As filed with the Securities and Exchange Commission on July 15, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

trivago N.V.

(Exact Name of Registrant as Specified in its Charter)

| | | | | |

The Netherlands | Not Applicable |

(State or other Jurisdiction of | (I.R.S. Employer Identification |

Incorporation or Organization) | Number) |

| Kesselstraße 5 - 7 |

| 40221 Düsseldorf |

Federal Republic of Germany

+49-171-6115916

(Address, including zip code, of registrant’s principal executive offices)

TRIVAGO N.V. AMENDED AND RESTATED 2016 OMNIBUS INCENTIVE PLAN

(Full title of the plan)

Cogency Global Inc.

122 East 42nd Street, 18th floor

New York, NY 10168

(212) 947-7200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

| | | | | |

trivago N.V. Kesselstraße 5 - 7 40221 Düsseldorf Federal Republic of Germany Attn: Legal Department +49-171-6115916 | Michael Albano Cleary Gottlieb Steen & Hamilton LLP One Liberty Plaza New York, NY 10006 +1 212 225 2438 |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐

Non-accelerated filer ☐

Emerging growth company ☐

Accelerated filer ☒

Smaller reporting company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Explanatory note

Pursuant to General Instruction E of Form S-8, trivago N.V. (the “Registrant”) is filing this registration statement on Form S-8 (this “Registration Statement”) with the U.S. Securities and Exchange Commission (the “Commission”) to register, in connection with the Registrant’s Amended and Restated 2016 Omnibus Incentive Plan (the “Plan”), an additional 20,526,250 shares of the same class as registered under the Registrant’s effective registration statement on Form S-8, File No. 333-215164, filed by the Registrant with the Commission on December 19, 2016 and the Registrant’s effective registration statement on Form S-8, File No. 333-258288, filed by the Registrant with the Commission on July 30, 2021 (together, the “Earlier Registration Statements”). The contents of the Earlier Registration Statements, where applicable, are hereby incorporated by reference, except that the provisions contained in Part II of such Earlier Registration Statements are modified as set forth in this Registration Statement.

Part I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Information required by Part I to be contained in the Section 10(a) prospectus is omitted from this Registration Statement in accordance with Rule 428 under the Securities Act of 1933, as amended (the “Securities Act”), and the Note to Part I of Form S-8. The documents containing information specified in this Part I will be separately provided to the participants covered by the Plan, as may be amended and restated, as specified by Rule 428(b)(1) under the Securities Act.

Part II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents, which the Registrant has filed with the Commission pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”) are hereby incorporated by reference herein, and shall be deemed to be a part of, this Registration Statement:

c.the description of the Registrant’s Class A shares, contained in Exhibit 2.6 of the Annual Report, together with any amendment thereto filed with the Commission for the purpose of updating such description.

All documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, after the date of this Registration Statement and prior to the filing of a post-effective amendment to this Registration Statement which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be part thereof from the date of filing of such documents.

For purposes of this Registration Statement, any document or any statement contained in a document incorporated or deemed to be incorporated herein by reference shall be deemed to be modified or superseded to the extent that a subsequently filed document or a statement contained therein, or in any other subsequently filed document which also is or is deemed to be incorporated by reference, modifies or supersedes such document or such statement in such document. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 8. Exhibits.

The following documents are filed as part of this Registration Statement:

| | | | | | | | | | | | | | | | | |

| | Incorporated by reference | |

| | Form | Exhibit | Filing Date | Filed herewith |

| 4.1 | | 20-F | 1.1 | 3/1/2024 | |

| 4.2 | | | | | # |

| 4.3 | | F-3 | 4.4 | 4/5/2018 | |

| 4.3(a) | | F-6 | (a)(ii) | 11/17/2023 | |

| 4.4 | | F-3 | 4.4 | 4/5/2018 | |

| 5.1 | | | | | # |

| 23.1 | | | | | # |

| 23.2 | | | | | # |

| 24.1 | | | | | # |

| 107 | | | | | # |

Signatures

Pursuant to the requirements of the Securities Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Düsseldorf, Federal Republic of Germany, on July 15, 2024.

| | | | | | | | |

| trivago N.V. |

| |

| By: | | /s/ Johannes Thomas |

| | Johannes Thomas |

| | Managing Director & Chief Executive Officer |

| |

| By: | | /s/ Robin Harries |

| | Robin Harries |

| | Managing Director & Chief Financial Officer |

| |

| By: | | /s/ Andrej Lehnert |

| | Andrej Lehnert |

| | Managing Director & Chief Product Officer |

| | |

| By: | | /s/ Jasmine Ezz |

| | Jasmine Ezz |

| | Managing Director & Chief Marketing Officer |

Power of Attorney

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints Johannes Thomas and Robin Harries, severally and individually, and each of them (with full power to each of them to act alone) his true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him and in his name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Commission, granting unto each said attorneys-in-fact and agents full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of their or his substitute or substitutes, may lawfully do or cause to be done by virtue thereof.

Pursuant to the requirements of the Securities Act, this registration statement has been signed by the following persons on July 15, 2024 in the capacities indicated. This document may be executed in counterparts that when so executed shall constitute one document, notwithstanding that all of the undersigned are not signatories to the original of the same counterpart.

| | | | | |

| Name | Title |

| /s/ Johannes Thomas | |

| Johannes Thomas | Managing Director & Chief Executive Officer |

| /s/ Robin Harries | |

| Robin Harries | Managing Director & Chief Financial Officer |

| /s/ Jasmine Ezz | |

| Jasmine Ezz | Managing Director & Chief Marketing Officer |

| /s/ Andrej Lehnert | |

| Andrej Lehnert | Managing Director & Chief Product Officer |

Signature of Authorized Representative in the United States

| | | | | | | | |

| Cogency Global Inc. |

| |

| By: | /s/ Colleen A. Devries |

| | Name: | Colleen A. Devries |

| | Title: | SVP on behalf of Cogency Global Inc. |

EXHIBIT 107

CALCULATION OF FILING FEE TABLES

Form S-8

(Form Type)

trivago N.V.

(Exact name of registrant as specified in its charter)

Table 1: Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | |

Security Type | Security Class Title | Fee Calculation Rule | Amount Registered (2) | Proposed Maximum Offering Price Per Unit (3) | Maximum Aggregate Offering Price | Fee Rate | Amount of Registration Fee |

Equity | Class A shares, nominal value of €0.06 per share, underlying American depositary shares (“ADSs”) (1) | Rule 457(c) and Rule 457(h) | 20,526,250 |

$0.40 |

$8,210,500 | $0.0001476 per dollar | $1,211.87 |

Total Offering Amounts | $8,210,500 |

| $1,211.87 |

Total Fee Offsets |

|

| — |

Net Fee Due |

|

| $1,211.87 |

| | | | | |

(1) | The Class A shares may be represented by the Registrant’s American Depositary Shares, or ADSs. Each ADS represents five (5) Class A shares. The Registrant’s ADSs issuable upon deposit of the Class A shares registered hereby have been registered pursuant to a separate registration statement on Form F-6 filed on November 17, 2023 (File No. 333-214914). |

(2) | Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement on Form S-8 shall also cover such indeterminate number of additional shares as may become issuable under the Registrant’s Amended and Restated 2016 Omnibus Incentive Plan (the “Plan”) in connection with any adjustment or anti-dilution provision of the Plan. |

(3) | The proposed maximum offering price per Class A share is estimated solely for the purposes of calculating the registration fee under Rule 457(c) and Rule 457(h) under the Securities Act. The per share price is calculated by dividing $2.00 per ADS, the average of the high and low sale prices per share of the ADSs on the Nasdaq Global Select Market on July 10, 2024, which date is within five business days prior to the filing of this registration statement, by five, the number of Class A shares underlying each ADS. The Class A shares only trade on Nasdaq in ADS form. |

TRIVAGO N.V.

