false000163411700016341172024-12-112024-12-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 11, 2024

| | | | | | | | | | | | | | | | | |

| BARNES & NOBLE EDUCATION, INC. |

| (Exact name of registrant as specified in its charter) |

| |

| Delaware | | 1-37499 | | 46-0599018 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | |

120 Mountainview Blvd., Basking Ridge, NJ 07920 |

| (Address of principal executive offices)(Zip Code) |

| |

| Registrant’s telephone number, including area code: | | (908) 991-2665 |

| |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

□ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

□ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

□ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

□ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Class | | Trading Symbol | | Name of Exchange on which registered |

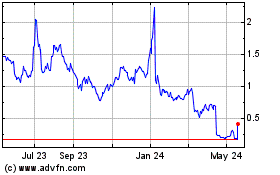

| Common Stock, $0.01 par value per share | | BNED | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company □

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. □

Item 8.01 Other Events.

Barnes & Noble Education, Inc. (the “Company”, “we”, “our”) is filing this Current Report on Form 8-K to recast certain financial information set forth in our Annual Report on Form 10-K for the fiscal year ended April 27, 2024 (“Report”) as filed on July 1, 2024, with the U.S. Securities and Exchange Commission (“SEC”) under the Securities Exchange Act of 1934, as amended.

As disclosed in our Quarterly Report on Form 10-Q for the quarterly periods ended October 26, 2024, we realigned our reportable segments for financial reporting purposes as a result of change in our Chief Operating Decision Maker and how business performance is monitored and resources are allocated to support our top strategic priorities. During the quarterly period ended October 26, 2024, we simplified our internal reporting to reflect one operating and reporting segment. This change aligns with the information regularly provided to the Chief Operating Decision Maker that is used for making operating and investment decisions and assessing business performance.

As required by Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 280, Segment Reporting, if a public entity changes the structure of its internal organization in a manner that causes the composition of its reportable segments to change, the corresponding information for earlier periods, including interim periods, shall be recast unless it is impracticable to do so. Accordingly, attached as Exhibit 99.1 of this Form 8-K, and incorporated by reference herein, are the following portions of the Form 10-K that have been revised to reflect the realignment of the Company’s segments.

• Part I. Item 1. Business;

• Part I. Item 1A., Risk Factors;

• Part II. Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations; and

• Part II. Item 8. Financial Statements and Supplementary Data.

Prior periods in Exhibit 99.1 have been recast to conform with the realigned segment. The information included in Exhibit 99.1 affects disclosures related to previously disclosed segment results and does not in any way restate or revise the consolidated financial position, results of operations or cash flows in any previously filed consolidated statements of operations, consolidated balance sheets or consolidated statements of cash flows.

No items in the Report other than those identified above are being updated by this filing, and this filing does not reflect any subsequent information or events other than the revised segment reporting. Exhibit 99.1 should be read in conjunction with the Report as filed, and other filings made with the SEC.

Item 9.01. Financial Statements and Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: December 11, 2024

BARNES & NOBLE EDUCATION, INC.

By: /s/ Kevin F. Watson

Name: Kevin F. Watson

Title: Chief Financial Officer

BARNES & NOBLE EDUCATION, INC.

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in Registration Statement Form S-3 333-282791; Form S-8 333-282251; Form S-3 333-281930; Form S-3 333-280775; S-1 333-278799; S-8 333-275114; S-8 333-260133; S-8 333-227515; S-8 333-213673; S-8 333-206893 on Form 8-K of Barnes & Noble Education, Inc. of our report dated July 1, 2024, except Note 4, as to which the date is December 11, 2024, relating to the consolidated financial statements of Barnes & Noble Education, Inc. as of and for the years ended April 27, 2024 and April 29, 2023 appearing in this Current Report on Form 8-K of Barnes & Noble Education, Inc.

/s/ Ernst & Young LLP

Iselin, New Jersey

December 11, 2024

Exhibit 99.1

EXPLANATORY NOTE

Barnes & Noble Education, Inc. (the “Company”, “we”, “our”) is filing this Current Report on Form 8-K to recast certain financial information set forth in our Annual Report on Form 10-K for the fiscal year ended April 27, 2024 (“Report”) as filed on July 1, 2024, with the U.S. Securities and Exchange Commission (“SEC”) under the Securities Exchange Act of 1934, as amended.

As disclosed in our Quarterly Report on Form 10-Q for the quarterly periods ended October 26, 2024, we realigned our reportable segments for financial reporting purposes as a result of change in our Chief Operating Decision Maker and how business performance is monitored and resources are allocated to support our top strategic priorities. During the quarterly period ended October 26, 2024, we simplified our internal reporting to reflect one operating and reporting segment. This change aligns with the information regularly provided to the Chief Operating Decision Maker that is used for making operating and investment decisions and assessing business performance.

As required by Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 280, Segment Reporting, if a public entity changes the structure of its internal organization in a manner that causes the composition of its reportable segments to change, the corresponding information for earlier periods, including interim periods, shall be recast unless it is impracticable to do so. Accordingly, attached as Exhibit 99.1 of this Form 8-K, and incorporated by reference herein, are the following portions of the Form 10-K that have been revised to reflect the realignment of the Company’s segments.

• Part I. Item 1. Business;

• Part I. Item 1A., Risk Factors;

• Part II. Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations; and

• Part II. Item 8. Financial Statements and Supplementary Data.

Prior periods in Exhibit 99.1 have been recast to conform with the realigned segment. The information included in Exhibit 99.1 affects disclosures related to previously disclosed segment results and does not in any way restate or revise the consolidated financial position, results of operations or cash flows in any previously filed consolidated statements of operations, consolidated balance sheets or consolidated statements of cash flows.

No items in the Report other than those identified above are being updated by this filing, and this filing does not reflect any subsequent information or events other than the revised segment reporting. Exhibit 99.1 should be read in conjunction with the Report as filed, and other filings made with the SEC.

PART I

Item 1. BUSINESS

Unless the context otherwise indicates, references to “we,” “us,” “our” and “the Company” refer to Barnes & Noble Education, Inc. or “BNED”, a Delaware corporation. References to “Barnes & Noble College” or “BNC” refer to our subsidiary Barnes & Noble College Booksellers, LLC. References to “MBS” refer to our subsidiary MBS Textbook Exchange, LLC.

Our fiscal year is comprised of 52 or 53 weeks, ending on the Saturday closest to the last day of April. “Fiscal 2024” means the 52 weeks ended April 27, 2024,“Fiscal 2023” means the 52 weeks ended April 29, 2023, and “Fiscal 2022” means the 52 weeks ended April 30, 2022.

OVERVIEW

General

Barnes & Noble Education, Inc. (“BNED”) is one of the largest contract operators of physical and virtual bookstores for college and university campuses and K-12 institutions across the United States.We are also a textbook wholesaler, and bookstore management hardware and software provider. We operate 1,245 physical, virtual, and custom bookstores and serve more than 5.8 million students, delivering essential educational content, tools and general merchandise within a dynamic omnichannel retail environment.

