As filed with the Securities and Exchange Commission on February 10, 2025

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Assured Guaranty Ltd.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Bermuda | | 98-0429991 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

Assured Guaranty Ltd. 2024 Long-Term Incentive Plan

(Full title of the plan)

| | | | | |

30 Woodbourne Avenue Hamilton HM 08 Bermuda Telephone: (441) 279-5700

| Assured Guaranty Inc.

1633 Broadway

New York, New York 10019

Attn: General Counsel

Telephone: (212) 974-0100

|

(Name, address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices) | (Address, including zip code, and telephone number,

including area code, of agent for service) |

copy to:

Anna Pinedo

Ryan Liebl

Alexandra Perry

Mayer Brown LLP

1221 Avenue of the Americas

New York, NY 10020

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

Pursuant to General Instruction E to Form S-8, the contents of the Registrant’s Registration Statements on Form S-8, File No. 333-115893, 333-159324 and 333-198248 (the “Prior Registration Statements”), are incorporated herein by reference. This Registration Statement covers 2,850,000 shares of the Registrant’s common shares, par value $0.01 per share (“Common Shares”) reserved for issuance under the Assured Guaranty Ltd. 2024 Long-Term Incentive Plan (“2024 LTIP”) which consists of (i) 1,750,000 Common Shares plus (ii) an estimated 1,100,000 Common Shares previously issued pursuant to one or more of the Prior Registration Statements, which are represented by awards granted under a prior plan that were or in the future are forfeited, expire or cancelled after the approval of the 2024 LTIP Plan without delivery of Common Shares or which result from the forfeiture of the Common Shares back to the Registrant to the extent that such Common Shares would have been recycled for future issuance under the applicable prior plan (subject to applicable adjustments). The actual number of shares to be issued under the 2024 LTIP may be significantly less than 2,850,000 Common Shares depending on, among other variables, the number of actual recycled prior plan shares.

PART I

Information required by Part I of Form S-8 to be contained in the Section 10(a) prospectus is omitted from this Registration Statement in accordance with Rule 428 under the Securities Act of 1933, as amended (the “Securities Act”). The documents containing the information specified in Part I will be delivered to the participants in the Assured Guaranty Ltd. 2024 Long-Term Incentive Plan as required by Rule 428(b). Such documents are not being filed with the Securities and Exchange Commission (the “Commission”) as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents, which have heretofore been filed by the Registrant with the Commission pursuant to the Securities Act and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are incorporated by reference herein and shall be deemed to be a part hereof:

| | | | | |

| (a) | |

| (b) | |

| (c) | The information specifically incorporated by reference into the 2023 Form 10-K from the Registrant’s definitive proxy statement on Schedule 14A filed with the Commission on March 20, 2024. |

| (d) | The Registrant’s Quarterly Reports on Form 10-Q for the quarter ended March 31, 2024, filed with the Commission on May 8, 2024, for the quarter ended June 30, 2024, filed with the Commission on August 8, 2024, and for the quarter ended September 30, 2024, filed with the Commission on November 12, 2024. |

| (e) | |

| (f) | The description of the Common Shares included in a registration statement on Form 8-A filed with the Commission on April 15, 2004, as updated by the description of the Common Shares contained in Exhibit 4.17 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the Commission on February 28, 2024, including any amendment or report filed for the purpose of updating such description. |

All documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act prior to the filing of a post-effective amendment which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold shall be deemed to be incorporated herein by reference and

shall be deemed a part hereof from the date of filing of such documents; provided, however, that documents or information deemed to have been furnished and not filed in accordance with the Securities and Exchange Commission rules shall not be deemed incorporated by reference into this Registration Statement.

Item 6. Indemnification of Directors and Officers.

