SHF Holdings, Inc., d/b/a/ Safe Harbor Financial (“Safe

Harbor” or the “Company”) (NASDAQ: SHFS), a leader in

facilitating financial services and credit facilities to the

regulated cannabis industry, announced today its financial results

for the first quarter ended March 31, 2024.

First Quarter 2024 Financial & Operational

Summary

- Net Income increased 245% to

approximately $2.0 million, compared to a net loss of approximately

$1.4 million in the same period of 2023;

- Revenue was approximately $4.1

million, compared to approximately $4.2 million for the first

quarter of 2023;

- Gross profit was approximately

$325,000, versus a gross loss of approximately $1.6 million in the

first quarter of 2024;

- Operating Expenses decreased 35.8%

to $3.7 million, compared to $5.8 million in the first quarter of

2023;

- Adjusted EBITDA increased 165.3% to

approximately $1.1 million, compared to $410,000 for the first

quarter of 2023(1).

(1) Adjusted EBITDA is a non-GAAP financial

metric. A reconciliation of non-GAAP to GAAP measures is included

below in this earnings release.

“We continued to expand the breadth of our

service offering in the first quarter, advancing several strategic

initiatives and establishing a more diversified income base,” said

Sundie Seefried, Chief Executive Officer of Safe Harbor Financial.

“We have been very successful with this effort, specifically within

our lending program, nearly tripling our loan book year-over-year

and driving a 251% increase in our loan income to $1.64 million in

the first quarter of 2024 compared to $466,293 in the comparable

period of 2023.”

“These results speak directly to our unique

ability to support the unmet financial needs of the cannabis

industry, and the continued growth opportunity for Safe Harbor to

address the evolving financial requirements of cannabis related

businesses (CRB’s) through our streamlined platform. With the

increasing likelihood that cannabis will be reclassified from a

Schedule I drug to a Schedule III drug, we believe there will be a

material increase of capital from these businesses moved into

financial institutions, thereby creating stronger demand for our

services,” concluded Seefried.

First Quarter 2024 Operational Highlights

- On January 4, 2024, the Company

announced it originated a $9 Million first lien secured loan for a

major, MSO-operated cultivation facility in Denver, Colorado.

- On March 12, 2024, Safe Harbor

announced it originated a $4.6 Million secured credit facility for

a Michigan cannabis operator.

Other Significant Events

- On April 15th, 2024, the Company

appointed CEO, Sundie Seefried to its Board of Directors.

First Quarter 2024 Financial

Results

For the first quarter ended March 31, 2024,

total revenue decreased 3% to $4.1 million, compared to $4.2

million in the prior year period, due to fewer accounts and lower

balances on deposit versus the prior year period.

First quarter 2024 net income was approximately

$2.0 million, compared to a net loss of $1.4 million in the prior

year period. The driver of the net income produced in the first

quarter 2024 was due to lower expenses across the Company. Overall,

operating expenses in the period decreased approximately 35.8% to

$3.7 million, compared to $5.8 million in the prior year

period.

As of March 31, 2024, the Company had cash and

cash equivalents of $5.6 million, compared to $4.9 million at

December 31, 2023.

For more information on the Company’s first

quarter 2024 financial results, please refer to our Form 10-Q for

the quarter ended March 31, 2024 filed with the U.S. Securities

& Exchange Commission (the “SEC”) and accessible at

www.sec.gov.

