FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of February, 2025

Commission File Number 001-15266

BANK OF CHILE

(Translation of registrant’s name into English)

Ahumada 251

Santiago, Chile

(Address of principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check mark

whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐

No ☒

If “Yes” is marked, indicate below the

file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ________

BANCO DE CHILE

REPORT ON FORM 6-K

Attached is a Press Release issued by Banco de Chile (“the Bank”)

on February 12, 2025, regarding its financial results for the Fourth Quarter 2024 and as of December 31, 2024.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: February 12, 2025

| |

Banco de Chile |

| |

|

| |

By: |

/s/ Eduardo Ebensperger O. |

| |

|

Eduardo Ebensperger O. |

| |

CEO |

Exhibit

99.1

| 1 Financial Management Review 4Q24 | February 2025 131 years contributing to the development of the country and its people. Quarterly YTD Report

Table of Contents 6 About Banco de Chile I. Our History Financial Snapshot on Banco de Chile 8 Corporate Governance II. Equity Composition and Ownership Structure Board of Directors, Committees and Managerial Structure 11 Business Strategy III. Corporate Statements and Commitments Stakeholders Engagement Competitive Landscape, Business Trends and Regulation Strategy of Banco de Chile At a Glance Business Segments Description Snapshot on Strategic Advances 23 Economic and Business Environment IV. Economic Outlook Banking Industry Performance and Projections Competitive Position 28 Management Discussion & Analysis V. Income Statement Analysis Business Segments Performance Balance Sheet Analysis 52 Risk & Capital Management VI. Risk Management Approach Funding Concentration and Liquidity Market Risk Operational Risk Capital Adequacy and Credit Ratings | 2

About this Report Basis for Presentation This financial report, which accompanies our quarterly financial statements, has been prepared as requested by the Chilean Financial Market Commission (CMF) in the Compendium of Accounting Standards for Banks while being elaborated in accordance with the IFRS Practice Statement 1 – Management Commentary as issued by the International Accounting Standards Board (IASB) . Figures included in this report “ Financial Management Review ” , for purposes of analysis, are based on both the financial statements and management information systems of Banco de Chile . Forward - Looking Information The information contained herein incorporates by reference statements which constitute “ forward - looking statements ” that include statements regarding the intent, belief or current expectations of our directors and officers with respect to our future operating performance . Such statements include any forecasts, projections and descriptions of anticipated cost savings or oth er synergies . You should be aware that any such forward - looking statements are not guarantees of future performance and may involve risks and uncertainties, and that actual results may differ from those set forth in the forward - looking statements as a result of various factors (including, without limitations, the actions of competitors, future global economic conditions, market conditions, foreign exchange rates, and operating and financial risks related to managing growth and integrating acquired businesses), many of which are beyond our control . The occurrence of any such factors not currently expected by us would significantly alter the results set forth in these statements . Factors that could cause actual results to differ materially and adversely include, but are not limited to : ⭬ changes in general economic, business or political or other conditions in Chile or changes in general economic or business conditions in Latin America; ⭬ changes in capital markets in general that may affect policies or attitudes toward lending to Chile or Chilean companies; ⭬ unexpected developments in certain existing litigation; ⭬ increased costs; ⭬ unanticipated increases in financing and other costs or the inability to obtain additional debt or equity financing on attractive terms; ⭬ natural disasters or pandemics; ⭬ the effect of tax laws or other kind of regulation on our business; ⭬ other risk factors as reported in our form 20F filed with the U.S. SEC. Undue reliance should not be placed on such statements, which speak only as of the date that they were made . Our independent public accountants have not examined or compiled the forward - looking statements and, accordingly, do not provide any assurance with respect to such statements . These cautionary statements should be considered in connection with any written or oral forward - looking statements that we may issue in the future . We do not undertake any obligation to release publicly any revisions to such forward - looking statements to reflect later events or circumstances or to reflect the occurrence of unanticipated events . | 3 Contacts Daniel Galarce Head of Financial Control & Capital Management Financial Control & Capital Area | Banco de Chile dgalarce@bancochile.cl Pablo Mejia Head of Investor Relations Investor Relations | Banco de Chile pmejiar@bancochile.cl

EY Chile Avda. Presidente Riesco 5435, piso 4, Las Condes, Santiago | 4 Tel: +56 (2) 2676 1000 www.eychile.cl Independent Auditor’s Report (Free translation of the report originally issued in spanish) To the Shareholders and the Board of Directors Banco de Chile We have reviewed the accompanying presentation of the “Management Commentary” financial report of Banco de Chile and its subsidiaries for the year 2024 , taken as a whole . In connection to this review, we have audited, in accordance with generally accepted auditing standards in Chile, the consolidated financial statements of Banco de Chile and its subsidiaries as of al December 31 , 2024 , and for the year then ended and the related notes to the consolidated financial statements . In our report dated February 11 , 2025 , we issued an unqualified opinion on such consolidated financial statements . Management’s Responsibility The Bank’s Management is responsible for the preparation and fair presentation of this “Management Commentary” of Banco de Chile and its subsidiaries in accordance with standards and instructions issued by the Financial Market Commission (CMF), established in Chapter C - 1 of the Compendium of Accounting Standards for Banks . Auditor’s Responsibility Our review was conducted in accordance with attestation standards issued by the Institute of Chilean Accountants . A review, consists, mainly, in the application of analytical procedures and making inquiries to those responsible for financial and accounting matters . A review consists mainly of applying analytical procedures and making inquiries, primarily of persons responsible for financial and accounting matters . A review is substantially less in scope than an exam which objective would be to present an opinion over the “Management Commentary” . Therefore, we do not express such opinion . The “Management Commentary” contains non - financial information such as operational, commercial information, sustainability indicators, macroeconomics projections and managerial information and others . Although this information may provide other additional elements for the analysis of the financial situation and results of the operations of Banco de Chile and its subsidiaries, our review does not extend to such type of information .

EY Chile Avda. Presidente Riesco 5435, piso 4, Las Condes, Santiago | 5 Tel: +56 (2) 2676 1000 www.eychile.cl The preparation and presentation of the “Management Commentary” of Banco de Chile and its subsidiaries as of December 31 , 2024 , requires management to interpret certain criteria, make determinations regarding the relevance of the information to be included and make estimates and assumptions that affects the information presented . The “Management Commentary” of Banco de Chile and its subsidiaries as of December 31 , 2024 , includes current and prospective information that estimates the future impact of transactions and events that have occurred or are expected to occur, estimates future expected sources of liquidity and financial resources, and also estimates operational and macroeconomic trends and commitments and uncertainties . The results obtained in the future may differ significantly from the current evaluation of this information presented by the management of Banco de Chile and its subsidiaries due the facts and circumstances frequently do not occur as expected . Our review has considered such information only to the extent that it has been used in the preparation and presentation of the financial information contained in the “Management Commentary” and not to express a conclusion on such information itself . Conclusion Based in our review, we are not aware of any significant changes that should be made to the presentation of the “Management Commentary” of Banco de Chile and its subsidiaries so that such presentation : i) Is in accordance with the elements required by the standards and instructions from the Financial Market Commission (CMF) ; ii) the historical financial amounts included in the presentation have been correctly extracted from the consolidated financial statements of Banco de Chile and its subsidiaries and iii) the information, determinations, estimates and underlying assumptions of Banco de Chile and its subsidiaries are consistent with the bases used for the preparation of the financial information contained in such presentation . Rodrigo Vera EY Audit Ltda. Santiago, February 11, 2025