Bye-law 30 of Registrant’s Bye-Laws provides, among other things, that the directors and officers (such term to include for purposes of Bye-laws 30 and 31 any person appointed to any committee by the board of directors and any person who is or was serving at the request of Registrant as a director, officer or employee of another corporation, partnership, joint venture, trust or other enterprise (and any person serving as a director, officer or employee of a subsidiary of the Registrant shall be deemed to be so serving at the request of the Registrant)) and the resident representative for the time being acting in relation to any of the affairs of Registrant or any subsidiary thereof and the liquidator or trustees (if any) for the time being acting in relation to any of the affairs of Registrant and every one of them, and their respective heirs, executors and administrators: (i) shall be indemnified and secured harmless out of the assets of Registrant from and against all actions, liabilities, costs, charges, losses, damages and expenses which they or any of them shall or may incur or sustain by or by reason of any act by such person, or other person or a collective of persons (including, without limitation, the Board) or by the Registrant done, concurred in or omitted (actual or alleged) in or about the execution of their duty, or supposed duty, or in their respective offices or trusts, and none of them shall be answerable for the acts, receipts, neglects or defaults of the others of them or for joining in any receipts for the sake of conformity, or for any bankers or other persons with whom any moneys or effects belonging to Registrant shall or may be lodged or deposited for safe custody, or for insufficiency or deficiency of any security upon which any moneys of or belonging to Registrant shall be placed out on or invested, or for any other loss, misfortune or damage which may happen in the execution of their respective offices or trusts, or in relation thereto, provided that this indemnity shall not extend to any matter in respect of fraud or dishonesty; (ii) shall not be liable for the acts, receipts, neglects or defaults of any other director or officer or other person, or for any loss or expense incurred by Registrant through the insufficiency or deficiency of title to any property acquired by the board of directors for or on behalf of Registrant, or for the insufficiency or deficiency of any security in or upon which any of the monies of Registrant is invested, or for any loss or damage arising from the bankruptcy, insolvency or tortious act of any person with whom any monies, securities or effects is deposited, or for any loss occasioned by any error of judgment, omission, default or oversight on his or her part, or for any other loss, damage or misfortune whatever which shall happen in relation to the execution of the duties of his or her office, or in relation thereto, unless the same happens through fraud or dishonesty on his or her part; and (iii) shall be indemnified out of the assets of Registrant against all liabilities, costs, changes, losses, damages and expenses which any of them shall or may incur or sustain, by or by reason of any act, by such person, or other person or a collective of persons (including, without limitation, the board of directors), or by Registrant, done, concurred in or omitted (actual or alleged) in or about the execution of his, her or their duty, or supposed duty, or in his, her or their respective offices or trusts, in defending or appearing or giving evidence in any proceedings (such term to include, for the purposes of Bye-law 30, threatened proceedings, investigations and enquiries, whether by a regulatory authority, prosecutions authority or otherwise), whether civil or criminal, including where allegations of fraud and dishonesty are made against such indemnified person, and Registrant shall pay to or on behalf of such indemnified person any and all reasonable costs, charges and expenses associated in defending or appearing or giving evidence with respect to such indemnified person in such proceedings (including, without limitation, independent representation and counseling by an attorney or other professional selected by such indemnified person) as and when such liabilities, losses, costs and expenses are incurred, provided that, in the event of a finding of fraud or dishonesty (such fraud or dishonesty having been established in a final judgment or decree not subject to appeal), such indemnified person shall reimburse to Registrant all funds paid by Registrant in respect of liabilities, losses, costs and expenses of defending such proceedings. The provisions of Bye-law 30 (and Bye-law 31) shall apply to, and for the benefit of, any person acting as (or with the reasonable belief that he or she will be appointed or elected as) a director, secretary, other officer, the resident representative, or liquidator or trustee in the reasonable belief that he or she has been so appointed or elected notwithstanding any defect in such appointment or election and to any person who is no longer, but at one time was, a director, secretary, other officer, resident representative or liquidator or trustee of Registrant. Bye-law 30 also permits the Registrant to purchase insurance for the benefit of directors, officers and employees against liabilities, costs, changes, losses, damages and expenses incurred in such capacity. Bye-law 30 is not exclusive of other rights indemnified persons may have. Bye-law 30 cannot be amended or repealed to the detriment

of an indemnified person for a claim based on an act or failure to act that occurred prior to such amendment, repeal or termination.

