely affect our business, prospects, financial condition, reputation, and the trading

price of our common stock.

Since

these statements and regulatory actions by the PRC government are newly published and official guidance and related implementation rules

have not been issued, it is uncertain how soon legislative or administrative regulation making bodies will respond and what existing

or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential

impact such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments

and list on an U.S. or other foreign exchange. The Standing Committee of the National People’s Congress, or the SCNPC, or other

PRC regulatory authorities may in the future promulgate laws, regulations or implementing rules that requires our company or any of our

subsidiaries to obtain regulatory approval from Chinese authorities before future offerings in the U.S. In other words, although the

Company is currently not required to obtain permission from any of the PRC federal or local government to obtain such permission and

has not received any denial to list on the U.S. exchange, our operations could be adversely affected, directly or indirectly; our ability

to offer, or continue to offer, securities to investors would be potentially hindered and the value of our securities might significantly

decline or be worthless, by existing or future laws and regulations relating to its business or industry or by intervene or interruption

by PRC governmental authorities, if we or our subsidiaries (i) do not receive or maintain such permissions or approvals, (ii) inadvertently

conclude that such permissions or approvals are not required, (iii) applicable laws, regulations, or interpretations change and we are

required to obtain such permissions or approvals in the future, or (iv) any intervention or interruption by PRC governmental with little

advance notice.

Please

see “Risk Factors” beginning on page 15 of this annual report for additional information.

Holding

Foreign Company Accountable Act

Our

common stock may be delisted from the Nasdaq under the Holding Foreign Companies Accountable Act (“HFCAA”), if the PCAOB

is unable to adequately inspect audit documentation located in China, or investigate our auditor. Furthermore, on June 22, 2021, the

U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which was signed into law, and amends the HFCAA and requires

the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to Public Company

Accounting Oversight Board (“PCAOB”) inspections for two consecutive years instead of three. Our auditor, Audit Alliance

LLP, the independent registered public accounting firm that issues the audit report included elsewhere in this annual report, is headquartered

in Singapore and is registered with the PCAOB, and was not included in the list of PCAOB Identified Firms in the PCAOB Determination

Report issued in December 2021. On August 26, 2022, the PCAOB signed the Protocol with the CSRC and the MOF of the People’s Republic

of China, governing inspections and investigations of audit firms based in mainland China and Hong Kong. The Protocol remains unpublished

and is subject to further explanation and implementation. Pursuant to the fact sheet with respect to the Protocol disclosed by the SEC,

the PCAOB shall have independent discretion to select any issuer audits for inspection or investigation and the unfettered ability to

transfer information to the SEC. On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and

investigate PCAOB-registered public accounting firms headquartered in China mainland and Hong Kong completely in 2022. The PCAOB Board

vacated its previous 2021 determinations that the PCAOB was unable to inspect or investigate completely registered public accounting

firms headquartered in China mainland and Hong Kong. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections

of PCAOB-registered public accounting firms headquartered in China mainland and Hong Kong is subject to uncertainty and depends on a

number of factors out of our, and our auditor’s control. The PCAOB is continuing to demand complete access in China mainland and

Hong Kong moving forward and is already making plans to resume regular inspections in early 2023 and beyond, as well as to continue pursuing

ongoing investigations and initiate new investigations as needed. The PCAOB has indicated that it will act immediately to consider the

need to issue new determinations with the HFCAA if needed. Therefore, the PCAOB in the future may determine that it is unable to inspect

or investigate completely registered public accounting firms in mainland China and Hong Kong. Our auditor’s working papers related

to us and our subsidiaries are located in China. If our auditor is not permitted to provide requested audit work papers located in China

to the PCAOB, investors would be deprived of the benefits of PCAOB’s oversight of our auditor through such inspections which could

result in limitation or restriction to our access to the U.S. capital markets and trading of our securities may be prohibited under the

HFCAA, which would result in the delisting of our securities from the Nasdaq. See “Risk Factors - Our common stock may be delisted

from the Nasdaq under the Holding Foreign Companies Accountable Act if the PCAOB is unable to adequately inspect audit documentation

located in China. The delisting of our common stock, or the threat of their being delisted, may materially and adversely affect the value

of your investment.”

