UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of: September, 2024

Commission File Number: 001-39557

Siyata Mobile Inc.

(Translation of registrant’s name into English)

7404 King George Blvd., Suite 200, King’s

Cross

Surrey, British Columbia V3W 1N6, Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

☒ Form 20-F ☐ Form

40-F

Resignation and Appointment of Independent Director(s)

On August 29, 2024, Mr. Stephen Ospalak notified

Siyata Mobile Inc., a British Columbia (Canada) company (“Company”) of his resignation as a director, the chairperson of the

Compensation Committee, and a member of the nominating and corporate governance committee and the audit committee of the Company, effective

immediately. Mr. Ospalak has advised that his resignation was due to personal reasons and not a result of any disagreement with the Company

on any matter related to the operations, policies, or practices of the Company.

To fill in the vacancies created by the resignation

of Mr. Ospalak, on September 1, 2024, the board of directors (the “Board”) of the Company appointed Mr. Campbell Becher to

serve as an independent director of the Company, effective immediately. Mr. Becher will act as a member of the nominating and corporate

governance committee, compensation committee, and the audit committee.

The following is the biographical information of Mr. Campbell Becher.

Campbell Becher is the Chief Executive Officer

of IberAmerican Lithium, and has held that position since September 2023. Mr. Becher has also been president or Orchid Capital Partners

Corp. since 2014, and has over 20 years of experience in investment banking, including the founding of Byron Capital Markets, an investment

bank focused on the electric metals sector. Mr. Becher served as Byron’s CEO from 2008 to 2014 and led its sponsorship of the Electric

Metals Conference for several years as well as sponsoring the Industrial Minerals World Lithium Conference. Mr. Becher currently serves

as a board member at Royal Helium Ltd. and Strategic Minerals Europe Corp. and previously served as a Managing Director at Haywood Securities

Inc. Mr. Becher attended both Lakehead University and Brock University studying Business Administration.

The Company’s press release related to the

current matter is furnished as Exhibit 99.1 to this Report and is incorporated herein by reference.

Additional Investment in Canadian Towers & Fiber Optics Inc.

Additionally, on August 29, 2024, the Company

also completed its additional round of strategic investment in Canadian Towers & Fiber Optics Inc. (“Canadian Towers”),

a developer of fiber optic systems for the telecommunications sector, for a total additional amount of $300,000 paid in cash. Pursuant

to this, the Company entered into a Subscription Agreement, dated August 29, 2024 with the Canadian Towers (the “Subscription Agreement”),

pursuant to which the Company agreed to acquire from the Canadian Towers, an aggregate of 283,795 common shares, no par value per share

(the “Shares”) of the Company, at a purchase price of $1.0571 per Share, for an aggregate purchase price of $ 300,000.00.

The description of terms and conditions of Subscription Agreement set forth herein does not purport to be complete and is qualified in

its entirety by the full text of the Subscription Agreement, a version of which is attached hereto as Exhibits 10.1.

Forward

Looking Statements

This Report

of Foreign Private Issuer on Form 6-K contains forward-looking statements within the meaning of the “safe harbor” provisions

of the Private Securities Litigation Reform Act of 1995 and other Federal securities laws. Words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions

or variations of such words are intended to identify forward-looking statements. Because such statements deal with future events and are

based on the Company’s current expectations, they are subject to various risks and uncertainties, and actual results, performance

or achievements of the Company could differ materially from those described in or implied by the statements in this Report. The forward-looking

statements contained or implied in this Report are subject to other risks and uncertainties, including those discussed under the heading

“Risk Factors” in the Company’s final prospectus filed with the Securities and Exchange Commission (“SEC”)

on April 8, 2024, and in any subsequent filings with the SEC. Except as otherwise required by law, the Company undertakes no obligation

to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect

the occurrence of unanticipated events. References and links to websites and social media have been provided as a convenience, and the

information contained on such websites is not incorporated by reference into this Report. The Company is not responsible for the contents

of third party websites.

EXHIBIT INDEX

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Company has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

| Date: September 3, 2024 |

SIYATA MOBILE INC. |

| |

|

|

| |

By: |

/s/ Marc Seelenfreund |

| |

Name: |

Marc Seelenfreund |

| |

Title: |

Chief Executive Officer |

Exhibit 10.1

COMMON SHARE SUBSCRIPTION AGREEMENT

| TO: |

Canadian Towers & Fiber Optics Inc. (the “Issuer”) |

| |

|

|

| FROM: |

Siyata Mobile Inc. |

|

| |

(Subscriber Name) |

|

| RE: |

Purchase of Common Shares of the Issuer at USD$1.0571 Per Common Share |

| REFERENCE DATE: |

August 29, 2024 |

THIS DOCUMENT CONTAINS A NUMBER

OF FORMS REQUIRED BY SECURITIES LEGISLATION AND POLICY, SOME OF WHICH YOU MUST COMPLETE AND OTHERS NOT DEPENDING ON SEVERAL FACTORS. PLEASE

READ THE FOLLOWING GUIDE CAREFULLY AS IT WILL ASSIST YOU IN COMPLETING THIS SUBSCRIPTION AGREEMENT CORRECTLY.

| STEP 1 | Enter the number of Shares you are purchasing, and your

name, address and telephone number and sign this document on the execution page on 20. |

| STEP 2 | Please complete the Registration

and Delivery Instructions on page 21 if your Shares are to be registered or delivered differently from your name and address on page

20. |

| STEP 3 | All Subscribers must complete

“Information Regarding the Subscriber” appearing on page 4. |

| STEP 4 | All Subscribers must complete the

“Acknowledgement in Respect of Subscription Funds” on pages 1 to 3 hereof. |

| STEP 4 | All Subscribers who are not individuals must complete Schedule

A – “Corporate Placee Registration Form” for filing with the TSX Venture Exchange, unless this form is already on file

with the TSX Venture Exchange and there is no change in the information already filed. |

| STEP 5 | If you are an “Accredited Investor” as defined

in National Instrument 45-106 or Securities Act (Ontario) (generally a high net worth or high income investor), you must complete

and sign Schedule B – “Accredited Investor Certificate” and the Appendix 2 attached to Schedule B if you are an individual. |

| STEP 6 | If you are a resident in an International Jurisdiction

other than in the United States, please review Section 7 for an exemption available to you. Please complete and sign Schedule B –

“Accredited Investor Certificate” if you are an “Accredited Investor” and the Appendix 2 attached to Schedule

B if you are an individual. |

| STEP 7 | Subscribers resident in Canada, and who are not “Accredited

Investors” but who are officers, directors, employees, family, close friends or business associates thereof, must complete and

sign Schedule C – “Family, Friends and Business Associates Certifications”; those in Ontario must also complete Appendix

1 attached to the Schedule C and those in Saskatchewan must complete Appendix 2 attached to the Schedule C. |

| STEP 9 | If you are subscribing in the United States or are a U.S.

