0001327811FALSE00013278112024-11-252024-11-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): November 25, 2024

WORKDAY, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-35680 | 20-2480422 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

6110 Stoneridge Mall Road

Pleasanton, California 94588

(Address of principal executive offices)

Registrant’s telephone number, including area code: (925) 951-9000

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, par value $0.001 | WDAY | The Nasdaq Stock Market LLC |

| | (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 – Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

(c) Appointment of Certain Officers

On November 25, 2024, the Board of Directors (the “Board”) of Workday, Inc. (“Workday”) appointed Robert Enslin as President, Chief Commercial Officer of Workday, effective December 2, 2024 (the “Effective Date”). Mr. Enslin will be responsible for driving Workday’s revenue growth and leading Workday’s global sales, partnerships, and customer experience efforts.

In connection with the appointment of Mr. Enslin, Doug Robinson will retire from his role as Co-President, effective as of the Effective Date. As previously disclosed in Workday’s Form 8-K filed on October 1, 2024, Mr. Robinson will continue to serve Workday as an Executive Advisor through April 30, 2025, assisting in the transition of his duties and helping to support go-to-market and other strategic opportunities. Additionally, on November 25, 2024, the Board appointed Sayan Chakraborty as President, Product and Technology, effective as of the Effective Date. Mr. Chakraborty previously served as Co-President. The change in title does not affect Mr. Chakraborty’s responsibilities or compensation.

Mr. Enslin, 61, served as the Chief Executive Officer of UiPath, Inc. (“UiPath”) from February 1, 2024 to June 1, 2024, as Co-CEO of UiPath from May 2022 through January 31, 2024, and as a director of UiPath from February 1, 2024 to June 20, 2024. Prior to joining UiPath, Mr. Enslin served as President, Cloud Sales at Google from April 2019 to May 2022. Prior to that, he spent 27 years at SAP, most recently as President of its Cloud Business Group and as an executive board member.

In connection with his appointment as President, Chief Commercial Officer, pursuant to the terms of an offer letter dated November 25, 2024, between Mr. Enslin and Workday (the “Offer Letter”), Mr. Enslin will receive an annual base salary of $750,000, a one-time signing bonus of $1,000,000 payable in two installments, and will be eligible to participate in the Workday cash incentive plan with a 100% target bonus. Pursuant to the Offer Letter, in accordance with Workday’s standard grant practices, Mr. Enslin will be granted an equity award consisting of restricted stock units with a grant date value of approximately $38,000,000 (the “RSU Award”). The RSU Award will be subject to a vesting term of four years with one-fourth of the total shares subject to the RSU Award vesting on the first anniversary of the vesting start date and the balance of the award vesting in equal quarterly installments over the following three years. Vesting is subject to Mr. Enslin’s continuous service with Workday. He will not be eligible for additional equity awards until April 2026. Mr. Enslin will participate in Workday’s Executive Severance and Change in Control Policy, as amended.

The foregoing description of the Offer Letter is qualified in its entirety by reference to the full text of the Offer Letter, which is filed hereto as Exhibit 10.1.

There are no arrangements or understandings between Mr. Enslin and any other persons pursuant to which he was selected as an officer, he has no family relationships with any of Workday’s directors or executive officers, and he has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K. Mr. Enslin is expected to enter into Workday’s standard form of indemnity agreement filed as Exhibit 10.1 to Workday’s Registration Statement on Form S-1 (File No. 333-183640) filed with the SEC on August 30, 2012.

(e) Compensatory Arrangements of Certain Officers

On November 25, 2024, the Board amended and restated the Workday, Inc. Executive Severance and Change in Control Policy (the “Policy”). The purpose of the amendment to the Policy (the “Amendment”) is to provide that equity awards granted to a participant coincident with, or as an inducement to, such participant’s hiring and/or commencement of employment or other service with Workday (“New Hire Awards”) shall be eligible for acceleration pursuant to the Policy in the event of a termination of employment by Workday without Cause outside of a Change in Control Period (as such terms are defined in the Policy). Equity awards granted within the twelve (12) months immediately prior to the date of a participant’s termination without Cause outside of a Change in Control Period that are not New Hire Awards shall continue to be excluded from acceleration pursuant to the Policy under such circumstances. Other than the Amendment, the compensation and benefits provided under the Policy are unchanged, and a description of the Policy previously has been included in the Form 8-K filed by the Company on December 1, 2023.

The above description of the Policy, as amended by the Amendment, does not purport to be complete and is qualified in its entirety by reference to the full text of the Policy, as amended by the Amendment, which is filed as Exhibit 10.2 hereto and incorporated herein by reference.

Item 7.01 – Regulation FD Disclosure

A copy of the press release announcing Mr. Enslin’s appointment is attached hereto as Exhibit 99.1. The information in the press release attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01 – Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 10.1 | | |

| 10.2 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document) |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 26, 2024 | | | | | |

| | Workday, Inc. |

| | /s/ Richard H. Sauer |

| | Richard H. Sauer |

| Chief Legal Officer, Head of Corporate Affairs, and Corporate Secretary |

Exhibit 10.1

November 25, 2024

DELIVERY VIA EMAIL

Robert Enslin

Dear Rob,

Workday, Inc. (“Workday”) is happy to offer you a position as President, Chief Commercial Officer reporting to Workday’s CEO, Carl Eschenbach. Your planned start date is December 2, 2024.

Your role will be based remotely from your home in Palm Beach Gardens, Florida. We expect that you and your manager will determine a schedule that meets both business and individual needs.

Your annualized starting salary is $750,000, which is payable according to Workday’s payroll cycle, and subject to applicable federal and state taxes.

You are eligible to participate in a variable (“incentive”) compensation plan, targeted at 100% of your annualized base pay. This plan, including terms and conditions, shall be provided shortly after commencing employment.

Workday will offer you a one-time hiring bonus of $1,000,000. This will be paid out in two installments. The first installment of $500,000 will be paid out within your first 30 days of employment, while the second installment of $500,000 will be paid approximately 12 months after your hire date in accordance with the Company’s standard payroll procedures. To receive either installment of the bonus, you must be employed by Workday and in good standing on the day of the payment. Your bonus payments will be subject to applicable federal and state taxes, and any other applicable withholdings. Receipt of this bonus, however, is conditioned on your remaining with Workday for at least one year.