Recent

Developments

We are currently exploring new business opportunities while continuing

to provide freight logistics services. On September 19, 2023, the Company formed a 100% owned subsidiary, New Energy Tech Limited, . (“New

Energy”) in New York for to engage in the commodity trading business . In August 2024, New Energy entered into a joint venture development

agreement with Market One Services Corp., a Wyoming corporation, to establish a joint venture to carry out the commodity trading business.

The parties also plan to expand into the sale of solar panels

The Company decided to develop the solar panel business based on its

insight into the broad prospects of new energy. In the decision-making process, the needs of environmental protection and market potential

were fully considered. This new solar panel business complements our existing businesses and will expand the company’s sustainable

development.

Special

Committee Investigation

As

previously disclosed, on May 6, 2022, the Board of Directors of the Company (the “Board”) formed a special committee (the

“Special Committee”) to investigate claims of alleged fraud, misrepresentation, and inadequate disclosure related to the

Company and certain of its management personnel raised in a report, published by Hindenburg Research on May 4, 2022 (the “Hindenburg

Report”). On February 23, 2023, the Board approved the dissolution of the Special Committee upon conclusion of the committee’s

investigation. On July 3, 2023, the Company entered into settlement and release agreement with Mr. Yang Jie, the Company’s former

CEO, which fully resolved his claims against the Company.

Executive

Changes

On

July 3, 2023, Mr. Tieliang Liu resigned as a director the Company and a member of the Compensation Committee, the Audit Committee, and

the Nominating and Corporate Governance Committee.

On

July 10, 2023, Company terminated the employment of its Chief Operating Officer, Jing Shan, with cause. The termination was effective

immediately.

On

July 31, 2023, the Company elected Mr. Zhongliang Xie as a Class II independent director to serve until the annual meeting of stockholders

for the fiscal year 2023, to fill the vacancy on the Board resulting from the resignation of Mr. Tieliang Liu. The Board appointed Mr.

Xie to serve as Chair of the Audit Committee, a member of the Compensation Committee and a member of the Nominating and Corporate Governance

Committee.

On

September 21, 2023, Mr. Heng Wang resigned as a director of the Company and a member of the Compensation Committee, the Audit Committee,

and the Nominating and Corporate Governance Committee.

On

September 25, 2023, the Company elected Mr. Xu Zhao as a Class I independent director to serve until the annual meeting of stockholders

for the fiscal year 2022, to fill the vacancy on the Board resulting from the resignation of Mr. Heng Wang. The Board appointed Mr. Zhao

to serve as a member of the Audit Committee, a member of the Compensation Committee and Chair of the Nominating and Corporate Governance

Committee.

On

September 28, 2023, Ms. Ling Jiang resigned as a director of the Company and a member of the Compensation Committee, the Audit Committee,

and the Nominating and Corporate Governance Committee.

On

October 6, 2023, the Company elected Ms. Yangyang Xu as a Class III independent director to serve until the annual meeting of stockholders

for the fiscal year 2024, to fill the vacancy resulting from the resignation of Ms. Ling Jiang. The Board appointed Ms. Xu to serve as

Chairwoman of the Compensation Committee and as a member of the Audit Committee and the Nominating and Corporate Governance Committee.

On

July 31, 2024, Mr. Haotian Song resigned from his position as a vice president of the Company and as a director of the Board.

On

August 6, 2024, the Company appointed Ms. Jia Yang as a vice president of the Company and as a director of the Board to fill the vacancy

resulting from Mr. Haotian Song’s resignation.

Litigation

On

December 9, 2022, Piero Crivellaro, purportedly on behalf of the persons or entities who purchased or acquired publicly traded securities

of the Company between February 2021 and November 2022, filed a putative class action against the Company and other defendants in the

United States District Court for the Eastern District of New York (“EDNY”), alleging violations of federal securities laws

related to alleged false or misleading disclosures made by the Company in its public filings (the “SGLY Securities Class Action”).

The plaintiff seeks damages, plus interest, costs, fees, and attorneys’ fees. The Company filed a motion to dismiss on November

20, 2023, which is fully-briefed and awaiting the Court’s determination. As this action is still in the early stage, the Company

cannot predict the outcome.