About Banco de Chile Our History Banco de Chile dates back to 1893 when the financial institution was formed following the merger of the Valparaíso, Agrícola and Nacional de Chile banks . We have played an important role in the economic history of Chile . Since the beginning, we have been a fundamental pillar for the development of the country and a financial and business reference, maintaining a leading position in the Chilean banking industry . Before the creation of the Central Bank in 1926 and prior to the enactment of the General Banking Act, we were the main stabilization agent of the Chilean banking system . Throughout our history we have developed a well - recognized brand name in Chile and expanded our operations in foreign markets, where we developed an extensive network of correspondent banks . In 1987 and 1988 , we established four subsidiaries to provide a full range of specialized financial products and services as permitted by the General Banking Act . In 1999 , we widened our sco pe of specialized financial services by creating our insurance brokerage and factoring subsidiaries . During the early 2000 s, the Chilean banking industry witnessed intense merger and acquisition activity . In 2002 , we merged wi th Banco de A . Edwards, which allowed us to expand our business to new customer segments . In 2008 , we merged our operations with Citibank Chile . As a result of these consolidations, we currently operate using the brand names “Banco de Chile” (which operates throughout Chile) and “Banco Edwards - Citi” (which is primarily oriented to higher income segments) . Likewise, most of our subsidiaries operate under the brand name “Banchile” . Our legal name is Banco de Chile and we are organized as a banking corporation under the laws of Chile and were licensed by t he CMF to operate as a commercial bank on September 17 , 1996 . Our main executive offices are located at Paseo Ahumada 251 , Santiago, Chile, our telephone number is + 56 ( 2 ) 2637 - 1111 and our website is www . bancochile . cl . We are a full - service financial institution that provides, directly and indirectly through our subsidiaries, a wide variety of lending and non - lending products and services to all segments of the Chilean financial market, providing our customers with power ful, differentiated and comprehensive value offerings . In addition to our traditional banking operations, our subsidiaries and aff iliates permit us to offer a variety of non - banking but specialized financial services including securities brokerage, mutual funds management, investment banking, insurance brokerage, collection services and acquiring and processing services for credit/debit cards . We are present in all Chilean regions through our nationwide branch network and we have one of the best digital and mobile ba nking platforms in Chile, which allow us to meet the needs of more than 2 million customers in timely and safe manner . From the international perspective, our alliance with Citigroup provides our customers with access to a wide network of products and services abroad . We have outstanding competitive strengths, such as excellent brand recognition, a comprehensive remote and non - remote distribution network, a distinctive and large customer base, a competitive funding structure, a solid equity base and a high credit quality loan portfolio . This is reflected in outstanding credit risk ratings by international agencies, which position us as one of the most solid private banks in Latin America . | 6

About Banco de Chile Financial Snapshot Net Income Annual Var. 1,207,392 Dec - 24 Annual Var. 298,066 4Q24 (2.9)% 1,243,635 Dec - 23 (22.7)% 385,544 4Q23 Operating Revenues Annual Var. 3,050,285 Dec - 24 Annual Var. 778,152 4Q24 +1.9% 2,994,872 Dec - 23 (9.8)% 863,061 4Q23 Expected Credit Losses Annual Var. 391,754 Dec - 24 Annual Var. 103,296 4Q24 +8.4% 361,251 Dec - 23 (19.2)% 127,900 4Q23 Operating Expenses Annual Var. 1,132,734 Dec - 24 Annual Var. 303,146 4Q24 +1.5% 1,116,099 Dec - 23 (4.9)% 318,900 4Q23 | 7

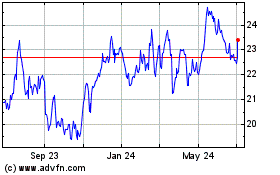

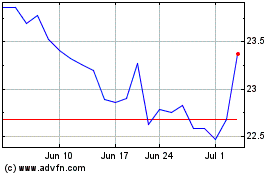

Corporate Governance Equity Composition and Ownership Structure Equity and Shares Our equity is composed of 101 , 017 , 081 , 114 fully paid - in shares of common stock, without nominal (par) value . These shares are traded on the Santiago and Electronic Stock Exchanges in Chile under the ticker symbol “CHILE” . Also, since January 2 , 2002 Banco de Chile’s shares are traded on the New York Stock Exchange under the American Depositary Receipts (ADR) program in the form of American Depositary Shares (ADS) under the ticker symbol “BCH” . Each of our ADS represents 200 shares of common stock without par value . JPMorgan Chase Bank is the depositary of our ADS . Ownership Structure Our main shareholder is the LQIF group, which directly and indirectly owns 51 . 15 % of our shares . LQIF is a joint a venture that is equally owned by Quiñenco S . A . ( 50 % ) and Citigroup Inc . ( 50 % each other) . A strategic partnership agreement between Quiñenco and Citigroup gives control to Quiñenco over LQIF and the companies directly and indirectly controlled by LQIF . As of December 31, 2024 | 8

Corporate Governance Board of Directors, Committees and Managerial Structure Board of Directors Our Board of Directors (Board) is the main corporate governance body and its most important duties include establishing strategic guidelines ; approving policies, procedures and mechanisms designed to meet the objectives of the corporate governance system ; and appointing a Chief Executive Officer . The Board is composed of eleven directors and two alternate directors, in accordance with our bylaws . The board is voted every three years . In March 2023 , the most recent election date, our shareholders elected new directors, of which eleven were proposed by LQIF (nine directors and two alternate directors) and other two members were proposed by shareholders other than LQIF, including an independent director . Currently, our Board is composed of three women and ten men . Our Board meets twice a month, except in February, when it meets once . Extraordinary sessions may be convened by the Chairman or by request of one or more regular directors . Board Committees Our Board delegates certain functions and activities to our committees to control, evaluate and report to the board of directors regarding specific matters which may affect our businesses. | 9

Corporate Governance Managerial Structure We organize our operations through a comprehensive organizational structure that is composed of business, control and support divisions . Furthermore, our subsidiaries also have independent management principles and structures that allow them to satisfy the challenges faced in the industries in which they participate . | 10

Business Strategy Corporate Statements and Commitments Mission Purpose We are a leading, globally - connected financial corporation with a prestigious business tradition. We provide financial services of excellence to each customer segment, offering creative, agile and effective solutions and thus ensuring value creation for our shareholders, our employees and the community at large. To contribute to the development of the country, people and companies. Corporate Values Vision In everything we do, we constantly strive to be the best bank for our customers, the best place to work, and the best investment for our shareholders. We do so in a way that demonstrates our commitment to the people in our organization and the community in general. | 11

Business Strategy Commitments Our Customers We pursue to be the bank with the best service quality, offering innovative, simple and secure products and services designed to meet the needs and aspirations of each segment, with timely, agile and proactive service in order to build trusted and long - term relationships . To achieve this we strive to continuously develop always - available service channels that allow fluid and timely communication, while counting on employees devoted to customer service that also have digital knowledge . Our Staff We are certain that our team is a distinctive asset and a solid competitive advantage in the industry . This is based on their commitment, dedication and excellence . For this reason, we offer development and growth opportunities based on merit, providing competitive compensation and economic and welfare benefits . At the same time, we seek to promote a respectful, friendly and collaborative work environment in a place that has suitable technological tools and infrastructure . We build a homogeneous and distinctive culture, based on corporate commitments and values through the involvement in social activities, in order to become a Corporation distinguished as the best place to work and the best team in Chilean banking industry . Our Shareholders We honor our shareholders' confidence by maximizing the company's value, with responsibility, prudence and a long - term business vision . We deploy our business strategy based on appropriate risk management and a culture of operational excellence that allows us to project the sustainable leadership of the corporation . Our Community We are convinced that our success is linked to the sustainable development of our country and the community . That is why in our daily actions we reflect our commitment to community by supporting diverse initiatives to overcome adversity, through the development of internal policies and being present in emblematic solidarity crusades . We are committed to respecting diversity and inclusion, entrepreneurship, environmental care and equality and governance dimensions . | 12