AMENDED AND RESTATED 2016 OMNIBUS INCENTIVE PLAN

Section 1. PURPOSE; DEFINITIONS

The purposes of this Plan are to give the Company a competitive advantage in attracting, retaining and motivating officers, employees, directors and/or consultants and to provide the Company and its Subsidiaries and Affiliates with a share and incentive plan providing incentives directly linked to shareholder value. Certain terms used herein have definitions given to them in the first place in which they are used. In addition, for purposes of this Plan, the following terms are defined as set forth below:

“ADSs” means American Depositary Shares, representing Ordinary Shares on deposit with a U.S. banking institution selected by the Company and which are registered pursuant to a Form F-6.

“Affiliate” means a corporation or other entity controlled by, controlling or under common control with, the Company.

“Annual Aggregate Cash-Based Award Limit” means an amount, determined each fiscal year, denominated in Euro, proposed by the Management Board and approved by the Committee in connection with the Company’s annual business plan, it being understood that if the Management Board and the Committee do not agree on an amount for a specific fiscal year, the amount will be zero.

“Annual Aggregate Share-Based Award Limit” means a number of Shares, determined each fiscal year, proposed by the Management Board and approved by the Committee in connection with the Company’s annual business plan, it being understood that if the Management Board and the Committee do not agree on a number of Shares for a specific fiscal year, the number will be zero.

“Annual Individual Cash-Based Award Limit” means an amount, determined each fiscal year, denominated in Euro, proposed by the Management Board and approved by the Committee in connection with the Company’s annual business plan, it being understood that if the Management Board and the Committee do not agree on an amount for a specific fiscal year, the amount will be zero.

“Annual Individual Share-Based Award Limit” means a number of Shares, determined each fiscal year, proposed by the Management Board and approved by the Committee in connection with the Company’s annual business plan, it being understood that if the Management Board and the Committee do not agree on a number of Shares for a specific fiscal year, the number will be zero.

“Annual Limits” means the Annual Aggregate Cash-Based Award Limit, the Annual Aggregate Share-Based Award Limit, the Annual Individual Cash-Based Award Limit and the Annual Individual Share-Based Award Limit.

“Applicable Exchange” means the NASDAQ, the NYSE or such other securities exchange as may at the applicable time be the principal market for the Shares.

“Award” means an Option, Share Appreciation Right, Restricted Share Unit, other share-based award or Cash-Based Award granted or assumed pursuant to the terms of this Plan.

“Award Agreement” means a written or electronic document or agreement setting forth the terms and conditions of a specific Award; the terms and conditions of which must be approved by the Committee.

“Cash-Based Award” means an Award denominated in an euro amount.

“Cause” means, unless otherwise provided in an Award Agreement, (a) “Cause” as defined in any Individual Agreement to which the applicable Participant is a party, or (b) if there is no such Individual Agreement or if it does not define Cause: (i) the willful or gross neglect by a Participant of his employment duties; (ii) the plea of guilty or nolo contendere to, or conviction for, the commission of a felony offense by a Participant under the applicable laws of the jurisdiction in which the Participant is employed; (iii) a material breach by a Participant of a fiduciary duty owed to the Company or any of its Subsidiaries; (iv) a material breach by a Participant of any nondisclosure, non-solicitation or non-competition obligation owed to the Company or any of its Affiliates; or (v) such other events as shall be determined by the Committee and set forth in a Participant’s Award Agreement.

"Code" means the U.S. Internal Revenue Code of 1986, as amended from time to time, and any successor thereto, the Treasury Regulations thereunder and other relevant interpretive guidance issued by the U.S. Internal Revenue Service or the Treasury Department. Reference to any specific section of the Code shall be deemed to include such regulations and guidance, as well as any successor provision of the Code.

“Commission” means the U.S. Securities and Exchange Commission or any successor agency.

“Committee” has the meaning set forth in Section 2(a).

“Corporate Transaction” has the meaning set forth in Section 3(c)(i).

“Company” means trivago N.V., a Dutch public limited company (naamloze vennootschap), or its successor.

“Director” means any Eligible Individual who is a member of the Management Board or the Supervisory Board.

“Disability” means (i) “Disability” as defined in any Individual Agreement to which the Participant is a party, or (ii) if there is no such Individual Agreement or it does not define “Disability,” (A) permanent and total disability as determined under the Company’s long-term disability plan applicable to the Participant, or (B) if there is no such plan applicable to the

Participant or the Committee determines otherwise in an applicable Award Agreement, “Disability” as determined by the Committee.

“Disaffiliation” means a Subsidiary’s or Affiliate’s ceasing to be a Subsidiary or Affiliate for any reason (including, without limitation, as a result of a public offering, or a spinoff or sale by the Company, of the share of the Subsidiary or Affiliate) or a sale of a division of the Company and its Affiliates.

“EBITA” means for any period, operating profit (loss) plus (i) amortization, including goodwill impairment, (ii) amortization of non-cash distribution and marketing expense and non-cash compensation expense, (iii) disengagement expenses, (iv) restructuring charges, (v) non cash write-downs of assets or goodwill, (vi) charges relating to disposal of lines of business, (vii) litigation settlement amounts and (viii) costs incurred for proposed and completed acquisitions.

“EBITDA” means for any period, operating profit (loss) plus (i) depreciation and amortization, including goodwill impairment, (ii) amortization of non-cash distribution and marketing expense and non-cash compensation expense, (iii) disengagement expenses, (iv) restructuring charges, (v) non cash write-downs of assets or goodwill, (vi) charges relating to disposal of lines of business, (vii) litigation settlement amounts and (viii) costs incurred for proposed and completed acquisitions.

“Effective Date” has the meaning set forth in Section 9(a).

“Eligible Individuals” means directors, officers, employees and consultants of the Company or any of its Subsidiaries or Affiliates, and prospective directors, officers, employees and consultants who have accepted offers of employment, service or consultancy from the Company or its Subsidiaries or Affiliates.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended from time to time, and any successor thereto.

“Fair Market Value” means, unless otherwise determined by the Committee, as of any date, the value of Shares determined as follows:

(a) If the Shares are listed on one or more established stock exchanges or traded on one or more automated quotation systems, the Fair Market Value shall be the closing price of a Share on the Applicable Exchange on the date of measurement, or if Shares were not traded on the Applicable Exchange on such measurement date, then on the next preceding date on which Shares were traded, all as reported by such source as the Committee may select; and

(b) If the Shares are not listed on an established stock exchange or traded on an automated quotation system, Fair Market Value shall be determined by the Committee in its good faith discretion.

“Free-Standing SAR” has the meaning set forth in Section 5(a).

“Grant Date” means (a) the date on which the Committee (or if so delegated, as the Management Board) by resolution selects an Eligible Individual to receive a grant of an Award and determines the number of Shares to be subject to such Award or the formula for earning a number of shares or cash amount, or (b) such date as the Committee (or if so delegated, as the Management Board) shall provide in such resolution.

“Individual Agreement” means an employment, service, consulting or similar agreement between a Participant and the Company or one of its Subsidiaries or Affiliates.

“Management Board” means the Management Board of the Company.

“NASDAQ” means the National Association of Securities Dealers Inc. Automated Quotation System.

“NYSE” means the New York Stock Exchange.

“Option” means an Award described under Section 5.

“Ordinary Shares” means the class A shares, with nominal value of €0.06 per share, of the Company.

“Participant” means an Eligible Individual to whom an Award is or has been granted.

“Plan” means this trivago N.V. 2016 Omnibus Incentive Plan, as set forth herein and as hereafter amended from time to time.

“Restricted Share Units” means an Award described under Section 6.