On

July 13, 2023, SG Shipping & Risk Solution Inc. (“SG Shipping”), an indirect wholly owned subsidiary of the Company,

filed a complaint against Jing Shan, its former chief operating officer, accusing her of the unauthorized wire transfer of $3 million

to Goalowen (the “Conversion Lawsuit”). On March 23, 2023, Jing Shan allegedly signed, without Board’s due authorization,

an operating income right transfer contract with Goalowen Inc., pursuant to which Goalowen agreed to transfer its rights to receive income

from operating a tuna fishing vessel to SG Shipping for $3 million. Ms. Shan alleged made the unauthorized wire transfer of $3 million

to Goalowen on May 5, 2023. This lawsuit is filed with the EDNY. Ms. Shan moved to dismiss the case on March 19, 2024 and the decision

is currently pending with the court. Fact discovery is currently underway. The Company remains committed to pursuing its claims and seeks

damages.

On

August 23, 2023, Jing Shan commenced a lawsuit against the Company in the Richmond City Circuit Court of Virginia for unpaid salaries

and indemnification of her litigation costs defending herself in the SGLY Securities Class Action and the Conversion Lawsuit. The court

entered an order on May 3, 2024, granted Jing Shan’s request for payment of withheld wages through the time of her termination,

plus liquidated damages, and litigation costs in prosecuting the withheld wages. The court denied Jing Shan’s motion for expenses

incurred in other ligation, deferring those issues to resolution by trial. The Company has paid the past due wages and statutory liquidated

damages. Jing Shan filed a motion for rule to show cause on July 29, 2024, demanding payment of attorney’s fees of $36,523.21,

plus sanctions by the court for the Company’s failure to comply with the court’s order of payment.

On

October 23, 2023, the Company filed a complaint against its former CFO, Tuo Pan, accusing her of conversion due to her alleged involvement

in two unauthorized transfers from the Company, amounting to $219,000 and $7,920, respectively. The Company decided not to pursue this

matter any further and withdrew the complaint.

On

January 18, 2024, John Levy, a former board member of the Company, filed a claim in the EDNY for reimbursement and advancement of reasonable

legal fees, costs, and expenses incurred in connection with defending the action Crivellaro v. Singularity Future Technology Ltd.,

22-cv-7499-BMC, in which John Levy was named as an individual defendant. On a letter dated August 6, 2024, John Levy notified the court

that it would move for default judgement. The Company does not intend to defend its position.

In

February 2024, Zhikang Huang, a former employee of the Company filed a lawsuit against the Company in the Richmond City Circuit Court

of Virginia. In the complaint, Zhikang Huang alleges claims that the Company failed to compensate him for the severance payment of $300,000

contemplated in Section 6.3 of the Employee Agreement, his two months’ salary of $25,000 for the months of November and December

2023 and the incentive-based bonus to which he is entitled pursuant to paragraph 4.2 of the Employee Agreement. A hearing on plaintiff’s

motion to compel discovery was scheduled on August 26, 2024. The Company intends to defend its position.

Government

Investigations

Following

the publication of the Hindenburg Report, the Company received subpoenas from the United States Attorney’s Office for the Southern

District of New York and the United States Securities and Exchange Commission (the “SEC”). The Company cooperated with these

governmental authorities regarding these matters. The Company is not able to estimate the outcome or duration of the government investigations.

As of the date of this report, the Company has not received any updates.

On

February 28, 2023 , the audit committee of the Company, after discussion with the management of the Company, and in consultation with

the Company’s independent registered public accounting firm, concluded that the Company’s previously issued financial statements

for the fiscal year ended June 30, 2021 included in the Company’s Annual Report on Form 10-K filed with the SEC on November 29,

2021 (the “2021 Form 10-K”) should no longer be relied upon as a result of incorrect accounting treatment of approximately

$4.6 million of related party loan receivable. The audit committee also concluded that the financial statements for the quarters

ended September 30, 2021 and December 31, 2021 included in the Company’s Quarterly Reports on Form 10-Q (the “2021 Form 10-Qs,”

collectively with the 2021 Form 10-K, the “Affected Reports”), filed with the SEC on November 12, 2021 and February 14, 2022,

respectively, should no longer be relied upon as a result of incorrect recognition of revenue from freight shipping services in the amount

of $980,200 for the three months ended September 30, 2021 and six months ended December 31, 2021. The Company corrected the errors referenced

above in an amendment to (1) the 2021 Form 10-K (the “Amended Form 10-K”) and (2) each of the 2021 Form 10-Qs (the “Amended

Form 10-Qs,” collectively with the Amended Form 10-K, the “Restatements”).