In accordance with Workday’s standard grant practices, you will be granted restricted stock units (RSUs) of the Company’s Class A Common Stock with an approximate value of $38,000,000 USD. The number of shares will be determined by dividing the USD value above by the trailing simple moving average stock price of Workday Class A common stock for the 20 day period immediately preceding the Date of Grant. You will vest in these shares at the rate of 1/4 of the RSU shares after 12 months of continuous service from your vesting start date, then in equal quarterly installments of 1/16th of the total RSU shares, fully vesting in 4 years from your vesting start date. Assuming your start date remains December 2, 2024, your vesting start date will be on or before January 5, 2025. Your RSU grant will be subject to the terms and conditions applicable to stock granted under the Company’s 2022 Equity Incentive Plan, as in effect on the date of grant (the “Plan”), as described in the Plan and the applicable Restricted Stock Unit Agreement.

Under Workday’s Total Rewards program, high performing employees are eligible to receive additional equity grants during their employment (“refresh grants”), at the sole discretion of the Company and subject to approval by the Company’s Board of Directors or its Compensation Committee. You shall be eligible for future equity grants beginning in April 2026 as determined by and pursuant to the terms established by the Compensation Committee. Refresh grant targets vary by the employee’s role and location, and receipt of a grant and actual grant amounts are based on each employee’s contributions, skills, and future potential.

You shall be eligible for the Workday Executive Severance and Change in Control Policy (“Severance Plan”), so long as you remain employed by Workday subject to the eligibility requirements, terms, and conditions of the Severance Plan, as amended from time to time. Receipt of the benefits under the Severance Plan is contingent on your execution and delivery of a signed general release of claims in favor of the Company. A release, substantially in the form of Schedule A, shall satisfy this requirement.

Subject to Conflict of Interest and the Policy Statement Regarding Senior Executive Service on Unaffiliated Boards of Directors, and related policies, you may manage personal investments, participate in civic, charitable, professional and academic activities (including serving on boards and committees), and serve on the board of directors (and any committees) of up to one (1) noncompetitive company pursuant to the terms of the Policy Statement Regarding Senior Executive Service on Unaffiliated Boards of Directors.

Your employment with Workday is “at-will”, meaning either you or Workday may terminate your employment at any time, for any reason or no reason, with or without notice. There is no promise by Workday that your employment will continue for a set period of time or that your employment will be terminated only under particular circumstances. Any exception to this at-will employment policy can only be made in writing by the Chief People Officer of Workday. In particular, this at-will employment policy cannot be modified by any statements, express or implied, contained in any employment handbook, application, memoranda, policy, procedure, or other materials or statements provided to you in connection with your employment.

Workday has its own way of doing business and its own unique, independently developed proprietary technology. We have neither the need nor desire to make any unauthorized use of any intellectual property or confidential information belonging to or developed by others. Workday understands the importance of protecting its own intellectual property and confidential information and respects the intellectual property and confidential information developed by other companies. We fully expect that each person who accepts a position with us will hold themselves to these same standards. No employee should reference, use or bring into the workplace any material that contains intellectual property or confidential information belonging to a previous employer or any other third party.

You will enter into an Indemnification Agreement with Workday and will be covered by the director and officer liability insurance policy currently maintained by the Company, or as may be maintained by the Company from time to time.

The offer of employment set forth in this Letter is contingent upon: (i) your execution of Workday’s Proprietary Information and Inventions Agreement prior to your start date; and (ii) your presentation of satisfactory documentary evidence of your identity and authorization to work in the U.S. within three (3) days of your date of hire. In addition, this offer of employment supersedes and replaces all prior verbal or written agreements between you and Workday, including, but not limited to, all prior offer letters. Like all Workday employees, you are also required, as a condition of your continued employment, to comply with Workday’s Employee Handbook and Code of Conduct as they may be updated and/or revised periodically.

Sincerely,

| | |

Ashley Goldsmith |

Chief People Officer |

By providing my signature below, I accept this offer of employment.

| | | | | |

Signature: | /s/ Robert Enslin |

Schedule A

General Release of Claims

CONFIDENTIAL

[Month] [Day], [20___]

DELIVERY VIA EMAIL

Robert Enslin

Re: General Release

This letter confirms the agreement (“Agreement”) between Robert Enslin (“You,” “Your” or “Yourself”) and Workday, Inc. (the “Company” or “Workday”) concerning the terms of your termination and offers you with the separation compensation (the “Separation Benefits”) as provided under the offer letter by and between you and the Company dated [Month] [Day], [20___], (the “Offer Letter”) in exchange for a general release of claims and covenant not to sue.

You and the Company agree as follows:

1. Termination Date.

[Month] [Day], [20___]_is your last day of employment with the Company (the “Termination Date”).

2. Acknowledgment of Payment of Wages.

By your signature below, you acknowledge that on [Month] [Day], [20___], we provided you one or more final paychecks for all wages, salary, bonuses, commissions, reimbursable expenses previously submitted by you, accrued vacation (if applicable) and any similar payments due you from the Company as of the Termination Date. By signing below, you acknowledge that the Company does not owe you any other amounts of a similar nature.

Please promptly submit for reimbursement all final outstanding expenses, if any and such business expenses required to be reimbursed as a matter of Workday policy or governing law will be promptly reimbursed. Similarly, even if You do not sign this Agreement, You will be offered benefits to which You are entitled, if any, under the Consolidated Omnibus Budget Reconciliation Act of 1985 (“COBRA”).

3. Separation Compensation.

In exchange for your agreement to the general release and waiver of claims and covenant not to sue set forth below and your other promises herein, and provided that You sign this Agreement and return it per the timeline and terms set out below, without revocation or rescission by You, the Company agrees to provide you with the Separation Benefits.

4. Release and Waiver

4.1 By signing this Agreement, You release and waive all claims of any kind whatsoever which You have or may have against Workday and its parent, subsidiary, and affiliated companies, and all related entities, and assigns and all of their officers, agents, employees, shareholders, members, managers, trustees, joint venturers, partners, directors and anyone claiming through them (hereinafter “Releasees” collectively), relating to or arising out of Your employment with Workday or termination therefrom or any and every other associated matter, event, act and/or omission. This release and waiver includes, but is not limited to:

(i)any claims for wrongful termination, defamation, or any other common law claims;

(ii)any claims for the breach of any implied, written or oral contract (excluding any contract claim resulting from a breach of this Agreement by Workday);

(iii)any claims of discrimination, harassment or retaliation based on such things as age, national origin, race, religion, gender, sexual orientation, pregnancy, parental or marital status, physical or mental disability, or medical condition, or any other form of legally prohibited conduct, discrimination or retaliation; and

(iv)to the greatest extent allowed by law, any claims for any compensation of any sort, including but not limited to salary, severance pay and benefits, including unused vacation accrual, leaves, equity compensation/options, commissions, wage differentials and bonuses.

