Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

13 July 2024 - 6:24AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

Commission File Number: 001-31909

ASPEN INSURANCE HOLDINGS LIMITED

(Translation of registrant’s name into English)

141 Front Street

Hamilton HM 19

Bermuda

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ý Form 40-F ¨

Aspen Insurance Holdings Limited (“Aspen”) today announced that, with effect from June 10, 2024 and following receipt of regulatory approvals and completion of internal governance procedures, it has appointed Ernst & Young Ltd. (“EY Bermuda”) as Aspen’s independent registered public accounting firm beginning with the fiscal year ending December 31, 2024. Aspen’s incumbent independent registered public accounting firm, Ernst & Young LLP (“EY London”), has accordingly resigned from such position, with effect from June 21, 2024.

The appointment of EY Bermuda and resignation of EY London reflects certain strategic and operational considerations and is not the result of any accounting or other dispute or disagreement between Aspen, its management and EY London. The change in Aspen’s independent registered public accounting firm was proposed and approved by the Audit Committee and Board of Directors of Aspen in May 2024.

During the two fiscal years ended December 31, 2022, and December 31, 2023, and the subsequent interim period through June 21, 2024, there were: (1) no “disagreements” (as that term is defined in Item 16F(a)(1)(iv) of Form 20-F and the instructions to Item 16F) between Aspen and EY London on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements if not resolved to Ernst & Young LLP’s satisfaction would have caused EY London to make reference in connection with its opinion to the subject matter of the disagreement, and (2) no “reportable events” (as that term is defined in Item 16F(a)(1)(v) of Form 20-F), except for the material weaknesses in Aspen’s internal control over financial reporting (“ICFR”) as of December 31, 2022 and December 31, 2023 related to Aspen’s process level procedures and controls around reinsurance premiums payable and reinsurance receivables, which were disclosed in Aspen’s respective Annual Reports on Form 20-F for the years ended December 31, 2022 and 2023 filed with the SEC.

The Audit Committee and Board of Directors of Aspen discussed the subject matter of such material weakness and associated remediation plans with EY London, and Aspen has authorized EY London to respond fully to the inquiries of EY Bermuda concerning such matters.

The audit reports of EY London on the consolidated financial statements of Aspen Insurance Holdings Limited and subsidiaries as of and for the years ended December 31, 2022 and 2023 did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles.

There are no limitations placed on EY Bermuda or EY London concerning any inquiry of any matter related to Aspen’s financial reporting.

During Aspen’s two most recent fiscal years ended December 31, 2022 and 2023 and the subsequent interim period through June 21, 2024, neither Aspen nor anyone on Aspen’s behalf consulted with EY Bermuda regarding any of the matters or events set forth in Item 16F(a)(2)(i) and (ii) of Form 20-F.

Aspen has provided a copy of the disclosures set forth in this report to EY London and has requested that EY London furnish Aspen with a letter addressed to the Securities and Exchange Commission stating whether it agrees with such disclosures and, if not, stating the respects in which it does not agree, a copy of which letter is furnished herewith as Exhibit 99.1.

The information included in this Form 6-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

EXHIBIT INDEX

Exhibit

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | ASPEN INSURANCE HOLDINGS LIMITED |

| | | |

| Dated: July 12, 2024 | | | | By: | | /s/ Christopher Coleman |

| | | | Name: | | Christopher Coleman |

| | | | Title: | | Chief Financial Officer |

Securities and Exchange Commission 12 July 2024

100 F Street, N.E.

Washington, DC 20549

Ladies and Gentlemen:

We have read the Form 6-K dated 12 July 2024 for Aspen Insurance Holdings Limited and are in agreement with the statements contained therein in relation to the resignation of the independent registered public accounting firm.

We have no basis to agree or disagree with other statements of the registrant contained therein.

/s/ Ernst & Young LLP

London, United Kingdom

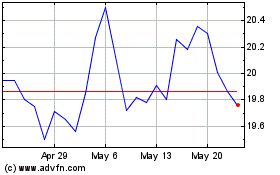

Aspen Insurance (NYSE:AHL-D)

Historical Stock Chart

From Oct 2024 to Nov 2024

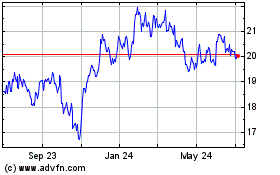

Aspen Insurance (NYSE:AHL-D)

Historical Stock Chart

From Nov 2023 to Nov 2024