On

June 17, 2024, the Company received a subpoena from the SEC requesting the production of certain documents related to an investigation

by the SEC regarding the Restatements (the “Investigation”). Because the Investigation is at an early stage, the Company

cannot predict its outcome, duration, or any potential consequences at this time. The SEC has not advised the Company that it has concluded

any legal violation has occurred, but any Investigation potentially could result in government enforcement actions and, to civil and/or

criminal sanctions under relevant laws. The Company intends to cooperate with the SEC with respect to the Investigation.

Nasdaq

Listing Deficiencies

On

July 7, 2023, the Company received an Notice of Noncompliance Letter (the “Letter”) from the Nasdaq Stock Market LLC (“Nasdaq”)

stating that the Company was not in compliance with Nasdaq Listing Rules due to its failure to timely hold an annual meeting of shareholders

for the fiscal year ended June 30, 2022, which is required to be held within twelve months of the Company’s fiscal year end under

Nasdaq Listing Rule 5620(a) and 5810(c)(2)(G). The Letter also states that the Company has 45 calendar days to submit a plan to regain

compliance and if Nasdaq accepts the Plan, it can grant the Company an exception of up to 180 calendar days from the fiscal year end,

or until December 27, 2023, to regain compliance. The Company complied with the Nasdaq requirement that the Plan be submitted no later

than August 21, 2023. On October 19, 2023, the Company received a formal notification from the Nasdaq confirming that the Company had

regained compliance with Listing Rule 5620(a), and that the matter is now closed.

On

July 13, 2023, the Company received a notice from Nasdaq stating that the Company no longer complies with Nasdaq’s independent

director and audit committee requirements under Nasdaq’s Listing Rule 5605 following the resignation of Mr. Liu from the Company’s

board of directors and audit committee effective July 3, 2023. Nasdaq advised the Company that in accordance with Nasdaq’s Listing

Rule 5605(c)(4), the Company has a cure period to regain compliance (1) until the earlier of the Company’s next annual shareholders’

meeting or July 3, 2024; or (2) if the next annual shareholders’ meeting is held before January 2, 2024, then the Company must

evidence compliance no later than January 2, 2024. In response to this notice, on July 31, 2023, the Company elected Mr. Zhongliang Xie

as a Class II independent director to serve until the annual meeting of stockholders for the fiscal year 2023, to fill the vacancy on

the Board resulting from the resignation of Mr. Liu. The Board appointed Mr. Xie to serve as Chair of the Audit Committee, a member of

the Compensation Committee and a member of the Nominating and Corporate Governance Committee.

On

July 13, 2023, the Company received a notice from Nasdaq stating that the Company failed to regain compliance with respect to the minimum

$1 bid price per share requirement under Nasdaq Listing Rules during the 180 calendar days given by Nasdaq for the Company to regain

compliance, which ended on July 5, 2023. However, Nasdaq has determined that the Company is eligible for an additional 180 calendar day

period, or until January 2, 2024, to regain compliance. On January 3, 2024, the Company received a notification from Nasdaq, notifying

the Company of the determination to delist the Company’s securities from Nasdaq because of the Company’s failure to regain

compliance with the $1 per share bid price requirement required for continued listing on the Nasdaq as set forth in Listing Rule 5550(a)(2).

On March 12, 2024, the Company received a formal notification from Nasdaq confirming that the Company had regained compliance with bid

price requirement required for continued listing on the Nasdaq as set forth in Listing Rule 5550(a)(2).

Corporate

History and Our Business Segments

From

inception in 2001 to our fiscal year ended June 30, 2013, our sole business was providing shipping agency services. In general, we provided

two types of shipping agency services: loading/discharging services and protective agency services, in which we acted as a general agent

to provide value added solutions to our customers. For loading/discharging agency services, we received the total payment from our customers

in U.S. dollars and paid the port charges on behalf of our customers in RMB. For protective agency services, we charged a fixed amount

as agent fee while customers were responsible for the payment of port costs and expenses.