The strengths of our business include our ability to compete by developing new products and solutions to meet market needs, our large operating footprint with direct access to students and faculty, our well-established, deep relationships with academic partners and stable, long-term contracts and our well-recognized brands. We provide product and service offerings designed to address the most pressing issues in higher education, including equitable access, enhanced convenience and improved affordability through innovative course material delivery models designed to drive improved student experiences and outcomes. We offer our BNC First Day® equitable and inclusive access programs, consisting of First Day Complete and First Day, which provide faculty required course materials on or before the first day of class at below market rates, as compared to the total retail price for the same course materials if purchased separately (a la carte), and students are billed the below market rate directly by the institution as a course charge or included in tuition. During the 52 weeks ended April 27, 2024, BNC First Day total revenue increased by $127 million, or 37%, to $474 million compared to $347 million during the prior year period. These programs have allowed us to reverse historical long-term trends in course materials revenue declines, which has been observed at those schools where such programs have been adopted, and improve predictability of our future results. In Fiscal 2024, the growth of our BNC First Day programs offset the declines in a la carte courseware sales and closed store sales. We are moving quickly to accelerate our First Day Complete strategy. Many institutions adopted First Day Complete in Fiscal 2024, and we plan to continue to scale the number of schools adopting First Day Complete in Fiscal 2025 and beyond.

We expect to continue to introduce scalable and advanced solutions focused largely on the student and customer experience, expand our e-commerce capabilities and accelerate such capabilities through our service providers, Fanatics Retail Group Fulfillment, LLC (“Fanatics”) and Fanatics Lids College, Inc. D/B/A “Lids” (“Lids”) (collectively referred to herein as the “F/L Relationship”), win new accounts, and expand our revenue opportunities through strategic relationships. We expect gross comparable store general merchandise sales to increase over the long term, as our product assortments continue to emphasize and reflect changing consumer trends, and we evolve our presentation concepts and merchandising of products in stores and online, which we expect to be further enhanced and accelerated through the F/L Relationship. Fanatics and Lids, acting on our behalf as our service providers, provide unparalleled product assortment, e-commerce capabilities and powerful digital marketing tools to drive increased value for customers and accelerate growth of our logo general merchandise business.

The Barnes & Noble brand (licensed from our former parent) along with our subsidiary brands, BNC and MBS, are synonymous with innovation in bookselling and campus retailing, and are widely recognized and respected brands in the United States. Our large college footprint, reputation, and credibility in the marketplace not only support our marketing efforts to universities, students, and faculty, but are also important to our relationship with leading publishers who rely on us as one of their primary distribution channels.

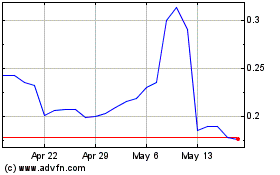

Financing Arrangements

On June 10, 2024, subsequent to the end of Fiscal 2024, we completed various transactions, including an equity rights offering, private equity investment, Term Loan debt conversion, and Credit Facility refinancing, to substantially deleverage our consolidated balance sheet. These transactions raised additional capital for repayment of indebtedness and provide additional flexibility for working capital needs, which will also allow us to strategically invest in innovation and continue to execute our strategic initiatives, including but not limited to the growth of our First Day Complete program. For additional information, see Part II - Item 8. Financial Statements and Supplementary Data - Note 17. Subsequent Events.

SEGMENT

We identify our segments in accordance with the way our business is managed (focusing on the financial information distributed) and the manner in which our chief operating decision maker allocates resources and assesses financial performance. We have one reportable segment as discussed below.

General

We operate 1,245 college, university, and K-12 school bookstores, comprised of 707 physical bookstores and 538 virtual bookstores. Our bookstores typically operate under agreements with the colleges, universities, or K-12 schools to be the official bookstore and the exclusive seller of course materials and supplies, including physical and digital products. The majority of the physical campus bookstores have school-branded e-commerce websites, which we operate independently or along with our merchant service providers, and which offer students access to required and recommended course materials and affinity products, including emblematic apparel and gifts.

We offer existing and prospective clients the flexibility of physical, virtual or custom store solutions. At certain institutions, students also have the flexibility of using financial aid, and proprietary campus debit cards for their course material purchases. Students have access to the right course materials at the right time, combined with a superior in-house customer service department to help with ordering, delivery, and digital content inquiries. We are able to source and distribute new and used textbooks through our inventory management and procurement strategies from suppliers at a lower cost for bulk deliveries and direct-to-customer fulfillment for our bookstores' orders where the bookstore cannot fulfill the order locally.

Our BNC First Day® equitable and inclusive access programs, consisting of First Day Complete and First Day, provide faculty required course materials on or before the first day of class at below market rates, as compared to the total retail price for the same course materials if purchased separately (a la carte), and students are billed the below market rate, directly by the institution as a course charge or included in tuition. We have entered into several agreements with major publishers, including Cengage Learning, McGraw-Hill Education and Pearson Education, to distribute their digital content through BNC First Day. In Fiscal 2024, BNC First Day total sales increased by 37% from the prior year. See BNC First Day Inclusive Access Programs discussion below. In addition to BNC First Day programs, we offer a suite of digital content and services to colleges and universities, including a variety of open education resources (“OER”) course material.

In Fiscal 2024, we signed contracts for 46 new physical and virtual bookstores for estimated first year annual sales of approximately $35 million, which is generally fully achieved as the store becomes fully-operational in their first full year of operations. In Fiscal 2024, we closed 167 stores, with estimated annual sales of $109 million. The Company’s strategic initiative is to close under-performing and less profitable stores. Many institutions have adopted First Day Complete in Fiscal 2024 and we plan to continue to scale the number of schools adopting First Day Complete in Fiscal 2025 and beyond. These programs have allowed us to reverse historical long-term trends in course materials revenue declines as the growth of our BNC First Day programs offsets declines in a la carte courseware sales and closed store sales.

Currently, we estimate that approximately 27% of college and university affiliated bookstores in the United States are operated by their respective institutions. We anticipate that schools will continue to outsource their campus bookstore, and we intend to aggressively pursue profitable new business opportunities to grow our footprint. We evaluate each new contract based on established profitability measures to ensure we maintain a portfolio of profitable accounts. Our ability to offer existing and prospective clients physical, virtual and custom store solutions is a key element of our competitive strategy.

BNC First Day Equitable and Inclusive Access Programs

We provide product and service offerings designed to address the most pressing issues in higher education, including equitable access, enhanced convenience and improved affordability through innovative course material delivery models designed to drive improved student experiences and outcomes. We offer our BNC First Day® equitable and inclusive access programs, consisting of First Day Complete and First Day, which provide faculty required course materials on or before the first day of class at below market rates, as compared to the total retail price for the same course materials if purchased separately (a la carte), and students are billed the below market rate directly by the institution as a course charge or included in tuition.

•First Day Complete is adopted by an institution and includes all or the majority of undergraduate classes (and on occasion graduate classes), providing students both physical and digital materials. The First Day Complete model drives substantially greater unit sales and sell-through for the bookstore.

•First Day is adopted by a faculty member for a single course, and students receive primarily digital course materials through their school's learning management system (“LMS”).