Bye-law 31 of Registrant’s Bye-Laws provides that Registrant and each shareholder agree to waive any claim or right of action it might have, whether individually or by or in the right of Registrant, against any director, chairman, president, secretary, other officer, resident representative or liquidator or trustee of Registrant on account of any action taken by such director or other such person, or the failure of such director or other such person to take any action in the performance of his or her duties with or for Registrant or any subsidiary thereof, provided that such waiver shall not extend to any matter in respect of any fraud or dishonesty which may attach to such director or other such person.

The Companies Act provides that a Bermuda company may indemnify its directors in respect of any loss arising or liability attaching to them as a result of any negligence, default, breach of trust of which they may be guilty. However, the Companies Act also provides that any provision, whether contained in the company’s bye-laws or in a contract or arrangement between the company and the director, indemnifying such director against any liability which would attach to him in respect of his fraud or dishonesty will be void.

In addition, Registrant has entered into indemnification agreements with its directors and executive officers. The indemnification agreements provide for indemnification arising out of specified indemnifiable events, such as events relating to the fact that the indemnitee is or was one of Registrant’s directors or officers or is or was a director, officer, employee or agent of another entity at Registrant’s request or relating to anything done or not done by the indemnitee in such a capacity. The indemnification agreements provide for advancement of expenses. These agreements provide for mandatory indemnification to the extent an indemnitee is successful on the merits. To the extent that indemnification is unavailable, the agreements provide for contribution. The indemnification agreements set forth procedures relating to indemnification claims. The agreements also provide for maintenance of directors’ and officer’s liability insurance.

Registrant has purchased directors’ and officers’ liability insurance policies. Such insurance would be available to Registrant’s directors’ and officers’ in accordance with its terms. In addition, certain directors may be covered by directors and officers liability insurance policies purchased by their respective employers.

The Registrant expects that any underwriting agreement that it may enter in connection with the securities registered pursuant to this registration statement may contain provisions providing that the underwriters are obligated, under certain circumstances, to indemnify the directors, certain officers and the controlling persons of Registrant against certain liabilities under the Securities Act.

Item 8. Exhibits.

| | | | | | | | | | | | | | |

| | EXHIBIT INDEX | | |

Exhibit

Number | | Description of Document | | Filed or furnished herewith |

| 4.1 | | | | |

| | | | |

| 4.2 | | | | |

| | | | |

| | | | | | | | | | | | | | |

| 4.3 | | | | |

| | | | |

| 4.4 | | | | |

| | | | |

| 5.1 | | | | X |

| | | | |

| 23.1 | | | | X |

| | | | |

| 23.2 | | Consent of Conyers Dill & Pearman Limited (included in Exhibit 5.1) | | X |

| | | | |

| 24.1 | | | | X |

| | | | |

| 107 | | | | X |

Item 9. Undertakings.

(a) The undersigned Registrant hereby undertakes:

1. To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of this registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in this registration statement or any material change to such information in this registration statement;

provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) above do not apply if the registration statement is on Form S-8 and the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished by the Registrant to the Commission pursuant to Section 13 or Section 15(d) of Exchange Act that are incorporated by reference in this registration statement.

2. That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

3. To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in this registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c)-(g) [Reserved.]

(h) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the provisions of the Registrant’s articles of incorporation, regulations of the board and committee charters or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Hamilton, Bermuda, on February 10, 2025.

Assured Guaranty Ltd.