“Retirement” means retirement from active employment with the Company, a Subsidiary or Affiliate at or after the Participant’s attainment of age 65.

“RSU Restriction Period” has the meaning set forth in Section 6(b)(ii).

“Share” means an Ordinary Share, unless there are ADSs available, in which case “Share” will mean the number of ADSs equal to an Ordinary Share. If the ratio of ADSs to Ordinary Shares is not 1:1, then (a) all amounts determined under Section 3 and (b) all Awards designated as Awards over Ordinary Shares will automatically be adjusted to reflect the ratio of the ADSs to Ordinary Shares, as reasonably determined by the Committee or the Supervisory Board.

“Share Appreciation Right” has the meaning set forth in Section 5.

“Share Change” has the meaning set forth in Section 3(c)(ii).

“Subsidiary” means any corporation, partnership, joint venture, limited liability company or other entity during any period in which at least a 50% voting or profits interest is owned, directly or indirectly, by the Company or any successor to the Company.

“Supervisory Board” means the Supervisory Board of the Company.

“Tandem SAR” has the meaning set forth in Section 5(b).

“Term” means the maximum period during which an Option or Share Appreciation Right may remain outstanding, subject to earlier termination upon Termination of Employment or otherwise, as specified in the applicable Award Agreement.

“Termination of Employment” means the termination of the applicable Participant’s employment with, or performance of services for, the Company and any of its Subsidiaries or Affiliates. Unless otherwise determined by the Committee, if a Participant’s employment with, or membership on a board of directors of, the Company and its Affiliates terminates but such Participant continues to provide services to the Company and its Affiliates in a non-employee director capacity or as an employee, as applicable, such change in status shall not be deemed a Termination of Employment. A Participant employed by, or performing services for, a Subsidiary or an Affiliate or a division of the Company and its Affiliates shall be deemed to incur a Termination of Employment if, as a result of a Disaffiliation, such Subsidiary, Affiliate, or division ceases to be a Subsidiary, Affiliate or division, as the case may be, and the Participant does not immediately thereafter become an employee of (or service provider for), or member of the board of directors of, the Company or another Subsidiary or Affiliate. Temporary absences from employment because of illness, vacation or leave of absence (including maternal leave and parental leave) and transfers among the Company and its Subsidiaries and Affiliates shall not be considered Terminations of Employment.

Section 2. ADMINISTRATION

(a)Committee. All aspects of this Plan shall be administered by a committee of the Supervisory Board as the Supervisory Board may from time to time designate (the “Committee”), which committee shall be composed of not less than two members of the Supervisory Board, and shall be appointed by and serve at the pleasure of the Supervisory Board. The Committee shall have plenary authority to grant Awards pursuant to the terms of this Plan to Directors and shall have the authority to approve any grants of Awards proposed by the Management Board to be made pursuant to the terms of this Plan to Eligible Individuals who are not Directors. Among other things, the Committee shall have the authority, subject to the terms of this Plan:

(i)to (A) select the Directors and (B) approve the Eligible Individuals (other than Directors) proposed by the Management Board, in each case, to whom Awards may from time to time be granted;

(ii)to determine (in the case of Directors), and to approve the determination proposed by the Management Board (in the case of Eligible Individuals who are not Directors) of, whether and to what extent Options, Share Appreciation Rights, Restricted Share Units, other share-based awards, Cash-Based Awards or any combination thereof, are to be granted hereunder and with respect to employees of the Company that are U.S.

taxpayers, whether and to what extent any Option is intended to qualify as an "incentive stock option" within the meaning of Section 422 of the Code;

(iii)to determine (in the case of Directors), and to approve the determination proposed by the Management Board (in the case of Eligible Individuals who are not Directors) of, the number of Shares to be covered by each Award granted hereunder or the amount of any Cash-Based Award;

(iv)to determine the terms and conditions of each Award granted hereunder, based on such factors as the Committee shall determine;

(v)subject to Section 9, to modify, amend or adjust the terms and conditions of any Award, at any time or from time to time;

(vi)to adopt, alter and repeal such administrative rules, guidelines and practices governing this Plan as it shall from time to time deem advisable;

(vii)to accelerate the vesting or lapse of restrictions of any outstanding Award, based, in each case, on such considerations as the Committee in its sole discretion determines;

(viii)to interpret the terms and provisions of this Plan and any Award issued under this Plan (and any agreement relating thereto);

(ix)to establish any “blackout” period that the Committee in its sole discretion deems necessary or advisable;

(x)to decide all other matters that must be determined in connection with an Award;

(xi)to designate whether such Awards will be over Ordinary Shares or ADSs; and

(xii)to otherwise administer this Plan.

(b)Procedures.

(i)The Committee may act only by a majority of its members then in office, except that the Committee may, except to the extent prohibited by applicable law or the listing standards of the Applicable Exchange, allocate all or any portion of its responsibilities and powers to any one or more of its members and may delegate all or any part of its responsibilities and powers to any person or persons selected by it.

(ii)Subject to any applicable law, regulation or listing standard, any authority granted to the Committee may also be exercised by the full Supervisory Board. To the

extent that any permitted action taken by the Supervisory Board conflicts with action taken by the Committee, the Supervisory Board action shall control.

(iii)Upon Awards being granted in accordance with the provisions of this Plan, the Management Board shall procure that it takes all relevant corporate action to give effect to such grant.

(c)Discretion of Committee. Any determination made by the Committee or by an appropriately delegated officer pursuant to delegated authority under the provisions of this Plan with respect to any Award shall be made in the sole discretion of the Committee or such delegate at the time of the grant of the Award or, unless in contravention of any express term of this Plan, at any time thereafter. To the extent permitted by applicable law, all decisions made by the Committee or any appropriately delegated officer pursuant to the provisions of this Plan shall be final and binding on all persons, including the Company, Participants, and Eligible Individuals.

(d)Award Agreements. The terms and conditions of each Award (other than any Cash-Based Award), as determined by the Committee, shall be set forth in an Award Agreement, which shall be delivered to the Participant receiving such Award upon, or as promptly as is reasonably practicable following, the grant of such Award. The effectiveness of an Award shall not be subject to the Award Agreement’s being signed by the Company and/or the Participant receiving the Award unless specifically so provided in the Award Agreement. Award Agreements may be amended only in accordance with Section 9.

(e)Delegation of Authority to Management Board. Without limiting the generality of Section 2(b)(i) and notwithstanding anything in Sections 2(a)(i), 2(a)(ii), 2(a)(iii), 2(a)(iv), 2(a)(v) and 2(a)(xi) to the contrary (but subject to the requirements of this Section 2(e)), during each fiscal year of the Company, the Management Board may grant to Eligible Individuals who are not Directors (and administer such Awards), (A) Cash-Based Awards up to and not in excess of (I) the Annual Aggregate Cash-Based Award Limit for all Cash-Based Awards granted during such fiscal year and (II) the Annual Individual Cash-Based Award Limit for any Eligible Individual during such fiscal year, and (B) Share-based Awards up to and not in excess of (I) the Annual Aggregate Share-Based Award Limit for all such Share-based Awards granted during such fiscal year and (II) the Annual Individual Share-Based Award Limit for any Eligible Individual during such fiscal year. Any Awards granted pursuant to this Section 2(e) shall be pursuant to a form Award Agreement approved by the Committee. The Committee may also delegate any other authority it may have under Section 2(a) to administer the Plan and Awards granted hereunder to the Management Board with respect to Eligible Individuals who are not Directors. To the extent that the Management Board takes action pursuant to the authority granted to it under this Section 2(e), then such action will for all purposes of the Plan be treated as an action by the Committee.