Offering course materials through our equitable and inclusive access First Day Complete and First Day models is an important strategic initiative of ours to meet the market demands of substantially reduced pricing to students, as well as the opportunity to improve student outcomes, while, at the same time, increasing our market share, revenue and relative gross

profits of course material sales given the higher volumes of units sold in such models as compared to historical sales models that rely on individual student marketing and sales. These programs have allowed us to reverse historical long-term trends in course materials revenue declines, which has been observed at those schools where such programs have been adopted, and improve predictability of our future results. In Fiscal 2024, the growth of our BNC First Day programs offset the declines in a la carte courseware sales and closed store sales. We are moving quickly to accelerate our First Day Complete strategy. Many institutions adopted First Day Complete in Fiscal 2024, and we plan to continue to scale the number of schools adopting First Day Complete in Fiscal 2025 and beyond.

The following table summarizes our BNC First Day sales for the 52 weeks ended April 27, 2024 and April 29, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dollars in millions | | 52 weeks ended |

| | April 27, 2024 | | April 29, 2023 | | $ Increase | | % Change |

First Day Complete Sales | | $ | 292.7 | | | $ | 197.8 | | | $ | 94.9 | | | 48% |

First Day Sales | | $ | 181.2 | | | $ | 148.9 | | | $ | 32.3 | | | 22% |

Total BNC First Day Sales | | $ | 473.9 | | | $ | 346.7 | | | $ | 127.2 | | | 37% |

| | | | | | | | |

| First Day Complete | | Spring 2024 | | Spring 2023 | | # Increase | | % Change |

| Number of campus stores | | 160 | | 116 | | 44 | | 38% |

Estimated enrollment (a) | | 805,000 | | 580,000 | | 225,000 | | 39% |

| | | | | | | | |

(a) Total undergraduate and graduate student enrollment as reported by National Center for Education Statistics (NCES) as of October 26, 2023. |

| | | | | | | | |

Relationship with Fanatics and Lids

In December 2020, we entered into the F/L Relationship. Fanatics and Lids, acting on our behalf as our service providers, provide unparalleled product assortment, e-commerce capabilities and powerful digital marketing tools to drive increased value for customers and accelerate growth of our logo general merchandise business. Fanatics operates as our service provider, including processing consumer personal information on our behalf, using their cutting-edge e-commerce and technology expertise to offer our campus store websites expanded product selection, a world-class online and mobile experience, and a progressive direct-to-consumer platform. Coupled with Lids, the leading standalone brick and mortar retailer focused exclusively on licensed fan and alumni products, our campus stores have improved access to trend and sales performance data on licensees, product styles, and design treatments.

We maintain our relationships with campus partners and remain responsible for staffing and managing the day-to-day operations of our campus bookstores. We also work closely with our campus partners to ensure that each campus store maintains unique aspects of in-store merchandising, including localized product assortments and specific styles and designs that reflect each campus’s brand. We leverage Fanatics’ e-commerce technology and expertise for the operational management of the emblematic merchandise and gift sections of our campus store websites. Lids manages in-store assortment planning and merchandising of emblematic apparel, headwear, and gift products for our partner campus stores, and Lids owns the inventory it manages, relieving us of the obligation to finance inventory purchases from working capital. As the logo and emblematic general merchandise sales are fulfilled by Lids and Fanatics, we recognize commission revenue earned for these sales on a net basis in our consolidated financial statements, as compared to the recognition of logo and emblematic general merchandise sales on a gross basis prior to April 2021.

Contracts

Physical and Custom Campus Bookstore Solutions

We operate 707 physical campus bookstores. Our physical bookstores are typically operated under management agreements with the college or university to be the official college or university bookstore and the exclusive seller of course materials and supplies, including physical and digital products sold in-store, online or through learning management systems. We pay the school a percentage of sales for the right to be the official college or university bookstore and the use of the premises; approximately half of our agreements do not have any minimum guaranteed amount to be paid to our partners. In addition, we have the non-exclusive right to sell all items typically sold in a college bookstore both in-store and online. We also have the ability to integrate the store's systems with the colleges and university’s systems in order to accept student financial aid, university debit cards and other forms of payment. Our decentralized management structure empowers local teams to make decisions based on the local campus needs and fosters collaborative working relationships with our partners.

For those on-campus stores with a limited store footprint, we also offer solutions for institutions to provide general merchandise products at the physical on-campus store, with course materials offered virtually and fulfilled direct-to-student (either to an individual address or a central campus pick-up point).

The physical bookstore management contracts with colleges and universities typically include five-year terms with renewal options and are typically cancellable by either party without penalty with 90 to 120 days' notice. Our campus bookstores have an average relationship tenure of 15 years. From Fiscal 2021 through Fiscal 2024, approximately 82% of these contracts were renewed or extended, often before their termination dates.

Virtual Campus Bookstore Solutions

We operate 538 virtual campus bookstores. Our virtual bookstores generally operate under a contract as the institution’s official source of course materials with exclusive rights to book lists and access to online programs that link course materials to the courses offered by the school. Our virtual-only solutions typically ship course materials directly to students, but also have the ability to offer ship-to-campus options.

Virtual bookstore agreements typically have terms between three and five years, with automatic renewal periods. For the past three years, we have retained approximately 90% of our contracts annually, with the majority of the contracts automatically renewed as per the contract terms or renewed before their expiration dates. We pay the school a percentage of sales for the right to be the official college or university bookstore.

We also operate Textbooks.comSM which is one of the largest e-commerce sites for new, used, and digital textbooks. This division is primarily for direct-to-student sales.

Customers and Distribution Network

As of April 27, 2024, we operate 707 physical college and university bookstore operations and 538 virtual bookstore operations (350 K-12 virtual stores or 65% and 188 Higher Education virtual stores or 35%) located in the United States, in 50 states and the District of Columbia. Our new business sales team is organized by specific territory and can offer all solutions (physical, virtual or custom store solutions) to public, state, private, community college, trade and technical, for-profit, online education institutions, within their respective territories.

Product and Service Offerings

We offer a broad suite of affordable course materials, including new and used print textbooks (which are available for sale or rent), digital textbooks and publisher-hosted digital courseware, at our physical and virtual bookstores, as well as offered directly to students through Textbooks.com. We offer a robust used textbook selection, unique guaranteed buyback program, dynamic pricing, and marketplace offerings.

Our physical and virtual bookstores provide a comprehensive e-commerce experience and a broad suite of affordable course materials. Additionally, our physical campus stores are social and academic hubs through which students can access affordable course materials, along with emblematic apparel and gifts, trade books, technology, school supplies, café offerings, convenience food and beverages, and graduation products. The majority of physical campus stores also have school-branded e-commerce sites which we operate independently or along with our merchant service providers, and which offer the same products as the on campus stores plus additional items.

Product and service offerings include:

•Course Material Sales and Rentals. Sales and rentals of course materials are a core revenue driver, and our faculty and student platforms operate as a seamless extension of our partner schools’ registration, student information and learning management systems. Students can purchase course materials, including new and used print (available for sale or rent), eTextbooks, and publisher digital courseware platforms. We work directly with faculty to ensure the course materials they have chosen for their courses are available in all required formats before the start of classes. Our distribution channel enables our bookstores to optimize textbook sourcing, so they are able to more efficiently source and distribute a comprehensive inventory of affordable course materials to customers. BNC's Adoption & Insights Portal (“AIP”) is an innovative platform that provides enhanced support for faculty and academic leadership to research, submit and monitor course material selections, further driving affordability and student success.