Person (as defined in Regulation S under the U.S. Securities Act of 1933, as amended) you must be a U.S. fiduciary excluded from the

definition of “U.S. Person” pursuant to Rule 902(k)(2)(i) of Regulation S or an “Accredited Investor” under U.S.

law – please complete and sign Schedule D – “U.S. Purchaser Certificate”. |

INFORMATION REGARDING THE SUBSCRIBER

Please check the appropriate box (and complete the required

information, if applicable) in each section:

| 1. | Security Holdings. Prior to giving effect to the securities being subscribed

for under this Subscription Agreement, the Subscriber and all persons acting jointly and in concert with the Subscriber currently own,

directly or indirectly, or exercise control or direction over (provide additional detail as applicable): |

| ☒ | 946,000 common shares of Canadian Towers & Fiber Optics Inc. (the “Issuer”)

and/or the following other kinds of shares and convertible securities (including but not limited to convertible debt, warrants and options)

entitling the Subscriber to acquire additional common shares or other kinds of shares of the Issuer: |

| | | |

| | | |

| | | |

| | | |

No shares of the Issuer or securities convertible into

shares of the Issuer.

| 2. | Insider Status. The Subscriber either: |

| ☐ | Is an “Insider” of the Issuer as defined in the Policies of the TSX-V by virtue of

being: |

| (a) | a director or senior officer of the Issuer; |

| (b) | a director or senior officer of a company that is an Insider or subsidiary of the Issuer; |

| (c) | a person that beneficially owns or controls, directly or indirectly, voting shares

of the Issuer carrying more than 10% of the voting rights attached to all the Issuer’s outstanding voting shares; or |

| (d) | the Issuer itself if it holds any of its own securities. |

| ☒ | Is not an Insider of the Issuer. |

| 3. | Pro Group Status. The Subscriber either: |

| | ☐ | Is a Member of the “Pro Group”, which is defined in the Rules of the TSX-V as either

individually or as a group: |

| 1. | the member (i.e. a member of the TSX-V under the TSX-V requirements); |

| 2. | employees of the member; |

| 3. | partners, officers and directors of the member; |

| 4. | affiliates of the member; |

| 5. | such other persons as the TSX-V may determine; and |

| 6. | associates of any parties referred to in paragraphs 1 through 5 above. |

| ☒ | Is not a member of the Pro Group. |

| 4. | Corporate Placee Registration Form. If the Subscriber is not an individual, the Subscriber

acknowledges that: |

| ☐ | a Corporate Placee Registration Form is already on file with the TSX Venture Exchange and there is

no change in the information already filed; |

| ☒ | the Subscriber will complete Schedule A – “Corporate Placee Registration Form” for

filing with the TSX Venture Exchange. |

| 5 | Registrant status. The Subscriber either: |

| ☐ | is a person registered or required to be registered under the Securities Act (British

Columbia); |

| ☒ | is not a person registered or required to be registered under

the Securities Act (British Columbia). |

| Re: | Purchase of USD $1.0571 Shares Exempt from Prospectus

Requirements |

| 1.1 | (a) “Accredited Investor” means a Subscriber resident in Canada

who is an accredited investor as defined in Section 1.1 of NI 45-106 or under the Securities Act (Ontario) if the Subscriber is

a resident in Ontario; |

(b) “Applicable

Securities Laws” means the securities legislation having application and the rules, policies, notices and orders issued by applicable

securities regulatory authorities, including the TSX-V, having application over this Offering and the Issuer in the Qualifying Jurisdictions

and the United States;

(c) “Closing”

means a completion of an issue and sale by the Issuer and the purchase by the Subscriber of the Shares pursuant to this Subscription Agreement

on the Closing Date. Closings may occur on one or more dates as the Issuer may determine within the requirements of the TSX-V;

(d) “Closing

Date” means the date of Closing of the Offering as the Issuer may determine within the requirements of the TSX-V;

(e) “consultant”

means, for an issuer, a person, other than an employee, executive officer, or director of the issuer or of a related entity of the issuer,

that

(i) is engaged

to provide services to the issuer or a related entity of the issuer, other than services provided in relation to a distribution,

(ii) provides

the services under a written contract with the issuer or a related entity of the issuer, and

(iii) spends or will

spend a significant amount of time and attention on the affairs and business of the issuer or a related entity of the issuer

and

includes, for an individual consultant, a corporation of which the individual consultant is an employee or shareholder, and a

partnership of which the individual consultant is an employee or partner;

(f) “Employee,

Executive Officer, Director and Consultant Exemptions” means the exemption from the prospectus requirements found in Section

2.24 of NI 45-106;

(g) “Exempt

Amount Exemption” means the exemption from the prospectus requirements under Applicable Securities Laws for subscriptions made

by non-individual Subscriber of CAD$150,000 paid in cash at the time of Closing and which does not require the Subscriber to be an Accredited

Investor;

(h) “Exemptions”

means the exemptions from the registration and prospectus or equivalent requirements under Applicable Securities Laws;

(i) “Family,

Friends and Business Associates Exemptions” means the exemptions from the prospectus requirements found in Sections 2.5 –

2.7 of NI 45-106;

(j) “fully

managed” in relation to an account, means that the Subscriber has the discretion as to the account as contemplated by Applicable

Securities Laws;

(k)

“International Jurisdiction” means a country other than Canada or the United States;

(l) “material”

means material in relation to the Issuer and any subsidiary considered on a consolidated basis;

(m) “material

change” means any change in the business, operations, assets, liabilities, ownership or capital of the Issuer and any subsidiary

considered on a consolidated basis that would reasonably be expected to have a significant effect on the market price or value of the

Issuer’s securities;

(n) “material

fact” means any fact that significantly affects or would reasonably be expected to have a significant effect on the market price

or value of the Issuer’s securities;

(o)

“misrepresentation” is as defined under Applicable Securities Laws;

(p) “NI

45-106” means National Instrument 45-106 – Prospectus Exemptions in the form adopted by the securities commissions in

all provinces and territories of Canada (a copy is available online at www.bcsc.bc.ca);

(q) “Offering”

means the sale by the Issuer of up to 2,500,000 Shares of the Issuer for aggregate proceeds of up to $500,000 on the terms set forth in

this Subscription Agreement. There is no minimum aggregate Offering and the Issuer reserves the right to decrease the size of the Offering

at its discretion;

(r) “permitted

assign” means, for a person that is an employee, executive officer, director or consultant of the Issuer or of a related entity

of the Issuer,

(i)

a trustee, custodian, or administrator acting on behalf of, or for the benefit of the person,

