Verde Clean Fuels, Inc. Announces Closing of $50 Million Equity Investment by Cottonmouth Ventures, LLC, a Wholly-Owned Subsidiary of Diamondback Energy, Inc.

30 January 2025 - 8:15AM

Business Wire

- Cottonmouth purchases 12.5 million shares of Verde Class A

common stock at a price of $4.00 per share

- Brings Cottonmouth’s total investment in Verde to $70 million

and makes Cottonmouth the second largest shareholder of Verde

- Proceeds from the investment are expected to be used to further

the development and construction of potential natural

gas-to-gasoline production plants and for other general corporate

purposes

- In connection with the closing of the investment, Verde

appoints a director designated by Cottonmouth to its Board of

Directors

Verde Clean Fuels, Inc. (“Verde” or, the “Company”) (NASDAQ:

VGAS) announced today the closing of the previously announced $50

million equity investment by Cottonmouth Ventures, LLC

("Cottonmouth"), a wholly-owned subsidiary of Diamondback Energy,

Inc. (“Diamondback”) (NASDAQ: FANG). The investment consists of the

purchase of 12.5 million shares of Verde’s Class A common stock by

Cottonmouth at a purchase price of $4.00 per share. The investment

represents the second investment by Cottonmouth in Verde over the

past two years, for a total investment of $70 million, making

Cottonmouth the second largest shareholder of Verde.

Proceeds from the investment are expected to be used to further

the development and construction of potential natural

gas-to-gasoline production plants and for other general corporate

purposes. The proposed plants to be jointly developed by Verde and

Cottonmouth would produce fully-refined gasoline utilizing Verde’s

patented (STG+®) process from associated natural gas feedstock

supplied from Diamondback's operations in the Permian Basin.

In connection with the investment, Verde expanded its Board of

Directors from seven to eight members and appointed Johnny Dossey,

as Cottonmouth’s director designee, to its Board of Directors.

"This investment is consistent with our commitment to efficiency

and sustainability in oil and gas operations. Verde's technology

provides an exciting opportunity to convert associated natural gas

from our Permian Basin operations into gasoline, as well as an

anticipated high value outlet for a volume of our natural gas with

the added potential benefit of flare mitigation and production of a

lower carbon fuel," said Mr. Dossey.

"We are proud and excited to announce the closing of

Cottonmouth's second investment in Verde," said Ernest Miller, CEO

of Verde. "Diamondback's continued confidence in our team and our

technology is instrumental as we continue advancing our plans to

deploy our technology. In addition, we are pleased to welcome

Johnny as a director to our Board of Directors. We look forward to

having him as part of our team as we look to finalize engineering

and design and shift focus toward constructing and operating

commercial production plants.”

Mr. Dossey currently serves as Vice President of Marketing at

Diamondback and has been with Diamondback since 2018. Prior to

Diamondback, Mr. Dossey served in marketing roles for Concho

Resources from 2014 to 2018. Prior to Concho, Mr. Dossey served in

various leadership and commercial roles for Western Refining,

Montana Refining Company, and Calumet Specialty Products Partners

and Holly Corporation (now HF Sinclair). Mr. Dossey received a

Bachelor of Business Administration in Management and a Master of

Business Administration from Texas Tech University.

About Verde Clean Fuels, Inc.

Verde is a clean fuels company focused on the deployment of its

innovative and proprietary liquid fuels processing technology

through development of commercial production plants. Verde's

syngas-to-gasoline plus (STG+®) process converts syngas, derived

from diverse feedstocks, into fully finished liquid fuels that

require no additional refining. Verde is currently focused on

opportunities to convert associated natural gas into gasoline,

which would provide a market for such natural gas with the added

potential benefits of flare mitigation and production of gasoline

with a lower carbon intensity than conventional gasoline.

About Diamondback Energy, Inc.

Diamondback is an independent oil and natural gas company

headquartered in Midland, Texas focused on the acquisition,

development, exploration, and exploitation of unconventional,

onshore oil and natural gas reserves in the Permian Basin.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements, other than statements of present or

historical fact included herein, regarding Verde’s expectations and

any future financial performance, as well as Verde’s strategy,

future operations, financial position, prospects, plans and

objectives of management are forward-looking statements, including,

but not limited to, statements regarding the intended use of

proceeds. When used herein, including any oral statements made in

connection herewith, the words “could,” “should,” “will,” "aims,"

“may,” “focused,” “believe,” “anticipate,” “intend,” “estimate,”

“expect,” “project,” “plans,” “potential,” "goal," "strategy,"

"proposed," the negative of such terms and other similar

expressions are intended to identify forward-looking statements,

although not all forward-looking statements contain such

identifying words. These forward-looking statements are based on

Verde management’s current expectations and assumptions about

future events and are based on currently available information as

to the outcome and timing of future events. Except as otherwise

required by applicable law, Verde disclaims any duty to update any

forward-looking statements, all of which are expressly qualified by

the statements in this section, to reflect events or circumstances

after the date hereof. Verde cautions you that these

forward-looking statements are subject to risks and uncertainties,

most of which are difficult to predict and many of which are beyond

the control of Verde. These risks and uncertainties include, but

are not limited to: the failure to realize the anticipated benefits

of the investment; general economic, financial, legal, political

and business conditions and changes in domestic and foreign

markets; the failure to develop its first commercial facility,

whether due to the inability to obtain the required financing or

for any other reason; the failure to develop any additional

commercial facility for any reason; the risks and uncertainties

relating to the implementation of Verde's business strategy and the

timing of any business milestone; Verde's ability to obtain

financing in connection with future transactions; and the effects

of competition on Verde's business strategy. Should one or more of

the risks or uncertainties described herein and in any oral

statements made in connection therewith occur, or should underlying

assumptions prove incorrect, actual results and plans could differ

materially from those expressed in any forward-looking statements.

There may be additional risks that Verde presently does not know or

that Verde currently believes are immaterial that could cause

actual results to differ from those contained in the

forward-looking statements. Additional information concerning these

and other factors that may impact Verde’s expectations and

projections can be found in Verde’s filings with the Securities and

Exchange Commission (the “SEC”). Verde’s filings with the SEC are

available publicly on the SEC’s website at www.sec.gov.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250129233935/en/

Investor Relations: Caldwell Bailey (ICR) verdeIR@icrinc.com

Media Relations: Juliet Fisher (Merchant)

juliet@merchant.agency

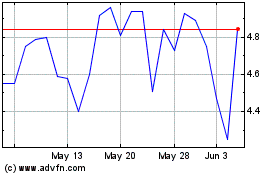

Verde Clean Fuels (NASDAQ:VGAS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Verde Clean Fuels (NASDAQ:VGAS)

Historical Stock Chart

From Feb 2024 to Feb 2025