Business Strategy Stakeholder Engagement Banco de Chile keeps several communication channels open with our stakeholders in order to gather information to answer questions and manage concerns regarding different issues. We also actively participate in social media and count on specific channels dedicated to managing inquiries and requirements. Frequency Mechanisms and/or Channels of Communication Engagement Objectives Stakeholders Ongoing Monthly Ongoing www.bancochile.c l Branches and ATMs Telephone banking service 600 637 37 37 Mobile applications Newsletter: Sustainability mass email https://cl.linkedin.com/company/banco - de - chile Twitter and Instagram:@bancodechile | @bancoedwards |@ayudaBancoChile Facebook: bancodechile | bancoedwards Offer excellent service characterized by integrity, personalization, agility and proactivity in order to build long - term, trust - based relationships . Use permanently available service channels to keep customers informed in a timely and appropriate manner . Provide differentiated financial solutions featuring quality, innovative products and services for each customer segment . They are the reason for our existence and the center of all our decisions. Customers Annual Quarterly Monthly Ongoing Shareholders’ meeting Annual Report & Form 20 - F Financial reporting Investor Relations: ir@bancochile.c l Webcasts Website Be the best investment option, maintaining a leading position by value of shares traded . Promote operational efficiency and productivity in order to encourage prudent risk management based on integrity and transparency . They share our purpose, trust in our project, and contribute financial resources for our operation. Shareholders Ongoing Intranet / Emails / SOY_DELCHILE Teams Group Competency Assessment Counseling Program (Programa Orienta) My Health Program (Programa Mi Salud) “Más Conectados” Platform Quality of Life Program / Active Chile Program Point Bank / Team meetings Contact: comitedeetica@bancochile.c l apoyolaboral@bancochile.c l centroatencionpersonas@bancochile.c l Offer merit - based development opportunities with competitive compensation and economic benefits . Promote a respectful, polite work environment in a location equipped with the appropriate technology and infrastructure . They represent a distinctive asset for us, whose commitment, dedication, and excellence allow us to honor our purpose every day. Employees Ongoing Contact: sostenibilidad@bancochile.c l www.bancochile.c l prensa@bancochile.c l www.bancochile.cl/saladeprensa https://cl.linkedin.com/company/banco - de - chile Twitter and Instagram:@bancodechile | @bancoedwards @ayudaBancoChile Facebook: bancodechile | bancoedwards Tik Tok: @fanaticosdelchile Promote financial education . Strengthen and enhance inclusion and respect for diversity for a more equitable society with greater opportunities . Manage the business in an environmentally respectful manner . Address press requirements . Support SMEs and entrepreneurs in developing their businesses . We are convinced that our success is linked to the sustainable development of the country and the community. Community Ongoing • proveedores2@bancochile.c l • denunciasley20393@bancochile.c l • ARIBA platform. Build long - term collaborative supplier relationships based on transparency, competition, efficiency, respect and objectivity . Streamline and increase the effectiveness of processes for supplying goods and services . Ensure that services are hired, and goods are acquired under market conditions . They enable us to carry out our operations and are part of our value chain. Suppliers | 13

Business Strategy Competitive Landscape, Business Trends and Regulation Chilean Financial Industry The financial system in Chile consists of various industries, including Banking, Pension Funds, Insurance and Mutual Funds, with the Banking sector being the most relevant, with total loans representing more than 80 % of the Chilean GDP . The Chilean banking industry, in turn, consists of 17 banks, 16 of which are private sector banks and one is an state - owned bank, namely, Banco Estado . Within the banking industry, we face significant and increasing competition in all market segments in which we operate . As a comprehensive commercial bank that offers a wide range of services to enterprises and individual customers, we deal with a variety of competitors, ranging from large private sector commercial banks to more specialized entities, such as “niche” banks . In addition, we face competition from other types of players, such as non - bank leasing, crowdfunding, factoring and automotive finance companies, fund managers and insurance companies within the savings product market, as well as insurance companies in the mortgage credit market . The Chilean banking industry has experienced increased levels of competition in recent years from domestic as well as foreign banks . It is worth mentioning that the progressive increase in competition has occurred in combination with the consolidation of the industry through diverse mergers and acquisitions, which have resulted in more comprehensive banking players that participate in all market segments . In this context, in recent years other non - traditional providers of financial services have emerged, such as e - commerce, local and foreign fintech companies, Telecom companies, like internet and mobile phone providers, and more recently some marketplaces that offer financing, directly to their customers or providers, which has resulted in the disintermediation of traditional banking service providers that have become increasingly challenged . In the retail market, we compete with other private sector Chilean banks, as well as with Banco del Estado . Among private sector banks, we believe our strongest competitors in this market are Banco Santander — Chile, Scotiabank Chile and BCI, which have developed diversified business strategies focused on both small and medium sized companies and middle - income segments of the Chilean population . In the wholesale market, our strongest competitors are Banco Santander - Chile, BCI, Itaú and Scotiabank Chile . Likewise, our most relevant competitors in the high - income segment are Banco Santander Chile and Banco Bice, which use specialized business models that provide wealth management services and traditional banking services, just like us . Additionally, our subsidiaries compete with companies that offer non - banking specialized financial services in the higher - income individuals segment and the middle market and corporate segment such as Larrain Vial, BTG Pactual, Moneda Patria Investments and Credicorp Capital, whose core businesses are stock brokerage, financial advisory and wealth management services . Other Chilean commercial entities also compete in these markets of specialized financial services, but they are less focused on such businesses . Key Trends in the Banking Business Banco de Chile’s strategy is continuously adapting to the evolution of the business environment . Below are the main elements and trends that currently characterize the business backdrop : Global Environment: Normalization of both inflation and interest rates. Climate change. Armed conflicts and geopolitical reordering. Lower profitability in the banking business. Local Environment: Economic slowdown and subdued private investment. Increased criminality. Political, legal, and institutional uncertainty. Political fragmentation. | 14

Business Strategy Health, pension, and tax reforms in pipeline. Strengthening of consumer rights (data security). | 15 Banking Industry: New technological capabilities (AI, Cloud, Cyber). Regulatory pressure and increasing capital requirements. Widened competitive perimeter (Open Banking, Fintechs). Sustainability and climate change. Business model modernization, talent management, and IT strategies to adapt to the new environment . More demanding customers. Optimization of the physical service network and consolidation of digital channels as the main way for interaction with customers . Cost base optimization to mitigate increased competition and regulatory requirements . Regulatory Environment The CMF: The CMF is responsible for regulating, supervising and sanctioning the operations, stability and development of the Chilean financial market (made up of listed companies, banks and financial institutions, insurance companies, insurance brokers, mutual funds and investment funds), promoting the participation of market agents and ensuring public confidence . To achieve this objective, the CMF must have a global and systemic vision, which allows the interests of investors and insured agents to be safeguarded . Regarding the specific powers of the CMF related to banking regulation, this entity authorizes the creation of new banks and has broad powers to interpret and enforce legal and regulatory requirements applicable to banks and financial institutions . Furthermore, in cases of noncompliance with its legal and regulatory requirements, the CMF has the ability to impose sanctions . In extreme cases, it can appoint, with the prior approval of the board of directors of the Central Bank, a provisional administrator to manage banks . It also has the mandate to approve any amendment to banks’ bylaws . A bank’s financial statements as of December 31 of each year must be audited and submitted to the CMF together with the opinion of its independent auditors . Also, banks are required by the CMF to include in mid - year financial statements (as of June 30 of every fiscal year) an auditor’s limited review statement in accordance with Chilean GAAP . In addition, banks are required to provide extensive information regarding their operations at various periodic intervals to the CMF by means of specialized reports associated with business - related risk, capital, products, debtors, transactions, distribution channels, among others . The Central Bank : The Central Bank is an autonomous legal entity created under the framework of the Chilean Constitution . It is subject to its Ley Orgánica Constitucional (the “Organic Constitutional Law”) and the current Chilean Constitution . The Central Bank is directed and administered by a board of directors composed of five members appointed by the President of Chile, subject to Senate approval . The legal purpose of the Central Bank is to maintain the stability of the Chilean peso, that is, to keep inflation low and stable over time . It must also promote the stability and efficiency of the financial system, ensuring the normal functioning of internal and external payments . The agency regulates the amount of money and credit in circulation, executes international exchange operations and issues monetary, credit, financial and international exchange regulations . The SEC : Since Banco de Chile has been listed on the New York Stock Exchange since January 1 st , 2002 , we are subject to regulation and supervision of the Securities and Exchange Commission . We are required to file with SEC the form 20 F, including audited financial statements, as of December of each year in accordance with IFRS as issued by the International Accounting Standards Board .