(ii)

a holding entity of the person,

(iii)

an RRSP or a RRIF of the person,

(iv)

a spouse of the person,

(v) a trustee,

custodian, or administrator acting on behalf of, or for the benefit of the spouse of the person,

(vi)

a holding entity of the spouse of the person, or

(vii)

an RRSP or a RRIF of the spouse of the person;

(s) “person”

means and includes any individual, corporation, partnership, firm, joint venture, syndicate, association, trust, government, governmental

agency or board or commission or authority, and any other form of entity or organization;

(t) “Portfolio

Manager” means an adviser who manages the investment portfolio of clients through discretionary authority granted by one or

more clients;

(u) “Public

Record” means information which has been publicly filed at www.sedar.com by the Issuer under Applicable Securities Laws;

(v) “Qualifying

Jurisdictions” means British Columbia, Alberta and Ontario and certain other jurisdictions referred to in National Instrument

45-102;

(w)

“Regulation D” means Regulation D under the U.S. Securities Act;

(x)

“Regulation S” means Regulation S under the U.S. Securities Act;

(y)

“Schedules” means the schedules attached hereto and forming part hereof and comprising of:

| (i) | A |

Corporate Placee Registration Form; |

| (ii) | B |

Accredited Investor Certificate; |

| (iii) | C |

Family, Friends and Business Associates Certifications; |

| (iv) | D |

U.S. Purchaser Certificate; and |

| (v) | E |

Contact Information of Public Officials in each applicable Canadian jurisdiction Regarding Indirect Collection of Personal Information |

(z)

“Securities” means the Shares;

(aa) “Share” means

a common share without par value in the capital of the Issuer;

(bb) “Subscriber”

means the person or persons named as a Subscriber on the execution page of this Subscription Agreement and if more than one person is

so named, means all of them jointly and severally;

(cc) “Subscription Agreement”

or “Agreement” means this subscription agreement between the Subscriber and the Issuer, including all Schedules

incorporated by reference, as it may be amended or supplemented from time to time;

(dd) “TSX-V” means

the TSX Venture Exchange and the NEX board of the TSX-V;

(ee) “U.S. Person”

means a U.S. Person as defined in Regulation S (the definition of which includes, but is not limited to, (i) any natural person resident

in the United States, (ii) any partnership or corporation organized or incorporated under the laws of the United States, (iii) any partnership

or corporation organized outside of the United States by a U.S. Person principally for the purpose of investing in securities not registered

under the U.S. Securities Act, unless it is organized, or incorporated, and owned, by accredited investors who are not natural persons,

estates or trusts, and (iv) any estate or trust of which any executor or administrator or trustee is a U.S. Person;

(ff) “U.S. Purchaser”

is (a) any “U.S. Person” as defined in Regulation S, (b) any person purchasing the Shares on behalf of any “U.S. Person”

or any person in the United States, (c) any person who receives or received an offer of the Shares while in the United States, or (d)

any person who is or was in the United States at the time the Subscriber’s buy order was made or this Agreement was executed or

delivered;

(gg) “U.S. Securities

Act” means the Securities Act of 1933, as amended, of the United States of America; and

(hh) “United States”

means the United States of America, its territories, any State of the United States and the District of Columbia.

| 1.2 | Words and phrases which are used in this Subscription Agreement and all Schedules

hereto and which are defined in NI 45-106 will have the meaning ascribed thereto in NI 45-106, unless otherwise specifically defined in

Section 1.1 of this Subscription Agreement. |

| 2. | Prospectus Exempt Subscription Commitment |

| 2.1 | The Subscriber (on its own behalf and, if applicable, on behalf

of each person on whose behalf the Subscriber is contracting) hereby irrevocably subscribes for and agrees to purchase from the Issuer,

subject to the terms and conditions set forth herein, that number of Shares set out above the Subscriber’s name on the execution

page of this Subscription Agreement at the price of CAD$0.20 per Share. Subject to the terms hereof, this Subscription Agreement will

be deemed to have been made and be effective only upon its acceptance by the Issuer. |

| 2.2 | The Subscriber (on its own behalf and, if applicable, on behalf

of each person on whose behalf the Subscriber is contracting) acknowledges and agrees that the Issuer reserves the right, in its absolute

discretion, to reject this subscription for Shares, in whole or in part, at any time prior to the Closing Date notwithstanding prior

receipt by the Subscriber of a notice of acceptance of this subscription. Upon the Issuer’s acceptance of this subscription, this

Subscription Agreement will constitute an agreement for the purchase by the Subscriber from the Issuer, and for the Issuer to issue and

sell to the Subscriber, the number of Shares set out on the execution page hereof and on the terms and conditions set out herein. If

this subscription is rejected in whole, any cheques or other forms of payment delivered to the Issuer representing payment for the Shares

subscribed for herein will be promptly returned to the Subscriber without interest or deduction. If this subscription is accepted only

in part, a cheque representing any refund for that portion of the subscription for the Shares which is not accepted will be promptly

delivered to the Subscriber by the Issuer without interest or deduction. |

| 3.1 | The Subscriber acknowledges (on its own behalf and, if applicable,

on behalf of each person on whose behalf the Subscriber is contracting) that there is no minimum number of Shares that must be subscribed

for under the Offering for the Offering to close and therefore the subscription amount tendered herewith may be releasable to the Issuer

on the Closing Date notwithstanding the number of Shares issued pursuant to the Offering. |

| 3.2 | The Subscriber further acknowledges (on its own behalf and,

if applicable, on behalf of each person on whose behalf the Subscriber is contracting) that, subject to Applicable Securities Laws, the

Issuer may pay a commission or finder’s fee up to the maximum amount allowable by the policies of the TSX-V in connection with

the Subscriber’s subscription for Shares hereunder. |

| 4.1 | Prior to Closing, the Subscriber agrees to deliver to the Issuer:

(a) this duly completed and executed Agreement, including all applicable Schedules hereto and Appendices thereto; and (b) the aggregate

subscription funds subscribed for under this Agreement in accordance with the Instructions on the Cover Page or payment of the same amount

in such other manner as is acceptable to the Issuer. If payment is made in a currency other than Canadian dollars, the Subscriber acknowledges

and agrees that it shall be responsible to make up for any deficiency in the payment of the aggregate subscription price as a result

of the exchange of such funds into Canadian dollars. |

| 4.2 | The Subscriber acknowledges and agrees that the offer, sale

and issuance of the Shares as contemplated by this Subscription Agreement is subject to, among other things, the following conditions

being fulfilled or performed on or before the Closing Date, which conditions are for the exclusive benefit of the Issuer and may be waived,

in whole or in part, by the Issuer in its sole discretion: |

(a) the

Subscriber, on or before the Closing Date, delivering the following in accordance with the terms and instructions set-out in this Agreement:

(i)

a fully completed and executed copy of this Subscription Agreement; and

(ii)

the aggregate subscription funds.