Later,

we expanded our business to include freight logistics services to provide import security filing services with the U.S. Customs and Department

of Homeland Security, on behalf of importers who ship goods into the U.S. and also provided inland transportation services to these importers

in the U.S. We also expanded into container trucking services as new business sectors to provide related transportation logistics services

to customers in the U.S. and in China. We shift our focus back to the shipping agency business around 2019.

In

2021, the Company set up a joint venture in Texas, Brilliant Warehouse Service Inc., to support its freight logistics services in the

U.S., and a new subsidiary, Gorgeous Trading Ltd., which mainly engages in smart warehouse and related business in Texas.

On

December 31, 2021, the Company terminated its variable interest entity (“VIE”) structure and deconsolidated its formerly

controlled entity Sino-Global Shipping Agency Ltd. (“Sino-China”). The Company controlled Sino-China through its wholly owned

subsidiary Trans Pacific Shipping Limited. The Company dissolved the VIE structure, Sino-China and its subsidiary Sino-Global Shipping

LA, Inc.

From

2021 to 2022, the Company engaged in cryptocurrency mining in China for a brief period of time but ceased such business in 2022 due to

restrictions and bans on crypto mining operations in China. Thor Miner Inc., a Delaware subsidiary of the Company that engaged in technical

development and commercialization of a bitcoin mining machine, was dissolved on February 14, 2024. The Company does not plan to

pursue bitcoin mining business at this moment.

The

following subsidiaries or joint ventures have no operations as of the date of this report: LSM Trading Ltd., Singularity (Shenzhen) Technology

Ltd., Phi Electric Motor, Inc. in New York, SG Shipping & Risk Solution Inc., in New York and SG Link LLC in New York.

Our

subsidiary, Ningbo Saimeinuo Web Technology Ltd., which primarily engaged in transportation management and freight logistics services,

including overseas shipping, was dissolved on October 24, 2023. Our subsidiary, Blumargo IT Solution Ltd., was dissolved on April 17,

2024.

On September 19, 2023, the Company formed a 100% owned subsidiary,

New Energy Tech Limited. (“New Energy”) in New York to engage in the commodity trading business . In August 2024, New Energy

entered into a joint venture development agreement with Market One Services Corp., a Wyoming corporation, to establish a joint venture

to carry out the commodity trading business. The parties also plan to expand into the sale of solar panels.

Our

Strategy

Our

strategy is to:

| ● | Provide

better solutions for issues and challenges faced by the entire shipping and freight logistics chain to better serve our customers and

explore additional growth avenues. |

| ● | Diversify

our current service offerings organically or through acquisitions and/or strategic alliance; continue to grow our business in the U.S.

market; |

| ● | Continue

to streamline our business practice, optimize our cost structure and improve our operating efficiency through effective planning, budgeting,

execution and cost control and strengthening our IT infrastructure; |

| ● | Continue

to reduce our dependency on our legacy business and few key customers; |

| ● | Continue

to monetize our relationships with our strategic partners and leverage their support and our innovation to expand our business; |

Continue

to explore cutting-edge technologies in new energy, such as the development of high-efficiency solar panel materials and innovative waste

recycling processes, and actively acquire small new energy companies with potential to rapidly expand our business footprint;

Use

vivid cases and data to showcase the company’s outstanding achievements in the field of new energy and attract public attention, and

organize new energy science activities to enhance brand reputation and social responsibility; and

Develop customized sales plans

for different customer groups and cooperate with financial institutions to launch new energy project financing services to reduce customer

costs and promote sales growth.

Our Goals

and Strategic Plan

By

leveraging our extensive business relationships, technical ability and in-depth knowledge of the shipping industry, our goal is to further

strengthen our position as a leading global logistics solution provider who offers innovative resolutions to better address complex issues

in different aspects in the entire shipping and freight logistics chain.

Meanwhile,

we plan to build a solar energy production facility in the United States. The Company actively seeks cooperation with multiple parties.

It plans to jointly develop new energy technologies with scientific research institutions to enhance its strength, to cooperate with

solar energy companies to establish recycling channels, to join hands with environmental protection organizations to promote concepts,

and to cooperate with the government to participate in projects and obtain support.