By: /s/ Ling Chow

Name: Ling Chow

Title: General Counsel

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that the undersigned directors and officers of Assured Guaranty Ltd. (the “Company”) hereby constitute and appoint Ling Chow, Dominic J. Frederico and Benjamin G. Rosenblum, and each of them, the true and lawful attorneys-in-fact and agents of the undersigned, with full power of substitution and re-substitution, for and in the name, place and stead of the undersigned, in any and all capacities, to sign this Registration Statement to effect the registration under the Securities Act of 1933, as amended (the “Securities Act”), of common shares of the Company deliverable pursuant to the Assured Guaranty Ltd. 2024 Long-Term Incentive Plan and any and all amendments (including post-effective amendments) to such Registration Statement and any registration statement relating to the offering covered by such registration statement and filed pursuant to Rule 462(b) under the Securities Act, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, and hereby grants to such attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done, as fully to all intents and purposes as the undersigned might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of them, or their substitute, or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed below by the following persons in the capacities and on the dates indicated.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Position | | Date | |

| | | | | | |

| /s/ Francisco L. Borges | | Chair of the Board; Director | | February 10, 2025 | |

| Francisco L. Borges |

| | | | | | |

| /s/ Dominic J. Frederico | | President and Chief Executive Officer and Director

(Principal Executive Officer) | | February 10, 2025 | |

| Dominic J. Frederico |

| | | | | | |

| /s/ Benjamin G. Rosenblum | | Chief Financial Officer (Principal Financial Officer) | | February 10, 2025 | |

| Benjamin G. Rosenblum |

| | | | | | |

| /s/ Laura Bieling | | Chief Accounting Officer (Principal Accounting Officer) | | February 10, 2025 | |

| Laura Bieling |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| /s/ Mark C. Batten | | Director | | February 10, 2025 | |

| Mark C. Batten |

|

| | | | | | |

| /s/ Bonnie L. Howard | | Director | | February 10, 2025 | |

| Bonnie L. Howard |

| | | | | | |

| /s/ Thomas W. Jones | | Director | | February 10, 2025 | |

| Thomas W. Jones |

| | | | | | |

| /s/ Alan J. Kreczko | | Director | | February 10, 2025 | |

| Alan J. Kreczko |

| | | | | | |

| /s/ Yukiko Omura | | Director | | February 10, 2025 | |

| Yukiko Omura |

| | | | | | |

| /s/ Lorin P.T. Radtke | | Director | | February 10, 2025 | |

| Lorin P.T. Radtke |

| | | | | | |

| /s/ Courtney C. Shea | | Director | | February 10, 2025 | |

| Courtney C. Shea |

| | | | | | |

| /s/ Dominic J. Frederico | | Authorized Representative in the United States | | February 10, 2025 | |

| Dominic J. Frederico | |

0001273813ASSURED GUARANTY LTDS-8S-8EX-FILING FEESxbrli:sharesiso4217:USDxbrli:pure000127381312025-02-102025-02-1000012738132025-02-102025-02-10

CALCULATION OF FILING FEE TABLES

| | |

| Assured Guaranty Ltd. |

| (Exact Name of Registrant as Specified in its Charter) |

Table 1: Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | Security Class Title | Fee Calculation Rule | Amount Registered(1) | Proposed Maximum Offering Price Per Unit | Maximum Aggregate

Offering Price | Fee Rate | Amount of

Registration Fee |

| Equity | Common Shares, par value of $0.0001 per share | Rule 457(c) Rule 457(h) | 2,850,000 | $92.90(2) | $264,765,000(2) | 0.0001531 | $40,535.52 |

| Total Offering Amounts | | $264,765,000 | | $40,535.52 |

| Total Fee Offsets | | | | $0 |

| Net Fee Due | | | | $40,535.52 |

(1)Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement on Form S-8 (“Registration Statement”) also covers any additional number of common shares, no par value per share (“Common Shares”) of Assured Guaranty Ltd. that become issuable under the Assured Guaranty Ltd. 2024 Long Term Incentive Plan by reason of any stock splits, stock dividends or other distribution, recapitalization or similar transaction effected without receipt of consideration that increases the number of outstanding number of Common Shares.