Section 3. SHARES SUBJECT TO PLAN

(a)Plan Maximums. The maximum number of Shares that may be delivered pursuant to Awards under this Plan shall be 80,161,948 Shares. Shares subject to an Award under this Plan may be authorized and unissued Ordinary Shares, Ordinary Shares held in treasury, or ADSs.

(b)Rules for Calculating Shares Delivered.

(i)With respect to Awards, to the extent that any Award is forfeited, terminates, expires or lapses without being exercised, or any Award is settled for cash, the Shares subject to such Award not delivered as a result thereof shall again be available for Awards under this Plan.

(ii)With respect to Awards, if the exercise price of any Option or Share Appreciation Right and/or the tax withholding obligations relating to any Award are satisfied by delivering Shares to the Company (by either actual delivery or by attestation), only the number of Shares issued net of the Shares delivered or attested to shall be deemed delivered for purposes of the limits set forth in Section 3(a).

(iii)With respect to Awards, to the extent any Shares subject to an Award are withheld (i.e., not issued or delivered) to satisfy the exercise price (in the case of an Option or Share Appreciation Right) and/or the tax withholding obligations relating to such Award, such Shares shall not be deemed to have been delivered for purposes of the limits set forth in Section 3(a).

(c)Adjustment Provisions.

(i)In the event of a merger, consolidation, acquisition of property or shares, share rights offering, liquidation, disposition for consideration of the Company’s direct or indirect ownership of a Subsidiary or Affiliate (including by reason of a Disaffiliation), or similar event affecting the Company or any of its Subsidiaries (each, a “Corporate Transaction”), the Committee or the Supervisory Board may in its discretion make such substitutions or adjustments as it deems appropriate and equitable to (A) the aggregate number and kind of Shares or other securities reserved for issuance and delivery under this Plan; (B) the various maximum limitations set forth in Sections 3(a) upon certain types of Awards and upon the grants to individuals of certain types of Awards; (C) the number and kind of Shares or other securities subject to outstanding Awards; and (D) the exercise price of outstanding Options and Share Appreciation Rights.

(ii)In the event of a share dividend, share split, reverse share split, reorganization, share combination, or recapitalization or similar event affecting the capital structure of the Company or a Disaffiliation, separation or spinoff, in each case, without consideration, or other extraordinary dividend of cash or other property (each, a “Share Change”), the Committee or the Supervisory Board shall make such substitutions

or adjustments as it deems appropriate and equitable to (A) the aggregate number and kind of Shares or other securities reserved for issuance and delivery under this Plan; (B) the various maximum limitations set forth in Sections 3(a)upon certain types of Awards and upon the grants to individuals of certain types of Awards; (C) the number and kind of Shares or other securities subject to outstanding Awards; and (D) the exercise price of outstanding Options and Share Appreciation Rights.

(iii)In the case of Corporate Transactions, the adjustments contemplated by clause (i) of this Section 3(c) may include, without limitation, (A) the cancellation of outstanding Awards in exchange for payments of cash, property or a combination thereof having an aggregate value equal to the value of such Awards, as determined by the Committee or the Supervisory Board in its sole discretion (it being understood that in the case of a Corporate Transaction with respect to which holders of Shares receive consideration other than publicly traded equity securities of the ultimate surviving entity, any such determination by the Committee that the value of an Option or Share Appreciation Right shall for this purpose be deemed to equal the excess, if any, of the value of the consideration being paid for each Share pursuant to such Corporate Transaction over the exercise price of such Option or Share Appreciation Right, shall conclusively be deemed valid); (B) the substitution of other property (including, without limitation, cash or other securities of the Company and securities of entities other than the Company) for the Shares subject to outstanding Awards; and (C) in connection with any Disaffiliation, arranging for the assumption of Awards, or replacement of Awards with new awards based on other property or other securities (including, without limitation, other securities of the Company and securities of entities other than the Company), by the affected Subsidiary, Affiliate, or division or by the entity that controls such Subsidiary, Affiliate, or division following such Disaffiliation (as well as any corresponding adjustments to Awards that remain based upon Company securities).

(iv)Any adjustment under this Section 3(c) need not be the same for all Participants.

Section 4. ELIGIBILITY

(a)Awards may be granted under this Plan to Eligible Individuals.

(b)Awards granted to Directors shall be subject to one or more of the factors, as selected by the Committee and specified in the applicable Award Agreement, from among the following objective measures, either individually, alternatively or in any combination, applied to the Company as a whole, any Subsidiary, Affiliate, division, department or business unit, either individually, alternatively, or in any combination, on a GAAP or non-GAAP basis, including relative to the performance of other entities, divisions or subsidiaries, and measured, to the extent applicable on an absolute basis or relative to a pre-established target: (i) earnings per share from continuing operations, (ii) net profit after tax, (iii) EBITDA, (iv) EBITA, (v) gross profit, (vi) cash generation, (vii) unit volume, (viii) market share, (ix) sales, including hotel room night

bookings or air tickets sold, (x) asset quality, (xi) earnings per share, (xii) operating income, (xiii) revenues, (xiv) return on assets, (xv) return on operating assets, (xvi) return on equity, (xvii) profits, (xviii) total shareholder return (measured in terms of Share price appreciation and/or dividend growth), (xix) cost saving levels, (xx) marketing- spending efficiency, (xxi) core non-interest income, (xxii) change in working capital, (xxiii) return on capital, and/or (xxix) Share price. The Committee shall have sole discretion to establish the performance goals and to determine whether the performance goals established with respect to an applicable Award Agreement have been satisfied. The Committee may, in recognition of unusual or non-recurring items such as acquisition-related activities or changes in applicable accounting rules, provide for one or more equitable adjustments (based on objective standards) to the performance factors described above to preserve the Committee’s original intent regarding such performance factors at the time of the initial Award grant. It is within the sole discretion of the Committee to make or not make any such equitable adjustments.

(c)Awards granted to members of the Supervisory Board require prior approval of the Company’s general meeting of shareholders.

Section 5. OPTIONS AND SHARE APPRECIATION RIGHTS

(a)Options. Options may be granted from time to time as determined by the Committee. At the discretion of the Committee, employees of the Company that are U.S. taxpayers may be issued Options that are intended to qualify as an "incentive stock option" within the meaning of Section 422 of the Code.

(b)Types and Nature of Share Appreciation Rights. Share Appreciation Rights may be “Tandem SARs,” which are granted in conjunction with an Option, or “Free-Standing SARs,” which are not granted in conjunction with an Option. Upon the exercise of a Share Appreciation Right, the Participant shall be entitled to receive an amount in cash, Shares, or both, in value equal to the product of (i) the excess of the Fair Market Value of one Share over the exercise price of the applicable Share Appreciation Right, multiplied by (ii) the number of Shares in respect of which the Share Appreciation Right has been exercised. The applicable Award Agreement shall specify whether such payment is to be made in cash or Shares or both, or shall reserve to the Committee or the Participant the right to make that determination prior to or upon the exercise of the Share Appreciation Right.

(c)Tandem SARs. A Tandem SAR may be granted at the Grant Date of the related Option. A Tandem SAR shall be exercisable only at such time or times and to the extent that the related Option is exercisable in accordance with the provisions of this Section 5, and shall have the same exercise price as the related Option. A Tandem SAR shall terminate or be forfeited upon the exercise or forfeiture of the related Option, and the related Option shall terminate or be forfeited upon the exercise or forfeiture of the Tandem SAR.

(d)Exercise Price. The exercise price per Share subject to an Option or Share Appreciation Right shall be determined by the Committee or, for an Option or Share

Appreciation Right granted under the Annual Limits pursuant to Section 2(e), by the Management Board, and set forth in the applicable Award Agreement.

(e)Term. The Term of each Option and each Share Appreciation Right shall be fixed by the Committee, but shall not exceed ten years from the Grant Date.