4.2 On behalf of Yourself and anyone claiming through You, You irrevocably and unconditionally agree to release, acquit and forever discharge, to the greatest extent allowed by law, Releasees in each’s individual and/or corporate capacities, from any and all claims, liabilities, promises, actions, damages and the like, known or unknown, which You ever had against any of the Releasees arising out of or relating to Your employment with the Company and/or the termination of Your employment with the Company and/or any and every other matter, event, act and/or omission. Said claims include, but are not limited to: (1) employment discrimination (including claims of sex discrimination and/or sexual harassment, age discrimination, disability discrimination) and retaliation under Title VII (42 U.S.C.A. 2000e etc.) and under 42 U.S.C.A. section 1981 and section 1983, age discrimination under the Age Discrimination in Employment Act (29 U.S.C.A. sections 621-634), the Older Workers Benefit Protection Act (OWBPA), under the State Constitution, and/or any relevant state statutes or municipal ordinances; (2) disputed wages; (3) wrongful discharge and/or breach of any alleged employment contract; and (4) claims based on any tort or alleged wrong, such as but not limited to negligence, invasion of privacy, defamation, fraud and infliction of emotional distress.

4.3 This release and waiver by You includes, to the fullest extent legally permissible, all claims relating to or arising out of Your employment with Workday or Your termination therefrom that may arise under the common law and all federal, state and local statutes, ordinances, rules, regulations and orders, including but not limited to any claim or cause of action based on the National Labor Relations Act, the Age Discrimination in Employment Act, the OWBPA, the Americans with Disabilities Act, the Civil Rights Acts of 1964, the Family and Medical Leave Act, the Employee Retirement Income Security Act of 1974, the Equal Pay Act, all state wage and hour laws, all laws relating to discrimination of any sort, and/or any other provision of federal, state or local statutory or common law or regulation. This release and waiver by You also includes, to the fullest extent legally permissible, all claims that may arise under the California Constitution, the California Labor Code, any applicable California Industrial Welfare Commission order, the California Fair Employment and Housing Act, the California Ralph Civil Rights Act, and the California Tom Bane Civil Rights Act, the San Francisco Paid Sick Leave Ordinance, the San Francisco Health Care Security Ordinance, the San Francisco Fair Chance Ordinance, the San Francisco Family Friendly Workplace Ordinance, and any and all claims under any other federal or California statute or regulation, or any local ordinance, law or regulation, or any claim that was or could have been asserted under common law.

4.4 Except as provided in Section 20, below, you agree that this release and waiver is effective for all claims relating to or arising out of Your employment with Workday or Your termination therefrom without regard to the legal nature of the claim alleged and without regard to whether any such claim is based upon tort, equity, implied or express contract, discrimination of any sort, or any federal, state or local law, statute or regulation or any claim for attorney’s fees.

4.5 You warrant that, to the extent not prohibited by applicable law, You have not and will not institute any lawsuit, claim, action, charge, complaint, petition, appeal, accusatory pleading, or proceeding of any kind against Workday relating to or arising out of any of the claims which are released and waived in this Section 4, and You waive, or at a minimum assign to Workday, any and all rights to any and all forms of recovery or compensation from any legal action brought by You or on Your behalf in connection with Your employment or the termination of Your employment with Workday. To the extent not prohibited by applicable law, in the event that a lawsuit or any of the foregoing actions are filed by You in breach of this covenant, it is expressly understood and agreed that this covenant shall constitute a complete defense to any such lawsuit or action. Although You are releasing claims that You may have under the OWBPA and the ADEA, nothing in this agreement limits You from bringing a claim to challenge this Agreement itself under the Age Discrimination in Employment Act and Older Workers Benefit Protection Act.

4.6 Further, it is understood and agreed that this is a full and final release applying not only to all claims as defined in these paragraphs which are presently known, anticipated, or disclosed to You, but also to all claims as defined in these paragraphs which are presently unknown, unanticipated, and undisclosed to You. You hereby waive any and all rights or benefits which You may now have, or may have in the future.

4.7. In addition, You are waiving the protection of §1542 of the California Civil Code, which states as follows:

A general release does not extend to claims that the creditor or releasing party does not know or suspect to exist in his or her favor at the time of executing the release and that, if known by him or her, would have materially affected his or her settlement with the debtor or released party.

4.8. This release and waiver does not include any rights or benefits (i) that may not be waived pursuant to applicable law including, without limitation, any right to indemnification pursuant to California Labor Code Section 2800 or Section 2802, or (ii) any right to indemnification under the indemnification agreement between You and the Company, any organizational document of the Company, for directors’ and officers’ insurance coverage, any worker’s compensation claims that You may possess or claim that cannot be released as a matter of law, although You represents that You are not currently aware of any such claim. Moreover, You will continue to be indemnified for Your actions taken while employed by the Company to the same extent as other former and officers of the Company under the Company’s Certificate of Incorporation and Bylaws and the indemnification agreement between You and the Company, if any, and You will continue to be covered by the Company’s directors and officers liability insurance policy as in effect from time to time to the same extent as other former officers of the Company, each subject to the requirements of the laws of the State of Delaware.

5. Confidentiality

Except as provided in Section 20, below, and for a purpose permitted by the National Labor Relations Act (such as the right of employees to self-organization, to form, join, or assist labor organizations, to bargain collectively through representatives of their own choosing, and to engage in other concerted activities for the purpose of collective bargaining or other mutual aid or protection), You agree that You will keep the fact, amount, and terms of this Agreement completely confidential and shall not disclose any information concerning this Agreement to anyone, provided that: (a) You may make such disclosures as are required by law, including as necessary for legitimate enforcement or compliance purposes; (b) You may disclose the fact, amount and terms of this Agreement to Your attorneys and tax advisors, when necessary for legitimate legal or financial reasons; and (c) You may disclose the fact, amount and terms of this Agreement to Your spouse, but only after You first obtain that person’s written agreement to maintain the information in strict confidence.