(b) the

offer, sale and issuance of the Shares by the Issuer to the Subscriber being exempt from the requirements as to the filing of a prospectus

and as to the preparation of an offering memorandum or similar document contained in any statute, regulation, instrument, rule or policy

applicable to the sale of the Shares or upon the issue of such orders, consents or approvals as may be required to permit such sale without

the requirement of filing a prospectus or delivering an offering memorandum or similar document;

(c) the

Issuer obtaining all orders, permits, approvals, waivers, consents, licenses or similar authorizations under Applicable Securities Laws

necessary to complete the offer, sale and issuance of the Shares; and

(d) the

representations and warranties of the Subscriber having been true and correct as of the date of this Subscription Agreement and being

true and correct at the time of Closing.

| 4.3 | On request by the Issuer, the Subscriber agrees to complete

and deliver any other documents, questionnaires, notices and undertakings as may possibly be required by regulatory authorities, stock

exchanges and Applicable Securities Laws to complete the transactions contemplated by this Agreement. |

| 4.4 | Closing will occur on the Closing Date at which time certificates

or DRS statements representing the Shares will be available against payment of funds for delivery to the Subscriber as the Subscriber

will instruct. The Subscriber hereby waives receiving any prior notice of Closing. |

| 5.1 | The Subscriber acknowledges and consents to the fact that the

Issuer is collecting the Subscriber’s (and any beneficial purchaser for which the Subscriber is contracting hereunder) personal

information (as that term is defined under applicable privacy legislation, including, without limitation, the Personal Information

Protection and Electronic Documents Act (Canada) and any other applicable similar replacement or supplemental provincial or federal

legislation or laws in effect from time to time) for the purpose of completing the Subscriber’s subscription. The Subscriber acknowledges

and consents to the Issuer retaining the personal information for so long as permitted or required by applicable law or business practices.

The Subscriber further acknowledges and consents to the fact that the Issuer may be required by Applicable Securities Laws, stock exchange

rules and/or Investment Industry Regulatory Organization of Canada rules to provide regulatory authorities any personal information provided

by the Subscriber respecting itself (and any beneficial purchaser for which the Subscriber is contracting hereunder). The Subscriber

represents and warrants that it has the authority to provide the consents and acknowledgements set out in this paragraph on behalf of

all beneficial purchasers for which the Subscriber is contracting. In addition to the foregoing, the Subscriber agrees and acknowledges

that the Issuer may use and disclose the Subscriber’s personal information, or that of each beneficial purchaser for whom the Subscriber

are contracting hereunder, as follows: |

(a) for

internal use with respect to managing the relationships between and contractual obligations of the Issuer and the Subscriber or any beneficial

purchaser for whom the Subscriber is contracting hereunder;

(b)

for use and disclosure to the Issuer’s transfer agent and registrar;

(c) for

use and disclosure for income tax related purposes, including without limitation, where required by law, disclosure to Canada Revenue

Agency;

(d) disclosure

to securities regulatory authorities (including the TSX-V) and other regulatory bodies with jurisdiction with respect to reports of trade

and similar regulatory filings;

(e) disclosure

to a governmental or other authority (including the TSX-V) to which the disclosure is required by court order or subpoena compelling such

disclosure and where there is no reasonable alternative to such disclosure;

(f) disclosure

to professional advisers of the Issuer in connection with the performance of their professional services;

(g) disclosure

to any person where such disclosure is necessary for legitimate business reasons and is made with the Subscriber’s prior written

consent;

(h)

disclosure to a court determining the rights of the parties under this Subscription Agreement; or

(i)

for use and disclosure as otherwise required or permitted by law.

| 5.2 | The Subscriber further acknowledges and agrees that the TSX-V

collects personal information in forms submitted by the Issuer, which will include personal information regarding the Subscriber. The

Subscriber agrees that the TSX-V may use this information in the manner provided for in Appendix 6A to the TSX-V Corporate Finance Policy

Manual or in Appendix 1 to the NEX policy, copies of which may be viewed at the TSX-V website, www.tsx.com and is incorporated herein

by reference. |

| 5.3 | The Subscriber (on its own behalf and, if applicable, on behalf

of any person to whose benefit the Subscriber is subscribing) acknowledges that the Subscriber has been notified by the Issuer: |

(a) of

the delivery of the personal information to all applicable securities regulatory authorities or regulators;

(b) that

the personal information is being collected by the securities regulatory authority or regulator under the authority granted in Applicable

Securities Laws for the purposes of the administration and enforcement of Applicable Securities Laws; and

(c) of

the contact information of the Public Official in each applicable Canadian jurisdiction who can answer questions about this indirect collection

of Personal Information as set out in Schedule E.

| 6. | Subscriber’s Acknowledgements – Regarding Risk, Restrictions, Independent Advice and Advancement

of Subscription Proceeds to the Issuer |

| 6.1 | The Subscriber represents and warrants and acknowledges and

agrees with (on its own behalf and, if applicable, on behalf of each beneficial purchaser for whom the Subscriber is contracting hereunder)

the Issuer that: |

(a) its

decision to execute this Subscription Agreement and purchase the Securities agreed to be purchased hereunder has not been based upon any

oral or written representation as to fact or otherwise made by or on behalf of the Issuer, and that its decision is based entirely upon

its review of information about the Issuer in the Public Record;

(b) no

prospectus has been filed by the Issuer with any securities commission or similar authority, in connection with the issuance of the Securities,

and the issuance and the sale of the Securities is subject to such sale being exempt from the prospectus/registration requirements under

Applicable Securities Laws and accordingly:

(i) the Subscriber

is restricted from using certain of the civil remedies available under such legislation;

(ii) the

Subscriber may not receive information that might otherwise be required to be provided to it under such legislation; and

(iii) the

Issuer is relieved from certain obligations that would otherwise apply under such legislation;

(c) the

Subscriber (or others for whom the Subscriber is contracting hereunder) has been advised to consult its own legal advisors with respect

to the merits and risks of an investment in the Securities and with respect to applicable resale restrictions and it (or others for whom

it is contracting hereunder) is solely responsible (and the Issuer is in no way responsible) for compliance with applicable resale restrictions;

(d) to

the knowledge of the Subscriber, the sale of the Securities was not accompanied by any advertisement;

(e) the

offer made by this Subscription Agreement is irrevocable (subject to the right of the Issuer to terminate this Subscription Agreement)

and requires acceptance by the Issuer;

(f) this

Subscription Agreement is not enforceable by the Subscriber unless it has been accepted by the Issuer and the Subscriber waives any requirement

on the Issuer’s behalf to communicate immediately its acceptance of this Subscription Agreement to the Subscriber;

(g) the

Securities are speculative investments which involve a substantial degree of risk and the Subscriber may lose its entire investment in

the Securities;