•Equitable and Inclusive Access. As discussed above, we offer our BNC First Day® equitable and inclusive access programs, consisting of First Day Complete and First Day, which provide faculty required course materials on or before the first day of class at below market rates, as compared to the total retail price for the same course materials if purchased separately (a la carte), and students are billed the below market rate directly by the institution as a course charge or included in tuition. We have contracted with VitalSource Technologies, Inc. (“VitalSource”) to use their technology to power our BNC First Day inclusive access platform, for digitally formatted courseware, from all major publishers, including Cengage Learning, McGraw-Hill Education and Pearson Education, allowing us to accelerate and optimize BNC First Day implementations. The seamless delivery is made possible by our BNC First Day technology and publishers' technology integrations with

campus systems. These initiatives provide students, faculty and institutions greater access to more affordable course materials. First Day is offered on a class-by-class basis, as adopted by the individual instructors on a campus, as compared to First Day Complete, an institution adopts the program for all or the vast majority of undergraduate (and on occasion graduate) courses. In Fiscal 2024, BNC First Day programs' total sales increased by 37% from the prior year. First Day Complete offers the delivery of both digital and physical course materials priced at below market rates, as compared to the total retail price for the same course materials if purchased separately (a la carte). Offering course materials through our equitable and inclusive access programs is an important strategic initiative of ours to meet the market demands of substantially reduced pricing to students while, at the same time, increasing our market share, revenue and relative gross margins of course materials sales given the higher volumes of units sold in such models as compared to historical sales models that rely on individual student marketing and sales.

•Inventory Distribution. Our large inventory of used textbooks consists of approximately 235,000 unique textbook titles in stock, and utilizes a highly automated distribution facility that is capable of processing over 21 million textbooks annually.

Additionally, we are a national distributor for rental textbooks offered through McGraw-Hill Education's consignment rental program (which includes approximately 1,136 titles) and Pearson Education’s consignment rental program (which includes approximately 922 titles). Through our centrally located, advanced distribution center, we offer seamless integration of these consignment rental programs and centralized administration and distribution to 1,450 stores, including institutionally run bookstores and contract managed campus bookstores, as well as our physical and virtual bookstores.

•eTextbooks. We have contracted with VitalSource, a global leader in building, enhancing and delivering digital content, on our digital reading platform and digital content catalog. The strategic relationship with VitalSource allows us to use its technology to power our BNC First Day platform, as well as our a la carte digital course material platform and catalog, for digitally formatted course materials, allowing us to accelerate and optimize BNC First Day implementations.

•General Merchandise. For our physical campus bookstores and custom store solutions, we drive general merchandise sales through both in-store and online channels and feature collegiate and athletic apparel, other custom-branded school spirit products, lifestyle and wellness products, technology products, supplies, graduation products and convenience items. We continue to see growth in general merchandise sales, which has been further bolstered through our F/L Relationship, as discussed above. We continue to enhance the user experience and product mix offered through our next generation e-commerce platform. In Fiscal 2024, Gross Comparable Store Sales for general merchandise increased by $6.6 million, or 1.2%.

We operate 48 True Spirit apparel and spirit shop e-commerce websites, through our F/L Relationship, which are virtual stores that appeal specifically to the alumni and sports fan base. We also operate pop-up retail locations at major sporting events, such as football and basketball games, for our partner colleges and universities. The True Spirit e-commerce websites for athletic branded merchandise and the physical pop-up retail locations build our partner schools’ brands through alumni and athletics, fostering school spirit and capturing the excitement of collegiate sports. We utilize event driven direct marketing strategies for events, such as tournaments and playoffs or homecoming events, to target an online population of students, alumni and sports fans, with emails, social media posts, and search engine marketing.

•Cafés and Convenience Stores. At our physical campus locations, we operate 63 customized cafés, featuring Starbucks Coffee®, as well as regional coffee roasters, and 19 stand-alone convenience stores. Our Café locations and convenience marketplaces offer diverse grab-and-go options including organic, vegan, gluten-free and regional fresh food products. These offerings increase traffic and time spent in our physical stores. As market needs change, we are adapting our model to include more grab-and-go pre-packed fresh food items, simplified menus to reduce food waste and new technology to reduce operating complexity and make the customer experience more efficient.

•Brand Marketing Programs. Through our unique relationship with students, colleges and universities, and our premier locations on campus and online, we operate as a media channel for brands looking to target the college demographic, and derive revenue from these marketing programs. We also focus on promoting lifestyle products to students and faculty by promoting various brands to connect on a much more personal level. We create strategic, integrated campaigns which include research, email, social media, display advertising, on-campus events, signage, and sampling. Our client list includes brands such as Clinique, College Ave, Dell, DoorDash, HelloFresh, Hewlett-Packard, and Wall Street Journal. Revenue from these services have high margin rates due to the relatively low incremental cost structure to provide these services.

•Inventory Management, Hardware and POS Software Services. We sell hardware and a software suite of applications that provides inventory management and point-of-sale solutions to approximately 325 college bookstores. We provide on-site installation for point-of-sale terminals and servers, and offer technical assistance through user training and our support center facility. The cost savings and ease of deployment ensure clients get the most out of their management systems and create strong customer loyalty.

Merchandising and Supply Chain Management

Our purchasing procedures vary based on type of bookstore (physical or virtual) and by product type (i.e., course materials, general merchandise or trade books).

Course Materials and Trade Books

Purchases are made at the bookstore level with strategic corporate oversight to determine purchase quantities and maintain appropriate inventory levels. After titles are adopted for an upcoming term, we determine how much inventory to purchase based on several factors, including student enrollment and the previous term’s course material sales history. For physical campus bookstores, we use an automated sourcing system to determine if another store has the necessary new or used textbooks on hand and may transfer the inventory to the appropriate store.

The fulfillment order is directed first to our textbook inventory warehouse before other sources of inventory are utilized. We utilize our textbook inventory distribution center to significantly increases our textbook supply at competitive prices, as well as our ability to liquidate non-returnable inventory. Our relationships with institutional bookstores, other bookstore operators, book dealers, publishers, and other distributors and wholesalers secures a supply of high demand new and used textbooks. The products that we sell originate from a wide variety of domestic and international vendors. Our ability to source new and used textbooks is also impacted by the broader macro-economic global supply chain. A primary supplier of used textbooks are students, through the return of previously rented and purchased books to their campus bookstore.

Through this close inventory management, we consolidate textbook units from our multiple bookstores and other non-traditional inventory sources into fewer, but larger, store shipments, reducing our shipping expenses and providing for efficiency of store handling, which puts our books on the stores' shelves faster. Our broad distribution channel and warehousing systems also drive inventory efficiencies by using real-time information regarding title availability, edition status and market prices, allowing us to optimize our course material sourcing and purchasing processes.

