Neuronetics Announces Pricing of $18 Million Underwritten Public Offering of Common Stock

07 February 2025 - 11:54PM

Neuronetics, Inc. (NASDAQ: STIM) (the “Company”) today announced

that it has priced its previously announced underwritten public

offering of its common stock, comprised of 8,000,000 shares of

common stock at a public offering price of $2.25 per share,

resulting in gross proceeds of approximately $18 million, before

deducting underwriting discounts and commissions and other offering

expenses payable by the Company.

The Company has also granted to the underwriter a 30-day option

to purchase up to an additional 1,200,000 shares of common stock at

the public offering price per share, less underwriter discounts and

commissions. All of the shares in the offering are being sold by

the Company. The Company currently intends to use the net proceeds

of this offering for general corporate purposes, including but not

limited to sales and marketing, research and development

activities, financing of potential acquisitions or establishment of

healthcare practices, purchases of inventory, general and

administrative matters, working capital and capital expenditures.

The offering is expected to close on or about February 10, 2025,

subject to the satisfaction of customary closing conditions.

Canaccord Genuity LLC is acting as sole bookrunner in connection

with the offering.

A shelf registration statement relating to the shares of common

stock being sold in this offering was previously filed with the

U.S. Securities and Exchange Commission (the “SEC”) on November 9,

2022 and was declared effective on November 14, 2022. The offering

is being made by means of a prospectus supplement and the

accompanying prospectus that form part of the registration

statement. A final prospectus supplement relating to and describing

the final terms of the offering will be filed with the SEC and will

be available on the SEC's website located at http://www.sec.gov.

When available, copies of the final prospectus supplement can be

obtained from Canaccord Genuity LLC, Attention: Syndication

Department, One Post Office Square, Suite 3000, Boston,

Massachusetts 02109, or by telephone at (617) 371-3900, or by email

at prospectus@cgf.com.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy, nor will there be any sales of

these securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of such

jurisdiction.

About Neuronetics

Neuronetics, Inc. (“Neuronetics”) believes that mental health is

as important as physical health. As a global leader in

neuroscience, Neuronetics is delivering more treatment options to

patients and physicians by offering

exceptional in-office treatments that produce

extraordinary results. NeuroStar Advanced Therapy (“NeuroStar

Therapy”) is a non-drug, noninvasive treatment that can

improve the quality of life for people suffering from neurohealth

conditions when traditional medication has not helped. In addition

to selling the NeuroStar Advanced Therapy System (the “NeuroStar

System”) and associated treatment sessions to customers,

Neuronetics operates Greenbrook TMS Inc. (“Greenbrook”) treatment

centers across the United States, offering NeuroStar Therapy for

the treatment of major depressive disorder (“MDD”) and other mental

health disorders.

NeuroStar Therapy is indicated for the treatment of depressive

episodes and for decreasing anxiety symptoms for those who may

exhibit comorbid anxiety symptoms in adult patients suffering from

MDD and who failed to achieve satisfactory improvement from

previous antidepressant medication treatment in the current

episode. It is also cleared by the U.S. Food and Drug

Administration, as an adjunct for adults with obsessive-compulsive

disorder and for adolescent patients aged 15 to 21 with MDD.

Neuronetics is committed to transforming lives by offering an

exceptional treatment that produces extraordinary results.

“Safe harbor” statement under the Private Securities

Litigation Reform Act of 1995:

Certain statements in this press release, including the

documents incorporated by reference herein, include

“forward-looking statements” within the meaning of Section 27A

of the Securities Act of 1933, as amended (the “Securities Act”),

Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbors

created by those laws and other applicable laws and

“forward-looking information” within the meaning of applicable

Canadian securities laws. Statements in this press release that are

not historical facts constitute “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements may be identified by terms

such as “outlook,” “potential,” “believe,” “expect,” “plan,”

“anticipate,” “predict,” “may,” “will,” “could,” “would” and

“should” as well as the negative of these terms and similar

expressions. These statements include those relating to the

contemplated public offering of common stock and the company’s

intended use of net proceeds from the offering. These statements

are subject to significant risks and uncertainties and actual

results could differ materially from those projected. The Company

cautions investors not to place undue reliance on the

forward-looking statements contained in this press release. These

risks and uncertainties include, without limitation, risks and

uncertainties related to: market conditions and the completion of

the public offering on the anticipated terms or at all, including

the satisfaction of customary closing conditions related to the

public offering; the effect of the transaction with Greenbrook, on

the Company’s business relationships, operating results and

business generally; the Company’s ability to execute its business

strategy; the Company’s ability to achieve or sustain profitable

operations due to its history of losses; the Company’s ability to

successfully complete the announced restructuring plans; the

Company’s reliance on the sale and use of the NeuroStar Advanced

Therapy System to generate revenues; the scale and efficacy of the

Company’s salesforce; the Company’s ability to retain talent;

availability of coverage and reimbursement from third-party payors

for treatments using the Company’s products; physician and patient

demand for treatments using the Company’s products; developments in

competing technologies and therapies for the indications that the

Company’s products treat; product defects; the Company’s revenue

has been concentrated among a small number of customers; the

Company’s ability to obtain and maintain intellectual property

protection for its technology; developments in clinical trials or

regulatory review of the NeuroStar System for additional

indications; developments in regulation in the U.S. and other

applicable jurisdictions; the terms of the Company’s credit

facility; the Company’s ability to successfully roll-out the

Company’s Better Me Provider program on the planned timeline; the

Company’s self-sustainability and existing cash balances; and the

Company’s ability to achieve cash flow break-even in the third

quarter of 2025. For a discussion of these and other related risks,

please refer to the Company’s recent filings with the SEC, which

are available on the SEC’s website at www.sec.gov, including,

without limitation, the factors described under the heading “Risk

Factors” in Neuronetics’ Annual Report on Form 10-K for the fiscal

year ended December 31, 2023 and its Quarterly Report on Form 10-Q

for the quarter ended September 30, 2024, and Greenbrook’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2023 and

its Quarterly Report on Form 10-Q for the quarter ended June 30,

2024, as each may be updated or supplemented by subsequent reports

that Neuronetics has filed or files with the SEC. These

forward-looking statements are based on the Company’s expectations

and assumptions as of the date of this press release. Except as

required by law, the Company undertakes no duty or obligation to

update any forward-looking statements contained in this press

release as a result of new information, future events, or changes

in the Company’s expectations.

Investor Contact:Mike Vallie or Mark

KlausnerICR Healthcare443-213-0499ir@neuronetics.com

Media

Contact:EvolveMKD646-517-4220NeuroStar@evolvemkd.com

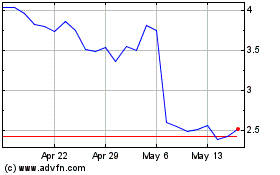

Neuronetics (NASDAQ:STIM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Neuronetics (NASDAQ:STIM)

Historical Stock Chart

From Feb 2024 to Feb 2025