Business Strategy Strategy of Banco de Chile At a Glance Competitive Strengths and Resources Financial Sustained leadership in profitability Robust capital base and demand deposits Strong credit and ESG risk ratings Human and Cultural Talent attraction and development capacity A collaborative work culture Risk management leadership Organizational Brand value Strong corporate governance Leader in digital banking Global presence through the strategic alliance with Citigroup Social Outstanding corporate reputation Broad customer base Strong supplier relationship Continued relationship with investors Recognized promoter of inclusion and entrepreneurship Strategic Pillars Sustainability and Commitment to Chile “An esteemed bank with a solid reputation” “A bank that supports entrepreneurship” Efficiency and Productivity “Quick, timely, secure and digital” Customer at the Center of our Decisions “Best Bank for our Customers” Mid - term Objectives Corporate Reputation (2) Top 3 Return on Average Capital and Reserves (1) Top 1 Efficiency Ratio ≤ 42% Business (1) Commercial Loans Consumer Loans Demand Deposits Top 1 Net Promoter Score ≥ 73% (1) Among relevant peers. Demand deposits denominated in local currency. Excluding operations of subsidiaries abroad for market share. (2) Based on Merco Ranking. | 16

Business Strategy Business Segments Description In line with our strategic pillar “Customer at the Center of our Decisions”, we pursue to offer the best value proposition in the banking industry by delivering excellent service quality, along with timely and effective solutions. Given the wide diversity of clients, ranging from individuals to private banking customers and from micro - entrepreneurs to corporations, we organize our operations and value propositions into four business segments: | 17

Business Strategy Retail Banking Segment This business unit provides universal financial solutions to students, employed workers, self – employed workers, retired people, individuals with medium to high incomes, as well as to and micro, small and medium - sized companies with annual sales of up to UF 70 , 000 . The value propositions are characterized by their differentiation, recognizing customers preferences in their way of interacting with the bank, whether on - site or remotely, according to their needs for the simplest to the most sophisticated products and services . The financial products and services offered by this segment include current accounts, debit cards, credit cards, lines of credit, mortgage loans, consumer loans, commercial loans, general purpose mortgage loans, finance leases, factoring services, mutual fund management and stock brokerage, foreign trade, payments and collections, insurance brokerage including life and general insurance, time deposits, savings instruments and foreign currency services, through a network of branches operating under the brand names “Banco de Chile” and “Banco Edwards Citi” . Wholesale Banking Segment The Wholesale Banking unit provides products and services to companies with annual sales that exceed UF 70 , 000 , which include a large proportion of Chilean listed and unlisted companies, subsidiaries of multinational companies and conglomerates operating in Chile, in the financial, commercial, manufacturing, industrial, infrastructure, real estate and construction sectors, as well as projects, concessions, family offices and large companies . This unit provides a wide range of products that include short and long - term commercial loans, working capital loans, lines of credit, corporate credit cards, foreign trade and foreign currency brokerage, factoring services, leases and long - term syndicated loans . Investment banking services are provided by the subsidiary Banchile Asesoría Financiera S . A . , such as transaction structuring services for mergers and acquisitions and assistance with debt restructuring . It provides cash management services, which include paying payroll, suppliers, pensions and dividends, collection services, connections to international funds transfer networks, checking accounts and deposits, fund management, treasury and investment management, derivative contracts, insurance brokerage, and other tailored services . | 18

Business Strategy Treasury Segment Our Treasury segment manages a wide range of financial services available to our customers, including currency intermediation, forward contracts, interest rate swaps, transactions under repurchase agreements and investment products based on bonds and deposits . Our Treasury manages currency, interest rate and term mismatches, ensures that our liquidity is sufficient, manages the investment portfolio and brokers fixed - income, foreign exchange and derivative instruments . It also manages mismatches with the aim of securing a suitable financing structure and diversifying its sources of finance . The Treasury segment is also responsible for : (i) the issuance of short - and long - term senior bonds, as well as long - term subordinated bonds, in Chile or abroad, (ii) monitoring compliance with regulatory deposit limits, technical reserves and maturity and rate matches/mismatches, (iii) monitoring our adherence to the security margins defined by regulatory limits, and risk limits for interest rate, currency and investment gaps . This segment continually monitors the Bank’s cost of funding by benchmarking with the rest of the local financial system and financing alternatives in Chile or abroad . Subsidiaries We have made several strategic long - term investments in financial services companies that are engaged in activities that complement our commercial banking activities . In making these investments our goal has been to develop a comprehensive financial group capable of meeting the diverse financial needs of our current and potential customers by offering traditional banking products and specialized financial services through our different subsidiaries . Our subsidiaries operate under Banchile brand name, with exception of Socofin and B - Pago . Through them we offer the following financial services to Banco de Chile’s customers and non - customers : Securities Brokerage and FX trading Mutual Funds and Investment Funds Management Insurance Brokerage Financial Advisory and Investment Banking Collection Services Acquiring and Processing Services for credit/debit cards On July 5 , 2024 , we received approval from the CMF for the establishment of an Acquiring and Processing Services Subsidiary (B - Pago) in the context of the four - party model in the credit cards business . | 19

Business Strategy Snapshot on Strategic Advances Strategic Pillar Key Performance Indicator As of December Mid - Term Target 2024 Compliance x 76.7% Net Promoter Score Customer at the Center of our Decisions — Top 2 Commercial Loans Market Share (1) in Business 3 — Top 2 Consumer Loans x Top 1 Demand Deposits x 37.1% Cost - to - Income Ratio Efficiency and Productivity x Top 1 Return on Average Capital and Reserves (1) Sustainability and Commitment to Chile x Top 2 Corporate Reputation (2) (1) Among relevant peers. Demand deposits denominated in local currency. Excluding operations of subsidiaries abroad for market share. (2) Based on Merco Ranking 2024. | 20

Business Strategy Main Strategic Achievements and Highlights of the Period Expansion of our ATM network through a new strategic partnership. Launch of new “FAN Ahorro” account with 100% digital onboarding and a new current account plans. Improvement of Loyalty Programs through new VIP lounges at Santiago International Airport. Improved market positioning through customization, simplification, value offering self - management, distinctive customer experience, and strengthened digital origination in lending and non - lending products , all of which allowed us to gain market share in local - currency DDA and consumer loans while keeping a market - leading position in insurance brokerage and mutual funds. We obtained the PROCALIDAD Award (National Customer Satisfaction) for second year in a row, in the Large Financial Institutions category and "Best of the best" in the contractual category. Significant advances in productivity based on robotic process automation , development of AI use cases and transaction digitization. Successful implementation and cultural change management of efficiency initiatives including the optimization of the in - person service network, organizational restructuring, task centralization, and contract renegotiation . These achievements have combined with improvements in already outstanding NPS and Organizational Climate levels. Significant advances in service model transformation , through the expansion of functionalities in both remote and self - service channels, together with suitable change management for early digital adoption by customers and reduction of in - person service times. Progress in the new ERP platform for automation and centralization of purchasing and payment tasks for both the Bank and subsidiaries, along with new processes to optimize the infrastructure capital expenditures. Strengthening of the technological architecture and high service standards by upgrading our data center networks and deploying a multi - cloud strategy . For the 11 th year in a row, we were distinguished as the Best Bank and 3 rd local company in Attracting and Retaining Talent by Merco Talento. Diverse initiatives of inclusion and entrepreneurship , such as the call for the 9th Entrepreneurial Challenge Contest, 4 th version of Inspiring Women Program and our market - leading position in the Fogape Chile Apoya program. Progress in the IT transformation and modernization of Banchile Administradora General de Fondos and Banchile Corredora de Bolsa. | 21

Business Strategy | 22 Stakeholders Commitment Advances (1) All

staff metrics consider the Banco de Chile’s workforce on an individual basis (excluding subsidiaries). (2) Consider customers with

financial activity in one of their products in the last six months. (3) Share of women in all management positions, including junior,

middle and top management positions. (4) Consider FAN demand accounts (Cuenta FAN, FAN Clan and FAN Emprende). Our Staff(1) Our Customers

Workforce Breakdown Total Active Customers (million)(2) Female in Management Positions(3) FAN Accounts(4) 1.7 million +22.0% vs dec2023

Carrer Development in 2024 Current Accounts 1.5 million +7.7% vs dec2023 Inclusion & Non- Discrimination 1.4% Total employees with

disabilities over total staff. Credit and Debit Cards (million) Female 51% Male 49% 2.6 2.7 2023 2024 33% 33% 2023 2024 461 490 Promotions