(h) the

Subscriber is sophisticated in financial investments, has had access to and has received all such information concerning the Issuer that

the Subscriber has considered necessary in connection with the Subscriber’s investment decision and the Subscriber will not receive

an offering memorandum or similar disclosure document;

(i) the

subscription proceeds will be available to the Issuer on Closing and this subscription is not conditional on any other subscription completing;

(j) no

agency, governmental authority, regulatory body, stock exchange or other entity has made any finding or determination as to the merit

for investment of, nor have any such agencies or governmental authorities made any recommendation or endorsement with respect to, the

Securities;

(k) the

Subscriber acknowledges that the Issuer may complete additional financings in the future which may have a dilutive effect on existing

shareholders at such time, including the Subscriber; and

(l) the

Issuer will rely on the representations and warranties made herein or otherwise provided by the Subscriber to the Issuer in completing

the sale and issue of the Shares to the Subscriber.

| 6.2 | The Subscriber hereby acknowledges and agrees that the subscription

proceeds, together with all subscription documents completed in the manner described herein, subject to any statutory rights of the Subscriber,

will be provided to the Issuer prior to the Closing Date. |

| 7. | Subscriber’s Exemption Status |

| 7.1 | The Subscriber, by its execution of this Subscription Agreement,

hereby further represents, warrants to, and covenants with, the Issuer (which representations, warranties and covenants will survive

the Closing of the Offering) that the Subscriber is purchasing the Shares as principal for its own account, it is purchasing such Shares

not for the benefit of any other person, and not with a view to the resale or distribution of the Shares and one of the following Exemptions

applies to the Subscriber: |

(a)

Family, Friends and Business Associates Exemptions

(i)

The Subscriber is a resident of a Province or Territory of Canada, and is:

(A) a director,

executive officer or control person of the Issuer, or of an affiliate of the Issuer,

(B) a spouse,

parent, grandparent, brother, sister, child or grandchild of a director, executive officer or control person of the Issuer, or of an affiliate

of the Issuer,

(C) a parent,

grandparent, brother, sister, child or grandchild of the spouse of a director, executive officer or control person of the Issuer or of

an affiliate of the Issuer,

(D) a close

personal friend of a director, executive officer or control person of the Issuer, or of an affiliate of the Issuer,

(E) a close

business associate of a director, executive officer or control person of the Issuer, or of an affiliate of the Issuer,

(F) a founder

of the Issuer or a spouse, parent, grandparent, brother, sister, child, grandchild , close personal friend or close business associate

of a founder of the Issuer,

(G) a

parent, grandparent, brother, sister, child or grandchild of a spouse of a founder of the Issuer,

(H) a

person of which a majority of the voting securities are beneficially owned by, or a majority of the directors are, persons described in

paragraphs (A) to (G), or

(I) a

trust or estate of which all of the beneficiaries or a majority of the trustees or executors are persons described in paragraphs (A) to

(G);

If the Subscriber is a resident of Saskatchewan, the Subscriber

must complete and sign the Risk Acknowledgement Form - 45-106F5 attached hereto as Appendix 2 of Schedule C;

(ii) The

Subscriber is a resident of Ontario and is not an investment fund, you have concurrently executed and delivered a Form 45-106F12 –

Risk Acknowledgement Form for Family, Friends and Business Associates in the form attached as Appendix 1 to Schedule C and signed

by all of the following:

(A)

the purchaser;

(B)

an executive officer of the Issuer other than the purchaser;

(C) if

the purchaser is a person referred to under paragraph 7.1(a)(i)(B), the director, executive officer or control person of the issuer or

an affiliate of the issuer who has the specified relationship with the purchaser;

(D) if

the purchaser is a person referred to under paragraph 7.1(a)(i)(C), the director, executive officer or control person of the issuer or

an affiliate of the issuer whose spouse has the specified relationship with the purchaser;

(E) if

the purchaser is a person referred to under paragraph 7.1(a)(i)(D) or (i)(E), the director, executive officer or control person of the

issuer or an affiliate of the issuer who is a close personal friend or a close business associate of the purchaser; and

(F) the

founder of the Issuer, if the purchaser is a person referred to in paragraph 7.1(a)(i)(F) and (i)(G) other than the founder of the Issuer;

and

(iii) you

have concurrently executed and delivered a certificate in the form attached as Schedule C attached hereto.

(b)

Employee, Executive Officer, Director and Consultant Exemptions

The Subscriber is:

(i)

an employee, executive officer, director or consultant of the Issuer,

(ii)

an employee, executive officer, director or consultant of a related entity of the Issuer, or

(iii)

a permitted assign of a person referred to in paragraphs (i) or (ii)

and the Subscriber’s purchase is voluntary;

(c)

Minimum Amount Exemption

You are not an individual

and the aggregate acquisition cost of purchasing the Shares will not be less than CAD$150,000 paid in cash at the time of purchase,

and the Subscriber has not been created or used solely to purchase or hold the Shares in reliance on this Exemption; or

(d)

Accredited Investor Exemption

(i) The

Subscriber is an “Accredited Investor” and the Subscriber has properly completed and duly executed the Accredited Investor

Certificate attached to this Subscription Agreement as Schedule B indicating the means by which the Subscriber is an Accredited Investor

and confirms the truth and accuracy of all statements made by the Subscriber in such certificate; and

(ii) If

you are an individual, you have concurrently executed and delivered Form 45-106F9 – Form for Individual Accredited Investors

in the form attached as Appendix 2 to Schedule B hereto.

| 7.2 | Subscriber Outside of Canada |

If the Subscriber is resident in an International Jurisdiction

or in the United States, it certifies in particular that it is not resident in British Columbia and further acknowledges and certifies

that:

(a) no securities

commission or similar regulatory authority has reviewed or passed on the merits of the Shares or the Securities;

(b)

there is no government or other insurance covering the Shares or the Securities;

(c)

there are risks associated with the purchase of the Shares;

(d) there

are restrictions on the Subscriber’s ability to resell the Securities and it is the responsibility of the Subscriber to determine

what those restrictions are and to comply with them before selling the Securities;

(e) the

Issuer has advised the Subscriber that the Issuer is relying on an exemption from the requirements to provide the Subscriber with a prospectus

and to sell the Securities through a person registered to sell the Securities under Applicable Securities Laws and, as a consequence of

acquiring securities pursuant to this exemption, certain protections, rights and remedies provided by Applicable Securities Laws, including

statutory rights of rescission or damages, will not be available to the Subscriber;

(f) the

Subscriber is knowledgeable of securities legislation having application or jurisdiction over the Subscriber and the Offering (other than

the laws of Canada and the United States) which would apply to this Subscription Agreement;

