Brookfield Renewable to Issue C$200 Million of Green Subordinated Hybrid Notes

06 December 2024 - 3:24PM

Brookfield Renewable (NYSE: BEP, BEPC; TSX: BEP.UN, BEPC)

(“Brookfield Renewable”) today announced that it has agreed to

issue C$200 million aggregate principal amount of Fixed-to-Fixed

Reset Rate Subordinated Hybrid Notes due March 12, 2055 (the

“Hybrid Notes”).

The notes will bear interest at an annual rate

of 5.450% and reset every five years starting on March 12, 2030 at

an annual rate equal to the five-year Government of Canada yield,

plus a spread of 2.499%. The Hybrid Notes will receive the same

rating treatment as our preferred shares and preferred units.

Brookfield Renewable Partners ULC, a subsidiary

of Brookfield Renewable, will be the issuer of the Hybrid Notes,

which will be fully and unconditionally guaranteed by Brookfield

Renewable and certain of its key holding subsidiaries.

The Hybrid Notes will be issued pursuant to a

base shelf prospectus dated September 8, 2023 and a related

prospectus supplement to be dated December 9, 2024. The issue is

expected to close on or about December 12, 2024 subject to

customary closing conditions.

The Hybrid Notes will represent Brookfield

Renewable’s fifteenth green labelled corporate securities issuance

in North America and the fourth issuance under Brookfield

Renewable’s 2024 Green Financing Framework (the “Green Financing

Framework”). Brookfield Renewable intends to use the net proceeds

from the sale of the Hybrid Notes to fund Eligible Investments (as

defined in the Green Financing Framework), including to repay

indebtedness incurred in respect thereof. The Green Financing

Framework is available on Brookfield Renewable’s website and

described in the prospectus supplement in respect of the

offering.

The Hybrid Notes are being offered through a

syndicate of underwriters led by BMO Capital Markets, CIBC Capital

Markets, Scotiabank, RBC Capital Markets, TD Securities and

National Bank Financial Markets, and including Desjardins, BNP

Paribas, Mizuho Securities, MUFG, SMBC Nikko and iA Private Wealth

Inc.

This news release shall not constitute an offer

to sell or the solicitation of an offer to buy the securities in

any jurisdiction, nor shall there be any offer or sale of the

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful. The securities being offered have not been

approved or disapproved by any regulatory authority nor has any

such authority passed upon the accuracy or adequacy of the short

form base shelf prospectus or the prospectus supplement. The offer

and sale of the securities has not been and will not be registered

under the United States Securities Act of 1933, as amended (the

“U.S. Securities Act”) or any state securities laws and may not be

offered or sold in the United States or to United States persons

absent registration or an applicable exemption from the

registration requirements of the U.S. Securities Act and applicable

state securities laws.

Access to the prospectus supplement, the

corresponding base shelf prospectus and any amendment thereto in

connection with the offering of the Hybrid Notes is provided in

accordance with securities legislation relating to procedures for

providing access to a prospectus supplement, a base shelf

prospectus and any amendment thereto. The prospectus supplement,

the corresponding base shelf prospectus and any amendment thereto

in connection with the offering will be accessible within two

business days at www.sedarplus.com.

An electronic or paper copy of the prospectus

supplement, the corresponding base shelf prospectus and any

amendment to the documents may be obtained, without charge, from

BMO Capital Markets by email at DCMCADSyndicateDesk@bmo.com or

phone at 416-359-6359, CIBC Capital Markets by email at

mailbox.cibcdebtsyndication@cibc.com or phone at 416-594-8515, or

Scotiabank by email at syndicate.toronto@scotiabank.com or phone at

416-862-3290.

Brookfield RenewableBrookfield

Renewable operates one of the world’s largest publicly traded

platforms for renewable power and sustainable solutions. Our

renewable power portfolio consists of hydroelectric, wind,

utility-scale solar, distributed generation and storage facilities

in North America, South America, Europe and Asia. Our operating

capacity totals over 35,000 megawatts and our development pipeline

stands at approximately 200,000 megawatts. Our portfolio of

sustainable solutions assets includes our investments in

Westinghouse (a leading global nuclear services business) and a

utility and independent power producer with operations in the

Caribbean and Latin America, as well as both operating assets and a

development pipeline of carbon capture and storage capacity,

agricultural renewable natural gas and materials recycling.

Investors can access the portfolio either

through Brookfield Renewable Partners L.P. (NYSE: BEP; TSX:

BEP.UN), a Bermuda-based limited partnership, or Brookfield

Renewable Corporation (NYSE, TSX: BEPC), a Canadian

corporation.

Brookfield Renewable is the flagship listed

renewable power and transition company of Brookfield Asset

Management, a leading global alternative asset manager with over $1

trillion of assets under management.

|

Contact information: |

|

|

Media: |

Investors: |

|

Simon Maine |

Alex Jackson |

|

+44 7398 909 278 |

+1 (416) 649-8196 |

|

simon.maine@brookfield.com |

alexander.jackson@brookfield.com |

|

|

|

Cautionary Statement Regarding

Forward-looking Statements

Note: This news release contains forward-looking

statements and information within the meaning of Canadian

securities laws. Forward-looking statements may include estimates,

plans, expectations, opinions, forecasts, projections, guidance or

other statements that are not statements of fact. Forward-looking

statements can be identified by the use of words such as “will”,

“expected”, “intend”, or variations of such words and phrases.

Forward-looking statements in this news release include statements

regarding the closing, the terms and the use of proceeds of the

offering of Hybrid Notes. Although Brookfield Renewable believes

that such forward-looking statements and information are based upon

reasonable assumptions and expectations, no assurance is given that

such expectations will prove to have been correct. The reader

should not place undue reliance on forward-looking statements and

information as such statements and information involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of Brookfield Renewable

to differ materially from anticipated future results, performance

or achievement expressed or implied by such forward-looking

statements and information. Except as required by law, Brookfield

Renewable does not undertake any obligation to publicly update or

revise any forward-looking statements or information, whether

written or oral, whether as a result of new information, future

events or otherwise.

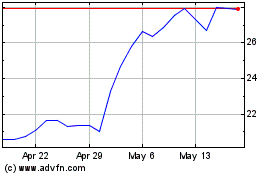

Brookfield Renewable Par... (NYSE:BEP)

Historical Stock Chart

From Jan 2025 to Feb 2025

Brookfield Renewable Par... (NYSE:BEP)

Historical Stock Chart

From Feb 2024 to Feb 2025