|

|

|

SHF Holdings, Inc.CONDENSED CONSOLIDATED

BALANCE SHEETS |

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024(Unaudited) |

|

|

December 31, 2023 |

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Current

Assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

5,626,362 |

|

|

$ |

4,888,769 |

|

|

Accounts receivable – trade |

|

|

153,208 |

|

|

|

121,875 |

|

|

Accounts receivable – related party |

|

|

1,111,390 |

|

|

|

2,095,320 |

|

|

Prepaid expenses – current portion |

|

|

506,634 |

|

|

|

546,437 |

|

|

Accrued interest receivable |

|

|

16,891 |

|

|

|

13,780 |

|

|

Short-term loans receivable, net |

|

|

12,620 |

|

|

|

12,391 |

|

|

Other current assets |

|

|

- |

|

|

|

82,657 |

|

| Total Current

Assets |

|

$ |

7,427,105 |

|

|

$ |

7,761,229 |

|

|

Long-term loans receivable, net |

|

|

379,863 |

|

|

|

381,463 |

|

|

Property, plant and equipment, net |

|

|

45,366 |

|

|

|

84,220 |

|

|

Operating lease right to use assets |

|

|

820,777 |

|

|

|

859,861 |

|

|

Goodwill |

|

|

6,058,000 |

|

|

|

6,058,000 |

|

|

Intangible assets, net |

|

|

3,564,890 |

|

|

|

3,721,745 |

|

|

Deferred tax asset |

|

|

44,278,374 |

|

|

|

43,829,019 |

|

|

Prepaid expenses – long term position |

|

|

525,000 |

|

|

|

562,500 |

|

|

Forward purchase receivable |

|

|

4,584,221 |

|

|

|

4,584,221 |

|

|

Security deposit |

|

|

18,875 |

|

|

|

18,651 |

|

| Total

Assets |

|

$ |

67,702,471 |

|

|

$ |

67,860,909 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current

Liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

179,242 |

|

|

$ |

217,392 |

|

|

Accounts payable-related party |

|

|

125,693 |

|

|

|

577,315 |

|

|

Accrued expenses |

|

|

645,635 |

|

|

|

1,008,987 |

|

|

Contract liabilities |

|

|

2,692 |

|

|

|

21,922 |

|

|

Lease liabilities – current |

|

|

142,863 |

|

|

|

132,546 |

|

|

Senior secured promissory note – current portion |

|

|

3,028,738 |

|

|

|

3,006,991 |

|

|

Deferred consideration – current portion |

|

|

2,921,257 |

|

|

|

2,889,792 |

|

|

Other current liabilities |

|

|

62,160 |

|

|

|

41,639 |

|

| Total Current

Liabilities |

|

$ |

7,108,280 |

|

|

$ |

7,896,584 |

|

|

Warrant liabilities |

|

|

2,908,642 |

|

|

|

4,164,129 |

|

|

Deferred consideration – long term portion |

|

|

594,000 |

|

|

|

810,000 |

|

|

Forward purchase derivative liability |

|

|

7,309,580 |

|

|

|

7,309,580 |

|

|

Senior secured promissory note—long term portion |

|

|

10,241,884 |

|

|

|

11,004,175 |

|

|

Net deferred indemnified loan origination fees |

|

|

421,907 |

|

|

|

63,275 |

|

|

Lease liabilities – long term |

|

|

835,598 |

|

|

|

875,447 |

|

|

Indemnity liability |

|

|

1,315,263 |

|

|

|

1,382,408 |

|

| Total

Liabilities |

|

$ |

30,735,154 |

|

|

$ |

33,505,598 |

|

| Commitment and

Contingencies (Note 13) |

|

|

|

|

|

|

|

|

| Stockholders’

Equity |

|

|

|

|

|

|

|

|

| Convertible preferred stock,

$.0001 par value, 1,250,000 shares authorized, 111 and 1,101 shares

issued and outstanding on March 31, 2024, and December 31, 2023,

respectively |

|

|

- |

|

|

|

- |

|

| Class A common stock, $.0001

par value, 130,000,000 shares authorized, 55,431,001 and 54,563,372

issued and outstanding on March 31, 2024, and December 31, 2023,

respectively |

|

|

5,545 |

|

|

|

5,458 |

|

| Additional paid in

capital |

|

|

107,348,166 |

|

|

|

105,919,674 |

|

| Retained deficit |

|

|

(70,386,394 |

) |

|

|

(71,569,821 |

) |

| Total Stockholders’

Equity |

|

$ |

36,967,317 |

|

|

$ |

34,355,311 |

|

| Total Liabilities and

Stockholders’ Equity |

|

$ |

67,702,471 |

|

|

$ |

67,860,909 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

SHF Holdings, Inc.CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS(Unaudited) |