6. Mutual Non-Disparagement

6.1 Further, and except as provided in Section 20, below, and for a purpose permitted by the National Labor Relations Act (such as the right of employees to self-organization, to form, join, or assist labor organizations, to bargain collectively through representatives of their own choosing, and to engage in other concerted activities for the purpose of collective bargaining or other mutual aid or protection), You agree not to make any written, oral or electronic statement about Workday or any Releasee which You know or reasonably should know to be untrue and agree not to make any negative or disparaging statement about Workday (including but not limited to its officers, directors, employees, agents, financial condition, business methods, products, and services) or the Releasees that is intended to or is reasonably likely to cause any form of injury or harm.

6.2 The Company agrees that neither it formally nor its current Chief Executive Officer or other current members of the Board of Directors will make, directly or indirectly, any negative or disparaging statements or comments, either as fact or as opinion, about you. Nothing in this paragraph shall prohibit you or the Company from providing truthful information in response to a subpoena or other legal process.

7. Knowing and Voluntary Release

You acknowledge that Your signing of and Your agreement to this Agreement is knowing, voluntary and deliberate, that You have been provided with all information needed to make an informed decision to enter this Agreement, and that You have not been coerced or threatened.

8. Return of Workday Property

You agree that You have returned all of Workday’s property in Your possession including, but not limited to, any phone cards, cellular phone, computer equipment and all of the tangible and intangible property belonging to the Company and relating to Your employment with the Company. You further represent and warrant that You have not retained any copies, electronic or otherwise, of such property. Workday shall have no obligation to provide You with the Severance Payment described in Section 3 until You have returned to Workday Your Workday laptop and work badge. If You have not returned to Workday Your Workday laptop and work badge by the Effective Date identified in Section 16, then Workday shall have no obligation to provide You with the Severance Payment described in Section 3 until 10 business days after You have returned the Workday laptop and work badge.

9. Continued Compliance with Proprietary and Confidentiality Agreement

9.1 You will continue to comply with the terms of the Proprietary Information and Inventions Agreement between You and the Company and know and understand that the obligations contained in that agreement survive execution of this Agreement and Your termination of employment. In particular, You shall not disclose any confidential or proprietary information (specifically including pricing, margins, key customer contacts and their profiles) that You acquired as an employee or agent of the Company to any other person or entity, or use such information in any manner that is detrimental to the interest of the Company.

9.2 Nevertheless, nothing in this Agreement prohibits You from reporting an event that You reasonably and in good faith believes is a violation of law to the relevant law-enforcement agency (such as the SEC, EEOC, or NLRB), from testifying truthfully under oath in any court, arbitration or administrative agency proceeding, from providing truthful information in the course of a government investigation or from cooperating in an investigation conducted by such a government agency. This may include disclosure of trade secret or confidential information within the limitations permitted by the 2016 Defend Trade Secrets Act (DTSA). You are hereby provided notice that under the DTSA, (1) no individual will be held criminally or civilly liable under federal or state trade secret law for the disclosure of a trade secret (as defined in the Economic Espionage Act) that (A) is made in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney; and made solely for the purpose of reporting or investigating a suspected violation of law; or, (B) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal so that it is not made public; and, (2) an individual who pursues a lawsuit for retaliation by an employer for reporting a suspected violation of the law may disclose the trade secret to the attorney of the individual and use the trade secret information in the court proceeding, if the individual files any document containing the trade secret under seal, and does not disclose the trade secret, except as permitted by court order.

10. Entire Agreement and Severability

10.1 The parties agree that, except as is expressly provided herein, this Agreement sets forth the entire agreement between them as to the matters set forth herein and supersedes any other written promises or oral understandings between the parties as to such matters, if any. The parties also agree and acknowledge that no other verbal or written promises or agreements have been offered for this Agreement (other than those described herein) and that no other promises or agreements between the parties related to the matters set forth herein will be binding unless they have been reduced to writing and signed by the parties and expressly referencing this Agreement.

10.2 You and Workday further agree that, if any portion of this Agreement is held to be invalid or legally unenforceable, such portion will be enforced to the greatest extent permitted by law and the remaining portions of this Agreement will not be affected and will be given full force and effect. The provisions of Sections 5 and 6 shall survive and continue in full force and effect in accordance with their respective terms notwithstanding any alleged breach of this Agreement. You acknowledge and agree that, in the event that the provisions of Sections 5 and/or 6 shall be deemed by a court of competent jurisdiction to be unenforceable, then the court is to modify such provisions to the minimum extent necessary to render the provisions valid and enforceable.

11. No Admission

The parties acknowledge that this Agreement does not constitute any admission by You or Workday of any wrongdoing or liability whatsoever, but results from the desire of the parties to resolve any actual and potential disputes between them. Nothing contained in this Agreement, or the fact of its submission to You, shall be admissible evidence in any judicial, administrative or other legal proceeding, of any liability or wrongdoing on the part of Workday or any related party of any violation of federal, state or local law.

12. Applicable Law

All provisions of this Agreement will be construed and governed by the laws in the state where You are principally employed without regard to choice of law principles or laws of any other jurisdiction. Any suit, claim or other legal proceeding brought by You and arising out of or relating to Your employment, termination of employment, or this Agreement shall be brought exclusively in the federal or state courts located in the state where You are principally employed, and You and Workday hereby submit to personal jurisdiction in the state where You are principally employed, and to venue in such courts. You acknowledge that a breach of the provisions of Sections 5 and 6 above by You will cause irreparable harm to Workday, and Workday shall be entitled to injunctive relief to restrain such breach or threatened breach by You or any person acting with You in any capacity whatsoever and to pay Workday’s legal expenses and costs incurred in bringing such actions against You. The language of this Agreement shall be construed according to its fair meaning, and not for or against any particular party.

13. Resolution of All Matters

This Agreement resolves all matters and claims You have or may have against Workday and the Releasees relating to Your employment and the termination of Your employment with Workday; it is and shall be binding upon and inure to the benefit of the parties and their respective heirs, legatees, personal representatives, successors and assigns. Upon execution, this Agreement becomes effective and binding on the parties as of the Effective Date. This Agreement may not be modified, altered or changed except by an express written document signed by all parties hereto, wherein specific reference is made to this Agreement.