(f)Vesting and Exercisability. Except as otherwise provided herein, Options and Share Appreciation Rights shall be exercisable at such time or times and subject to such terms and conditions as shall be determined by the Committee. If the Committee provides that any Option or Share Appreciation Right will become exercisable only in installments, the Committee may at any time waive such installment exercise provisions, in whole or in part, based on such factors as the Committee may determine. In addition, the Committee may at any time accelerate the exercisability of any Option or Share Appreciation Right.

(g)Method of Exercise. Subject to the provisions of this Section 5, Options and Share Appreciation Rights may be exercised, in whole or in part, at any time during the applicable Term by giving written notice of exercise to the Company (whereby textual form shall be sufficient if applicable law does not allow for requesting a stricter form than textual form) or through the procedures established with the Company’s appointed third-party administrator specifying the number of Shares as to which the Option or Share Appreciation Right is being exercised; provided, however, that, unless otherwise permitted by the Committee, any such exercise must be with respect to a portion of the applicable Option or Share Appreciation Right relating to no less than the lesser of the number of Shares then subject to such Option or Share Appreciation Right or 100 Shares. In the case of the exercise of an Option, such notice shall be accompanied by payment in full of the aggregate purchase price (which shall equal the product of such number of Shares subject to such Option multiplied by the applicable per Share exercise price) by certified or bank check or such other instrument as the Company may accept. If approved by the Committee, payment, in full or in part, may also be made as follows:

(i)To the extent permitted by applicable law, payment may be made in the form of unrestricted Shares already owned by Participant (by delivery of such Shares or by attestation) of the same class as the Shares subject to the Option (based on the Fair Market Value of the Shares on the date the Option is exercised).

(ii)To the extent permitted by applicable law, payment may be made by delivering a properly executed exercise notice to the Company, together with a copy of irrevocable instructions to a broker to deliver promptly to the Company the amount of sale proceeds necessary to pay the purchase price, and, if requested, the amount of any federal, state, local or foreign withholding taxes. To facilitate the foregoing, the Company may, to the extent permitted by applicable law, enter into agreements for coordinated procedures with one or more brokerage firms. To the extent permitted by applicable law, the Committee may also provide for Company loans to be made for purposes of the exercise of Options by Participants who are employees of the Company or its Subsidiaries.

(iii)Payment may be made by instructing the Company to withhold a number of Shares having a Fair Market Value (based on the Fair Market Value of the Shares on the date the applicable Option is exercised) equal to the product of (A) the exercise price per Share multiplied by (B) the number of Shares in respect of which the Option shall have been exercised.

(iv)Without prejudice to the other provisions of this Section 5(f), upon the exercise of an Option or a Share Appreciation Right resulting in an issuance of Shares, the Participant shall immediately pay in cash the par value of an Ordinary Share in connection with such issuance, unless the Committee has decided that such par value shall be charged against the Company's reserves (subject to applicable law).

(h)Delivery; Rights of Shareholders. No Shares shall be delivered pursuant to the exercise of an Option or Share Appreciation Right until the exercise price therefor and the par value per Ordinary Share (in case of such exercise resulting in an issuance of Shares, unless such par value shall be charged against the Company's reserves) has been fully paid and applicable taxes have been withheld. The applicable Participant shall have all of the rights of a shareholder of the Company holding the class or series of Shares that is subject to the Option or Share Appreciation Right (including, if applicable, the right to vote the applicable Shares and the right to receive dividends), when the Participant (i) has given written notice of exercise (whereby textual notice of exercise shall be sufficient if applicable law does not allow for requesting a stricter form than textual form), (ii) if requested, has given the representation described in Section 11(a), (iii) in the case of an Option, has paid in full for such Shares, and (iv) has been issued such Shares.

(i)Nontransferability of Options and Share Appreciation Rights. No Option or Share Appreciation Right shall be transferable by a Participant other than (i) by will or by the laws of descent and distribution, or (ii) in the case of an Option or Share Appreciation Right, pursuant to a qualified domestic relations order or as otherwise expressly permitted by the Committee, including, if so permitted, pursuant to a transfer to the Participant’s family members or to a charitable organization, whether directly or indirectly or by means of a trust or partnership or otherwise. For purposes of this Plan, unless otherwise determined by the Committee, “family member” shall have the meaning given to such term in General Instructions A.1(a)(5) to Form S-8 under the U.S. Securities Act of 1933, as amended, and any successor thereto. A Tandem SAR shall be transferable only with the related Option as permitted by the preceding sentence. Any Option or Share Appreciation Right shall be exercisable, subject to the terms of this Plan, only by the applicable Participant, the guardian or legal representative of such Participant, or any person to whom such Option or Share Appreciation Right is permissibly transferred pursuant to this Section 5(h) or the guardian or legal representative of such permitted transferee, it being understood that the term “Participant” includes such guardian, legal representative and other transferee; provided, however, that the term “Termination of Employment” shall continue to refer to the Termination of Employment of the original Participant.

Section 6. RESTRICTED SHARE UNITS

(a)Nature of Awards. Restricted Share Units are Awards denominated in Shares that will be settled, subject to the terms and conditions of the Restricted Share Units, in an amount in cash, Shares or both, based upon the Fair Market Value of a specified number of Shares.

(b)Terms and Conditions. Restricted Share Units shall be subject to the following terms and conditions:

(i)The Committee shall, prior to or at the time of grant, condition the grant, vesting, or transferability of Restricted Share Units upon the continued service of the applicable Participant or the attainment of performance goals, or the attainment of performance goals and the continued service of the applicable Participant. The conditions for grant, vesting or transferability and the other provisions of Restricted Share Units (including, without limitation, any performance goals) need not be the same with respect to each Participant.

(ii)Subject to the provisions of this Plan and the applicable Award Agreement, so long as an Award of Restricted Share Units remains subject to the satisfaction of vesting conditions (the “RSU Restriction Period”), the Participant shall not be permitted to sell, assign, transfer, pledge or otherwise encumber Restricted Share Units.

(iii)The Award Agreement for Restricted Share Units shall specify whether, to what extent and on what terms and conditions the applicable Participant shall be entitled to receive current or delayed payments of cash, Shares or other property corresponding to the dividends payable on the Shares (subject to Section 11(e)).

(iv)Except as otherwise set forth in the applicable Award Agreement, upon a Participant’s Termination of Employment for any reason during the RSU Restriction Period or before the applicable performance goals are satisfied, all Restricted Share Units still subject to restriction shall be forfeited by such Participant; provided, however, that the Committee shall have the discretion to waive, in whole or in part, any or all remaining restrictions with respect to any or all of such Participant’s Restricted Share Units.

(v)Except to the extent otherwise provided in the applicable Award Agreement, an award of Restricted Share Units shall be settled as and when the Restricted Share Units vest.

(vi)Upon the vesting of a Restricted Share Unit resulting in an issuance of Shares, the Participant shall immediately pay in cash the par value of an Ordinary Share in connection with such issuance, unless the Committee has decided that such par value shall be charged against the Company's reserves (subject to applicable law).

Section 7. OTHER SHARE-BASED AWARDS

Other Awards of Shares and other Awards that are valued in whole or in part by reference to, or are otherwise based upon or settled in, Shares, including, without limitation, unrestricted share, performance units, dividend equivalents, and convertible debentures, may be granted under this Plan.

Section 8. CASH-BASED AWARDS

Cash-Based Awards may be granted under this Plan. Cash-Based Awards may be paid in cash or in Shares (valued as of the date of payment) as determined by the Committee.

