Sutro Biopharma, Inc. (Sutro or the Company) (NASDAQ: STRO), a

clinical-stage oncology company pioneering site-specific and

novel-format antibody drug conjugates (ADCs), today reported its

financial results for the full year 2023, its recent business

highlights, and a preview of select anticipated milestones.

“The year 2023 was pivotal for Sutro, with the initiation of

REFRαME-O1, our registration-directed study of luvelta for

platinum-resistant ovarian cancer (PROC) patients, further

validating our next-generation ADC capabilities. In addition, we

advanced our earlier stage programs, strengthened our management

team, and bolstered our already strong cash position with

additional non-dilutive capital,” said Bill Newell, Sutro’s Chief

Executive Officer. “We look forward to continuing the momentum in

2024, with the initiation of a second registration-directed trial

with luvelta, REFRαME-P1, for pediatric patients with CBF/GLIS AML,

and two additional planned INDs. I am delighted with the strides we

are taking towards meaningfully impacting the lives of cancer

patients in need.”

Recent Business

Highlights and

Select Anticipated

Milestones

STRO-002, International Nonproprietary Name, “luveltamab

tazevibulin,” abbreviated as “luvelta,” FolRα-Targeting ADC

Franchise:

- In January 2024, Sutro hosted an

investor webcast highlighting luvelta’s broad opportunity to

address unmet needs in several FolRα-expressing cancers, including

platinum-resistant ovarian cancer (PROC), endometrial cancer,

CBFA2T3::GLIS2 (CBF/GLIS; RAM phenotype) acute myeloid leukemia

(AML), and non-small cell lung cancer (NSCLC).

- The registration-directed trial,

REFRαME-O1, for treatment of PROC is enrolling, with an anticipated

~140 sites in ~20 countries to be opened by the end of 2024.

Enrollment of Part 1 of the trial is expected to be completed in

the first half of 2024.

- In December 2023, data demonstrating

anti-leukemic activity with luvelta, either as a single agent or in

combination, in pediatric patients with CBF/GLIS AML, were

presented at the 65th American Society of Hematology Annual Meeting

and Exposition (ASH 2023), including complete remission in 42% of

patients with CBF/GLIS AML with ≥5% blasts and in 75% of pediatric

patients with CBF/GLIS AML with <5% blasts.

- Enrollment of REFRαME-P1, a

registration-enabling trial for pediatric patients with CBF/GLIS

AML, is expected to be initiated in the second half of 2024.

- An Investigational New Drug (IND)

application submission is planned for treatment of non-small cell

lung cancer (NSCLC) in the first half of 2024.

- Continued clinical development is

planned in combination with bevacizumab for the treatment of

ovarian cancer and in endometrial cancer, as resources permit.

Additional Pipeline Development and Collaboration

Updates:

- Sutro plans to submit an IND for

STRO-003, a ROR1-targeting ADC, in 2024.

- Sutro plans to submit an IND for

STRO-004, a tissue factor-targeting ADC, in 2025.

- Sutro continues to seek to maximize the

value of its proprietary cell-free platform by working with

partners on programs in multiple disease spaces and geographies and

has generated from collaborators an aggregate of approximately $854

million in payments through December 31, 2023, including equity

investments.

- In November 2023, Vaxcyte exercised its

option to enter into a manufacturing rights agreement with Sutro to

obtain control over the development and manufacture of cell-free

extract for use under its license agreement with Sutro, including

for Vaxcyte’s pneumococcal conjugate vaccine (PCV) franchise, which

includes VAX-24 and VAX-31. Upon exercising the option, Vaxcyte

paid Sutro $50 million and is obligated to pay Sutro an additional

$25 million within six months. Upon the occurrence of certain

regulatory milestones, Vaxcyte would be obligated to pay Sutro up

to an additional $60 million.

Corporate Updates:

- Sutro continues to build a world-class

leadership team through the promotion of Jane Chung to President

and Chief Operating Officer, a newly created role in which she will

be responsible for driving operational excellence, strategic

growth, and overall business success at Sutro.

Full Year 2023 Financial

Highlights

Cash, Cash Equivalents and Marketable SecuritiesAs of December

31, 2023, Sutro had cash, cash equivalents and marketable

securities of $333.7 million, as compared to $321.1 million as of

September 30, 2023, and approximately 0.7 million shares of Vaxcyte

common stock with a fair value of $41.9 million, which together

provide a projected cash runway into the second half of 2025, based

on current business plans and assumptions. Current market

conditions provide a challenging financing environment. In this

context, Sutro is continuing its process of evaluating its programs

and spending.