|

|

|

|

|

|

|

|

For the three months endedMarch

31, |

|

|

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

Revenue |

|

$ |

4,050,799 |

|

|

$ |

4,180,379 |

|

| |

|

|

|

|

|

|

|

|

| Operating Expenses |

|

|

|

|

|

|

|

|

|

Compensation and employee benefits |

|

$ |

2,280,038 |

|

|

$ |

3,659,520 |

|

|

General and administrative expenses |

|

|

984,220 |

|

|

|

1,538,874 |

|

|

Professional services |

|

|

460,950 |

|

|

|

449,246 |

|

|

Rent expense |

|

|

69,437 |

|

|

|

87,742 |

|

|

Provision (benefit) for credit losses |

|

|

(68,787 |

) |

|

|

66,666 |

|

|

Total operating expenses |

|

$ |

3,725,858 |

|

|

$ |

5,802,048 |

|

| Operating income/ (loss) |

|

|

324,941 |

|

|

|

(1,621,669 |

) |

| Other (income) expenses |

|

|

|

|

|

|

|

|

|

Change in the fair value of deferred consideration |

|

|

(184,535 |

) |

|

|

190,943 |

|

|

Interest expense |

|

|

154,172 |

|

|

|

643,260 |

|

|

Change in fair value of warrant liabilities |

|

|

(1,255,487 |

) |

|

|

(433,148 |

) |

| Total other (income)/

expenses |

|

$ |

(1,285,850 |

) |

|

$ |

401,055 |

|

| Net income/ (loss) before

income tax |

|

|

1,610,791 |

|

|

|

(2,022,724 |

) |

| Income tax benefit |

|

$ |

438,885 |

|

|

$ |

609,277 |

|

| Net income/ (loss) |

|

|

2,049,676 |

|

|

|

(1,413,447 |

) |

| Weighted average shares

outstanding, basic |

|

|

55,213,609 |

|

|

|

25,670,730 |

|

| Basic net income/ (loss) per

share |

|

$ |

0.04 |

|

|

$ |

(0.06 |

) |

| Weighted average shares

outstanding, diluted |

|

|

56,268,075 |

|

|

|

25,670,730 |

|

| Diluted income/ (loss) per

share |

|

$ |

0.04 |

|

|

$ |

(0.06 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

SHF Holdings, Inc.Condensed Consolidated

Statements of Stockholders’

Equity(Unaudited) |

|

|

|

FOR THE THREE MONTHS ENDED MARCH 31, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock |

|

|

Class ACommon Stock |

|

|

AdditionalPaid-in |

|

|

Retained |

|

|

Total Shareholders’ |

|

|

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Earnings |

|

|

Equity |

|

|

Balance, December 31, 2023 |

|

|

1,101 |

|

|

$ |

- |

|

|

|

54,563,372 |

|

|

$ |

5,458 |

|

|

$ |

105,919,674 |

|

|

$ |

(71,569,821 |

) |

|

$ |

34,355,311 |

|

| Conversion of PIPE shares |

|

|

(990 |

) |

|

|

- |

|

|

|

792,000 |

|

|

|

79 |

|

|

|

866,170 |

|

|

|

(866,249 |

) |

|

|

- |

|

| Restricted stock units (net of

tax) |

|

|

- |

|

|

|

- |

|

|

|

75,629 |

|

|

|

8 |

|

|

|

(14,325 |

) |

|

|

- |

|

|

|

(14,317 |

) |

| Stock compensation cost |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

576,647 |

|

|

|

- |

|

|

|

576,647 |

|

| Net Income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2,049,676 |

|

|

|

2,049,676 |

|

| Balance, March 31, 2024 |

|

|

111 |

|

|

|

- |

|

|

|

55,431,001 |

|

|

|

5,545 |

|

|

|

107,348,166 |

|

|

|

(70,386,394 |

) |

|

|

36,967,317 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHF Holdings, Inc.Condensed Consolidated

Statements of Stockholders’

Equity(Unaudited) |

|

|

|

FOR THE THREE MONTHS ENDED MARCH 31, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock |

|

|

Class ACommon Stock |

|

|

AdditionalPaid-in |

|

|

Retained |

|

|

Total Shareholders’ |

|

|

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Earnings |

|

|

Equity |

|

|

Balance, December 31, 2022 |

|

|

14,616 |

|

|

$ |

1 |

|

|

|

23,732,889 |

|

|

$ |

2,374 |

|

|

$ |

44,806,031 |

|

|

$ |

(39,695,281 |

) |

|

$ |

5,113,125 |

|

| Cumulative effect from

adoption of CECL |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(581,321 |