After internal sourcing, the bookstore purchases remaining inventory needs from outside suppliers and publishers. Out of stock inventory is minimized by managing inventory through our distribution center. For course material sales and rentals, we utilize sophisticated inventory management platforms to manage pricing and inventory across all stores. Our primary suppliers of new textbooks are publishers, including Pearson Education, Cengage Learning, McGraw-Hill Education, Macmillan Learning, and John Wiley & Sons. Both unsold textbooks and trade books are generally returnable to publishers for full credit. We also receive a supply of used textbooks from students, through returns of previously rented and purchased books. We offer a “Cash for Books” program in which students can sell their books back to the physical or virtual bookstore at the end of the semester, typically in December and May. Students typically receive up to 50% of the price they originally paid for the book if it has been adopted for a future class or the current wholesale price if it has not.

The larger physical bookstores feature an expanded selection of trade books (general reading). Merchants meet with publishers on a regular basis to identify new titles and trends to support this changing business.

General Merchandise

General merchandise vendors and product selection is driven by our central merchant organization that is responsible for curating the overall product assortment, as well as in conjunction with Fanatics and Lids through our F/L Relationship for logo and emblematic general merchandise assortment in-store and online, respectively. Benchmarks are established across school type, region and the demographics of each of our schools to allow for store level insights and customization for a product assortment that is unique to address the needs of each school that we serve. Our ability to support and promote our partner schools’ brands strengthens our relationships with the administration, faculty, alumni, fans, parents and students.

Our ability to source school supplies and general merchandise sold in our campus bookstores, including technology-related products and emblematic clothing, is impacted by the broader macro-economic global supply chain.

Customer Engagement and Marketing

Campus Community

Our campus relationships and contractual agreements allow us to seamlessly integrate into the college and university community. With direct access to our customer base through both physical and digital channels, we drive awareness, revenue and loyalty for the schools that we serve. We actively market and promote to our customer base for our physical and virtual bookstores, as well as Textbooks.com. We develop fully-integrated marketing programs to drive engagement with the students, parents, alumni and fans to promote all of our product and services, with a focus on academic course material needs, as well as school spirit, supply, graduation and technology categories. Textbooks.com marketing strategies target an online population of students, lifelong learners, parents and general textbook shoppers through a variety of channels including email, search engine marketing and affiliate marketing.

We have robust research capabilities that keep us ahead of the rapidly changing needs and behaviors of our customers, which allow us to proactively respond with relevant and dynamic solutions. Our Barnes & Noble College Insights® platform,

which gives us the ability to reach approximately 7 million active students, parents, and alumni via email, and our on-campus activities and opportunities with students and faculty, help to guide and inform our strategies and direction. In addition, we expect to benefit from the F/L Relationship for insights on logo and emblematic merchandise, brand selection and style preferences, as Lids may be able to identify certain retail trends for similar age demographics at their more than 1,100 Lids retail locations. We believe Lids has its finger on the pulse of the buyer behavior of the 12-20 year old student consumer to identify and act on trends prior to other retailers.

Our customizable technology delivers a seamless experience providing students and faculty with the ability to research, locate and purchase the most affordable course materials. Our platforms include single sign-on (“SSO”), student information system integration, registration integration, learning management system integration, real-time financial aid platform, point of sale platform and course fee solutions. Through our fully-integrated purchasing process, students can purchase their course materials in-store, online, or when registering for classes.

Faculty and School Administrators

We support faculty and academic leadership with our proprietary online platform which allows for seamless content research, discovery and course material adoption, enabling them to offer course materials that are both relevant and affordable for their students.

Seasonality

Our business is highly seasonal, particularly with respect to textbook sales and rentals, with the major portion of sales and operating profit realized during the second and third fiscal quarters when college students generally purchase and rent textbooks for the upcoming semesters and lowest in the first and fourth fiscal quarters. Our quarterly results also may fluctuate depending on the timing of the start of the various schools’ semesters, the revenue impact of accounting principles with respect to the recognition of revenue associated with our equitable and inclusive access programs, the ability to secure inventory on a timely basis, as well as shifts in our fiscal calendar dates. These shifts in timing may affect the comparability of our results across periods.

Product revenue is recognized when the customer takes physical possession of our products, which occurs either at the point of sale for products purchased at physical locations or upon receipt of our products by our customers for products ordered through our websites and virtual bookstores. Revenue from the sale of digital textbooks, which contains a single performance obligation, is recognized when the customer accesses the digital content as product revenue in our consolidated financial statements. Revenue from the rental of physical textbooks is deferred and recognized over the rental period based on the passage of time commencing at the point of sale, when control of the product transfers to the customer and is recognized as rental income in our consolidated financial statements. Depending on the product mix offered under the BNC First Day offerings, revenue recognized is consistent with our policies for product, digital and rental sales, net of an anticipated opt-out or return provision.

Given the growth of BNC First Day programs, the timing of cash collection from our school partners may shift to periods subsequent to when the revenue is recognized. When a school adopts our BNC First Day equitable and inclusive access offerings, cash collection from the school generally occurs after the institution’s drop/add dates, which is later in the working capital cycle, particularly in our third quarter given the timing of the Spring Term and our quarterly reporting period, as compared to direct-to-student point-of-sale transactions where cash is generally collected during the point-of-sale transaction or within a few days from the credit card processor. As a higher percentage of our sales shift to BNC First Day equitable and inclusive access offerings, we are focused on efforts to better align the timing of our cash outflows to course material vendors and cash inflows from collections from schools. As the concentration of digital product sales increases, revenue will be recognized earlier during the academic term as digital textbook revenue is recognized when the customer accesses the digital content compared to: (i) the rental of physical textbook where revenue is recognized over the rental period, and (ii) a la carte courseware sales where revenue is recognized when the customer takes physical possession of our products, which occurs either at the point of sale for products purchased at physical locations or upon receipt of our products by our customers for products ordered through our websites and virtual bookstores.

COMPETITION

We operate within a competitive and rapidly changing business environment, and face competition for the products and services we offer. As it relates to our full-service campus bookstore operations, Follett Corporation is the primary competitor for institutional contracts. We also compete with other vendors, including eCampus, BBA Solutions, University Gear Shop, Valore Campus, Textbook Brokers, Texas Book Company, BibliU, Slingshot, Akademos, and on occasion, Ambassador Educational Solutions for virtual store operations. We also face competition from direct-to-student course material channels, including Amazon, Chegg.com, publishers (e.g., Cengage Learning, Pearson Education and McGraw-Hill Education) that bypass the retail distribution channel by selling directly to students and institutions and other third-party websites and/or local bookstores. New and used textbook inventory and distribution competitors include Amazon, GoTextbooks, Valore Books, and

Texas Book Company. We face competition from eTextbook/digital content providers VitalSource Technologies, Inc., and Red Shelf, which offer independent bookstores a catalog of digital content and distribution services and also have direct-to-student selling channels for digital materials. VitalSource recently acquired Akademos, providing a distribution solution for print materials.

Competitors for institutional contracts for our cafe and convenience general merchandise offerings include Sodexo and Aramark. Our general merchandise business also faces competition from direct-to-student sales from Walmart, Amazon, Dick’s Sporting Goods, Fanatics, Lids, and other third-party online retailers, physical and online office supply stores and local and national retailers that offer college-themed and other general merchandise.