(g) the

Subscriber is purchasing the Shares pursuant to exemptions from any prospectus, registration or similar requirements under the laws of

that International Jurisdiction and or, if such is not applicable, the Subscriber is permitted to purchase the Shares, and the Issuer

has no filing obligations in the International Jurisdiction;

(h) no

laws in the International Jurisdiction require the Issuer to make any filings or seek any approvals of any kind whatsoever from any regulatory

authority of any kind whatsoever in the International Jurisdiction; and

(i) the

Shares are being acquired for investment only and not with a view to resale and distribution within the International Jurisdiction.

| 7.3 | Additional Representations and Acknowledgements Applicable

to U.S. Purchasers. If the Subscriber is a U.S. Purchaser, the Subscriber represents and warrants either: |

(a) the

Subscriber is a discretionary or similar account (other than an estate or trust) that is excluded from the definition of “U.S. Person”

pursuant to Rule 902(k)(2)(i) of Regulation S under the U.S. Securities Act and is held on behalf of a person that is not a U.S. Person

by a dealer or other professional fiduciary organized, incorporated, or (if an individual) resident in the United States; or

(b) the

Subscriber is, or is acting for the account or benefit of, a U.S. Person or a person located in the United States and is an “accredited

investor” as defined in Regulation D of the U.S. Securities Act (a “U.S. Accredited Investor”), and is acquiring

the Shares for its own account or for the account or benefit of a U.S. Accredited Investor as to which it exercises sole investment discretion,

to be held for investment only and not with a view to any resale, distribution or other disposition of the Shares in violation of United

States securities laws or applicable state securities laws; and

IN EITHER CASE, the Subscriber

has properly completed and duly executed a U.S. Purchaser Certificate attached to this Subscription Agreement as Schedule D, and confirms

the truth and accuracy of all statements made by the Subscriber in such certificate.

| 7.4 | Other General Representations Applicable to the Subscriber |

(a) the

Subscriber has no knowledge of a “material fact” or “material change”, as those terms are defined herein, in respect

of the affairs of the Issuer that has not been generally disclosed to the public;

(b) the

Subscriber (and, if applicable, any beneficial purchaser for whom it is acting) is resident in the jurisdiction set out under the heading

“Name and Address of Subscriber” on the execution page of this Subscription Agreement;

(c) the

Subscriber is of legal age and has the legal capacity and competence to enter into and execute this Subscription Agreement and to take

all actions required pursuant hereto and, if the Subscriber is a corporation, it is duly incorporated and validly subsisting under the

laws of its jurisdiction of incorporation and all necessary approvals by its directors, shareholders and others have been obtained to

authorize execution of this Subscription Agreement on behalf of the Subscriber;

(d) the

entering into of this Subscription Agreement and the transactions contemplated hereby do not result in the violation of any of the terms

and provisions of any law applicable to, or the constating documents of, the Subscriber or of any agreement, written or oral, to which

the Subscriber may be a party or by which the Subscriber is or may be bound;

(e) the

Subscriber has duly and validly authorized, executed and delivered this Subscription Agreement and understands it is intended to constitute

a valid and binding agreement of the Subscriber enforceable against the Subscriber;

(f) in

connection with the Subscriber’s investment in the Shares, the Subscriber has not relied upon the Issuer for investment, legal or

tax advice, and has, in all cases sought the advice of the Subscriber’s own personal investment advisor, legal counsel and tax advisers

or has waived its rights thereto and the Subscriber is either experienced in or knowledgeable with regard to the affairs of the Issuer,

or either alone or with its professional advisors is capable, by reason of knowledge and experience in financial and business matters

in general, and investments in particular, of evaluating the merits and risks of an investment in the Shares and is able to bear the economic

risk of the investment and it can otherwise be reasonably assumed to have the capacity to protect its own interest in connection with

the investment in the Shares;

(g)

no person has made to the Subscriber any written or oral representations:

(i)

that any person will resell or repurchase the Shares;

(ii)

that any person will refund the purchase price for the Shares;

(iii)

as to the future price or value of the Shares; or

(iv) that

the Shares will be listed and posted for trading on a stock exchange or that application has been made to list and post the Shares for

trading on a stock exchange, other than the TSX-V;

Not a person in the United States

or a U.S. Person

(h) Unless

the Subscriber completes the U.S. Purchaser Certificate included herein as Schedule D (in which case the Subscriber represents, warrants

and covenants to the Issuer as to the accuracy of all matters set out therein) in connection with a purchase of the Securities made in

reliance on Regulation D, the Subscriber represents and warrants that:

(i)

the Securities are not being acquired, directly or indirectly, for the account or benefit of a U.S. Person or a person in the United

States and the Subscriber does not have any agreement or understanding (either written or oral) with any U.S. Person or a person in

the United States respecting:

(A)

the transfer or assignment of any rights or interests in any of the Securities;

(B) the division

of profits, losses, fees, commissions, or any financial stake in connection with this Subscription Agreement; or

(C)

the voting of the Securities; and

(ii) the

Subscriber has no intention to distribute either directly or indirectly any of the Securities in the United States or to U.S. Persons;

(iii)

the Subscriber represents that the current structure of this transaction and all transactions and activities contemplated hereunder is

not a scheme to avoid the registration requirements of the U.S. Securities Act;

(iv) the

Subscriber is a not a “U.S. Person” and is not purchasing the Securities for the account or benefit of any U.S. Person or

a person in the United States or for offering, resale or delivery for the account or benefit of any U.S. Person or a person in the United

States;

(v) the

Subscriber was outside the United States at the time of execution and delivery of this Subscription Agreement within the meaning of Regulation

S;

(vi) no

offers to sell the Securities were made by any person to the Subscriber while the Subscriber was in the United States;

(vii)

the Subscriber acknowledges that the Securities have not been and will not be registered under the U.S. Securities Act or the

securities laws of any state of the United States, and that the Securities may not be offered or sold in the United States, or to or

for the account or benefit of a U.S. Person or a person in the United States, unless an exemption from such registration

requirements is available. The Subscriber understands that the Issuer has no obligation or present intention of filing a

registration statement under the U.S. Securities Act in respect of the Securities; and

(viii) the

Subscriber will not engage in any directed selling efforts (as defined by Regulation S under the U.S. Securities Act) in the United States

in respect of the Securities, which would include any activities undertaken for the purpose of, or that could reasonably be expected to

have the effect of conditioning the market in the United States for the resale of the Securities.