Section 9. TERM, AMENDMENT AND TERMINATION

(a)Effectiveness. The Management Board, the Supervisory Board and the Company’s general meeting of shareholders initially approved this Plan on November 9, 2016, November 25, 2016 and December 16, 2016, respectively. The effective date (the “Effective Date”) of this Plan is the date of consummation of the Company’s initial public offering of Shares. This Amendment and Restatement of the Plan was approved by the Company's general meeting on June 28, 2024. The Plan was previously amended on March 6, 2017, March 2, 2021 and May 23, 2023, pursuant to the terms hereof.

(b)Termination. This Plan will terminate on the tenth anniversary of the Effective Date. Awards outstanding as of such date shall not be affected or impaired by the termination of this Plan.

(c)Amendment of Plan. The Supervisory Board may amend, alter or discontinue this Plan, but no amendment, alteration or discontinuation shall be made that would materially impair the rights of the Participant with respect to a previously granted Award without such Participant’s consent, except such an amendment made to comply with applicable law, listing standards of the Applicable Exchange or accounting rules. In addition, no amendment shall be made without the approval of the Company’s general meeting of shareholders to the extent such approval is required by applicable law or the listing standards of the Applicable Exchange.

(d)Amendment of Awards. Subject to Section 5(c), the Committee may unilaterally amend the terms of any Award theretofore granted, but no such amendment shall, without the Participant’s consent, materially impair the rights of any Participant with respect to an Award, except such an amendment made to cause this Plan or such Award to comply with applicable law, the listing standards of the Applicable Exchange or accounting rules.

Section 10. UNFUNDED STATUS OF PLAN

It is intended that this Plan constitute an “unfunded” plan. The Committee may authorize the creation of trusts or other arrangements to meet the obligations created under this Plan to deliver Shares or make payments; provided, however, that the existence of such trusts or other arrangements is consistent with the “unfunded” status of this Plan.

Section 11. GENERAL PROVISIONS

(a)Conditions for Issuance. The Committee may require each person purchasing or receiving Shares pursuant to an Award to represent to and agree with the Company in writing that such person is acquiring the Shares without a view to the distribution thereof. The certificates for such Shares may include any legend that the Committee deems appropriate to reflect any restrictions on transfer. Notwithstanding any other provision of this Plan or agreements made pursuant thereto, the Company shall not be required to issue or deliver any certificate or certificates for Shares under this Plan prior to fulfillment of all of the following conditions: (i) listing or approval for listing upon notice of issuance, of such Shares on the Applicable Exchange; (ii) any registration or other qualification of such Shares of the Company under any state, federal or foreign law or regulation, or the maintaining in effect of any such registration or other qualification that the Committee shall, in its absolute discretion upon the advice of counsel, deem necessary or advisable; and (iii) obtaining any other consent, approval or permit from any state, federal or foreign governmental agency that the Committee shall, in its absolute discretion after receiving the advice of counsel, determine to be necessary or advisable.

(b)Additional Compensation Arrangements. Nothing contained in this Plan shall prevent the Company or any Subsidiary or Affiliate from adopting other or additional compensation arrangements for its employees or officers.

(c)No Contract of Employment. This Plan shall not constitute a contract of employment, and adoption of this Plan shall not confer upon any employee any right to continued employment or service, nor shall it interfere in any way with the right of the Company or any Subsidiary or Affiliate to terminate the employment or service of any employee or officer at any time.

(d)Required Taxes. No later than the date as of which an amount first becomes includible in the gross income of a Participant for federal, state, local or foreign income or employment or other tax purposes with respect to any Award under this Plan, such Participant shall pay to the Company, or make arrangements satisfactory to the Company regarding the payment of, any federal, state, local or foreign taxes of any kind required by law to be withheld with respect to such amount. If determined by the Company, withholding obligations may be settled with Shares, including Shares that are part of the Award that gives rise to the withholding requirement. The obligations of the Company under this Plan shall be conditional on such payment or arrangements, and the Company and its Affiliates shall, to the extent permitted by law, have the right to deduct any such taxes from any payment otherwise due to such Participant. The Committee may establish such procedures as it deems appropriate, including making irrevocable elections, for the settlement of withholding obligations with Shares.

(e)Limitation on Dividend Reinvestment and Dividend Equivalents. The payment of Shares with respect to dividends to Participants holding Awards of Restricted Share Units shall only be permissible if sufficient Shares are available under Section 3 for such reinvestment or payment (taking into account then outstanding Awards). In the event that a sufficient number of Shares is not available for such reinvestment or payment, such reinvestment or payment shall be

made in the form of a grant of additional Restricted Share Units equal in number to the Shares that would have been obtained by such payment or reinvestment, the terms of which Restricted Share Units shall provide for settlement in cash and for dividend equivalent reinvestment in further Restricted Share Units on the terms contemplated by this Section 11(e).

(f)Designation of Death Beneficiary. The Committee shall establish such procedures as it deems appropriate for a Participant to designate a beneficiary to whom any amounts payable or Shares deliverable in the event of such Participant’s death are to be paid or delivered or by whom any rights of such Participant, after such Participant’s death, may be exercised.

(g)Subsidiary Employees. Subject to applicable law, in the case of a grant of an Award to any employee or officer of a Subsidiary, the Company may, if the Committee so directs, transfer the Shares, if any, covered by the Award to the Subsidiary, for such lawful consideration as the Committee may specify, upon the condition or understanding that the Subsidiary will transfer the Shares to the employee or officer in accordance with the terms of the Award specified by the Committee pursuant to the provisions of this Plan. All such Shares underlying Awards that are forfeited or cancelled shall revert to the Company.

(h)Governing Law and Interpretation. This Plan and all Awards made and actions taken thereunder shall be governed by and construed in accordance with the laws of the Netherlands, without reference to principles of conflict of laws. The captions of this Plan are not part of the provisions hereof and shall have no force or effect.

(i)Nontransferability. Except as otherwise provided in Section 5(h) or as determined by the Committee, Awards under this Plan are not transferable except by will or by laws of descent and distribution.

(j)Foreign Employees and Foreign Law Considerations. The Committee may grant Awards to Eligible Individuals who are foreign nationals, who are located outside the Netherlands or Germany or who are not compensated from a payroll maintained in the Netherlands or Germany, or who are otherwise subject to (or could cause the Company to be subject to) legal or regulatory provisions of countries or jurisdictions outside the Netherlands or Germany, on such terms and conditions different from those specified in this Plan as may, in the judgment of the Committee, be necessary or desirable to foster and promote achievement of the purposes of this Plan, and, in furtherance of such purposes, the Committee may make such modifications, amendments, procedures or subplans as may be necessary or advisable to comply with such legal or regulatory provisions.

(k)Applicable Law, Articles of Association and Internal Rules. This Plan, including the administration hereof by the Supervisory Board, the Committee, and, to the extent applicable, the Management Board, shall in all respects be subject to applicable law, the Company’s articles of association and other internal rules applicable to the Management Board and/or the Supervisory Board from time to time. Any disputes between the Company and any Participant arising out of or in connection with the operation of this Plan shall be settled by the Supervisory

Board, whose decision shall be considered final and decisive among the Company and such Participant, unless the Company or such Participant decides to submit such dispute to the exclusive jurisdiction of the competent court in Amsterdam, in each case unless otherwise provided in the applicable Award Agreement.

| | | | | | | | |

| ATTORNEYS • CIVIL LAW NOTARIES • TAX ADVISERS | |

P.O. Box 7113 1007 JC Amsterdam Beethovenstraat 400 1082 PR Amsterdam T +31 20 71 71 000 F +31 20 71 71 111 | |

Amsterdam, 15 July 2024. |

Exhibit 5.1Amsterdam, 15 July 2024.

To the Company:

We have acted as legal counsel as to Dutch law to the Company in connection with the Plan. This opinion letter is rendered to you in order to be filed with the SEC as an exhibit to the Registration Statement.