TRENDS AND OTHER BUSINESS CONDITIONS AFFECTING OUR BUSINESS

The market for educational materials continues to undergo significant change. As tuition and other costs rise, colleges and universities face increasing pressure to attract and retain students and provide them with innovative, affordable educational content and tools that support their educational development. Current trends, competition and other factors affecting our business include:

•Overall Capital Markets, Economic Environment, College Enrollment and Consumer Spending Patterns. Our business is affected by capital markets, the overall economic environment, funding levels at colleges and universities, by changes in enrollments at colleges and universities, and spending on course materials and general merchandise.

•Capital Market Trends: We may require additional capital in the future to sustain or grow our business, including implementation of our strategic initiatives. The future availability of financing will depend on a variety of factors, such as economic and market conditions, and the availability of credit. These factors have and could continue to materially adversely affect our costs of borrowing, and our financial position and results of operations would be adversely impacted. Volatility in global financial markets may also limit our ability to access the capital markets at a time when we would like, or need, to raise capital, which could have an impact on our ability to react to changing economic and business conditions.

•Economic Environment: General merchandise sales are subject to short-term fluctuations driven by the broader retail environment and other economic factors, such as interest rate fluctuations and inflationary considerations. Broader macro-economic global supply chain issues could impact our ability to source textbooks, school supplies and general merchandise sold in our campus bookstores, including technology-related products and emblematic clothing. Union and labor market issues may also impact our ability to provide services and products to our customers. A significant reduction in U.S. economic activity could lead to decreased consumer spending.

•Enrollment Trends: The growth of our business depends on our ability to attract new customers and to increase the level of engagement by our current customers. In the Fall of 2023 and Spring of 2024, we observed increased year-over-year enrollment trends. Enrollment trends, specifically at community colleges, generally correlate with changes in the economy and unemployment factors, e.g., low unemployment tends to lead to low enrollment and higher unemployment rates tend to lead to higher enrollment trends, as students generally enroll to obtain skills that are in demand in the workforce. Additionally, enrollment trends are impacted by the dip in the United States birth rate resulting in fewer students at the traditional 18-24 year-old college age. Online degree program enrollments continue to grow, which impacts the level of in-store traffic for general merchandise sales, just as for cafe and convenience products.

•Increased Use of Open Educational Resources ("OER"), Online and Digital Platforms as Companions or Alternatives to Traditional Course Materials, Including Artificial Intelligence ("AI") Technologies. Students and faculty can now choose from a wider variety of educational content and tools than ever before, delivered across both print and digital platforms.

•Increasing Costs Associated with Defending Against Security Breaches and Other Data Loss, Including Cyber-Attacks. We are increasingly dependent upon information technology systems, infrastructure and data. Cyber-attacks are increasing in their frequency, sophistication and intensity, and have become increasingly difficult to detect. We continue to invest in data protection, including insurance, and information technology to prevent or minimize these risks and, to date, we have not experienced any material service interruptions and are not aware of any material breaches.

•Distribution Network Evolving. The way course materials are distributed and consumed is changing significantly, a trend that is expected to continue. The market for course materials, including textbooks and supplemental materials, is intensely competitive and subject to rapid change.

•Disintermediation. We are experiencing growing competition from alternative media and alternative sources of textbooks and other course materials. In addition to the official physical or virtual campus bookstore, course materials are also sold through off-campus bookstores, e-commerce outlets, digital platform companies, and publishers,

including Cengage Learning, McGraw-Hill Education and Pearson Education, bypassing the bookstore distribution channel by selling or renting directly to students and educational institutions, including student-to-student transactions over the Internet, and multi-title subscription access.

•Suppliers, Supply Chain and Inventory. The products that we sell originate from a wide variety of domestic and international vendors. During Fiscal 2024, our four largest suppliers accounted for approximately 28% of our merchandise purchased, with the largest supplier accounting for approximately 7% of our merchandise purchased. Since the demand for used textbooks has historically been greater than the available supply, our financial results are highly dependent upon our ability to build our textbook inventory from suppliers in advance of the selling season. Some textbook publishers have begun to supply textbooks pursuant to consignment or rental programs which could impact used textbook supplies in the future. Additionally, we are a national distributor for rental textbooks offered through McGraw-Hill Education's and Pearson Education’s consignment rental program. We do not have long-term arrangements with most of our suppliers to guarantee availability of merchandise, content or services, particular payment terms or the extension of credit limits. If our current suppliers were to stop selling merchandise, content or services to us on acceptable terms, including as a result of one or more supplier bankruptcies due to poor economic conditions or refusal by such suppliers to ship products to us due to delayed or extended payment windows as a result of our own liquidity constraints, we may be unable to procure the same merchandise, content or services from other suppliers in a timely and efficient manner and on acceptable terms, or at all. Additionally, delayed or incomplete publisher shipments of physical textbook orders, or delays in receiving digital courseware access codes, could have an adverse impact on sales, including our BNC First Day Complete equitable access program, which relies upon timely receipt of inventory in advance of class start dates each academic term. The broader macro-economic global supply chain issues may also impact our ability to source school supplies and general merchandise sold in our campus bookstores, including technology-related products and emblematic clothing.

•Price Competition. In addition to the competition in the services we provide to our customers, our textbook and other course materials business faces significant price competition. Students purchase textbooks and other course materials from multiple providers, are highly price sensitive, and can easily shift spending from one provider or format to another.

•First Day Complete and First Day Models. Offering course materials sales through our equitable and inclusive access First Day Complete and First Day models is a key, and increasingly important, strategic initiative of ours to meet the market demands of substantially reduced pricing to students. Our First Day Complete and First Day programs contribute to improved student outcomes, while increasing our market share, revenue and relative gross profits of course materials sales given the higher volumes of units sold in such models as compared to historical sales models that rely on individual student marketing and sales. These programs have allowed us to reverse historical long-term trends in course materials revenue declines as the growth of our BNC First Day programs offsets declines in a la carte courseware sales and closed store sales. We are moving quickly to accelerate our First Day Complete strategy. Many institutions adopted First Day Complete in Fiscal 2024, and we plan to continue to scale the number of schools adopting First Day Complete in Fiscal 2025 and beyond. We cannot guarantee that we will be able to achieve these plans within these timeframes or at all. Additionally, the United States Department of Education has recently proposed regulatory changes that, if adopted as proposed, could impact equitable and inclusive access models across the higher education industry.

•A Large Number of Traditional Campus Bookstores Have Yet to be Outsourced.

•Outsourcing Trends. We continue to see the trend towards outsourcing in the campus bookstore market and also continue to see a variety of business models being pursued for the provision of course materials (such as equitable and inclusive access programs and publisher subscription models) and general merchandise.

•New and Existing Bookstore Contracts. We expect awards of new accounts resulting in new physical and virtual store openings will continue to be an important driver of future growth in our business. We also expect that certain less profitable or non-essential bookstores we operate may close, as we focus on the profitability of our stores. In Fiscal 2024, the growth of our BNC First Day programs offset the declines in a la carte courseware sales and closed store sales. We are moving quickly and decisively to accelerate our First Day Complete strategy.