14. No Pending Claims

You hereby represent and warrant that You do not currently have pending any claims, charges, lawsuits, or other proceedings against Workday concerning any of the claims released by this Agreement, including but not limited to any claims for unlawful workplace harassment or discrimination, failure to prevent an act of workplace harassment or discrimination, or act of retaliation against a person for reporting or opposing harassment or discrimination whether or not filed in court, before an administrative action, or through an internal complaint process against Employer or the Releasees. You further represent and warrant that You have not heretofore assigned any claims that You have or may have against Workday covered by this Agreement.

15. Review and Revocation

You understand that You have been given a period of at least twenty-one (21) days from the date this Agreement was provided to You to review and consider this Agreement before signing it. Any changes to this document, whether material or immaterial, do not restart the running of this twenty-one (21) day consideration period. You further understand that You may use as much of this twenty-one (21) day period as You wish prior to signing. You may revoke this Agreement within seven (7) calendar days of signing it. Revocation can be made by delivering a written notice of revocation to Rich Sauer, 6110 Stoneridge Mall Road, Pleasanton, CA 94588. For this revocation to be effective, written notice must be received by Rich Sauer no later than the seventh (7th) day after You sign this Agreement. If You revoke this Agreement, it shall not be effective or enforceable and You will not receive the severance benefits described in this document. By signing this Agreement, You agree that You have carefully read and fully understand all of its provisions. The Company hereby advises You in writing to consult with Your attorney before executing this Agreement, and You acknowledge and agree that You have been so advised. You further understand that rights or claims that may arise after the date You sign this Agreement are not waived.

16. Effective Date

This Effective Date of this Agreement occurs eight (8) calendar days after it is signed and delivered to the Company, provided that the Agreement has not been timely revoked as set forth in Section 15.

17. Stock Option Plans

If You have any vested stock options, You may have a period of time following the Termination Date during which You may exercise them. The specific period of time shall be as stated in the Company’s 2022 Equity Incentive Plan, as appropriate, and as set forth in the applicable stock option agreements. You acknowledge that You will refer to these applicable plan documents to confirm the period during which You may exercise vested stock options. This Agreement shall not be construed to amend, modify or supersede any of the provisions of any Workday stock option plan that may be applicable to You.

18. Successors and Assigns

This Agreement may be assigned or transferred to, and shall be binding upon and shall inure to the benefit of, any successor or assign of Workday, and any such successor or assign shall be deemed substituted for all purposes for Workday under the terms of this Agreement.

19. Counterparts

This Agreement may be executed in counterparts, and a facsimile or electronic signature shall be deemed to be an original signature for all purposes.

20. No Interference with Rights

Nothing in this Agreement is intended to waive claims (i) for unemployment or workers’ compensation benefits, (ii) for vested rights under ERISA-covered employee benefit plans as applicable on the date You sign this Agreement, or (iii) which cannot be released by private agreement. In addition, nothing in this Agreement, including but not limited to the release of claims, proprietary information, confidentiality, cooperation, and non-disparagement provisions: (a) waives Your right to testify in an administrative, legislative, or judicial proceeding concerning alleged criminal conduct or alleged sexual harassment on the part of Workday, or on the part of the agents or employees of Workday, when You have been required or requested to attend such a proceeding pursuant to a court order, subpoena, or written request from an administrative agency or the legislature; (b) prevents You from discussing or disclosing information about unlawful acts in the workplace, such as harassment or discrimination or any other conduct that You have reason to believe is unlawful; (c) prevents You from filing a charge or complaint with, providing information or documents to, and/or from participating in an investigation or proceeding conducted by the Equal Employment Opportunity Commission (EEOC), National Labor Relations Board (NLRB), the Securities and Exchange Commission (SEC), or any other any federal, state or local agency charged with the enforcement of any laws, or (d) prevents You from exercising rights under Section 7 of the National Labor Relations Act (NLRA) to engage in joint activity with other employees or individuals, provided that by signing this Agreement You are waiving the right to individual relief based on claims asserted in such a charge or complaint, or asserted by any third-party on Your behalf, except where such a waiver of individual relief is prohibited and except for any right You may have to receive a payment from a government agency (and not Workday) for information provided to a government agency.

21. Not Signed Before Termination Date

Regardless of when this Agreement was provided to You, You may not sign this Agreement prior to Your Termination Date. By signing below, You affirm that You did not sign this Agreement prior to Your Termination Date.

By signing this Agreement below, You represent that You fully understand and voluntarily agree to be bound by all of its terms. Accepted and agreed to on this ___ day of _________________, ______, which is a date on or after Your Termination Date.

| | | | | | | | | | | |

| | | Workday Inc. |

| | | |

| | | |

Robert Enslin | | | Ashley Goldsmith |

| | | Chief People Officer |

Exhibit 10.2

Workday, Inc.

Executive Severance and Change in Control Policy

(as amended November 25, 2024)

| | | | | |

PURPOSE; EFFECTIVE DATE | This Executive Severance and Change in Control Policy (this “Policy”) was adopted by the Board of Directors (the “Board”) of Workday, Inc., a Delaware corporation (the “Workday”) on November 30, 2023 and was most recently amended November 25, 2024 (the date most recently amended, the “Effective Date”). This Policy sets forth the separation benefits for eligible executives upon certain terminations of their employment with Workday under the conditions set forth herein. |

ELIGIBILITY | Executive officers for purposes of Section 16 of the Exchange Act of 1934, as amended (“Section 16 Officers”), other Executive Vice Presidents, and other employees as designated (“Designated Employees”) by the Board or the Compensation Committee of the Board (the “Committee”) are eligible to participate in this Policy (each, a “Participant”). A Participant shall cease to be a Participant under this Policy upon the earlier of (i) the date Participant’s employment with Workday terminates for a reason other than a Non-CIC Qualifying Termination or a CIC Qualifying Termination (as each is defined below), (ii) unless otherwise determined by the Board or the Committee in its sole discretion, the date on which Participant is no longer either a Section 16 Officer or an Executive Vice President, or (iii) as applicable to Designated Employees only, confirmation by the Board or the Committee, upon the recommendation of the Chief Executive Officer or Co-Chief Executive Officer (referred to herein as “CEO”) or the Chief People Officer; provided, that, in the event of a Change in Control (as defined below), Participant’s participation in this Policy may not be terminated pursuant to (ii) or (iii) above. For the avoidance of doubt, in no event shall a Participant receive payment under both the section entitled Benefits upon a Non-CIC Qualifying Termination and the section entitled Benefits upon a CIC Qualifying Termination. |