Lateral Transfers 1.7 1.8 2023 2024 Credit Card 3.6 4.1 2023 2024 Debit Card l6

Economic & Business Environment Economic Outlook The Chilean economy has continued posting signs of recovery . According to the monthly economic activity index (IMACEC, released by the Central Bank), in the 4 Q 24 , the GDP increased by 3 . 7 % on an annual basis, after expanding by 2 . 3 % in the previous quarter . The breakdown shows that the GDP growth was primarily driven by exports, with mining increasing by 7 . 5 % on an annual basis, and domestic consumption, as reflected by commercial activity rising 7 . 4 % on an annual basis . On a sequential basis, the economy had positive performance in the second half of the year, as demonstrated by annualized growth rates of 3 . 1 % and 1 . 7 % in the 3 Q 24 and 4 Q 24 , respectively . As a result of these trends, the economic growth would have improved from 0 . 2 % in 2023 to 2 . 5 % in 2024 , due to the recovery in the domestic demand, which was reflected in the 3 . 8 % annual expansion in commerce, a positive figure from the 3 . 5 % contraction posted last year . Also, there was a positive contribution from net exports, steered by the 5 . 9 % expansion in mining activity . In fact, the trade balance posted a surplus of US $ 22 Bn, representing the highest figure since 2007 . GDP Growth (Annual growth, %) 2.5 1.6 2.3 0.4 Dec - 23 Mar - 24 Jun - 24 Sep - 24 Dec - 24(f) Regarding the labor market, the unemployment rate stood at 8 . 1 % in December 2024 while declining 40 bp . when compared to the 8 . 5 % reported in the same period of 2023 . This change 3.7 had mainly to do with a 0.5% annual growth in the labor force and a 0.9% annual increase in the employed population. 12m CPI Change & 3m Average Unemployment (In Percentage) 3.9 3.7 4.2 4.1 4.5 8.5 8.7 8.3 8.9 8.1 Dec - 23 Dec - 24 Mar - 24 Jun - 24 Sep - 24 CPI Unemployment In terms of prices, headline inflation rate in Chile continued hovering at the upper bound of the Central Bank’s target range (between 2 % and 4 % , centered at 3 % ) . The annual inflation rate in December 2024 was 4 . 5 % , above the 3 . 9 % observed a year earlier . The persistence of inflation in Chile is attributable to the upward trend in several volatile prices, such as energy and food, which rose 11 . 4 % and 3 . 2 % on an annual basis, respectively, in 2024 . The core inflation (i . e . excluding volatile items), which has historically been related to indexation and second round effects, went up by 4 . 3 % in 2024 , remaining well above the monetary policy range . Notwithstanding the above, the Central Bank has continued reducing the interest rate . In the Monetary Policy meeting held in December, the Board decided to cut the policy rate by 25 bp . to the current level of 5 . 0 % while keeping it unchanged in the meeting held in January 2025 . Consequently, the overnight rate has declined by 325 bp . since December 2023 and by 625 bp . since the beginning of the easing cycle (July of 2023 ), when the reference rate reached 11 . 25 % . | 23

Economic & Business Environment Expectations for 2025 Available information suggests that the Chilean economy grew 2 . 5 % in 2024 , after the weak 0 . 2 % expansion seen in 2023 . For 2025 , we foresee an expansion of 2 . 0 % , in line with the economy’s growth potential . We expect the expansion to be a consequence of diverse trends, including : (i) exports that will likely continue contributing positively to GDP growth, given the combination of still high copper prices, weak exchange rate and faster growth in the main trade partners, and (ii) a slight recovery in private investment (gross fixed capital formation), particularly in the machinery in equipment component, as the construction sector will probably remain subdued . Also, we foresee an expansion of total consumption in line with the overall economy . In our baseline scenario, inflation will remain above the Central Bank’s target range in 2025 . As such, we expect inflation to be at 3 . 8 % by December 2025 , because of the impact of different factors, such as the rise in electricity bills, the lagged effects of the weaker Chilean peso and the adjustment in several inflation - linked services prices . The CPI is unlikely to converge to the 3 . 0 % mid - point before 2026 . However, given the temporary nature of this shock, it is probable that the Central Bank would continue deploying the easing cycle throughout 2025 . These projections are subject to several uncertainties . In the external front, the following factors should be taken into consideration : (i) the evolution of global growth, especially in the main trade partners of Chile, such as China and the U . S . , and (ii) the evolution of geopolitical factors and armed conflicts in Middle East and Eastern Europe . On the local side, it is important to monitor : (i) the evolution of growth perspectives, especially those related to private investment, (ii) potential second - round effects in inflation, for example due to the Ch $ depreciation, and (iii) political factors, such as the discussion of key reforms (e . g . taxes and pension system), especially considering the presidential and congress elections that will take place by the end of 2025 . 2025(f) Chilean Economy (1) ~2.0% GDP Growth ~3.8% CPI Variation (EoP) ~4.5% Monetary Policy Interest Rate (EoP) (1) Based on Banco de Chile’s own estimates and forecasts provided by the Chilean Central Bank in the last Monetary Policy Report as of December 2024. | 24

Economic & Business Environment Banking Industry Performance and Projections 0.1% - 0.2% - 2.6% - 0.4% - 1.9% The loan portfolio managed by the Chilean banking industry reached Ch $ 241 , 867 , 904 million as of December 31 , 2024 (latest available data), excluding operations of foreign subsidiaries . When compared to December 2023 , this amount represents a 4 . 0 % nominal growth in total loans, which turns into a 0 . 4 % real contraction when adjusting for 12 - month inflation (measured as UF variation) . The evolution of total loans has been marked by the path followed by commercial loans over the year . As such, after showing a modest recovery in terms of 12 - month real growth during the first quarter of the year, diverse business dynamics affecting the demand for commercial loans, including a comparison base effect, resulted in an annual contraction . Loan Growth (1) (12m % change, in real terms) 2.5% 2.4% 2.4% 1.9% - 1.5% - 2.3% - 3.7% - 1.1% - 1.7% - 1.4% - 1.6% - 1.6% 1.7% 0.2% Dec - 23 Jun - 24 Mar - 24 Total Loans Residential Loans - 5.7% Sep - 24 Dec - 24 Commercial Loans Consumer Loans (1) Figures do not include operations of subsidiaries abroad. In detail, as of December 31 , 2024 commercial loans handled by the industry posted an annual real decrease of 1 . 9 % ( 2 . 4 % nominal increase) . As mentioned in previous reports, this behavior has primarily been influenced by the annual decline portrayed by private investment (gross fixed capital formation), particularly in construction and infrastructure, due to both economic and business dynamics that have continued to negatively impact on the companies’ business sentiment, yet it is fair to note the improving trend shown in the 2 H 24 . All in all, in the wholesale banking segment, the main factors conducting the annual contraction, were : (i) weakened financial condition of some industries, such as Real Estate and Construction, after a long period of high interest rates and increased capital requirements on these sectors, (ii) the end of tax benefits for residential construction, (iii) longer than expected timelines for large scale projects, and (iv) uncertainty on the future of economic reforms on diverse fields . Regarding the SMEs and middle market segments, bounded household consumption and subdued economic activity, along with interest rates above expectations, explained the sluggish demand for loans . These trends are consistent with findings unveiled by the Central Banks’ quarterly credit surveys, which revealed the demand from corporations and large companies and SMEs remained weak, particularly in the real estate and construction sectors, while access to credit would remain tightened . Regarding personal banking, real annual growth in consumer loans has remained subdued, as demonstrated by a 0 . 2 % real expansion ( 4 . 6 % nominal increase) as of December 31 , 2024 . This trend has been influenced by both supply and demand conditions, including : (i) subdued household consumption, particularly over the second half of the year, (ii) the increase in delinquency indicators, and (iii) market labor dynamic . On the other hand, mortgage loans continued to be the only lending family displaying positive real growth by posting a 12 - month expansion of 1 . 7 % ( 6 . 2 % nominal increase) as of December 31 , 2024 . Nevertheless, this level is well below the growth rates seen in the 2010 decade while evidencing a downward trend over the year . Although demand for housing continues to positively drive the demand for residential mortgage loans, other factors, such long - term interest rates, have increased borrowing costs for debtors . Dynamics in personal banking loans are aligned with conclusions obtained from the Central Bank’s credit surveys . Regarding liabilities, during 2024 total deposits represented the main funding source for the local banking industry . As of December 31 , 2024 Time Deposits (excluding foreign subsidiaries) amounted to Ch $ 111 , 771 , 899 million, which | 25