GOVERNMENT LAWS AND REGULATIONS

We are subject to a number of laws and regulations that affect companies conducting business on the Internet and in the education industry, many of which are still evolving and could be interpreted in ways that could harm our business. For example, we often cannot be certain how existing laws and regulations, or new laws and regulations, will apply in the e-commerce and online context, including, but not limited to such topics as privacy, antitrust, credit card fraud, advertising, taxation, sweepstakes, promotions, content regulation, financial aid, scholarships, student matriculation and recruitment, quality of products and services and intellectual property ownership and infringement.

Numerous laws and regulatory schemes have been adopted at the national and state level in the United States, and in some cases internationally, that have a direct impact on our business and operations. For example:

The Controlling and Assault of Non-Solicited Pornography and Marketing Act of 2003 (“CAN-SPAM Act”) and similar laws adopted by most U.S. states, which pertain directly or indirectly to commercial email, regulate unsolicited commercial emails, create criminal penalties for emails containing fraudulent headers and control other abusive online marketing practices. Similarly, the U.S. Federal Trade Commission (“FTC”) has guidelines that impose responsibilities on us with respect to communications with consumers and impose fines and liability for failure to comply with rules with respect to advertising or marketing practices they may deem misleading or deceptive.

The Telephone Consumer Protection Act of 1991 (“TCPA”) restricts telemarketing and the use of automated telephone equipment. The TCPA limits the use of automatic dialing systems, artificial or prerecorded voice messages, SMS text messages and fax machines. It also applies to unsolicited text messages advertising the commercial availability of goods or services. Additionally, a number of states have enacted statutes that address telemarketing. For example, some states, such as California, Illinois and New York, have created do-not-call lists. Other states, such as Oregon and Washington, have enacted “no rebuttal statutes” that require the telemarketer to end the call when the consumer indicates that he or she is not interested in the product being sold. Restrictions on telephone marketing, including calls and text messages, are enforced by the FTC, the Federal Communications Commission, states and through the availability of statutory damages and class action lawsuits for violations of the TCPA.

The Restore Online Shopper Confidence Act (“ROSCA”), and similar state laws, impose requirements and restrictions on online services that automatically charge payment cards on a periodic basis to renew a subscription service, if the consumer does not cancel the service.

Laws and regulations related to the Program Participation Agreement of the U.S. Department of Education, which define the terms and conditions that an institution must meet to begin and continue participation in the Title IV federal student aid programs, and other similar laws regulate the recruitment of students to colleges and other institutions of higher learning.

The Digital Millennium Copyright Act (“DMCA”) provides relief for claims of circumvention of copyright protected technologies and includes a safe harbor intended to reduce the liability of online service providers for hosting, listing or linking to third-party content that infringes copyrights of others.

The Communications Decency Act provides that online service providers will not be considered the publisher or speaker of content provided by others, such as individuals who post content on an online service provider’s website.

The Company is subject to certain laws relating to the collection, use, retention, security and transfer of personal information. In many cases, these laws and regulations apply to not only third-party transfers of personal information, but also may impact transfers of personal information among the company and its affiliates. In the absence of a federal comprehensive consumer data privacy law, 16 U.S. states have enacted comprehensive consumer privacy laws as of April 29, 2024, including California, Colorado, Connecticut, Delaware, Indiana, Iowa, Kentucky, Montana, Nebraska, New Hampshire, New Jersey, Oregon, Tennessee, Texas, Utah and Virginia.

HUMAN CAPITAL

Overview

As of April 27, 2023, we had approximately 3,750 domestic employees, of which approximately 2,400 were full-time and the remaining were regularly scheduled part-time employees, and approximately 120 full-time international employees. In addition, we employed approximately 5,000 temporary and seasonal domestic employees during peak periods during Fiscal 2024. Our employees are not represented by unions, except for 9 employees, in locations with existing collective bargaining agreements and approximately 40 employees at a single location for which an initial collective bargaining agreement is pending negotiations. We believe that our relationship with our employees is good.

Personnel recruitment and training

We believe our continued success is dependent in part on our ability to attract, retain and motivate quality employees. Our success depends on our ability to promote and recruit qualified corporate personnel, regional and store managers and full-time and part-time store employees. Regional managers are primarily responsible for recruiting new store managers, while store managers are responsible for the hiring and training of store employees. Many of our part-time retail store employees are students attending the colleges and universities we serve. To attract and retain motivated and talented people, we look for opportunities to promote from within the Company.

We are always actively recruiting talented people with a passion for education for our retail stores and corporate offices, including our part-time and seasonal roles, and to be a part of our work study/internship program. To find our pool of talent, we

network internally and externally via our talent acquisition team, through agency relationships and current employees whom we mobilize as “talent scouts” and brand ambassadors.

We are committed to diversity in the workplace as we believe our company’s talent should reflect the faculty, students and communities we serve on each of our campuses. As we aim to hire a truly diverse overall workforce, we have formed partnerships with Historically Black Colleges and Universities (“HBCUs”) and Hispanic Serving Institutions (“HSIs”) and are looking to continue developing relationships with veteran agencies and organizations that support individuals with disabilities to assist with the recruitment of these individuals.

We invest in our employees through structured training programs that offer all employees opportunities for development. We create, manage, or offer a large collection of courses for employees that cover a range of subjects such as goal setting, how to be an effective leader, situational leadership, and effective communication.

Student employees have the opportunity to participate in our Aspiring Leaders Management Development Program, which is geared toward our Campus Store Team Members and Supervisors that show interest in developing their managerial skills as well as learning more about the ins and outs of running one of our unique campus bookstores. Learning and Development has created a comprehensive and interactive program for those interested in joining.

As a major employer of Millennials and Generation Z employees, Barnes & Noble College has become an “employer of choice” among students nationwide and our distribution warehouse also offers employment opportunities to students.

Compensation and benefits

We are committed to providing competitive pay and benefits to our employees. Corporate and store management, including store directors, regional managers and store managers, are compensated with base pay plus annual bonuses based on financial metrics. We also offer equity awards to employees in several levels of management. Non-management employees are compensated on an hourly basis in addition to periodic contests and rewards. Many of our employees participate in one of our various incentive programs, which provide the opportunity to receive additional compensation based upon department or Company performance.

We also provide our eligible employees the opportunity to participate in a 401(k)-retirement savings plan which includes an annual end of fiscal year discretionary Company match. We offer a competitive benefits package for eligible employees and an employee discount on merchandise purchased from our stores.

In addition, we offer an employee assistance program that provides employees and their family members immediate support and guidance, including access to free short-term licensed counseling services, as well as assessments and referrals for further services. Employees have 24-hour access by phone and through an interactive website to find information and resources for hundreds of everyday work and life issues, search for clinicians, submit online service requests and participate in interactive, customizable self-improvement programs.

Diversity, Equity and Inclusion (“DEI”)

We are focused on creating an inclusive culture and a diverse employee base to better serve our diverse customer base. We provide programming to our employees on diversity, equity and inclusion topics. Approximately 66% of our full-time and part-time domestic employees identify as women and approximately 33% identify as ethnically diverse.