(2)Estimated solely for the purpose of computing the registration fee pursuant to Rule 457(h) and 457(c) under the Securities Act on the basis of the average of the high and low prices of the Common Shares reported on the New York Stock Exchange on February 5, 2025.

| | |

CONYERS DILL & PEARMAN LIMITED Clarendon House, 2 Church Street Hamilton HM 11, Bermuda Mail: PO Box HM 666, Hamilton HM CX, Bermuda T +1 441 295 1422 conyers.com

|

10 February 2025

Matter No.: 328554

+1 441 278 7909

Jessica.Harris@conyers.com

Assured Guaranty Ltd.

30 Woodbourne Ave, 5th Floor

Hamilton HM 11

Bermuda

Dear Sir or Madam,

Re: Assured Guaranty Ltd. (the “Company”)

We have acted as special Bermuda legal counsel to the Company in connection with a registration statement on form S-8 to be filed with the Securities and Exchange Commission (the “Commission”) on10 February 2025 (the “Registration Statement”, which term does not include any other document or agreement whether or not specifically referred to therein or attached as an exhibit or schedule thereto) relating to the registration under the United States Securities Act of 1933, as amended, (the “Securities Act”) of 2,850,000 common shares, par value $0.01 per share (the “Common Shares”), issuable pursuant to the Company’s 2024 Long-Term Incentive Plan (the “Plan”, which term does not include any other document or agreement whether or not specifically referred to therein or attached as an exhibit or schedule thereto).

1.DOCUMENTS REVIEWED

For the purposes of giving this opinion, we have examined electronic copies of the following documents:

1.1.the Registration Statement; and

1.2.the Plan.

We have also reviewed:

1.3.copies of the memorandum of association and the bye-laws of the Company, each certified by the Assistant Secretary of the Company on 7 February 2025;

1.4.copies of extracts of the minutes of a meeting of its directors held on 21 February 2024 and the minutes of a meeting of its members held on 2 May 2024, each certified by the Secretary of the Company on 7 February 2025 (together, the “Resolutions”); and

1.5.such other documents and made such enquiries as to questions of law as we have deemed necessary in order to render the opinion set forth below.

2.ASSUMPTIONS

We have assumed:

2.1.the genuineness and authenticity of all signatures and the conformity to the originals of all copies (whether or not certified) of all documents examined by us and the authenticity and completeness of the originals from which such copies were taken;

2.2.that where a document has been examined by us in draft form, it will be or has been executed and/or filed in the form of that draft, and where a number of drafts of a document have been examined by us all changes thereto have been marked or otherwise drawn to our attention;

2.3.the accuracy and completeness of all factual representations made in the Registration Statement, the Plan and other documents reviewed by us;

2.4.that the Resolutions were passed at one or more duly convened, constituted and quorate meetings, or by unanimous written resolutions, remain in full force and effect and have not been rescinded or amended;

2.5.that there is no provision of the law of any jurisdiction, other than Bermuda, which would have any implication in relation to the opinions expressed herein;

2.6.the validity and binding effect under the applicable governing laws, to the extent not Bermuda, of the Plan in accordance with its terms;

2.7.that there is no provision of any award agreement which would have any implication in relation to the opinions expressed herein;

2.8.that, upon the issue of any Common Shares, the Company will receive consideration for the full issue price thereof which shall be equal to at least the par value thereof;

2.9.that on the date of issuance of any of the Common Shares the Company will have sufficient authorised but unissued common shares;

2.10.that on the date of issuance of any award under the Plan, the Company will be able to pay its liabilities as they become due;

2.11.that the Company’s shares will be listed on an appointed stock exchange, as defined in the Companies Act 1981, as amended, and the consent to the issue and free transfer of the Common Shares given by the Bermuda Monetary Authority dated 16 January 2004, 7 April 2004, and 20 April 2004 will not have been revoked or amended at the time of issuance of any Common Shares.