Economic & Business Environment denotes a 5 . 4 % nominal growth and moderate real expansion when adjusting for inflation as compared to December 2023 . Over 2024 Time Deposits lost growth momentum on the grounds of the easing monetary cycle deployed by the Central Bank, from which these types of deposits became less attractive for customers . Nonetheless, particularly by the end of 2024 , since market factors have reasonably returned to normality, some banking players have increasingly begun to raise funding through Time Deposits in order to fund their balance sheet, for instance, after the end of the FCIC . Instead, Demand Deposits reached Ch $ 69 , 992 , 155 million in December 2024 , which indicates a 6 . 6 % annual nominal growth and a real increase of 2 . 1 % over the year . As noticed throughout the year, Demand Deposits have returned to normality after non - recurring factors seen in prior periods . As a result, the industry’s reciprocity ratio of demand deposits to total loans reached 28 . 9 % in December 2024 , which remains above the level of ~ 25 . 0 % seen before 2020 . In relation to long - term funding, the Debt Issued by the industry (including regulatory capital instruments) amounted to Ch $ 73 , 019 , 678 million as of December 31 , 2024 , which denotes a 6 . 6 % annual nominal increase while representing the most dynamic funding source during the year . This trend has to do with both the maturity of the FCIC, and the reinforcement of the capital base in the context of stricter Basel III requirements for certain banks . The bottom line of industry amounted to Ch $ 5 , 047 , 072 million as of December 31 , 2024 , amount that was 10 . 5 % above the level posted as of December 31 , 2023 . This expansion was primarily caused by : (i) operating revenues that grew 5 . 3 % , due mainly to higher net interest income, and (ii) a decrease of 12 . 9 % in expected credit losses, partly as a result of the release of additional allowances by some banks during 2024 . These factors were partly offset by : (i) operating expenses that went up 7 . 2 % , due to the effect of cumulative inflation on prices and fares, and (ii) income tax that increased 19 . 8 % , on the grounds of greater income before income tax earned by the industry . Expectations for 2025 Regarding loan growth, we expect lending activity to gain some momentum in 2025 . Give that, the industry’s loan book would expand ~ 4 . 5 % in nominal terms on an annual basis by December 2025 principally as a result of lower nominal interest rates . In this regard, the forecasted recovery for private investment and an overall more dynamic economic activity would result in improved banking activity, though below multiples on GDP seen in the past . We expect personal banking to be the main engine for loan growth . In this regard, consumer and residential mortgage loans would grow positively in real terms in the range of 2 . 5 % to 3 . 0 % , based on both a pickup in household consumption and a steadily increasing demand for housing . On the other hand, commercial loans would go away from negative territory by achieving a flat trend in real terms in 2025 when compared to 2024 . In terms of funding sources, given the trend followed by demand deposits over the 2 H 24 , Demand Deposits are expected to grow in line with total loans by increasing ~ 4 . 5 % in nominal terms by December 2025 . For that reason, we foresee a reciprocity ratio in the range of 27 % to 28 % , in consistency with the level achieved by the end of 2024 . The main underlying factors for this growth would be both nominal interest rates that should continue to decrease, aligned with the monetary reference rate that should converge to neutral levels a 12 - month inflation decreasing towards the mid - point of the Central Bank’s target range . Based on this trend, growth in Time Deposits and Debt Issued will depend on banks’ funding needs and decisions made to manage both liquidity risk and interest rate risk in the banking book . Accordingly, banks would be more encouraged to raise long - term debt to meet funding needs arising from expected growth in residential mortgage loans while raising funds from Time Deposits to address short - term funding needs . Regarding results, we expect NIM for the industry to return to normalized levels in the range of 3 . 5 % to 3 . 8 % , which would be sustained by both : (i) 12 - month inflation – measured as UF variation – that would ended up 2025 at the level of ~ 3 . 5 % , and (ii) the convergence of the monetary policy interest rate to neutral levels of ~ 4 . 5 % by December 2025 . Concerning credit risk, we expect past - due loans to decrease slightly to the range of 2 . 0 % to 2 . 2 % , given a more dynamic labor market and improved business conditions for companies, while expected credit losses would hover in the range of 1 . 2 % to 1 . 4 % , excluding additional provisions . FY2025(f) Banking System (1) ~4.5% Nominal Loan Growth 27% - 28% DDA / Total Loans 3.5% – 3.8% Net Interest Margin 1.2% – 1.4% ECL / Avg. Loans 2.0% – 2.2% Past - Due Loans (>90d) (1) Based on Banco de Chile’s own estimates. | 26

Economic & Business Environment Market Share in Consumer Loans (1) (As of December 2024) Market Share in Commercial Loans (1) (As of December 2024) 19.9% 18.6% 14.7% 10.6% 8.4% 16.7% 15.9% 14.1% 11.2% 10.8% Market Share in Assets Under Management (2) (As of December 2024) Market Share in Demand Deposits in Local Currency (1) (As of December 2024) 23.6% 18.0% 12.3% 6.1% 5.8% 20.1% 20.0% 14.9% 8.0% 5.2% Return on Average Capital and Reserves (As of December 2024) Market Share in Net Income (As of December 2024) 23.1% 20.3% 12.7% 12.9% 10.0% 23.9% 17.1% 15.9% 9.1% 7.5% 90 - day Past Due Loans (As of December 2024) Cost - to - Income Ratio (As of December 2024) 3.2% 2.2% 2.4% 1.4% 1.6% 48.9% 49.8% 37.1% 39.0% 40.7% Sources: CMF and Mutual Funds Association (1) Excluding operations of subsidiaries abroad. (2) AUM stands for Asset Under Management and the chart includes banking and non - banking mutual funds subsidiaries | 27

Management Discussion & Analysis Income Statement Analysis 4Q24 and 2024 YTD (In Millions of Ch$) Net Income 4 Q 24 vs . 4 Q 23 Our net income amounted to Ch $ 298 , 066 million in the 4 Q 24 , which denoted an annual decrease of Ch $ 87 , 478 million or 22 . 7 % when compared to the figure posted in the 4 Q 23 . Quarterly Net Income (In millions of Ch$) Income Tax 385,544 19,937 (104,846) 24,604 15,754 (42,927) 298,066 4Q23 4Q24 Non - Customer Income Customer Income Expected Credit Losses Operating Expenses - 22.7% The annual variation in net income was primarily steered by : ⭬ An annual decrease of Ch $ 84 , 909 million or 9 . 8 % in operating revenues, which was largely explained by an annual decline in non - customer income, as a result of : (i) lower income from asset and liability management as a consequence of the maturity of the FCIC obligation, (ii) lower revenues from the management of trading and investment positions due to a high comparison base represented by the 4 Q 23 , when we benefited from favourable market factors, and (iii) a decline in the contribution of our UF net asset exposure, as a result of lower inflation in the 4 Q 24 when compared to the 4 Q 23 . These drivers were partly offset by a rise in customer income supported by improvements in income from loans, deposits margin and fee - based income . ⭬ An annual increase of Ch $ 42 , 927 million or 139 . 7 % in income tax, mostly explained by the impact of lower volumes of fixed - income securities that complied with conditions established in Art . 104 of the Chilean Tax Law together with a decrease in the inflation effect on equity which is tax deductible under the Chilean tax system, given lower inflation in the 4 Q 24 with respect to the 4 Q 23 . These factors were to some degree counterbalanced by : ⭬ An annual decrease of Ch $ 24 , 604 million or 19 . 2 % in Expected Credit Losses (ECL), which was mainly explained by lower credit expenses in the Retail Banking segment in the 4 Q 24 when compared to the 4 Q 23 , as a result of higher - than - usual ECL in the 4 Q 23 related to adjustments to provisioning models used for the Retail Banking segment and overall improved asset quality . ⭬ A yearly decline of Ch $ 15 , 754 million or 4 . 9 % in operating expenses, mainly attributable to greater benefits provided to the staff in the 4 Q 23 (recognized as personnel expenses), as result of the collective bargaining processes accomplished in that period with unions representing the staff of the Bank and some of our subsidiaries . 2024 YTD vs . 2023 YTD For the FY 2024 , we reached a bottom line of Ch $ 1 , 207 , 392 million, which indicates a slight decrease of Ch $ 36 , 243 million or 2 . 9 % when compared to the same period last year . The main underlying cause for this performance was : ⭬ An annual rise of Ch $ 44 , 518 million or 16 . 3 % in income tax, prompted by diverse factors, including : (i) lower balances of fixed - income securities in 2024 that benefited from the tax treatment associated with Art . 104 of the Chilean Tax Law in 2023 , (ii) lower inflation effect on equity accounts, which is tax deductible under the Chilean tax law, due to the decrease in CPI variation in 2024 when compared to 2023 , and (iii) an annual increase of 0 . 5 % in pre - tax income . | 28