We have required all employees to complete training aimed at preventing harassment and discrimination. To establish our DEI program, we engaged an outside consultant to evaluate current practices and impressions and assist us in educating employees on aspects of diversity and inclusion about which they may not have been aware.

We have developed a DEI blueprint to help fulfill our company’s mission and purpose to elevate lives through education and build a stronger sense of belonging by actively engaging employees and collaborating closely with the campuses we serve. We understand that to affirm our mission and values, we must commit to a set of DEI best practices that will help us recognize changing demographics and shifting needs of the institutions, students, faculty and communities we serve in order to actively respond and adapt as needed.

Our DEI program is managed by Corporate Communications and our Chief Human Resources Officer and overseen by our Board of Directors. The following is an overview of the DEI initiatives we have undertaken:

•Ensuring our commitment to DEI is clear to our employees and the constituents we serve by promoting the DEI statement we developed in Fiscal 2022;

•Continuing to update DEI policies as a fundamental element in the way we do business;

•Partnering with Billie Jean King Enterprises from January 2022 through March 2023 to help establish DEI programming and initiatives;

•Utilizing internal channels, including employee portals, to celebrate cultural themes, and calendars to help drive a greater sense of belonging for all employees across our company;

•Providing DEI learning and development opportunities including training on Diversity Awareness, Inclusive Leadership and Confronting Unconscious Bias;

•Launching our Company’s Employee Resource Group (“ERG”) program, with a company-wide ERG survey, internal learning session, providing ongoing support for the first two ERGs: Gender Equity and Community Pride 365 as well as internal communications on the programming and the groups’ initiatives;

•Partnering with our campus clients to explore new ways to increase our role as a model of diverse and inclusive business operations;

•Promoting campus partner activities; and

•In recent years, we have hosted external webinars featuring partner institutions and industry experts on how to serve the evolving needs of students and their communities. Discussions have included equitable access, solutions for the future workforce, how to better serve a diverse student population, Hispanic Serving Institutions and students with intellectual and developmental disabilities, and mental health and wellness.

Safety

Employee safety is a top priority. We have developed policies to ensure the safety of each employee and compliance with Occupational Safety and Health Administration standards.

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

The following sets forth information regarding our executive officers, including their positions (ages as of June 21, 2024):

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

| Jonathan Shar | | 55 | | Chief Executive Officer |

| Michael C. Miller | | 52 | | Executive Vice President, Corporate Development & Affairs, Chief Legal Officer, and Secretary |

Kevin F. Watson | | 58 | | Executive Vice President, Chief Financial Officer |

| Seema C. Paul | | 60 | | Senior Vice President, Chief Accounting Officer |

Jonathan Shar, age 55, was appointed Chief Executive Officer in June 2024. Previously, Mr. Shar served as our Executive Vice President, BNED Retail and President, Barnes & Noble College Booksellers, LLC since October 2021. Prior to that, he served as Executive Vice President, Retail. Mr. Shar has overall responsibility for the growth and profitability of the Company, including the development and implementation of client-focused solutions that deliver innovation and increased value to the higher education marketplace; and providing strategic direction and operational leadership across the Company. Mr. Shar also leads strategy and execution for merchandising, marketing, and business development, serving the higher education and K-12 markets. Previously, Mr. Shar served as Senior Vice President, Revenue and Product Development for the Company. Prior to joining BNED in 2018, Mr. Shar was Chief Marketing Officer at Akademos, Inc., an e-commerce and digital marketing company that provides online bookstore services, from 2014 to 2018. He previously was the General Manager of NOOK Digital Content at Barnes & Noble, Inc. where he oversaw business development, product development and marketing for the Global NOOK Newsstand, NOOK Video and NOOK Apps digital businesses. Prior to his nearly five years with NOOK, he served as Senior Vice President and General Manager at CNNMoney, responsible for the CNNMoney website and mobile franchise. Prior to that, he was Vice President of Consumer Marketing at Sports Illustrated Group and Director of Consumer Marketing for FORTUNE Magazine Group.

Michael C. Miller, age 52, serves as our Executive Vice President, Corporate Development & Affairs, Chief Legal Officer, and Corporate Secretary. Previously, Mr. Miller served as Executive Vice President, Corporate Strategy and General Counsel. Mr. Miller joined Barnes & Noble Education in April 2017. Before joining the Company, he served as Executive Vice President, General Counsel and Secretary of Monster Worldwide, Inc. from December 2008 through December 2016, as Vice President and Deputy General Counsel from July 2008 to December 2008, and as Vice President and Associate General Counsel from October 2007 to July 2008. Prior to Monster, Mr. Miller was Senior Counsel for Motorola, Inc. from February 2007 to September 2007. From June 2002 to January 2007, he served in various capacities as Senior Corporate Counsel for Symbol Technologies, Inc. Prior to joining Symbol, Mr. Miller was associated with both Sullivan & Cromwell, LLP and Winthrop, Stimson, Putnam & Roberts in New York.

Kevin F. Watson, age 58, was appointed as Executive Vice President, Chief Financial Officer in September 2023. In this role, Mr. Watson is responsible for the company’s financial management, including leading the accounting, treasury, tax, financial planning and operations, internal audit and investor relations teams. Prior to joining BNED, he was Executive Vice President and Chief Financial Officer for Paraco Gas Corporation. At Paraco, he oversaw the financial management of the Company, including accounting, tax, internal audit, human resources, information technology, supply chain, business intelligence, risk management, and mergers and acquisitions. Before joining Paraco Gas in 2018, he served as a senior financial

executive for Cablevision Systems Corporation, PanAmSat Corporation and Entex IT Services, as well as various finance roles at MCI Telecommunications and Prudential Securities, Inc. Mr. Watson holds a Bachelor of Business Administration in Finance from Iona University.

Seema C. Paul, age 60, has served as our Senior Vice President, Chief Accounting Officer since July 2015. In this role she manages the external reporting, technical accounting, and corporate accounting functions of the Company. Prior to joining the Company, Ms. Paul held positions of increasing responsibility at Covanta Holding Corporation, including Corporate Controller from July 2014 to July 2015, Senior Director-External Reporting & Technical Accounting from June 2013 to July 2014, Director-External Reporting from January 2011 to May 2013 and Manager-External Reporting from August 2005 to December 2010. Ms. Paul is a Certified Public Accountant and has held various senior financial roles with several large companies, including Net2Phone, Sybase, Inc. and Liberty Mutual Insurance Company.

Item 1A. RISK FACTORS

The risks and uncertainties set forth below, as well as other risks and uncertainties described elsewhere in this Annual Report on Form 10-K including in our consolidated financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” or in other filings by BNED with the SEC, could adversely affect our business, financial condition, results of operations and the trading price of our common stock. Additional risks and uncertainties that are not currently known to us or that are not currently believed by us to be material may also harm our business operations and financial results. Because of the following risks and uncertainties, as well as other factors affecting our financial condition and operating results, past financial performance should not be considered to be a reliable indicator of future performance, and investors should not use historical trends to anticipate results or trends in future periods.

Risks Relating to our Business and Industry

We are dependent upon access to the capital markets, bank credit facilities, and short-term vendor financing for liquidity needs.