3.QUALIFICATIONS

3.1.We express no opinion with respect to the issuance of shares pursuant to any provision of the Plan that purports to obligate the Company to issue shares following the commencement of a winding up or liquidation.

3.2.We have made no investigation of and express no opinion in relation to the laws of any jurisdiction other than Bermuda.

3.3.This opinion is to be governed by and construed in accordance with the laws of Bermuda and is limited to and is given on the basis of the current law and practice in Bermuda.

3.4.This opinion is issued solely for the purposes of the filing of the Registration Statement and the issuance of the Common Shares by the Company pursuant to the Plan and is not to be relied upon in respect of any other matter.

4.OPINION

On the basis of and subject to the foregoing, we are of the opinion that:

4.1.The Company is duly incorporated and existing under the laws of Bermuda in good standing (meaning solely that it has not failed to make any filing with any Bermuda governmental authority under the Companies Act 1981, or to pay any Bermuda government fee or tax, which would make it liable to be struck off the Register of Companies and thereby cease to exist under the laws of Bermuda).

4.2.When issued and paid for in accordance with the terms of the Plan, the Common Shares will be validly issued, fully paid and non-assessable (which term means when used herein that no further sums are required to be paid by the holders thereof in connection with the issue of such shares).

We consent to the filing of this opinion as an exhibit to the Registration Statement. In giving such consent, we do not hereby admit that we are experts within the meaning of Section 11 of the Securities Act or that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the Rules and Regulations of the Commission promulgated thereunder.

Yours faithfully,

/s/ Conyers Dill & Pearman Limited

Conyers Dill & Pearman Limited

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of Assured Guaranty Ltd. of our report dated February 28, 2024 relating to the financial statements and the effectiveness of internal control over financial reporting, which appears in Assured Guaranty Ltd.'s Annual Report on Form 10-K for the year ended December 31, 2023.

/s/ PricewaterhouseCoopers LLP

New York, New York

February 10, 2025

v3.25.0.1

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.25.0.1

Offerings - Offering: 1

|

Feb. 10, 2025

USD ($)

shares

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Common Shares, par value of $0.0001 per share

|

| Amount Registered | shares |

2,850,000

|

| Proposed Maximum Offering Price per Unit |

92.90

|

| Maximum Aggregate Offering Price |

$ 264,765,000

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 40,535.52

|

| Offering Note |

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement on Form S-8 (“Registration Statement”) also covers any additional number of common shares, no par value per share (“Common Shares”) of Assured Guaranty Ltd. that become issuable under the Assured Guaranty Ltd. 2024 Long Term Incentive Plan by reason of any stock splits, stock dividends or other distribution, recapitalization or similar transaction effected without receipt of consideration that increases the number of outstanding number of Common Shares. (2)Estimated solely for the purpose of computing the registration fee pursuant to Rule 457(h) and 457(c) under the Securities Act on the basis of the average of the high and low prices of the Common Shares reported on the New York Stock Exchange on February 5, 2025.

|

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCheckbox indicating whether filer is using a rule other than 457(a), 457(o), or 457(f) to calculate the registration fee due. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesOthrRuleFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ffd_OfferingAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.25.0.1

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NetFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOfferingAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOffsetAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

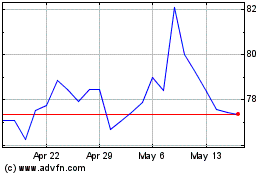

Assured Guaranty Municipal (NYSE:AGO)

Historical Stock Chart

From Jan 2025 to Feb 2025

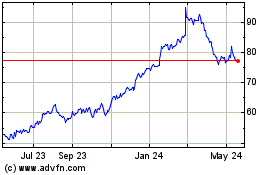

Assured Guaranty Municipal (NYSE:AGO)

Historical Stock Chart

From Feb 2024 to Feb 2025