Our Customers

Our

main customers for the fiscal years ended June 30, 2024 and 2023 are Chongqing Iron & Steel Ltd.

and SOSNY. For the years ended June 30, 2024 and 2023, Chongqing Iron

& Steel Ltd. accounted for 77.2% and 52.7% of the Company’s revenues, respectively. For the years ended June 30, 2024

and 2023, SOSNY accounted for nil and 16.1% of the Company’s gross revenue.

Our

Suppliers

Our

operations consist of working directly with our customers to understand in detail their needs and expectations and then managing local

suppliers to ensure that our customers’ needs are met. For the year ended June 30, 2024, two suppliers accounted for approximately

21.2% and 20.1% of our total purchases, respectively. For the year ended June 30, 2023, two suppliers accounted for approximately 19.6%

and 19.5% of our total purchases, respectively.

Our

Strengths

We

believe that the following strengths differentiate us from our competitors:

| ● | Proven

industry experience and problem-solving reputation. We are a non-asset based global shipping and freight logistics solution provider.

We provide tailored solutions and value-added services to our customers to drive effectiveness and control in related aspects throughout

the entire shipping and freight logistic chain. We believe that our years of successful track record of applying integrated solutions

to complex issues in the global shipping logistics business gives us a competitive advantage in attracting large clients and helps us

maintain strong long terms business relationship with them. |

| ● | A

competent professional team. Most of our employees have marine business experience, and many of our managers/chief operators served

in other large Chinese shipping companies prior to joining us. With these professionals and experienced staff, we believe that we provide

the best services to our customers at competitive prices. |

| ● | Extensive

network and positive industry recognition. Doing business in China often requires a strong business network and support of key strategic

partners. The Company served as one of the executive directors of China Association of Shipping Agencies & Non-Vessel-Operating Common

Carriers (CASA), the authoritative industry association in China. We are the only non-state-owned enterprise represented on the CASA

board guiding the development of the industry. Our good reputation and industry recognition enables us to maintain strong relationships

with our business partners and have an extensive network of contacts throughout the industry, which helps us gain necessary support to

execute our business plans. |

| ● | Lean

organization and a flexible business model. Although we are a small business with limited resources, we have a cohesive and effective

organizational structure with the goal of maximizing customer value while minimizing waste. Our unique flexible business model allows

us to quickly respond to changing market demand and offer our customers innovative problem-solving solutions, quality customer service,

and competitive prices to achieve greater market acceptance and gain additional market share. |

| ● | U.S.-registered

and NASDAQ-listed public company. We believe our status as a U.S. corporation gives us more credibility among existing and potential

customers, suppliers, and other business partners than a privately owned company would have in our industry. Our ability to raise capital

through the capital market or use our common stock as “currency” to facility potential merger and acquisition transactions

can also help us carry out or accelerate our growth strategies. |

Our

Opportunities

For

more than thirty years, the shipping and freight logistics industry has been operated under traditional business models without meaningful

change. Many of these business practices are inefficient and problematic; therefore, maintaining an innovative mindset is critical to

achieving continuous business success and growth. We are a value-added logistics solution provider with successful past performance and

individuals that have been in the industry for a long time. Instead of playing the traditional logistics broker role, we focus on providing

technology solutions and innovative leading-edge services to bridge the asset-based world with the digital world. We shape our industry

practice and profit model by analyzing wider developments both in the global markets and the technology industry so we can address unique

problems that are currently pervasive across the shipping and freight logistics industry.

We

believe we can capture the business opportunity and grow our business organically or through acquisitions or strategic alliance by:

| ● | Continuing

to streamline our business operations and improve our operating efficiency through innovative technology, effective planning, budgeting,

execution and cost control; |

| ● | Diversifying

our business to focus on providing innovative technology based solution to our customers to promote our sustainable business growth; |

The

current market of China’s shipping agency industry is mature comparing to what it was ten years ago when the shipping agency industry

was fueled by the massive construction of China’s infrastructure, yet the over-supply of shipping agencies has also shrunk the

profits of the industry. Many shipping agencies were constrained by the small size and the limited services. We have the professionalism

and are the pioneers and leaders in the shipping agency industry in China. We maintain strong relationships with customers and market

resources. The current shipping agency market is more competitive yet enable companies like us who has better resources in this market

niche to expand.