| | | | | |

BENEFITS UPON A NON-CIC QUALIFYING TERMINATION | Under this Policy, in the event of a Non-CIC Qualifying Termination, and contingent upon the Participant’s execution and non-revocation of a binding separation and release agreement in a form acceptable to Workday (a “Release”) within sixty (60) days following the Non-CIC Qualifying Termination, the Participant will be entitled to receive: (i)If the Participant was serving as CEO immediately prior to the Non-CIC Qualifying Termination: a.A lump sum cash payment in an amount equal to one times such Participant’s annual base salary as in effect immediately prior to the Non-CIC Qualifying Termination, plus one times such Participant’s Target Bonus for the fiscal year in which the Non-CIC Qualifying Termination occurs, less applicable withholding taxes; b.A lump sum cash payment in an amount equal to the following: i.If the Non-CIC Qualifying Termination occurs in the first fiscal quarter of any fiscal year, one times the Participant’s Target Bonus for the prior fiscal year, minus any portion of the annual bonus paid to the Participant for the prior fiscal year, less applicable withholding taxes; or ii.If the Non-CIC Qualifying Termination occurs in the second, third, or fourth quarter of any fiscal year, one times such Participant’s Target Bonus for the fiscal year in which the Non-CIC Qualifying Termination occurs, pro rata based on the date of the Non-CIC Qualifying Termination, minus any portion of the annual bonus paid to the Participant for the fiscal year in which the Non-CIC Qualifying Termination occurs, less applicable withholding taxes; c.Accelerated vesting of the portion of Participant’s unvested equity awards that would otherwise vest in the twelve (12) months following the Non-CIC Qualifying Termination (excluding Performance Awards (as defined below)); provided that any equity awards, except for New Hire Awards (as defined below), granted within the twelve (12) months immediately prior to the date of the Non-CIC Qualifying Termination shall not be eligible for accelerated vesting. With respect to awards that would otherwise vest only upon satisfaction of performance criteria (“Performance Awards”), vesting will accelerate, if at all, as set forth in the terms of the applicable performance-based award agreement; and d.A lump sum cash payment in an amount equal to an estimate of the aggregate premiums for continuation coverage for twelve (12) months pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985 (“COBRA”), less applicable withholding taxes. (ii)If the Participant was serving in a role other than CEO immediately prior to the Non-CIC Qualifying Termination: a.A lump sum cash payment in an amount equal to one times such Participant’s annual base salary as in effect immediately prior to the Non-CIC Qualifying Termination, less applicable withholding taxes; |

| | | | | |

| b.A lump sum cash payment in an amount equal to the following: i.If the Non-CIC Qualifying Termination occurs in the first fiscal quarter of any fiscal year, one times the Participant’s Target Bonus for the prior fiscal year, minus any portion of the annual bonus paid to the Participant for the prior fiscal year, less applicable withholding taxes; or ii.If the Non-CIC Qualifying Termination occurs in the second, third, or fourth quarter of any fiscal year, one times such Participant’s Target Bonus for the fiscal year in which the Non-CIC Qualifying Termination occurs, pro rata based on the date of the Non-CIC Qualifying Termination, minus any portion of the annual bonus paid to the Participant for the fiscal year in which the Non-CIC Qualifying Termination occurs, less applicable withholding taxes; c.Accelerated vesting of the portion of Participant’s unvested equity awards that would otherwise vest in the twelve (12) months following the Non-CIC Qualifying Termination (excluding Performance Awards); provided that any equity awards, except for New Hire Awards, granted within the twelve (12) months immediately prior to the date of the Non-CIC Qualifying Termination shall not be eligible for accelerated vesting. Performance Awards will accelerate, if at all, only as set forth in the terms of the applicable performance-based award agreement; and d.A lump sum cash payment in an amount equal to an estimate of the aggregate premiums for continuation coverage for twelve (12) months pursuant to COBRA, less applicable withholding taxes. The foregoing benefits payable in cash will be provided on Workday’s first customary payroll date that is ten (10) or more business days following the sixty-first (61st) day following the Non-CIC Qualifying Termination, and in any event no later than March 15 of the year following the year in which the Non-CIC Qualifying Termination occurs. |

| | | | | |

BENEFITS UPON A CIC QUALIFYING TERMINATION | Under this Policy, in the event of a CIC Qualifying Termination, and contingent upon the Participant’s execution and non-revocation of a Release within sixty (60) days following the CIC Qualifying Termination, the Participant will be entitled to receive: (i)If the Participant was serving as CEO immediately prior to the Change in Control: a.A lump sum cash payment in an amount equal to two times such Participant’s annual base salary as in effect immediately prior to the CIC Qualifying Termination (or at the rate in effect immediately prior to a reduction in the base salary that gave rise to Good Reason) or the Change in Control, whichever is greater, less applicable withholding taxes; b.A lump sum cash payment in an amount equal to two times such Participant’s Target Bonus for the fiscal year in which the CIC Qualifying Termination occurs, less applicable withholding taxes; c.Accelerated vesting of 100% of the amount of Participant’s unvested equity awards (excluding Performance Awards) immediately prior to the CIC Qualifying Termination. With respect to Performance Awards, vesting will accelerate, if at all, as set forth in the terms of the applicable performance-based award agreement; and d.A lump sum cash payment in an amount equal to an estimate of the aggregate premiums for continuation coverage for twenty-four (24) months pursuant to COBRA, less applicable withholding taxes. (ii)If the Participant was serving in a role other than CEO immediately prior to the Change in Control: a.A lump sum cash payment in an amount equal to such Participant’s annual base salary as in effect immediately prior to the CIC Qualifying Termination (or at the rate in effect immediately prior to a reduction in the base salary that gave rise to Good Reason) or the Change in Control, whichever is greater, less applicable withholding taxes; b.A lump sum cash payment in an amount equal to such Participant’s Target Bonus for the fiscal year in which the CIC Qualifying Termination occurs, less applicable withholding taxes; c.Accelerated vesting of 100% of the amount of Participant’s unvested equity awards (excluding Performance Awards) immediately prior to the CIC Qualifying Termination. With respect to Performance Awards, vesting will accelerate, if at all, as set forth in the terms of the applicable performance-based award agreement; and d.A lump sum cash payment in an amount equal to an estimate of the aggregate premiums for continuation coverage for twelve (12) months pursuant to COBRA, less applicable withholding taxes. The foregoing benefits payable in cash will be provided on Workday’s first customary payroll date that is ten (10) or more business days following the sixty-first (61st) day following the CIC Qualifying Termination, and in any event no later than March 15 of the year following the year in which the CIC Qualifying Termination occurs. |