Compliance with Resale Laws

(i) the

Subscriber will comply with Applicable Securities Laws and, if applicable, Rule 904 of Regulation S concerning the resale of the Securities

and all related restrictions (and the Issuer is not in any way responsible for such compliance) and will speak and consult with its own

legal advisors with respect to such compliance;

Own Expense

(j) the

Subscriber acknowledges and agrees that all costs and expenses incurred by the Subscriber (including any fees and disbursements of any

special counsel or other advisors retained by the Subscriber) relating to the purchase of the Shares will be borne by the Subscriber;

Indemnity

(k) The

foregoing acknowledgements are made by the Subscriber with the intent that they be relied upon by the Issuer in determining its suitability

as a purchaser of the Shares, and the Subscriber hereby agrees to indemnify the Issuer against all losses, claims, costs, expenses and

damages or liabilities which the Issuer may suffer or incur as a result of reliance thereon.

| 8. | The Issuer’s Representations |

| 8.1 | The Issuer represents and warrants to the Subscriber that, as

of the date of this Subscription Agreement and at Closing hereunder: |

(a) the

Issuer and any subsidiaries are valid and subsisting corporations duly incorporated and in good standing under the laws of the jurisdictions

in which they are incorporated, continued or amalgamated;

(b) the

Issuer has complied, or will comply, with all applicable corporate and securities laws and regulations in connection with the offer, sale

and issuance of the Securities;

(c) the

Issuer and any subsidiaries are the beneficial owners (or have the right to acquire) of the properties, business and assets or the interests

in the properties, business or assets referred to in its Public Record and except as disclosed therein, all agreements by which the Issuer

or its subsidiaries holds an interest in a property, business or asset are in good standing according to their terms, and the properties

are in good standing under the applicable laws of the jurisdictions in which they are situated;

(d)

no offering memorandum has been or will be provided to the Subscriber;

(e) the

financial statements comprised in the Public Record accurately reflect the financial position of the Issuer as at the date thereof, and

no adverse material changes in the financial position of the Issuer have taken place since the date of the Issuer’s last financial

statements except as filed in the Public Record;

(f) the

creation, issuance and sale of the Securities by the Issuer does not and will not conflict with and does not and will not result in a

breach of any of the terms, conditions or provisions of its constating documents or any agreement or instrument to which the Issuer is

a party;

(g) the

Securities will, at the time of issue, be duly allotted, validly issued, fully paid and non-assessable and will be free of all liens,

charges and encumbrances and the Issuer will reserve sufficient shares in the treasury of the Issuer to enable it to issue the Securities;

(h) this

Subscription Agreement, when accepted, will have been duly authorized by all necessary corporate action on the part of the Issuer and,

subject to acceptance by the Issuer, will constitute a valid obligation of the Issuer legally binding upon it and enforceable in accordance

with its terms;

(i) neither

the Issuer nor any of its subsidiaries is a party to any actions, suits or proceedings which could materially affect its business or financial

condition, and to the best of the Issuer’s knowledge no such actions, suits or proceedings have been threatened as at the date hereof,

except as disclosed in the Public Record;

(j) no

order ceasing or suspending trading in the securities of the Issuer nor prohibiting sale of such securities has been issued to the Issuer

or its directors, officers or promoters and to the best of the Issuer’s knowledge no investigations or proceedings for such purposes

are pending or threatened; and

(k) except

as set out in the Public Record or herein, no person has any right, agreement or option, present or future, contingent or absolute, or

any right capable of becoming a right, agreement or option for the issue or allotment of any unissued common shares of the Issuer or any

other security convertible or exchangeable for any such shares or to require the Issuer to purchase, redeem or otherwise acquire any of

the issued or outstanding shares of the Issuer.

| 9. | Covenants of the Issuer |

| 9.1 | The Issuer hereby covenants with each Subscriber that it will: |

(a) offer,

sell, issue and deliver the Securities pursuant to exemptions from the prospectus filing, registration or qualification requirements of

Applicable Securities Laws and otherwise fulfil all legal requirements required to be fulfilled by the Issuer (including without limitation,

compliance with all Applicable Securities Laws in connection with the Offering;

(b) within

the required time, file with the TSX-V any documents, reports and information, in the required form, required to be filed by Applicable

Securities Laws in connection with the Offering, together with any applicable filing fees and other materials;

(c) the

Issuer will use reasonable commercial efforts to satisfy as expeditiously as possible any conditions of the TSX-V required to be satisfied

prior to the TSX-V’s acceptance of the Issuer’s notice of the Offering; and

(d)

use its reasonable commercial efforts to obtain all necessary approvals for this Offering.

| 10. | No Contractual Right of Action for Rescission |

| 10.1 | The Subscriber acknowledges that it is purchasing the Securities

issued hereunder pursuant to an exemption which does not require delivery to the Subscriber of an offering memorandum, that it will not

receive any offering memorandum in connection with this Subscription Agreement and therefore is not entitled to contractual rights of

action or rescission. |

| 11. | Resale Restrictions and Legending of Securities |

| 11.1 | The Subscriber acknowledges that any resale of the Securities

will be subject to resale restrictions contained in the Applicable Securities Laws applicable to the Issuer, the Subscriber or any proposed

transferee. Subscribers with a Canadian or international address will receive a certificate bearing the following legends imprinted thereon: |

“Unless permitted under

securities legislation, the holder of this security must not trade the security before [four months plus one day from the Closing Date]”;

and

“Without

prior written approval of TSX Venture Exchange and compliance with all applicable securities legislation, the securities represented

by this certificate may not be sold, transferred, hypothecated or otherwise traded on or through the facilities of TSX Venture Exchange

or otherwise in Canada or to or for the benefit of a Canadian resident until [four (4) months from the Closing Date.]”

| 11.2 | If Subscriber is, or is acting for the account or benefit of,

a U.S. Person or a person in the United States, in addition to the legends set forth in paragraphs 11.1 and 11.2 above, the certificates

representing the Securities will bear a U.S. restrictive legend set forth in Schedule D hereto. |

| 11.3 | The Subscriber is aware that the Securities have not been and

will not be registered under the U.S. Securities Act or the securities laws of any state and that the Securities may not be offered or

sold in the United States without registration under the U.S. Securities Act or compliance with requirements of an exemption from registration

and the applicable laws of all applicable states and acknowledges that the Issuer has no present intention of filing a registration statement

under the U.S. Securities Act in respect of the Securities. |

| 12.1 | Time is of the essence hereof. |

| 12.2 | Neither this Subscription Agreement nor any provision hereof

will be modified, changed, discharged or terminated except by an instrument in writing signed by the party against whom any waiver, change,

discharge or termination is sought. |

| 12.3 | The parties hereto will execute and deliver all such further

documents and instruments and do all such acts and things as may either before or after the execution of this Subscription Agreement

be reasonably required to carry out the full intent and meaning of this Subscription Agreement. |

| 12.4 | This Subscription Agreement will be subject to, governed by

and construed in accordance with the laws of British Columbia and the laws of Canada as applicable therein and the Subscriber hereby

irrevocably attorns to the jurisdiction of the Courts situate therein. |

| 12.5 | This Subscription Agreement may not be assigned by any party

hereto. |

| 12.6 | Without limitation, this Subscription Agreement and the transactions

contemplated hereby are conditional upon and subject to the Issuer receiving the acceptance of the TSX-V for this Subscription Agreement

and the transactions contemplated hereby. |

| 12.7 | The Issuer will be entitled to rely on delivery of a facsimile

or other electronic copy of this Subscription Agreement, and acceptance by the Issuer of a facsimile or other electronic copy of this