) |

|

|

(581,321 |

) |

| Conversion of PIPE shares |

|

|

(3,720 |

) |

|

|

- |

|

|

|

4,726,200 |

|

|

|

473 |

|

|

|

5,004,727 |

|

|

|

(5,005,200 |

) |

|

|

- |

|

| Stock option conversion |

|

|

- |

|

|

|

- |

|

|

|

629,728 |

|

|

|

62 |

|

|

|

1,570,719 |

|

|

|

- |

|

|

|

1,570,781 |

|

| Issuance of shares to PCCU

(net of tax) |

|

|

- |

|

|

|

- |

|

|

|

11,200,000 |

|

|

|

1,120 |

|

|

|

38,405,288 |

|

|

|

- |

|

|

|

38,406,408 |

|

| Reversal of deferred

underwriting cost |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

900,500 |

|

|

|

- |

|

|

|

900,500 |

|

| Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,413,447 |

) |

|

|

(1,413,447 |

) |

| Balance, March 31, 2023 |

|

|

10,896 |

|

|

$ |

1 |

|

|

|

40,288,817 |

|

|

$ |

4,029 |

|

|

$ |

90,687,265 |

|

|

$ |

(46,695,249 |

) |

|

$ |

43,996,046 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

SHF Holdings, Inc.CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS(Unaudited) |

| |

|

|

|

| |

|

For the three months endedMarch

31, |

|

| |

|

2024 |

|

|

2023 |

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Net income/ (loss) |

|

$ |

2,049,676 |

|

|

$ |

(1,413,447 |

) |

| Adjustments to reconcile net

income/ (loss) to net cash provided by/ (used in) operating

activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization expense |

|

|

195,709 |

|

|

|

751,225 |

|

|

Stock compensation expense |

|

|

562,330 |

|

|

|

1,570,781 |

|

|

Amortization of deferred origination fees |

|

|

(27,970 |

) |

|

|

(14,104 |

) |

|

Interest expense |

|

|

- |

|

|

|

873,289 |

|

|

(Benefit)/ provision for credit losses |

|

|

(68,787 |

) |

|

|

66,666 |

|

|

Amortization of right of use assets |

|

|

9,552 |

|

|

|

17,762 |

|

|

Income tax benefit |

|

|

(438,885 |

) |

|

|

(609,277 |

) |

|

Change in the fair value of deferred consideration |

|

|

(184,535 |

) |

|

|

190,943 |

|

|

Change in fair value of warrant |

|

|

(1,255,487 |

) |

|

|

(433,148 |

) |

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable – Trade |

|

|

(31,333 |

) |

|

|

(30,716 |

) |

|

Accounts receivable – related party |

|

|

983,930 |

|

|

|

182,824 |

|

|

Contract assets |

|

|

- |

|

|

|

(13,019 |

) |

|

Prepaid expenses |

|

|

77,303 |

|

|

|

77,436 |

|

|

Accrued interest receivable |

|

|

(3,111 |

) |

|

|

(146,106 |

) |

|

Deferred underwriting payable |

|

|

- |

|

|

|

(550,000 |

) |

|

Other current assets |

|

|

82,657 |

|

|

|

150,817 |

|

|

Other current liabilities |

|

|

10,048 |

|

|

|

75,000 |

|

|

Accounts payable |

|

|

(38,153 |

) |

|

|

(533,945 |

) |

|

Accounts Payable – related party |

|

|

(451,622 |

) |

|

|

(65,288 |

) |

|

Accrued expenses |

|

|

(363,347 |

) |

|

|

(466,849 |

) |

|

Contract liabilities |

|

|

(19,230 |

) |

|

|

78,616 |

|

|

Net deferred indemnified loan origination fees |

|

|

386,602 |

|

|

|

8,500 |

|

|

Security deposit |

|

|

(224 |

) |

|

|

- |

|

|

Net cash provided by (used in) operating activities |

|

|

1,475,123 |

|

|

|

(232,040 |

) |

| CASH FLOWS PROVIDED BY

INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

- |

|

|

|

(548,671 |

) |

|

Net repayment of loans |

|

|

3,014 |

|

|

|

1,019,268 |

|

|

Net cash provided by investing activities |

|

|

3,014 |

|

|

|

470,597 |

|

| CASH FLOWS USED IN

FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Repayment of senior secured promissory note |

|

|

(740,544 |

) |

|

|

- |

|

|

Net cash used in financing activities |

|

|

(740,544 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Net increase in cash and cash