| | | | | |

DEFINITIONS | A “Change in Control” shall be deemed to have occurred if any one of the following events shall have occurred: (i)any “person” (as such term is used in Sections 13(d) and 14(d) of the Securities Exchange Act of 1934 (the “Exchange Act”)) other than Workday’s founders or a trust, foundation or other estate planning vehicle established by one of Workday’s founders, becomes the “beneficial owner” (as defined in Rule 13d-3 of the Exchange Act), directly or indirectly, of securities representing fifty percent (50%) or more of the total voting power represented by Workday’s then-outstanding voting securities; (ii)the consummation of the sale or disposition of all or substantially all of Workday’s assets; or (iii)the consummation of a merger or consolidation of Workday with any other corporation, other than a merger or consolidation which would result in Workday’s voting securities outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity or its parent) at least fifty percent (50%) of the total voting power represented by our voting securities or such surviving entity or its parent outstanding immediately after such merger or consolidation. “Change in Control Period” means the period commencing upon a Change in Control and ending twelve (12) months following a Change in Control. “CIC Qualifying Termination” shall be (i) an involuntary termination of Participant’s employment other than for “Cause,” death, or disability or (ii) Participant’s voluntary resignation for “Good Reason”, in each case occurring within a Change in Control Period. “Cause” shall mean: (i)Gross negligence or misconduct in the performance of Participant’s duties; (ii)Participant’s conviction or a plea of “guilty” or “no contest” for (x) a felony or (y) any violent crime or crime involving theft, dishonesty, moral turpitude, or money laundering; (iii)Participant’s negligent or intentional act or omission which is, or is reasonably likely to be, materially injurious to the financial condition or reputation of Workday or its affiliates; (iv)Participant’s breach of Workday’s standard Proprietary Information and Inventions Agreement; or (v)Participants breach of Workday’s written policies and procedures, including without limitation a code of conduct, or any contract or agreement between Participant and Workday, in either case which is, or is reasonably likely to be, materially injurious to the financial condition or reputation of Workday or its affiliates. “Good Reason” shall mean: (i)any material reduction in Participant’s Base Salary or target bonus opportunity (excluding a reduction affecting substantially all similarly situated Participants or any change in the value of equity incentives); (ii)the relocation of the Participant’s primary work location such that Participant’s one-way commute is increased by more than fifty (50) miles; (iii)a material diminution to Participant’s duties and responsibilities as in effect immediately prior to a Change in Control; or |

| | | | | |

| (iv)a successor of Workday as set forth in the section “Successors” hereof does not assume this Policy; provided, that, any of the events described in clauses (i)-(iv) of this section shall constitute Good Reason only if Workday fails to cure such event within 30 days after receipt from Participant of written notice of the event which constitutes Good Reason and Participant resigns his or her employment within 30 days following expiration of such cure period; provided, further, that Good Reason shall cease to exist for an event on the 90th day following its initial occurrence, unless Participant has given Workday written notice thereof prior to such date. The notice provided by Participant to Workday must set forth in reasonable detail the specific conduct of Workday that constitutes Good Reason and the specific provision(s) of this definition on which the Participant is relying. The “Code” shall mean the Internal Revenue Code of 1986, as amended. “New Hire Award” means a Company equity award granted to a Participant coincident with, or as an inducement to, such Participant’s hiring and/or commencement of employment or other service with the Company. “Non-CIC Qualifying Termination” shall be an involuntary termination of Participant’s employment other than for “Cause,” death, or disability occurring outside of a Change in Control Period. “Target Bonus” shall mean the Participant’s annual target bonus at the rate then in effect (a) immediately prior to the Non-CIC Qualifying Termination, in the event of Participant’s Non-CIC Qualifying Termination or (b) immediately prior to the CIC Qualifying Termination (ignoring any decrease in Target Bonus that forms the basis for Good Reason) or the Change in Control, whichever is greater, in the event of Participant’s CIC Qualifying Termination, as applicable. For purposes of this Policy, “Target Bonus” shall not include any other Company cash incentive payments for which Participant may be eligible (e.g., commission payments, sign-on bonus, etc.). |

POLICY EFFECTIVENESS; TERMINATION | This Policy is effective as of the Effective Date and replaces and supersedes in its entirety the Change in Control Policies which were effective as of September 3, 2020, and April 22, 2021, respectively, and any prior versions of this Policy. This Policy will be reviewed regularly by the Committee and may be amended or terminated by the Committee or Board. Notwithstanding anything herein to the contrary, in no event shall any amendment or termination adversely affect the rights of any Participant (i) during the Change in Control Period or (ii) who is then receiving or entitled to receive payments or benefits under this Policy, without the prior written consent of such Participant. |

SUCCESSORS | Workday shall require any successor (whether pursuant to a Change in Control, direct or indirect, and whether by purchase, merger, consolidation, liquidation or otherwise) to all or substantially all of the business and/or assets of Workday to expressly assume and agree to perform the obligations under this Policy in the same manner and to the same extent as Workday would be required to perform in the absence of such a succession of Workday. For all purposes of this Policy, the term “Workday” shall include any successor to Workday’s business and/or assets or which becomes bound by this Policy by operation of law. |

OTHER SEVERANCE ARRANGEMENTS | A Participant shall be entitled to receive the greatest of (a) the total payments, equity acceleration and benefits provided for under this Policy, subject to the applicable terms and conditions of this Policy or (b) the total payments, equity acceleration and benefits provided in the event of a change of control and/or qualifying termination of employment provided under arrangements entered into by and between Participant and Workday prior to the Effective Date of this Policy, subject to the applicable terms and conditions of such arrangements. For the purposes of this section, the value of (a) and (b) shall be calculated and determined by Workday at its discretion. |

| | | | | |

280G BEST-OF PROVISION | If the benefits described in this Policy constitute “parachute payments” within the meaning of the Code and would be subject to the excise tax imposed by Section 4999 of the Code, then at the Participant’s discretion, the benefits will be payable either (i) in full, or (ii) as to such lesser amount which would result in no portion of such benefits being subject to the excise tax under Section 4999 of the Code, whichever of the foregoing amounts (taking into consideration applicable taxes, including the excise tax under Section 4999) would result in the receipt by Participant on an after-tax basis of the greatest amount of benefits (even if some of such benefits are taxable under Section 4999). |