Management Discussion & Analysis ⭬ An annual increase of Ch $ 30 , 503 million or 8 . 4 % in Expected Credit Losses, which was mostly explained by a net asset quality deterioration, particularly in the Wholesale Banking segment, due to a low comparison base in 2023 and weakened financial condition of some customers in 2024 , together with moderate loan growth in the Retail Banking segment . ⭬ Higher Operating Expenses by Ch $ 16 , 635 million or 1 . 5 % on an annual basis, due primarily to increased administrative expenses, mostly as a consequence increased IT - expenses, which is aligned with the deployment of our digital strategy that pursue to enhance our productivity and efficiency in the mid - term . Year - to - Date Net Income (In millions of Ch$) 1,243,635 204,390 (148,977) (30,503) (16,635) (44,518) 1,207,392 Dec - 24 Non - Customer Income Income Tax Customer Income Expected Credit Losses Operating Expenses Dec - 23 These factors were to some degree counterbalanced by : ⭬ An annual increase of Ch $ 55 , 413 million or 1 . 9 % in operating revenues, principally on the grounds of improved customer income that benefited from higher income from loans and greater contribution of deposits to our funding cost . These factors enabled us to deal with an annual decline in non - customer income caused by headwinds coming from the effect of the expiration of the FCIC on revenues from asset and liability management, which in turn was partly offset by improved performance in the management of trading and investment positions, for which we profited from specific windows of opportunity in 2024 . Return on Average Capital & Reserves (ROAC) As of December 31 , 2024 and given the drivers mentioned above, we achieved a ROAC of 23 . 8 % in the 4 Q 24 that represented a decline when compares the 33 . 6 % reached a year earlier . Similarly, in a yearly comparison our ROAC amounted to 23 . 1 % , in 2024 , which is below the 26 . 1 % registered a year ago . - 2.9% Return on Average Capital & Reserves (1) (Annualized) 33.6% 23.8% 26.1% 23.1% 17.2% 15.4% 16.0% 15.8% 4Q23 4Q24 Dec - 24 Dec - 23 Industry ROAC (1) Net income for the period divided by average capital and reserves. Capital and reserves refers to total equity less net income for the period and provisions for minimum dividends. | 29 Projections For the FY 2025 , we forecast a NIM of 4 . 5 % - 4 . 7 % , as a consequence of : (i) a decline in inflation from a UF variation of 4 . 4 % in 2024 to ~ 3 . 5 % in 2025 , (ii) a monetary policy interest rate landing from the current 5 . 0 % to 4 . 5 % in December 2025 , and (iii) local yield curves that would remain more flattened than positively sloped, particularly over the 1 H 25 . The decline in short - term interest rates, together with expected cuts to the FED Fund rate, would reduce the contribution of demand deposits, which would be partly offset by the repricing of short - term time deposits . Besides, flattened yield curves would result in lower revenues from ALM . These factors would partly be offset by higher lending spreads, as long as our portfolio mix returns to normality . From the credit risk perspective, we foresee our ECL ratio to stand in the range of 1 . 0 % to 1 . 2 % , excluding the effect of the new standardized provisioning model for consumer loans that will be addressed by a release of additional allowances . In terms of past - due loans we expect a convergence to around ~ 1 . 3 % over 2025 . As for efficiency, given more normalized market factors conducting revenues and a strict cost control we see our cost - to - income ratio standing at ~ 40 % by December 2025 . Based on the above, in absence of non - recurrent factors, we expect our ROAC converging to mid - term levels of ~ 18 % for 2025 . FY2025 Banco de Chile Slightly above industry Loan Growth (Nominal) 4.5% - 4.7% Net Interest Margin (NIM) 1.0% - 1.2% Expected Credit Losses / Avg. Loans ~40% Efficiency Ratio ~18% Return on Average Capital (ROAC)

Management Discussion & Analysis Change Dec - 24/Dec - 23 Ch$ % Year - to - Date Dec - 23 Dec - 24 Operating Revenues Breakdown (In millions of Ch$) Quarter Change 4Q24/4Q23 4Q23 4Q24 Ch$ % +13.2 % 250,191 2,140,851 1,890,660 (1.1)% - 5,921 555,602 561,523 Net Interest Income (Interest and Inflation) (41.2)% - 192,578 275,187 467,765 (57.1)% - 66,752 50,207 116,959 Financial Results (1) +2.4 % 57,613 2,416,038 2,358,425 (10.7)% - 72,673 605,809 678,482 Net Financial Income +4.8 % 25,953 571,883 545,930 +3.4 % 4,746 144,650 139,904 Net Fees and Commisions (29.0)% - 21,162 51,777 72,939 (43.8)% - 16,938 21,725 38,663 Other Operating Income +18.2 % 2,620 17,052 14,432 +96.4 % 4,893 9,968 5,075 Income attributable to affiliates - - 9,611 - 6,465 3,146 - - 4,937 - 4,000 937 Income from Non - Current Assets Held for Sale +1.9 % 55,413 3,050,285 2,994,872 (9.8)% - 84,909 778,152 863,061 Total Operating Revenues bp. Dec - 24 Dec - 23 bp. 4Q24 4Q23 Key Ratios 25 4.88% 4.63% - 10 5.16% 5.26% Net Interest Margin 27 5.23% 4.96% - 16 5.46% 5.62% Net Financial Margin 2 1.50% 1.48% 1 1.51% 1.50% Fees to Average Loans In Millions of Ch$ (1) Include results from financial assets held for trading measured at fair value in P&L, financial assets measured at fair value through other comprehensive income, financial liabilities measured at fair value, trading derivatives, hedge accounting derivatives and foreign exchange transactions. Net Financial Income 4Q24 vs. 4Q23 Net Financial Income Breakdown (In Millions of Ch$) 445,569 460,759 232,913 145,050 678,482 605,809 4Q23 4Q24 Non - Customer Financial Income Customer Financial Income | 30 The net financial income amounted to Ch $ 605 , 809 million in the 4 Q 24 , which is Ch $ 72 , 673 million or 10 . 7 % below the Ch $ 678 , 482 million posted in the 4 Q 23 . This annual contraction was primarily linked to a decline of Ch $ 87 , 864 million in non - customer financial income, which was in turn highly influenced by the expiration of the FCIC and lower inflation . Positively, this performance was partly offset by an annual increment of Ch $ 15 , 191 million in customer financial income, principally fostered by income from loans that have continued to show positive figures on an annual basis . In detail, this annual change may be summarized, as follows : ⭬ An annual decrease of Ch $ 79 , 854 million in revenues from asset and liability management (ALM hereafter) along with income from financial positions, including : (i) lower revenues coming from both the term and interest rate gapping as a consequence of the end of the FCIC in 2024 the effect of lower inflation on an annual basis on the directional UF net asset position managed by our Treasury, which explained Ch $ 62 , 205 million of lower income from ALM, (ii) an annual contraction of Ch $ 15 , 690 million in the contribution of our structural UF net asset position that hedges our equity against inflation, due to lower inflation, and (iii) an annual decline of Ch $ 7 , 996 million in revenues from the management of the investment and trading activities . These effects were to some extent offset by an annual improvement of Ch $ 5 , 964 million revenues from the FX asset position that hedges expenses denominated in USD due to the sharp depreciation of the Ch $ in the 4 Q 24 when compared to the same period a year ago . ⭬ An annual decrease of Ch $ 10 , 970 million in income from Time Deposits, mostly associated with : (i) an annual decrease of 6 . 9 % in average balances in the 4 Q 24 when compared to the 4 Q 23 , and (ii) a change in the mix, since Time Deposits balances held by wholesale customers, usually bearing lower margins, have continued to increase, while balances held by retail clients have decreased on an annual basis .