In

terms of the new Solar Panel Business, the United States has a developed steel industry and has a certain demand for scrap steel. On

the one hand, domestic steel production in the United States consumes scrap steel, especially when iron ore prices fluctuate, steel mills

may increase the use of scrap steel to reduce costs; on the other hand, the demand for steel in the manufacturing industry and other

industries in the United States also indirectly drives the demand for scrap steel. For example, the construction industry and the automobile

manufacturing industry are all large consumers of steel, and the development of these industries will increase the demand for scrap steel.

It

is estimated that North America has installed more than 80 GW of solar power, a figure that could grow to more than 400 GW by 2030. Bloomberg

News estimates that about 26,000 tons of photovoltaic panels were wasted in 2020, and as photovoltaic panels reach the end of their life

in the 2030s, the amount of waste will grow to millions of tons. The solar recycling business market is a rapidly emerging but still

developing field. As the global solar industry booms, a large number of photovoltaic modules will reach the end of their life and face

retirement in the next few years. This brings both environmental challenges and huge market opportunities.

Our

Challenges

We

face significant challenges when executing our strategy, including:

| ● | Given

the complexity and length of restructuring our business, we face the challenge of generating sufficient cash from our current business

activities to support our daily operations during the transition; |

| ● | We

may not be able to establish a separate department to solve critical issues in today’s shipping logistics industry; |

| ● | We

may not be able to manage our growth when we form more joint ventures for our shipping agency business as we need to better our standard

operating and control procedures which may pose more challenges to our management. |

| ● | We

may not have or not be able to get the necessary funds to continue to expand our service and market our services successfully; |

| ● | Our

ability to respond to increasing competitive pressure on our growth and margins; |

| ● | Our

ability to gain further expertise and to serve new customers in new service areas; |

| ● | From

time to time, we may have difficulty carrying out services effectively and in a profitable way due to the cyclical nature of the shipping

industry, which could lead to a prolonged period of sluggish demand for our services; |

| ● | Our

ability to respond promptly to a changing regulatory environment, macroeconomic conditions, industry trends, and competitive landscape;

and |

| ● | Developing

a winning business model takes time and a new business model may not be recognized by the market immediately. As a publicly traded company,

management may be forced to fulfill near-term performance goals that may not be consistent with the Company’s long-term vision. |

Our

Competition

The

market segment that we now operate in, which is freight logistics services including warehouse services, does not have high entry barriers.

In terms of our competition in China, there are many companies ranging from small to large that provide freight logistics services, and

the state-owned companies in China generate a significant portion of the revenues in the industry. Our primary competitors in China are

the China branches of international shipping companies or their exclusive agents in China. These companies include Evergreen Marine Corp.,

Orient Overseas Container Line, Ocean Network Express which includes Kawasaki Kisen Kaisha, Ltd, Mitsui O.S.K. Lines and Nippon Yusen

Kabushiki Kaisha. The competition is intense due to the significant excess capacity. These companies have greater service capabilities,

a larger customer base and more financial, marketing, network and human resources than we do. Most of them engage in a wide range of

businesses and involve many aspects of the industry chain. However, we focus on providing tailored solutions and value-added services

to customers in freight logistic services. As a boutique company with limited resources and history, we face intense competition. Our

ability to grow in our industry depends on (1) our deep understanding of the complexity of industry issues and challenges and (2) our

ability to develop optimal solutions to respond to the identified issues and provide effective problem-solving strategies to our targeted

customers.

In

terms of our competition in the United States, the freight logistics services industry is well developed, highly fragmented, and competition

is fierce nationwide. Our primary competitors in the U.S. are local warehouse services providers and freight forwarding companies in

Houston, for example, Bizto LLC, Golden Eagle Guns LLC, and Smart Supply Chain. Competition in the freight logistics services industry

is driven by factors such as price, service quality, technology, and geographic reach. Companies that can offer a combination of these

factors are often more competitive in the market. Additionally, companies that can adapt to changing customer demands and market trends,

such as the shift towards e-commerce, are likely to be more successful in the long term. We aim at providing tailored and valued-added

services for our international clients with needs for U.S. domestic logistics services.

Employees

As

of the date of this Report, we have 15 full-time employees, 10 of whom are based in China and 5 are based in the United States. Of the

total full-time employees, 6 are in management, 6 are in operations, 4 are in finance and accounting related and 1 are in administration

and technical support. We believe that our relationship with our employees is good. We have never had a work stoppage, and our employees

are not subject to a collective bargaining agreement.