Capitalised terms used in this opinion letter have the meanings set forth in Exhibit A to this opinion letter. The section headings used in this opinion letter are for convenience of reference only and are not to affect its construction or to be taken into consideration in its interpretation.

This opinion letter is strictly limited to the matters stated in it and may not be read as extending by implication to any matters not specifically referred to in it. Nothing in this opinion letter should be taken as expressing an opinion in respect of any representations or warranties, or other information, contained in any document reviewed by us in connection with this opinion letter.

In rendering the opinions expressed in this opinion letter, we have reviewed and relied upon a draft of the Plan, a draft of the Registration Statement and pdf copies of the Corporate Documents and we have assumed that Awards under the Plan shall be made for bona fide commercial reasons. We have not investigated or verified any factual matter disclosed to us in the course of our review.

This opinion letter sets out our opinion on certain matters of the laws with general applicability of the Netherlands, and, insofar as they are directly applicable in the Netherlands, of the European Union, as at today's date and as presently interpreted under published authoritative case law of the Dutch courts, the General Court and the Court of Justice of the European Union. We do not express any opinion on Dutch or European competition law, data protection law, tax law, securitisation law or regulatory law. No undertaking is assumed on our part to revise, update or amend this opinion letter in connection with, or to notify or inform you of, any developments and/or changes of Dutch law subsequent to today's date. We do not purport to opine on the consequences of amendments to the Plan, the Registration Statement or the Corporate Documents subsequent to the date of this opinion letter.

The opinions expressed in this opinion letter are to be construed and interpreted in accordance with Dutch law. The competent courts at Amsterdam, the Netherlands, have exclusive jurisdiction to settle any issues of interpretation or liability arising out of or in connection with this opinion letter. Any legal

All legal relationships are subject to NautaDutilh N.V.'s general terms and conditions (see https://www.nautadutilh.com/terms), which apply mutatis mutandis to our relationship with third parties relying on statements of NautaDutilh N.V., include a limitation of liability clause, have been filed with the Rotterdam District Court and will be provided free of charge upon request. NautaDutilh N.V.; corporate seat Rotterdam; trade register no. 24338323.

82041388 M 55369609 / 5

relationship arising out of or in connection with this opinion letter (whether contractual or non-contractual), including the above submission to jurisdiction, is governed by Dutch law and shall be subject to the general terms and conditions of NautaDutilh. Any liability arising out of or in connection with this opinion letter shall be limited to the amount which is paid out under NautaDutilh's insurance policy in the matter concerned. No person other than NautaDutilh may be held liable in connection with this opinion letter.

In this opinion letter, legal concepts are expressed in English terms. The Dutch legal concepts concerned may not be identical in meaning to the concepts described by the English terms as they exist under the law of other jurisdictions. In the event of a conflict or inconsistency, the relevant expression shall be deemed to refer only to the Dutch legal concepts described by the English terms.

For the purposes of this opinion letter, we have assumed that:

a.each copy of a document conforms to the original, each original is authentic, and each signature is the genuine signature of the individual purported to have placed that signature;

b.if any signature under any document is an electronic signature (as opposed to a handwritten ("wet ink") signature) only, it is either a qualified electronic signature within the meaning of the eIDAS Regulation, or the method used for signing is otherwise sufficiently reliable;

c.the Registration Statement has been or will be declared effective by the SEC in the form reviewed by us;

d.the Deed of Incorporation is a valid notarial deed;

e.at each Relevant Moment, (i) Class A Shares shall have been admitted for trading on a trading system outside the European Economic Area comparable to a regulated market or a multilateral trading facility as referred to in Section 2:86c(1) DCC and (ii) no financial instruments issued by the Company (or depository receipts for or otherwise representing such financial instruments) have been admitted to trading on a regulated market, multilateral trading facility or organised trading facility operating in the European Economic Area (and no request for

admission of any such financial instruments to trading on any such trading venue has been made;

f.the Current Articles are the Articles of Association currently in force and as they will be in force at each Relevant Moment;

g.at each Relevant Moment, the authorised share capital (maatschappelijk kapitaal) of the Company shall allow for the grant of Awards and the issuance of Plan Shares pursuant to the exercise or settlement thereof;

h.at each Relevant Moment, the Company will not have (i) been dissolved (ontbonden), (ii) ceased to exist pursuant to a merger (fusie) or a division (splitsing), (iii) been converted (omgezet) into another legal form, either national or foreign, (iv) had its assets placed under administration (onder bewind gesteld), (v) been declared bankrupt (failliet verklaard), (vi) been granted a suspension of payments (surseance van betaling verleend), (vii) started or become subject to statutory proceedings for the restructuring of its debts (akkoordprocedure) or (viii) been made subject to similar proceedings in any jurisdiction or otherwise been limited in its power to dispose of its assets;

i.no Awards shall be offered to the public (aanbieden aan het publiek) in the Netherlands other than in conformity with the Prospectus Regulation and the rules promulgated thereunder;

j.at each Relevant Moment, the relevant Award(s) (i) shall have been validly granted as a right to subscribe for Class A Shares (recht tot het nemen van aandelen) by the corporate body authorised to do so, (ii) shall be in full force and effect upon being exercised or settled, as applicable, (iii) shall have been validly exercised or settled, as applicable, in accordance with the terms and conditions applicable to such Award(s) and (iv) any pre-emption rights in respect of such Award(s) shall have been validly excluded by the corporate body authorised to do so; and

k.at each Relevant Moment, each holder of the relevant Award(s) shall be an individual who has not (i) deceased, (ii) had such individual's assets placed under administration (onder bewind gesteld), (iii) been declared bankrupt (failliet verklaard), (iv) been granted a suspension of payments (surseance van betaling verleend), (v) been subjected to a debt reorganisation procedure (schuldsanering), (vi) started or become subject

to statutory proceedings for the restructuring of such individual's debts (akkoordprocedure) or (vii) been made subject to similar proceedings in any jurisdiction or otherwise been limited in the power to dispose of such individual's assets.

Based upon and subject to the foregoing and subject to the qualifications set forth in this opinion letter and to any matters, documents or events not disclosed to us, we express the following opinions:

Corporate Status

1.The Company has been duly incorporated as a besloten vennootschap met beperkte aansprakelijkheid and is validly existing as a naamloze vennootschap.

Plan Shares

2.Subject to receipt by the Company of payment in full for, or other satisfaction of the issue price of, the Plan Shares in accordance with the Plan, and when issued by the Company and accepted by the acquiror(s) thereof, in accordance with the Plan, the Plan Shares shall be validly issued, fully paid and non-assessable.

The opinions expressed above are subject to the following qualifications:

A.Opinion 1 must not be read to imply that the Company cannot be dissolved (ontbonden). A company such as the Company may be dissolved, inter alia by the competent court at the request of the company's board of directors, any interested party (belanghebbende) or the public prosecution office in certain circumstances, such as when there are certain defects in the incorporation of the company. Any such dissolution will not have retro-active effect.

B.Pursuant to Section 2:7 DCC, any transaction entered into by a legal entity may be nullified by the legal entity itself or its liquidator in bankruptcy proceedings (curator) if the objects of that entity were transgressed by the transaction and the other party to the transaction knew or should have known this without independent investigation (wist of zonder eigen onderzoek moest weten). The Dutch Supreme Court (Hoge Raad der Nederlanden) has ruled that in determining whether the objects of a legal entity are transgressed, not only the description of the objects in

that legal entity's articles of association (statuten) is decisive, but all (relevant) circumstances must be taken into account, in particular whether the interests of the legal entity were served by the transaction. Based on the objects clause contained in the Current Articles, we have no reason to believe that, by making Awards under the Plan, the Company would transgress the description of the objects contained in its Articles of Association. However, we cannot assess whether there are other relevant circumstances that must be taken into account, in particular whether the interests of the Company are served by making Awards under the Plan since this is a matter of fact.

