Clearwater Paper Corporation (NYSE:CLW), a premier

independent supplier of bleached paperboard to North American

converters today reported financial results for the third quarter

and nine months ended September 30, 2024.

THIRD QUARTER HIGHLIGHTS

With the consummation of the sale of our tissue business on

November 1, 2024, all periods presented include our former tissue

segment as discontinued operations and the paperboard segment plus

corporate expenses as continuing operations. Total operations

includes both continuing and discontinued operations.

- Net sales from continuing operations of $393 million, up 41%

from the third quarter of last year primarily due to incremental

volume from our Augusta facility

- Net sales from total operations of $644 million, up 24% from

the third quarter of last year

- Net loss from continuing operations of $11 million, or 0.64 per

diluted share compared to net income from continuing operations of

$15 million, or $0.88 per diluted share in the third quarter of

last year

- Net income from total operations of $6 million, or $0.35 per

diluted share compared to $37 million, or $2.17 per diluted share

in the third quarter of last year

- Adjusted EBITDA from total operations of $64 million compared

to $81 million in the third quarter of last year

“We delivered a strong third quarter, even as we dealt with the

impact of Hurricane Helene at our Augusta, Georgia and Shelby,

North Carolina facilities,” said Arsen Kitch, president and CEO.

“We are also pleased that we closed on the sale of our tissue

business and are now well positioned to execute on our strategy of

building a premier paperboard company that is focused on servicing

independent converters in North America.”

NEW $100 MILLION SHARE REPURCHASE AUTHORIZATION

Clearwater Paper's Board of Directors has approved a new $100

million share repurchase authorization, allowing the Company to

opportunistically repurchase shares in addition to offsetting the

dilution from employee share grants. This authorization replaces

the Company’s previous authorization. The timing and amount of any

repurchases of common stock will be solely at the discretion of the

Company and is subject to general business and market conditions,

as well as other factors. The authorization permits the Company to

make repurchases of its common stock from time to time in open

market or privately negotiated transactions, including accelerated

share repurchase transactions and the use of Rule 10b5-1 trading

plans. The authorization has no expiration date.

OVERALL RESULTS

For the third quarter of 2024, Clearwater Paper reported net

sales from total operations of $644 million compared to $520

million for the third quarter of 2023. Clearwater Paper reported

net income from total operations for the third quarter of 2024 of

$6 million, or $0.35 per diluted share compared to $37 million, or

$2.17 per diluted share in the third quarter of 2023. Adjusted

EBITDA from total operations was $64 million compared to third

quarter of 2023 of $81 million. The decrease in Adjusted EBITDA

from total operations was primarily driven by lower sales prices

and the residual impacts of the company's planned major maintenance

outage at its Lewiston, Idaho facility offset by higher sales

volume due to the inclusion of our Augusta facility.

For the first nine months of 2024, Clearwater Paper reported net

sales from total operations of $1.7 billion, a 10% increase

compared to $1.6 billion for the first nine months of 2023.

Clearwater Paper reported a net loss from total operations for the

first nine months of 2024 of $3 million, or $0.17 per diluted

share, compared to net income from total operations for the first

nine months of 2023 of $90 million, or $5.29 per diluted share.

Adjusted EBITDA from total operations for the first nine months of

2024 was $160 million, compared to the first nine months of 2023 of

$218 million. The decrease in Adjusted EBITDA from total operations

was primarily driven by lower sales prices and the impacts of the

company's planned major maintenance outage at its Lewiston Idaho

facility, partially offset by lower input costs.

Paperboard sales volumes and prices:

- Sales volumes were 314,320 tons in the third quarter of 2024,

an increase of 67% compared to 187,944 tons in the third quarter of

2023. Sales volumes were 774,207 tons in the first nine months of

2024, an increase of 37% compared to 563,502 tons in the first nine

months of 2023.

- Paperboard average net selling price decreased 12% to $1,192

per ton for the third quarter of 2024, compared to $1,350 per ton

in the third quarter of 2023. Paperboard average net selling price

decreased 13% to $1,223 per ton for the first nine months of 2024,

compared to $1,401 per ton in the first nine months of 2023.

COMPANY OUTLOOK

“While we are currently experiencing challenging SBS industry

conditions, we remain confident in the long-term fundamentals of

paperboard packaging. We are taking actions to reduce our costs to

ensure that we deliver strong cash flows regardless of where we are

in the industry cycle. We used proceeds from the sale of our tissue

business to de-lever our balance sheet and position ourselves to

take advantage of opportunities to grow and diversify our

paperboard product portfolio.”

WEBCAST INFORMATION

Clearwater Paper Corporation will discuss these results during

an earnings conference call that begins at 2:00 p.m. Pacific Time

today. A live webcast and accompanying supplemental information

will be available on the company's website. A replay of today's

conference call will be available on the website beginning at 5:00

p.m. Pacific Time today.

ABOUT CLEARWATER PAPER CORPORATION

Clearwater Paper is a premier independent supplier of paperboard

packaging products to North American converters. Headquartered in

Spokane, Wash., our team produces high-quality paperboard that

provides sustainable packaging solutions for consumer goods and

food service applications. For additional information, please visit

our website at www.clearwaterpaper.com.