Unrealized Gain from Increase in Value of Vaxcyte Common

Stock

The non-operating, unrealized gain of $9.9 million for the year

2023 was due to the increase since December 31, 2022 in the

estimated fair value of Sutro’s holdings of Vaxcyte common stock.

Vaxcyte common stock held by Sutro will be remeasured at fair value

based on the closing price of Vaxcyte’s common stock on the last

trading day of each reporting period, with any non-operating,

unrealized gains and losses recorded in Sutro’s statements of

operations.

Revenue

Revenue was $153.7 million for the year ended December 31, 2023,

as compared to $67.8 million for the same period in 2022, with the

2023 amount related principally to the Vaxcyte manufacturing rights

agreement option exercise, Astellas and Merck collaborations, and

the recognition of a contingent payment from Tasly. Future

collaboration and license revenue under existing agreements, and

from any additional collaboration and license partners, will

fluctuate as a result of the amount and timing of revenue

recognition of upfront, milestones, and other agreement

payments.

Operating Expenses

Total operating expenses for the year ended December 31, 2023

were $243.0 million, as compared to $196.7 million for the same

period in 2022. The year 2023 includes non-cash expenses for

stock-based compensation of $24.9 million and depreciation and

amortization of $6.8 million, as compared to $26.3 million and $5.7

million, respectively, in the comparable 2022 period. Total

operating expenses for the year ended December 31, 2023 were

comprised of research and development expenses of $180.4 million

and general and administrative expenses of $62.6 million.

About Sutro Biopharma Sutro Biopharma,

Inc., is a clinical-stage company relentlessly focused on the

discovery and development of precisely designed cancer

therapeutics, to transform what science can do for patients.

Sutro’s fit-for-purpose technology, including cell-free XpressCF®,

provides the opportunity for broader patient benefit and an

improved patient experience. Sutro has multiple clinical stage

candidates, including luveltamab tazevibulin, or luvelta, a

registrational-stage folate receptor alpha (FolRα)-targeting ADC in

clinical studies. A robust pipeline, coupled with high-value

collaborations and industry partnerships, validates Sutro’s

continuous product innovation. Sutro is headquartered in South San

Francisco. For more information, follow Sutro on social

media @Sutrobio, or visit www.sutrobio.com.

Forward-Looking Statements This press release

contains forward-looking statements within the meaning of the “safe

harbor” provisions of the Private Securities Litigation Reform Act

of 1995, including, but not limited to, anticipated preclinical and

clinical development activities, including enrollment and site

activation; timing of announcements of clinical results, trial

initiation, and regulatory filings; outcome of regulatory

decisions; potential benefits of luvelta and the Company’s other

product candidates and platform; potential expansion into other

indications and combinations, including the timing and development

activities related to such expansion; potential market

opportunities for luvelta and the Company’s other product

candidates; and the Company’s expected cash runway;. All statements

other than statements of historical fact are statements that could

be deemed forward-looking statements. Although the Company believes

that the expectations reflected in such forward-looking statements

are reasonable, the Company cannot guarantee future events,

results, actions, levels of activity, performance or achievements,

and the timing and results of biotechnology development and

potential regulatory approval is inherently uncertain.

Forward-looking statements are subject to risks and uncertainties

that may cause the Company’s actual activities or results to differ

significantly from those expressed in any forward-looking

statement, including risks and uncertainties related to the

Company’s ability to advance its product candidates, the receipt

and timing of potential regulatory designations, approvals and

commercialization of product candidates and the Company’s ability

to successfully leverage Fast Track designation, the market size

for the Company’s product candidates to be smaller than

anticipated, clinical trial sites, supply chain and manufacturing

facilities, the Company’s ability to maintain and recognize the

benefits of certain designations received by product candidates,

the timing and results of preclinical and clinical trials, the

Company’s ability to fund development activities and achieve

development goals, the Company’s ability to protect intellectual

property, the value of the Company’s holdings of Vaxcyte common

stock, and the Company’s commercial collaborations with third

parties and other risks and uncertainties described under the

heading “Risk Factors” in documents the Company files from time to

time with the Securities and Exchange Commission. These

forward-looking statements speak only as of the date of this press

release, and the Company undertakes no obligation to revise or

update any forward-looking statements to reflect events or

circumstances after the date hereof.