SECTION 409A | For purposes of this Policy, no payment will be made to any Participant upon termination of the Participant’s employment unless such termination constitutes a “separation from service” within the meaning of Section 409A of the Code. It is intended that the right of any Participant to receive installment payments pursuant to this Policy shall be treated as a right to receive a series of separate and distinct payments for purposes of Section 409A of the Code. It is further intended that all payments and benefits hereunder satisfy, to the greatest extent possible, the exemption from the application of Section 409A of the Code (and any state law of similar effect) provided under Treasury Regulation Section 1.409A-1(b)(4) (as a “short-term deferral”) and are otherwise exempt from or comply with Section 409A of the Code. Accordingly, to the maximum extent permitted, this Policy shall be interpreted in accordance with that intent. To the extent necessary to comply with Section 409A of the Code, if the designated payment period for any payment under this Policy begins in one taxable year and ends in the next taxable year, the payment will commence or otherwise be made in the later taxable year. For purposes of Section 409A of the Code, if Workday determines that a Participant is a “specified employee” under Section 409A(a)(2)(B)(i) of the Code at the time of his or her separation from service, then to the extent delayed commencement of any portion of the payments or benefits to which the Participant is entitled pursuant to this Policy is required in order to avoid a prohibited distribution under Section 409A(a)(2)(B)(i) of the Code, such portion shall not be provided to the Participant until the earlier (i) the expiration of the six-month period measured from the Participant’s separation from service or (ii) the date of the Participant’s death. As soon as administratively practicable following the expiration of the applicable Section 409A(2)(B)(i) period, all payments deferred pursuant to the preceding sentence shall paid in a lump-sum to the Participant and any remaining payments due pursuant to this Policy shall be paid as otherwise provided herein. |

Exhibit 99.1

Workday Names Rob Enslin President, Chief Commercial Officer

Longtime SAP Veteran, Former UiPath CEO and Google Cloud President to Lead Workday’s Global Commercial Strategy for the Company’s Next Phase of Growth

PLEASANTON, Calif., Nov. 26, 2024 -- Workday, Inc. (NASDAQ: WDAY), a leading provider of solutions to help organizations manage their people and money, today announced the appointment of Rob Enslin to the newly created role of president, chief commercial officer (CCO). Enslin will be responsible for driving Workday’s revenue growth and leading the company’s global sales, partnership and customer experience efforts.

Enslin brings more than 30 years of experience in the technology industry, most recently serving as CEO of UiPath where he led the company to non-GAAP profitability, advanced the company’s AI strategy, and drove expansion into new markets. Before joining UiPath, Enslin was president of cloud sales at Google Cloud, where he scaled the company’s sales operations and drove significant revenue growth. Enslin’s extensive career also includes 27 years at SAP, culminating in his role as president of the Cloud Business Group and executive board member. In addition to deep enterprise expertise, Enslin brings a strong global perspective, having held roles in South Africa, USA, Germany, and Japan throughout his career.

“Rob is a world-class leader with a track record of building high performing go-to-market teams, a deep understanding of industry and partner ecosystems, and unique global experience, making him the ideal leader to help guide Workday’s next phase of growth,” said Carl Eschenbach, CEO, Workday. “We’re confident that his vision and commitment to providing exceptional customer experiences will unlock even greater potential for Workday and businesses around the world.”

“Joining Workday at this pivotal moment is incredibly exciting,” said Enslin. “Workday’s unparalleled dataset, combined with its commitment to innovation, positions the company to become the definitive AI leader in the ERP market. I’m thrilled to be part of this transformation and shape the future of work.”

Enslin’s appointment will be effective as of December 2, 2024.

About Workday

Workday is a leading enterprise platform that helps organizations manage their most important assets – their people and money. The Workday platform is built with AI at the core to help customers elevate people, supercharge work, and move their business forever forward. Workday is used by more than 10,500 organizations around the world and across industries – from medium-sized businesses to more than 60% of the Fortune 500. For more information about Workday, visit workday.com.

© 2024 Workday, Inc. All rights reserved. Workday and the Workday logo are registered trademarks of Workday, Inc. All other brand and product names are trademarks or registered trademarks of their respective holders.

Forward-Looking Statements

This press release contains forward-looking statements including, among other things, statements regarding Workday’s leadership, growth, transformation, and potential. These forward-looking statements are based only on currently available information and our current beliefs, expectations, and assumptions. Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties, assumptions, and changes in circumstances that are difficult to predict and many of which are outside of our control. If the risks materialize, assumptions prove incorrect, or we experience unexpected changes in circumstances, actual results could differ materially from the results implied by these forward-looking statements, and therefore you should not rely on any forward-looking statements. Risks include, but are not limited to, risks described in our filings with the Securities and Exchange Commission (“SEC”), including our most recent report on Form 10-Q or Form 10-K and other reports that we have filed and will file with the SEC from time to time, which could cause actual results to vary from expectations. Workday assumes no obligation to, and does not currently intend to, update any such forward-looking statements after the date of this release, except as required by law.

Any unreleased services, features, or functions referenced in this document, our website, or other press releases or public statements that are not currently available are subject to change at Workday’s discretion and may not be delivered as planned or at all. Customers who purchase Workday services should make their purchase decisions based upon services, features, and functions that are currently available.

For further information:

Investor Relations: ir@workday.com

Media Inquiries: media@workday.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

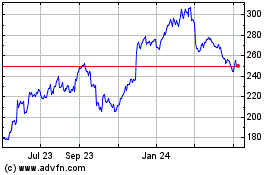

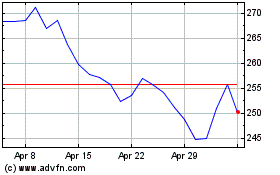

Workday (NASDAQ:WDAY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Workday (NASDAQ:WDAY)

Historical Stock Chart

From Nov 2023 to Nov 2024