equivalents |

|

|

737,593 |

|

|

|

238,557 |

|

| Cash and cash equivalents –

beginning of period |

|

|

4,888,769 |

|

|

|

8,390,195 |

|

| Cash and cash equivalents –

end of period |

|

$ |

5,626,362 |

|

|

$ |

8,628,752 |

|

| Supplemental

disclosure of cash flow information |

|

|

|

|

|

|

|

|

| Interest paid |

|

$ |

156,414 |

|

|

$ |

- |

|

| Non-Cash

transactions: |

|

|

|

|

|

|

|

|

| Shares issued for the

settlement of PCCU debt obligation |

|

$ |

- |

|

|

$ |

38,406,408 |

|

| Cumulative effect from

adoption of CECL |

|

$ |

- |

|

|

$ |

581,321 |

|

| |

|

|

|

|

|

|

|

|

Reconciliation of Net income (loss) to

non-GAAP EBITDA and Adjusted

EBITDA(Unaudited)

Safe Harbor Financial discloses EBITDA and

Adjusted EBITDA, both of which are non-GAAP financial measures and

are calculated as net income before taxes and depreciation and

amortization expense in the case of EBITDA and further adjusted to

exclude non-cash, unusual and/or infrequent costs in the case of

Adjusted EBITDA. Management of the Company uses this information in

evaluating period over period performance because it believes that

EBITDA and Adjusted EBITDA present important metrics regarding the

Company’s ongoing operating performance. Investors should consider

non-GAAP financial measures only as a supplement to, not as a

substitute for or as superior to, measures of financial performance

prepared in accordance with GAAP.

A reconciliation of Net income (loss) to

non-GAAP EBITDA and Adjusted EBITDA is as follows:

|

|

|

Three Months Ended March 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

Net income/(loss) |

|

$ |

2,049,676 |

|

|

$ |

(1,413,447 |

) |

| Interest expense |

|

|

154,172 |

|

|

|

643,260 |

|

| Depreciation and

amortization |

|

|

195,709 |

|

|

|

396,314 |

|

| Taxes |

|

|

(438,885 |

) |

|

|

(609,277 |

) |

| EBITDA |

|

$ |

1,960,672 |

|

|

$ |

(983,150 |

) |

| |

|

|

|

|

|

|

|

|

| Other adjustments – |

|

|

|

|

|

|

|

|

|

(Benefit)/ Provision for credit losses |

|

|

(68,787 |

) |

|

|

66,666 |

|

|

Change in the fair value of warrants |

|

|

(1,255,487 |

) |

|

|

(433,148 |

) |

|

Change in the fair value of deferred consideration |

|

|

(184,535 |

) |

|

|

190,943 |

|

|

Stock based compensation |

|

|

612,124 |

|

|

|

1,570,782 |

|

|

Loan origination fees and costs |

|

|

23,373 |

|

|

|

(2,175 |

) |

| Adjusted EBITDA |

|

$ |

1,087,360 |

|

|

$ |

409,918 |

|

| |

|

|

|

|

|

|

|

|

For the quarter ending March 31, 2024, our

EBITDA income improved primarily as a result of lower General and

Administrative expenses and reduced stock-based compensation.

Additionally, the increase in adjusted EBITDA income during this

period was mainly attributed to the decrease in General and

Administrative expenses. This reduction was driven by lower

investment hosting fees, decreased amortization and depreciation

expenses, and reduced business insurance costs. Additionally, there

were decreases in compensation, employee benefits, marketing

expenses, and other insurance costs. These factors contributing to

our financial performance are further discussed in the “Discussion

of our Results of Operations” section below. Other adjustments

include estimated future credit losses not yet realized, including

amounts indemnified to PCCU for loans funded by them. The Company

had entered into a Commercial alliance agreement with PCCU,

pursuant to which the Company agreed to indemnify PCCU for claims

associated with CRB activities including any loan default related

losses for loans funded by PCCU. Deferred loan origination fees and

costs represent the change in net deferred loan origination fees

and costs. When included with a new loan origination, we receive an

upfront loan origination fee in conjunction with new loans funded

by our financial institution partners and incur costs associated

with originating a specific loan. For accounting purposes, the cash

received for loan origination fees and costs is initially deferred

and recognized as interest income utilizing the interest

method.