USE OF NON-GAAP MEASURES

In this press release, the company presents certain non-GAAP

financial information for the third quarter and first nine months

of 2024 and 2023, including Adjusted EBITDA from total operations

which includes both continuing and discontinued operations and net

sales from total operations which includes both continuing and

discontinued. Because these amounts are not in accordance with

GAAP, reconciliations to net income as determined in accordance

with GAAP are included in the tables at the end of this press

release. The company presents these non-GAAP metrics because

management believes they assist investors and analysts in comparing

the company's performance across reporting periods on a consistent

basis by excluding items that the company does not believe are

indicative of its core operating performance. In addition, the

company uses Adjusted EBITDA from total operations: (i) as a factor

in evaluating management’s performance when determining incentive

compensation, (ii) to evaluate the effectiveness of the company's

business strategies, and (iii) because the company's credit

agreement and the indentures governing the company's outstanding

notes use metrics similar to Adjusted EBITDA from total operations

to measure the company's compliance with certain covenants.

FORWARD-LOOKING STATEMENTS

This press release contains certain “forward-looking” statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended by the Private Securities Litigation Reform Act of 1995 as

amended, including statements regarding: the recent sale of our

consumer products division (tissue business); the acquisition of

the paperboard manufacturing facility and associated business in

Augusta, Georgia; our expectations regarding paperboard demand; the

company’s paperboard strategy, including its plans to grow and

diversify its paperboard business; the company’s plans for the

proceeds from the recent consumer products division (tissue

business) sale transaction; and the company’s expectation that

paperboard represents the best opportunity for steady and

sustainable value creation. These forward-looking statements are

based on management’s current expectations, estimates, assumptions

and projections that are subject to change. Our actual results of

operations may differ materially from those expressed or implied by

the forward-looking statements contained in this press release.

Factors that could cause or contribute to such material differences

in actual results include, but are not limited to: there may be

unexpected costs, charges or expenses resulting from the recent

tissue business sale transaction; competitive responses to the

recent tissue business sale transaction; achievement of anticipated

financial results and other benefits of the recent tissue business

sale transaction; potential risks associated with operating without

the tissue business, including less diversification in products

offered; changes in our capital structure; there may be stockholder

litigation in connection with the recent tissue business sale

transaction or the acquisition of the Augusta, Georgia paperboard

manufacturing facility or other settlements; our inability to

realize the expected benefits of the Augusta, Georgia paperboard

manufacturing facility acquisition because of integration

difficulties or other challenges; risks relating to the integration

of the Augusta, Georgia paperboard manufacturing facility and

achievement of anticipated financial results and other benefits of

the acquisition; competitive pricing pressures for our products,

including as a result of capacity additions, demand reduction and

the impact of foreign currency fluctuations on the pricing of

products globally; changes in the U.S. and international economies

and in general economic conditions in the regions and industries in

which we operate; manufacturing or operating disruptions, including

equipment malfunctions and damage to our manufacturing facilities;

the loss of, changes in prices in regard to, or reduction in,

orders from a significant customer; changes in the cost and

availability of wood fiber and wood pulp; changes in energy,

chemicals, packaging and transportation costs and disruptions in

transportation services impacting our ability to receive inputs or

ship products to customers; reliance on a limited number of

third-party suppliers, vendors and service providers required for

the production of our products and our operations; changes in

customer product preferences and competitors’ product offerings;

cyber-security risks; larger competitors having operational,

financial and other advantages; consolidation and vertical

integration of converting operations in the paperboard industry;

our ability to successfully execute capital projects and other

activities to operate our assets, including effective maintenance,

implement our operational efficiencies and realize higher

throughput or lower costs; IT system disruptions and IT system

implementation failures; labor disruptions; cyclical industry

conditions; changes in expenses, required contributions and

potential withdrawal costs associated with our pension plans;

environmental liabilities or expenditures and climate change; our

ability to attract, motivate, train and retain qualified and key

personnel; our ability to service our debt obligations and

restrictions on our business from debt covenants and terms; changes

in our banking relations, or in our customer supply chain

financing; negative changes in our credit agency ratings; changes

in laws, regulations or industry standards affecting our business;

and other risks and uncertainties described from time to time in

the company’s public filings with the Securities and Exchange

Commission, including its Annual Report on Form 10-K for the year

ended December 31, 2023. The forward-looking statements are made as

of the date of this press release and the company does not

undertake to update any forward-looking statements based on new

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104599041/en/

Clearwater Paper Corporation

Investors: Sloan Bohlen Solebury Strategic Communications

509-344-5906 investorinfo@clearwaterpaper.com

News media: Virginia Aulin, Vice President, Public

Affairs 509-344-5967 Virginia.aulin@clearwaterpaper.com

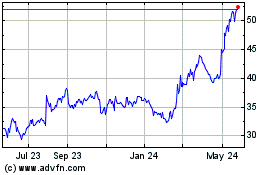

ClearWater Paper (NYSE:CLW)

Historical Stock Chart

From Nov 2024 to Dec 2024

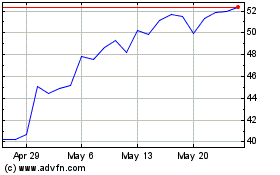

ClearWater Paper (NYSE:CLW)

Historical Stock Chart

From Dec 2023 to Dec 2024