Tenneco Announces Strategic Investment to Accelerate Growth

25 February 2025 - 8:30AM

Tenneco, Inc. (“Tenneco”) today announced a strategic investment

from Apollo Fund X into the company’s Clean Air and Powertrain

businesses – an important step in unlocking growth opportunities

and strengthening the company’s long-term position as a leading

global automotive supplier. American Industrial Partners, a leading

industrial-focused private equity firm with a strong track record

in manufacturing and automotive, will invest alongside Apollo Fund

X.

Tenneco will continue to operate as one company with no changes

to the management team and structure, operational cadence, or

strategic priorities. This access to capital will enhance Tenneco’s

ability to execute streamlined growth strategies and provide the

flexibility to invest in a pipeline of emerging opportunities. The

transaction will drive both organic and inorganic growth,

positioning the business for top-tier operational performance and

enhanced execution.

Since its acquisition by funds managed by affiliates of Apollo

(NYSE: APO) (the “Apollo Funds”) in November 2022, Tenneco has

undergone a significant transformation, putting in place a

world-class management team, optimizing operations, and investing

in advanced manufacturing capabilities. These efforts have resulted

in best-in-class business performance, including top-quartile

EBITDA margins, and have laid the groundwork for the next phase of

growth supported by this investment.

“Over the past two years, we have built an incredible company

with a culture rooted in safety, financial performance, and

operational excellence,” said Jim Voss, CEO of Tenneco. “With

Apollo’s continued support and belief in Tenneco’s long-term

potential, this investment enables us to execute more strategically

as we deliver on our purpose of being the best partner and world’s

best manufacturer and distributor in the transportation

industry.”“This investment marks a critical step in Tenneco’s

transformation,” said Michael Reiss and Shahid Bosan, Deal Team

Leads at Apollo. “Since acquiring Tenneco, we have seen tremendous

progress, with the team delivering exceptional operational and

financial results. This move reflects the strong partnership

between Apollo and Tenneco’s leadership and reinforces our shared

commitment to long-term success in a sector we believe in.”

This transaction is expected to be completed in the second

quarter of 2025.

AdvisorsCitigroup Inc. and Deutsche Bank

Securities Inc. are serving as financial advisors to Tenneco.

Barclays Capital Inc, Lazard and PJT Partners LP are serving as

financial advisors to Apollo Funds.

About TennecoTenneco is one of the world's

leading designers, manufacturers, and marketers of automotive

products for original equipment and aftermarket customers. Through

our DRiV, Performance Solutions, Clean Air and Powertrain groups,

Tenneco is driving advancements in global mobility by delivering

technology solutions for light vehicle, commercial truck,

off-highway, industrial, motorsport and the aftermarket. Visit

www.tenneco.com to learn more.

About ApolloApollo is a high-growth, global

alternative asset manager. In our asset management business, we

seek to provide our clients excess return at every point along the

risk-reward spectrum from investment grade credit to private

equity. For more than three decades, our investing expertise across

our fully integrated platform has served the financial return needs

of our clients and provided businesses with innovative capital

solutions for growth. Through Athene, our retirement services

business, we specialize in helping clients achieve financial

security by providing a suite of retirement savings products and

acting as a solutions provider to institutions. Our patient,

creative, and knowledgeable approach to investing aligns our

clients, businesses we invest in, our employees, and the

communities we impact, to expand opportunity and achieve positive

outcomes. As of December 31, 2024, Apollo had approximately $751

billion of assets under management. To learn more, please visit

www.apollo.com.

About American Industrial PartnersAmerican

Industrial Partners (“AIP”) is an industrials investor, with

approximately $17 billion in assets under management. AIP

is distinctively focused on industrial businesses across end

markets that include: aerospace and defense, automotive, building

products, capital goods, chemicals, industrial services, industrial

technology, logistics, metals & mining, and transportation,

among others. AIP looks to generate differentiated returns by

investing in quality industrial businesses with strong management

teams and working with those teams to implement comprehensive

Operating Agendas to build long-term value. Current AIP portfolio

companies generate aggregate annual revenues of

approximately $26 billion and employ approximately 74,000

employees as of September 30,

2024. www.americanindustrial.com

Tenneco Contacts:Alexandra

IordacheVice President, Global Communicationsmedia@tenneco.com

Apollo Contacts:Noah GunnGlobal

Head of Investor RelationsApollo Global Management, Inc.(212)

822-0540IR@apollo.com

Joanna RoseGlobal Head of Corporate CommunicationsApollo Global

Management, Inc.(212) 822-0491Communications@apollo.com

American Industrial Partners

Contacts:American Industrial

Partnerspro-AIP@prosek.com

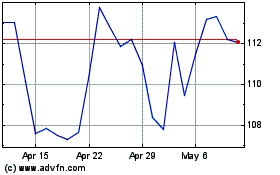

Apollo Global Management (NYSE:APO)

Historical Stock Chart

From Jan 2025 to Feb 2025

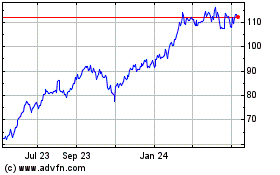

Apollo Global Management (NYSE:APO)

Historical Stock Chart

From Feb 2024 to Feb 2025