Intellectual

Property

As

of the date of this Report, we do not have any registered patents, copyrights, or trademarks. We have seven registered domain names,

including our corporate website https://www.singularity.us/.

Item

1A. Risk Factors.

As

a smaller reporting company, we are not required to include risk factors in this Report. However, below are a number of material risks,

uncertainties and other factors that could have a material effect on the Company and its operations as a result of recent developments.

You should carefully consider the risks described below before purchasing our common stock. The risks highlighted here are not the only

ones that we may face. For example, additional risks presently unknown to us or that we currently consider immaterial or unlikely to

occur could also impair our operations. If any of the risks or uncertainties described below or any such additional risks and uncertainties

actually occur, our business, prospects, financial condition, or results of operations could be negatively affected, and you might lose

all or part of your investment.

We

are, and may continue to be, subject to litigation including individual and class action lawsuits, as well as investigations and enforcement

actions by regulators and governmental authorities. These matters are often expensive and time consuming, and, if resolved adversely,

could harm our business, financial condition, and operating results.

As

discussed in “Item 1. Business - Recent Developments,” we are, and from time to time may become, subject to litigation and

various legal proceedings, including litigation and proceedings related to stockholder derivative suits, class action lawsuits and other

matters, that involve claims for substantial amounts of money or for other relief or that might necessitate changes to our business or

operations. In addition to this, we have been, currently are, and may from time to time become subject to, government and regulatory

investigations, inquiries, actions or requests, other proceedings and enforcement actions alleging violations of laws, rules, and regulations,

both foreign and domestic. The defense of these actions may be both time consuming and expensive. We evaluate these litigation claims

and legal proceedings to assess the likelihood of unfavorable outcomes and to estimate, if possible, the monetary amount of potential

losses. Based on these assessments and estimates, we may establish reserves and/or disclose the relevant litigation claims or legal proceedings,

as and when required or appropriate. These assessments and estimates are based on information available to management at the time of

such assessment or estimation and involve a significant amount of judgment. As a result, actual outcomes or losses could differ materially

from those envisioned by our current assessments and estimates. Our failure to successfully defend or settle any of these litigations

or legal proceedings could result in liability that, to the extent not covered by our insurance, could have an adverse effect on our

business, financial condition and results of operations.

The

scope, determination, and impact of claims, lawsuits, government and regulatory investigations, enforcement actions, disputes, and proceedings

to which we are subject cannot be predicted with certainty, and may result in:

| |

● |

substantial

payments to satisfy judgments, fines, or penalties; |

| |

|

|

| |

● |

substantial

outside counsel, advisor, and consultant fees and costs; |

| |

|

|

| |

● |

substantial

administrative costs, including arbitration fees; |

| |

|

|

| |

● |

loss

of productivity and high demands on employee time; |

| |

|

|

| |

● |

criminal

sanctions or consent decrees; |

| |

|

|

| |

● |

termination

of certain employees, including members of our executive team; |

| |

|

|

| |

● |

barring

of certain employees from participating in our business in whole or in part; |

| |

|

|

| |

● |

orders

that restrict our business or prevent us from offering certain products or services; |

| |

|

|

| |

● |

changes

to our business model and practices |

| |

|

|

| |

● |

delays

to planned transactions, service launches or improvements; and |

| |

|

|

| |

● |

damage

to our brand and reputation. |

We

are, and may continue to be, subject to securities litigation, which is expensive and could divert management attention, cause harm to

our reputation and result in significant damages for which we could be responsible.

We

are subject to securities class action litigation, which is expensive, could divert our management’s attention, harm our reputation,

and leave us liable for substantial damages. For example, as discussed in “Item 1. Business - Recent Developments,” on December

9, 2022, Piero Crivellaro, purportedly on behalf of the persons or entities who purchased or acquired publicly traded securities of the

Company between February 2021 and November 2022, filed a putative class action against the Company, certain of our officers and directors,

and other defendants in the United States District Court for the Eastern District of New York, alleging violations of federal securities

laws related to alleged false or misleading disclosures made by the Company in its public filings. The plaintiff seeks unspecified damages,