ContactEmily WhiteSutro Biopharma (650)

823-7681

ewhite@sutrobio.com

|

|

|

|

Sutro Biopharma, Inc.Selected Statements

of Operations Financial

Data(Unaudited)(In thousands,

except share and per share amounts) |

|

|

|

|

|

|

For the year ended December 31 |

|

|

|

2023 |

|

|

2022 |

|

|

2021 |

|

|

Revenues |

$ |

153,731 |

|

|

$ |

67,772 |

|

|

$ |

61,880 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

180,425 |

|

|

|

137,171 |

|

|

|

104,400 |

|

|

General and administrative |

|

62,584 |

|

|

|

59,544 |

|

|

|

56,004 |

|

| Total operating expenses |

|

243,009 |

|

|

|

196,715 |

|

|

|

160,404 |

|

| Loss from operations |

|

(89,278 |

) |

|

|

(128,943 |

) |

|

|

(98,524 |

) |

| Interest income |

|

14,510 |

|

|

|

3,455 |

|

|

|

577 |

|

| Unrealized gain (loss) on

equity securities |

|

9,917 |

|

|

|

12,130 |

|

|

|

(4,454 |

) |

| Non-cash interest expense

related to the sale of future royalties |

|

(12,570 |

) |

|

|

- |

|

|

|

- |

|

| Interest and other income

(expense), net |

|

(11,180 |

) |

|

|

(3,346 |

) |

|

|

(3,137 |

) |

| Loss before provision for

income taxes |

|

(88,601 |

) |

|

|

(116,704 |

) |

|

|

(105,538 |

) |

| Provision for income

taxes |

|

18,192 |

|

|

|

2,500 |

|

|

|

- |

|

| Net loss |

$ |

(106,793 |

) |

|

$ |

(119,204 |

) |

|

$ |

(105,538 |

) |

| Net loss per share, basic and

diluted |

$ |

(1.78 |

) |

|

$ |

(2.35 |

) |

|

$ |

(2.29 |

) |

| Weighted-average shares used

in computing basic and diluted loss per share |

|

60,163,542 |

|

|

|

50,739,185 |

|

|

|

46,119,089 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Sutro Biopharma, Inc.Selected Balance

Sheets Financial

Data(Unaudited)(In

thousands) |

|

|

|

|

December 31, |

|

|

|

2023(1) |

|

|

2022(2) |

|

|

Assets |

|

|

|

|

|

|

|

|

Cash, cash equivalents and marketable securities |

$ |

333,681 |

|

|

$ |

302,344 |

|

|

Investment in equity securities |

|

41,937 |

|

|

|

32,020 |

|

|

Accounts receivable |

|

36,078 |

|

|

|

7,122 |

|

|

Property and equipment, net |

|

21,940 |

|

|

|

24,621 |

|

|

Operating lease right-of-use assets |

|

22,815 |

|

|

|

26,443 |

|

|

Other assets |

|

14,285 |

|

|

|

14,394 |

|

| Total

Assets |

$ |

470,736 |

|

|

$ |

406,944 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

|

|

|

Accounts payable, accrued expenses and other liabilities |

$ |

64,293 |

|

|

$ |

32,822 |

|

|

Deferred revenue |

|

74,045 |

|

|

|

106,644 |

|

|

Operating lease liability |

|

29,574 |

|

|

|

34,159 |

|

|

Debt |

|

4,061 |

|

|

|

16,271 |

|

|

Deferred royalty obligation related to the sale of future

royalties |

|

149,114 |

|

|

|

- |

|

| Total liabilities |

|

321,087 |

|

|

|

189,896 |

|

| Total stockholders’

equity |

|

149,649 |

|

|

|

217,048 |

|

| Total Liabilities and

Stockholders’ Equity |

$ |

470,736 |

|

|

$ |

406,944 |

|

|

(1) |

The condensed balance sheet as of December 31, 2023 was derived

from the unaudited financial statements included in the Company's

Annual Report on Form 10-K for the year ended December 31, 2023,

filed with the Securities and Exchange Commission on March 25,

2024. |

| (2) |

The condensed balance sheet as of

December 31, 2022 was derived from the audited financial statements

included in the Company's Annual Report on Form 10-K for the year

ended December 31, 2022, filed with the Securities and Exchange

Commission on March 30, 2023. |

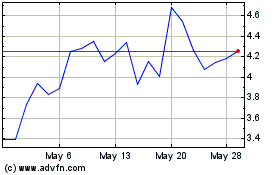

Sutro Biopharma (NASDAQ:STRO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sutro Biopharma (NASDAQ:STRO)

Historical Stock Chart

From Jan 2024 to Jan 2025