Management Discussion & Analysis ⭬ An annual decline of Ch $ 6 , 452 million in net financial income from subsidiaries, given lower results from the management of the fixed - income portfolio held by our securities brokerage subsidiary, as a consequence of unfavourable shifts in short - term interest rates . The factors mentioned above were to some extent offset by an annual increase of Ch $ 20 , 561 million or 9 . 0 % in income from loans, from Ch $ 229 , 574 million in the 4 Q 23 to Ch $ 250 , 134 million in the 4 Q 24 . At a lending product level, consumer loans were the main contributor to this growth by increasing Ch $ 16 , 985 million, steered by both a surge of 4 . 3 % in average loans and lending spreads growing 92 bp . To a lesser extent, income from residential mortgage loans rose Ch $ 3 , 503 million, largely fostered by an expansion of 7 . 3 % in average loans . On a negative tone, income from commercial loans posted a nil variation in the period, which was aligned with an all but flat trend in average balances when compared to the 4 Q 23 while reflecting the prevailing economic landscape, particularly in terms of private investment stagnation in 2024 . 2024 YTD vs . 2023 YTD Net Financial Income Breakdown (In Millions of Ch$) 1,654,888 1,833,325 703,537 582,713 2,358,425 2,416,038 Dec - 23 Dec - 24 Non - Customer Financial Income Customer Financial Income For the FY 2024 we posted net financial income of Ch $ 2 , 416 , 038 million, representing an annual increase of Ch $ 57 , 613 million or 2 . 4 % when compared to the FY 2023 . During 2024 , we made significant advances in strengthening the customer relationship framework we have built over the years, which has enabled us to enhance our core revenue generation capacity . As a result, we managed to grow Ch $ 178 , 436 million or 10 . 8 % in customer financial income in 2024 when compared to 2023 . This factor was partly offset by an annual decline of Ch $ 120 , 823 million in non - customer financial income, mostly influenced by the end of the FCIC financing and the effect of lower inflation . | 31 The main underlying factors explaining these figures were : ⭬ An annual increment of Ch $ 107 , 428 million in income from loans in 2024 , which had to do with : (i) an annual increment in income from consumer loans by Ch $ 99 , 708 million backed by improvements in both average loan balances and lending spreads, and (ii) greater income from residential mortgage loans as a result of average balances increasing 7 . 4 % in 2024 when compared to 2023 . ⭬ An annual surge of Ch $ 40 , 377 million in the contribution of demand deposits (DDA) balances to our funding cost, on the grounds of a 6 . 8 % expansion in average balances . It is important to note that the normalization observed in DDA balances during the first half of the year was followed by an upward trend in the 2 H 24 , which translated into a reciprocity ratio of demand deposit to total loans to stand above our historic levels . The strong expansion in DDA replaced time deposit origination during 2024 as the latter lost appeal as an investment alternative, in line with repeated cuts to the local reference rate . Furthermore, the annual increase in DDA balances coupled with higher average margins when compared to 2023 . ⭬ Income from TD that grew Ch $ 30 , 104 million in 2024 when compared to 2023 , which was mostly influenced by higher margins given proactive pricing management . To a lesser extent, the slight 1 . 2 % annual increment in average balances also contributed to this performance . These factors were partly counterbalanced by : ⭬ An annual drop of Ch $ 120 , 669 million in revenues from treasury activities, mostly as a consequence of : (i) lower results from interest rate and term gapping due to the end of the FCIC in 2024 , (ii) the impact of lower inflation on the contribution of our net asset exposure to the UF, given a 4 . 4 % UF variation in 2024 when compared to the 4 . 8 % seen in 2023 , and (iii) lower results from Sales & Structuring, due to lower overall business activity amid subdued economic growth . These effects were partly offset by : (i) increased results from the management of both our investment and trading portfolios, given better performance in fixed - income securities and trading derivatives in 2024 , in conjunction with lower results in trading securities in 2023 owing to unfavourable shifts in market factors in 2023 , and (ii) further income from the FX asset position that hedges USD - denominated expenses, given the 13 . 8 % depreciation of the Ch $ in 2024 as compared to the 2 . 8 % depreciation in 2023 . ⭬ Net financial income from subsidiaries that decreased Ch $ 6 , 260 million in 2024 due to below - average results from the fixed - income portfolio managed by our securities brokerage subsidiary during the 4 Q 24 , as a consequence of the pickup in interest rates .

Management Discussion & Analysis Net Financial Margin (NFM) In the 4 Q 24 , we posted net financial margin of 5 . 46 % , figure that compares to the 5 . 62 % posted in the 4 Q 23 . This annual change was influenced by two main industry - wide factors : (i) lower inflation, and (ii) the end of the FCIC that was totally repaid in July 2024 . Regardless of the effect these drivers had on each banking player, once again we managed to stand 102 bp . above the industry’s ratio of 4 . 44 % in the 4 Q 24 . Net Financial Margin (Net Financial Income / Avg. Interest Earning Assets) 5.62% 5.46% 4.96% 5.23% 4.38% 4.44% 4.06% 4.25% 4Q23 4Q24 Dec - 24 Dec - 23 BCH Industry For the FY 2024 , we reached a net financial margin of 5 . 23 % , representing an annual increase of 27 bp . when compared to the 4 . 96 % posted in 2023 . This figure was closely connected with our enhanced revenue generation capacity, which allowed us to display a strong performance throughout 2024 , particularly in terms of the recovery experienced by customer financial income . Based on this behavior, we outperformed by 98 bp . the industry’s ratio of 4 . 25 % as of December 31 , 2024 . Net Fee Income 4 Q 24 vs . 4 Q 23 In the 4 Q 24 the net fee income amounted to Ch $ 144 , 650 million, which denotes an annual increase of Ch $ 4 , 746 million or 3 . 4 % when contrasted to the 4 Q 23 . Main underlying causes explaining the annual increment were : ⭬ A yearly increase of Ch $ 7 , 534 million or 24 . 3 % in fees from Mutual Funds and Investment Funds management . This change was explained by a 36 . 0 % annual increment in average balances of assets under management (AUM), principally sustained by the launch of new mutual funds series (representing around 86 % of the total increase in AUM in 2024 ), which have been mainly concentrated in funds invested in fixed - income securities in order to meet investors’ needs in a context of sliding short - term interest rates . 44,244 29,393 24,743 30,974 38,508 15,107 17,665 17,899 2,287 17,030 3,074 139,904 ⭬ Higher fee - income from Credits and Contingent Loans by Ch $ 2 , 558 million or 16 . 9 % on an annual basis, which was comprised of : (i) an increase of Ch $ 1 , 396 million in fee - income from letters of credit, guarantees and collaterals, which was partly related to performance displayed by trade finance loans and (ii) greater fees from credit prepayment by Ch $ 1 , 251 million on an annual basis, mainly concentrated in consumer loans, due to the decline in local interest rates . ⭬ Cash management fees that increased Ch $ 1 , 732 million that is almost fivefold the amount recorded in the 4 Q 23 , primarily explained by lower fees paid on interbank clearance services that were revised downwards during 2024 . Net Fee Income (In Millions of Ch$) 144,650 Others Stock Brokerage Credits, contingent loans and repayments Mutual Funds Insurance Brokerage 43,630 Transactional Services 4Q23 4Q24 These positive factors were to some degree offset by : ⭬ An annual decrease of Ch $ 4 , 650 million or 15 . 8 % in fees from Insurance Brokerage . The change was mainly caused by : (i) a decline of 2 . 9 % in written premiums in the 4 Q 24 in comparison with the same period last year, partly explained by specific dynamics in the casualty insurance business related to residential mortgage loans and lower activity in non - credit related insurance, (ii) a decline in the recognition of the upfront fee received as part of our strategic alliance in 2019 , as clawback clauses expired this year, and (iii) higher reimbursement of non - accrued insurance brokerage fees due to the increase in loan prepayments, as mentioned earlier . ⭬ Fees from Financial Advisory Services that decreased Ch $ 1 , 374 million on an annual basis, which had primarily to do with lower amount of M&A transactions carried out over the year, in consistency with subdued economic activity . | 32