Subscription Agreement will create a legal, valid and binding agreement between the Subscriber and the Issuer in accordance with its

terms. |

| 12.8 | This Subscription Agreement may be signed by the parties in

as many counterparts as may be deemed necessary, each of which so signed will be deemed to be an original, and all such counterparts

together will constitute one and the same instrument. |

| 12.9 | This Subscription Agreement is deemed to be entered into on

the acceptance date by Issuer, notwithstanding its actual date of execution by the Subscriber. |

| 12.10 | The Subscriber and each beneficial purchaser, if any, acknowledge

their consent and request that all documents evidencing or relating in any way to the purchase of the Shares be drawn up in the English

language only. Nous reconnaissons par les présentes avoir consenté et demandé que tous les documents faisant

foi ou se rapportant de quelque manière à l’achat des actions ordinaries soient rédigés en anglais

seulement. |

| 12.11 | This Subscription Agreement, including, without limitation,

the representations, warranties, acknowledgements and covenants contained herein, will survive and continue in full force and effect

and be binding upon the parties notwithstanding the completion of the purchase of the Shares by the Subscriber pursuant hereto, the completion

of the issue of Shares of the Issuer and any subsequent disposition by the Subscriber of the Shares. |

| 12.12 | The invalidity or unenforceability of any particular provision

of this Subscription Agreement will not affect or limit the validity or enforceability of the remaining provisions of this Subscription

Agreement. |

| 12.13 | Except as expressly provided in this Subscription Agreement

and in the agreements, instruments and other documents contemplated or provided for herein, this Subscription Agreement contains the

entire agreement between the parties with respect to the sale of the Securities and there are no other terms, conditions, representations

or warranties, whether expressed, implied, oral or written, by statute, by common law, by the Issuer, by the Subscriber, or by anyone

else. In the event that execution pages are delivered to the Issuer without this entire Agreement, the Issuer is entitled to assume that

the Subscriber, and each beneficial purchaser for whom it is acting, has accepted all of the terms and conditions contained in the parts

of this Subscription Agreement that are not returned, without amendment or modification. |

| 12.14 | Unless otherwise stated, all monetary amounts expressed herein

are Canadian Dollars. |

[Execution Page Follows]

Exhibit 99.1

N E W S R E L E A S E

Siyata Mobile Appoints Campbell Becher to Board

of Directors

Vancouver, BC – September 3, 2024 --

Siyata Mobile Inc. (Nasdaq: SYTA) (“Siyata” or the “Company”),

a global developer and vendor of Push-to-Talk over Cellular (PoC) handsets and accessories, today announces the appointment of Mr. Campbell

Becher to the Siyata board of directors (the “Board”) effective September 1, 2024.

Following the appointment, the Board is comprised

of 4 directors, 3 of whom are independent. Mr. Becher fills the board seat vacated by Stephen Ospalak who resigned earlier.

Marc Seelenfreund, CEO of Siyata, commented, “Campbell

is a seasoned investment banker with years of experience in growing small cap public companies, and we are pleased to welcome him to the

Siyata Board. His leadership and financial expertise will be tremendous assets to the company as we strive to further grow our business.

We thank Stephen for his many years of dedication to Siyata and wish him all the best in his next endeavors.”

Mr. Becher currently serves as the Chief Executive

Officer of IberAmerican Lithium. Mr. Becher has more than 20 years of experience in investment banking, including the founding of Byron

Capital Markets, where he served as CEO and led its sponsorship of the Electric Metals Conference for several years and sponsored the

Industrial Minerals World Lithium Conference. Mr. Becher currently serves as a board member at Royal Helium Ltd. and Strategic Minerals

Europe Corp. He previously served as a Managing Director at Haywood Securities Inc.

About Siyata Mobile

Siyata Mobile Inc. is

a B2B global developer and vendor of next-generation Push-To-Talk over Cellular handsets and accessories. Its portfolio of rugged PTT

handsets and accessories enables first responders and enterprise workers to instantly communicate over a nationwide cellular network of

choice, to increase situational awareness and save lives. Police, fire, and ambulance organizations as well as schools, utilities, security

companies, hospitals, waste management companies, resorts and many other organizations use Siyata PTT handsets and accessories today.

In support of our Push-to-Talk

handsets and accessories, Siyata also offers enterprise-grade In-Vehicle solutions and Cellular Booster systems enabling our customers

to communicate effectively when they are in their vehicles, and even in areas where the cellular signal is weak.

Siyata sells its portfolio

through leading North American cellular carriers, and through international cellular carriers and distributors.

Siyata’s common shares trade on the Nasdaq under

the symbol “SYTA”.

Visit www.siyata.net and unidencellular.com to learn more.

Investor Relations:

Brett Maas

Hayden IR

SYTA@Haydenir.com

646-536-7331

Siyata Mobile Corporate:

Glenn Kennedy, VP of International Sales

Siyata Mobile Inc.

glenn@siyata.net

Forward Looking Statements

This press release contains forward-looking statements

within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 and other Federal

securities laws. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,”

“seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking

statements. Because such statements deal with future events and are based on Siyata’s current expectations, they are subject to various

risks and uncertainties and actual results, performance, or achievements of Siyata could differ materially from those described in or

implied by the statements in this press release. The forward-looking statements contained or implied in this press release are subject

to other risks and uncertainties, including those discussed under the heading “Risk Factors” in Siyata’s filings with the Securities

and Exchange Commission (“SEC”), and in any subsequent filings with the SEC. Except as otherwise required by law, Siyata undertakes

no obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date

hereof or to reflect the occurrence of unanticipated events. References and links to websites and social media have been provided as a

convenience, and the information contained on such websites or social media is not incorporated by reference into this press release.

- END -

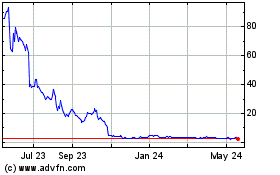

Siyata Mobile (NASDAQ:SYTA)

Historical Stock Chart

From Oct 2024 to Nov 2024

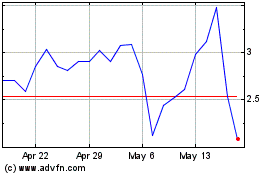

Siyata Mobile (NASDAQ:SYTA)

Historical Stock Chart

From Nov 2023 to Nov 2024