Conference Call Details:

The Company’s Chief Executive

Officer, Sundie Seefried, and Chief Financial

Officer, Jim Dennedy, will host a conference call and

webcast at 4:30 pm ET / 1:30 pm PT on May 13,

2024, to discuss the Company's financial results and provide

investors with key business highlights.

For those interested in listening in to the

conference call, please dial in and ask to join the Safe Harbor

Financial call.

| |

|

|

Date: |

Monday, May 13, 2024 |

|

Time: |

4:30 p.m. ET / 1:30 p.m. PT |

|

Live webcast and replay: |

https://edge.media-server.com/mmc/p/q2tyra8n |

|

Participant Dial-In: |

646-307-1963 or 800-715-9871 (Toll Free) |

|

Passcode: |

9092789 |

| |

|

About Safe Harbor

Safe Harbor is among the first service providers

to offer compliance, monitoring and validation services to

financial institutions, providing traditional banking services to

cannabis, hemp, CBD, and ancillary operators, making communities

safer, driving growth in local economies, and fostering long-term

partnerships. Safe Harbor, through its financial institution

clients, implements high standards of accountability, transparency,

monitoring, reporting and risk mitigation measures while meeting

Bank Secrecy Act obligations in line with FinCEN guidance on

cannabis-related businesses. Over the past eight years, Safe Harbor

has facilitated more than $21 billion in deposit transactions for

businesses with operations spanning over 41 states and US

territories with regulated cannabis markets. For more information,

visit www.shfinancial.org.

Forward-Looking Statements

Certain statements contained in this press

release constitute "forward-looking statements'' within the meaning

of federal securities laws. Forward-looking statements may include,

but are not limited to, statements with respect to trends in the

cannabis industry, including proposed changes in U.S. and state

laws, rules, regulations and guidance relating to Safe Harbor's

services; Safe Harbor's growth prospects and Safe Harbor's market

size; Safe Harbor's projected financial and operational

performance, including relative to its competitors and loan

performance; new product and service offerings Safe Harbor may

introduce in the future; the impact of recent volatility in the

capital markets, which may adversely affect the price of the

Company's securities; Safe Harbor’s ability to make the same or

similar loans in the future; the outcome of any legal proceedings

that may be instituted against Safe Harbor; other statements

regarding Safe Harbor's expectations, hopes, beliefs, intentions or

strategies regarding the future; and the other risk factors

discussed in Safe Harbor's filings from time to time with the SEC.

In addition, any statements that refer to projections, forecasts or

other characterizations of future events or circumstances,

including any underlying assumptions, are forward-looking

statements. The words "anticipate," "believe," "continue," "could,"

"estimate," "expect," "intends," "outlook," "may," "might," "plan,"

"possible," "potential," "predict," "project," "should," "would,"

and similar expressions may identify forward-looking statements,

but the absence of these words does not mean that a statement is

not forward-looking. Forward-looking statements are predictions,

projections and other statements about future events that are based

on current expectations and assumptions and, as a result, are

subject, are subject to risks and uncertainties. These

forward-looking statements involve a number of risks and

uncertainties (some of which are beyond the control of Safe

Harbor), and other assumptions, that may cause the actual results

or performance to be materially different from those expressed or

implied by these forward-looking statements. These and other risks

are discussed in detail in the periodic reports that Safe Harbor

files with the SEC, and investors are urged to review those

periodic reports and Safe Harbor’s other filings with the SEC,

which are accessible on the SEC’s website at www.sec.gov, before

making an investment decision. Safe Harbor assumes no obligation to

update its forward-looking statements except as required by

law.

Contact Information

Safe Harbor MediaNick Callaio, Marketing

Manager720.951.0619Nick@SHFinancial.org

Safe Harbor Investor Relationsir@SHFinancial.org

KCSA Strategic CommunicationsPhil Carlsonsafeharbor@kcsa.com

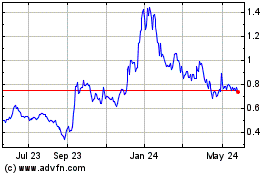

SHF (NASDAQ:SHFS)

Historical Stock Chart

From Dec 2024 to Jan 2025

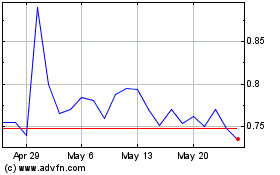

SHF (NASDAQ:SHFS)

Historical Stock Chart

From Jan 2024 to Jan 2025