C.Pursuant to Section 2:98c DCC, a company such as the Company may grant loans (leningen verstrekken) only in accordance with the restrictions set out in Section 2:98c DCC, and may not provide security (zekerheid stellen), give a price guarantee (koersgarantie geven) or otherwise bind itself, whether jointly and severally or otherwise with or for third parties (zich op andere wijze sterk maken of zich hoofdelijk of anderszins naast of voor anderen verbinden) with a view to (met het oog op) the subscription or acquisition by third parties of shares in its share capital or depository receipts. This prohibition also applies to its subsidiaries (dochtervennootschappen). It is generally assumed that a transaction entered into in violation of Section 2:98c DCC is null and void (nietig). Based on the content of the Plan, we have no reason to believe that the Company or its subsidiaries will violate Section 2:98c DCC in connection with the issue of Plan Shares. However, we cannot confirm this definitively, since the determination of whether a company (or a subsidiary) has provided security, has given a price guarantee or has otherwise bound itself, with a view to the subscription or acquisition by third parties of shares in its share capital or depository receipts, as described above, is a matter of fact.

D.The opinions expressed in this opinion letter may be limited or affected by:

a.rules relating to Insolvency Proceedings or similar proceedings under a foreign law and other rules affecting creditors' rights generally;

b.the provisions of fraudulent preference and fraudulent conveyance (Actio Pauliana) and similar rights available in other jurisdictions to insolvency practitioners and insolvency office holders in bankruptcy proceedings or creditors;

c.claims based on tort (onrechtmatige daad);

d.sanctions and measures, including but not limited to those concerning export control, pursuant to European Union regulations, under the Dutch Sanctions Act 1977 (Sanctiewet 1977) or other legislation;

e.the Anti-Boycott Regulation, Anti Money Laundering Laws and related legislation;

f.any intervention, recovery or resolution measure by any regulatory or other authority or governmental body in relation to financial enterprises or their affiliated entities; and

g.the rules of force majeure (niet toerekenbare tekortkoming), reasonableness and fairness (redelijkheid en billijkheid), suspension (opschorting), dissolution (ontbinding), unforeseen circumstances (onvoorziene omstandigheden) and vitiated consent (i.e., duress (bedreiging), fraud (bedrog), abuse of circumstances (misbruik van omstandigheden) and error (dwaling)) or a difference of intention (wil) and declaration (verklaring).

E.The term "non-assessable" has no equivalent in the Dutch language and for purposes of this opinion letter such term should be interpreted to mean that a holder of a Class A Share shall not by reason of merely being such a holder be subject to assessment or calls by the Company or its creditors for further payment on such Class A Share.

F.This opinion letter does not purport to express any opinion or view on the operational rules and procedures of any clearing or settlement system or agency.

We consent to the filing of this opinion letter as an exhibit to the Registration Statement. In giving this consent we do not admit or imply that we are a person

whose consent is required under Section 7 of the United States Securities Act of 1933, as amended, or any rules and regulations promulgated thereunder.

Sincerely yours,

/s/NautaDutilh N.V.

NautaDutilh N.V.

EXHIBIT A

LIST OF DEFINITIONS

| | | | | |

"Anti Money Laundering Laws" | The European Anti-Money Laundering Directives, as implemented in the Netherlands in the Money Laundering and Terrorist Financing Prevention Act (Wet ter voorkoming van witwassen en financieren van terrorisme) and the Dutch Criminal Code (Wetboek van Strafrecht). |

"Anti-Boycott Regulation" | The Council Regulation (EC) No 2271/96 of 22 November 1996 on protecting against the effects of the extra-territorial application of legislation adopted by a third country, and actions based thereon or resulting therefrom. |

"Articles of Association" | The Company's articles of association (statuten) as they read from time to time. |

"Awards" | Rights to subscribe for Class A Shares granted pursuant to the terms and conditions of the Plan. |

"Bankruptcy Code" | The Dutch Bankruptcy Code (Faillissementswet). |

"Class A Shares" | Class A shares in the Company's capital, with a nominal value of EUR 0.06 each. |

"Commercial Register" | The Dutch Commercial Register (handelsregister). |

| | | | | |

"Company" | trivago N.V., a public company with limited liability (naamloze vennootschap), registered with the Commercial Register under number 67222927. |

"Corporate Documents" | The Deed of Incorporation, the Deed of Conversion, the Current Articles and the Extract. |

"Current Articles" | The Articles of Association as they read immediately after the execution of a deed of amendment dated 20 October 2023, following which, according to the Extract, no amendment to the Articles of Association was effected. |

"DCC" | The Dutch Civil Code (Burgerlijk Wetboek). |

"Deed of Conversion" | The deed of conversion and amendment to the Articles of Association dated 16 December 2016 (at which time the Company was named travel B.V.). |

"Deed of Incorporation" | The deed of incorporation (akte van oprichting) of the Company (at that time named travel B.V.) dated 7 November 2016. |

"eIDAS Regulation" | Regulation (EU) No 910/2014 of the European Parliament and of the Council of 23 July 2014 on electronic identification and trust services for electronic transactions in the internal market and repealing Directive 1999/93/EC. |

| | | | | |

"Extract" | An extract from the Commercial Register relating to the Company, dated the date of this opinion letter. |

"Insolvency Proceedings" | Any insolvency proceedings within the meaning of Regulation (EU) 2015/848 of the European Parliament and of the Council of 20 May 2015 on insolvency proceedings (recast), as amended by Regulation (EU) 2021/2260 of the European Parliament and of the Counsel of 15 December 2021, listed in Annex A thereto and any statutory proceedings for the restructuring of debts (akkoordprocedure) pursuant to the Bankruptcy Code. |

"NautaDutilh" | NautaDutilh N.V. |

"the Netherlands" | The European territory of the Kingdom of the Netherlands and "Dutch" is in or from the Netherlands. |

"Plan" | The trivago N.V. Amended and Restated 2016 Omnibus Incentive Plan of the Company in the form attached as exhibit 4.2 to the Registration Statement. |

"Plan Shares" | 20,526,250 Class A Shares available for issuance under the Plan. |

"Prospectus Regulation" | Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017 on the prospectus to be published when securities are offered to the public or admitted to trading on a regulated market, and repealing Directive 2003/71/EC. |

"Registration Statement" | The Company's registration statement on Form S-8 filed or to be filed with the SEC in the form reviewed by us. |

| | | | | |

"Relevant Moment" | Each time when one or more Awards are granted or one or more Plan Shares are issued pursuant to the exercise or settlement of the relevant Award(s). |

"SEC" | The United States Securities and Exchange Commission. |

| | |

|

| Consent of Independent Registered Public Accounting Firm |

| | |

| We consent to the incorporation by reference in the Registration Statement on Form S-8 filed with the Securities and Exchange Commission on July 15, 2024 pertaining to the trivago N.V. Amended and Restated 2016 Omnibus Incentive Plan of our reports dated March 1, 2024, with respect to the consolidated financial statements of trivago N.V. and the effectiveness of internal control over financial reporting of trivago N.V., included in its Annual Report (Form 20-F) for the year ended December 31, 2023, filed with the Securities and Exchange Commission. |

|

/s/ EY GmbH & Co. KG Wirtschaftsprüfungsgesellschaft

Cologne, Germany

July 15, 2024

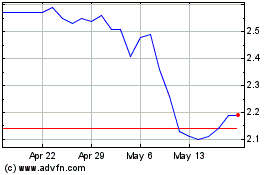

trivago NV (NASDAQ:TRVG)

Historical Stock Chart

From Nov 2024 to Dec 2024

trivago NV (NASDAQ:TRVG)

Historical Stock Chart

From Dec 2023 to Dec 2024